Tariffs could be spur europes single market needs – Tariffs could be spur Europe’s single market needs, prompting a deep dive into the potential consequences for the EU. This exploration examines how trade barriers might reshape intra-European trade, potentially disrupting supply chains and increasing costs for businesses. We’ll analyze the implications for the single market, considering its fundamental principles and the impact on global competitiveness. The discussion will also touch upon alternative policy responses, historical context, potential economic disparities, consumer impact, political ramifications, and the role of EU institutions.

The analysis will delve into the potential effects of tariffs on various sectors of the European economy, from agriculture to manufacturing and services. It will also explore the potential for economic disparities among member states and the impact on consumer prices and choices. The potential for trade disputes and diplomatic tensions, as well as the strategies and procedures the EU might employ to respond, will also be addressed.

Ultimately, this discussion seeks to understand the complex interplay of tariffs, the single market, and the future of the European economy.

Impact on Intra-European Trade

Intra-European trade, a cornerstone of the European economy, relies heavily on frictionless movement of goods and services across borders. Tariffs, even internal ones, can significantly disrupt this delicate balance, impacting businesses, consumers, and the overall economic health of the continent. This analysis explores the potential ramifications of tariffs on intra-European trade.Internal tariffs, while theoretically possible within the EU, are largely discouraged by the single market principles.

However, the potential for trade barriers, even temporary or localized ones, warrants careful consideration.

Potential Effects on Trade Volume and Value

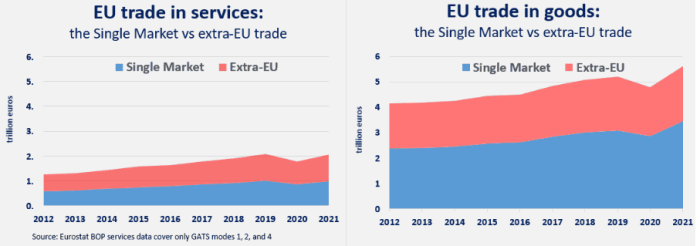

Intra-European trade relies on a vast network of supply chains, and tariffs could disrupt these chains significantly. If tariffs are implemented, the volume of trade between European countries could decline. This reduction in trade would affect not only the quantity of goods exchanged but also the total value of those transactions. Businesses reliant on these exchanges could face decreased revenues, and potentially reduced profits.

Disruptions to EU Supply Chains

Tariffs imposed on goods exchanged between EU members would create bottlenecks in supply chains. Businesses that depend on components or raw materials from other EU countries could face delays in production, and increased costs. For example, a German car manufacturer relying on Italian parts suppliers could see production halted if tariffs make the Italian components prohibitively expensive.

Increased Costs for Cross-Border Transactions

The imposition of tariffs would inevitably lead to increased costs for businesses involved in cross-border transactions. These costs would include not only the tariff itself, but also administrative costs associated with complying with the new regulations. This could lead to price increases for consumers, affecting purchasing power and potentially hindering economic growth.

Potential Impact on Sectors

| Sector | Potential Impact of Tariffs |

|---|---|

| Agriculture | Tariffs on agricultural products could lead to price increases for consumers and limit the availability of certain produce. Farmers reliant on cross-border sales could experience a decline in revenue. |

| Manufacturing | Tariffs on manufactured goods could increase production costs, potentially making European-made products less competitive in the market. This could lead to job losses and decreased economic activity. |

| Services | Tariffs on services, while less tangible, could also have significant effects. For example, cross-border business consulting could become more expensive, affecting businesses and reducing market competitiveness. |

| Energy | Tariffs on energy sources could increase the price of electricity and fuel, which would impact numerous industries and increase the cost of living. This could affect both businesses and consumers. |

Implications for the Single Market

The European Single Market, a cornerstone of the EU’s economic success, hinges on the free movement of goods, services, capital, and people. This interconnectedness fosters competition, innovation, and economic growth across member states. However, the imposition of tariffs could significantly disrupt this delicate balance, potentially harming the very foundation of the single market.The fundamental principles of the single market rely on the elimination of trade barriers between member states.

This allows for a competitive environment where businesses can operate freely across borders, benefiting from economies of scale and wider consumer markets. Tariffs, by their nature, introduce obstacles to this free flow of goods and services, leading to higher prices for consumers and reduced competitiveness for businesses.

