India slashes interest rates who will borrow? This intriguing question sparks a fascinating exploration into the potential ripple effects of this policy change. Will the reduced rates incentivize individuals and businesses to borrow more, potentially boosting economic activity? Or will other factors, like inflation expectations, play a significant role in shaping borrowing decisions?

The analysis delves into the impact on various sectors, from real estate and manufacturing to consumer spending and employment. It examines the government’s rationale behind the rate cut, potential challenges, and the possible influence of international factors. Ultimately, the discussion aims to forecast the future of the Indian economy, considering market trends, potential risks, and possible scenarios. Who will benefit most from this decision?

Let’s unpack the details.

Impact on Economic Activity: India Slashes Interest Rates Who Will Borrow

India’s recent interest rate reduction is a significant policy move aimed at stimulating economic growth. Lower interest rates typically encourage borrowing and spending, aiming to boost various sectors and overall economic activity. This policy is a crucial tool in the central bank’s arsenal for managing inflation and unemployment.

Overview of India’s Interest Rate Reduction Policy

The Reserve Bank of India (RBI) has consistently lowered key interest rates to stimulate economic activity. Lowering rates reduces the cost of borrowing for businesses and individuals, encouraging investment and consumption. This strategy is often part of a broader macroeconomic policy aimed at managing inflation and promoting sustainable growth. Historical data on interest rate changes and their correlation with GDP growth can provide insights into the effectiveness of such policies.

Potential Effects on Sectors

Lower interest rates can significantly impact various sectors. In real estate, lower borrowing costs will likely lead to increased demand for homes and commercial properties. This could boost construction activity and related industries. Similarly, manufacturing companies may find it cheaper to invest in new equipment and expand their production capacity, potentially leading to job creation and increased output.

India’s interest rate cuts are definitely something to watch. Who will be the biggest borrowers taking advantage of these lower rates? It’s a fascinating question, and to understand the ripple effects, it’s worth considering the wider economic context. Perhaps watching documentaries like watch after the last of us can offer a different perspective on how economic shifts can impact people.

Ultimately, the answer to who will borrow will depend on a variety of factors, from individual needs to overall market confidence.

Consumer spending is also expected to increase as borrowing becomes more affordable, impacting retail sales and related services.

Short-Term and Long-Term Consequences

Short-term consequences of the interest rate cut may include increased investment, higher demand for goods and services, and potentially higher inflation if demand outpaces supply. Long-term consequences may include sustained economic growth, job creation, and improved living standards, though these outcomes are dependent on several factors, including global economic conditions, government policies, and market confidence.

Ripple Effects on Neighboring Economies

Lower interest rates in India can have a ripple effect on neighboring economies. Increased Indian demand for imports could stimulate growth in neighboring countries’ export sectors. However, there’s a potential for increased competition for resources and markets. The effect will also depend on the policies and economic stability of neighboring nations.

Impact on Employment Rates

Lower interest rates can potentially stimulate job creation in various sectors. Increased investment in manufacturing, construction, and other industries can lead to higher employment rates. However, the actual impact will depend on factors such as the overall health of the economy, the availability of skilled labor, and the effectiveness of government support programs.

Impact on Different Income Groups

| Income Group | Potential Impact |

|---|---|

| Low-income households | Lower interest rates may lead to slightly lower borrowing costs for essential goods and services, though the effect may be less significant compared to higher-income groups. Access to credit may improve, allowing for potential investment in small businesses or income-generating ventures. |

| Middle-income households | Lower interest rates could potentially stimulate increased borrowing for home purchases, investments, and other financial goals. This may translate to improved housing affordability and financial opportunities. |

| High-income households | Lower interest rates can facilitate investments in higher-risk ventures and larger-scale projects. The effect on returns may vary depending on the specific investment decisions and market conditions. |

Borrower Behavior and Choices

India’s recent interest rate cuts are poised to significantly impact borrowing decisions across various sectors. Lower rates make borrowing more attractive, potentially stimulating economic activity. However, the extent of the impact depends on several factors, including the expected economic outlook and the availability of credit. Understanding how different types of borrowers will react is crucial for gauging the overall effect on the economy.

