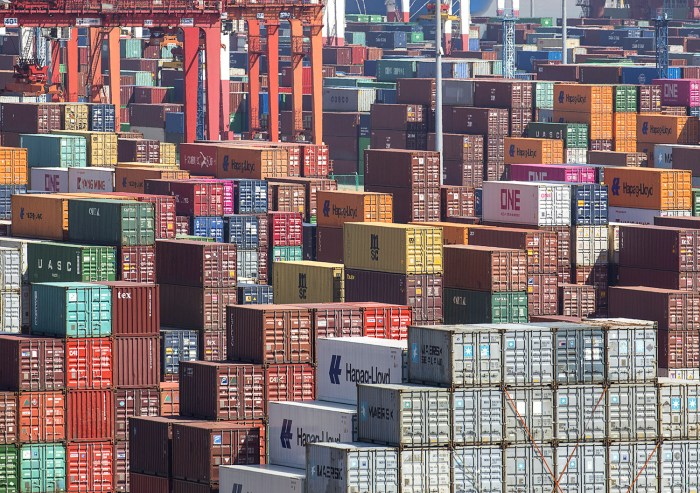

Trump administration considers allowing tariffs up 15 150 days wsj reports – Trump administration considers allowing tariffs up to 150 days, WSJ reports, setting the stage for a potential escalation in trade tensions. This decision, if finalized, could significantly impact various sectors of the economy, from consumer goods to international relations. The potential for price increases, business disruptions, and retaliatory measures from other countries is substantial. Let’s dive into the complexities of this proposed policy and explore its potential ramifications.

The Trump administration’s proposed extension of tariffs is part of a broader trade policy strategy that has been in place since his presidency. This policy has involved imposing tariffs on various goods from countries like China. The rationale behind these actions, according to past statements, has been to protect American industries and jobs. However, the impact on consumers and the global economy is often a contentious point of debate.

The proposed extension of these tariffs could have profound consequences.

Background of the Tariff Proposal: Trump Administration Considers Allowing Tariffs Up 15 150 Days Wsj Reports

The Trump administration’s trade policies were largely characterized by a protectionist stance, heavily reliant on tariffs to pressure foreign trading partners. This approach aimed to reduce the trade deficit and encourage American manufacturing. The WSJ report, detailing the consideration of further tariff increases, suggests a continuation of this strategy, albeit with potentially significant economic ramifications.

Trump Administration’s Trade Policies

The Trump administration implemented numerous tariffs on goods from various countries, particularly China, during its tenure. These actions were often justified by claims of unfair trade practices and intellectual property theft. The stated objective was to level the playing field for American businesses and protect domestic industries. The administration’s approach sparked significant international trade disputes and retaliatory measures from other countries.

Historical Context of Tariffs

The imposition of tariffs during the Trump presidency was a departure from decades of more lenient trade policies. Previous administrations had generally favored free trade agreements, aiming to reduce barriers to international commerce. The Trump administration’s shift towards protectionism marked a significant change in approach. This reversal prompted concerns about global economic stability and the potential for trade wars.

The Trump administration is reportedly considering extending tariffs for up to 150 days, according to WSJ reports. This comes at a time of heightened geopolitical tension, with Iran threatening US bases in the region if military conflict arises. This escalating threat could significantly impact the ongoing trade disputes, potentially complicating the administration’s tariff extension plans and adding further uncertainty to the global economic climate.

Ultimately, the tariffs’ future likely hinges on the diplomatic developments surrounding the escalating tensions.

Tariffs were implemented on a range of products, including steel, aluminum, and various Chinese imports.

Potential Motivations Behind Further Tariffs

The reported consideration of further tariff increases likely stems from the administration’s desire to address ongoing trade imbalances and perceived unfair trade practices by specific countries. A key motivation could be the belief that additional tariffs will encourage these countries to modify their trade practices or provide better market access for American goods. The rationale could also be linked to bolstering specific domestic industries struggling to compete in the global market.

This tactic often involves leveraging the power of tariffs as leverage to negotiate better trade deals.

Potential Impact on Sectors

The potential impact of additional tariffs is multifaceted and likely to affect various sectors of the economy. Tariffs can increase import costs for businesses, leading to higher prices for consumers and reduced competitiveness. Industries reliant on imported inputs or exporting goods to affected markets may experience disruptions in supply chains and reduced profitability. Consumers will likely face higher prices for imported goods, potentially impacting their purchasing power.

