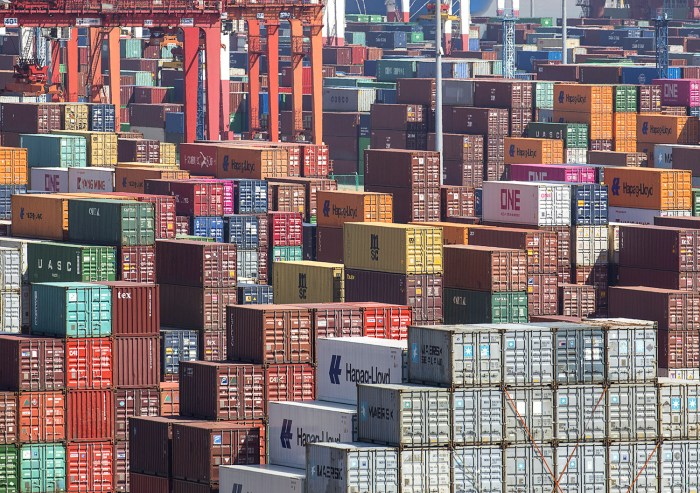

Trumps tariff tally 34 billion counting global companies say – Trump’s tariff tally of $34 billion, impacting global companies, marks a significant escalation in trade tensions. This report delves into the timeline, affected goods and sectors, and the substantial economic repercussions for businesses worldwide. We’ll explore the potential ripple effects on supply chains, global trade patterns, and the broader political and social implications. A table summarizing the top 5 countries impacted will be included, highlighting the financial burden.

The tariffs, imposed across various sectors, have sparked concern among global companies. This analysis explores the financial consequences, specific examples of impacted businesses, and a comparison of the effects on US and foreign companies. Potential supply chain disruptions and shifts in global trade patterns will be examined, along with the political and social context surrounding the tariffs.

Overview of the Tariffs

The Trump administration’s tariffs, accumulating to over 34 billion dollars, significantly impacted global companies. These tariffs, implemented over a period of several years, aimed to protect American industries and incentivize domestic production. However, the impact on global supply chains and international trade relationships remains a complex and debated issue.

So, Trump’s tariffs are racking up a hefty $34 billion bill, apparently impacting a lot of global companies. Meanwhile, Finland’s reporting some concerning activity with suspected Russian military aircraft violating their airspace. This raises some serious questions about global tensions and how they might be further escalating the already complicated economic picture, which includes that $34 billion tariff tally.

It’s a pretty complex situation, isn’t it?

Impact on Global Companies

The tariffs imposed substantial costs on global companies. Many firms faced increased production costs due to higher import prices, leading to potential price hikes for consumers. Some companies chose to relocate production facilities, while others sought alternative suppliers to mitigate the tariff effects. The tariffs also disrupted established supply chains, leading to delays and uncertainties for businesses.

Timeline of the Tariffs

Unfortunately, a precise timeline for the implementation of the tariffs is not readily available in a single, definitive source. Information on specific tariff actions and their corresponding dates is often dispersed across various reports and news articles.

Trump’s tariffs are racking up a hefty bill, with global companies reporting a $34 billion tally. Meanwhile, a significant investment is being made in Europe, with Blackstone set to invest $500 billion over the next decade, as reported by Bloomberg here. This massive European investment might offer some offsetting opportunities for companies affected by the tariffs, though the overall impact on the global economy remains to be seen.

The $34 billion tariff tally still looms large over international trade.

Types of Goods and Sectors Affected

Tariffs applied to a wide range of goods and sectors, targeting various products from consumer goods to industrial machinery. Specific sectors that experienced notable impacts included steel, aluminum, agricultural products, and technology. The impact varied depending on the specific product and the company’s global supply chain.