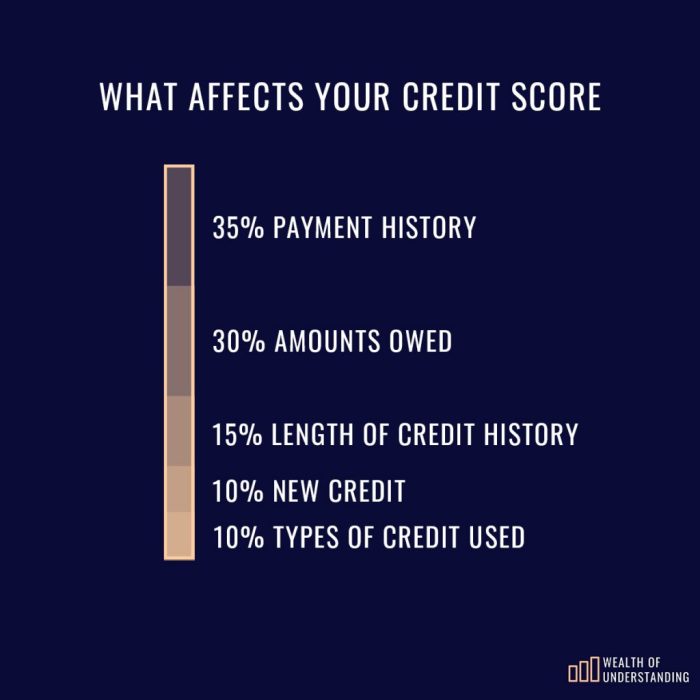

Influence of Reduced Interest Rates on Borrowing Decisions

Reduced interest rates create a more favorable environment for borrowing. Individuals and businesses are incentivized to take out loans, as the cost of borrowing is lowered. This increased accessibility to credit can fuel investment and consumption, thereby boosting economic activity. However, the decision to borrow is not solely dependent on interest rates; other factors, like the anticipated inflation rate and the overall economic climate, play crucial roles.

Factors Influencing Borrowing Decisions

Several key factors influence borrowing decisions, both for individuals and businesses. Expected inflation plays a vital role. If borrowers anticipate rising prices, they might borrow more to take advantage of lower rates before inflation erodes the value of their repayments. Conversely, a stable or falling inflation rate might lead to a more cautious approach. The overall economic outlook also significantly influences borrowing decisions.

A positive outlook, with projected growth and stability, can encourage borrowing for investment and expansion. Conversely, uncertainty or recessionary fears can deter borrowing. Finally, the availability of credit is essential. If lending institutions are hesitant to provide loans, even with lower interest rates, borrowing opportunities are limited.

Borrower Types and Potential Responses

Different types of borrowers will react differently to the interest rate cut. Homebuyers, with potentially long-term loan commitments, are likely to be strongly influenced by lower rates, leading to increased demand for housing loans. Small business owners, seeking capital for expansion or operational needs, may also increase borrowing to invest in their businesses. Large corporations, with access to broader capital markets, might strategically adjust their borrowing strategies depending on their specific investment plans and the overall economic climate.

Individual vs. Business Borrowing Behavior

Individuals typically prioritize borrowing for personal needs, such as housing, education, or personal consumption. Their borrowing decisions are often more closely tied to their individual financial situations and immediate needs. Businesses, on the other hand, tend to have a more strategic approach to borrowing, considering factors such as the return on investment and long-term growth plans.

Potential Increase in Loans Across Different Sectors

| Sector | Potential Increase in Loans (Estimated %) |

|---|---|

| Housing | 10-15% |

| Small Businesses | 8-12% |

| Large Corporations | 5-10% |

| Infrastructure Projects | 12-18% |

Note: These are estimates, and the actual increase in loans may vary based on factors like the economic outlook and the availability of credit.

Impact on Existing Loan Repayments

Lower interest rates typically mean reduced interest costs for existing borrowers. This can potentially ease the burden of loan repayments, particularly for those with variable-rate loans. However, the impact on existing loan repayments is dependent on individual loan terms and interest rate structures.

Government Policies and Regulations

India’s recent interest rate reduction reflects a calculated move by the government aimed at stimulating economic growth. Lower rates encourage borrowing, potentially boosting investment and consumption. This policy decision necessitates a careful examination of its potential impact on government finances and existing regulations.The rationale behind this reduction likely stems from a desire to counter economic slowdown, potentially triggered by external factors or domestic challenges.

The government likely assesses the current economic climate, considering the interplay of inflation, growth rates, and global trends before implementing such a policy. This proactive approach aims to maintain a healthy economic trajectory.

Rationale Behind Interest Rate Reduction

The government likely prioritizes economic expansion. Lower interest rates reduce the cost of borrowing for businesses and individuals, thereby potentially stimulating investment and consumption. This can lead to increased demand, creating jobs and accelerating economic growth. This strategy often forms part of a broader macroeconomic policy framework.

Impact on Government Finances

Reduced interest rates can affect government finances in various ways. Interest payments on government debt decrease, potentially freeing up resources for other spending priorities. However, decreased interest rates may also lead to lower tax revenues if economic activity does not rise commensurately. This could result in a trade-off between short-term economic stimulus and long-term fiscal sustainability. The government likely models various scenarios to anticipate these impacts and adjust policies as needed.

