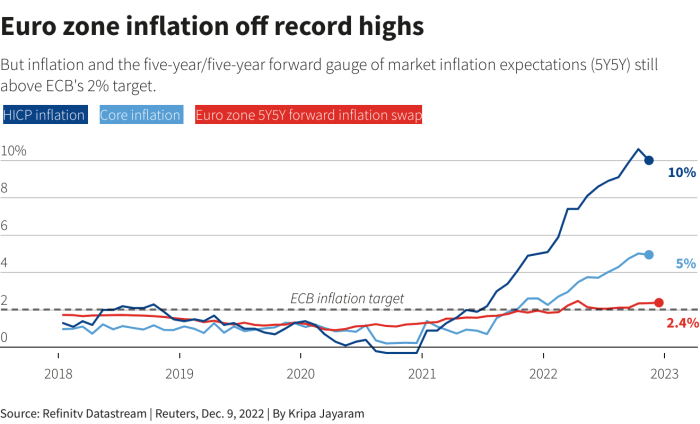

Ecb should not overreact if inflation edges below 2 vujcic says – ECB should not overreact if inflation edges below 2% Vujcic says, sparking a fascinating debate about the best course of action for the European Central Bank (ECB) in a potentially tricky economic climate. This statement suggests a measured approach, contrasting with some previous instances where aggressive responses might have been considered. What are the potential risks of overreaction or underreaction, and how might various economic actors be affected?

This analysis delves into the complexities surrounding the ECB’s potential response to falling inflation below the 2% target. We’ll explore the rationale behind Vujcic’s statement, examining the historical context, potential economic motivations, and possible implications for different sectors. We’ll also consider alternative viewpoints, including the arguments for and against the ECB’s cautious approach.

Contextual Understanding of the Statement

The statement that the ECB should not overreact if inflation edges below 2% reflects a nuanced approach to monetary policy, acknowledging the complexities of economic fluctuations and the potential for unintended consequences. This perspective suggests a focus on maintaining price stability while avoiding aggressive measures that could stifle economic growth. It emphasizes a measured response to short-term deviations in inflation, prioritizing long-term economic health.

Detailed Explanation of the Statement

The statement implies a cautious approach to reacting to temporary dips in inflation below the 2% target. This target, while often cited, is not a rigid threshold, but rather a benchmark for central banks to aim for. Slight fluctuations below this level, especially if they are part of a broader trend of disinflation, may not necessitate immediate, drastic policy adjustments.

Overreaction could lead to unnecessary tightening of monetary policy, potentially harming economic activity and employment. Instead, the ECB may choose to monitor the situation closely and adjust policy based on a broader picture of the economy, including underlying factors like wage growth and supply chain dynamics.

Potential Economic Motivations

The motivation behind this statement is to avoid a potential recession or economic slowdown. Aggressive measures to lower inflation could stifle economic growth and lead to job losses. The ECB might prefer a more gradual approach to managing inflation, allowing the economy to adjust organically to changes in market conditions. A significant economic downturn could have more severe and long-lasting consequences than a temporary period of inflation below the 2% target.

Historical Context of Similar Situations

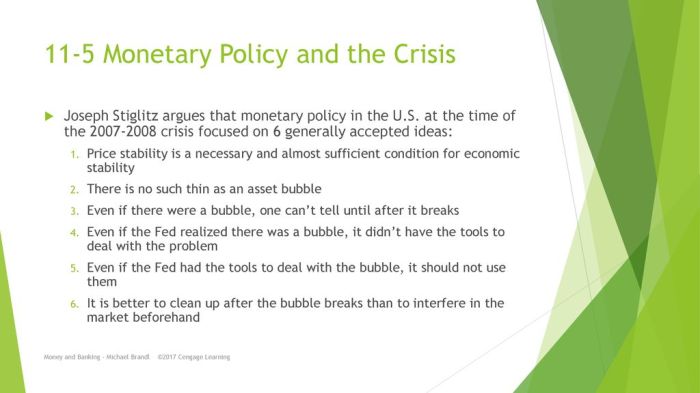

Numerous historical instances exist where central banks have faced challenges in managing inflation. The 1990s saw episodes of disinflationary pressures, and central banks had to carefully calibrate their responses to avoid unnecessary economic hardship. The recent experience of low inflation in some countries, coupled with other factors like globalization and technological advancements, may have led to a more cautious approach.

