EU target Nord Stream Russian oil cap new sanctions package FT reports details the European Union’s escalating pressure on Russia. This new package aims to further isolate Russia economically, impacting energy supplies and potentially global markets. The EU’s actions, particularly concerning the Nord Stream pipeline and oil exports, are likely to spark significant repercussions, potentially leading to energy price fluctuations and geopolitical tensions.

The Financial Times (FT) reports on this complex issue, offering insights into the rationale behind the sanctions and their potential consequences.

The EU’s strategy appears to combine multiple approaches to curb Russian influence. Targeting Nord Stream pipelines seeks to cut off a crucial energy artery, while the oil cap aims to restrict Russia’s revenue. The new sanctions package likely includes various measures, from financial restrictions to export controls, further intensifying the pressure. The FT’s reporting contextualizes these developments, offering an in-depth analysis of the situation and potential ramifications.

The report likely considers various stakeholder perspectives, including Russia, European countries, and international organizations, to offer a comprehensive overview.

EU Target on Nord Stream

The EU’s stance on Russian energy, particularly regarding gas pipelines like Nord Stream, has evolved significantly over time. Initially, there was a reliance on Russian gas, seen as a relatively affordable and reliable energy source. However, this reliance has been increasingly questioned due to geopolitical considerations and concerns over energy security.

Historical Overview of EU’s Stance on Russian Energy

The EU’s relationship with Russian energy, specifically natural gas, has been characterized by a mix of economic incentives and geopolitical considerations. Historically, the low cost and substantial supply of Russian gas made it an attractive option for many European nations. However, the situation has become increasingly complex as geopolitical tensions have risen, impacting energy security concerns.

EU Rationale for Targeting Nord Stream

The EU’s rationale for targeting Nord Stream is multifaceted, stemming from a combination of security and political considerations. The Nord Stream pipelines, while providing a substantial supply of Russian gas to Europe, are perceived as a vulnerability in terms of energy security. The EU’s move is driven by concerns about Russia’s potential to weaponize energy supplies, as well as a broader desire to reduce reliance on a single supplier and diversify energy sources.

Furthermore, the EU seeks to punish Russia for its actions, in this case, the war in Ukraine. The move also aligns with the EU’s broader strategy to reduce its reliance on Russian energy sources.

Potential Impacts on Stakeholders

The EU’s actions regarding Nord Stream have far-reaching implications for various stakeholders. European consumers face potential price increases and supply disruptions. Energy companies are impacted by changing market conditions, and potential losses associated with investments in the pipeline. Russia faces a significant economic blow due to reduced revenue from energy exports.

Comparison of Past EU Actions and Their Effects on Russian Energy Exports

| EU Action | Effect on Russian Energy Exports |

|---|---|

| Sanctions on specific Russian entities involved in Nord Stream | Reduced revenue for those entities, impacting Russia’s overall energy exports. |

| Phasing out of Russian oil imports | Significant reduction in Russia’s oil export revenues. |

| Diversification of energy sources | Weakened Russia’s position as a primary energy supplier to Europe. |

| Increased investment in renewable energy sources | Long-term shift away from reliance on Russian energy. |

This table illustrates the historical trends in EU actions and their perceived impacts on Russian energy exports. It’s important to note that the actual impact can be complex and is influenced by many factors, including global market conditions and the reactions of other countries.

Russian Oil Cap

The EU’s proposed cap on Russian oil prices marks a significant escalation in efforts to curb Moscow’s revenue streams. This measure aims to limit the financial benefits Russia derives from its oil exports, potentially weakening its war effort and bolstering the global economy’s resilience against price shocks. The cap’s implementation, however, presents complex challenges and potential ramifications for both global energy markets and Russia’s economy.The proposed cap on Russian oil exports seeks to limit the price at which Russian oil can be sold internationally.

This price limit is intended to restrict the flow of revenue to the Russian government, thereby reducing its ability to fund its military operations. The specifics of the cap, including the exact price threshold, and the mechanisms for its enforcement, are still under negotiation and development. Various countries are involved in this process, adding complexity to the implementation.

Details of the Proposed Russian Oil Cap

The EU’s proposed cap on Russian oil prices is a complex mechanism aimed at curtailing Russian revenue from oil exports. The exact price limit is a key component still under negotiation and likely to be adjusted in response to market dynamics. The mechanism for enforcing the cap will also be critical; this may involve sanctions on entities that facilitate sales above the limit.

This could encompass shipping companies, insurers, and traders.

