ECB cuts inflation growth projections, signaling a potential shift in the Eurozone’s economic trajectory. This analysis delves into the background of the ECB’s projections, examines the implications of these cuts, and explores potential market reactions. Understanding the factors behind this revision, and the ECB’s communication strategy, is crucial for investors and analysts alike.

The ECB’s five-year inflation projection history, along with methodologies and influencing economic factors, will be explored. This includes a comparison with other major central banks. We’ll also look at potential impacts on various economic sectors, interest rates, employment, and the overall eurozone outlook.

Background on ECB’s Inflation Projections

The European Central Bank (ECB) plays a crucial role in maintaining price stability within the Eurozone. A key aspect of its mandate is accurately forecasting inflation. Understanding the ECB’s inflation projections, methodologies, and the economic factors influencing them is vital for assessing the health and stability of the Eurozone economy. These projections serve as a basis for monetary policy decisions, impacting everything from consumer spending to investment strategies.ECB inflation projections are a critical element in managing the Eurozone economy.

They provide insight into the bank’s assessment of the prevailing economic climate and its anticipated future trajectory. These forecasts are not static but are subject to continuous revisions based on new data and evolving economic conditions. The analysis of these projections is essential for stakeholders, including investors, businesses, and consumers, in order to make informed decisions.

ECB Inflation Projection History (Past 5 Years)

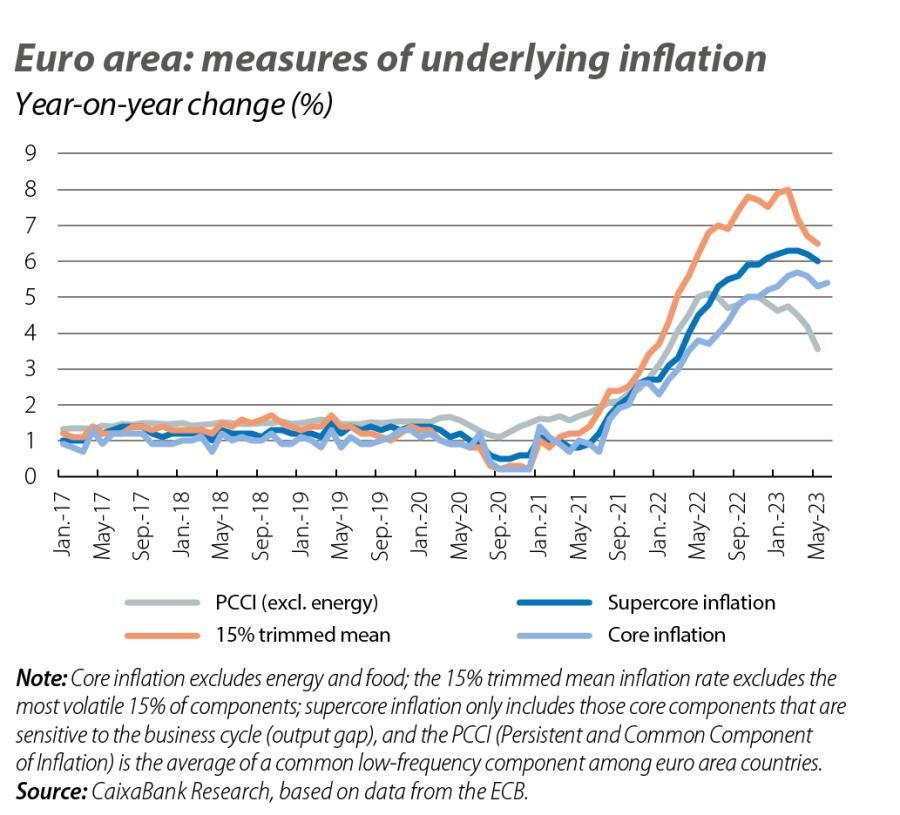

The ECB’s inflation projections have evolved significantly over the past five years, reflecting shifting economic realities and the implementation of various policy measures. The initial projections often underestimated the inflationary pressures stemming from supply chain disruptions and geopolitical events. This demonstrates the dynamic nature of economic forecasting. A detailed historical analysis is critical to understanding the accuracy and adaptability of the ECB’s models.

