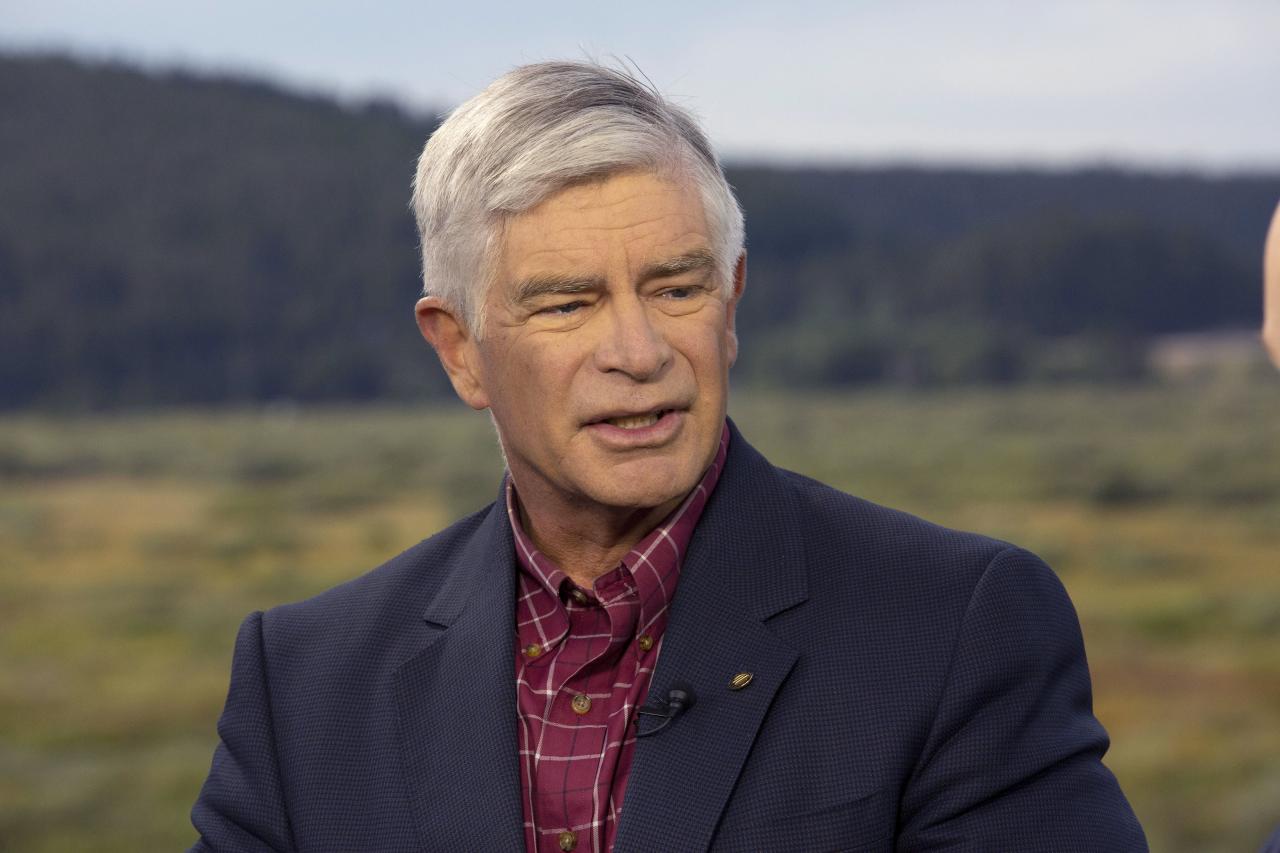

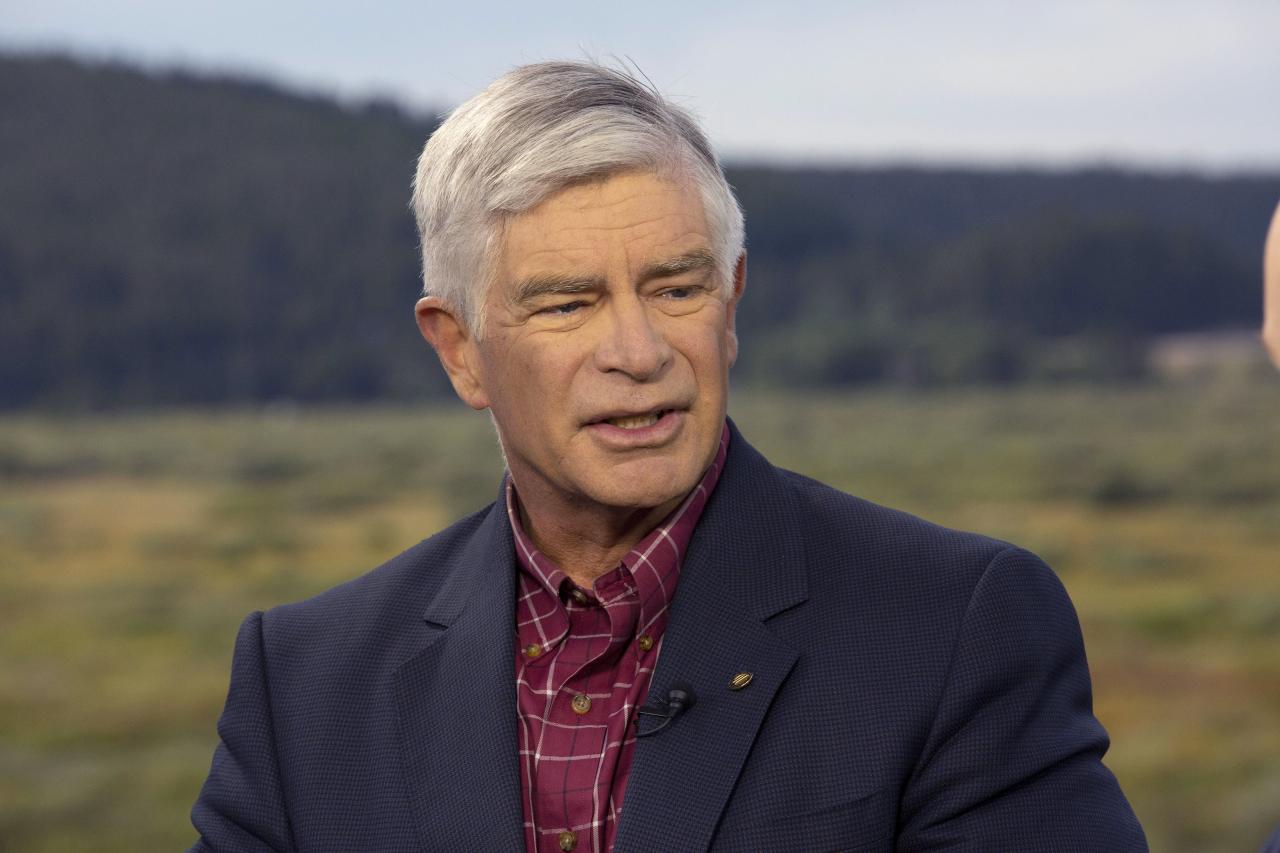

Feds harker says its time caution monetary policy amid uncertainty – Feds Harker says it’s time for caution in monetary policy amid uncertainty. This signals a potential shift in the Federal Reserve’s approach to managing the economy, driven by the current economic climate and the need to navigate a period of ambiguity. The Federal Reserve, tasked with maintaining price stability and full employment, faces a complex challenge. This cautious stance could lead to various implications, impacting interest rates, inflation, and the overall economy.

The statement highlights the Fed’s awareness of the current economic headwinds. Uncertainty in global markets, rising inflation concerns, and potential recessionary pressures are likely influencing this call for caution. Understanding the motivations behind this policy shift is crucial to predicting its potential effects.

