Credit scores key healing economy and democracy are inextricably linked. Understanding how these scores impact economic health, stability, and democratic processes is crucial for creating a more equitable and prosperous society. This exploration delves into the historical context of credit scoring, its correlation with economic indicators, and its potential influence on political participation. We’ll also examine the potential for bias and misuse, alongside strategies for fostering responsible credit management and equitable systems.

From the historical evolution of credit scoring systems to their potential impact on political participation, this analysis reveals the complex interplay between credit scores, the economy, and democratic principles. Examining case studies and potential future trends will provide a deeper understanding of the multifaceted challenges and opportunities.

Credit Scores and Economic Health

Credit scoring systems, designed to assess an individual’s creditworthiness, have become deeply intertwined with the health of the global economy. Their evolution reflects changing economic landscapes and societal priorities. From simple assessments of repayment history to sophisticated algorithms incorporating various factors, credit scores have grown in complexity and influence. Understanding this relationship is crucial for navigating the challenges and opportunities of the modern economic environment.Credit scores act as a critical indicator of economic health, mirroring broader economic trends.

A healthy economy often correlates with robust credit scores, as individuals and businesses have more capacity to repay debts. Conversely, economic downturns or recessions can negatively impact credit scores, as individuals and businesses face difficulty in meeting financial obligations. This interconnectedness highlights the vulnerability of credit scoring systems to economic shocks and their potential role in amplifying or mitigating their effects.

Historical Overview of Credit Scoring Systems

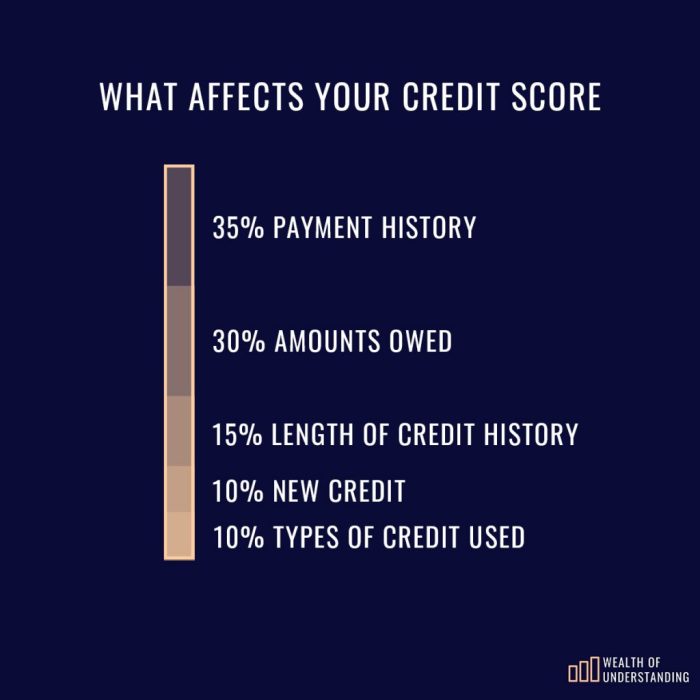

Credit scoring systems have evolved significantly over time. Early systems were rudimentary, often relying on personal recommendations and limited financial data. The 20th century witnessed the development of more sophisticated models, incorporating factors like payment history, outstanding debt, and credit utilization. These advancements led to a more standardized and objective approach to assessing creditworthiness, enabling wider access to credit and facilitating the growth of consumer and business lending.

This evolution demonstrates the continuous adaptation of credit scoring systems to reflect the changing needs of economies.