A cascading effect on related industries and the global economy is also a significant concern.

| Date | Policy Type | Rationale | Potential Effects |

|---|---|---|---|

| 2018-2020 | Tariffs on steel, aluminum, and Chinese goods | National security concerns, unfair trade practices | Increased import costs, trade disputes, potential job losses in import-dependent sectors, inflationary pressures |

| Potential future date | Further tariffs on unspecified goods | Addressing trade imbalances, enforcing trade agreements | Uncertainty on specific impact, but likely to impact specific industries, increase prices for consumers, potential for global trade wars, impact on global supply chains |

Potential Impacts of Increased Tariffs

The proposed 15% tariff increase, as reported by the WSJ, promises a complex ripple effect across various sectors. Understanding these potential impacts is crucial for businesses, consumers, and policymakers alike. This analysis will explore the probable consequences of this policy change on consumer prices, businesses of varying sizes, international trade, and specific affected industries.

Effects on Consumer Prices

Increased tariffs typically translate to higher import costs. These elevated costs are frequently passed on to consumers in the form of higher prices for goods. This is a direct consequence of the tariffs impacting the supply chain, making products more expensive to acquire. The extent of the price increase will depend on the specific goods and the elasticity of demand for those products.

Some consumers may shift to substitute goods, potentially influencing market dynamics.

Impact on Businesses

The effect on businesses will vary considerably depending on size and sector. Small businesses, often more reliant on imported components or raw materials, will likely face a disproportionately higher burden. Higher input costs will directly translate into reduced profit margins and potentially hinder their growth. Large corporations, with their greater purchasing power and established supply chains, may be better equipped to absorb these increased costs.

However, even large corporations could face disruptions to their supply chains, which could impact production and profitability.

Repercussions for International Trade Relations and Global Markets

Increased tariffs can create a negative feedback loop in international trade relations. Retaliatory tariffs from other countries are a likely response, potentially escalating into a broader trade war. Such conflicts can lead to uncertainty in global markets, impacting investor confidence and potentially slowing economic growth. History provides numerous examples of trade wars leading to reduced global trade and economic downturns.

Consequences for Specific Industries

The specific industries most affected will vary. Industries heavily reliant on imported components or raw materials, such as the automotive, electronics, and apparel industries, will likely experience the most pronounced impact. For example, the increased cost of imported steel could significantly impact the construction and manufacturing sectors. Furthermore, the food industry could face higher prices for imported ingredients, impacting consumer costs for processed foods.

The Trump administration is reportedly considering extending tariffs for up to 150 days, according to WSJ reports. This potential move, while seemingly focused on economic policy, mirrors some of the political struggles seen elsewhere, like Thailand’s stalled cash handout scheme, which is reportedly souring voters on the ruling party ( thailands stalled cash handout scheme sours voters ruling party ).

Ultimately, these economic decisions often have ripple effects, and the potential 150-day tariff extension could significantly impact international trade.

Possible Price Fluctuations for Consumer Goods

| Product Type | Current Price (USD) | Projected Price Increase (USD) | Reasoning |

|---|---|---|---|

| Imported Smartphones | 700 | 105 | Tariffs on imported components increase manufacturing costs. |

| Imported Clothing | 50 | 7.50 | Higher costs for imported fabrics and production. |

| Imported Electronics | 200 | 30 | Tariffs on imported parts and assembly impact pricing. |

| Imported Toys | 25 | 3.75 | Increased costs of imported raw materials and manufacturing. |

| Imported Furniture | 300 | 45 | Tariffs on imported wood and other materials raise production costs. |

Increased tariffs often lead to a cascading effect on prices throughout the supply chain.

Potential Responses to the Tariff Proposal

The Trump administration’s consideration of raising tariffs by up to 15% on a range of goods, as reported by the WSJ, is a significant development with potentially far-reaching consequences. This action, if implemented, will likely trigger a cascade of reactions from various stakeholders, including foreign governments, domestic industries, and legislative bodies. Understanding these potential responses is crucial to assessing the overall impact of such a policy shift.The decision to raise tariffs is often a contentious one, prompting a variety of reactions from different groups.

