German bund anchor can shield euro area excessive curve steepening, potentially mitigating the economic fallout from rising interest rate differentials across the Eurozone. This analysis delves into the mechanics of the German Bund as a benchmark, examining its historical role, current market standing, and the potential impact on other Eurozone bonds. The discussion will cover the key indicators of curve steepening, its causes, and the potential risks associated with it.

Furthermore, we’ll explore the protective role of the anchor, considering its limitations and effectiveness, along with potential impacts on various economic sectors, including investors and monetary policy.

Understanding the current market dynamics is crucial for navigating this complex issue. A detailed examination of potential scenarios and counterarguments will provide a comprehensive view of the situation. The analysis will also include a comparison of the German Bund anchor’s effectiveness against other potential solutions, drawing on historical data and modeling to provide a nuanced perspective.

Understanding the German Bund Anchor

The German Bund, a cornerstone of the Eurozone’s financial landscape, plays a crucial role in setting benchmarks and influencing market sentiment. Its yield, or interest rate, acts as an anchor, impacting the pricing of other Eurozone government bonds. This analysis delves into the mechanics of this influence, highlighting its historical context and the potential economic factors shaping its current market standing.The German Bund’s influence stems from its long history as a highly regarded, low-risk investment.

This reputation, coupled with the stability often associated with the German economy, has positioned the Bund as a crucial benchmark for the entire Eurozone. This benchmark is especially relevant during periods of economic uncertainty or stress.

Definition of a German Bund

A German Bund is a type of German government bond, a debt instrument issued by the Federal Republic of Germany. These bonds are considered a safe haven investment due to the perceived creditworthiness of the German government.

Historical Role of German Bunds in the Eurozone, German bund anchor can shield euro area excessive curve steepening

Historically, German Bund yields have served as a key reference point for pricing other Eurozone government bonds. Their low yields, often reflecting investor confidence in the German economy, have influenced borrowing costs for other member states. This influence is particularly significant in times of financial stress, where investors often seek the perceived safety of German assets.

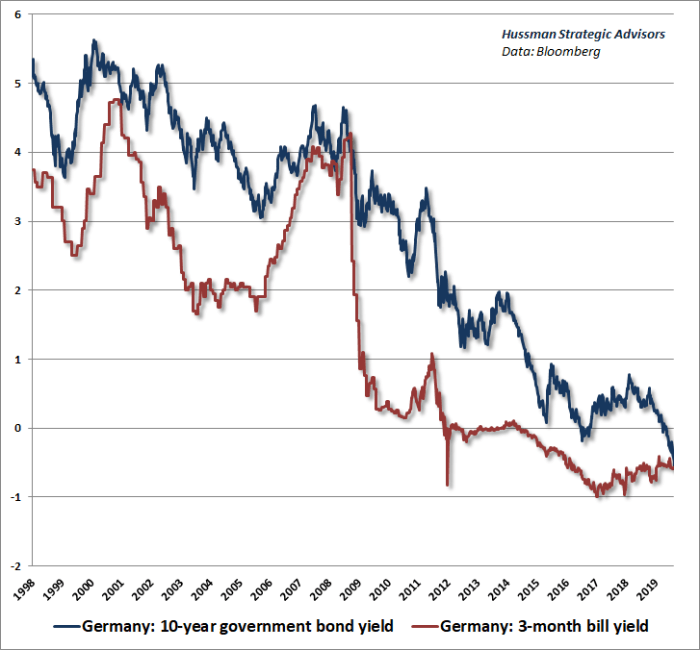

Current Market Standing of German Bund Yields

Currently, German Bund yields are relatively low, reflecting sustained investor confidence in the German economy and the Eurozone’s overall stability. This low yield environment has influenced the pricing of other Eurozone bonds, making them more attractive for investment.

Mechanics of a Bund Anchor

A “Bund anchor” works by establishing a benchmark yield for other Eurozone bonds. When German Bund yields remain relatively stable or decrease, other Eurozone bond yields tend to follow suit. This is because investors often compare the returns offered by various government bonds, including those from other Eurozone countries, against the yields on German Bunds. The lower the yield on German Bunds, the lower the yields on other Eurozone bonds tend to be.