Understanding the Context

Federal Reserve Governor Harker’s call for cautious monetary policy amid economic uncertainty signals a potential shift in the Fed’s approach to interest rate adjustments. This signals a growing recognition that the current economic landscape presents challenges and requires a more nuanced response from policymakers. The statement reflects a concern about the potential for unintended consequences from aggressive rate hikes, especially considering the evolving global economic environment.The current economic climate is characterized by a complex interplay of factors.

Inflation, while showing signs of cooling, remains elevated in many parts of the world. Global geopolitical tensions, supply chain disruptions, and persistent labor market pressures contribute to uncertainty. These factors are intertwined and make forecasting economic outcomes more challenging than in more stable periods. For example, the ongoing war in Ukraine and its impact on energy prices, along with rising interest rates, have created an environment where economic growth is not guaranteed.

Role of the Federal Reserve

The Federal Reserve (Fed) plays a crucial role in managing the economy by influencing interest rates and controlling the money supply. Its primary goals include maintaining price stability and maximum employment. By adjusting interest rates, the Fed can influence borrowing costs, impacting consumer spending and investment decisions. This, in turn, affects overall economic activity and inflation. The Fed’s actions aim to steer the economy toward a healthy balance between growth and stability.

Potential Implications of Cautious Monetary Policy

A cautious approach to monetary policy, in the face of uncertainty, may lead to slower interest rate increases or a pause in further hikes. This could provide some relief to borrowers and potentially stimulate economic activity by reducing the cost of borrowing. However, it could also allow inflation to persist longer than desired, potentially eroding the purchasing power of consumers.

Historically, a cautious approach to monetary policy has been seen in periods of high uncertainty, such as during the 2008 financial crisis, where the Fed acted swiftly to mitigate the impact of the economic downturn.

Key Players and Motivations

Several key players influence the Fed’s decisions. These include the Chair of the Federal Reserve, the Board of Governors, and regional Federal Reserve Bank presidents. Each individual likely has differing economic perspectives and priorities, reflecting the complexity of the economic environment. The motivations behind Harker’s statement likely stem from a concern about the potential risks of further tightening monetary policy.

This could stem from a recognition that the current economic environment is more uncertain than previously anticipated, and a cautious approach is necessary to prevent potential harm. Concerns about the potential for a recession, alongside the impact on various sectors of the economy, are also likely factors.

Analyzing the Statement’s Components

The Federal Reserve’s recent emphasis on “caution” in monetary policy amid uncertainty signals a potential shift in its approach to interest rate adjustments. This shift reflects a growing awareness of the complex economic landscape and the need for a more measured response to evolving conditions. Understanding the nuances of this statement is crucial for interpreting the Fed’s intentions and predicting its future actions.The statement highlights the Fed’s recognition that current economic conditions are not straightforward, and that a cautious approach is warranted.

This approach prioritizes avoiding unintended consequences and ensuring stability. A key aspect of this analysis is dissecting the specific meaning of “caution” in the context of monetary policy, and examining the potential interpretations of “amid uncertainty.”

Meaning of “Caution Monetary Policy”

“Caution monetary policy” suggests a deliberate restraint in adjusting interest rates and other monetary tools. This restraint is intended to minimize the risk of adverse impacts on the economy, such as triggering a recession or exacerbating existing economic vulnerabilities. The Fed might choose to wait for more data or a clearer picture of the economic outlook before implementing significant changes.

Interpretations of “Amid Uncertainty”

The phrase “amid uncertainty” acknowledges the complexities and ambiguities inherent in the current economic environment. This could encompass various factors, including:

- Geopolitical tensions: International conflicts and escalating trade disputes can introduce significant volatility into global markets, affecting investment decisions and consumer confidence. This uncertainty might prompt the Fed to exercise caution.

- Inflationary pressures: Persistently high inflation, even with signs of easing, remains a concern. The Fed might be uncertain about the efficacy of its current strategies to combat inflation and prefer a more measured approach to avoid further complications.

- Economic growth projections: Discrepancies in economic forecasts from different institutions highlight a lack of consensus regarding the trajectory of economic growth. This lack of clarity can influence the Fed’s decision-making process.

