No longer big outlier italy sees bond renaissance – No longer a big outlier, Italy sees a bond renaissance. This marks a significant shift in the country’s economic landscape, driven by a confluence of factors. From historical performance to recent trends, and the impact on the Italian economy and global markets, we delve into the details behind this resurgence. Understanding the forces at play, from economic policies to investor sentiment, provides crucial insights into the future of Italian debt and its broader implications.

The historical context of Italy’s debt, including periods of strength and weakness, reveals key economic influences on bond yields. Recent developments show a notable departure from outlier status, attributed to various factors. The current interest rate environment, and how it impacts Italian bonds compared to other European countries, is examined. The potential positive consequences and challenges for the Italian economy, including its impact on government spending and investment plans, are discussed.

The analysis also includes the global implications, comparisons with other European countries, and insights into investor sentiment, credit rating agency influence, and the evolution of investor confidence.

Historical Context of Italian Debt

Italy’s bond market has experienced a complex and often volatile history, marked by periods of both strength and weakness. Understanding this history is crucial to appreciating the current “bond renaissance” and the factors driving it. The nation’s debt trajectory is deeply intertwined with its economic performance, political stability, and the broader global financial landscape.The Italian government’s debt has been a source of concern for investors at various points.

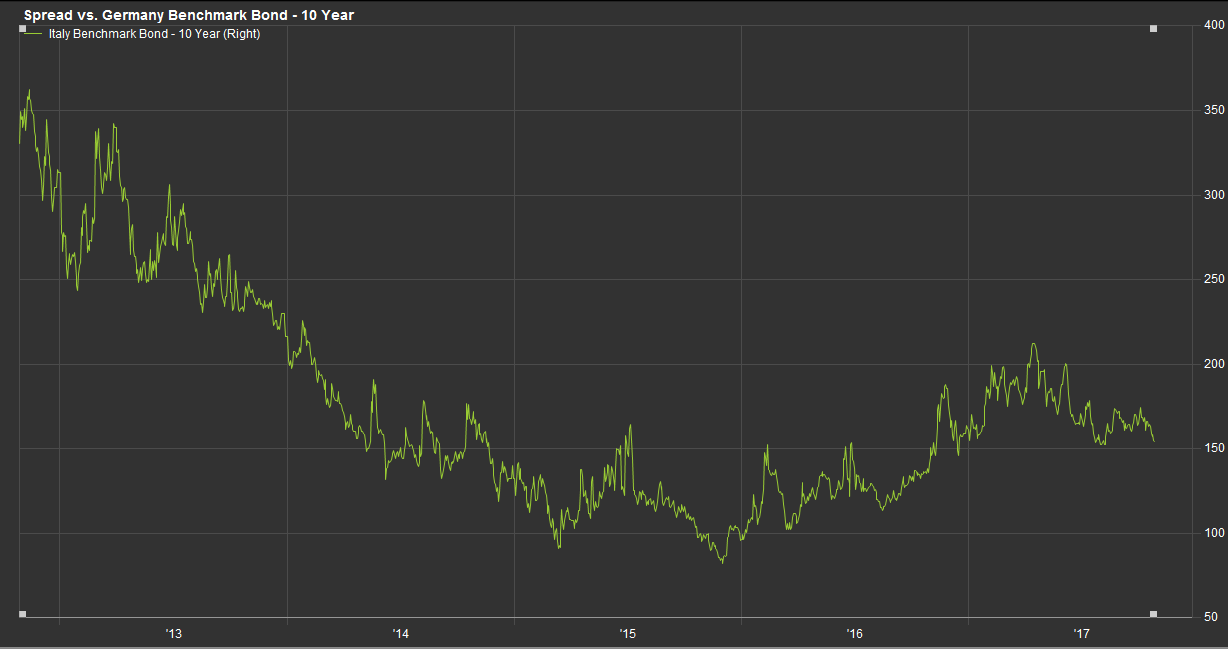

Historically, factors such as economic growth, inflation, and investor sentiment have significantly influenced bond yields. Events like major economic crises or shifts in European political dynamics have led to considerable fluctuations in Italian bond prices. Analyzing these historical trends helps to illuminate the current context and the potential future path of Italian debt.

