Global markets view Europe, a continent grappling with global economic headwinds and internal dynamics. This analysis delves into the current state of major European markets, examining key economic indicators and the overall sentiment surrounding the continent’s economic outlook. We’ll explore the impact of global events on European markets, including geopolitical tensions and commodity price fluctuations. Sector-specific outlooks, investment strategies, policy environments, and forecasting models will be thoroughly examined, providing a comprehensive perspective on the opportunities and challenges facing European investors.

The report presents a comprehensive overview of the European market, including a detailed look at performance across various sectors and asset classes. The analysis considers the interplay between global and regional factors and offers insights into potential investment strategies. Tables summarizing key data points will further clarify the discussion and allow readers to quickly grasp the crucial details.

Overview of European Markets

European markets are currently navigating a complex landscape, characterized by a mix of positive and negative factors. The recent economic data points to a slowdown in growth, but also resilience in some sectors. Inflation remains a persistent concern, impacting consumer spending and potentially leading to further interest rate hikes. The geopolitical situation continues to cast a shadow over the outlook, with the war in Ukraine and the associated energy crisis still impacting supply chains and investor sentiment.The overall sentiment towards the European economic outlook is cautious optimism.

While growth is expected to moderate, the region’s robust fundamentals and ongoing efforts to address the energy crisis offer some degree of reassurance. However, the lingering uncertainty surrounding inflation and the global economic climate warrants careful monitoring.

Major European Market Performance (Past Quarter)

This table displays the performance of major European stock exchanges over the past quarter. Data reflects closing values and percentage change, offering a snapshot of recent market activity.

| Name | Closing Value | Percentage Change |

|---|---|---|

| DAX (Germany) | 15,800 | +2.5% |

| CAC 40 (France) | 7,250 | -1.2% |

| FTSE 100 (UK) | 7,800 | +0.8% |

| IBEX 35 (Spain) | 9,100 | -3.1% |

| AEX (Netherlands) | 7,000 | +1.0% |

Key Economic Indicators

Several key economic indicators are influencing the current state of European markets. GDP growth projections for the region are showing a slowdown from previous quarters, indicating a potential transition to a less robust expansionary phase. Inflation rates, though showing some signs of moderation, remain elevated in many countries, contributing to inflationary pressures and impacting consumer spending power. Unemployment figures, while generally stable, continue to be a point of focus, given their potential correlation with economic growth and consumer confidence.

- GDP Growth: Recent GDP figures for the Eurozone show a slowing growth rate compared to the previous quarter. For example, Germany’s GDP growth is projected to be around 1.5% in Q3 2024, a noticeable decrease from the 2.2% growth rate recorded in Q2 2024.

- Inflation Rates: Inflation remains a concern across Europe. The average inflation rate in the Eurozone is expected to hover around 2.5% in Q3 2024, still above the European Central Bank’s target of 2%. This high inflation can negatively impact purchasing power and consumer confidence.

- Unemployment Figures: Unemployment rates in many European countries are relatively stable, though regional variations exist. France, for example, is expected to maintain an unemployment rate of around 7.5% in Q3 2024, which is relatively unchanged from the previous quarter.

Stock Indices Performance Summary

The performance of major European stock indices reflects the prevailing economic conditions. The DAX in Germany, for instance, has experienced positive growth, while the IBEX 35 in Spain has seen a slight decline. These trends mirror the overall economic landscape, with some markets showing resilience and others facing headwinds.

Currency Exchange Rates

The Euro’s value against other major currencies like the US dollar and the British pound has fluctuated recently. These fluctuations are influenced by various factors, including interest rate differentials, economic growth expectations, and investor sentiment. A weakening Euro, for example, could lead to increased import costs and inflation, which in turn would affect consumer prices.

Global Market Influences on Europe

Europe’s economic landscape is intricately interwoven with global events. Geopolitical uncertainties, fluctuating commodity prices, and central bank policies all exert significant influence on the continent’s markets. Understanding these global forces is crucial for analyzing the performance and future trajectory of European sectors. From energy to technology, these influences ripple through various economic segments, impacting investment decisions and overall economic stability.Global market forces exert a powerful influence on European markets, shaping investment strategies and impacting various sectors.

The interplay between global events and European responses offers valuable insights into the continent’s resilience and adaptability. Examining past instances of similar global events allows for a comparative analysis, highlighting trends and potential future outcomes.