Potential Economic Consequences for Russia

A price cap on Russian oil will likely lead to a decrease in Russian oil exports, as buyers may seek alternative sources to avoid the cap. This reduced export volume will directly impact Russia’s revenue streams, significantly affecting its ability to fund its military operations and its broader economy. The impact could vary depending on the cap’s effectiveness and the degree to which other countries seek alternative suppliers.

Historical instances of trade restrictions on specific countries, such as those related to sanctions on Iran or Venezuela, provide examples of the potential for reduced export volumes and economic disruption.

Potential Impact on Global Oil Markets

The implementation of a price cap could influence global oil markets by affecting supply and demand dynamics. If Russian oil is less accessible, the global market might experience increased prices for oil from alternative sources. This could potentially affect countries heavily reliant on Russian oil imports, potentially increasing their energy costs. It’s crucial to note that global oil markets are influenced by many factors, including global demand, geopolitical events, and the overall health of the global economy.

A disruption in the supply of Russian oil could create a ripple effect, influencing prices for other commodities.

Alternative Strategies to Reduce Russian Oil Reliance

To mitigate the potential impact of the oil cap and to reduce reliance on Russian oil, countries could explore alternative energy sources, such as renewable energy, and increase domestic production. Diversification of energy sources and investments in infrastructure to support this diversification are crucial elements in a long-term strategy. The transition to renewable energy and increased domestic production will be gradual and require significant investment.

Comparison of the Effectiveness of this Oil Cap with Other Sanctions

The effectiveness of this oil cap will be contingent on several factors, including the cap’s level, the degree of compliance by participating countries, and the response from Russia. Other sanctions, like export restrictions on goods or services, have had varying levels of success in achieving their intended objectives. A comparison of sanctions requires an evaluation of their individual context, target, and impact, as the effectiveness can differ significantly.

Projected Oil Prices under Different Scenarios

| Scenario | Projected Oil Price (USD/barrel) | Rationale |

|---|---|---|

| Cap in Place | $80 – $90 | Reduced Russian supply leads to increased demand for other oil sources, driving prices up. |

| Cap Lifted | $70 – $80 | Increased Russian supply re-enters the market, easing demand pressures and potentially lowering prices. |

| Cap with Strong Enforcement | $90 – $100 | Strict adherence to the cap and limited Russian oil availability increase global demand and prices. |

New Sanctions Package: Eu Target Nord Stream Russian Oil Cap New Sanctions Package Ft Reports

The EU’s response to Russia’s aggression continues to evolve with the implementation of a new sanctions package. This package builds upon previous measures, aiming to further isolate Russia economically and limit its ability to fund its war effort. The new measures target various sectors and individuals, demonstrating a growing commitment to sustained pressure. The EU recognizes the complex interplay between sanctions and global economic stability, and the need for careful consideration of potential unintended consequences.The EU’s latest sanctions package represents a significant escalation in the pressure exerted on Russia.

It reflects a determination to maintain and strengthen the collective response to the ongoing conflict, while also attempting to mitigate potential economic disruptions beyond Russia’s borders. The package’s design considers various factors, including the potential for Russian retaliation, the need to minimize collateral damage, and the need to maintain unity amongst EU member states.

Components of the New Sanctions Package

The new sanctions package encompasses a range of measures targeting different aspects of the Russian economy. These measures include restrictions on specific sectors, such as advanced technology and finance, as well as asset freezes and travel bans for individuals deemed responsible for supporting the war effort. The aim is to cripple Russia’s ability to function at its current level, and to further isolate it from the global financial system.

Potential Loopholes and Vulnerabilities

Despite the comprehensive nature of the sanctions, potential loopholes and vulnerabilities remain. One key area of concern is the possibility of circumvention through alternative financial channels, including those operating in countries with less stringent regulations. Furthermore, the effectiveness of sanctions depends heavily on international cooperation, and any weaknesses in the enforcement mechanisms could allow Russia to find ways around the restrictions.

The sanctions must also account for the complex global financial system, as the sanctions may unintentionally harm or disrupt the global trade.

EU’s new sanctions package targeting Russian oil, potentially impacting the Nord Stream pipeline, is a big deal. However, this also highlights the ripple effects of global supply chain issues. For example, India’s Maruti Suzuki is reportedly cutting near-term EV production due to a rare earths crisis. This underscores how interconnected these global challenges are, making the EU’s oil cap strategy even more complicated.