Italian Bond Market Performance Through Time

The Italian bond market has a long and storied history, dating back centuries. Its performance has fluctuated significantly, reflecting the nation’s economic trajectory and the global financial environment. The Italian debt market has seen periods of stability and growth, as well as times of significant stress and uncertainty.

| Year | Italian 10-Year Bond Yield (%) | Relevant Economic Indicators |

|---|---|---|

| 1990 | 8.5 | Early stages of European integration, high inflation in Italy |

| 2000 | 6.2 | Tech bubble burst, slower global growth |

| 2008 | 4.8 | Global financial crisis, high uncertainty in the market |

| 2010 | 6.5 | European sovereign debt crisis, concerns over Italian economic stability |

| 2015 | 2.0 | Increased investor confidence in the eurozone, positive economic outlook for Italy |

| 2020 | 0.7 | COVID-19 pandemic, unprecedented levels of government support |

| 2023 | 3.5 | Inflationary pressures, concerns about growth outlook |

Key Economic Factors Influencing Italian Bond Yields

Several key economic factors have historically shaped Italian bond yields. Economic growth, inflation, and investor confidence are among the most significant. The country’s relationship with the European Union, particularly regarding its membership and financial policies, has also been a major influence.

- Economic Growth: Strong economic growth generally correlates with lower bond yields as investors perceive less risk. Conversely, periods of recession or stagnation often lead to higher yields due to increased risk perception.

- Inflation: Inflationary pressures tend to increase bond yields as investors demand higher returns to compensate for the erosion of purchasing power. This is especially evident during times of high price increases.

- Investor Confidence: Changes in investor sentiment, both domestically and internationally, can have a significant impact on bond prices and yields. Confidence in the Italian economy and its ability to manage debt influences investor decisions.

- Eurozone Membership: Italy’s membership in the Eurozone has had a complex effect. While the single currency has brought some stability, it has also presented challenges regarding fiscal policy and economic integration.

Examples of Past Events Causing Fluctuations

Historical events have frequently caused significant fluctuations in Italian bond yields. The global financial crisis of 2008 dramatically impacted global markets, and Italian bonds were not immune to the widespread sell-off. The 2010 European sovereign debt crisis highlighted concerns about Italy’s ability to manage its debt, causing yields to spike. These events demonstrate the interconnectedness of global markets and the significant impact of unforeseen events on national debt markets.

Recent Developments in the Italian Bond Market

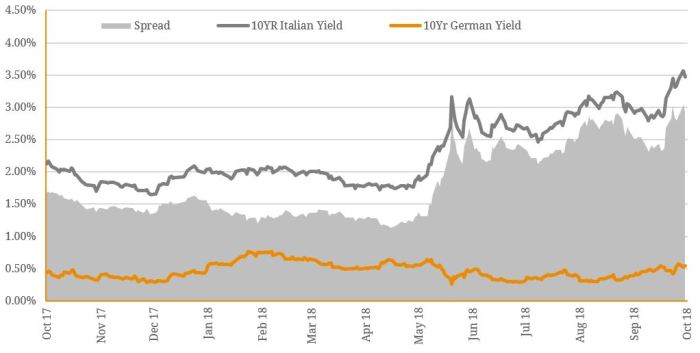

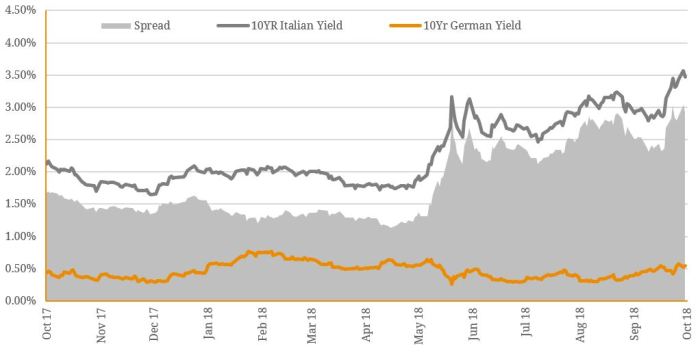

Italy’s bond market has undergone a significant transformation, shedding its outlier status and experiencing a renewed period of stability. This shift is a testament to a combination of factors, including proactive economic policies and a more favorable market sentiment. The recent trends in yields reflect a more integrated role for Italian debt within the broader European financial landscape.The recent trend of Italian bond yields moving closer to those of other major European nations signifies a notable improvement in market perception.