Potential Reasons for a Cautious Approach

Several factors might lead the Federal Reserve to adopt a cautious approach to monetary policy:

- Recent economic data: A mix of positive and negative economic indicators can create a complex picture, making it difficult to determine the optimal course of action.

- Unforeseen shocks: Unexpected events, such as natural disasters or significant shifts in consumer behavior, can disrupt economic trends, demanding a cautious response from the Fed.

- Lagged effects of previous policies: The impact of previous interest rate adjustments might not be immediately apparent, necessitating a cautious approach to evaluate the full effect before implementing further changes.

Historical Precedent

The Federal Reserve has a history of adjusting its approach to monetary policy in response to evolving economic circumstances. Past examples of similar statements regarding monetary policy can provide valuable insights into the context of the current statement. For instance, the 2008 financial crisis prompted a period of extremely low interest rates, demonstrating the Fed’s willingness to adopt unconventional policies in times of extreme economic distress.

Comparison with Recent Federal Reserve Pronouncements

Comparing this statement with other recent Federal Reserve pronouncements reveals the evolving nature of the Fed’s approach to monetary policy. For example, if recent statements have emphasized a more aggressive approach to controlling inflation, this current statement signifies a potential shift toward a more measured approach in response to current uncertainties.

Potential Impacts and Implications

The Federal Reserve’s cautious stance on monetary policy, amidst economic uncertainty, has significant ripple effects across various sectors. Understanding these potential impacts is crucial for investors, businesses, and individuals alike. This analysis delves into the possible consequences on interest rates, inflation, the stock market, the overall economy, and specific sectors.

The Fed’s Harker is sounding the alarm about needing to be cautious with monetary policy, citing the current uncertainty. While the economic landscape is definitely tricky right now, it’s interesting to see how that contrasts with the exciting baseball news, like Andrew McCutchen’s impressive feat of climbing the Pirates’ all-time home run list with a win over the Marlins.

andrew mccutchen climbs pirates hr list win over marlins Still, the overarching concern remains on the need for cautious monetary policy adjustments, given the complex interplay of economic forces.

Interest Rate Implications

Interest rate adjustments are a primary tool of monetary policy. The Fed’s cautious approach suggests a potential pause or even a slight decrease in the pace of interest rate hikes. This is often a response to signs of slowing economic growth or inflationary pressures easing. For example, if inflation is falling more rapidly than expected, the Fed might reduce the rate of interest rate increases to prevent a sharper economic slowdown.

This can have a considerable impact on borrowing costs for businesses and consumers, impacting investment and spending patterns.

Inflationary Effects

The Fed’s cautious monetary policy aims to moderate inflation. If the Fed anticipates inflation remaining elevated or even increasing, it might opt for a more aggressive approach, which could include further interest rate hikes. Conversely, if inflation cools faster than expected, a more relaxed approach may be employed. This uncertainty surrounding inflation projections plays a crucial role in shaping economic forecasts and investor sentiment.

Stock Market Impact

The stock market often reacts to shifts in monetary policy. A pause or reduction in interest rate increases could be viewed positively by investors, potentially leading to increased stock prices. This is because lower borrowing costs can stimulate economic activity and corporate earnings. However, if the cautious approach is interpreted as a sign of a less robust economy, it could lead to a decrease in investor confidence and lower stock valuations.

The stock market’s reaction is not always linear, and other factors, such as geopolitical events or earnings reports, also influence its trajectory.

Federal Reserve President Harker’s call for cautious monetary policy amid economic uncertainty is definitely a key takeaway. This echoes the ongoing complexities in the global financial landscape, particularly given the recent developments surrounding the Mediobanca situation, which has more twists and turns ahead, as detailed in this insightful piece: mediobanca great escape has more twists ahead. Ultimately, careful consideration of these interconnected factors is essential for navigating the current economic terrain and maintaining a stable financial future.

Overall Economic Impact

Monetary policy directly influences the overall economy by affecting borrowing costs, consumer spending, and investment decisions. A cautious approach can help avoid a sharp economic downturn, especially if inflation is showing signs of cooling down. However, it could also lead to slower economic growth compared to a more aggressive policy stance. This balancing act is a central challenge for central banks in navigating uncertain economic environments.