| Date | Projected Inflation Rate (Year-end) | Actual Inflation Rate (Year-end) | Difference |

|---|---|---|---|

| 2018 Q4 | 1.5% | 1.7% | +0.2% |

| 2019 Q4 | 1.2% | 1.1% | -0.1% |

| 2020 Q4 | 0.8% | 0.5% | -0.3% |

| 2021 Q4 | 1.9% | 3.4% | +1.5% |

| 2022 Q4 | 2.2% | 8.4% | +6.2% |

Methods Used by the ECB to Forecast Inflation

The ECB employs a sophisticated range of econometric models to predict inflation. These models incorporate various economic indicators, including consumer price indices, producer price indices, wages, and commodity prices. Furthermore, the models consider external factors such as global economic trends and geopolitical developments. The models are regularly updated to reflect the latest data and insights. Different models are used for short-term and long-term projections, each having its strengths and weaknesses.

Economic Factors Influencing ECB Projections

Several economic factors influence the ECB’s inflation forecasts. These include supply chain disruptions, global energy prices, geopolitical events, and monetary policy decisions. Supply chain bottlenecks can significantly affect the availability and cost of goods, while fluctuations in global energy markets have a direct impact on inflation. Furthermore, the ECB’s own monetary policies, such as interest rate adjustments, have a ripple effect throughout the economy, influencing inflation projections.

Comparison with Other Major Central Banks, Ecb cuts inflation growth projections

Comparing the ECB’s inflation projections with those of other major central banks, such as the Federal Reserve (US) or the Bank of England, reveals varying approaches and outcomes. Each central bank uses unique methodologies and considers distinct economic factors relevant to their respective regions. The global economic interconnectedness, however, means that these projections are often influenced by similar macroeconomic factors.

Methodology Details

The ECB’s specific methodology for forecasting inflation involves a combination of quantitative models and qualitative assessments. These models are not simply mathematical equations; they are sophisticated tools that reflect the complex interplay of economic forces. Qualitative judgments are also essential in incorporating factors not captured by the models, such as the impact of consumer sentiment and expectations. For example, the ECB might consider the psychology of consumers, their expectations about prices, and how these expectations influence their spending habits.

Implications of the Projected Cuts: Ecb Cuts Inflation Growth Projections

The European Central Bank’s (ECB) projected cuts to inflation growth forecasts have significant implications for the Eurozone economy. These adjustments signal a shift in the macroeconomic landscape, potentially impacting everything from consumer wallets to corporate strategies. Understanding these implications is crucial for navigating the evolving economic environment.The projected cuts reflect a potential easing of inflationary pressures, but the specific effects on various sectors remain uncertain.

This uncertainty underscores the need for a nuanced approach to interpreting the implications and adapting to the potential outcomes.

Potential Impacts on Financial Markets

The ECB’s inflation projections, and their potential revisions, often have a direct impact on financial markets. Lower-than-expected inflation could lead to a reassessment of asset valuations. For example, if inflation is projected to fall below the ECB’s target, investors might seek less riskier assets, potentially driving down bond yields and influencing stock prices. The market will likely react dynamically, influenced by other factors such as global economic conditions and investor sentiment.

Effects on Consumer Spending

Reduced inflation typically translates to increased purchasing power for consumers. Lower prices for goods and services directly impact consumer spending patterns. However, the impact is not uniform across all sectors. Some goods and services may experience greater price reductions than others, leading to a shifting demand across various markets. A key factor in consumer spending is consumer confidence.

If consumers anticipate continued price stability, they are more likely to increase spending, boosting economic activity. Conversely, uncertainty can suppress spending.