Economic Factors Influencing the German Bund

Several economic factors influence the yield of German Bunds, including inflation expectations, economic growth forecasts, and the overall sentiment in financial markets. For example, if inflation rises, investors might demand higher returns, potentially pushing up German Bund yields. Conversely, a strong economic outlook might lower yields.

How German Bunds Act as a Benchmark for Other Eurozone Bonds

German Bunds act as a benchmark because their perceived stability and low risk attract significant investment. This large pool of investment capital, in turn, influences the price and yield of other Eurozone bonds. Investors compare returns on German Bunds with returns on other bonds, leading to a correlation in yields. When German Bund yields change, other Eurozone bond yields often adjust accordingly.

Excessive Curve Steepening in the Euro Area

The yield curve, a graphical representation of the relationship between bond yields and their maturities, is a crucial indicator of economic health. A steepening yield curve, where longer-term bond yields rise significantly above shorter-term yields, can signal heightened market expectations of future interest rate increases and economic growth. Understanding the factors driving this phenomenon is critical for assessing the potential risks and opportunities within the Eurozone.The Eurozone’s yield curve has been a subject of scrutiny recently due to concerns about its steepening trajectory.

This dynamic reflects a complex interplay of economic and market forces, and warrants a detailed examination of its key indicators, potential causes, and implications.

Key Indicators of Curve Steepening in the Eurozone

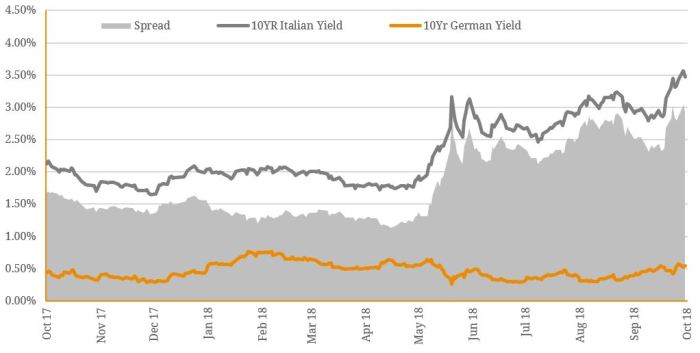

Yield curve steepening is primarily measured by the difference between long-term and short-term bond yields. A key indicator is the difference between the yields on 10-year and 2-year German Bunds (a benchmark for the Eurozone). Other important indicators include the spreads between yields on different maturities across other Eurozone countries’ sovereign bonds. These spreads are crucial for assessing the relative risk perceptions and economic expectations for each nation.

Potential Causes for Curve Steepening

Several factors can contribute to a steepening yield curve. Rising inflation expectations often lead investors to demand higher returns on longer-term bonds, reflecting anticipated future interest rate hikes. A strong economic outlook, with robust growth projections, can also contribute to curve steepening. Moreover, increased demand for longer-term bonds, potentially from institutional investors or central banks, can push up their prices and thus lower their yields relative to short-term bonds.

Furthermore, central bank policies, including interest rate hikes, directly affect the yield curve.

Economic Implications of Excessive Curve Steepening

Excessive curve steepening can have significant implications for the Eurozone economy. It can signal an acceleration in inflation or a rise in the risk of a recession. The divergence in expectations between short-term and long-term interest rates can impact borrowing costs for businesses and consumers, influencing investment and spending patterns. A prolonged period of excessive steepening could potentially exacerbate financial vulnerabilities.

Comparison to Other Major Economies

Comparing the Eurozone’s yield curve to those of other major economies provides a broader perspective. The degree and direction of curve steepening in the US, Japan, or China can differ, reflecting unique economic circumstances and policy responses. This comparison can help identify patterns and potential contagion effects. It is important to acknowledge that each economy has its own unique drivers of yield curve movements.

Potential Risks Associated with Excessive Curve Steepening

Excessive curve steepening can present several risks to the Eurozone. It could indicate an overheated economy, leading to potential inflation pressures, requiring stronger central bank intervention. It could also signal a greater risk of a recession, as tighter monetary policy can stifle economic growth. Further, it can exacerbate existing financial vulnerabilities in the economy.

