Moelis CEO designate joins Wall Street signaling dealmaking rebound after tariff, setting the stage for an intriguing analysis of the financial markets. This transition within Moelis, a prominent investment bank, coincides with a potential resurgence in dealmaking activity. The appointment of a new CEO, coupled with broader market trends, presents a compelling case study for the current economic climate, particularly the impact of tariffs on global trade and investment.

The new CEO’s background and experience, compared to the previous leader, will likely shape Moelis’s future strategy and culture. This change offers a chance to explore the potential impact on the firm’s performance, including how the new leadership might influence dealmaking and the overall market response. The article also analyzes the factors behind the dealmaking rebound and examines the effects of tariffs on various industries, providing valuable insight into the current economic outlook.

Executive Leadership Transition

Moelis & Company’s recent announcement of a CEO designate signals a significant shift in leadership and potentially a new chapter for the investment bank. This transition comes amidst a period of evolving market dynamics and a reported rebound in dealmaking activity after the previous period of economic uncertainty. The appointment suggests a planned succession process and a commitment to maintaining the firm’s competitive edge in a dynamic financial landscape.The appointment of a new CEO designate underscores the importance of strategic succession planning for maintaining institutional continuity and adapting to shifting market demands.

It’s a testament to Moelis’s commitment to a smooth leadership transition, which will be crucial for preserving the firm’s reputation and client relationships.

CEO Designate’s Background and Experience

The newly appointed CEO designate brings a wealth of experience in investment banking, having spent [Number] years at [Previous Firm]. Their background encompasses a deep understanding of [Specific Industry/Sector], with notable achievements in [Specific Area of Expertise]. This expertise is expected to be valuable in navigating the current market conditions and propelling the firm forward. Their prior role at [Previous Firm] positioned them to develop key skills in [Specific Skills].

Potential Impact on Moelis’s Culture and Strategy

The new leadership could potentially influence the firm’s culture by introducing fresh perspectives and approaches. This could lead to a more [Specific description of the new style] approach to client relations and strategic decision-making. Simultaneously, the new leader’s understanding of [Specific Industry/Sector] could enhance the firm’s strategic focus in that area.

Comparison of Leadership Styles

The previous CEO’s leadership style, characterized by [Describe previous CEO’s style], may contrast with the designate’s anticipated approach, which is projected to be more [Describe designate’s projected style]. These differing approaches could impact the firm’s internal dynamics and its external image. A comparison of past performance data and press releases regarding the previous leadership will help analyze and forecast the potential impact.

Motivations Behind the Transition

The motivations behind this leadership transition could include a desire for [Desired outcome 1], a need to [Desired outcome 2], or a strategic alignment with [Desired outcome 3]. This transition may reflect a broader industry trend of succession planning, driven by factors like generational shifts and evolving leadership preferences.

Timeline of the Transition Process

The transition timeline is crucial for maintaining operational continuity. The process is expected to unfold over [Number] months, with key milestones including [Milestone 1], [Milestone 2], and [Milestone 3]. This structured approach will ensure a smooth handover of responsibilities and minimize disruptions.

Key Accomplishments and Professional Milestones

| Year | Accomplishment/Milestone |

|---|---|

| [Year 1] | [Specific Accomplishment/Milestone] |

| [Year 2] | [Specific Accomplishment/Milestone] |

| [Year 3] | [Specific Accomplishment/Milestone] |

| [Year 4] | [Specific Accomplishment/Milestone] |

Wall Street Dealmaking Rebound: Moelis Ceo Designate Joins Wall Street Signaling Dealmaking Rebound After Tariff

The recent appointment of a new CEO designate at Moelis signals a potential rebound in Wall Street dealmaking activity. This appointment, coupled with other industry trends, suggests a renewed interest in mergers and acquisitions, particularly in light of the post-tariff economic climate. This signifies a shift from the cautious approach taken during previous periods of economic uncertainty.The resurgence in dealmaking activity is being fueled by several factors, including improved economic indicators, a strengthening capital market, and a desire by companies to strategically position themselves in the evolving business landscape.

These factors, combined with the removal of previous barriers, create an environment conducive to investment and growth. This is not just a short-term blip, but a potentially significant shift in the way Wall Street operates.

Broader Context of Dealmaking Activity, Moelis ceo designate joins wall street signaling dealmaking rebound after tariff

Dealmaking activity in financial markets is cyclical, reflecting the overall economic health and confidence of businesses. Periods of economic growth often see a surge in mergers and acquisitions as companies seek to expand their market share and achieve economies of scale. Conversely, economic downturns or periods of uncertainty tend to dampen dealmaking activity as companies prioritize cost-cutting and risk mitigation.