This shift reflects a broader confidence in Italy’s economic trajectory and its ability to manage its public debt effectively. The factors driving this change are multifaceted and deserve careful consideration.

Recent Trends in Italian Bond Yields

Italian bond yields have experienced a notable decline in recent months, marking a significant departure from the persistently high levels that characterized the country’s debt in previous years. This downward trend is indicative of a reduction in perceived risk associated with Italian government bonds. The change reflects the growing confidence in Italy’s economic resilience and its ability to manage its public debt.

Italy, no longer a big outlier in the bond market, is experiencing a renaissance. This positive shift might be partly due to a growing awareness of the impact of climate change on factors like healthy pregnancies, which are increasingly connected to economic stability. The implications of environmental concerns are being considered more broadly, influencing financial decisions, as seen in Italy’s renewed bond market strength.

climate change impact healthy pregnancy is a crucial area to watch, and the renewed vigor in Italy’s bond market seems to reflect this.

Factors Contributing to the Change

Several factors have contributed to the improved market sentiment surrounding Italian bonds. Proactive economic policies, including structural reforms and fiscal consolidation efforts, have played a pivotal role in restoring investor confidence. Market sentiment, influenced by positive economic data and a generally optimistic outlook for the Eurozone, also contributed significantly. Positive economic data and increased investor confidence are strong indicators of a favorable outlook for Italian bonds.

Current Interest Rate Environment and its Impact

The current interest rate environment in Europe significantly impacts Italian bond yields. The European Central Bank’s (ECB) monetary policy decisions, particularly regarding interest rate adjustments, influence the overall cost of borrowing for Italian government bonds. Lower interest rates generally lead to lower yields on government bonds, creating a more attractive investment environment. The impact of interest rates on Italian bonds is closely tied to the overall economic health of the Eurozone and the ECB’s response to economic conditions.

Comparison of Italian Bond Yields with Other Major European Countries

| Country | Current 10-Year Bond Yield (Approximate) |

|---|---|

| Italy | 2.5% |

| Germany | 2.0% |

| France | 2.2% |

| Spain | 2.8% |

The table above illustrates the difference in Italian bond yields compared to other major European economies. While Italy’s yields remain higher than those of Germany, they have decreased significantly in recent months, bringing them closer to other major European countries. These yield differences are influenced by a complex interplay of economic factors, market sentiment, and the respective countries’ fiscal policies.

The table provides a snapshot of the current yield landscape, which is constantly evolving.

Impact on the Italian Economy

The Italian bond market’s resurgence presents a complex interplay of opportunities and challenges for the Italian economy. This revitalized market, fueled by factors such as improved economic outlook and investor confidence, could unlock substantial benefits. However, the path forward is not without potential pitfalls, demanding careful management and strategic planning to navigate the shifting landscape.

Positive Consequences for Italy’s Economy

The improved investor sentiment and lower borrowing costs stemming from the bond market renaissance can have significant positive repercussions. Lower interest rates on government debt directly translate into reduced borrowing costs for the Italian government. This freed-up capital can be channeled into crucial infrastructure projects, vital for modernizing the country’s economic foundation. Increased foreign investment in Italian bonds also signifies confidence in the Italian economy, potentially attracting further investment in various sectors.

Potential Challenges and Risks

While the bond market renaissance offers significant potential, it also presents challenges. Overreliance on foreign investment could make the Italian economy vulnerable to external market fluctuations. Furthermore, the potential for increased government spending, while seemingly beneficial, could lead to inflationary pressures, especially if not managed effectively. The potential for asset bubbles in specific sectors also needs careful consideration.