Enforcement Mechanisms

The proposed mechanisms for enforcing the new sanctions include enhanced cooperation between EU member states and international partners. The EU will likely focus on strengthening information sharing and coordination among relevant agencies to identify and address violations. Further implementation relies on a robust system of financial monitoring and reporting to identify transactions that violate the sanctions regime. The effectiveness of the enforcement will depend on the resolve of all participating parties to adhere to the sanctions.

Potential Responses from Russia

Russia is expected to respond to the new sanctions package with a variety of countermeasures. These could include retaliatory sanctions against EU member states, further disruption of energy supplies, and potential efforts to weaken the global financial system by promoting alternative financial structures. The precise nature of Russia’s response will depend on the perceived severity and impact of the sanctions.

Historical examples show that sanctions often lead to various countermeasures, which are designed to mitigate the sanctions’ effects and to protect the country’s interests.

Comparison with Previous Sanctions Packages

The new sanctions package builds upon previous measures, expanding the scope of targeted sectors and individuals. Previous packages primarily focused on financial institutions and individuals associated with the Russian government. The latest package demonstrates a shift towards broader economic restrictions, aiming to cut off Russia’s access to vital resources and technologies. This new approach aims to disrupt Russia’s ability to operate at its current capacity.

Targets and Types of Sanctions in the New Package

| Target | Type of Sanctions |

|---|---|

| Russian defense industry | Export controls, restrictions on technology |

| Russian financial institutions | Asset freezes, transaction restrictions |

| Russian oligarchs and individuals | Travel bans, asset freezes |

| Russian energy sector | Price caps on oil and gas |

| Russian state-owned companies | Restrictions on investment, access to international markets |

FT Reports

Financial Times (FT) reporting on the EU’s actions regarding Nord Stream, Russian oil, and new sanctions packages provides crucial context for understanding the evolving geopolitical landscape. FT analyses often go beyond surface-level summaries, delving into the motivations, potential consequences, and economic implications of these decisions. Their reporting frequently features expert opinions and data analysis, offering a nuanced perspective on the intricate interplay of global politics and economics.

Significance of FT Reporting

The FT’s reporting is significant due to its reputation for in-depth, well-researched financial and business news. Their analyses often influence public perception and policy discussions, highlighting potential risks and opportunities related to the EU’s strategies. Their influence extends beyond the financial sector, affecting public discourse on energy security and international relations.

FT’s Perspective on EU Actions

The FT’s perspective on the EU’s actions is often characterized by a critical yet balanced approach. While acknowledging the EU’s stated goals of countering Russian aggression and promoting energy independence, the FT frequently examines the potential economic costs and unintended consequences of these policies. They may highlight the challenges faced by European businesses and consumers due to supply disruptions or price increases.

The FT’s analyses frequently consider the broader implications for global markets and the long-term effects of the EU’s policies.

Potential Influence on Public Opinion and Policy Decisions

The FT’s reporting can significantly impact public opinion and subsequent policy decisions. Their detailed analysis and expert commentary shape public discourse, informing public understanding of the complexities surrounding the EU’s sanctions and energy policies. Their articles can influence policymakers by presenting alternative viewpoints and highlighting potential trade-offs. For example, FT articles discussing the impact of sanctions on energy prices could sway public opinion toward policies that mitigate those consequences.

The EU’s targeting of Nord Stream and a new Russian oil cap, as reported by the FT, is definitely a big deal. It’s all about the ongoing sanctions, but it got me thinking about how these global events often intertwine with other things. For example, did you catch Nicole Scherzinger at the TIME100 gala? Nicole Scherzinger time100 gala was pretty spectacular, and that’s a complete aside, but you have to admit, it was a nice distraction from the ongoing political tension.

Still, the EU’s sanctions strategy remains a crucial topic, and the FT reports are always worth a read.

This influence is particularly evident in discussions concerning energy security and economic resilience.

Potential Biases in FT Reporting

While aiming for objectivity, any news organization, including the FT, can exhibit potential biases. The FT, as a major international financial publication, may lean towards a perspective that prioritizes market stability and economic efficiency. This may influence their coverage of the EU’s actions, potentially focusing on the financial aspects of sanctions or energy policies, rather than fully exploring all social and political dimensions.

The FT may also reflect a particular viewpoint on international relations, such as the importance of free markets or the role of international institutions.

Key Points from FT Reports, Eu target nord stream russian oil cap new sanctions package ft reports

The following points, derived from FT reports, illustrate the key aspects of the EU’s actions:

- The EU’s implementation of a price cap on Russian oil aimed to reduce revenue for Russia and limit its ability to finance the war in Ukraine.

- The implementation of the price cap is expected to affect global oil markets, impacting both supply and demand. Experts from the FT have analyzed the potential volatility of global oil prices.

