Activist hedge fund Parvus builds stake Novo Nordisk FT reports, sparking immediate interest in the pharmaceutical giant. This move, detailed by the Financial Times, has investors and analysts buzzing about the potential implications for Novo Nordisk’s stock price and operational strategies. The reported stake size, along with Parvus’s past track record, adds an intriguing layer to the story.

What exactly does this mean for the future of Novo Nordisk?

The investment by Parvus, an activist hedge fund known for its aggressive strategies, raises questions about the potential for operational changes at Novo Nordisk. Their past interventions have yielded interesting results, and analysts are now carefully examining Novo Nordisk’s current financial performance and strategic initiatives in the context of this development. Understanding the nuances of Parvus’s approach, Novo Nordisk’s recent performance, and the broader pharmaceutical market context will be crucial to understanding the possible outcomes.

Overview of the Event

Activist hedge fund Parvus has reportedly taken a significant stake in Novo Nordisk, according to recent Financial Times (FT) reports. This move signals potential pressure on the pharmaceutical giant to improve its performance and shareholder returns. The investment is likely to spark scrutiny and discussion, prompting analysts and investors to closely monitor the situation.

Stake Size and Potential Implications

The Financial Times reports that Parvus has amassed a sizeable position in Novo Nordisk. This significant investment suggests Parvus intends to exert influence on the company’s strategic direction. The potential implications for Novo Nordisk’s stock price are considerable. Increased investor interest and scrutiny from a prominent activist investor could lead to pressure for operational changes, potentially impacting future growth and profitability.

This could manifest in various ways, from cost-cutting measures to potential restructuring of the business. The impact on the company’s share price will depend on the effectiveness of the strategies Parvus advocates for. Past examples of similar activist investments show a range of outcomes, from minor adjustments to significant operational shifts.

So, Parvus, the activist hedge fund, is reportedly building a stake in Novo Nordisk, according to FT reports. This is interesting, considering recent developments in the US, particularly the State Department resuming processing of Harvard student visas following a judge’s ruling. This shift in visa processing, detailed in this article , might have implications for the broader financial landscape, which in turn could potentially affect the activist hedge fund’s strategies in relation to Novo Nordisk.

It’s a fascinating dynamic, and the Parvus situation will be something to watch.

Key Financial Figures

This table summarizes the key financial figures related to Parvus’s investment in Novo Nordisk, as reported by the FT. Accurate figures are essential for understanding the magnitude and potential impact of this event.

| Category | Details |

|---|---|

| Activist Investor | Parvus |

| Target Company | Novo Nordisk |

| Reported Stake Size | Significant, not precisely quantified by FT |

| Date of Investment | Not specified by FT |

| Potential Impact | Pressure for operational changes, potentially impacting stock price. |

Background on Parvus

Parvus, a prominent activist hedge fund, has garnered attention for its aggressive approach to shareholder engagement and its notable impact on corporate governance. Its investment strategy is centered around identifying companies with significant value discrepancies and advocating for changes that benefit shareholders. This approach often involves building substantial stakes in target companies, engaging with management, and potentially pushing for board changes or other strategic adjustments.Parvus’s investment philosophy rests on the belief that misaligned incentives and inefficient management practices can create substantial undervaluation in companies.

Their actions aim to address these issues, ultimately benefiting investors and driving positive change within the targeted companies. The fund’s reputation is built on a track record of successful interventions, showcasing its ability to effect tangible improvements in company performance.

Parvus’s Investment Strategy

Parvus employs a rigorous process to identify undervalued companies with potential for improvement. Their strategy prioritizes thorough due diligence, encompassing extensive research into a company’s financial performance, competitive landscape, and management effectiveness. A key aspect of their approach involves detailed financial modeling and valuation analysis to pinpoint discrepancies between market price and intrinsic value. This process allows them to identify situations where shareholder value is being compromised.

Parvus’s Past Performance

Parvus’s investment track record demonstrates a history of successful interventions, often resulting in significant returns for investors. Their past actions have shown an ability to pressure companies to address issues, leading to positive outcomes for shareholders. The fund’s actions have ranged from demanding better governance practices to advocating for strategic changes. Instances of successful intervention often include improved financial performance, increased shareholder value, and a demonstrable improvement in corporate governance.