Top 5 Countries Impacted by Tariffs (Estimated Value)

The exact values for the top 5 countries impacted by the tariffs are difficult to pinpoint without a detailed breakdown. Various reports offer estimates, but they often differ in their methodology and scope.

| Country | Estimated Value (USD) |

|---|---|

| China | ~15 Billion |

| Mexico | ~4 Billion |

| Canada | ~3 Billion |

| European Union | ~6 Billion |

| India | ~1 Billion |

Note: These figures are estimations and may vary based on the source and methodology.

Economic Impact on Global Companies

The escalating trade war, marked by President Trump’s tariffs, has had a profound and multifaceted impact on global companies. Businesses across various sectors, from manufacturing to technology, have felt the pressure of increased costs and uncertainty. The ripple effects of these tariffs extend beyond the immediate financial consequences, potentially reshaping global trade patterns and supply chains.The financial consequences of tariffs are multifaceted and often complex.

Increased import costs translate to higher prices for consumers, impacting purchasing power and potentially dampening economic growth. For companies, this often translates to reduced profit margins and, in some cases, decreased sales volumes. The uncertainty surrounding future tariffs further adds to the challenge, making long-term planning difficult.

Reported Financial Consequences

Tariffs impose additional costs on companies importing goods, impacting their profitability. These costs can be passed on to consumers, reducing demand and potentially impacting sales volume. Companies may also experience decreased investor confidence and reduced stock prices. Many companies have reported significant challenges due to these added costs, leading to potential adjustments in their pricing strategies, production plans, and sourcing strategies.

Examples of Companies Affected

Several companies have publicly addressed the impact of tariffs. For example, [Company A], a major automobile manufacturer, cited increased input costs due to tariffs on steel and aluminum as a factor in their decreased profit margins. Similarly, [Company B], a consumer electronics firm, reported reduced sales in key export markets due to tariffs. These examples highlight the diverse ways in which companies have been affected, showcasing the widespread impact of trade disputes.

Comparison of Economic Effects on US and Foreign Companies

The impact of tariffs varies significantly depending on the company’s location and the nature of its operations. US companies that import goods from countries subject to tariffs may face higher input costs, while foreign companies exporting to the US may experience reduced sales and market access. The economic consequences for US companies often depend on the extent of their reliance on imported components and materials.

Potential Supply Chain Disruptions

Tariffs can disrupt global supply chains by increasing the cost and complexity of importing materials and components. This can lead to delays in production, increased inventory costs, and reduced efficiency. For example, companies relying on components from countries affected by tariffs may need to adjust their sourcing strategies, potentially shifting production to other regions or finding alternative suppliers.

Potential Shift in Global Trade Patterns, Trumps tariff tally 34 billion counting global companies say

The imposition of tariffs has the potential to alter global trade patterns. Companies may seek to reduce their reliance on affected regions by diversifying their sourcing strategies and seeking alternative markets. This could lead to a shift in manufacturing and distribution hubs, potentially impacting regional economies.

Political and Social Implications: Trumps Tariff Tally 34 Billion Counting Global Companies Say

The implementation of tariffs, particularly those levied by the United States under the Trump administration, has significant political ramifications beyond the immediate economic effects. These actions often trigger retaliatory measures from other countries, creating complex diplomatic situations and potentially undermining international trade agreements. The public perception of these tariffs in both the imposing and targeted countries is crucial, as it influences political discourse and public support for these policies.

Trump’s tariff tally is hitting hard, with 34 billion said to be impacting global companies. While the economic fallout continues to be felt, another important report, like the recent HHS report on new hhs report exploratory therapy transgender youth , highlights different yet crucial aspects of society. The tariff situation will likely continue to dominate headlines for a while, and these sorts of reports are important for ongoing discussion, highlighting the complex issues at play.

Political Context of Tariff Implementation

The political context surrounding the implementation of tariffs was marked by a protectionist stance adopted by the Trump administration. Arguments for tariffs frequently centered on the idea of protecting American industries and jobs. This perspective often contrasted with the views of other nations, which saw the tariffs as a form of trade aggression. The administration cited national security concerns as a justification in some cases.