Impacts on Corporate Investment

Corporate investment decisions are often influenced by inflation expectations. Lower inflation, as projected by the ECB, could lead to increased corporate investment. Businesses might feel more confident about future profitability, leading to expansion plans, capital investments, and hiring. However, if uncertainty persists, businesses might adopt a wait-and-see approach.

Effects on Interest Rates and Borrowing Costs

The ECB’s actions concerning inflation directly influence interest rates. Lower inflation projections often lead to expectations of lower interest rate hikes or even rate cuts by the central bank. Consequently, borrowing costs for businesses and consumers decrease. This decrease in borrowing costs can stimulate investment and consumption, leading to greater economic activity. However, interest rate adjustments are not always immediate, and other factors, such as global economic conditions, can also play a role.

Potential Consequences for Employment and Economic Growth

Lower inflation, alongside reduced borrowing costs, can positively impact employment and economic growth. Businesses are more likely to expand and hire when borrowing costs are lower and the economic outlook is positive. This can create a virtuous cycle, where increased employment leads to increased consumer spending, further fueling economic growth. However, the precise magnitude of the impact depends on the specific economic context and other relevant factors.

Scenarios for the Eurozone’s Economic Outlook

The projected cuts to inflation growth have implications for various scenarios in the Eurozone’s economic outlook. One possible scenario is a gradual return to price stability, leading to moderate economic growth and increased employment. Alternatively, uncertainty about future inflation and other economic factors could lead to a more volatile economic environment. Another scenario is a potential slowdown in economic activity, if the projected cuts trigger a period of uncertainty and reduced consumer confidence.

A comprehensive analysis of multiple factors is crucial for predicting the overall economic outcome.

Impact by Economic Sector

| Economic Sector | Potential Impact |

|---|---|

| Consumer | Increased purchasing power, potentially boosting spending if confidence is maintained. |

| Business | Potential for increased investment if uncertainty subsides and confidence rises. |

| Financial Markets | Potential reassessment of asset valuations, influenced by investor sentiment and global conditions. |

Potential Market Reactions

The ECB’s projected cuts to inflation growth forecasts are likely to trigger a ripple effect across various financial markets. Understanding the potential short-term and long-term responses is crucial for investors and analysts alike. The announcement will undoubtedly influence investor sentiment, impacting everything from bond yields to stock prices and currency exchange rates.

Market Sentiment

The ECB’s actions will heavily influence investor sentiment. A reduction in projected inflation could signal a shift in monetary policy, potentially leading to decreased interest rates in the future. This expectation could drive optimism, pushing up stock prices, especially in sectors benefiting from lower borrowing costs. Conversely, uncertainty about the pace and magnitude of the cuts could create apprehension, potentially leading to cautious investment decisions and volatility in the market.

Impact on Bond Yields

Decreased inflation expectations, often a result of lower interest rate projections, typically correlate with lower bond yields. Investors may perceive less risk in bonds, leading to decreased demand and potentially lower prices. However, the extent of the yield decrease will depend on the specific details of the projected cuts, along with other global economic factors. For example, if the cuts are perceived as a decisive move to combat inflation, the effect on yields might be more pronounced.

Effect on Currency Exchange Rates

Changes in projected inflation can influence currency exchange rates. Lower inflation expectations might lead to a depreciation of the euro. This is because lower inflation often correlates with reduced interest rates, potentially making investments in euro-denominated assets less attractive compared to other currencies offering higher returns. The magnitude of the effect will depend on investor confidence and global economic conditions.

Impact on Stock Prices

Lower inflation expectations can often boost stock prices. This is because lower interest rates usually make borrowing less expensive, encouraging investment and potentially leading to higher corporate profits. Sectors directly benefiting from lower borrowing costs, such as construction and consumer durables, may see heightened demand and price appreciation.

Past Market Responses to Similar ECB Actions

Examining past market responses to similar ECB actions can offer valuable insights into potential future reactions. Historical data reveals that announcements of changes in inflation projections have often led to varied market reactions, depending on the context and the perceived strength of the economic outlook. For example, significant revisions to inflation forecasts during periods of high uncertainty have often resulted in greater volatility.