Implications for Economic Actors

The statement has implications for various economic actors. Businesses might find a stable, predictable monetary policy environment more conducive to investment and planning. Consumers could experience a smoother transition in prices, although sustained low inflation might also lead to reduced purchasing power. Investors may view the cautious approach as a sign of stability and potentially lower risk.

Key Players and Potential Responses

The primary players involved are the ECB, national governments, and businesses. The ECB will likely monitor inflation data closely and adjust its policies accordingly. Governments may adopt supportive fiscal policies to offset any potential negative impact of the ECB’s actions. Businesses will need to adapt to the changing economic environment and adjust their pricing strategies accordingly. Central banks often communicate their intentions clearly to avoid market uncertainty and manage expectations.

Defining “Overreact”

Central banks, tasked with maintaining price stability, face a constant balancing act. A crucial aspect of this balancing act is the ability to distinguish between a genuine economic fluctuation and a signal demanding a forceful response. “Overreaction,” in this context, isn’t simply a deviation from the target; it’s a disproportionate policy response that risks harming the economy.Defining “overreaction” requires a nuanced understanding of the specific context and the available data.

A framework for assessing overreaction in inflation targets needs to consider both the magnitude and the duration of the deviation from the target, as well as the central bank’s pre-existing stance on inflation. It’s not just about reaching a certain inflation rate, but also about the speed and direction of change.

Framework for Defining “Overreaction”

A framework for defining “overreaction” in inflation targets must incorporate several key elements:

- Magnitude of Deviation: The degree to which inflation deviates from the target rate. A small, temporary deviation might not necessitate a significant response, whereas a sustained, substantial deviation would warrant closer scrutiny.

- Duration of Deviation: The length of time the deviation persists. A brief blip in inflation might not be cause for concern, but a prolonged period above or below the target warrants a more active response.

- Pre-existing Stance: A central bank’s pre-existing policy stance plays a role. If a bank is already tightening monetary policy, a further tightening might be considered overreaction.

- Underlying Economic Conditions: Factors like economic growth, employment, and global conditions influence the appropriate response. A robust economy might tolerate higher inflation than a struggling one.

- Policy Tools and Capacity: The central bank’s capacity to respond effectively to the inflation environment is important. Aggressive measures may not be suitable if the tools are insufficient.

Potential Risks of Overreaction and Underreaction

Overreacting and underreacting to inflation pose distinct risks.

- Overreaction Risks: Overly aggressive monetary policy can stifle economic growth, increase unemployment, and potentially trigger a recession. The 1980s Volcker disinflation in the US, while ultimately successful, came at a significant cost in terms of job losses.

- Underreaction Risks: Failing to address persistent inflation can lead to a loss of credibility for the central bank, eroding public trust and potentially leading to a more severe and protracted inflation problem. The 1970s stagflation in the US highlights the danger of ignoring rising prices.

Examples of Past Overreaction and Underreaction

Historical examples provide insight into the challenges of managing inflation.

- Overreaction: The Volcker disinflation in the early 1980s is often cited as an example of a potentially overreaction, with high interest rates and recessionary pressures. The aggressive response was needed to curb high inflation, but the severity of the recession caused concerns.

- Underreaction: The 1970s stagflation period is an example of underreaction. Central banks struggled to address both high inflation and high unemployment simultaneously. This led to a loss of public trust and ultimately a more challenging period of economic adjustment.

Comparison of Approaches to Managing Inflation

Various approaches exist for managing inflation.