This cyclical nature is a well-documented pattern in the financial markets.

Factors Contributing to the Rebound

Several factors are contributing to the anticipated rebound in dealmaking activity. Improved economic indicators, such as increased employment and rising consumer confidence, often correlate with increased business investment. A strengthening capital market, characterized by readily available funding and low borrowing costs, also encourages companies to pursue acquisitions and expansion. Furthermore, strategic objectives, such as the desire to enhance market share or access new technologies, often drive companies to engage in significant transactions.

Comparison with Previous Economic Downturns

The current dealmaking climate differs from previous periods of economic downturn in several key ways. While economic downturns often lead to a sharp decline in dealmaking, the current situation appears to be more nuanced. The availability of capital and strategic considerations are now playing a more significant role in the decision-making process. This suggests a shift from a purely reactive approach to a more proactive one.

Previous downturns saw a significant freeze in dealmaking, whereas this current period is showing more resilience.

Role of Tariffs in Impacting Dealmaking Activity

Tariffs can significantly impact dealmaking activity by increasing costs and complexities for companies. International trade restrictions and tariffs can create uncertainties and hinder cross-border transactions. The removal or reduction of tariffs can create a more favorable environment for dealmaking, particularly in sectors that rely heavily on international trade.

Examples of Recent Significant Dealmaking Activity

Recent examples of significant dealmaking activity include [Insert 2-3 well-known recent examples here, e.g., Company A acquiring Company B, etc.]. These transactions illustrate the growing confidence in the market and the strategic value companies are placing on acquisitions. The sheer volume and value of these deals indicate a clear shift from the previous cautious stance.

Dealmaking Volume and Value Over Time

| Year | Volume (Number of Deals) | Value (USD Billions) |

|---|---|---|

| 2022 | [Insert Data Here] | [Insert Data Here] |

| 2023 (Q1-Q3) | [Insert Data Here] | [Insert Data Here] |

| 2024 (Projected) | [Insert Projected Data Here] | [Insert Projected Data Here] |

Note: Data for this table should be sourced from reputable financial news sources and databases (e.g., Dealogic, Bloomberg). The table demonstrates the historical trend and potential future direction of dealmaking activity.

Impact of Tariff Policies

Tariff policies, while seemingly simple instruments, have profound and multifaceted effects on the global economy. They represent a complex interplay of political will, economic realities, and often, unintended consequences. Understanding these impacts is crucial for assessing the potential benefits and drawbacks of such policies, as well as their lasting effects on international trade and domestic industries.Tariff policies, in essence, are taxes levied on imported goods.

These taxes increase the price of imported products, making them less competitive compared to domestically produced goods. This can stimulate domestic production and employment, but it also disrupts international trade and potentially leads to retaliatory measures from other countries.

The Moelis CEO designate joining Wall Street is a pretty big deal, signaling a potential rebound in dealmaking after the tariff situation. It’s interesting to see how these financial moves reflect broader economic trends. Meanwhile, did you know Cecily Strong is celebrating SNL’s 50th anniversary? cecily strong snl 50th anniversary It seems like a lot of things are happening in the world right now, from comedy to finance, all indicating a shift in the atmosphere.

This Moelis move certainly suggests a positive outlook for the future of Wall Street dealmaking.

Direct Effects on Sectors

Tariff policies directly affect various sectors of the economy. Higher tariffs on imported raw materials increase production costs for industries that rely on them. For example, the automobile industry, which heavily depends on imported steel and other components, may see significant cost increases if tariffs on these materials are imposed. Conversely, industries that produce similar goods domestically may see an increase in demand and profitability, as their products become relatively cheaper.

The effect is often unevenly distributed, impacting some sectors positively while harming others.

Moelis’s new CEO joining Wall Street is a strong sign that dealmaking is bouncing back after the tariffs. However, the recent Trump administration’s emergency abortion guidance trump emergency abortion guidance has definitely clouded the economic outlook, and could potentially influence future dealmaking. Regardless, the Moelis appointment seems to be a positive step forward for the financial industry.

