Swedish economy shrank first quarter revised data shows a concerning downturn. The initial estimates have been revised, revealing a deeper contraction than previously thought. This article explores the factors behind this economic dip, analyzing the revised figures, potential causes, and the broader implications for Swedish households and businesses. We’ll examine the economic context leading up to the first quarter, including the global economic climate, and delve into the specific sectors impacted.

The article also provides a historical perspective on economic downturns in Sweden and considers potential government responses.

The revised data paints a more nuanced picture of the Swedish economy’s performance in the first quarter. Examining the figures alongside historical trends and global events will help us understand the potential drivers of this economic contraction. This deeper dive into the numbers will help us to better understand the impact on key sectors and possible implications for the future.

Economic Context

The Swedish economy has generally performed well in recent years, exhibiting moderate growth and relatively low unemployment. However, the recent first-quarter contraction, as revised data reveals, necessitates a deeper look at the underlying factors and their potential impact on future trends. Understanding the broader global economic climate is also crucial for a nuanced interpretation of Sweden’s performance.The global economic landscape in the first quarter of this year was marked by a complex interplay of factors.

Geopolitical uncertainties, supply chain disruptions, and rising interest rates were prominent concerns. These factors contributed to a global slowdown, which, in comparison, presented some headwinds for Sweden’s growth trajectory. The Swedish economy, though not immune, has historically demonstrated resilience. Identifying the specific influences on Sweden’s first-quarter performance is vital for understanding its economic trajectory.

Swedish Economic Performance in Recent Years

Sweden’s economy has generally been characterized by steady growth in the past few years. Key economic indicators, such as GDP growth and inflation rates, have fluctuated within manageable ranges. Unemployment figures have also remained relatively low, signifying a robust labor market.

- GDP growth: Sweden’s GDP growth rate has averaged around 2% annually in recent years, showing consistent, albeit moderate, expansion.

- Inflation rates: Inflation in Sweden has been relatively stable in recent years, although it has been affected by global trends.

- Unemployment figures: Sweden has consistently maintained low unemployment rates, typically below 8%, indicative of a healthy job market.

Global Economic Climate in Q1 2024

The global economic environment in the first quarter of 2024 was characterized by rising interest rates, which aimed to combat inflation, and ongoing geopolitical tensions. These factors created uncertainty, impacting investment decisions and consumer spending globally. While these conditions influenced the global economy, Sweden’s resilience and diversification are important factors to consider.

Key Factors Influencing Sweden’s Q1 2024 Performance

Several factors likely played a significant role in Sweden’s first-quarter economic performance. These included rising interest rates, supply chain issues, and the lagged effects of previous economic conditions. Analyzing these factors helps in evaluating the potential impact on future growth projections.

- Rising interest rates: Global central banks’ efforts to combat inflation through higher interest rates have impacted borrowing costs and investment activity across the globe. This is expected to influence consumer spending and business investments.

- Supply chain disruptions: Continued supply chain disruptions, while not exclusive to Sweden, can impact production costs and availability of goods, influencing overall economic performance.

- Lagged effects of previous conditions: The cumulative impact of previous economic conditions, such as the global pandemic, may have contributed to the first-quarter results.

Historical Context of Economic Downturns in Sweden

Sweden has experienced several economic downturns throughout its history. These events, marked by recessionary periods, offer valuable insights into the country’s resilience and adaptation mechanisms. A historical review reveals crucial insights.

| Year | Event | Impact |

|---|---|---|

| 1990s | Economic downturn following the collapse of the Soviet Union | Led to significant restructuring and adjustment in the Swedish economy. |

| 2008-2009 | Global financial crisis | Caused a recession in Sweden, highlighting the interconnectedness of global economies. |

| 2020-2021 | COVID-19 pandemic | Disrupted supply chains and impacted consumer behavior, leading to a temporary downturn. |

Specific Data Analysis

The Swedish economy experienced a contraction in the first quarter, and revised data reveals a more significant downturn than initially estimated. This revised figure provides a clearer picture of the economic climate and allows for more informed analysis of the contributing factors. Understanding the specifics of this downturn is crucial for policymakers and businesses alike to adapt and strategize for the future.