Impact on the Free Flow of Goods

Tariffs directly increase the cost of imported goods, impacting consumers and businesses. Higher prices for raw materials or finished products reduce competitiveness for European manufacturers. For example, a tariff on imported steel would increase the cost of steel for car manufacturers, potentially making European cars less competitive in global markets. This can lead to job losses and reduced economic output in sectors reliant on imported components.

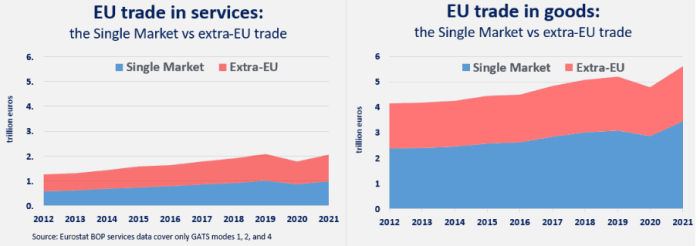

Impact on the Free Flow of Services

Tariffs, while often associated with physical goods, can also affect service sectors. For instance, a tariff on digital services could increase the cost of cloud computing or software licenses for European businesses. This would hinder innovation and competitiveness in these sectors. A tariff on consulting services would also impact the ability of European companies to export services and compete in international markets.

Impact on the Free Flow of Capital

The single market facilitates the free movement of capital, allowing for investment across borders. Tariffs could create uncertainty and discourage foreign investment in the EU, potentially slowing down economic growth. The imposition of tariffs on investments could deter companies from expanding operations within the EU.

Tariffs might surprisingly be a catalyst for Europe’s single market, forcing a re-evaluation of its needs. While interbank traders are shifting their focus to dollar-rupee forwards and spot markets, as reported in this article ( interbank traders turn focus dollar rupee forwards spot treads water ), this could ultimately lead to a more robust and adaptable single market. This redirection of focus, in turn, could incentivize the EU to prioritize internal trade and reduce reliance on external factors, potentially strengthening the single market’s resilience to future trade shocks.

Impact on the Free Flow of People

While not always directly associated with tariffs, the economic consequences of tariffs can indirectly impact the free movement of people. Job losses in sectors affected by tariffs could lead to increased migration pressures, and create social and economic difficulties for affected communities.

Differential Impacts on Member States

The impact of tariffs will vary significantly between EU member states. Countries with a higher reliance on exports or imports of specific goods will bear a greater brunt of the impact. For example, countries heavily reliant on agricultural exports may see a substantial reduction in trade if tariffs are imposed on their products. Conversely, countries that are major exporters of goods like automobiles or pharmaceuticals will experience a different level of disruption.

This uneven impact could lead to economic tensions and disputes between member states.

Consequences for Global Competitiveness

Tariffs imposed by the EU could potentially reduce the EU’s competitiveness in global markets. Higher prices for European goods and services could make them less attractive to consumers worldwide. This could lead to a loss of market share for European companies to competitors outside the EU. Moreover, retaliatory tariffs from other countries could further limit the EU’s ability to trade internationally.

Alternative Policy Responses

Navigating the complexities of global trade requires proactive strategies to mitigate potential disruptions. Tariffs, while often employed as a tool for economic policy, can have far-reaching consequences, particularly for integrated markets like the European Union’s. Alternative approaches that support European businesses and bolster the single market’s resilience are crucial for weathering these storms.European businesses face challenges when tariffs impact their supply chains and export markets.

These difficulties necessitate a multifaceted response encompassing financial support, strategic partnerships, and innovative trade policies. Adapting to a changing global trade landscape is paramount for maintaining the single market’s prosperity and competitiveness.

Diversification of Supply Chains

The reliance on a single source for critical inputs can expose businesses to risks associated with tariffs. Diversifying supply chains reduces vulnerability by spreading the risk across multiple suppliers. This necessitates proactive measures by European companies to source materials and components from various countries, thereby reducing dependence on specific regions. This diversification not only strengthens resilience against tariffs but also potentially creates opportunities for new partnerships and investments.

Financial Support for Businesses

Financial aid packages designed to assist European companies in navigating tariff-related challenges are essential. These measures could include grants, loans, and tax incentives specifically targeted at businesses affected by tariffs. Targeted support will help companies adapt to new market realities, invest in alternative sourcing strategies, and maintain competitiveness. Success stories of government support programs in similar contexts demonstrate the positive impact of such interventions.

Non-Tariff Barriers and Trade Strategies

Non-tariff barriers, such as stricter import regulations or bureaucratic hurdles, can have a similar impact to tariffs. The EU could implement measures to streamline trade procedures and reduce administrative burdens on businesses. This will improve competitiveness, lower operational costs, and provide a more efficient market for European exporters.