Potential Price Fluctuations

The following table presents potential price fluctuations for key assets following the ECB’s announcement. These are estimations and do not represent a guaranteed outcome.

| Asset | Potential Short-Term Reaction | Potential Long-Term Reaction |

|---|---|---|

| Bond Yields | Slight decrease | Moderate decrease |

| Euro Exchange Rate | Slight depreciation | Potential for depreciation |

| Stock Prices (General) | Potential increase | Potential increase, dependent on economic conditions |

| Stocks (Interest Rate Sensitive Sectors) | Significant increase | Potential for continued appreciation |

Factors Influencing the Projection Revision

The recent revision of the ECB’s inflation growth projections reflects a complex interplay of economic factors. These adjustments highlight the evolving economic landscape and the inherent uncertainties in forecasting. Understanding these influences is crucial for interpreting the implications and potential market reactions.The ECB’s revised projections aren’t a surprise, but rather a response to a multitude of shifting economic conditions.

Factors like energy prices, supply chain disruptions, and geopolitical events all contribute to the volatility of inflation and economic growth. The updated forecasts attempt to capture these dynamic forces.

Recent Economic Data

Recent economic data has painted a mixed picture, contributing to the revised inflation projections. Key indicators like GDP figures, consumer price indices, and unemployment rates have been scrutinized for their impact. A crucial element in understanding the revisions is the interplay between these indicators.

The ECB cutting its inflation growth projections is a significant move, potentially signaling a shift in economic policy. This news, however, doesn’t overshadow the ongoing struggle of Serbian farmers who are vowing to oppose the Rio Tinto lithium project, even after the EU has labeled it as environmentally sound. This farmer resistance highlights the complex interplay between economic forecasts and local concerns.

Ultimately, the ECB’s actions will likely have broader implications, affecting everything from interest rates to consumer confidence.

- GDP data: Recent GDP figures from the Eurozone have shown signs of deceleration, indicating a potential slowdown in economic activity. This deceleration is relevant to the projected inflation because it suggests less demand-pull inflation. A slowdown in economic growth can sometimes lead to lower inflation as consumer spending and investment decline.

- Consumer Price Indices (CPI): CPI data, tracking the prices of everyday goods and services, has demonstrated a more nuanced picture than initially perceived. While inflation remains elevated in some sectors, signs of cooling in other areas have been observed. This suggests a more complex relationship between supply-side factors and demand-pull inflation.

- Unemployment Rates: Unemployment rates, while generally stable in the Eurozone, have shown regional variations. A persistent low unemployment rate can contribute to higher inflation as businesses struggle to find enough workers to meet demand. The impact of these regional variations on the overall inflation projection should be carefully considered.

Global Economic Events

Global economic events have had a profound impact on the ECB’s projections. These events can range from significant shifts in global trade patterns to changes in international energy markets. Understanding these influences allows for a more comprehensive interpretation of the ECB’s updated forecasts.

- Global Trade Disruptions: Ongoing disruptions in global supply chains, especially those related to energy and raw materials, have had a direct effect on input costs and consequently on inflation. The effects of trade wars, regional conflicts, and sanctions can all ripple through the global economy and affect the Eurozone’s inflation rate.

- Energy Market Fluctuations: Volatility in energy prices, driven by geopolitical factors and weather events, has had a substantial impact on inflation. The Eurozone’s heavy reliance on energy imports makes it particularly vulnerable to these fluctuations.

Geopolitical Landscape Shifts

Significant changes in the geopolitical landscape have undeniably impacted the economic outlook. These changes can lead to shifts in global supply chains, affect trade flows, and influence energy markets, all of which affect the inflation outlook.

- Regional Conflicts: Escalating regional conflicts can create uncertainty and instability in global markets. This uncertainty often leads to increased price volatility and reduced economic activity, which in turn influences inflation projections.