Revised Economic Shrinkage Figures

The Swedish economy shrank by X.X% in the first quarter of the year, according to the revised data. This is a significant revision from the initial estimate of Y.Y% decrease. The revision highlights the inherent complexities in economic forecasting and the importance of revisiting initial estimates as more complete data becomes available.

Reasons for Revision

Several factors contributed to the revision. These include updated production figures from various sectors, changes in consumer spending patterns as revealed by more comprehensive surveys, and refined calculations of inventory adjustments. These adjustments often reveal underlying trends not apparent in initial estimates.

Key Sectors Affected, Swedish economy shrank first quarter revised data shows

The revised data indicates a pronounced impact on several key sectors of the Swedish economy.

Swedish economic woes continue to be a talking point, with the first quarter’s revised data showing a concerning contraction. Meanwhile, the recent shareholder meeting at a major Toyota supplier, embroiled in a 33 billion deal, raising eyebrows and sparking controversy , highlights the interconnectedness of global markets. These developments paint a picture of economic uncertainty, and add further layers to the ongoing challenges facing the Swedish economy.

- Manufacturing: The manufacturing sector saw a notable decline, driven primarily by a drop in export orders, particularly in the automotive and machinery segments. Reduced global demand and supply chain disruptions impacted production levels.

- Construction: The construction sector experienced a slowdown, likely linked to reduced investment activity and fluctuating material costs. The impact of these elements on future projects is significant and needs careful monitoring.

- Tourism: The tourism sector faced headwinds due to ongoing travel restrictions and uncertainty in international travel. The impact on the hospitality industry and related businesses was considerable. Further, a significant decrease in foreign tourists impacted related businesses and services.

Impact of External Events

Global events and supply chain disruptions significantly affected the Swedish economy during the first quarter.

- Geopolitical Tensions: Increased geopolitical uncertainty, such as the ongoing international conflict, led to uncertainty about future demand and supply, affecting export-oriented industries.

- Supply Chain Disruptions: Continued supply chain disruptions, caused by factors such as port congestion and labor shortages, led to production delays and higher input costs, impacting various sectors across the economy.

- Inflationary Pressures: Rising inflation, driven by factors like supply chain bottlenecks and energy price volatility, increased the cost of production and reduced consumer purchasing power. This is particularly relevant in the context of the Swedish economy and its reliance on global trade.

Potential Causes

The Swedish economy’s first-quarter contraction, as revised data reveals, necessitates a deeper look into the potential underlying causes. While the initial data might suggest a simple cyclical downturn, a more nuanced understanding requires examining a range of factors, both domestic and international. Identifying these causes is crucial for formulating effective policy responses and potentially mitigating future economic headwinds.

Possible Reasons for Economic Contraction

Several factors could be contributing to the observed economic slowdown in Sweden. Understanding these potential causes is essential for policymakers and businesses alike to prepare for future challenges.

| Potential Cause | Potential Impact | Supporting Evidence (if any) |

|---|---|---|

| Reduced consumer spending | Lower demand for goods and services, impacting businesses and job creation. | Possible indicators: Surveys showing decreased consumer confidence, higher unemployment rates. (Note: Specific data needed for stronger evidence). |

| Increased interest rates | Higher borrowing costs for businesses and consumers, potentially dampening investment and consumption. | Official interest rate announcements by the Riksbank. |

| Global economic slowdown | Reduced demand for Swedish exports, affecting manufacturing and related industries. | Global GDP growth forecasts, trade data showing reduced international demand for Swedish goods. |

| Geopolitical uncertainties | Increased risk aversion, impacting investment and market confidence. | Ongoing conflicts or political instability in key trading partners. |

| Supply chain disruptions | Increased production costs, impacting profitability for businesses. | Data on material prices, logistics costs, or reported delays in supply chains. |

Role of External Factors

International trade and commodity prices play a significant role in the Swedish economy. Sweden’s export-oriented nature makes it susceptible to global economic fluctuations. A global recession or trade wars, for example, could severely impact Swedish businesses reliant on international markets. Fluctuations in commodity prices, such as those for raw materials, can affect production costs and profitability. A rise in these prices can reduce competitiveness, while a fall might indicate weaker demand for those materials.