Vujcic’s argument that the ECB shouldn’t overreact if inflation dips below 2% makes a lot of sense, especially considering the current economic climate. It’s a bit like how blue states are bailing out red states financially, with federal programs often filling the gaps. This dynamic highlights a larger issue of interconnectedness, which ultimately suggests that the ECB should remain cautious and not overreact to minor fluctuations in inflation numbers.

- Gradualism: A gradual approach to monetary policy, involving a series of small adjustments, can help to avoid sudden shocks to the economy. This approach prioritizes stability over rapid changes.

- Aggressive Measures: Aggressive policy responses can quickly curb inflation, but carry the risk of creating economic instability. These measures may be necessary in cases of hyperinflation or extremely high inflation.

Metrics Used to Assess Inflation

Inflation is measured using various indicators.

- Consumer Price Index (CPI): Measures the average change over time in the prices paid by urban consumers for a basket of consumer goods and services.

- Producer Price Index (PPI): Measures the average change in selling prices received by domestic producers for their output.

- GDP Deflator: Measures the change in the prices of all goods and services included in gross domestic product (GDP).

Analyzing Inflation Below 2%

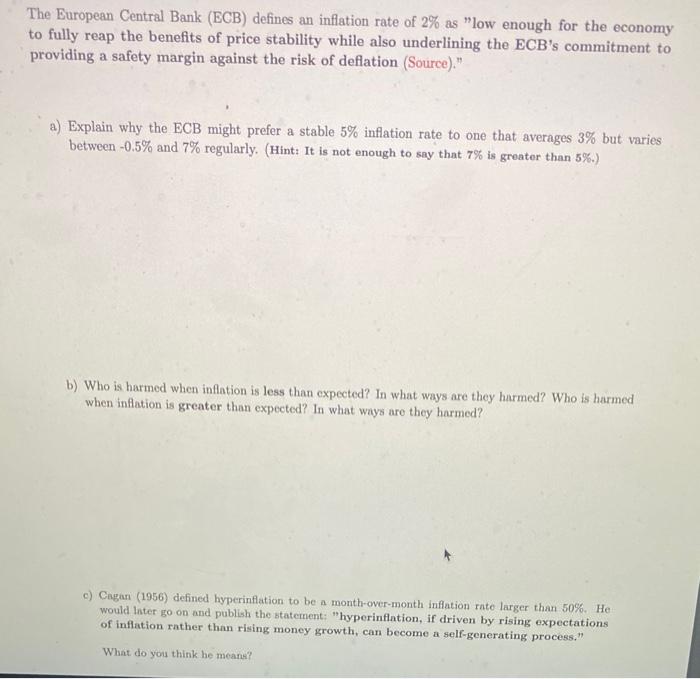

Inflation consistently falling below the 2% target, while seemingly benign, presents a complex interplay of economic factors. Central banks must carefully consider the potential ramifications for growth, employment, and overall economic stability. The implications extend beyond simple price movements, influencing investment decisions, consumer behavior, and the overall health of the economy.

Vujcic’s take on the ECB not overreacting to inflation dipping below 2% is interesting, especially given the current political climate. The recent House GOP scramble surrounding Trump’s “big beautiful bill” trumps big beautiful bill house gop scrambles highlights the complexities of economic and political forces at play. Ultimately, the ECB’s response to inflation will be crucial, and hopefully, they won’t overreact to minor fluctuations.

Economic Implications of Sub-2% Inflation

Falling inflation below the 2% target can lead to several economic consequences. Reduced price increases often correlate with decreased demand, potentially impacting businesses’ profit margins. This can affect investment, leading to a slowdown in economic activity. Conversely, if inflation remains persistently low, it could signal underlying economic weakness. Low inflation can also make borrowing less attractive, impacting investment and economic growth.

The specific impact depends on the specific economic context and the central bank’s response.

Potential Benefits of Sustained Low Inflation

Sustained low inflation can offer some advantages. Reduced inflationary pressures can make borrowing more affordable, stimulating investment and potentially fostering economic growth. Consumers may experience increased purchasing power, leading to higher standards of living. Moreover, stable prices create a predictable economic environment, benefiting businesses and individuals. However, the benefits are not automatic and depend on various factors.