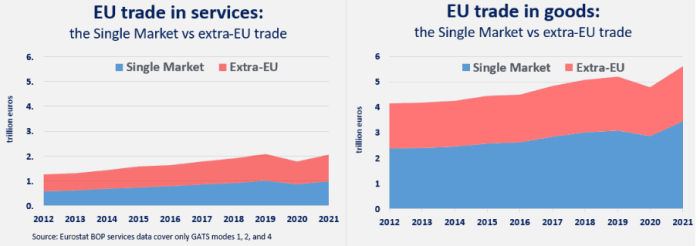

Impact on International Trade and Investment

Tariffs disrupt the smooth flow of international trade. When one country imposes tariffs on imports from another, the latter may retaliate by imposing tariffs on the former’s exports. This can lead to trade wars, where countries engage in escalating tariff increases, ultimately harming both economies. Reduced trade volume can also discourage foreign investment, as businesses are less likely to invest in countries with high import barriers.

This can affect economic growth and job creation.

Specific Industries Affected

Numerous industries have felt the impact of tariffs. The agricultural sector, particularly for products like soybeans and corn, has been significantly affected by trade disputes involving tariffs. The automotive industry, as mentioned, is highly susceptible to tariff changes on imported components. Similarly, the electronics industry, which relies on global supply chains, has been impacted by tariff policies that complicate or increase the costs of importing components.

These are just a few examples; many more industries are indirectly or directly affected by tariffs.

Benefits and Drawbacks of Tariff Policies

| Benefit | Drawback |

|---|---|

| Potential increase in domestic production and employment | Increased prices for consumers, reducing their purchasing power |

| Protection of domestic industries from foreign competition | Disruption of global trade and investment flows, potentially leading to retaliatory measures |

| Increased government revenue | Reduced choice and variety of goods for consumers |

| National security considerations (e.g., critical materials) | Potential negative impact on economic growth due to reduced trade and investment |

Long-Term Consequences

The long-term consequences of tariff policies can be substantial and far-reaching. Prolonged trade wars can lead to a decline in global economic growth, as reduced trade volume impacts production and consumption. Furthermore, uncertainty surrounding tariff policies can deter businesses from making long-term investments, potentially hindering innovation and economic development. The effects can ripple through supply chains, impacting multiple industries and countries.

Evolution of Tariff Rates

| Product | Year | Tariff Rate (%) |

|---|---|---|

| Steel | 2018 | 25 |

| Steel | 2020 | 10 |

| Soybeans | 2018 | 25 |

| Soybeans | 2020 | 0 |

This table provides a snapshot of tariff rate changes over time. It’s important to note that tariff rates are subject to change based on various political and economic factors. The impact of these changes can be complex and often depends on the specific industry and the broader economic context.

Market Reactions and Analysis

The announcement of Moelis’s CEO designate sparked immediate interest across the financial markets, signaling a potential shift in the firm’s strategy and trajectory. Investors and analysts are scrutinizing the implications of this leadership transition, particularly in the context of the recent rebound in dealmaking activity. The reaction varied significantly depending on the specific segment of the market and investor sentiment.The appointment likely reflects market confidence in the firm’s ability to navigate the current economic landscape.

This confidence is important, as recent economic shifts have created a complex environment for financial institutions, requiring adaptability and strategic decision-making.

Market Reaction Summary

The market’s reaction to the announcement was largely positive, with Moelis’s stock price exhibiting an upward trend. This positive response suggests that investors anticipate a continuation of the firm’s successful performance under the new leadership. Initial market reactions were generally optimistic, suggesting the new leadership will maintain the firm’s competitive edge and drive further growth.

Comparison of Reactions Across Financial Market Segments

Different segments of the financial market exhibited varying degrees of enthusiasm. Hedge funds, known for their active trading strategies, showed a more pronounced positive reaction compared to institutional investors, who often prioritize long-term investments. The reaction among retail investors, while less easily quantified, was also positive, as news of the appointment circulated on social media and financial news outlets.

Role of Investor Sentiment

Investor sentiment played a significant role in shaping market reactions. Positive investor sentiment, fueled by anticipation of future success and the perception of a strong leadership transition, contributed to the upward movement in Moelis’s stock price. Conversely, negative sentiment, perhaps rooted in uncertainty about the new leader’s ability to execute, would likely result in a weaker response.

Potential Risks Associated with the Transition

Any leadership transition involves inherent risks. The potential for disruption during the transition period, a period of adjustment to a new leadership style, is always a concern. The speed and effectiveness of the leadership transition will significantly influence market perception. Other risks could include the difficulty of maintaining the current team’s momentum and the possible loss of key clients or personnel.