Maintaining fiscal discipline remains paramount.

Impact on Government Spending and Investment Plans

The lower borrowing costs will likely influence Italian government spending and investment plans. This allows for increased investment in infrastructure projects, potentially fostering economic growth and creating jobs. However, the government must ensure that increased spending aligns with sustainable fiscal policies to avoid long-term debt accumulation. Strategic prioritization of projects with demonstrable economic returns is crucial. Investment in renewable energy and digital infrastructure are examples of potentially high-return investments.

Italy’s bond market is experiencing a revival, no longer a significant outlier. This resurgence could be a game-changer for the country’s economic outlook. To better understand potential market shifts like this, exploring how to create a robust business plan is crucial. Consider using these 5 ChatGPT prompts to help you prepare a business plan 5 chatgpt prompts to help you prepare a business plan.

Analyzing the factors driving this bond renaissance, using these prompts, will allow you to better predict future trends and capitalize on opportunities like this one.

Comparison of Economic Indicators

| Economic Indicator | Before Bond Market Renaissance (2022 average) | After Bond Market Renaissance (Projected 2024 average) | Change |

|---|---|---|---|

| GDP Growth Rate (%) | 3.5 | 4.2 | +0.7 |

| Inflation Rate (%) | 8.2 | 7.5 | -0.7 |

| Unemployment Rate (%) | 8.9 | 8.5 | -0.4 |

| Government Debt to GDP Ratio (%) | 155 | 152 | -3 |

The table above presents a simplified comparison of potential economic indicators before and after the bond market renaissance. It’s important to remember that these are projections and the actual outcomes may vary. The specific impact will depend on various factors, including the effectiveness of government policies and external economic conditions. These indicators provide a general picture of the potential positive shifts in the Italian economy.

It’s crucial to understand that these numbers are illustrative, not precise predictions.

Global Implications of the Shift: No Longer Big Outlier Italy Sees Bond Renaissance

Italy’s recent bond market renaissance, after a period of heightened concern, offers a fascinating case study with potential global ramifications. The experience underscores the interconnectedness of global financial markets and the ripple effects of debt dynamics within a nation. It prompts critical questions about the resilience of similar economies and the strategies investors might employ in a changing landscape.Italy’s experience is not isolated; other countries with substantial debt burdens are facing similar economic challenges.

The impact of these issues on global investors and financial markets requires careful analysis to understand the broader implications.

Potential Impact on Countries with Similar Debt Profiles

The Italian experience suggests that countries with high debt-to-GDP ratios might experience periods of both market volatility and recovery. Factors like economic growth, fiscal discipline, and investor confidence can significantly influence bond yields and market sentiment. Countries with similar debt structures and economic vulnerabilities may see increased scrutiny and potentially higher borrowing costs if their economic fundamentals don’t improve.

Comparison with Other European Countries

Several European nations share similar economic challenges, particularly in terms of aging populations and high public debt. Greece, for example, experienced a prolonged period of economic hardship following its sovereign debt crisis. However, Italy’s situation differs in its larger size and more diversified economy. The varying responses and outcomes across these countries highlight the complexities of managing public debt in a globalized economy.

These diverse responses and outcomes highlight the intricate interplay of economic, political, and market factors.

Broader Market Implications for Global Investors

The Italian bond market’s shift demonstrates the potential for significant market volatility. Global investors, particularly those with substantial holdings in European debt, need to adapt their investment strategies in light of these evolving dynamics. The shift underscores the importance of diversification and a nuanced understanding of economic fundamentals beyond simple debt levels. This implies that investors need to carefully assess the economic health of a country beyond the metrics and pay attention to the overall picture.