Predicting the precise nature and intensity of these responses is challenging, but analyzing historical precedents and current economic conditions provides a framework for understanding the likely scenarios.

Potential Reactions from Foreign Governments

Foreign governments are likely to respond to increased tariffs with a range of actions, from retaliatory measures to diplomatic pressure. Past instances of trade disputes demonstrate that countries often implement countermeasures to protect their own industries and maintain fair trade practices. For example, China’s response to US tariffs in recent years included retaliatory tariffs on American goods, highlighting the potential for escalating trade conflicts.

These responses often involve consultations with international bodies and seeking multilateral solutions.

Potential Responses from Domestic Industries and Businesses

Domestic industries and businesses will likely react to the tariff proposal in various ways. Some industries may experience immediate challenges, such as increased input costs and reduced export opportunities. Others may see benefits, such as increased domestic demand for substitute products. These responses are expected to range from lobbying efforts to restructuring plans to adapt to the new trade environment.

Lobbying efforts will likely focus on persuading the administration to modify or withdraw the proposal, while restructuring plans may involve shifting production to areas with lower tariffs or diversifying supply chains.

Potential Legislative Actions

Legislative responses to the proposed tariffs will likely vary depending on political viewpoints. Congressional committees may initiate investigations into the economic impact of the proposed tariffs, potentially leading to hearings and reports. This is expected to be a significant area of debate and negotiation. Congress may also introduce legislation aimed at mitigating the negative impacts of tariffs on specific industries or consumers.

The political climate and prevailing ideologies will greatly influence the form and substance of any proposed legislation.

Comparison of Potential Responses from Different Political Viewpoints

Different political viewpoints will likely lead to contrasting responses to the tariff proposal. Supporters of the proposal will emphasize the need to protect domestic industries and secure favorable trade terms, while opponents will focus on the potential negative consequences for consumers, businesses, and the overall economy. Historical trade policies and economic theories will likely be invoked to justify and refute the proposed tariffs.

For instance, arguments in favor of tariffs might invoke protectionist principles, whereas opponents might point to the benefits of free trade and the potential for global economic instability.

Potential Reactions Summary Table

| Stakeholder Type | Anticipated Action | Rationale | Potential Consequences |

|---|---|---|---|

| Foreign Governments | Retaliatory tariffs, diplomatic pressure, WTO complaints | Protection of domestic industries, maintaining fair trade | Escalation of trade conflicts, global economic instability, reduced international trade |

| Domestic Industries (affected) | Lobbying efforts, restructuring plans, production shifts | Mitigation of increased costs, reduced export opportunities | Increased costs for consumers, job losses, potential relocation of businesses |

| Domestic Industries (benefiting) | Increased production, expansion | Increased domestic demand, reduced competition | Potential inflationary pressures, market dominance |

| Legislative Bodies | Investigations, legislation | Assessing economic impact, mitigating negative effects | Potential for policy gridlock, legislative delays, increased political tension |

Economic Analysis of the Proposed Tariffs

The Trump administration’s consideration of increasing tariffs by up to 15% on a range of goods raises significant economic questions. This potential action, while aimed at potentially bolstering domestic industries, carries the risk of substantial negative consequences for consumers and businesses. A thorough examination of the potential benefits and costs is crucial to understanding the full implications.

Potential Economic Benefits of Increased Tariffs

Increased tariffs can theoretically protect domestic industries from foreign competition, potentially leading to increased domestic production and job creation in specific sectors. The theory is that higher import costs make foreign goods less competitive, prompting consumers to purchase domestically produced alternatives. However, this protectionist approach can be a double-edged sword, with potential negative consequences for consumers. This effect has been observed in various historical trade wars, where the impact on domestic industries is often less pronounced than anticipated.

For example, the impact on the automotive industry in the 1980s saw mixed results, with some companies benefiting and others facing increased production costs.

Potential Economic Costs of Increased Tariffs

Increased tariffs can lead to higher prices for consumers as imported goods become more expensive. This can impact essential goods, affecting consumer spending and potentially reducing overall economic growth. Furthermore, retaliatory tariffs from other countries are a significant concern. Other countries may impose tariffs on American exports, reducing demand for US goods and services. This domino effect can result in decreased exports and reduced economic activity.