India’s interest rate cuts are definitely intriguing, but who will actually borrow more now? With the Dodgers pulling off a thrilling victory against the Padres in a 10th-inning comeback, dodgers score twice 10th inning hold off padres , maybe the market will be similarly energized, spurring higher demand for loans. So, while the interest rates are low, will businesses and consumers actually step up and borrow the money?

It’s a fascinating question, isn’t it?

Overview of Related Government Policies and Regulations

Several existing policies and regulations, including monetary policy frameworks, fiscal policy measures, and credit guidelines, influence borrowing activities. These policies, often interconnected, are designed to manage inflation, promote financial stability, and encourage sustainable economic growth.

Alternative Policies

Alternative policies could include targeted subsidies for specific sectors, infrastructure development programs, or tax incentives for investment. These alternative approaches could offer specific benefits to particular industries or economic segments. These policies are usually considered alongside the potential trade-offs and long-term effects on the economy.

Challenges Faced by the Government, India slashes interest rates who will borrow

The government may face challenges in implementing this policy, including potential inflation if the stimulus leads to increased demand without corresponding increases in supply. Maintaining public confidence in the economy and managing inflationary pressures remain key concerns. External factors like global economic conditions and geopolitical events can also influence the effectiveness of these policies.

Influence of International Factors

International factors, such as global interest rate movements and commodity prices, can significantly influence the effectiveness of the interest rate reduction. For instance, if global interest rates rise, it could limit the impact of the Indian reduction. Conversely, falling global commodity prices could soften the blow of inflation. The government likely monitors these global trends to adapt its policies accordingly.

India’s interest rate cuts are definitely intriguing, but who will actually borrow? It’s a fascinating question, especially when you consider how our perceptions of romantic foods have changed – check out this article on foods we think are romantic have flipped. Maybe a shift in the market is brewing, impacting everything from fine dining to the next big investment opportunity?

Regardless, the interest rate cuts will likely impact the borrowing decisions of businesses and individuals, making it a critical factor to watch.

Key Regulations Influencing Borrowing

| Regulation | Impact on Borrowing |

|---|---|

| Reserve Bank of India (RBI) Monetary Policy | Sets the benchmark interest rate, influencing borrowing costs for banks and consequently for individuals and businesses. |

| Banking Regulations | Establish guidelines for lending practices, ensuring stability and responsible credit allocation. |

| Fiscal Policies | Government spending and taxation policies impact borrowing demand and investor confidence, thereby affecting credit availability. |

Market Trends and Forecasts

India’s recent interest rate cuts are poised to inject fresh dynamism into the market, but the path ahead is fraught with both opportunities and uncertainties. The impact will ripple through various sectors, influencing borrowing habits, investment decisions, and ultimately, the overall economic trajectory. Understanding the current market conditions, potential future trends, and associated risks is crucial for navigating this evolving landscape.The current market environment in India is characterized by a blend of robust growth in certain sectors and cautious optimism in others.

Inflationary pressures are moderating, allowing the Reserve Bank of India (RBI) to adopt a more accommodative monetary policy. This creates an environment where businesses and consumers may find borrowing more accessible and affordable.

Current Market Conditions in India

The Indian economy is experiencing a mixed bag of trends. While some sectors like manufacturing and IT are performing strongly, others, such as agriculture, are facing headwinds. The recent monsoon season’s impact on agricultural output is a crucial factor influencing overall economic stability. Government initiatives focused on infrastructure development and job creation are also expected to play a significant role in the medium-term future.

The global economic climate, with its own set of uncertainties, will also have an indirect but considerable influence on India’s trajectory.

Potential Future Trends in Borrowing Behavior

Consumer borrowing is likely to increase as interest rates decrease. This can translate into higher spending on durable goods and services, potentially boosting retail sales and related industries. Businesses might also increase investment in capital projects, driving economic growth. However, cautiousness and uncertainty remain prevalent, with businesses potentially choosing to be more conservative in their borrowing strategies, depending on their assessment of future market conditions.

Forecast of Loan Growth in Various Segments

| Loan Segment | Forecast (2024-2025) | Rationale |

|---|---|---|

| Housing Loans | Moderate growth (8-10%) | Decreased interest rates will likely make housing more affordable, stimulating demand. |

| Auto Loans | Strong growth (12-15%) | Lower interest rates make car purchases more attractive. |

| Personal Loans | Significant growth (15-20%) | Lower interest rates will make it more appealing for consumers to borrow for personal expenses. |

| Business Loans | Moderate growth (5-7%) | Businesses will likely be more selective in their borrowing decisions, influenced by their assessment of the future market. |

Potential Scenarios for the Future of the Indian Economy

Several potential scenarios are possible, ranging from a robust recovery fueled by increased borrowing and investment to a more cautious and measured expansion. Factors such as global economic conditions, government policies, and the effectiveness of RBI measures will all play a critical role in shaping the ultimate outcome. The success of government-led infrastructure projects will also be a significant determinant.