- Concerns were raised about potential unintended consequences of the price cap, including disruptions to global supply chains and potential energy shortages in Europe.

- The FT reported on potential impacts on European economies, highlighting the need for alternative energy sources and potential economic hardship.

- The FT also reported on the geopolitical implications of the EU’s actions, analyzing the potential responses from Russia and other actors.

- FT articles have analyzed the effectiveness of the price cap, examining whether it has achieved its intended goals and discussing alternative strategies that could achieve similar results.

Interconnected Impacts

The EU’s coordinated actions targeting Nord Stream, Russian oil, and implementing new sanctions represent a significant escalation in the geopolitical response to the ongoing conflict. These measures are deeply intertwined, aiming to cripple Russia’s economy and influence its war effort. However, the consequences extend far beyond Europe’s borders, potentially reshaping global energy markets and impacting international relations.The interconnected nature of these sanctions is crucial.

Restricting Russian oil imports is not a standalone measure; it’s directly linked to the broader sanctions regime and the desire to isolate Russia economically. The effects of these actions will ripple across various sectors, from energy markets to global trade, and are likely to produce unforeseen consequences.

Interconnectedness of EU Actions

The EU’s strategy reflects a deliberate attempt to weaken Russia’s ability to fund its war machine. The Nord Stream pipeline disruption, intended to impede Russian energy exports, is coupled with a cap on Russian oil prices, aiming to reduce Moscow’s revenue. These measures are reinforced by a broader package of sanctions that target various sectors of the Russian economy.

This coordinated approach seeks to maximize the impact on Russia while minimizing the economic harm to European countries.

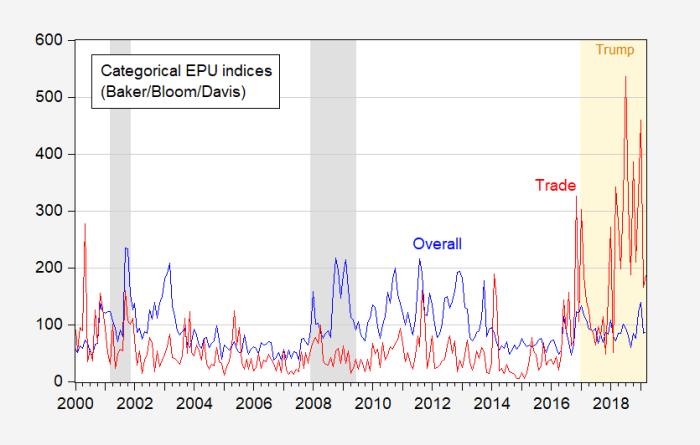

EU’s targeting of Nord Stream Russian oil with a new sanctions package, as reported by the FT, is likely to exacerbate existing economic uncertainty. This new move adds to the already challenging global economic climate, with tariffs and potential recessionary pressures looming large. The interplay between these factors and the EU’s sanctions strategy is complex, and its long-term effects on the global energy market remain to be seen, potentially impacting the global economy in ways we are only beginning to understand, as explored in more detail in this piece on economic uncertainty tariffs recession.

This new EU initiative will undoubtedly influence the global energy landscape further.

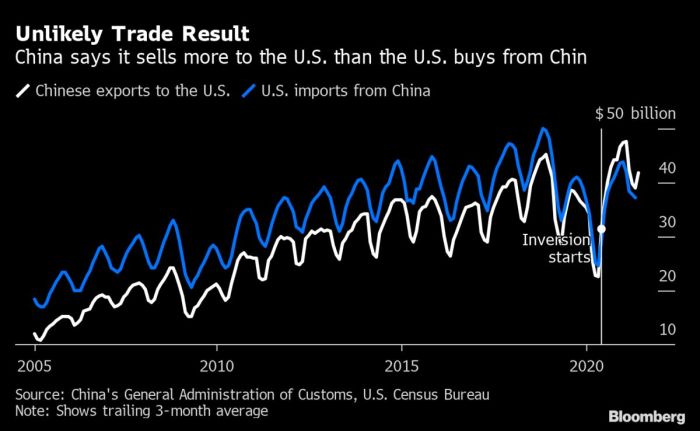

Influence on Global Energy Markets

The EU’s actions will likely cause significant volatility in global energy markets. The reduction in Russian oil supply, coupled with the price cap, could lead to increased demand for alternative energy sources, potentially driving up prices in the short term. The impact will vary across different regions depending on their reliance on Russian oil and their ability to secure alternative energy sources.