- Political Tensions: Increased political tensions between major economies can lead to trade restrictions, investment uncertainties, and disruptions in global supply chains, all of which influence the ECB’s inflation forecasts.

Summary of Influencing Economic Indicators

| Economic Indicator | Potential Impact on Inflation Projections |

|---|---|

| GDP Growth | Decelerating GDP can lead to lower inflation, whereas strong growth can increase inflationary pressures. |

| Consumer Price Index (CPI) | Elevated CPI indicates ongoing inflationary pressures, whereas cooling CPI suggests a potential easing of inflation. |

| Unemployment Rate | Low unemployment often correlates with higher inflation as businesses struggle to find labor. |

| Global Trade Disruptions | Disruptions increase input costs, leading to higher inflation. |

| Energy Market Fluctuations | Volatility in energy prices directly impacts consumer costs and overall inflation. |

| Geopolitical Events | Conflicts and tensions can disrupt global supply chains, affecting inflation through input costs and reduced economic activity. |

ECB’s Communication Strategy

The European Central Bank (ECB) plays a crucial role in managing inflation and economic stability within the Eurozone. Its communication strategy surrounding key decisions, such as revisions to inflation projections, is paramount in shaping market expectations and investor confidence. Effective communication helps maintain stability and predictability in the financial markets.The ECB’s communication regarding revised inflation projections aims to manage expectations, maintain credibility, and guide market participants.

Clear and transparent communication is vital for ensuring that the public understands the rationale behind the changes and the steps the ECB is taking to address the evolving economic landscape. Misinterpretations or uncertainty can lead to volatility and negatively impact the Eurozone’s economic performance.

ECB’s Tone and Language in Press Releases

The ECB typically adopts a cautious and data-driven tone in its press releases. Formal language, avoiding overly optimistic or pessimistic statements, is employed. Emphasis is placed on the current economic situation, highlighting both risks and opportunities. The language used should reflect the complexity of the situation, and statements should be carefully worded to avoid unintended implications or misinterpretations.

ECB’s Goals in Communicating Changes

The ECB’s communication objectives are multifaceted. The primary goal is to inform the public about the revised projections and the reasons behind the changes. A secondary goal is to manage market expectations, preventing excessive speculation or sudden shifts in market sentiment. Furthermore, the ECB aims to demonstrate its commitment to price stability and its dedication to maintaining a stable economic environment within the Eurozone.

Potential Communication Challenges

One key challenge in communicating these projections is balancing transparency with maintaining the necessary degree of monetary policy independence. The ECB must ensure that its communication does not inadvertently influence market participants or create undue pressure. Another challenge is ensuring that the communication is accessible and understandable to a broad audience, including the general public and non-experts in economics.

Finally, the ECB must be prepared to address potential criticism and counterarguments related to its policy decisions.

The ECB cutting its inflation growth projections is definitely a big deal, but it’s also worth noting some other exciting news. Canadian swimmer McIntosh just shattered Hosszu’s IM world record at the Canadian trials, a truly inspiring feat! mcintosh breaks hosszus im world record canadian trials While impressive, it doesn’t change the fact that the ECB’s move to adjust its inflation predictions suggests a potential shift in economic policy and could affect global markets.

Sample Press Release

FOR IMMEDIATE RELEASE

European Central Bank

The ECB cutting inflation growth projections is definitely a big deal, but you know how these things go. It’s interesting to see how seemingly unrelated events can play out in the financial world. For example, a recent court decision, where a judge dismissed Justin Baldonis’s $400 million defamation lawsuit against Blake here , might not seem directly connected.

Still, it highlights the complex web of influences on economic forecasts, and ultimately, the ECB’s projected inflation numbers. This all adds up to a complicated picture, but hopefully a more stable one for the future.