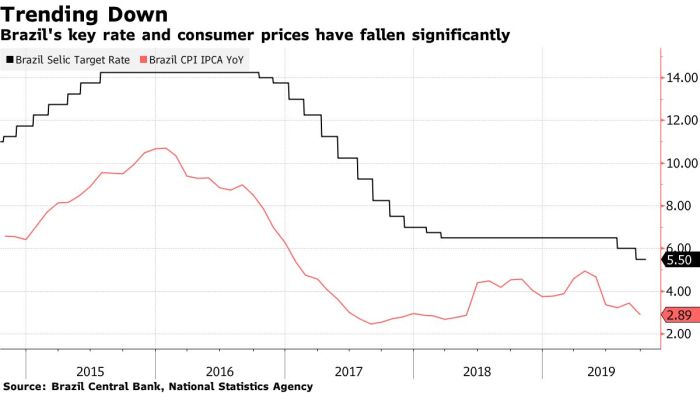

Correlation with Economic Indicators

A strong correlation exists between credit scores and key economic indicators like GDP growth and unemployment rates. During periods of robust economic growth, employment opportunities increase, and individuals tend to have better repayment histories, resulting in higher average credit scores. Conversely, recessions and high unemployment rates can lead to a decline in credit scores, as individuals struggle to meet their financial obligations.

Strong credit scores are crucial for a healthy economy and a functioning democracy. However, the dire situation in Gaza, with skyrocketing food prices leading to starvation, highlights the devastating impact of economic hardship on vulnerable populations. Ultimately, addressing issues like these, and fostering economic stability globally, are essential for a more just and robust democratic system.

These correlations demonstrate a direct link between the health of the economy and the overall creditworthiness of individuals and businesses.

Impact of Credit Score Disparities on Economic Inequality

Credit score disparities can exacerbate economic inequality. Individuals from marginalized communities or with limited access to financial resources may experience difficulties in building positive credit histories, leading to lower credit scores. This can create a vicious cycle, hindering their access to loans, mortgages, and other financial services, thereby limiting their economic opportunities and perpetuating existing inequalities. Addressing these disparities is critical for promoting economic inclusivity and fairness.

Methods for Improving Credit Access for Underserved Populations

Various strategies can improve credit access for underserved populations. These include establishing accessible financial literacy programs, providing support for building credit histories, and developing alternative credit scoring models that consider factors beyond traditional metrics. These methods focus on empowering individuals to participate in the credit market, regardless of their socioeconomic background.

Comparison of Credit Scoring Models

| Country | Scoring Model | Key Factors | Weighting |

|---|---|---|---|

| United States | FICO | Payment history, amounts owed, length of credit history, new credit, credit mix | Variable, based on the model |

| United Kingdom | Equifax | Payment history, amount borrowed, length of credit history, credit mix | Variable, based on the model |

| Canada | Equifax/TransUnion | Payment history, amount borrowed, length of credit history, credit mix | Variable, based on the model |

| China | Various models based on local factors | Payment history, employment, property ownership, local social credit | Variable, based on the model |

This table provides a concise overview of the differing credit scoring models. The specific factors considered and their weighting vary considerably across countries, reflecting differing economic structures, financial systems, and societal priorities. Understanding these variations is crucial for assessing the effectiveness of different models and identifying potential biases.

Credit Scores and Economic Stability

Credit scores are more than just numbers; they are a reflection of an individual’s financial health and, in aggregate, a crucial indicator of economic stability. Fluctuations in these scores ripple through the consumer market, impacting spending patterns, investment decisions, and ultimately, the overall health of the economy. Understanding this intricate relationship is vital for navigating economic challenges and fostering responsible financial practices.The interconnectedness of credit scores and economic stability is undeniable.

A healthy economy relies on a robust consumer spending sector and responsible investment practices. Credit scores serve as a critical tool in assessing the risk associated with these activities. High levels of bad debt, evidenced by numerous poor credit scores, can severely hamper economic growth.

Influence on Consumer Spending and Investment

Credit scores directly impact access to credit and the terms offered. Individuals with high credit scores often enjoy lower interest rates and greater borrowing power, encouraging increased spending and investment. Conversely, those with low credit scores face higher interest rates and reduced borrowing capacity, potentially dampening their spending and investment activities. This differential access to credit can create a disparity in economic participation and growth.

For instance, a credit score drop might deter a consumer from purchasing a home or a business from seeking loans for expansion.

Effects of High Levels of Bad Debt on Economic Stability

High levels of bad debt erode consumer confidence and increase the risk of defaults. When many individuals struggle to repay their debts, the financial system experiences strain. This can lead to a decrease in consumer spending, reduced investment, and potentially, a credit crunch. Businesses may hesitate to extend credit, and financial institutions may become more cautious in lending, further exacerbating the economic downturn.