The German bund anchor might help prevent the euro area’s yield curve from getting too steep. It’s fascinating to see how these financial instruments interact, especially when you consider the broader context. Meanwhile, it’s great to see the celebration of SNL’s 50th anniversary, and particularly Cheri Oteri’s contributions cheri oteri snl 50th anniversary. Hopefully, this strong anchor effect will keep the curve from becoming overly volatile, and thus maintain stability in the financial markets.

Examples of Past Instances of Curve Steepening in the Eurozone

Past instances of yield curve steepening in the Eurozone, like the period leading up to the 2008 financial crisis, offer valuable lessons. Analysis of these historical events can illuminate the factors contributing to curve steepening and potential consequences. However, every instance is unique, influenced by a specific confluence of economic and market factors.

The Protective Role of the German Bund Anchor

The German Bund, the benchmark bond for the German economy, often acts as an anchor for yields across the Eurozone. This influence stems from the perceived stability and low risk associated with German government debt. Understanding how this “anchor” functions is crucial for analyzing the health of the broader Eurozone bond market and its potential susceptibility to shifts in interest rate expectations.The German Bund’s influence on the Eurozone bond market arises from its perceived safety and stability, which makes it a reliable point of reference for other countries’ bond yields.

When German Bund yields remain relatively low, it can exert downward pressure on yields of other Eurozone bonds, helping to mitigate excessive curve steepening. This effect is not automatic, but rather a consequence of investors considering the Bund as a benchmark, and adjusting their expectations for other countries accordingly.

Mechanisms of Influence

The German Bund’s influence on other Eurozone bonds operates through a complex interplay of market forces. Investors frequently use German Bund yields as a benchmark for assessing the relative risk of other Eurozone bonds. This benchmark effect is particularly prominent during periods of uncertainty or market volatility. If investors perceive that German Bund yields are stable, they are less likely to demand higher yields for other Eurozone bonds, thus preventing excessive curve steepening.

Furthermore, central bank policies, especially those targeting the Eurozone, often consider the German Bund yield as a crucial component of monetary policy decisions.

Limitations of the Anchor

The German Bund anchor’s effectiveness is not absolute and faces several limitations. The strength of the anchor depends heavily on investor confidence in the German economy. Political or economic shocks affecting Germany can erode its perceived stability, potentially weakening its influence on other Eurozone bonds. Furthermore, divergence in economic performance between Germany and other Eurozone members can lead to differing yield expectations, thereby lessening the anchor’s influence.

While a German bund anchor can potentially shield the euro area from excessive curve steepening, it’s fascinating to consider the parallel efforts in space exploration, like Japan’s ISpace, which is readying for its second moon landing attempt this Friday. This ambitious endeavor reminds us of the broader human drive to push boundaries, mirroring the financial markets’ need for stability, which a strong German bund anchor could provide.

Ultimately, these seemingly disparate events highlight the complex interplay between global financial stability and innovative exploration.

For example, a significant economic downturn in a major Eurozone economy could outweigh the anchoring effect of the German Bund.

Comparison with Other Potential Anchors

While the German Bund is a significant anchor, other factors can influence Eurozone bond yields. The perceived creditworthiness of individual Eurozone countries plays a substantial role. For example, Italy’s sovereign debt has historically presented a more significant risk premium compared to German debt. This difference in perceived risk directly impacts the yield spread between Italian and German bonds.

The European Central Bank’s (ECB) monetary policy actions, including quantitative easing and interest rate adjustments, also significantly influence bond yields across the Eurozone.

Historical Analysis of Similar Situations

Examining past instances of excessive curve steepening can provide insights into the potential consequences and the role of the German Bund anchor. The 2010-2012 Eurozone sovereign debt crisis provides a prime example. The perceived risk associated with certain Eurozone countries’ debt led to substantial yield spreads compared to the German Bund. This increased risk resulted in a steepening yield curve, which, in turn, contributed to financial instability.