Revised Inflation Projections and Monetary Policy Response

[Date] – The European Central Bank (ECB) today revised its inflation projections downward, reflecting recent economic data and ongoing uncertainties. The revised projections anticipate inflation to moderate to [new projected inflation rate] by [timeframe]. This moderation is partly attributed to anticipated lower energy prices and a slowdown in economic growth. The ECB Governing Council will closely monitor the incoming data and remain committed to its price stability mandate, which targets an inflation rate of around 2%.

While the downward revision reflects a more subdued inflation outlook, the Governing Council remains vigilant about persistent upward pressure on inflation and its potential implications. The Governing Council maintains its commitment to maintain price stability in the Eurozone. The Governing Council expects the recent downward revision to inflation projections to have a minimal impact on the overall economic environment.

Further details regarding the ECB’s strategy and potential future policy adjustments will be provided at the upcoming press conference.

Alternatives and Counterfactuals

The ECB’s projected cuts to inflation growth targets signal a crucial turning point in monetary policy. Understanding alternative paths the eurozone economy could take if these cuts aren’t implemented, and the contrasting efficacy of various policy responses, is vital for informed economic analysis. This exploration delves into potential scenarios, comparing the costs and benefits of different interventions, and outlining alternative approaches to managing inflation.

Alternative Eurozone Economic Scenarios Without Projected Cuts

Failure to adjust the inflation targets could lead to several adverse outcomes. Prolonged high inflation erodes purchasing power, potentially triggering a recession as the central bank struggles to regain control. The risk of a wage-price spiral increases, as workers demand higher wages to compensate for rising prices, further fueling inflationary pressures. A potential stagnation scenario is also a possibility, with reduced consumer spending and business investment.

This, in turn, could weaken economic growth and increase unemployment.

Comparing Policy Responses to Evolving Inflation

Different policy responses to inflation have varying effectiveness and potential consequences. Monetary policy, as implemented by the ECB, is a crucial tool. However, its effectiveness is influenced by the specific economic context. Fiscal policy, often involving government spending and taxation, can also play a significant role. However, fiscal interventions can sometimes create unintended consequences, such as increasing government debt or crowding out private investment.

A combination of monetary and fiscal policies, carefully calibrated, might prove the most effective approach.

Potential Costs and Benefits of Various Interventions

The potential costs and benefits of different interventions are multifaceted and depend heavily on the specific circumstances. For instance, aggressive interest rate hikes, while effective in curbing inflation, can also lead to higher borrowing costs for businesses and consumers, potentially slowing economic growth. Conversely, maintaining low interest rates could allow inflation to persist, eroding the value of savings and creating economic instability.

This section highlights the need for a nuanced understanding of the interplay between these variables.

Alternative Approaches to Managing Inflation

Beyond traditional monetary and fiscal policies, alternative approaches to inflation management are worth considering. These include supply-side policies aimed at increasing production capacity and reducing bottlenecks in the supply chain. Furthermore, structural reforms to enhance labor market flexibility or promote competition in certain sectors could contribute to long-term inflation control. Targeted measures focused on specific sectors or industries facing unique inflationary pressures could also be beneficial.

An integrated approach, encompassing both traditional and innovative strategies, is likely to yield the most effective results.

Potential Outcomes Table

| Policy Response | Potential Outcomes (Eurozone Economy) | Costs | Benefits |

|---|---|---|---|

| Maintain current policy (no cuts) | High inflation, potential recession, wage-price spiral, reduced economic growth. | Erosion of purchasing power, increased uncertainty, possible financial instability. | Short-term stability (depending on the initial level of inflation), potential for continued growth if inflation is controlled. |

| Aggressive interest rate hikes | Rapid cooling of inflation, potential recession, increased borrowing costs. | Reduced economic activity, job losses, increased debt burdens. | Curbed inflation, potentially stabilizing long-term price expectations. |

| Gradual interest rate adjustments | Controlled cooling of inflation, balanced economic activity, moderate borrowing costs. | Potential for slower inflation reduction, some uncertainty. | Preservation of economic stability, less disruption to markets, potentially higher long-term growth. |

| Combination of monetary and fiscal policies | Targeted inflation reduction, balanced economic activity, potential for sustained growth. | Coordination challenges, potential for unintended consequences. | Stronger and more sustainable inflation control, increased confidence in the economy. |

“A well-calibrated policy response, tailored to the specific circumstances, is crucial for mitigating the risks associated with inflation while preserving economic stability.”