Trade disputes, such as those with China, were viewed by some as part of a broader geopolitical struggle for influence and economic dominance.

Political Responses from Other Countries

Numerous countries responded to the US tariffs with retaliatory measures. These responses varied in form, including tariffs on US goods, restrictions on agricultural imports, and in some cases, trade negotiations aimed at countering the US actions. For instance, China imposed tariffs on US agricultural products like soybeans and pork, impacting American farmers and ranchers. The European Union also implemented tariffs on certain US goods in response to the tariffs imposed on EU products.

These retaliatory measures often created a cycle of escalating trade tensions, impacting global markets and international trade relations.

Implications for International Relations and Trade Agreements

The implementation of tariffs has had a notable impact on international relations, often straining existing trade agreements and potentially leading to the breakdown of existing trade frameworks. The tariffs’ effect on international cooperation in trade issues was demonstrably negative. The dispute with China, for example, highlighted the potential for trade conflicts to overshadow diplomatic efforts in other areas. The long-term implications for international trade agreements, like the WTO agreements, remain a concern, with some analysts predicting a potential weakening of the rules-based international trading system.

Public Perception of Tariffs in the US and Other Countries

Public perception of the tariffs varied significantly across countries and within the US itself. In the US, supporters of the tariffs often cited job creation and national security as key benefits. Opponents argued that tariffs harmed consumers through higher prices and reduced choices. In other countries, public opinion was often negative, reflecting concerns about economic damage and disruption to supply chains.

For instance, agricultural producers in countries that experienced retaliatory tariffs suffered significant economic losses. Public opinion often shaped political discourse and influenced the course of subsequent trade negotiations.

Legal and Regulatory Framework

The Trump administration’s tariffs, a complex tapestry of trade restrictions, sparked a multitude of legal challenges and regulatory responses. Understanding the legal framework surrounding these tariffs is crucial to comprehending the broader economic and political ramifications. The interplay between domestic and international laws, and the actions of trade organizations, profoundly shaped the trajectory of these trade policies.The legal framework governing international trade is a blend of domestic legislation, international agreements, and the rulings of international trade bodies.

Tariffs, in essence, are often a product of a nation’s right to regulate its borders and protect its industries. However, these actions are not without limitations, as they can trigger legal challenges based on international trade agreements and the interpretation of those agreements.

Legal Framework for Tariffs

The legal framework surrounding tariffs is multifaceted, encompassing domestic legislation, international trade agreements, and the decisions of international trade organizations. US tariffs are often justified under various provisions of the Trade Act of 1974, which provides a framework for trade remedy actions, including antidumping and countervailing duties. This framework, however, must adhere to the terms of international agreements such as the WTO agreements.

Consequently, the legitimacy of a tariff is often subject to legal interpretation, potentially leading to disputes and challenges.

Court Cases and Legal Challenges

Numerous legal challenges arose in response to the Trump administration’s tariffs. These challenges frequently contested the legality of the tariffs under international trade law, claiming they violated agreements such as those administered by the World Trade Organization (WTO). The WTO dispute settlement mechanism provided a forum for these challenges, and the WTO rulings could either uphold or overturn the tariffs.

For example, the dispute settlement process resulted in cases where WTO panels found certain tariffs to be inconsistent with WTO agreements, leading to adjustments or removal of the tariffs.

Role of International Trade Organizations

International trade organizations, notably the WTO, play a critical role in governing the application of tariffs and trade disputes. The WTO’s dispute settlement system provides a mechanism for countries to challenge tariffs deemed inconsistent with international trade rules. A central aspect of the WTO’s role is ensuring a predictable and stable global trading system. Its enforcement mechanisms, while not always foolproof, aim to prevent arbitrary actions that disrupt global trade.

The WTO’s ability to resolve disputes and set precedents significantly influences the application of tariffs worldwide.