For instance, the 2018 trade war between the US and China saw negative impacts on both economies.

Potential Effects on Employment Rates in Different Sectors

The impact on employment rates is complex and depends on the specific sectors affected. While tariffs may boost employment in industries producing protected goods, they can simultaneously reduce employment in export-oriented industries and those reliant on imported inputs. The net effect on employment rates across the entire economy is often unpredictable.

Comparison with Other Trade Policies

Comparison with other trade policies, such as free trade agreements or quotas, reveals that tariffs are just one tool in a complex trade policy toolbox. Free trade agreements, while promoting overall economic growth, can sometimes lead to job losses in specific sectors. Quotas, which limit the quantity of imports, can also have similar implications to tariffs in terms of price increases and potential retaliatory measures.

Economic Impact Analysis Table

| Sector | Predicted employment change | Reasoning | Alternatives |

|---|---|---|---|

| Automotive | Potentially mixed | Increased tariffs may benefit domestic manufacturers but increase input costs, impacting employment in the supply chain. | Negotiated trade agreements, focusing on specific areas of concern. |

| Agriculture | Potentially negative | Increased tariffs on agricultural imports could reduce exports and increase production costs. | Supporting domestic farming with subsidies or investments in agricultural technology, rather than relying solely on tariffs. |

| Technology | Potentially negative | Increased tariffs on tech components could impact manufacturing costs and reduce export opportunities. | Focus on developing domestic technology production, or exploring alternative supply chains. |

| Textiles | Potentially positive | Tariffs may benefit domestic textile manufacturers, but could negatively impact the broader textile industry if there are retaliatory tariffs. | Invest in domestic textile production facilities and improve efficiency, rather than just relying on tariffs. |

Historical Precedents and Similar Events

The Trump administration’s potential tariff increase, escalating to 15%, is a significant move with echoes of past trade disputes. Understanding the historical precedents, the outcomes of similar policies, and the lessons learned from them is crucial for assessing the potential impact of this proposed action. Analyzing these parallels can offer insights into the likely economic and political consequences, potentially mitigating the risks.Analyzing historical trade wars reveals a complex interplay of economic and political factors.

Past instances of significant tariff increases often resulted in unpredictable outcomes, impacting not only the targeted countries but also global markets. Understanding these precedents can provide valuable context for evaluating the current situation and predicting potential outcomes.

Summary of Similar Tariff Policies, Trump administration considers allowing tariffs up 15 150 days wsj reports

Several significant tariff policies have been implemented throughout history, demonstrating the cyclical nature of trade disputes. The Smoot-Hawley Tariff Act of 1930, for instance, drastically raised tariffs on imported goods, contributing to the global economic downturn of the Great Depression. More recently, the trade wars initiated by the US in the 2010s and 2020s have further underscored the potential for unintended consequences.

These historical precedents demonstrate that trade protectionism can have significant, often negative, repercussions for both the imposing nation and the global economy.

Outcomes of Previous Tariff Increases

The effects of previous tariff increases have been multifaceted and often far-reaching. Economically, tariffs can lead to higher prices for consumers, reduced trade volumes, and disruptions in supply chains. The Smoot-Hawley Tariff Act, for example, resulted in retaliatory tariffs from other nations, drastically shrinking global trade and deepening the Great Depression. Political ramifications can also be substantial, including strained international relations and potential diplomatic conflicts.

The 2010s trade wars highlight the difficulties in predicting the precise consequences of protectionist policies, as their impact often ripples through various sectors and nations.

Parallels Between the Current Situation and Past Events

Certain parallels exist between the current tariff proposal and past events. The proposed increase in tariffs, like previous policies, carries the risk of triggering retaliatory measures from other countries. This could lead to a trade war, significantly impacting global trade and economic growth. The potential for reduced trade volumes, increased prices, and disrupted supply chains mirrors the outcomes of past tariff increases.

However, the specific economic and political landscape of the current era introduces new complexities and uncertainties.

The Trump administration is reportedly considering allowing tariffs up to 15% for 150 days, according to WSJ reports. This potential tariff action has echoes of previous trade disputes, particularly when considering the significant Amazon tariff haul during the Trump era, as detailed here. Ultimately, the potential impact of these tariffs on various industries and consumers remains to be seen, as the administration weighs the pros and cons of this policy approach.