Potential Drawbacks of Sustained Low Inflation

While low inflation offers potential advantages, it can also present drawbacks. Persistent low inflation can signal a lack of demand, potentially leading to a slowdown in economic activity and job creation. Falling inflation can also affect central banks’ ability to use interest rate cuts to stimulate the economy during recessions, limiting their policy options. Additionally, very low inflation can discourage investment, potentially impacting future economic growth.

Influence of Economic Factors on Inflation

Numerous factors influence inflation, and falling below 2% could be a result of various economic shifts. Global supply chain disruptions, such as those experienced during the COVID-19 pandemic, can significantly impact inflation rates. Geopolitical events, such as trade wars or international conflicts, can also cause inflationary pressures to decrease or increase, impacting global commodity prices and influencing inflation.

Monetary policy decisions, including interest rate adjustments, can also impact inflation, influencing consumer spending and business investment.

Impact on Sectors of the Economy

| Sector | Impact of Sub-2% Inflation |

|---|---|

| Housing | Lower inflation may lead to decreased demand, affecting housing prices and construction activity. Reduced price increases may also impact homebuyer affordability, potentially slowing down the housing market. |

| Energy | Lower inflation in energy markets could indicate reduced demand, impacting energy companies’ profits and investment. This can influence exploration and production activities. |

| Manufacturing | Lower inflation might indicate reduced demand for manufactured goods, potentially leading to lower production levels and impacting employment in the manufacturing sector. Declining prices may also affect profitability. |

| Retail | Reduced inflation might lead to decreased sales volume for retail businesses as consumer spending slows. Profit margins may also be impacted by lower prices and reduced consumer demand. |

ECB’s Potential Actions

The European Central Bank (ECB) faces a nuanced situation as inflation potentially dips below its 2% target. While a sustained drop below target could indicate a healthier economy, it also presents a challenge for the ECB in maintaining price stability. This necessitates a careful consideration of various potential actions, weighing the advantages and disadvantages of each approach. The ECB’s response will be crucial in ensuring the Eurozone’s continued economic health.

Potential Policy Adjustments

The ECB possesses a range of instruments to address potential deflationary pressures. These instruments vary in their impact and potential consequences. A key consideration is how any action affects market confidence and long-term economic growth.

- Interest Rate Adjustments: The ECB could lower its benchmark interest rates further. Lower rates stimulate borrowing and spending, potentially boosting demand and inflation. However, excessively low rates could lead to asset bubbles and financial instability. Historical examples show that aggressive rate cuts can be effective in combating recession but need to be carefully calibrated.

- Quantitative Easing (QE) Resumption: The ECB might resume large-scale asset purchases, injecting liquidity into the financial system. This approach can lower borrowing costs and encourage lending. However, it could also potentially lead to inflation in asset prices and potentially contribute to financial instability, as seen in previous rounds of QE.

- Negative Interest Rates on Reserves: The ECB might extend or deepen negative interest rates on commercial banks’ reserves held at the central bank. This incentivizes banks to lend rather than hold cash. This approach has proven effective in certain contexts, but prolonged negative rates could negatively affect bank profitability and potentially discourage lending, as seen in the past.

- Targeted Interventions: The ECB could use targeted measures, such as specific credit programs or measures aimed at particular sectors, to address potential vulnerabilities. These interventions could offer more precise support, but their effectiveness depends on the targeted sector’s vulnerability and the nature of the intervention.

Comparing Current Mandate with Past Actions

The ECB’s mandate emphasizes price stability as its primary goal, with the secondary objective of supporting economic growth. In the past, the ECB has responded to periods of high inflation with aggressive interest rate hikes. However, the current situation, with potentially lower inflation, requires a different approach. The ECB’s past responses to economic downturns and deflationary periods, while effective in certain circumstances, might need a more nuanced response to maintain price stability without hindering economic growth.