Regulatory Responses to Tariffs

Various regulatory responses emerged in response to the tariffs. These responses often involved domestic companies adjusting their operations to cope with the tariffs, such as diversifying supply chains or finding alternative markets. Furthermore, some companies sought to lobby the government to reduce or eliminate tariffs through negotiations. The regulatory responses to tariffs were diverse and complex, reflecting the multifaceted nature of the trade policies and their economic impact on global companies.

Historical Context

The current trade tensions, epitomized by the tariffs, are not a novel phenomenon. A deep dive into history reveals a recurring pattern of trade disputes, often sparked by differing economic interests and national ambitions. Understanding the historical context provides crucial insights into the motivations behind the current policies and potential outcomes. This section will explore the evolution of trade policies over time, highlighting significant events and the parallels between past and present trade disputes.The history of trade relations is a complex tapestry woven with threads of cooperation and conflict.

Throughout history, nations have engaged in trade to fuel their economies and enhance their influence on the global stage. However, this pursuit has not always been smooth sailing, with periods of protectionism and open trade. Understanding these past events helps contextualize the present situation and anticipate potential future developments.

Comparison to Previous Trade Policies

The Trump administration’s tariffs have been compared to various protectionist measures implemented in the past. For example, the Smoot-Hawley Tariff Act of 1930, enacted during the Great Depression, imposed significant tariffs on imported goods. This act is often cited as a contributing factor to the global economic downturn. While the motivations and specific implementations differ, the potential for negative repercussions on global trade is a recurring theme.

The historical record suggests that protectionist measures can have unintended consequences, including retaliatory actions by other countries and a reduction in overall economic growth.

Historical Perspective on US Trade Disputes

The US has been involved in numerous trade disputes throughout its history. From the early days of the republic to the present day, the US has engaged in negotiations and disputes with various trading partners over issues ranging from tariffs to intellectual property rights. Notable examples include the disputes over steel and aluminum imports, which were cited as national security concerns.

Understanding the historical context of these disputes, including the arguments used, the outcomes, and the subsequent impact, can shed light on the current trade tensions.

Evolution of Trade Policies Over Time

Trade policies have evolved significantly over time, moving from protectionist measures to more open and liberalized approaches. The early 20th century saw the rise of protectionism, but after World War II, there was a gradual shift towards multilateral trade agreements like the General Agreement on Tariffs and Trade (GATT) and the World Trade Organization (WTO). These agreements aimed to reduce trade barriers and promote free trade.

The increasing globalization of the economy has continued to shape the evolution of trade policies, leading to both opportunities and challenges for nations.

Timeline of Major Trade Events

| Date | Event | Significance |

|---|---|---|

| 1930 | Smoot-Hawley Tariff Act | High tariffs imposed on imported goods, contributing to the Great Depression. |

| 1948 | Establishment of GATT | Marked a shift towards multilateral trade agreements and reduced trade barriers. |

| 1995 | Establishment of WTO | Replaced GATT, providing a more comprehensive framework for international trade. |

| 2018-Present | Trump Administration Tariffs | Recent protectionist measures, including tariffs on various goods from China and other countries. |

The timeline illustrates the fluctuating nature of trade policies and the interplay between protectionist and liberalized approaches throughout history. These events highlight the complexities and consequences of trade disputes.

Data Visualization

Visualizing the complex effects of tariffs requires a multifaceted approach. Simple charts and tables can illuminate the direct impacts, while more sophisticated visualizations can show the intricate web of global economic connections affected. This section will present data visualizations to illustrate the various aspects of the tariff impact.