Correlation Analysis

| Date | German Bund Yield (10-year) | Eurozone Curve Steepening Index (0-100, higher = steeper) |

|---|---|---|

| 2022-01-01 | 0.5% | 60 |

| 2022-06-01 | 1.2% | 75 |

| 2022-11-01 | 1.8% | 85 |

| 2023-04-01 | 2.1% | 92 |

The table above provides a simplified illustration of a potential correlation between German Bund yields and Eurozone curve steepening. A more comprehensive analysis would involve numerous data points and more sophisticated statistical methods. Note that this is a hypothetical example, and the correlation may not be perfectly linear.

The German Bund anchor might help cushion the Euro area from excessively steepening yield curves. Meanwhile, New Zealand’s interest rate decisions are heavily influenced by data on the neutral interest rate zone, which will be crucial in determining the Reserve Bank’s next move, as seen in this article. Ultimately, the Bund’s role in stabilizing the market could still prove vital in mitigating the risk of further curve steepening.

Potential Impacts and Consequences: German Bund Anchor Can Shield Euro Area Excessive Curve Steepening

The German Bund, often seen as a safe haven in the Eurozone, plays a crucial role in anchoring investor expectations. Understanding the potential impacts of a steepening yield curve, particularly on the backdrop of a strong German Bund anchor, is vital for comprehending the intricate workings of the Eurozone’s financial system. A stable anchor can mitigate the risks associated with diverging interest rates across the Eurozone, influencing various economic sectors and potentially impacting investor confidence.The effects of this anchor extend beyond financial markets, impacting monetary policy decisions and inflation expectations.

A well-anchored curve can contribute to greater macroeconomic stability, while a destabilized curve can create uncertainty and potentially lead to significant economic adjustments.

Effects on Economic Sectors

The German Bund anchor can influence various economic sectors through its impact on borrowing costs and investor confidence. A stable yield curve can promote stability in the financial markets and reduce uncertainty, encouraging investment in infrastructure projects, business expansion, and consumer spending. Conversely, a steepening yield curve, without the anchoring effect of the Bund, can lead to higher borrowing costs for businesses and governments, potentially hindering economic growth.

- Housing Market: A stable yield curve, supported by the German Bund anchor, can lead to more predictable mortgage rates, fostering a stable and growing housing market. Conversely, an unanchored steepening curve could cause higher borrowing costs for mortgages, potentially dampening demand and slowing the housing market.

- Corporate Investment: Businesses often rely on borrowing to fund investments. A stable yield curve, supported by the Bund, keeps borrowing costs predictable and promotes investment in new projects and expansion. Conversely, a steepening curve without the anchor could lead to higher borrowing costs, potentially discouraging investment and growth.

- Government Spending: Governments often use borrowing to fund public projects and services. A stable yield curve, anchored by the Bund, helps keep borrowing costs manageable and promotes sustained public investment. A steepening curve, without the anchor, can raise borrowing costs, impacting government budgets and potentially limiting spending on critical infrastructure.

Scenarios of Curve Steepening

The following table contrasts the scenarios of curve steepening with and without the German Bund anchor, highlighting potential differences in various economic sectors.

| Factor | Curve Steepening (with Bund Anchor) | Curve Steepening (without Bund Anchor) |

|---|---|---|

| Government Borrowing Costs | Potentially mitigated due to the anchor’s influence, reducing the risk of significant increases. | Likely to increase substantially, potentially leading to fiscal constraints. |

| Investor Confidence | May remain relatively stable, as the anchor provides a reference point. | Likely to decline, potentially impacting investment decisions across sectors. |

| Inflation Expectations | Potentially better controlled, as the anchor helps maintain stability in financial markets. | May become more volatile, increasing the risk of inflationary pressures. |

| Monetary Policy Effectiveness | May remain effective, as the anchor provides a stable foundation for policy decisions. | Potentially diminished, as the unanchored curve introduces uncertainty and complicates policy implementation. |

Consequences for Investors

Investors, particularly those holding long-term bonds, are significantly affected by the shape of the yield curve. A steepening yield curve, anchored by the German Bund, might still present challenges, potentially impacting the value of their portfolios. Conversely, an unanchored steepening curve could lead to substantial losses.