ECB Policy Instruments and Potential Impact

| Policy Instrument | Potential Impact | Pros | Cons |

|---|---|---|---|

| Interest Rate Cuts | Stimulates borrowing and spending, potentially boosting demand and inflation. | Increased economic activity, potentially lower unemployment. | Potential for asset bubbles, financial instability, and increased risk of inflation in the future. |

| QE Resumption | Injects liquidity into the financial system, lowering borrowing costs, and encouraging lending. | Increased liquidity, potentially lower borrowing costs. | Potential for asset price inflation, financial instability, and inflation in the future. |

| Negative Interest Rates | Incentivizes banks to lend rather than hold cash. | Potential for increased lending, reduced borrowing costs. | Potentially negative impact on bank profitability, discouragement of lending in the long term. |

| Targeted Interventions | Provides precise support to specific sectors or markets. | Potential for precise impact, targeted assistance. | Potential for unintended consequences, difficulty in identifying appropriate sectors, and political challenges. |

Alternative Perspectives on the Statement

The ECB’s recent statement regarding a potential reluctance to overreact if inflation dips below 2% opens the door to diverse interpretations and analyses. Different stakeholders, from businesses to consumers, will be affected by the central bank’s approach, making the decision’s impact far-reaching. This section delves into alternative viewpoints, considering the influence of various groups and the broader economic implications.

Arguments For Non-Overreaction

The ECB’s cautious approach, aiming to avoid stifling economic growth, finds support in several arguments. A key factor is the potential for a prolonged period of subdued inflation, not necessarily reflecting a fundamental shift in the economy’s underlying dynamics. A temporary dip below 2% might be caused by transitory factors, such as supply chain disruptions easing or a decline in energy prices.

A swift and forceful response could induce a recession, exacerbating the situation. Maintaining a steady hand could be seen as more beneficial in the long run, potentially fostering a more robust and sustainable recovery.

Arguments Against Non-Overreaction

Conversely, some argue that inaction could lead to a loss of credibility and encourage inflationary expectations. Persistent low inflation could signal a lack of control over monetary policy, leading to future inflationary pressures. Furthermore, a significant and prolonged deviation from the target could weaken the ECB’s commitment to its price stability mandate, impacting investor confidence. The potential for a delayed and potentially harsher response to persistent low inflation could be considered a major risk.

Influence of Interest Groups

The ECB’s decision-making process is not solely based on economic models but also influenced by various interest groups. Labor unions, advocating for wage increases, might pressure the ECB to avoid overly restrictive policies. Businesses, concerned about potential economic slowdowns, might lobby for a more accommodating stance. The government’s economic objectives and political priorities also play a significant role.

These competing interests often lead to complex trade-offs, requiring the ECB to carefully balance the concerns of various parties.

Global Economic Implications

The ECB’s approach has broader implications for the global economy. If the ECB adopts a less aggressive stance, it could potentially trigger similar responses from other central banks. This could lead to a coordinated easing of monetary policies, potentially affecting global inflation rates and financial markets. Conversely, if the ECB maintains its commitment to price stability, it could influence other central banks to adopt a similar approach.

Vujcic’s point about the ECB not overreacting if inflation dips below 2% is interesting, especially considering the recent US worker productivity slump in the first quarter. This downturn could signal a broader economic slowdown, potentially impacting inflation pressures. While a dip in inflation might seem concerning, it could also be a natural consequence of these factors, suggesting the ECB shouldn’t necessarily panic.

Ultimately, a measured response from the ECB remains crucial.

The global economic context, including trade relations and geopolitical events, significantly influences the ECB’s choices.

Comparison with Other Central Banks

Other central banks have faced similar situations in the past. The Bank of England’s response to periods of low inflation or deflation can provide insights into the ECB’s choices. Examining the Federal Reserve’s approach to inflation targets can also highlight different strategies. Understanding how other central banks have handled similar situations can provide a comparative perspective on the ECB’s options.

Economic Models

Several economic models can be used to assess the ECB’s statement, including Phillips Curve models, which analyze the relationship between inflation and unemployment. Aggregate demand and supply models can be used to analyze the potential effects of the ECB’s actions on the economy. Furthermore, models incorporating expectations and uncertainty can provide a more nuanced view of the situation.