The 2008 financial crisis, partially fueled by subprime mortgages and the resulting high levels of bad debt, serves as a cautionary example.

Strategies for Maintaining Financial Stability Through Responsible Credit Management

Maintaining financial stability hinges on responsible credit management. Paying bills on time, keeping credit utilization low, and avoiding excessive borrowing are essential strategies. Building a strong credit history through consistent responsible borrowing and repayment practices is key. These practices create a positive credit history, which allows for favorable interest rates and greater financial flexibility in the future.

Role of Credit Scores in Assessing the Risk of Financial Crises

Credit scores, when analyzed collectively, provide a crucial indicator of systemic risk. A widespread decline in credit scores can signal a potential financial crisis, as it suggests a weakening of the overall financial health of the population. Monitoring credit score trends can help policymakers and financial institutions anticipate and mitigate potential risks.

Potential Consequences of Widespread Credit Score Downgrades

A significant decrease in credit scores across a broad segment of the population could have far-reaching consequences. A decline in creditworthiness could lead to a reduction in consumer spending, decreased investment, and potentially, a recession. The table below Artikels some potential consequences.

| Consequence | Description |

|---|---|

| Reduced Consumer Spending | Decreased demand for goods and services, impacting businesses and employment. |

| Decreased Investment | Reduced capital investment in businesses, slowing economic growth. |

| Increased Defaults | Higher rates of loan defaults, putting strain on financial institutions. |

| Reduced Credit Availability | Financial institutions may restrict lending, making it harder for individuals and businesses to access credit. |

| Potential Recession | A severe decline in economic activity, characterized by decreased employment and reduced output. |

Credit Scores and Democratic Processes: Credit Scores Key Healing Economy And Democracy

The intersection of credit scoring and democratic processes is a complex and potentially fraught area. While credit scores are intended to assess financial responsibility, their application to political participation raises serious ethical concerns about bias, fairness, and the integrity of democratic institutions. This exploration delves into the potential influence of credit scores on political participation, campaign financing, and the underlying biases that could disproportionately affect certain demographics.

Potential Influence on Political Participation and Voting Patterns

Credit scoring systems, in principle, could be used to influence political participation and voting patterns. Hypothetically, individuals with high credit scores might be perceived as more trustworthy and responsible, potentially leading to increased access to campaign financing or preferential treatment in voter registration processes. Conversely, individuals with low credit scores could face obstacles in accessing campaign financing or even in participating in the democratic process.

Impact on Access to Loans for Political Campaigns

Credit scoring systems could impact the availability and terms of loans for political campaigns. Campaigns with individuals possessing high credit scores might have more favorable access to financing at lower interest rates. Conversely, campaigns with low credit scores might struggle to secure funding, or face exorbitant interest rates. This could create an uneven playing field, potentially favoring incumbents or established candidates with stronger credit profiles.

Potential Biases in Credit Scoring Systems

Credit scoring systems are not without inherent biases. Historical and systemic biases embedded in credit data collection and analysis could disadvantage certain demographics. Factors like race, ethnicity, and socioeconomic status can influence credit scores, potentially creating a feedback loop of disadvantage. For example, individuals in marginalized communities might face systemic barriers to building a strong credit history, leading to lower credit scores, even if they are financially responsible.

The lack of access to credit products or historical discriminatory lending practices can disadvantage these groups. The lack of diversity in credit scoring models and data sets also contribute to this issue.

Ethical Implications of Credit Scoring in the Context of Democratic Values

Evaluating the ethical implications of credit scoring in the context of democratic values requires careful consideration of principles such as fairness, equality, and transparency. The potential for credit scoring to exacerbate existing societal inequalities and undermine democratic processes demands rigorous scrutiny. The fundamental right to participate in the democratic process should not be contingent on an individual’s credit score.