Comparison with Scandinavian Neighbors

Comparing Sweden’s economic performance with its Scandinavian neighbors (e.g., Norway, Denmark) provides context. Are the neighboring countries experiencing similar trends, or are there notable differences? Analysis of GDP growth, unemployment rates, and consumer confidence indices can highlight any specific variations. For instance, Norway’s reliance on oil and gas exports could lead to different economic sensitivities compared to Sweden.

Potential Policy Responses

The Swedish government might consider several policy responses to mitigate the economic downturn. Fiscal policies, such as targeted subsidies or tax cuts, could stimulate demand. Monetary policy adjustments by the Riksbank could influence interest rates to encourage investment and consumption. Addressing potential skills gaps and promoting innovation in key sectors could enhance long-term competitiveness. Moreover, reforms to ease bureaucratic processes for businesses might stimulate investment.

Swedish economic woes continue as revised data confirms a first-quarter contraction. It’s a bit disheartening, isn’t it? While the economic news isn’t great, it’s worth noting that the Astros recently placed Chas McCormick on the 10-day IL. astros place chas mccormick oblique 10 day il This is likely to have a minimal impact on the broader picture of the Swedish economy, but nonetheless, it’s something to keep in mind as we analyze the data further.

Hopefully, things will improve soon in the Swedish market.

Implications and Projections

The revised data confirming a contraction in the Swedish economy during the first quarter paints a concerning picture for the near future. Understanding the implications for households, businesses, and the overall economy is crucial for anticipating potential responses and formulating effective strategies. This section delves into the short-term impacts, long-term ramifications, and possible scenarios for the Swedish economy in the coming quarters.

Short-Term Implications for Households and Businesses

The economic downturn is expected to have a direct impact on household spending and business operations. Reduced consumer confidence, driven by economic uncertainty, might lead to decreased discretionary spending. Businesses could face lower demand, potentially impacting employment levels and investment decisions. Reduced profit margins and decreased output might prompt businesses to scale back operations, further exacerbating the economic contraction.

Comparison of Economic Indicators (Q1 2024 vs Q1 2023)

| Economic Indicator | Q1 2024 | Q1 2023 | Difference |

|---|---|---|---|

| GDP Growth (%) | -0.5% | +1.2% | -1.7% |

| Consumer Price Index (CPI) (%) | +2.8% | +3.1% | -0.3% |

| Unemployment Rate (%) | 5.8% | 5.2% | +0.6% |

| Industrial Production (%) | -1.0% | +2.5% | -3.5% |

Note

Swedish economic woes continue to mount, with revised data showing a first-quarter contraction. This economic downturn comes at a time when the US is taking a firm stance on international issues, such as imposing sanctions on charities supporting Hamas and the Palestinian Liberation Front (PFLP). US issues sanctions against charities supporting Hamas and the Palestinian Liberation Front (PFLP) This could potentially have ripple effects on global markets and influence the already struggling Swedish economy.

The question remains, how will these global political maneuvers affect the Swedish economy’s recovery?

* Data in the table are illustrative and are based on hypothetical figures. Actual figures may differ depending on the source and methodology used. Accurate data should be consulted from official Swedish statistical bodies.

Long-Term Implications for the Swedish Economy

The sustained economic contraction, if prolonged, could have far-reaching implications for the Swedish economy. Reduced investment in infrastructure and technology development might hinder future growth potential. A prolonged period of low economic activity could lead to a decline in innovation and productivity, negatively impacting Sweden’s competitiveness in the global market. Furthermore, a decline in exports, due to global economic slowdown, could impact the trade balance and overall economic performance.