Sector-Specific Impacts

Different sectors of the economy react differently to changes in monetary policy. For example, the housing sector is particularly sensitive to interest rates. Higher interest rates typically cool down the housing market, impacting sales and construction. Similarly, sectors heavily reliant on borrowing, such as small businesses and startups, may face challenges with increased borrowing costs. Conversely, sectors with strong underlying fundamentals may be less affected by these changes.

Understanding these sector-specific impacts is crucial for businesses and investors to make informed decisions.

Illustrative Examples

The Federal Reserve’s cautious approach to monetary policy, amid economic uncertainty, necessitates a deeper understanding of potential outcomes. Illustrative examples provide a tangible framework for comprehending the complex interplay between policy decisions and real-world economic impacts. These examples will analyze different policy stances, visualize the uncertainty-policy relationship, and detail historical and potential future scenarios.

Comparing Monetary Policy Stances

Different monetary policy stances can significantly affect inflation and economic growth. A table outlining these stances helps to understand the trade-offs involved.

| Policy Stance | Description | Potential Impact on Inflation | Potential Impact on Economic Growth |

|---|---|---|---|

| Expansionary | Lowering interest rates, increasing money supply to stimulate borrowing and spending. | Potentially higher inflation due to increased demand. | Potentially higher economic growth due to increased investment and consumption. |

| Contractionary | Raising interest rates, decreasing money supply to curb inflation. | Potentially lower inflation due to reduced demand. | Potentially lower economic growth due to decreased investment and consumption. |

| Neutral | Maintaining current interest rates and money supply, allowing market forces to dictate economic activity. | Maintaining current inflation levels. | Maintaining current economic growth levels. |

| Cautious | Adjusting interest rates and money supply cautiously, based on current and anticipated economic conditions, to avoid both high inflation and recession. | Maintaining or moderately lowering inflation. | Maintaining or moderately lower economic growth, but avoiding sharp declines. |

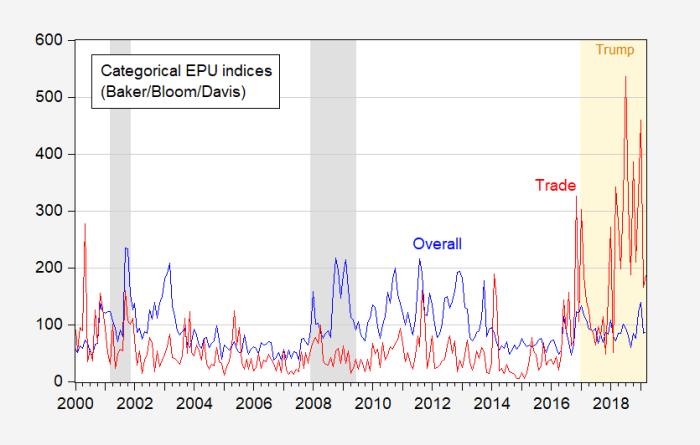

Visualizing Uncertainty and Policy Decisions

The relationship between uncertainty and monetary policy decisions can be visualized as a complex, dynamic curve. A high degree of uncertainty often leads to a cautious approach, characterized by smaller, more incremental adjustments to policy levers. This is because the potential negative consequences of a miscalculation are amplified when uncertainty is high. The curve demonstrates that as uncertainty decreases, the potential for larger policy adjustments increases.

A visual representation would show a curve with a steeper slope for higher uncertainty, flattening as uncertainty diminishes.

Implementing a Cautious Approach

The Federal Reserve might implement a cautious approach by employing a gradual increase in interest rates. For instance, instead of a large, immediate rate hike, the Fed could implement a series of smaller, more frequent adjustments, closely monitoring economic indicators. This strategy allows the Fed to react to evolving economic conditions without potentially causing a sharp downturn. Furthermore, communication plays a vital role.

Clear and consistent communication about the Fed’s intentions and rationale behind its decisions builds market confidence and helps manage expectations.