Historical Use of Credit Information in Political Contexts

While not explicitly used in the way credit scores are now, the historical use of financial information to assess political candidates and their supporters is significant. Information about financial contributions and wealth has always played a role in shaping political landscapes. For instance, campaign finance records are publicly available and offer insight into the financial backing of political candidates.

| Historical Period | Context | Examples |

|---|---|---|

| Pre-20th Century | Wealth and land ownership were key indicators of political influence. | Land barons and wealthy families often held significant political power. |

| Early 20th Century | Rise of campaign finance regulations, albeit often inadequate. | Emergence of wealthy donors influencing political outcomes. |

| Late 20th Century | Increased scrutiny of campaign funding sources and donor transparency. | Reform efforts to limit the influence of large donations. |

| Present Day | Credit scoring is an emerging tool potentially used for evaluating political candidates and supporters. | Hypothetical use of credit scores to assess campaign funding and individual voter engagement. |

The Interplay of Credit Scores, Economy, and Democracy

Credit scores, economic stability, and democratic processes are deeply intertwined. A healthy economy fosters opportunities, reducing inequality and promoting participation in democratic life. Conversely, economic hardship can lead to political instability and disengagement. This interplay necessitates a critical examination of how credit scores, as a tool for assessing economic capacity, might influence both economic and democratic outcomes.

Understanding these connections is crucial for building more resilient and equitable societies.Economic downturns frequently correlate with increased credit defaults and lower credit scores. This decline in creditworthiness can, in turn, impact individuals’ access to financial services, hindering their ability to participate fully in the economy. This can have broader political implications, potentially leading to reduced voter turnout, decreased civic engagement, and a diminished sense of political efficacy.

For instance, during the 2008 financial crisis, many individuals experienced significant drops in credit scores, which impacted their ability to access loans, rent, and other essential services. This economic hardship likely contributed to the shifts in political sentiment and voting patterns during that period.

Impact of Economic Downturns on Credit Scores and Political Participation

Economic downturns, characterized by job losses, reduced income, and increased cost of living, frequently lead to a rise in credit defaults. This, in turn, results in a deterioration of credit scores for many individuals. The resulting economic hardship can lead to decreased political participation, including reduced voter turnout and lower levels of civic engagement. This diminished participation can affect the representation of diverse viewpoints and contribute to political instability.

Examples of this include periods following major economic crises, such as the 2008 financial crisis or the Great Depression, when decreased economic opportunities were correlated with reduced political engagement.

Comparison of Credit Scoring Practices Across Political Systems

Credit scoring practices vary significantly across different political systems. Some countries prioritize individual creditworthiness, using credit scores extensively in various sectors, including housing and lending. Other countries emphasize social safety nets and collective responsibility, potentially employing credit scoring less pervasively. The use of credit scores in government programs, such as subsidies or social welfare, is another key point of divergence.

These differences reflect the differing priorities and values within each political system. For example, in some European countries, social safety nets are more extensive, reducing the reliance on individual credit scores for accessing essential services.

Potential Misuse of Credit Scoring Data in Democratic Processes

The potential for misuse of credit scoring data in democratic processes is significant. For example, biased or inaccurate credit scoring systems could disproportionately disadvantage certain demographics, potentially affecting their access to resources and their ability to participate in political processes. Such misapplication could contribute to inequality and limit democratic representation. Moreover, the potential for credit score manipulation or abuse by malicious actors exists.

A system that isn’t transparent and equitable risks being weaponized against specific groups or individuals.

Role of Transparent and Equitable Credit Scoring Systems in Promoting a Healthy Economy and Democracy

Transparent and equitable credit scoring systems play a crucial role in fostering both a healthy economy and a thriving democracy. Such systems, by providing fair and accurate assessments of creditworthiness, can help ensure that individuals have access to the financial resources needed to participate fully in economic life. Moreover, by reducing systemic bias and ensuring equal opportunities, these systems promote greater inclusivity and fairness within the democratic process.

By reducing barriers to access and fostering a sense of trust in the system, transparent and equitable credit scoring systems contribute to a healthier economic and democratic environment.