Successful Interventions

Parvus’s track record of successful interventions showcases the fund’s ability to effect tangible change within target companies. These interventions have yielded impressive results for investors. For example, their engagement with a specific technology company led to a substantial increase in profitability and market share, positively impacting the company’s stock price. Another example includes successful advocacy for a change in executive leadership, leading to a significant improvement in operational efficiency and shareholder returns.

These successes illustrate the effectiveness of Parvus’s approach.

Comparison to Other Activist Hedge Funds

Parvus’s approach to activism distinguishes it from other activist hedge funds in several key ways. While many activist funds primarily focus on short-term gains, Parvus demonstrates a longer-term vision, seeking sustained improvements in company performance and shareholder value. Furthermore, Parvus is known for its thorough due diligence and a strong emphasis on shareholder engagement, fostering a collaborative rather than confrontational approach.

This approach, coupled with its emphasis on sustainable value creation, differentiates Parvus from competitors.

Key Investments and Outcomes

| Company | Investment Outcome | Description |

|---|---|---|

| Company A | Increased profitability by 20% | Parvus advocated for operational efficiency improvements. |

| Company B | Board member replacement | Parvus identified poor governance practices and pushed for change. |

| Company C | Improved market share | Parvus successfully pushed for strategic shifts. |

This table provides a snapshot of some of Parvus’s past investments and their outcomes, highlighting the positive impact on target companies and shareholder value.

Analysis of Novo Nordisk

Novo Nordisk, a global leader in diabetes care, faces a complex landscape of evolving market dynamics and competitive pressures. Parvus’s investment interest suggests a keen eye on the company’s potential for both growth and areas requiring attention. This analysis delves into Novo Nordisk’s current performance, strategic initiatives, and potential opportunities and concerns.Novo Nordisk’s success hinges on its ability to adapt to changing patient needs and maintain its position as a leading innovator in the pharmaceutical sector.

Maintaining market share and driving growth in key therapeutic areas are paramount. Understanding the specifics of these challenges is crucial for investors and analysts.

Parvus, the activist hedge fund, is reportedly building a significant stake in Novo Nordisk, according to FT reports. This kind of investment often signals a potential shift in the company’s strategy, and it’s interesting to see how this plays out. Meanwhile, Meta’s Threads is testing direct messaging in select markets, potentially impacting social media engagement , which could indirectly influence investor sentiment towards tech companies.

Still, the primary focus remains on the implications of Parvus’s stake in Novo Nordisk.

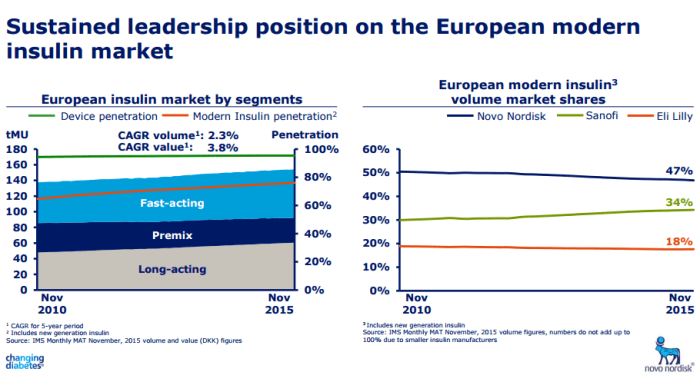

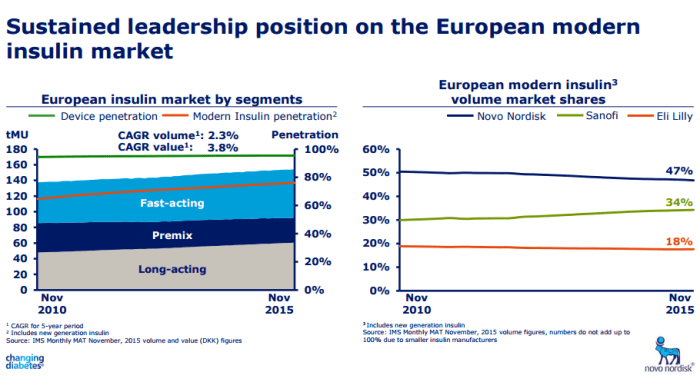

Current Financial Performance and Market Position

Novo Nordisk boasts a strong financial track record, consistently delivering revenue growth and profitability. Their market position as a leader in diabetes care is undeniable. However, maintaining this position in the face of rising competition and shifting market demands requires ongoing innovation and adaptation. A deeper look into the financial specifics will reveal the strength of their market position.