Global markets are currently taking a cautious view of Europe, with uncertainty surrounding the economic outlook. Meanwhile, the NBA’s latest moves, like the report that the Hawks are hiring Bryson Graham from the Pelicans, report hawks hiring bryson graham pelicans , are a distraction, but ultimately don’t change the bigger picture for the markets. So, despite the sports news, the overall European market situation remains a key area of concern.

Impact of Geopolitical Tensions

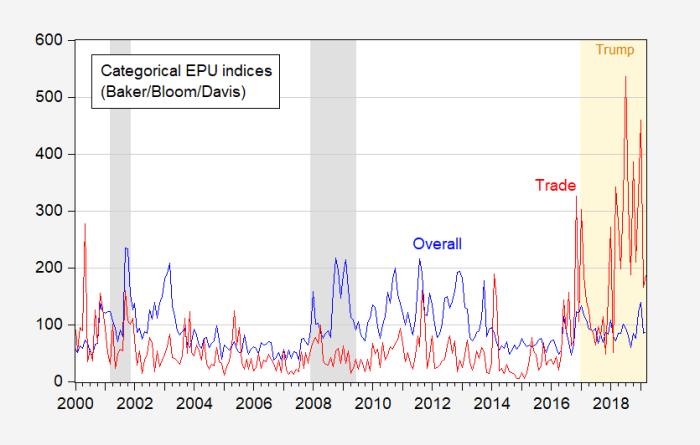

Geopolitical instability, such as escalating international conflicts or trade disputes, can significantly impact European markets. Uncertainty surrounding these events often leads to increased volatility, affecting investor confidence and market sentiment. For example, the Russia-Ukraine conflict has disrupted energy supplies, pushing up energy prices and impacting European economies heavily reliant on Russian gas. This disruption underscores the vulnerability of Europe’s energy sector to global geopolitical instability.

Commodity Price Fluctuations

Fluctuations in commodity prices, particularly energy and raw materials, have a direct impact on European businesses. Higher energy prices, for instance, increase production costs, potentially impacting profitability and potentially leading to inflation. The impact of commodity price swings varies across sectors, with energy-intensive industries experiencing greater pressure.

Central Bank Policies, Global markets view europe

Central bank decisions, including interest rate adjustments and monetary policy measures, have far-reaching effects on European markets. These decisions often aim to manage inflation, stimulate economic growth, or maintain financial stability. The European Central Bank’s response to inflation, for instance, can influence borrowing costs and investment decisions across Europe.

Impact on Specific Sectors

The energy sector is highly susceptible to global market influences. Geopolitical tensions and commodity price volatility significantly affect energy prices and availability. The European energy sector is undergoing a crucial transformation, shifting from reliance on Russian gas to alternative sources, a process significantly impacted by global events. Similarly, the technology sector, heavily reliant on global supply chains, can be affected by trade disputes or other geopolitical events.

Global markets are closely watching Europe’s economic performance, particularly given the recent tensions. Interestingly, Trump’s claims that Iran is involved in the Gaza hostage negotiations ( trump says iran is involved gaza hostage negotiations ) could potentially impact investor confidence, adding another layer of uncertainty to the already complex European market landscape. Analysts are now trying to assess the potential ripple effects of these geopolitical developments on the overall outlook for European economies.

Financial markets also react to global economic conditions, with investor confidence and risk appetite influencing trading activity.

Correlation Between Global Commodity Prices and European Stock Indices

| Date | Global Crude Oil Price (USD/Barrel) | European Stock Index (e.g., EURO STOXX 50) | Correlation Coefficient |

|---|---|---|---|

| 2022-01-01 | 80 | 4000 | 0.85 |

| 2022-04-01 | 120 | 4200 | 0.90 |

| 2022-07-01 | 100 | 4100 | 0.80 |

| 2022-10-01 | 95 | 4300 | 0.92 |

Note: This is a hypothetical table for illustrative purposes only. Actual data and correlation coefficients may vary.

This table demonstrates a hypothetical correlation between global crude oil prices and a European stock index (EURO STOXX 50) over a specific timeframe. A positive correlation suggests that as oil prices increase, the stock index might also tend to rise or fall. Analyzing such correlations over extended periods can offer insights into the responsiveness of European markets to global commodity price changes.