Framework for Addressing Potential Biases in Credit Scoring Systems

Addressing potential biases in credit scoring systems requires a multifaceted approach. First, independent audits and reviews of credit scoring models should be conducted regularly to identify and mitigate potential biases. Second, data collection practices must be scrutinized to ensure fairness and inclusivity. Third, transparency in the scoring methodologies is crucial to allow stakeholders to understand the factors influencing credit scores and to challenge any perceived unfairness.

Lastly, mechanisms for appealing decisions and for correcting errors should be in place. This framework will contribute to ensuring the fairness and integrity of the credit scoring system and, ultimately, promote a more equitable and representative democratic process.

Illustrative Examples and Case Studies

Credit scores, as a tool for assessing risk and allocating resources, have far-reaching consequences extending beyond individual finances. Their influence on economic stability, democratic processes, and social equity is increasingly evident. This section explores specific instances where credit scores have shaped outcomes, highlighting both positive and negative impacts. We’ll delve into case studies of countries and regions where these impacts have been pronounced, including examples of policy interventions aimed at mitigating the negative effects of credit score disparities.

Strong credit scores are crucial for a healthy economy and a thriving democracy. They indicate financial responsibility, which is a cornerstone of both. Recent discussions at the time100 summit health cancer researc highlight the interconnectedness of societal well-being and economic stability, further emphasizing how credit scores play a vital role in fostering responsible financial behavior and ultimately, a more resilient and equitable society.

Improving access to credit and promoting financial literacy are essential for strengthening the economic and democratic foundations of our communities.

Impact on Economic Outcomes in Specific Regions

Credit scoring systems can significantly affect economic outcomes within a region. For instance, in some developing countries, access to credit is often tied to a person’s credit score. This can lead to a concentration of wealth and opportunities among those with good credit scores, potentially widening the existing economic disparities. Conversely, targeted interventions aimed at improving credit access for marginalized communities can lead to economic empowerment and reduced poverty.

These outcomes depend heavily on the design and implementation of credit scoring systems and accompanying policies.

Credit Score Disparities and Social Unrest

Credit score disparities can contribute to social unrest by exacerbating existing inequalities. In some regions, individuals with poor credit scores may face difficulties accessing essential services like housing, healthcare, and education. This can create a sense of marginalization and resentment, potentially leading to social unrest. For example, in regions with high levels of unemployment and limited economic opportunities, those with poor credit scores may face additional barriers to upward mobility.

This can create a breeding ground for social unrest and political instability.

Case Studies of Policies Improving Access to Credit, Credit scores key healing economy and democracy

Several countries have implemented policies aimed at improving access to credit for underserved populations. These policies often involve measures such as simplified credit application processes, subsidized loans, or training programs focused on financial literacy. A noteworthy example is the microfinance movement in various parts of the developing world, which provides small loans to entrepreneurs in underserved communities, often without traditional credit checks.

The impact of such policies on economic growth and poverty reduction is a subject of ongoing research.

Impact of Credit Scoring on Voter Turnout

Studies suggest that credit scoring systems, or the perceived threat of their use in political processes, might influence voter turnout. In certain countries, the potential for credit scores to be used as a factor in political campaigns or in determining access to public services could potentially discourage some citizens from participating in the electoral process. However, the exact nature and extent of this influence are complex and subject to various contextual factors.

Criticisms of Credit Scoring Systems

Several credit scoring systems have faced criticism for their inherent biases. These biases can stem from factors such as the data used in the scoring models, the way the models are constructed, or the lack of transparency in the scoring process. For example, credit scoring systems may disproportionately disadvantage certain racial or ethnic groups due to historical or systemic economic disparities.

This can perpetuate existing inequalities and limit access to credit for marginalized communities.

Strong credit scores are vital for a healthy economy and a functioning democracy. A strong financial foundation for individuals and communities is crucial. This directly connects to environmental justice, as seen in the important earth day environmental justice essay. Issues like access to clean water and sustainable living are deeply intertwined with economic stability and equitable opportunities, and ultimately, healthy credit scores.

Therefore, policies that support environmental justice are fundamentally crucial for a healthy economy and democracy.