For example, countries heavily dependent on Russian gas imports might face substantial disruptions to their energy supply chains, and their energy costs could increase substantially.

Ripple Effects on Other Countries and Regions

The EU’s actions are not confined to Europe. The measures will have profound ripple effects on other countries and regions. Developing nations heavily reliant on Russian oil imports may face severe economic hardship due to price increases. Furthermore, the potential for supply chain disruptions, inflation, and political instability in affected regions is significant. For example, countries in Africa or Southeast Asia, which are significant importers of Russian oil, may see a spike in fuel prices, affecting transportation costs and food security.

Potential for International Cooperation or Conflict

The EU’s actions might foster international cooperation or escalate tensions, depending on the response from other countries. Some countries might support the EU’s initiative, potentially leading to a unified front against Russia. However, other nations might resist the sanctions, fearing economic repercussions or geopolitical instability. For instance, countries that maintain close economic ties with Russia might retaliate, potentially leading to trade wars or other forms of conflict.

Visual Representation (Interconnected Impacts Diagram)

The diagram would show the EU actions (e.g., sanctions, oil cap) at the top, branching down to the impacts on global energy markets (e.g., price volatility, alternative source demand). Further branches would illustrate the ripple effects on other countries (e.g., economic hardship, political instability), and the possibility of international cooperation or conflict. A visual representation of this kind would help to grasp the complex interactions between the different elements.

Alternative Perspectives

The EU’s multifaceted approach to countering Russian aggression, encompassing sanctions, energy diversification, and support for Ukraine, has sparked a range of responses and analyses. While the stated aims are clear, alternative viewpoints highlight potential pitfalls and offer contrasting strategies. These perspectives often center on the complex interplay of geopolitical realities and economic ramifications, prompting critical examination of the EU’s choices.Examining these alternative viewpoints provides valuable context for understanding the broader implications of the EU’s actions and potential unintended consequences.

This exploration also sheds light on the diverse stakeholder perspectives and the role of international organizations in navigating this intricate geopolitical landscape.

Alternative Strategies for the EU

The EU’s approach to sanctions and energy security is not universally lauded. Alternative strategies often emphasize different priorities and approaches. Some contend that a more focused approach, tailored to specific Russian vulnerabilities, might prove more effective. Others advocate for a greater emphasis on diplomatic engagement, exploring avenues for de-escalation and dialogue. A nuanced understanding of these alternative strategies is crucial to evaluating the long-term effectiveness of the EU’s current course.

Unintended Consequences of the EU’s Measures

The EU’s sanctions and oil cap policies, while aimed at isolating Russia, could also have unforeseen economic repercussions. For instance, energy price spikes might disproportionately affect vulnerable populations in EU member states. The disruption of global supply chains could lead to shortages and inflationary pressures, affecting consumers and businesses alike. These are important considerations when evaluating the full spectrum of potential outcomes.

Stakeholder Perspectives: Russia, EU Members, and Oil Companies

Different stakeholders hold contrasting viewpoints regarding the EU’s actions. Russia views the sanctions as hostile and retaliates with measures aimed at minimizing the impact on its economy. EU member states face economic pressures stemming from higher energy costs and supply chain disruptions. Oil companies are caught in the crossfire, facing the challenge of adjusting to new market realities and potentially incurring financial losses.

Role of International Organizations

International organizations, like the IMF and the UN, play a crucial role in mediating and managing the impacts of the crisis. Their contributions include providing financial assistance to affected nations, coordinating humanitarian aid, and promoting dialogue between conflicting parties.

Contrasting EU Approaches with Alternative Strategies

| Feature | EU Approach | Alternative Strategies (e.g., Diplomatic Engagement) |

|---|---|---|

| Primary Goal | Isolate Russia, support Ukraine | De-escalate tensions, find common ground |

| Focus | Sanctions, energy restrictions | Diplomacy, negotiation, international cooperation |

| Potential Outcomes | Economic disruption, energy price hikes, geopolitical instability | Potential for de-escalation, but slower progress, possible compromises |

| Risk Assessment | High risk of unintended consequences | Higher risk of failure to achieve rapid results |

Closing Summary

In conclusion, the EU’s multifaceted approach to sanctioning Russia, detailed in FT reports, highlights the complex interplay between energy, economics, and geopolitics. The consequences of these actions extend beyond the immediate impact on Russia and the EU, potentially influencing global energy markets and international relations. The interconnectedness of these measures warrants close observation, as potential ripple effects and unintended consequences could reshape the global energy landscape.