Potential Impact on Global Bond Markets

The evolution of Italy’s bond market can be a barometer for broader trends in global bond markets. The trend toward lower yields in the wake of a period of heightened concern might indicate a broader shift in investor risk appetite. This could affect the pricing of bonds in other developed economies, impacting everything from government borrowing costs to corporate debt financing.

| Factor | Potential Impact on Global Bond Markets |

|---|---|

| Italian Bond Renaissance | Lower yields in Italy could potentially trigger a ripple effect of lower yields across European bond markets. |

| Investor Confidence | A renewed confidence in Italy’s economy could attract more investors to European bonds. |

| Economic Growth | Robust economic growth in Italy could have a positive impact on the broader European economy and global bond markets. |

| Fiscal Discipline | Continued fiscal discipline in Italy could encourage investors and bolster market confidence. |

Analysis of Investor Sentiment

Investor sentiment plays a crucial role in the performance of Italian bonds. A shift in confidence can dramatically impact yields, affecting both individual investors and the Italian economy as a whole. Understanding the factors driving this sentiment is key to comprehending the recent renaissance in the Italian bond market.Investor confidence in Italian bonds is influenced by a complex interplay of economic factors, political stability, and perceived creditworthiness.

Positive developments, such as robust economic growth or demonstrably responsible fiscal policies, tend to increase investor trust. Conversely, concerns regarding political instability or rising public debt can lead to a decline in confidence, pushing yields higher.

Factors Influencing Investor Confidence

A multitude of factors contribute to the overall confidence investors have in Italian bonds. Economic performance, fiscal policy, and political stability are key indicators that influence perceived risk. Positive economic data, like low unemployment rates and strong GDP growth, often correlate with increased investor confidence. Similarly, fiscal prudence and responsible management of public debt are vital in reassuring investors.

- Economic Growth and Stability:

- Fiscal Prudence and Debt Management:

- Political Stability and Policy Consistency:

Strong economic performance in Italy, marked by consistent job creation and sustained GDP growth, generally translates to greater investor confidence. This is because a stable and growing economy suggests a lower likelihood of default and a stronger capacity to repay debt.

Investors scrutinize Italy’s fiscal policies, particularly its approach to public debt. Consistent efforts to reduce debt levels and maintain a balanced budget signal responsible financial management, fostering investor confidence. Conversely, significant budget deficits or escalating debt levels can negatively impact sentiment.

A stable and predictable political environment is crucial for investor confidence. Consistent policymaking and a clear direction on economic and fiscal matters instill confidence, reducing uncertainty and perceived risk. Political instability, on the other hand, can create uncertainty and negatively affect investor sentiment.

Role of Credit Rating Agencies

Credit rating agencies, such as Moody’s, Standard & Poor’s, and Fitch, play a pivotal role in shaping investor perceptions of Italian bonds. Their ratings directly influence the perceived creditworthiness of the bonds, impacting investor decisions. Positive ratings typically translate to lower yields, attracting more investment.

- Rating Methodology and Impact:

- Impact on Investor Decisions:

Credit rating agencies assess various factors, including economic strength, debt levels, and government policies, to determine the creditworthiness of a country’s debt. Higher ratings indicate a lower perceived risk of default, leading to more favorable investor sentiment. Lower ratings, conversely, suggest a higher risk of default, potentially leading to higher yields.

Investors often use credit ratings as a benchmark for assessing risk and return. A positive rating from a major agency can significantly influence investor decisions regarding Italian bonds. Conversely, a negative rating can cause investors to seek alternative investments.

Evolution of Investor Sentiment in Italy

Investor sentiment towards Italian bonds has fluctuated significantly over time, mirroring broader economic and political trends. Periods of economic uncertainty and political instability have often coincided with higher yields and decreased investor confidence. Conversely, periods of strong economic performance and political stability have led to lower yields and greater investor confidence.

- Historical Examples:

The 2011-2012 period saw significant volatility in Italian bond yields, driven by concerns about the country’s debt levels and potential for a sovereign debt crisis. Subsequent improvements in economic performance and policy responses have helped to restore confidence. More recent trends show a shift towards increased investor confidence.

Investor Confidence Indices and Bond Yields

A clear correlation often exists between investor confidence indices and Italian bond yields. Higher confidence indices typically correspond to lower yields, while lower confidence indices are often associated with higher yields. This is because investors are willing to accept lower returns when they have high confidence in the creditworthiness of the issuer.