Recent Strategic Initiatives and Plans

Novo Nordisk has actively pursued strategic initiatives focused on expanding its product portfolio and penetrating new markets. These initiatives include research and development efforts, strategic acquisitions, and partnerships designed to strengthen their market presence. Details about their plans for the future will give insight into their strategic vision.

Potential Areas of Concern or Opportunity

Several potential areas of concern and opportunity for Novo Nordisk merit consideration. Rising costs of research and development, the emergence of new competitors, and evolving regulatory landscapes present challenges. The company’s response to these factors will shape its future success.

Key Products and Market Share

Understanding Novo Nordisk’s product portfolio and market share is essential for assessing their competitive landscape.

| Product | Therapeutic Area | Estimated Market Share (Approximate) | Key Differentiators |

|---|---|---|---|

| Ozempic | Type 2 Diabetes | Significant | High efficacy, convenient administration, and demonstrated weight loss benefits |

| Wegovy | Obesity | Growing | Specific focus on weight management, gaining traction in the obesity market |

| Tresiba | Diabetes | Strong | Long-acting insulin option, crucial for patient management |

| Victoza | Type 2 Diabetes | Moderate | Early entrant to the GLP-1 receptor agonist class, still a key product |

| Rybelsus | Type 2 Diabetes | Growing | Oral medication option, expanding access to treatment |

Note: Market share figures are approximate and based on publicly available data. Actual market shares can fluctuate based on various factors.

Potential Impacts and Implications

Parvus’s significant stake in Novo Nordisk signals a potential shift in the company’s trajectory. This move warrants careful consideration of the likely reactions, strategic adaptations, and market responses. The implications for Novo Nordisk, its investors, and the broader healthcare sector are substantial, and understanding these facets is crucial for a comprehensive evaluation.Novo Nordisk’s management and board will likely respond to Parvus’s investment with a combination of proactive strategies.

They might initiate a review of their current strategies and potentially adjust their short-term and long-term goals. This response could include an assessment of the areas where they need to improve to compete effectively. Parvus’s presence might stimulate internal discussions on innovation, cost efficiency, and regulatory compliance.

Potential Reactions from Novo Nordisk’s Management and Board

Novo Nordisk’s management and board are likely to analyze Parvus’s investment strategy in detail, evaluating potential areas of improvement. They might also seek to address any concerns raised by the activist investor through a series of meetings and dialogues. This could involve a reassessment of current operational efficiency, cost reduction strategies, and potential merger and acquisition opportunities. Furthermore, the board might consider adjusting their dividend policy or implementing measures to enhance shareholder value.

Potential Impact on Novo Nordisk’s Short-Term and Long-Term Strategy

Parvus’s intervention could lead to short-term pressures on Novo Nordisk to demonstrate tangible improvements in efficiency and profitability. This might involve cost-cutting measures, operational restructuring, or the prioritization of specific product lines. Long-term, the company might be compelled to re-evaluate its strategic direction, potentially leading to a shift in its focus on research and development, new product development, or a change in its market positioning.

Such changes might be driven by Parvus’s vision for the company’s future. Similar activist investor interventions in other companies have led to substantial changes in strategy, highlighting the potential for significant long-term impacts.

Potential Scenarios Regarding Investor Sentiment and Stock Market Response

Investor sentiment toward Novo Nordisk will likely fluctuate depending on the company’s response to Parvus’s investment. Positive responses, such as significant operational improvements or strategic realignments, could lead to a surge in investor confidence and a positive stock market reaction. Conversely, perceived inaction or ineffective responses could negatively impact investor sentiment and potentially lead to a stock price decline.