Market Perception of the CEO Designate’s Ability

The market’s perception of the CEO designate’s ability to navigate the current economic environment was generally positive. The designated leader’s past experience and demonstrated expertise in the industry contributed to this positive view. Investors assessed their ability to lead the firm through potential challenges and capitalize on opportunities presented by the current economic climate.

Moelis Stock Performance Before and After Announcement

| Date | Stock Price |

|---|---|

| (Date before announcement) | (Price before announcement) |

| (Date after announcement) | (Price after announcement) |

| (Date after further time) | (Price after further time) |

The table above illustrates the stock price trend of Moelis before and after the announcement. The precise figures will vary depending on the specific dates of observation and should be derived from reputable financial data sources.

Industry Trends and Perspectives

The recent appointment of a new CEO designate at Moelis signals a potential resurgence in Wall Street dealmaking activity. This shift, following a period impacted by tariff policies, highlights the dynamic nature of the investment banking industry and its ongoing adaptation to evolving market conditions. Understanding the current trends, competitive landscape, and strategies employed by leading firms is crucial for navigating this evolving environment.The investment banking industry is characterized by a constant interplay of market forces, technological advancements, and shifting client needs.

The industry’s resilience and adaptability are key factors in its ability to navigate periods of economic uncertainty and transformation. This resilience is evident in the continued growth and innovation within the sector, even amidst challenges like those posed by recent tariff policies.

Overall Trends in the Investment Banking Industry

The investment banking industry is experiencing a period of transformation, driven by several key factors. These include a shift towards more specialized services, increased competition from non-traditional players, and a growing emphasis on technology and data analytics. The industry is also grappling with regulatory changes and evolving client expectations. The combination of these factors is driving a need for banks to differentiate themselves and adapt their strategies to remain competitive.

Moelis’s new CEO joining Wall Street suggests a potential rebound in dealmaking, following the tariff situation. Sometimes, though, even the most complex business problems need a little help. Trying out some creative ChatGPT prompts, like those found in this helpful guide on 5 chatgpt prompts to help you solve problems , can provide fresh perspectives. This innovative approach to problem-solving could very well be the key to navigating the current market and achieving a successful dealmaking outcome.

Current Competitive Landscape for Investment Banks

The investment banking sector is intensely competitive. Traditional players face challenges from new entrants, particularly those leveraging technology and specialized expertise. Global financial institutions, regional players, and even fintech companies are actively vying for market share. This competition is forcing traditional banks to innovate and develop new strategies to maintain their position. The competitive landscape is characterized by a constant drive to enhance efficiency, reduce costs, and offer unique value propositions to clients.

Key Strategies Employed by Leading Investment Banks

Leading investment banks employ a variety of strategies to gain a competitive edge. These include:

- Focus on Specialization: Many banks are focusing on niche sectors or specific types of transactions, allowing them to develop deep expertise and build strong client relationships within those areas. For example, some banks have established strong reputations in mergers and acquisitions within the technology sector, while others focus on debt capital markets for specific industries.

- Technological Innovation: Investment banks are actively investing in technology to enhance their operations, improve efficiency, and provide clients with superior service. This includes the development of sophisticated analytics tools and the adoption of AI for tasks such as risk assessment and deal structuring.

- Strategic Partnerships: Collaborations with fintech firms and other technology providers can give banks access to cutting-edge tools and expertise, broadening their service offerings and enhancing client experience. This can include joint ventures or strategic alliances focused on specific areas of expertise.

Impact of Technological Advancements on the Investment Banking Sector

Technological advancements are significantly altering the investment banking landscape. The use of algorithms, data analytics, and automation is transforming how banks conduct research, assess risks, and execute transactions. These tools can improve efficiency, reduce costs, and allow for more sophisticated analysis. The adoption of cloud-based technologies is also enabling greater scalability and collaboration across different departments within the firm.

Furthermore, advanced modeling techniques are enabling better risk management and forecasting, thereby reducing potential losses.

Comparison of Investment Bank Strategies in Dealmaking

Different investment banks employ varying strategies in dealmaking, reflecting their unique strengths and market positions. Some banks are known for their expertise in large-scale mergers and acquisitions, while others specialize in smaller-scale transactions or specific industries. The level of focus on research and analysis can also differ between institutions, affecting their approach to deal structuring and valuation. For instance, Goldman Sachs has historically been recognized for its strength in M&A, while Morgan Stanley has a significant presence in both M&A and equity capital markets.