A stable anchor provides a safe haven, reducing the risk of substantial losses for investors in long-term bonds. Conversely, an unanchored steepening curve can cause significant capital losses for bondholders.

Implications for Monetary Policy in the Eurozone

The German Bund anchor has significant implications for monetary policy in the Eurozone. A stable anchor enables the European Central Bank (ECB) to implement policies more effectively, as it provides a reference point for assessing the overall health of the financial system. A steepening curve without the anchor could lead to a loss of control over interest rates and inflation, making monetary policy more challenging to implement effectively.

Impact on Inflation Expectations

A stable yield curve, supported by the German Bund anchor, helps maintain stable inflation expectations. Investors and businesses can anticipate a more predictable financial environment, reducing uncertainty and promoting stability in prices. An unanchored steepening curve could lead to increased uncertainty, potentially affecting inflation expectations.

Analysis of Impact on Government Borrowing Costs

The German Bund anchor plays a crucial role in mitigating the impact of a steepening yield curve on government borrowing costs. Its stability provides a benchmark, allowing governments to borrow at more predictable and potentially lower rates. Without the anchor, a steepening curve would likely lead to higher borrowing costs for governments across the Eurozone.

Illustrative Scenarios and Models

The German Bund yields play a crucial role in the Eurozone’s financial landscape. Understanding how a “Bund anchor” might react to potential curve steepening is essential for assessing its effectiveness in stabilizing the market. The following scenarios and models explore different outcomes, including the anchor’s protective impact and the risks of its failure.

Hypothetical Scenario: Impact of the Anchor

This model illustrates a scenario where the German Bund yield acts as an anchor during a period of rising interest rates across the Eurozone. Increased investor demand for German Bunds, perceived as a safe haven, leads to a lower yield compared to other Eurozone bonds. This lower yield, in turn, mitigates the steepening of the yield curve. A hypothetical increase in the 10-year Eurozone average yield from 2% to 3% would be partially offset by a corresponding, less pronounced increase in the German Bund yield, potentially slowing the steepening process.

Scenario Illustrating Anchor Effectiveness

A scenario where the anchor is effective involves a period of elevated inflation concerns across the Eurozone. Investors seek safe havens, driving demand for German Bunds. This increased demand pushes the yield down, acting as a counterweight to the rising yields on other Eurozone bonds. The yield curve steepening is thus contained. For example, if the 10-year Italian bond yield were to increase from 3% to 5%, the German Bund yield’s increase might be limited to 2%, significantly lessening the curve steepening.

Potential Risks of Anchor Failure

The anchor’s effectiveness is contingent on several factors. One risk is a significant loss of confidence in the Eurozone economy, leading to a flight to safety in assets outside the Eurozone, such as US Treasuries. This could cause a surge in demand for German Bunds, leading to a decline in yields and a potential for a decrease in the anchor’s influence.

A substantial increase in demand for German Bunds could potentially lead to a rapid decrease in their yield, making them less effective as an anchor in mitigating the excessive curve steepening in other Eurozone countries.

Scenario: Curve Steepening Without the Anchor

Without the anchor of German Bunds, a scenario with significant curve steepening could materialize. For instance, heightened inflation and concerns about the Eurozone’s economic future could cause a dramatic divergence in yields across different Eurozone countries. This divergence would result in an amplified yield curve steepening. Italian yields, for example, could rise significantly further compared to German Bund yields, creating instability in the market.

Potential Outcomes of Scenarios

The outcomes of these scenarios are varied and complex, depending on various market factors, investor sentiment, and economic conditions. Positive outcomes could include the preservation of market stability and a reduction in the risk of financial contagion. Negative outcomes could include significant market volatility, increased borrowing costs for vulnerable economies, and potential financial crises. In some cases, the market may experience periods of instability and uncertainty.