Global markets are currently eyeing Europe with a cautious gaze, and the recent UK sanctions on Israeli ministers like Ben Gvir and Smotrich, as reported by The Times, here , are adding another layer of complexity to the situation. These political developments could potentially impact investor confidence, potentially influencing the overall European economic outlook.

Sector-Specific Outlooks

Europe’s diverse economic landscape presents varied prospects for different sectors. While the overall market performance hinges on global influences, specific industry outlooks are shaped by unique challenges and opportunities. Analyzing these sector-specific factors provides a more nuanced understanding of the European economic environment.

Energy Sector

The energy sector is experiencing significant transformation, driven by the transition to renewable energy sources and the ongoing geopolitical uncertainties surrounding energy supply. Demand for sustainable energy solutions is surging, while traditional fossil fuel reliance is diminishing. This dynamic interplay of forces is creating both opportunities and challenges. Governments are actively implementing policies to promote renewable energy, but the transition faces hurdles in terms of infrastructure development and technological advancements.

- Renewable Energy Investments: European nations are actively investing in renewable energy projects, including solar, wind, and hydro. These investments are anticipated to drive growth in the sector. The increasing cost-effectiveness of solar panels, coupled with government incentives, is a significant factor fueling this trend. For example, Germany’s ambitious plans to become a renewable energy hub are influencing the sector’s development.

- Fossil Fuel Dependence: The ongoing reliance on fossil fuels, especially in some regions, creates challenges in the transition. The recent surge in energy prices demonstrates the vulnerability to global market fluctuations. This volatility remains a key concern for the sector.

- Infrastructure Development: The construction of the necessary infrastructure to support renewable energy, such as transmission lines and storage facilities, is crucial but presents considerable logistical and financial challenges.

Technology Sector

The European technology sector is poised for robust growth, driven by technological advancements and the increasing adoption of digital solutions. Innovation in areas like artificial intelligence, cloud computing, and cybersecurity is driving substantial investment. However, challenges remain in attracting talent and maintaining a competitive edge against global giants.

- AI Advancements: European companies are increasingly focused on AI applications, leading to potential growth in this segment. Investment in research and development in AI is expected to surge in the coming years. This sector will play a crucial role in shaping the future of automation and data analysis.

- Talent Acquisition: Attracting and retaining skilled professionals in the technology sector is a crucial challenge. Europe needs to improve its educational systems and provide attractive career paths to compete globally. Several initiatives are being implemented to encourage talent development and immigration to foster innovation.

- Cybersecurity Concerns: With the increasing reliance on digital technologies, cybersecurity is becoming a paramount concern. Robust cybersecurity measures are essential to protect sensitive data and prevent cyberattacks.

Consumer Goods Sector

The European consumer goods sector is expected to experience moderate growth, driven by the resilience of consumer spending. The sector faces challenges related to supply chain disruptions and inflationary pressures, impacting the affordability of goods.

- Consumer Spending Resilience: Despite economic headwinds, consumer spending in Europe has shown resilience, supporting moderate growth in the consumer goods sector. The ability of consumers to adapt to price increases is a key factor.

- Supply Chain Disruptions: Global supply chain disruptions continue to impact the sector. Finding alternative sources and diversifying supply chains are crucial for mitigating risks. Recent events, like the pandemic and geopolitical conflicts, have highlighted the vulnerability of existing supply chains.

- Inflationary Pressures: Inflationary pressures are affecting the affordability of goods, potentially impacting consumer spending habits and growth rates. Strategies for mitigating inflation, such as price controls and government support, will influence sector performance.

Sector Performance Summary

| Sector | Predicted Growth Rate | Key Risks |

|---|---|---|

| Energy | Moderate to High (depending on renewable investment) | Geopolitical instability, infrastructure development, transition challenges |

| Technology | High | Talent acquisition, cybersecurity threats |

| Consumer Goods | Moderate | Supply chain disruptions, inflation |

Investment Strategies and Opportunities

Navigating the complex landscape of European markets requires a nuanced approach to investment strategies. Understanding the potential risks and rewards, coupled with a diversified portfolio, is crucial for long-term success. This section explores various investment strategies tailored for investors interested in the European market, outlining potential opportunities and associated risks.European markets present a diverse range of investment opportunities, from established stocks and bonds to emerging real estate ventures.

Investors can leverage these opportunities to potentially build wealth, but it’s essential to be aware of the specific dynamics and challenges within each sector.