Each model offers a unique perspective on the statement, offering insights into the potential outcomes.

Illustrative Scenarios

The ECB’s stance on not overreacting to inflation dipping below 2% presents a nuanced challenge. While maintaining price stability is paramount, the potential for misjudging the economic landscape and reacting inappropriately must be carefully considered. This section will explore hypothetical scenarios, examining the ECB’s potential responses and their likely outcomes, with a focus on both the risks of underreaction and overreaction.

Hypothetical Inflation Scenarios and ECB Responses

Understanding the ECB’s potential responses to various inflation scenarios requires considering a range of economic factors. Different economic conditions might prompt different reactions, necessitating a flexible approach. The following table Artikels potential scenarios and the ECB’s likely responses.

| Scenario | Inflation Rate | Economic Context | ECB Response | Likely Outcome |

|---|---|---|---|---|

| Mild Dip | 1.8% – 2.0% | Stable economic growth, low unemployment, modest wage increases. | Monitor developments, potentially maintain current policy. | Continued stable economic conditions, minimal impact on inflation expectations. |

| Sustained Dip | 1.5% – 1.8% | Slowing economic growth, rising unemployment, muted wage increases. | Assess underlying causes, possibly reduce interest rates slightly to stimulate growth. | Potential for a slight economic recovery, though inflation may remain subdued. |

| Sharp Dip | 1.0% – 1.5% | Significant economic slowdown, high unemployment, deflationary pressures. | More aggressive measures to stimulate growth: lowering interest rates, potentially introducing quantitative easing. | Risk of prolonged economic stagnation and potential deflationary spiral if not handled correctly. |

| Inflationary Expectations Remain High | 1.8% – 2.0% | Inflationary expectations remain high, despite the dip, and there are concerns about second-round effects. | Maintain current policy to combat potential inflationary expectations and ensure price stability. | Potential for inflation to rise again, especially if inflationary expectations are not addressed. |

Underreacting to Low Inflation: A Risk Assessment, Ecb should not overreact if inflation edges below 2 vujcic says

Failing to address persistent low inflation can have significant consequences. If the ECB underestimates the severity of the economic slowdown, or if the root causes of low inflation are not adequately addressed, it could lead to a prolonged period of weak growth and potential deflationary pressures. This could result in lower consumer confidence, reduced investment, and decreased demand.

“Prolonged periods of low inflation can erode confidence in the economy, leading to a self-fulfilling prophecy of further economic decline.”

Overreacting to Low Inflation: Potential Costs

While addressing low inflation is necessary, overreacting can also lead to negative consequences. An overly aggressive response, such as a significant interest rate cut, could lead to unintended inflation in the future, particularly if the initial cause of low inflation was temporary. Furthermore, excessively loose monetary policy could fuel asset bubbles or lead to an unsustainable boom followed by a sharp contraction.

“Excessive monetary easing can create financial instability and lead to inflationary pressures in the long run, potentially undermining the very stability the ECB is trying to achieve.”

Illustrative Economic Relationship: Inflation and Monetary Policy

The relationship between inflation and monetary policy is complex. Low inflation, if sustained and not adequately addressed, can negatively impact economic growth. The ECB’s response to low inflation must consider the potential for both under- and overreaction. A calibrated approach, taking into account various economic factors, is crucial.

(Note: Replace placeholder_for_a_graph.png with a suitable graph.)

End of Discussion: Ecb Should Not Overreact If Inflation Edges Below 2 Vujcic Says

In conclusion, the ECB’s response to potential inflation below 2% hinges on a delicate balance between stability and economic growth. This analysis highlights the importance of careful consideration, avoiding both overreaction and underreaction, and the potential for varied impacts across different economic sectors. The ECB’s decision-making process, influenced by various interest groups and global factors, will undoubtedly be a key element in shaping the future economic landscape.

Further investigation into potential scenarios and alternative perspectives is vital for a comprehensive understanding.