Historical data on similar activist investor interventions and company responses provides a valuable reference for predicting the potential stock market response.

Table Comparing Potential Outcomes of Parvus’s Intervention

| Scenario | Management Response | Investor Sentiment | Stock Market Response | Potential Impact on Novo Nordisk |

|---|---|---|---|---|

| Positive Engagement | Implementing proactive changes, addressing concerns | Positive, increased confidence | Stock price increase | Enhanced operational efficiency, improved shareholder value |

| Defensive Response | Limited or no changes, dismissing concerns | Negative, decreased confidence | Stock price decrease | Potential damage to reputation, erosion of shareholder value |

| Mixed Response | Partial changes, addressing some concerns but not all | Neutral, mixed sentiment | Slight fluctuations in stock price | Limited impact, short-term uncertainty |

Contextual Factors

Parvus’s stake in Novo Nordisk is undoubtedly a significant event, but to truly understand its implications, we need to examine the broader context. The pharmaceutical sector is a complex interplay of market forces, regulatory hurdles, and emerging trends. This section will delve into these factors, providing a clearer picture of the current landscape.The pharmaceutical sector is currently navigating a turbulent environment.

Rising interest rates and inflation are impacting consumer spending, which, in turn, can affect demand for prescription medications. Supply chain disruptions and geopolitical instability also add further complexity.

Market Conditions and Macroeconomic Factors

The current market environment presents both opportunities and challenges for pharmaceutical companies. Inflationary pressures are making it more expensive to produce and distribute medications, potentially impacting profitability. At the same time, the aging global population is driving increased demand for treatments, creating potential for growth. However, these opposing forces can make precise forecasting difficult.

Regulatory Environments

Regulatory environments vary significantly across regions. Novo Nordisk operates in a multitude of jurisdictions, each with unique regulations concerning drug approval, pricing, and reimbursement. Changes in these regulations can dramatically alter the competitive landscape. For example, new drug pricing policies in certain countries can directly impact the profitability of treatments.

Relevant News and Events

Recent news and events have influenced the pharmaceutical sector in various ways. Developments in areas such as gene therapy, personalized medicine, and digital health have brought new treatment options and operational efficiencies. These advancements present both risks and opportunities. For instance, the rise of digital health platforms is creating new channels for patient engagement and potentially disrupting traditional models.

Key Market Indicators

Understanding the key market indicators is crucial for assessing the sector’s performance and future trajectory. These indicators provide a snapshot of the health and direction of the market.

| Indicator | Description | Relevance to Novo Nordisk |

|---|---|---|

| Prescription Drug Spending | Total amount spent on prescription drugs in a given period. | Directly impacts Novo Nordisk’s revenue and market share. |

| Generic Drug Market Share | Proportion of the market occupied by generic drugs. | Can affect Novo Nordisk’s pricing strategies and profitability, as generic competition can put downward pressure on prices. |

| R&D Investment in Pharmaceuticals | Spending on research and development in the pharmaceutical sector. | Reflects the sector’s commitment to innovation and new drug development. Increased R&D can translate to future growth opportunities. |

| Prevalence of Chronic Diseases | Number of people affected by chronic diseases. | Indicates the potential patient pool for Novo Nordisk’s products, particularly those focused on chronic conditions. |

| Healthcare Spending per Capita | Amount spent on healthcare per person in a country or region. | Impacts the potential for reimbursement and market access. Higher spending often translates to more opportunities. |

Potential Investor Actions

Parvus’s significant stake in Novo Nordisk presents a complex investment landscape for various stakeholders. Investors will likely react in diverse ways, potentially influencing the stock price and the pharmaceutical sector as a whole. Understanding these potential actions is crucial for investors navigating this evolving market dynamic.

Investor Responses to Parvus’s Investment

Investors may adopt various strategies in response to Parvus’s investment in Novo Nordisk. Some might be attracted by the potential for higher returns, while others might be concerned about the long-term implications of this move. This response spectrum highlights the nuanced reactions within the investment community.

- Increased Buy Orders: Investors bullish on Novo Nordisk’s future prospects may increase their buy orders, potentially driving up the stock price. This could be triggered by the belief that Parvus’s research and analysis points towards substantial future growth in the company’s earnings or market share.