EU-Led Trade Agreements and Partnerships, Tariffs could be spur europes single market needs

Strategic trade agreements and collaborations with other economies can help counter the effects of tariffs imposed by other nations. The EU could explore bilateral and multilateral agreements with countries that are not imposing tariffs or have a strong commitment to free trade. This could involve creating reciprocal agreements, lowering trade barriers between participating countries, and ensuring that the impact of tariffs from one country is balanced by agreements with another.

The EU’s previous trade agreements with other countries illustrate the potential of such collaborations. These agreements can facilitate smoother trade flows and reduce the negative impact of tariffs on European businesses.

Case Studies and Historical Context

Tariffs, often implemented as a tool for protectionism, have a complex and often detrimental history, particularly when it comes to regional trade blocs. Understanding these historical precedents is crucial for assessing the potential impact of tariffs on the EU single market. This section delves into specific case studies, highlighting how tariffs have historically hindered trade and influenced economic integration in various parts of the world.

The aim is to provide context for understanding the possible consequences of tariff implementation on the EU’s economic landscape.Historical instances of tariffs harming trade and economic integration offer valuable lessons. The negative impact of protectionist measures on regional or global trade has been documented extensively, demonstrating how tariffs can hinder the free flow of goods and services, potentially creating economic instability and hindering the growth of participating economies.

The Smoot-Hawley Tariff Act

The Smoot-Hawley Tariff Act of 1930, enacted in the United States, serves as a prime example of how tariffs can escalate into trade wars. The act significantly increased tariffs on imported goods, aiming to protect American industries. However, the retaliatory tariffs imposed by other countries resulted in a dramatic decline in global trade, exacerbating the Great Depression. This demonstrates the domino effect of tariffs, where actions taken by one nation can have far-reaching consequences for the global economy.

The decline in international trade during this period clearly illustrates the potential for tariffs to cripple economic activity across borders.

Tariffs might actually push Europe’s single market to innovate and find new solutions. Thinking about how different dietary supplements like protein shakes impact health, are protein shakes good for you ? Ultimately, these external pressures could spark a surge in creativity and efficiency, potentially strengthening the single market in the long run.

The 1970s Oil Crisis and OPEC Tariffs

The 1970s oil crisis exemplifies how tariffs can disrupt supply chains and affect global economies. The Organization of the Petroleum Exporting Countries (OPEC) implemented an oil embargo and price increases, effectively raising tariffs on oil imports. This triggered energy shortages, inflation, and economic instability across the globe. These events underscore the vulnerability of economies reliant on international trade and the potential for tariffs to manipulate commodity prices, impacting consumer goods and international relations.

The Effects on Specific European Industries

The automotive industry in Europe has experienced notable fluctuations in production and trade due to tariffs. For example, if a country imposes tariffs on car imports, it can impact European manufacturers’ ability to access key markets, thereby potentially hindering the competitiveness of European car brands in the global market. Similarly, tariffs on components or raw materials used in manufacturing can affect production costs and overall profitability.

The impact on specific sectors and companies varies depending on their supply chain and market positioning.

| Industry | Potential Impact of Tariffs |

|---|---|

| Automotive | Reduced exports, higher production costs, potential for job losses |

| Agriculture | Increased import costs, reduced access to markets, impact on farmers’ income |

| Electronics | Increased component costs, reduced competitiveness in global markets |

Tariffs and Economic Integration in Other Regions

The impact of tariffs on economic integration can be seen in various regional blocs, such as the North American Free Trade Agreement (NAFTA). The implementation of tariffs can alter trade flows, potentially leading to the realignment of supply chains and shifts in economic activity. This realignment can lead to economic integration and specialization in certain regions or industries.

The experience of the European Union itself illustrates the importance of free trade agreements in fostering economic integration. The EU’s single market, with its reduced trade barriers, has been a key driver of economic growth and prosperity.

Potential for Economic Disparities

Tariffs, even within a unified market like the EU, can create significant economic imbalances. The potential for disparities among member states, stemming from varying degrees of exposure to tariffed goods and differing industrial strengths, is a crucial consideration. Uneven impacts on employment and income levels can potentially lead to social unrest and political instability. Understanding these potential scenarios is vital for crafting effective policy responses.

Uneven Exposure to Tariffs

Different EU member states have varying levels of reliance on specific imported goods. A tariff on a product heavily imported by one nation, while impacting others, may have a disproportionately large effect on a particular region’s economy. For example, if a tariff is placed on agricultural products, countries heavily reliant on agricultural exports to the affected regions will bear a greater burden than those with less exposure.