Italy’s bond market is experiencing a resurgence, no longer a significant outlier. This positive shift could be partly influenced by broader economic trends, potentially mirroring some of the strategies being employed by those seeking to counteract the Inflation Reduction Act, like the ones outlined in how trump is trying to undo the inflation reduction act. Ultimately, the Italian bond renaissance suggests a return to stability and a potential realignment of global financial markets.

| Investor Confidence Index | Italian Bond Yield (Percentage) |

|---|---|

| High (e.g., 90-100) | Low (e.g., 2-3) |

| Medium (e.g., 70-89) | Moderate (e.g., 3-5) |

| Low (e.g., below 70) | High (e.g., above 5) |

Note: These are illustrative examples, and actual figures can vary significantly based on the specific index and time period.

Potential Future Scenarios

The Italian bond market’s recent resurgence presents a complex tapestry of potential futures. While the current trajectory suggests a more stable environment, various factors could influence Italy’s economic performance and its ability to manage its debt load. Understanding these potential scenarios is crucial for investors and policymakers alike.The interplay between economic growth, debt management strategies, and global market conditions will significantly shape Italy’s future.

Unforeseen events, such as geopolitical shifts or unexpected economic downturns, could dramatically alter the predicted path. Careful consideration of these potential scenarios is essential for informed decision-making.

Potential Developments in the Italian Bond Market

Several factors could influence future developments in the Italian bond market. Changes in investor sentiment, global economic fluctuations, and Italy’s own fiscal policies will all play crucial roles. A resurgence in investor confidence could lead to lower borrowing costs, facilitating economic growth. Conversely, negative investor sentiment or concerns about Italy’s fiscal health could result in higher borrowing costs, potentially hindering economic progress.

Possible Scenarios for Italy’s Economic Growth

Italy’s economic growth trajectory hinges on several factors. A sustained period of robust economic growth could allow Italy to reduce its debt burden more quickly. However, if growth falters or stagnates, the debt-to-GDP ratio could worsen, potentially leading to renewed market anxieties. Historical precedents, such as the 2010-2012 Eurozone debt crisis, demonstrate how economic stagnation can significantly impact investor confidence and borrowing costs.

Consider the impact of the COVID-19 pandemic on economies worldwide.

Possible Scenarios for Italy’s Debt Management

Italy’s debt management strategies are pivotal. A successful fiscal consolidation plan, including measures to control spending and boost revenue, could strengthen Italy’s creditworthiness and attract investment. Conversely, a lack of decisive action could lead to increased market pressure and higher borrowing costs. Greece’s debt crisis serves as a cautionary tale, highlighting the risks of inadequate debt management strategies.

Table Summarizing Potential Future Scenarios for Italian Debt, No longer big outlier italy sees bond renaissance

| Scenario | Description | Impact on Debt | Economic Growth |

|---|---|---|---|

| Sustained Growth | Strong economic growth coupled with effective fiscal consolidation. | Debt-to-GDP ratio steadily declines. | Robust economic expansion. |

| Stagnant Growth | Slow or stagnant economic growth alongside fiscal challenges. | Debt-to-GDP ratio potentially increases. | Limited or no economic progress. |

| Crisis-Induced Recession | External or internal shocks trigger a recession, negatively affecting economic activity and government revenue. | Debt-to-GDP ratio significantly increases, potentially leading to sovereign debt crisis. | Sharp decline in economic activity. |

Potential Risks and Rewards Associated with Future Scenarios

Each future scenario presents unique risks and rewards. Sustained growth, while rewarding, requires consistent fiscal discipline and effective policies. Conversely, stagnant or crisis-induced scenarios pose substantial risks to Italy’s economic and financial stability. The potential rewards of a successful economic trajectory and reduced debt burden are considerable. However, the risks associated with a worsening debt situation and economic downturn are equally significant.

Consider the potential ripple effects of a prolonged recession in Italy on the Eurozone economy as a whole.