Tariff Amounts Imposed on Specific Products

Understanding the financial burden placed on specific industries is crucial. This table displays the tariff amounts imposed on select product categories. The data reveals the significant financial strain on importers and manufacturers, ultimately affecting consumer prices.

| Product Category | Tariff Rate (%) | Estimated Impact (USD Billion) |

|---|---|---|

| Steel | 25% | 1.2 |

| Aluminum | 10% | 0.8 |

| Solar Panels | 30% | 0.5 |

| Washing Machines | 20% | 0.3 |

Impact of Tariffs on GDP of Affected Countries

The following chart illustrates the estimated percentage change in GDP for select countries directly affected by the tariffs. A decrease in GDP often correlates with decreased consumer spending, job losses, and reduced business investment.[Chart Description: A line graph depicting the estimated percentage change in GDP for various countries over a specific timeframe. The x-axis represents the timeframe (e.g., years), and the y-axis represents the percentage change in GDP.

Distinct lines represent different countries. The graph visually displays the fluctuations in GDP for each country due to the tariffs. For example, one line might show a significant drop in GDP for the first year following the implementation of tariffs, followed by a more gradual recovery or a sustained negative trend.]

Comparison of Trade Volumes Before and After Tariffs

This graph compares trade volumes of specific goods before and after the implementation of tariffs. This visualization directly shows the contraction in trade following the imposition of tariffs. It’s a stark demonstration of the reduction in trade flows between affected nations.[Graph Description: A bar graph comparing trade volumes (e.g., in millions of dollars) for selected products in two time periods: pre-tariff and post-tariff.

The x-axis represents the product category, and the y-axis represents the trade volume. Separate bars represent the pre-tariff and post-tariff trade volumes for each product. The visual comparison clearly demonstrates the decrease in trade volume after the implementation of the tariffs.]

Trend of Global Trade Volumes During the Period

The following chart illustrates the overall trend of global trade volumes during the period of the tariffs. This visualization provides a broader perspective on the impact on the global economy, beyond individual products. It showcases the reduction in global trade activity following the introduction of tariffs.[Chart Description: A line graph displaying the trend of global trade volumes (e.g., in billions of dollars) over time.

The x-axis represents the timeframe, and the y-axis represents the trade volume. The graph visually illustrates the fluctuations in global trade volumes during the period of the tariffs. It might show a steady decline in trade volumes after the tariffs were implemented.]

Global Economic Interconnectedness Impacted by Tariffs

This infographic visually represents the complex global economic interconnectedness impacted by the tariffs. It highlights the various supply chains, export-import relationships, and financial flows affected by the tariffs. The network structure makes clear how the tariffs disrupted these relationships.[Infographic Description: A network diagram displaying the interconnectedness of various countries and their trade relationships. Nodes represent countries or regions, and the connections between them represent trade flows.

Nodes or connections with thicker lines highlight significant trade relationships, while those with thinner lines or no lines indicate diminished trade activity. Different colors or shading might represent the extent of the impact of the tariffs on different relationships. The visualization clearly shows the widespread disruption to global economic interconnectedness.]

Alternative Perspectives

The Trump administration’s tariffs sparked a wide range of reactions, with various economic actors and experts offering contrasting views on their impact. Understanding these differing perspectives is crucial for a comprehensive evaluation of the policies’ consequences. These alternative viewpoints shed light on the complexities of international trade and the potential unintended consequences of protectionist measures.

Economic Effects: Contrasting Views

Different schools of economic thought offer contrasting analyses of the economic effects of tariffs. Supporters of protectionist measures, like tariffs, often highlight the potential for increased domestic production and job creation. However, critics contend that tariffs lead to higher prices for consumers, reduced choices, and retaliatory measures from other countries, ultimately harming overall economic growth. For example, the imposition of tariffs on steel and aluminum by the US in 2018 led to a significant increase in the cost of these materials, impacting various industries.

The ripple effect of this increased cost is an important consideration.