This unequal exposure will undoubtedly exacerbate existing economic disparities.

Disproportionate Impact on Specific Regions

Certain regions of Europe, with specific industrial strengths, will be more susceptible to tariff impacts than others. Areas heavily reliant on industries producing goods subject to tariffs will face job losses and reduced income. For instance, a tariff on steel imports could significantly affect steel-producing regions in the EU, leading to factory closures and unemployment. A significant decline in demand for steel, due to the tariff, could lead to a cascading effect on associated industries.

Impact on Employment and Income Levels

The potential for job losses and income reduction is a significant concern. Industries heavily dependent on imports from the countries imposing tariffs will see their profits and employment decline. For example, a tariff on automobiles imported from a particular country might lead to job losses in the automobile sector of a member state that heavily imports these vehicles.

The resulting income reduction could have knock-on effects in other sectors of the economy.

Tariffs might actually be a catalyst for Europe’s single market, forcing a closer look at internal efficiencies. The current state of ECB monetary policy, as discussed by ECB’s Schnabel in ecb monetary policy is good place now ecbs schnabel , suggests a stable backdrop. This stability could potentially encourage member states to prioritize market integration and streamline trade processes, ultimately bolstering the single market’s resilience.

Potential for Increased Social Unrest

The uneven distribution of tariff impacts can lead to increased social unrest. When certain regions or industries experience significant economic hardship, there’s a heightened risk of social unrest. This can manifest in protests, strikes, or even political instability. Historical examples, like those associated with trade disputes, show that economic disparities can create fertile ground for social tensions.

The possibility of widespread dissatisfaction and political turmoil underscores the importance of carefully considering the potential for social unrest in the policy design process.

Consumer Impact

Tariffs, a seemingly abstract economic concept, have a tangible and direct impact on the everyday lives of European consumers. These levies, imposed on imported goods, inevitably ripple through the market, influencing prices, availability, and ultimately, consumer choices. Understanding this impact is crucial to assessing the potential ramifications of tariff policies within the EU.

Price Fluctuations and Affordability

Tariff implementation leads to a predictable increase in the price of imported goods. This is because the tariff effectively adds a tax to the cost of the imported item, which is then passed on to the consumer. This can lead to significant price increases, especially for goods heavily reliant on imports. For example, if a tariff is placed on imported electronics, the cost of those products in the EU market will rise, potentially making them less affordable for consumers.

This price increase can affect various segments of the population differently, with lower-income households potentially feeling the pinch more acutely due to the higher proportion of their budgets allocated to necessities.

Consumer Choices and Shifting Preferences

Tariffs can significantly alter consumer choices. When a tariff increases the price of a specific imported product, consumers may opt for domestically produced alternatives, or they might substitute with a similar product from a different country with lower tariffs or no tariffs at all. For example, if a tariff on French wine is implemented, consumers might choose to buy Spanish or Italian wine instead.

These shifts in consumer preferences can have profound consequences for the EU’s internal market and its trade relations with other countries.

Availability and Accessibility of Goods and Services

The availability of goods and services within the EU can be impacted by tariffs. If a tariff significantly increases the cost of imported goods, it may become less attractive for companies to import them, potentially leading to a decrease in the availability of those goods. This could particularly affect consumers in regions that rely heavily on imported goods for their consumption.

For instance, consumers in a region reliant on imported fruits and vegetables might face a reduced supply and potential price increases if tariffs on these products are implemented.

Consumer Welfare and Purchasing Power

The combined effect of tariff-induced price increases and reduced availability of certain goods can significantly impact consumer welfare and purchasing power. The higher cost of goods can decrease purchasing power, leading to potential negative consequences on overall economic wellbeing. In extreme cases, it may cause a decrease in overall consumption levels across the EU. The cumulative impact of various tariffs on different goods can create a cascade effect, leading to broader economic consequences that are difficult to predict or isolate.

Political Implications: Tariffs Could Be Spur Europes Single Market Needs

Tariffs, while seemingly an economic tool, have profound political consequences. They can quickly escalate from mere trade disputes to major diplomatic confrontations, impacting international relations and potentially reshaping the global political landscape. The EU’s internal political dynamics are also significantly affected, as member states may have differing views on tariffs and their impact on their own economies.The imposition of tariffs by the EU can strain relationships with trading partners, leading to retaliatory measures and a complex web of political and economic interactions.