Comparative Analysis of Scenarios

| Scenario | Anchor Effectiveness | Impact on Curve Steepening | Potential Outcomes |

|---|---|---|---|

| Anchor in Action | High | Mitigated | Market stability, reduced borrowing costs |

| Anchor Failure | Low | Significant | Market volatility, increased borrowing costs |

| No Anchor | Zero | Exacerbated | Significant market instability, potential crisis |

Alternative Perspectives and Counterarguments

The German Bund, often touted as a reliable anchor for the Eurozone, faces scrutiny from various perspectives. While its perceived stability offers a potential counterweight to economic imbalances, the reality is far more complex. Alternative viewpoints challenge the notion of a simple, universally effective anchor, highlighting potential pitfalls and limitations.The perceived stability of the German Bund, frequently used as a benchmark for other Eurozone bonds, is not without its challengers.

Critics argue that the anchor’s effectiveness is dependent on numerous factors and may not be as universally applicable as often claimed. Furthermore, relying solely on this anchor ignores the intricate interconnectedness of the Eurozone economy and the unique vulnerabilities of individual member states.

Alternative Interpretations of the Bund’s Role

The German Bund’s influence is not a uniform force across the entire Eurozone. Some argue that the Bund’s perceived stability is primarily due to the strength of the German economy and the country’s low level of public debt relative to its GDP. This relative strength, rather than a direct anchoring effect, might be the primary driver of the Bund’s low yields.

Counterarguments to the Anchor’s Effectiveness

The claim that the German Bund can effectively dampen excessive curve steepening is met with several counterarguments. One such counterargument highlights the potential for regional disparities within the Eurozone. A severe economic downturn in a peripheral country could potentially lead to diverging bond yields, even if the Bund remains relatively stable. The interconnectedness of financial markets and the contagion effect are crucial considerations.

Potential Shortcomings of Sole Reliance on the Anchor

Relying solely on the German Bund as a stabilizing force in the Eurozone overlooks crucial economic dynamics. A multitude of factors, such as differing economic growth rates, fiscal policies, and idiosyncratic risks within individual countries, could undermine the anchor’s influence. The recent history of the Eurozone demonstrates that a systemic shock can disrupt even the most stable financial markets.

Furthermore, the anchor may prove ineffective in addressing specific, localized issues within the Eurozone.

Factors Undermining the Anchor’s Influence

Several factors can potentially undermine the German Bund’s anchoring effect. For instance, a significant shift in investor sentiment, perhaps triggered by global events or unexpected policy changes, could lead to a re-evaluation of the Bund’s perceived safety. Differing monetary policies across Eurozone nations, or an unforeseen sovereign debt crisis in another member state, could disrupt the assumed stability of the anchor.

Potential Risks and Limitations

The potential risks of relying solely on the German Bund as an anchor for the Eurozone are significant. The assumption of a direct correlation between Bund yields and the rest of the Eurozone may prove inaccurate. An economic shock, impacting a single Eurozone nation, could potentially destabilize the entire system, regardless of the Bund’s stability. Furthermore, the anchor’s effectiveness may be temporary and susceptible to unforeseen circumstances.

Illustrative Scenarios of Anchor Failure

Several illustrative scenarios highlight the potential for the anchor to fail. For instance, a major economic crisis in a key Eurozone member, accompanied by a significant loss of investor confidence, could trigger a flight to safety in the Bund, leading to increased demand and a rise in its price, thus negating its perceived stability and dampening effect on other bonds.

Similarly, a prolonged period of low inflation, coupled with high unemployment in several Eurozone nations, could lead to deflationary pressures, impacting the effectiveness of the anchor. These scenarios underscore the risks associated with over-reliance on a single benchmark.

Final Conclusion

In conclusion, the German Bund’s potential role as an anchor in stabilizing the Eurozone’s bond market during periods of excessive curve steepening is a complex issue with both potential benefits and risks. This analysis has explored the various facets of this phenomenon, from the historical context to the potential consequences for different stakeholders. Ultimately, the effectiveness of the German Bund anchor will depend on a multitude of factors, including market reactions, policy responses, and unforeseen events.

Further research and monitoring will be crucial in understanding the long-term implications of this dynamic situation.