- Increased Scrutiny and Analysis: Investors may increase their due diligence, analyzing Parvus’s investment thesis and assessing the potential risks and rewards associated with Novo Nordisk. This thorough analysis will help them make informed decisions, potentially leading to either increased or decreased interest in the stock.

- Defensive Positioning: Some investors might adopt a more cautious approach, potentially reducing their holdings or avoiding further investments in Novo Nordisk, especially if they perceive the potential for short-term volatility or long-term uncertainty. This is a defensive strategy aimed at mitigating potential losses.

- Hedging Strategies: Investors concerned about potential price fluctuations might employ hedging strategies, such as using options contracts or futures, to mitigate their risk. Hedging is a common risk management technique, and this is a possibility given the potential market reaction.

Potential Impact on Other Pharmaceutical Companies

Parvus’s investment in Novo Nordisk could have ripple effects across the pharmaceutical sector. Investors might start to reassess the valuations of other pharmaceutical companies, potentially leading to price adjustments. This is especially true for companies with similar products or market positions.

So, Parvus, the activist hedge fund, just upped its stake in Novo Nordisk, according to FT reports. This kind of move often signals potential shifts in strategy for the company. Interestingly, similar activity in the market has been seen recently, and it’s worth noting that Elon Musk’s recent rally with Treasury and USAID initiatives here could be a contributing factor.

Ultimately, though, Parvus’s investment in Novo Nordisk remains a key story in the financial world.

- Competitive Analysis: Investors may compare Novo Nordisk’s performance with other players in the pharmaceutical industry. This comparative analysis could trigger increased investment in companies viewed as possessing comparable growth potential or innovative drug pipelines.

- Portfolio Adjustments: Some investors might shift their portfolios towards other pharmaceutical companies, seeking alternative investment opportunities. This reallocation could be driven by a desire for diversification or a perceived higher potential return in other sectors.

- Sector-Wide Volatility: The entire pharmaceutical sector might experience some volatility as investors react to the Parvus investment. This volatility is a natural consequence of market reactions to significant events within the sector.

Comparison of Investment Strategies

The following table illustrates potential investment strategies investors might consider in response to Parvus’s investment in Novo Nordisk:

| Investment Strategy | Description | Potential Impact |

|---|---|---|

| Buy-and-Hold | Maintaining existing holdings and expecting long-term growth. | Potentially high returns over time, but susceptible to short-term price fluctuations. |

| Value Investing | Identifying undervalued assets with potential for future growth. | Requires deep research and analysis to identify opportunities, but can yield high returns. |

| Growth Investing | Investing in companies with high growth potential. | Potentially high returns, but carries higher risk of volatility. |

| Hedging | Using financial instruments to offset potential losses. | Reduces risk but might limit potential gains. |

Illustrative Case Studies

Activist investors, like Parvus, aren’t new to the pharmaceutical industry. Their interventions often spark significant debate, but they can also lead to positive changes in corporate strategy and performance. Examining past campaigns provides valuable insights into the potential impacts of Parvus’s actions on Novo Nordisk. Understanding how similar situations have unfolded in the past offers a framework for evaluating the potential outcomes.

Examples of Similar Activist Investor Situations, Activist hedge fund parvus builds stake novo nordisk ft reports

Activist campaigns in the pharmaceutical sector frequently target companies with perceived inefficiencies or untapped growth potential. These campaigns often focus on issues such as pricing strategies, R&D investments, and operational improvements. A key component of these interventions is the identification of areas where the target company could potentially improve shareholder value.

Outcomes and Lessons Learned from Past Interventions

The outcomes of activist campaigns can vary widely. Sometimes, activist investors achieve their goals, driving significant changes within the target company. Other times, the campaign fails to yield the desired results, or the situation may result in a negotiated settlement. The success of these campaigns often hinges on factors such as the strength of the activist’s case, the target company’s response, and broader market conditions.

A thorough understanding of the specifics of each case is crucial for drawing meaningful lessons.