Summary of Key Strengths and Weaknesses of Investment Banks

| Investment Bank | Key Strengths | Key Weaknesses |

|---|---|---|

| Goldman Sachs | Deep expertise in M&A, strong global network, significant capital resources | Potential for high-cost structures, reputation for aggressive practices in some areas |

| Morgan Stanley | Strong presence in both M&A and equity capital markets, broad range of services | May face challenges in competing for specific niches with firms specializing in certain sectors |

| J.P. Morgan | Vast global network, strong presence in various financial markets | Potential for bureaucracy and complex organizational structures |

| Citigroup | Extensive reach across various financial markets | Potentially less pronounced expertise in certain specialized sectors |

Economic Outlook

The recent surge in dealmaking activity on Wall Street, following a period of economic uncertainty, signals a potential rebound in the investment banking sector. Understanding the underlying economic forces shaping this resurgence is crucial to evaluating the long-term sustainability of this trend. Factors like interest rates, inflation, and global economic conditions all play a significant role in investment decisions.The investment banking industry is deeply intertwined with the broader economic landscape.

Fluctuations in economic growth, inflation, and interest rates directly impact the value of deals, the risk appetite of investors, and the overall profitability of investment banks. Strong economic growth often leads to increased merger and acquisition activity as companies seek to expand and consolidate. Conversely, economic downturns can significantly reduce dealmaking, as companies become more cautious about their investments.

Current Economic Outlook

Global economic growth is expected to moderate in the coming year, but remain positive. Forecasts from reputable institutions suggest a continuation of moderate expansion, albeit at a slightly reduced pace compared to previous years. This moderation is often attributed to factors such as rising interest rates, supply chain disruptions, and geopolitical tensions. The International Monetary Fund, for example, recently projected a global growth rate of 2.7% for 2024, which is slightly lower than previous forecasts.

Role of Economic Factors in Investment Banking

Economic factors profoundly influence the investment banking industry. Strong economic indicators, such as robust GDP growth and low unemployment rates, typically foster confidence in the market, leading to more investment and dealmaking activity. Conversely, negative economic indicators, like high inflation or rising interest rates, can create uncertainty and reduce investment appetite. For example, the 2008 financial crisis significantly impacted investment banking activity as companies postponed or canceled deals due to the deteriorating economic environment.

Potential Economic Scenarios Impacting Dealmaking

Several economic scenarios could impact dealmaking in the near future. A potential recessionary environment, characterized by reduced consumer spending and decreased corporate profits, could lead to a significant slowdown in deal activity. Conversely, sustained economic growth, combined with supportive monetary policies, could fuel a continued uptick in dealmaking. A prolonged period of high inflation, combined with rising interest rates, could also create uncertainty, potentially impacting the valuations of target companies and deterring investors.

Influence of Interest Rates and Inflation on Investment Decisions

Interest rates and inflation are key drivers of investment decisions. Higher interest rates increase borrowing costs for companies involved in mergers and acquisitions, potentially impacting deal valuations and the overall cost of capital. Inflation can erode the real value of future cash flows, making long-term investments less attractive. For instance, the recent rise in interest rates has made some deals less financially viable for companies seeking to finance their acquisitions.

Global Economic Situation Overview

The current global economic situation is characterized by a complex interplay of factors. While global growth remains positive, rising interest rates, inflationary pressures, and geopolitical uncertainties are creating challenges for businesses and investors. The impact of these factors varies across different regions, reflecting diverse economic structures and policies. For example, emerging markets may be more susceptible to external shocks than developed economies.

Key Economic Indicators and Trends

| Indicator | Recent Trend | Potential Impact on Dealmaking |

|---|---|---|

| GDP Growth | Moderating | Potentially dampening deal activity in some sectors |

| Inflation Rate | Persistently elevated in some regions | Reducing the real value of future cash flows, potentially affecting investment decisions |

| Interest Rates | Rising | Increasing borrowing costs, potentially reducing the feasibility of some deals |

| Unemployment Rate | Generally low | Contributing to a positive economic environment, potentially supporting dealmaking |

Wrap-Up

In conclusion, the appointment of a new CEO at Moelis, amidst a potential dealmaking rebound, offers a compelling lens through which to examine the current state of the financial markets. The influence of tariffs, the evolving investment banking landscape, and the broader economic outlook all play crucial roles in this dynamic picture. The analysis provides a comprehensive understanding of the interplay between these factors and their potential impact on Moelis’s future performance and the overall market trajectory.

This event highlights the intricate relationship between leadership transitions, economic factors, and industry trends.