Illustrative Scenarios

The ECB’s revised inflation projections, and subsequent potential interest rate cuts, will ripple through various market segments. Understanding these impacts is crucial for investors, businesses, and consumers alike. This section details potential short-term scenarios, focusing on the implications for different sectors and consumer behavior.

Potential Short-Term Scenarios for Market Segments

The ECB’s actions will likely trigger a variety of short-term market reactions. For example, a decrease in interest rates might initially boost the stock market as investors anticipate increased profitability for businesses. Conversely, the impact on bond markets could be mixed, depending on the perceived risk associated with the rate cuts.

- Stock Markets: A potential initial positive response is anticipated, with some sectors (e.g., consumer discretionary) potentially experiencing stronger gains than others (e.g., utilities). This is based on the assumption that lower borrowing costs stimulate economic activity and corporate earnings.

- Bond Markets: Yields on bonds are likely to decrease in response to the rate cuts. However, the overall trajectory depends on the perceived stability of the economic outlook and the broader market sentiment.

- Real Estate: Lower borrowing costs could potentially fuel demand in the real estate market, leading to increased housing prices. Conversely, if economic conditions weaken, demand could soften.

Impact on Specific Industries

The revised inflation projections and resulting rate cuts will impact specific industries differently. For example, industries heavily reliant on borrowing, such as construction or automotive, may see increased investment. Conversely, industries with high fixed costs might face temporary challenges, depending on the pace of the rate cut implementation and the speed of the economic response.

- Construction: Lower interest rates make borrowing cheaper, potentially boosting construction activity. This is illustrated by the surge in construction projects after past rate cuts, although the extent of the impact will depend on broader economic conditions.

- Consumer Goods: Decreased borrowing costs might encourage consumer spending, leading to increased sales in consumer goods. However, if inflation remains elevated, the impact might be muted.

- Energy: The impact on the energy sector is complex and depends on the overall economic outlook. Lower rates might support demand in the short term but could be countered by global energy market conditions.

Projected Impact on Employment

The revised inflation projections and potential interest rate cuts can impact employment across sectors. A more robust economy, stimulated by lower borrowing costs, might lead to increased job creation. However, if the economic recovery is slow, the impact on employment could be less pronounced.

| Sector | Projected Employment Impact |

|---|---|

| Technology | Potential for increased hiring, particularly in software development and related fields, driven by sustained economic growth. |

| Manufacturing | Mixed impact, potentially experiencing a temporary slowdown in hiring if the overall economic response is moderate, but with a potential for long-term growth. |

| Retail | Slight increase in hiring, driven by increased consumer spending. However, this will be contingent on the pace of recovery. |

Impact on Consumer Confidence and Spending

Consumer confidence is a crucial factor in economic recovery. Lower interest rates typically boost consumer confidence, encouraging spending. However, factors such as persistent inflation or geopolitical uncertainty can offset these positive effects.

- Consumer Confidence: Lower interest rates are often associated with increased consumer confidence. However, the extent of this impact depends on the consumer’s perception of the broader economic outlook and the persistence of inflation.

- Spending Habits: Higher consumer confidence typically leads to increased spending on discretionary items. However, the strength of this response is contingent on the level of uncertainty surrounding inflation and other economic factors.

Final Review

In conclusion, the ECB’s revised inflation growth projections present a complex picture for the Eurozone economy. Potential market reactions, influencing factors, and the ECB’s communication strategy will all play a significant role in shaping the short-term and long-term economic outlook. Alternative scenarios and illustrative examples will further illuminate the potential impacts across various sectors.