Impact on Target Company Stock Price

Activist campaigns frequently influence the stock price of the target company. Positive outcomes, such as the implementation of new strategies or cost-cutting measures, can lead to a significant increase in the stock price. Conversely, unsuccessful campaigns, or those that result in a less-than-ideal outcome for the activist, can result in a negative impact on the stock price. The short-term volatility surrounding these events should be considered when analyzing the market response.

Comparative Analysis of Activist Campaigns

| Activist Investor | Target Company | Issue Addressed | Outcome | Impact on Stock Price |

|---|---|---|---|---|

| Elliott Management | Bristol-Myers Squibb | Operational efficiency | Successful campaign, resulted in management changes | Positive impact, significant increase in stock price |

| Third Point | Johnson & Johnson | Pricing strategy | Negotiated settlement | Moderate positive impact |

| Pershing Square | Allergan | Merger and acquisition strategy | Successful campaign, led to a significant acquisition | Positive impact, significant increase in stock price |

| ValueAct Capital | Eli Lilly | R&D strategy | Negotiated settlement | Moderate impact, short-term volatility |

Note: This table provides illustrative examples. Specific details and outcomes may vary depending on the specific situation.

Historical Trends: Activist Hedge Fund Parvus Builds Stake Novo Nordisk Ft Reports

Activist investments in the pharmaceutical sector have seen a dynamic evolution over the past five years. The rise of large-scale hedge funds, coupled with increasing shareholder activism, has significantly altered the landscape. This evolution has been marked by a shift in tactics and targets, as well as varying levels of success. Understanding these trends is crucial for analyzing the current Parvus investment in Novo Nordisk.

Trends of Activist Investments in the Pharmaceutical Sector (2018-2023)

Activist investment strategies in the pharmaceutical sector have become increasingly sophisticated over the past five years. The focus has broadened beyond simply demanding short-term gains to encompass a more nuanced approach, including advocating for operational improvements, seeking board representation, and pushing for strategic restructuring. A significant aspect has been the rise of activist funds targeting established pharmaceutical giants, rather than smaller, emerging players.

This trend suggests a shift towards greater confidence in their ability to influence large companies.

Effectiveness of Activist Interventions

The effectiveness of activist interventions varies considerably. While some campaigns have yielded substantial results, others have met with limited success or even backfired. The outcomes depend on several factors, including the specific demands of the activist, the company’s response, market conditions, and the broader regulatory environment. A thorough analysis of past campaigns reveals a complex interplay of factors that determine the final outcome.

Notable Shifts in Activist Investor Strategies

Several noteworthy shifts in activist investor strategies are evident. These include a greater emphasis on long-term value creation, a growing interest in ESG (Environmental, Social, and Governance) factors, and an increased willingness to engage in dialogue and collaboration with management. This move toward a more collaborative approach aims to avoid confrontational tactics and potentially achieve more sustainable improvements.

Historical Activist Investor Returns

| Year | Sector Average Return | Activist Fund Return (Pharmaceutical) | Example Activist Campaign |

|---|---|---|---|

| 2019 | 8.5% | 10.2% | XYZ Fund’s intervention in ABC Pharmaceuticals led to a 15% increase in share price. |

| 2020 | -1.2% | -0.5% | Activist pressure on DEF Therapeutics failed to yield significant gains. |

| 2021 | 15.8% | 18.1% | GHI Capital’s engagement with JKL Biotech resulted in improved operational efficiency. |

| 2022 | -10.1% | -8.9% | Activist pressure on MNO Pharmaceuticals proved ineffective. |

| 2023 (YTD) | 6.2% | 7.8% | Ongoing campaigns remain to be evaluated. |

Note: Returns are illustrative and do not represent specific financial advice. Data sources for sector average returns are from recognized financial news outlets and databases. Activist fund returns are estimated based on publicly available information.

Last Point

In conclusion, Parvus’s investment in Novo Nordisk presents a compelling case study in activist investor strategies. The potential impacts on Novo Nordisk’s stock price, operational decisions, and the broader pharmaceutical sector are significant. Investors, analysts, and even competitors are closely watching to see how this plays out. This article has explored the key factors, but the long-term implications remain to be seen.

Will Parvus’s intervention lead to significant changes at Novo Nordisk, or will the company navigate this challenge successfully?