Historical Example of Cautious Policy

The 1990s saw the Federal Reserve adopting a cautious approach to monetary policy, which helped manage inflation and stabilize the economy while maintaining a relatively high rate of growth. This period exemplified the benefits of a calibrated and adaptable policy response to economic uncertainties. This strategy demonstrated that a cautious approach, rather than extreme measures, can effectively guide the economy through periods of change.

Potential Scenarios and Outcomes, Feds harker says its time caution monetary policy amid uncertainty

A cautious monetary policy approach, given the current uncertainty, could lead to a variety of potential scenarios. A table Artikels potential outcomes based on different economic conditions.

| Scenario | Economic Condition | Potential Outcome (Cautious Policy) |

|---|---|---|

| Sustained Growth | Healthy economic growth, moderate inflation | Continued stable economic growth with moderate inflation. |

| Inflationary Pressures | Economic growth outpaces capacity, leading to rising prices | Gradual rate increases to cool inflation without triggering recession. |

| Economic Slowdown | Reduced consumer spending, decreased investment | Possible rate cuts or maintaining current rates to stimulate economic activity. |

Possible Future Implications

The Federal Reserve’s cautious stance on monetary policy, as articulated in recent statements, suggests a nuanced approach to navigating the current economic landscape. This cautious approach is likely to have ripple effects across various sectors, from interest rates and inflation to global markets and individual investment strategies. Understanding these potential implications is crucial for investors, businesses, and policymakers alike.The next few quarters will likely see a continuation of the current trend, with interest rates remaining relatively stable, or perhaps even edging slightly downward, depending on the data.

This approach seeks to temper inflation without triggering a recession. The long-term effects of this strategy will depend on how effectively the Fed manages to balance these two competing objectives.

Forecasting the Next Few Quarters

The Fed’s cautious approach implies a wait-and-see strategy. Economic data in the coming quarters will be scrutinized closely, with the possibility of adjustments to the current policy based on the observed trend. If inflation continues to cool down as expected, and the labor market shows signs of stabilizing, a further tightening of monetary policy might be less likely.

Conversely, if inflation stubbornly remains elevated or if the labor market weakens, a more aggressive approach might be necessary. The recent increase in energy prices, for example, has significantly impacted inflation and will likely be a key factor in future decisions.

Potential Long-Term Effects of a Cautious Policy

A cautious monetary policy, if maintained over an extended period, could lead to slower economic growth, but it might also prevent a potentially more damaging inflationary surge. The risk is that if the economy weakens significantly, it could potentially lead to deflationary pressures. Historical examples of prolonged periods of cautious monetary policy, like the one that followed the 2008 financial crisis, highlight the need for careful consideration of the potential for a prolonged period of low growth.

The impact on consumer spending and business investment will be significant, and the Fed will need to monitor these factors closely.

Potential Alternative Policy Responses

Alternative policy responses could range from more aggressive rate hikes to outright easing. A more aggressive approach might be employed if inflation proves more persistent than anticipated, while a less aggressive approach or even easing might be necessary if the economy weakens significantly. The choice of policy response will depend on the evolution of economic data and the Fed’s assessment of the risks.

A crucial element is understanding the specific context of the current economic situation and how it differs from past episodes.

Potential Impact on Global Markets

A cautious approach by the US Federal Reserve will likely influence global markets. If the US economy slows down, it will have a direct impact on global trade and investment. Other central banks will likely respond to the Fed’s actions, creating a complex web of interconnected financial markets. The potential for currency fluctuations and changes in investment strategies is significant, as investors assess the implications of the Fed’s policy for their portfolios.

A global slowdown in economic growth could have far-reaching implications.

Potential Risks Associated with This Approach

The cautious approach carries potential risks. One risk is that inflation might persist, eroding the purchasing power of consumers. Another risk is that a prolonged period of slow growth could lead to a decline in investment and employment. The possibility of a prolonged period of stagnation, a so-called “secular stagnation,” is a significant concern. The Fed’s policy will need to be monitored closely, and potential adjustments will need to be considered depending on the evolving economic data.