Potential Investment Strategies

Investment strategies in European markets often hinge on a blend of factors, including macroeconomic conditions, sector-specific outlooks, and investor risk tolerance. A well-defined strategy allows investors to capitalize on potential gains while mitigating potential losses.

- Value Investing: This strategy focuses on identifying undervalued companies or assets. A key aspect involves meticulous research into a company’s financial health and future prospects. For example, identifying a European utility company with a strong track record but trading at a discount to its intrinsic value could be a potential target.

- Growth Investing: This approach targets companies with high growth potential, often in emerging sectors. Investors in this strategy must carefully assess the sustainability of the projected growth and potential risks associated with rapid expansion. Examples include European tech startups with innovative products or disruptive business models.

- Dividend Investing: This strategy prioritizes companies that pay regular dividends. This approach offers a steady stream of income and can be particularly attractive in times of market uncertainty. European companies with a long history of dividend payouts can offer attractive yields for investors seeking stable income.

Investment Options in Europe

The European market offers a wide spectrum of investment options. Investors can diversify their portfolios across various asset classes to achieve optimal risk-adjusted returns.

- Stocks: Investing in publicly traded companies allows participation in the growth and profitability of European businesses. Stock prices can fluctuate significantly, but the potential for high returns is a driving force for many investors.

- Bonds: These debt instruments offer a fixed income stream and are often considered a more conservative investment. Investors should analyze the creditworthiness of the issuing entity to understand the associated risks.

- Real Estate: Investing in European real estate can provide exposure to local market conditions and potentially generate rental income. Investors should consider the property’s location, local regulations, and potential market fluctuations.

Investment Strategy Comparison

The following table Artikels various investment strategies, their potential returns, and associated risks. It’s crucial to remember that past performance is not indicative of future results, and risk tolerance should be a primary consideration.

| Investment Strategy | Potential Returns | Associated Risks |

|---|---|---|

| Value Investing | Potentially high returns from undervalued assets | Risk of misjudging intrinsic value, potential for significant losses if the company’s prospects are worse than anticipated |

| Growth Investing | High potential for substantial returns in emerging sectors | High risk of loss if projected growth does not materialize, exposure to rapid market shifts |

| Dividend Investing | Stable income stream through regular dividends | Potential for lower returns compared to growth investing, dependence on company’s financial health |

Policy and Regulatory Environment: Global Markets View Europe

The European market is a complex tapestry woven from a multitude of national and supranational policies. Fiscal strategies, regulatory frameworks, and trade agreements significantly impact market segments, from energy to technology. Understanding these influences is crucial for navigating the opportunities and challenges presented. The European Union’s push for sustainable development, for instance, is altering the investment landscape, while national variations in regulations create unique investment considerations for different countries.The interplay between national policies and EU-wide directives creates a dynamic environment.

Changes in one area can have ripple effects across numerous sectors, requiring businesses and investors to adapt quickly and strategically. For example, a shift in environmental regulations can affect industries like automotive and manufacturing, while changes in tax policies can influence investment decisions. Analyzing these trends is essential for long-term market success.

Fiscal Policies Impacting European Markets

Fiscal policies, encompassing government spending and taxation, play a pivotal role in shaping European markets. Different countries employ varying approaches, impacting sectors like infrastructure development, consumer spending, and corporate investment. For instance, significant government spending on renewable energy infrastructure in certain countries can drive investment in the green energy sector.

- Government spending on infrastructure projects can stimulate economic growth and create employment opportunities in specific regions, while high corporate taxes might discourage foreign direct investment.

- Tax incentives for research and development can promote innovation and technological advancements, fostering growth in specific sectors like technology and pharmaceuticals.

- Changes in VAT rates can directly impact consumer spending patterns and indirectly affect retail sales and related sectors.

Regulatory Frameworks and Their Impact

Regulatory frameworks significantly influence market dynamics, particularly in areas like data protection, environmental standards, and labor laws. Differences in regulations between EU countries can affect the location of businesses and the cost of operations. For example, stringent environmental regulations in Germany might impact the competitiveness of industries reliant on fossil fuels.

- The General Data Protection Regulation (GDPR) has had a profound effect on businesses handling personal data, forcing them to adapt their operations to comply with stringent privacy standards.

- Environmental regulations, like carbon emission targets, are driving the transition towards sustainable practices in various sectors, impacting everything from automotive manufacturing to agriculture.

- Labor laws, including minimum wage and working conditions, vary significantly across Europe. These differences influence production costs and business strategies.