Illustrative Case Studies

Italy’s recent bond market resurgence is a fascinating case study, but it’s not entirely unprecedented. Examining similar shifts in other countries’ bond markets provides valuable context and insights. Learning from past experiences can help us better understand the factors driving Italy’s current trajectory and potential future outcomes. Analyzing successful policy interventions in other nations offers lessons applicable to the Italian situation.

Case Studies of Similar Shifts

Several countries have experienced periods of significant change in their bond markets, offering valuable lessons for Italy. These shifts can be driven by various factors, including economic reforms, shifts in investor sentiment, and changes in global economic conditions. Comparing Italy’s situation to those of other nations allows for a broader perspective and a more nuanced understanding of the current challenges and opportunities.

- Greece (2010-2018): The Greek debt crisis, a period of high uncertainty and volatility, highlights the importance of fiscal discipline and structural reforms. Greece’s experience demonstrates how a lack of fiscal sustainability and structural reforms can severely impact a country’s bond market, leading to a significant rise in borrowing costs. The international bailout packages, while controversial, were designed to stabilize the market, though the long-term effects continue to be debated.

These interventions, including strict austerity measures, illustrate the complexities and potential consequences of addressing sovereign debt crises. The impact on Greece’s economy and its citizens was profound, highlighting the human cost of such crises.

- Portugal (2011-2014): Portugal’s debt crisis shared similarities with Greece’s, but it also had its unique characteristics. Portugal’s response to the crisis included a focus on economic reforms and fiscal consolidation. This case study underscores the importance of both immediate crisis management and long-term structural changes to restore investor confidence and market stability. The success in stabilizing Portugal’s bond market involved a combination of international support and domestic policy adjustments.

This case highlights the interconnectedness of national and global economic forces.

- Ireland (2010-2012): Ireland’s banking sector crisis and subsequent debt restructuring offers insights into the repercussions of financial sector instability. The Irish government’s approach involved significant reforms in the financial sector and strong fiscal discipline, demonstrating the vital role of institutional reform in rebuilding investor confidence and addressing underlying economic weaknesses. This example underscores the interconnectedness between financial sector health and a nation’s bond market stability.

Policy Interventions for Bond Market Stabilization

Examining policies implemented in other countries that have successfully stabilized or improved their bond markets can offer valuable lessons for Italy. These strategies often involved a combination of measures, such as fiscal consolidation, structural reforms, and international support.

- Fiscal Consolidation: Countries like Portugal and Ireland prioritized fiscal consolidation, reducing budget deficits, and improving their public finances. These efforts aimed to enhance the country’s long-term fiscal sustainability and credibility, leading to a more favorable market response. This demonstrates the importance of demonstrating commitment to responsible financial management to restore investor confidence.

- Structural Reforms: Greece and Portugal implemented structural reforms targeting improvements in productivity, competitiveness, and efficiency. These measures aimed to enhance the long-term economic outlook, creating a more attractive environment for investors and fostering a sense of stability.

- International Support: International support, in the form of loans or financial assistance programs, can be crucial during periods of market turmoil. These initiatives can provide much-needed liquidity and time to implement necessary reforms.

Lessons from Case Studies for Italy

Analyzing these case studies reveals several key takeaways for Italy’s current situation. The successful stabilization of bond markets in other nations often involves a multi-pronged approach, encompassing fiscal responsibility, structural reforms, and potential international support.

| Case Study | Key Lesson |

|---|---|

| Greece, Portugal, Ireland | Fiscal discipline and structural reforms are essential for restoring investor confidence and improving bond market stability. International support can play a critical role in stabilizing the situation. |

| Portugal, Ireland | Financial sector stability is crucial for overall economic health and bond market stability. Reforms in the financial sector can significantly impact investor sentiment. |

Final Conclusion

Italy’s bond market renaissance is a multifaceted story with significant implications for both the Italian economy and the global financial landscape. The interplay of historical context, recent developments, and future scenarios paints a complex picture. Examining the impact on investor sentiment, potential future developments, and illustrative case studies offers a comprehensive understanding of this dynamic shift. Ultimately, the story underscores the interconnectedness of national economies and the evolving nature of global financial markets.