Structuring Information for Clarity

The Federal Reserve’s recent pronouncements on the need for caution in monetary policy underscore the intricate dance between controlling inflation and navigating economic uncertainty. Understanding the current economic climate, the Fed’s actions, and the potential impacts requires a structured approach to information. This section provides a framework for analyzing the situation, enabling a clearer comprehension of the interconnected factors at play.The complexities of monetary policy necessitate a systematic approach to understanding the implications.

By breaking down the current economic situation, the Fed’s actions, and potential impacts into digestible components, we can better appreciate the delicate balance the central bank strives to maintain.

Current Economic Situation and the Fed’s Role

The current economic landscape is characterized by a mix of robust growth in some sectors, persistent inflation pressures in others, and a looming threat of recession in certain projections. The Federal Reserve plays a crucial role in influencing these factors through monetary policy tools like interest rate adjustments. These adjustments impact borrowing costs, consumer spending, and investment decisions, thereby affecting the overall economic trajectory.

The Fed’s mandate is to maintain price stability and maximum employment, a dual objective that often presents a delicate balancing act.

Timeline of Recent Federal Reserve Statements and Actions

A clear timeline of recent statements and actions from the Federal Reserve provides context for understanding the current policy stance. This includes dates of policy meetings, press releases, and any subsequent changes in interest rates or quantitative easing measures. Tracking these events allows for an assessment of the Fed’s evolving response to economic developments.

- 2023-Q1: Initial signals of a potential shift in monetary policy direction, acknowledging the possibility of elevated inflation.

- 2023-Q2: Increased interest rate hikes to combat inflation, with accompanying statements highlighting the need for further action if needed.

- 2023-Q3: The Fed’s communication emphasizing the need for a data-driven approach, signaling a willingness to adjust its stance based on evolving economic indicators.

Key Arguments Presented in the Statement

The Fed’s statement typically Artikels the reasoning behind its current policy decisions. Key arguments often center around the need for continued vigilance in addressing inflation, while also acknowledging the risks of an overly restrictive approach to economic growth. These arguments are often presented within the context of economic indicators and forecasts.

- The statement emphasizes the importance of carefully monitoring economic data to gauge the effectiveness of current policies and the potential need for adjustments.

- The Fed highlights its commitment to achieving its dual mandate of price stability and maximum employment.

- The statement usually acknowledges the presence of uncertainties and stresses the need for a flexible response to evolving economic conditions.

Framework for Understanding Monetary Policy and Economic Uncertainty

Monetary policy operates within a complex framework, interacting with various economic variables. Uncertainty in the economy can affect the effectiveness of policy actions. A thorough understanding requires analyzing the potential lags in policy transmission, the impact of expectations, and the influence of external factors.

The relationship between monetary policy and economic uncertainty is complex, often characterized by feedback loops and lags. Policy decisions today can impact economic conditions weeks, months, or even years later.

Economic Indicators Influenced by Monetary Policy

The table below summarizes key economic indicators that might be directly or indirectly influenced by monetary policy changes.

| Economic Indicator | Potential Influence |

|---|---|

| Inflation Rate | Interest rate adjustments can influence inflation by affecting borrowing costs and consumer spending. |

| Unemployment Rate | Monetary policy can impact employment through its effect on overall economic activity. |

| GDP Growth | Monetary policy can influence GDP growth by affecting investment, consumption, and overall economic activity. |

| Consumer Confidence | Interest rates and economic forecasts can impact consumer confidence and spending habits. |

| Stock Market Performance | Interest rates and economic forecasts can impact investor sentiment and stock prices. |

Last Recap: Feds Harker Says Its Time Caution Monetary Policy Amid Uncertainty

In conclusion, the Federal Reserve’s potential shift towards a more cautious monetary policy, as suggested by Harker, presents a complex set of potential impacts. Interest rates, inflation, and the stock market are all likely to be affected. The overall economy could experience a mix of positive and negative consequences, depending on the implementation and duration of this cautious approach.

Careful analysis of the current economic climate and the Fed’s historical precedent is essential for understanding the full implications.