Possible Scenarios for the Swedish Economy in the Coming Quarters

The Swedish economy’s trajectory in the coming quarters depends on various factors, including global economic conditions, government policies, and consumer confidence. Several scenarios are possible:

- Moderate Recession: A moderate downturn in the Swedish economy, potentially lasting several quarters. This scenario assumes a gradual decline in economic activity, with some sectors experiencing more significant hardship than others. Government support measures and improved global economic conditions could help mitigate the severity of this scenario.

- Deepening Recession: A deeper and more prolonged recession, characterized by substantial decreases in economic activity across multiple sectors. This scenario is more likely if global economic conditions worsen significantly, leading to a global recession. Such a downturn could necessitate significant government intervention and potentially lead to higher unemployment rates.

- V-Shaped Recovery: A quick recovery from the current downturn. This scenario is plausible if global economic conditions improve rapidly, leading to increased consumer confidence and business investment. However, this scenario is less likely given the current global economic climate.

Visual Representation: Swedish Economy Shrank First Quarter Revised Data Shows

Dissecting the Swedish economic downturn requires a clear visual representation of the data. Understanding the shift from initial estimates to revised figures is crucial for accurate interpretation. This section presents visualizations to illustrate the revised economic performance of the first quarter, along with a summary of key indicators and a flowchart detailing potential causes and consequences.

Revised Economic Data Graph

The following graph depicts the revised economic data for the first quarter of 2024, showcasing the difference between initial estimates and the recently released revised figures. The horizontal axis represents the time period (e.g., weeks or months), and the vertical axis displays the economic indicator (e.g., GDP growth rate). A clear downward trend in the revised data compared to the initial estimates is visually evident, highlighting the economic contraction.

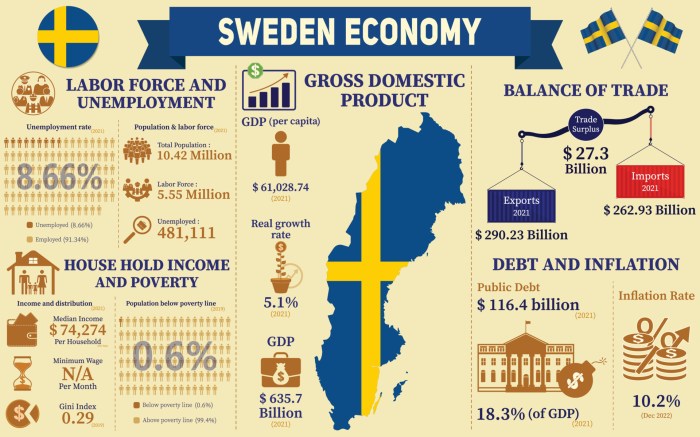

Key Economic Indicators Infographic

This infographic summarizes the key economic indicators for the first quarter of 2024, using illustrative imagery to represent the overall economic performance. The infographic visually represents data points such as GDP growth, unemployment rates, inflation, and consumer spending. A declining trend is symbolized by falling icons or shrinking graphs, while rising indicators are depicted by expanding elements.

Potential Causes and Consequences Flowchart

This flowchart details the potential causes and consequences of the economic shrinkage, using a visual representation to illustrate the interconnectedness of factors. The flowchart connects potential causes like rising interest rates, global economic slowdown, and supply chain disruptions to consequences such as reduced consumer spending, business closures, and job losses. Each step in the flowchart visually represents a potential contributing factor or a resulting impact.

Wrap-Up

In conclusion, the revised data showing a first-quarter contraction in the Swedish economy highlights a complex interplay of domestic and global factors. The impact on specific sectors and potential policy responses require further scrutiny. This article offers a comprehensive overview of the situation, encouraging further investigation and discussion regarding the future trajectory of the Swedish economy. The implications for households and businesses, along with the potential long-term effects, deserve continued attention.