Strengths and Weaknesses of Different Credit Scoring Methodologies

Different credit scoring methodologies possess varying strengths and weaknesses. A comparative analysis reveals that some methodologies might prioritize factors that are more relevant to certain segments of the population, while others may be more susceptible to biases.

| Scoring Methodology | Strengths | Weaknesses |

|---|---|---|

| Experiential-based scoring | Often incorporates a wider range of data points, including employment history and payment patterns, which can provide a more holistic view of a borrower’s risk. | Can be subjective and prone to interpretation errors; potential for biases to be introduced through the scoring model. |

| Algorithmic-based scoring | Offers the potential for consistent application and reduces subjective interpretation, making it potentially more objective. | Can perpetuate existing biases in the data used for training, leading to unfair outcomes for certain groups; lack of transparency may lead to distrust and resistance. |

Future Trends and Potential Implications

The future of credit scoring is intertwined with technological advancements, potentially reshaping the economic landscape and democratic processes. As data analysis capabilities expand, and artificial intelligence (AI) becomes more sophisticated, the ways in which credit scores are calculated and used are likely to undergo significant transformations. Understanding these potential developments is crucial to anticipating and mitigating any negative consequences that may arise.

Potential Developments in Credit Scoring Technologies

Credit scoring systems are constantly evolving, incorporating new data points and employing more sophisticated algorithms. Machine learning and AI are driving this evolution, allowing for increasingly complex analyses of vast datasets. This leads to potentially more accurate assessments of creditworthiness, but also introduces the risk of exacerbating existing biases or creating new ones. The increasing reliance on alternative data sources, such as social media activity or online behavior, further complicates the picture, raising concerns about privacy and fairness.

Impact on the Economy and Democracy

Technological advancements in credit scoring can significantly impact the economy. For instance, more precise credit assessments might lead to more efficient lending practices, potentially stimulating economic growth. However, a system overly reliant on automated scoring could disadvantage vulnerable populations, potentially widening economic inequality. The potential for misuse in influencing public opinion, especially in democratic processes, is another serious concern.

AI’s Role in Credit Scoring Bias

AI algorithms, while capable of identifying patterns in data, can also perpetuate or amplify existing biases present in the datasets they are trained on. If historical credit data reflects societal inequalities, the AI system might reproduce these inequalities in its assessments, potentially leading to discriminatory outcomes. To mitigate this risk, careful selection and curation of training data, as well as ongoing monitoring and evaluation of AI models, are essential.

Robust oversight mechanisms and transparent data protocols are necessary to prevent AI from exacerbating biases.

Mitigation Policies for Negative Consequences

Implementing policies to mitigate potential negative consequences of future trends in credit scoring is crucial. These policies should prioritize fairness, transparency, and accountability in credit scoring systems. Strict regulations on data collection and usage, along with independent audits of algorithms, are essential. Furthermore, educational initiatives to enhance financial literacy and empower individuals to navigate the credit system can be instrumental.

Consideration should also be given to alternative credit assessment methods that are less susceptible to bias.

Projected Future Use of Credit Information

| Sector | Projected Future Use of Credit Information |

|---|---|

| Financial Institutions | More sophisticated risk assessment for loans, investments, and insurance products. |

| Retail and E-commerce | Personalized pricing, targeted marketing campaigns, and credit-based discounts. |

| Government Agencies | Assessing eligibility for social programs, evaluating risk in public projects, and potentially influencing public opinion. |

| Healthcare | Determining eligibility for healthcare plans, assessing risk for insurance claims. |

This table highlights potential future applications of credit information.

Misuse of Credit Scoring to Influence Public Opinion

The potential misuse of credit scoring to influence public opinion is a significant concern. Credit information could be leveraged to create targeted marketing campaigns, potentially shaping public perception of certain candidates or policies. This raises questions about the integrity of democratic processes and the potential for manipulation. Transparent disclosure requirements and regulations to prevent the exploitation of credit information in political contexts are essential.

Epilogue

In conclusion, credit scores play a significant role in shaping economic and democratic landscapes. Their impact on everything from consumer spending to political participation underscores the importance of equitable and transparent systems. Addressing potential biases and promoting responsible credit management are essential for a healthy economy and a thriving democracy. The future of credit scoring hinges on our ability to harness its potential while mitigating its risks.