Lessons Learned from Previous Tariff Policies

The historical record offers several key lessons about the effectiveness and consequences of tariff policies. Past experiences highlight the difficulty in predicting the precise outcomes of such policies, as their impact can be widespread and unpredictable. The retaliatory actions of other nations often create a cascade of negative consequences, extending beyond the initial participants. Moreover, tariffs can have unintended consequences on domestic industries and consumers.

The Smoot-Hawley Tariff Act, while intended to protect domestic industries, ultimately contributed to the global economic downturn of the 1930s. This event serves as a cautionary tale, emphasizing the potential for significant unintended consequences of protectionist trade policies. Key features of this event include the significant increase in tariffs, the widespread retaliatory tariffs, and the dramatic contraction of global trade. Lessons learned include the importance of considering the potential for retaliation and the interconnectedness of global economies.

Alternative Policies and Solutions

The Trump administration’s consideration of increasing tariffs raises crucial questions about alternative approaches to addressing trade imbalances and protecting domestic industries. While tariffs can be a tool in international trade negotiations, they often come with significant economic costs, impacting consumers and businesses. This section explores alternative policies that could achieve similar objectives with potentially less disruptive outcomes.Alternative policies offer a spectrum of approaches beyond tariffs, ranging from diplomatic negotiations to domestic industry support programs.

Each alternative carries its own set of advantages and disadvantages, and the optimal choice depends on the specific circumstances and goals. Understanding these alternatives allows for a more comprehensive assessment of the potential impact of tariffs and the broader economic implications.

Potential Alternative Policies

Several alternative policies can address concerns about trade imbalances and domestic industry competitiveness without resorting to tariffs. These include targeted subsidies, investment incentives, and improved regulatory frameworks for domestic industries.

- Targeted Subsidies: Providing financial assistance to specific sectors experiencing difficulties due to foreign competition can help them maintain competitiveness. Examples include grants or tax breaks for renewable energy companies facing imports from countries with lower environmental standards. Benefits include potentially boosting domestic production and creating jobs. Drawbacks include potential for government overspending and concerns about unfair competition if subsidies are not carefully targeted and monitored.

- Investment Incentives: Encouraging domestic investment in strategic industries through tax breaks or other incentives can foster innovation and growth. Benefits include potential for increased productivity, job creation, and technological advancement. Drawbacks include potential for inefficient allocation of resources if incentives are not carefully designed, and the possibility of capital flight if investors perceive a lack of long-term stability.

- Improved Regulatory Frameworks: Streamlining regulations and reducing bureaucratic hurdles for domestic industries can boost their competitiveness. Benefits include potential for reduced production costs, increased efficiency, and enhanced global competitiveness. Drawbacks include the potential for unintended consequences if regulations are not well-designed and can be politically challenging to implement.

- Trade Agreements: Negotiating and enforcing robust trade agreements that include dispute resolution mechanisms can address unfair trade practices. Benefits include potential for fair trade practices, improved market access, and the reduction of trade barriers. Drawbacks include the complexity of international negotiations, potential for trade wars if agreements are not well-structured, and the possibility of political compromises impacting desired outcomes.

Comparison of Alternative Policies with Tariffs

A table comparing the proposed tariffs with alternative policies highlights the potential outcomes. These alternatives are presented as more nuanced and potentially less damaging strategies.

| Policy | Benefits | Drawbacks | Comparison to Tariffs |

|---|---|---|---|

| Targeted Subsidies | Boost domestic production, job creation, and sector-specific growth | Potential for government overspending, unfair competition concerns | Potentially less disruptive to global trade, more focused on specific sectors |

| Investment Incentives | Increased productivity, job creation, technological advancement | Potential for inefficient resource allocation, capital flight | Potentially less disruptive to international trade, incentivizes long-term growth |

| Improved Regulatory Frameworks | Reduced production costs, increased efficiency, global competitiveness | Potential for unintended consequences, political challenges | Focuses on domestic improvements rather than external barriers |

| Trade Agreements | Fair trade practices, market access, reduced trade barriers | Complexity of international negotiations, potential trade wars | Aimed at addressing root causes of trade imbalances rather than immediate protectionist measures |

| Proposed Tariffs | Potential for revenue generation, increased domestic production | Disruption of global trade, retaliation from other countries, higher consumer prices, reduced international cooperation | Directly targets foreign goods, may result in significant global trade friction |