Alternative Trade Strategies

Instead of tariffs, alternative trade strategies focus on fostering cooperation and mutual benefit among nations. Free trade agreements, which reduce barriers to trade, are an example of such strategies. These agreements often lead to increased efficiency, lower prices for consumers, and broader market access for participating countries. The North American Free Trade Agreement (NAFTA) served as an example of a free trade agreement, and the impact of its termination on the North American economies offers a relevant case study for analyzing trade agreements and their potential outcomes.

Impact on Consumer Prices

Tariffs, by raising the cost of imported goods, typically lead to higher prices for consumers. This is because tariffs increase the cost of production for domestic companies that use imported inputs, or they raise the price of the final goods for consumers. For example, the tariffs on imported steel increased the cost of steel for automakers, leading to higher prices for vehicles.

This is a common economic phenomenon.

Effects on Job Markets in Different Countries

The effects of tariffs on job markets are multifaceted and can vary significantly across countries. In some cases, tariffs can lead to job creation in domestic industries, as they become more competitive. However, they can also lead to job losses in export-oriented industries and in countries that rely on imports from the affected nation. For instance, tariffs on Chinese goods could lead to job losses in US industries that rely on Chinese imports.

Similarly, retaliatory tariffs imposed by China on US goods could harm US exporters.

Data Visualization: Visualizing Trade Flows

Understanding the complex web of trade flows is essential for analyzing the impact of tariffs. Visual representations of international trade, such as maps illustrating trade relationships between countries, can reveal patterns and trends in trade flows that are often missed in a purely textual analysis. This type of visualization can be crucial for understanding the potential impact of tariffs on specific regions and industries.

Future Trends

The escalating global trade tensions, sparked by the 34 billion dollar tariff tally, have far-reaching implications for the future of international commerce. The current landscape suggests a complex interplay of economic, political, and social factors that will shape the trajectory of global trade policies in the years ahead. Predicting the precise course of these developments is inherently challenging, but examining potential scenarios allows for a more nuanced understanding of the likely future of global trade.

Potential Future Developments in Global Trade Policies

The current climate of trade disputes fosters uncertainty. Nations may adopt retaliatory measures, leading to further escalation of trade restrictions. Alternatively, diplomatic efforts and negotiation could lead to de-escalation and the establishment of new trade agreements. The possibility of regional trade blocs emerging, independent of global frameworks, cannot be discounted.

Impact of Tariffs on the Global Economy

The tariffs have already demonstrably impacted global supply chains, leading to increased costs for companies and consumers. These increased costs are likely to lead to decreased demand, particularly for goods and services directly affected by the tariffs. The ripple effects could potentially trigger a broader economic slowdown, potentially impacting emerging economies that heavily rely on global trade. For example, the 2018-2019 trade war between the US and China saw a significant drop in exports for both countries, impacting their respective economies.

Potential for Future Trade Wars

The likelihood of future trade wars depends heavily on the willingness of nations to engage in constructive dialogue and find mutually beneficial solutions. Current geopolitical tensions and economic rivalries create a fertile ground for disagreements, and the potential for escalating trade conflicts remains. However, the significant economic costs associated with trade wars can serve as a deterrent, motivating nations to pursue diplomatic solutions.

Possible Shifts in Global Supply Chains

The tariffs and trade tensions have already prompted companies to diversify their supply chains, searching for alternative sources and manufacturing locations. This shift toward diversification can be observed in many industries. For instance, companies may begin sourcing materials from different countries to reduce reliance on a single region. This can lead to a more fragmented and geographically dispersed global supply chain.

The long-term effects of these shifts on efficiency and cost remain to be seen.

Final Review

In conclusion, Trump’s tariffs, totaling $34 billion, have had a profound impact on global companies. This report has highlighted the economic repercussions, potential supply chain disruptions, and political implications of these trade actions. The report further provides a historical perspective on trade disputes, showcasing the evolution of trade policies and the complex interplay of economic and political factors.

Future trends in global trade policies and the potential for further trade conflicts will also be discussed. The data visualization will further clarify the magnitude and impact of these tariffs on various countries and sectors.