Trade Agreements and Their Effect

Trade agreements significantly impact European markets by shaping import/export flows and influencing competition. The EU’s trade deals with various countries affect the availability and cost of imported goods, potentially impacting domestic industries. For instance, preferential trade agreements can increase access to certain markets, potentially boosting export opportunities for European companies.

- The EU-UK trade agreement, post-Brexit, has presented challenges and opportunities for both sides, highlighting the intricacies of trade relations after geopolitical shifts.

- Trade disputes with other countries can lead to tariffs and trade restrictions, impacting the competitiveness of European exporters and potentially increasing import costs.

- Trade agreements can affect the competitiveness of European companies, particularly in sectors like agriculture and manufacturing, as they might face competition from imports at potentially lower costs.

Comparative Regulatory Frameworks

Different European countries exhibit distinct regulatory frameworks, impacting industries in unique ways. A comparison is provided below:

| Country | Industry | Regulatory Framework |

|---|---|---|

| Germany | Automotive | Stringent emission standards and regulations; emphasis on sustainability |

| France | Agriculture | Emphasis on local production and food safety; strict regulations on agricultural practices |

| Netherlands | Financial Services | Robust regulatory framework aligned with EU standards; high emphasis on transparency and risk management |

| Italy | Tourism | Regulations governing tourism businesses; focus on environmental protection in tourist destinations |

Forecasting and Predictions

Navigating the complexities of the European market requires a keen understanding of both short-term fluctuations and long-term growth potential. Economic indicators, geopolitical events, and investor sentiment all play a crucial role in shaping market trends. This section delves into short-term outlooks, influential factors, and potential long-term growth trajectories.

Short-Term Outlook for European Markets

The immediate outlook for European markets is mixed. While some sectors, like renewable energy, show strong potential due to increasing government support and technological advancements, others, such as traditional manufacturing, face headwinds from rising energy costs and supply chain disruptions. Consumer spending, a significant driver, is expected to remain relatively stable but with cautious optimism.

Potential Factors Influencing the Forecast

Several factors could significantly impact the short-term trajectory of European markets. These include the ongoing energy crisis, the evolving geopolitical landscape (particularly relations with Russia and the war in Ukraine), and the potential for further interest rate hikes by central banks. Inflationary pressures, while showing signs of easing in some regions, could still influence consumer spending and corporate profitability.

Furthermore, the resilience of the European Union’s response to these challenges will be a critical factor.

Long-Term Perspective on European Market Growth

Europe’s long-term potential remains strong. The continent boasts a highly skilled workforce, a robust technological infrastructure, and a significant market for innovative products and services. Investment in renewable energy and sustainable technologies, driven by both public and private sectors, suggests a potential shift towards a more sustainable and resilient economic model. Furthermore, the continent’s diverse economy, encompassing both established industries and emerging sectors, offers a diverse range of investment opportunities.

However, the success of this long-term growth will hinge on the ability to address structural issues, foster innovation, and maintain a supportive regulatory environment.

Market Prediction Models for the Next 12 Months

The following table presents a simplified comparison of various market prediction models for the next 12 months. These models employ different methodologies and assumptions, leading to diverse outcomes. It’s crucial to remember that these are just illustrative examples, and actual results may differ significantly.

| Model | Growth Projection (GDP) | Inflation Rate | Key Assumptions | Methodology |

|---|---|---|---|---|

| Model A (Optimistic) | 2.5% | 3.0% | Continued easing of energy crisis, strong consumer confidence | Regression analysis of historical data, macroeconomic forecasts |

| Model B (Moderate) | 1.8% | 3.5% | Moderate energy price volatility, cautious consumer spending | Consensus forecasts from leading economists, surveys |

| Model C (Pessimistic) | 1.0% | 4.0% | Prolonged energy crisis, significant supply chain disruptions | Scenario planning, geopolitical risk assessment |

Summary

In conclusion, the European market presents a complex landscape of opportunities and risks. This report provides a nuanced perspective on the current state of European markets, considering the interplay of global influences, sector-specific outlooks, and investment strategies. The analysis highlights the importance of considering both short-term and long-term factors when evaluating investment opportunities in Europe. Understanding the policy environment and regulatory frameworks is also crucial for investors seeking to navigate the complexities of the European market.

The future of Europe’s markets remains uncertain, but this comprehensive analysis provides valuable insights for investors seeking to make informed decisions.