International Relations and Global Trade

The Trump administration’s consideration of increasing tariffs by 15% on various goods raises significant concerns about its impact on international relations and global trade. This potential escalation of trade protectionism could trigger a cascade of retaliatory actions, potentially disrupting established global trade agreements and harming international cooperation. The ripple effects of such a decision extend far beyond the immediate economic impacts, impacting geopolitical stability and the broader global economic landscape.

Potential Impact on International Relations

The proposed tariffs could severely strain existing international relationships. Past instances of trade disputes, like the 2018 steel and aluminum tariffs, have demonstrated the potential for escalating tensions between nations. Trade disputes often lead to diplomatic friction and erode trust, making future cooperation more challenging. The potential for retaliatory measures further exacerbates this risk, creating a cycle of escalating trade conflict.

Likely Responses from Other Countries

Predicting the precise responses of other countries is complex, as each nation’s response will depend on various factors including its economic reliance on trade with the United States, its political priorities, and its assessment of the potential impact of the tariffs. However, several patterns can be observed. Many countries are likely to retaliate with tariffs on American goods, aiming to mitigate the negative effects of the increased tariffs.

Some countries might seek to form alliances or initiate diplomatic negotiations to counter the tariffs, while others may choose to pursue alternative trade agreements or seek other economic partners. These reactions will vary based on the specific goods targeted by the tariffs and the level of economic interdependence between countries.

Potential Repercussions for Global Trade Agreements

The proposed tariffs pose a significant threat to the integrity of global trade agreements. The World Trade Organization (WTO) system relies on the principle of reciprocal concessions and non-discrimination in trade. By unilaterally imposing tariffs, the US undermines this fundamental principle, creating uncertainty and discouraging future participation in multilateral trade agreements. The precedent set by such actions could embolden other countries to pursue similar protectionist measures, potentially leading to a significant erosion of the global trading system.

Potential for Retaliation from Other Countries

The potential for retaliation from other countries is high. History provides numerous examples of trade disputes leading to retaliatory tariffs. The 1930 Smoot-Hawley Tariff Act, for instance, contributed to the Great Depression by triggering a global trade war. The current geopolitical climate, with rising trade tensions and protectionist sentiments in various parts of the world, makes the risk of retaliation even greater.

The potential economic losses from such a trade war would be significant.

Summary Table of Potential Responses from Different Countries

| Country | Anticipated Response | Reasoning | Potential Impact |

|---|---|---|---|

| China | Likely to retaliate with tariffs on US goods, potentially targeting agricultural products or technology. | China is a major trading partner of the US and is likely to feel the negative impacts of the proposed tariffs. | Could lead to a significant escalation of trade tensions, impacting global supply chains and economic growth. |

| European Union | Possible imposition of retaliatory tariffs on US goods, potentially focusing on agricultural products or industrial goods. | The EU has strong economic ties with the US and may seek to protect its own industries and agricultural sectors. | Increased trade friction with the EU could disrupt the transatlantic economic relationship and impact European industries. |

| Canada | Likely to retaliate with tariffs on US goods, particularly those related to agricultural products. | Canada is a significant trading partner with close economic ties to the US. | Could severely impact agricultural sectors in both countries, potentially leading to further trade disputes. |

| Mexico | Likely to retaliate with tariffs on US goods, especially those from industries that rely heavily on the US market. | Mexico is an important trading partner for the US, and tariffs would affect both countries’ economies. | Could disrupt the North American Free Trade Agreement (NAFTA) and negatively affect cross-border trade and investment. |

Closure

The Trump administration’s consideration of extending tariffs for 150 days presents a complex web of potential economic, social, and geopolitical implications. From potential price hikes for consumers to the risk of international trade conflicts, the decision has wide-ranging consequences. This proposed extension will undoubtedly spark debate and potentially lead to a range of responses from businesses, foreign governments, and international organizations.

The future course of this policy will be crucial in determining the trajectory of global trade in the coming months.