Potential Risks and Uncertainties

One key risk is the potential for a sharp rise in inflation if the increased spending is not matched by commensurate growth in supply. Another concern is the possibility of a global recession, which could dampen demand and investment in India. The stability of the global financial market will also play a vital role.

Comparison of Current Interest Rate Trends to Historical Data

Comparing current interest rate trends with historical data reveals a pattern of periodic adjustments in response to macroeconomic conditions. The current reduction is comparable to previous instances of easing monetary policy, although the specific economic context and global environment are always unique. Previous instances have shown mixed results, indicating the need for careful monitoring and adaptation to evolving circumstances.

Impact on the Indian Stock Market

The reduction in interest rates is likely to have a positive impact on the Indian stock market, particularly on sectors that benefit from increased borrowing and investment. Companies with strong growth prospects and access to funding are likely to see an uptick in their valuations. However, investor sentiment and global market trends will also play a crucial role in the market’s performance.

Specific Sectors and Their Responses

India’s recent interest rate cut is poised to ripple through various sectors, impacting investment decisions and economic activity. Understanding the potential reactions of different industries is crucial for forecasting the overall economic impact. This analysis delves into the likely responses of key sectors, considering the potential upsides and downsides of lower borrowing costs.Lower interest rates typically stimulate economic activity by making borrowing cheaper and more attractive.

Businesses, consumers, and investors will be incentivized to take on more debt, leading to increased spending and investment. However, the actual impact on each sector will vary based on specific factors like existing debt levels, future demand projections, and government policies.

Real Estate Sector

Lower interest rates will likely boost the real estate sector. Mortgages become more affordable, encouraging homebuyers to enter the market. Developers might see increased demand, leading to potential construction projects and job creation. Historical data shows that periods of low interest rates often correlate with significant growth in the real estate market. For example, the 2020 interest rate cuts had a similar impact on the real estate sector.

However, the impact will also depend on factors like the availability of construction materials and the overall economic outlook.

Automobile Industry

The automobile industry is another sector expected to benefit from lower interest rates. Lower financing costs for car loans can stimulate demand. Consumers might be more inclined to purchase new vehicles, boosting sales and production. This effect has been observed in the past; for instance, during periods of reduced interest rates, car sales typically increase. However, the impact also depends on factors such as the current state of the automotive market and consumer confidence.

Infrastructure Projects

Lower interest rates can incentivize investment in infrastructure projects. Government and private entities may find it more economical to borrow for large-scale infrastructure projects, such as road construction, power generation, and water supply. This can contribute significantly to long-term economic growth. For instance, several countries have successfully used lower interest rates to jumpstart infrastructure development projects. The specific impact on infrastructure projects will depend on government policies and funding availability.

Technology Companies

Technology companies are likely to react in a nuanced way to interest rate cuts. While lower borrowing costs can facilitate expansion and innovation, the sector’s success is more intertwined with factors like technological advancements and global market trends. Interest rate cuts alone are unlikely to significantly impact their growth trajectory. For example, despite interest rate changes, the technology sector in India has demonstrated resilience.

Agricultural Sector

The agricultural sector’s response to interest rate cuts will be dependent on various factors. Lower interest rates can make it more affordable for farmers to borrow money for agricultural inputs, equipment, and other operational expenses. This can lead to increased productivity and potentially higher yields. However, the impact on farmers will depend on the specific needs and circumstances of each farmer, as well as the prevailing market conditions for agricultural products.

Export-Oriented Industries

Export-oriented industries might see mixed effects. While lower interest rates can reduce the cost of borrowing, the sector’s competitiveness hinges on global market conditions and exchange rates. Lower borrowing costs might stimulate domestic production, but the impact on exports will depend heavily on global demand. For instance, previous interest rate cuts have had varied effects on export-oriented industries depending on the interplay of international trade and economic trends.

Industry Reaction Table

| Industry | Likely Reaction | Key Considerations |

|---|---|---|

| Real Estate | Increased demand, construction | Mortgage affordability, availability of materials |

| Automobile | Increased sales | Car loan affordability, consumer confidence |

| Infrastructure | Increased investment | Government policies, funding availability |

| Technology | Nuanced response | Technological advancements, market trends |

| Agriculture | Potential productivity gains | Farmer needs, market conditions |

| Export-Oriented | Mixed effects | Global market conditions, exchange rates |

Final Wrap-Up

India’s interest rate reduction presents a complex interplay of economic forces. While it promises to stimulate economic activity, the actual impact will depend on various factors, including borrower behavior, market conditions, and government policies. The potential benefits for certain sectors, like real estate, are significant, but the overall outcome hinges on how individuals and businesses respond. The analysis suggests a nuanced picture, where the future trajectory of the Indian economy is contingent upon a multitude of considerations.

The coming months will be crucial in evaluating the effectiveness of this policy.