This can create a ripple effect, affecting the EU’s influence in global forums and its ability to achieve its political objectives on the world stage. Understanding these implications is crucial for navigating the potential complexities and uncertainties that tariffs introduce.

EU’s Relationship with Other Countries

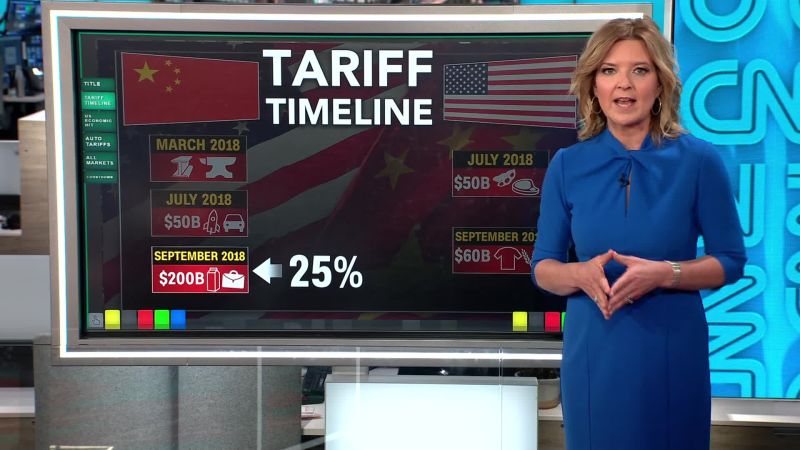

The EU’s relationships with key trading partners, like the US, China, and other blocs, will be significantly impacted by tariff policies. Disagreements on trade policies can quickly escalate into trade wars, characterized by retaliatory measures, and disrupt established economic partnerships. For example, the 2018 trade war between the US and China saw tariffs imposed on a wide range of goods, disrupting supply chains and impacting businesses worldwide.

These confrontations can extend beyond economics to encompass broader political disagreements, and even security concerns.

Trade Disputes and Diplomatic Tensions

Tariffs can readily escalate into full-blown trade disputes. The imposition of tariffs, especially if deemed unfair or discriminatory, can trigger retaliatory measures from other countries. This creates a cycle of tit-for-tat actions, leading to significant diplomatic tensions and potentially jeopardizing established trade agreements. Past examples like the ongoing trade disputes between the EU and the US over certain sectors demonstrate the potential for tariffs to disrupt diplomatic efforts and compromise established alliances.

The EU’s approach to these disputes will significantly influence its global standing and credibility.

Influence on EU’s Political Standing

The EU’s political standing on the global stage is contingent on its economic strength and its ability to negotiate effectively in international forums. Tariffs, if not managed carefully, can weaken the EU’s negotiating position and damage its reputation for stability and economic cooperation. A lack of consistent and well-reasoned tariff policies can lead to accusations of protectionism, undermining the EU’s commitment to free trade and international collaboration.

The EU’s handling of tariffs will reflect its ability to balance its economic interests with its commitment to international diplomacy.

Consequences for EU-Member State Relationships

The impact of tariffs on EU member states will vary. Some member states may be more heavily reliant on exports to particular countries affected by tariffs, making them more vulnerable to economic disruptions. This can create internal political pressure within the EU, potentially leading to disputes and disagreements on trade policies. The uneven distribution of tariff impacts among member states could exacerbate existing economic disparities within the EU.

The EU needs to adopt strategies to ensure that the burdens of tariffs are shared equitably among its members. Furthermore, it is crucial to acknowledge the potential for tariff-related issues to affect political stability and unity within the EU.

EU Institutions and Responses

The European Union, a complex and multifaceted political entity, possesses a range of institutions dedicated to managing trade relations and responding to external pressures like tariffs. Understanding their roles and potential responses is crucial for assessing the impact of trade barriers on the EU’s single market. This section explores the mechanisms the EU employs to navigate and counter tariff actions.The EU’s response to tariffs involves a multifaceted approach encompassing diplomatic negotiations, legal action, and, in some cases, retaliatory measures.

The interplay between the various EU institutions, such as the European Commission, the Council of the European Union, and the European Parliament, is pivotal in shaping the EU’s overall strategy.

Roles and Responsibilities of EU Institutions

The European Commission plays a leading role in trade negotiations and policymaking. Its responsibilities include representing the EU in international trade talks, proposing legislation related to trade, and monitoring compliance with trade agreements. The Council of the European Union, representing the member states, approves trade agreements and authorizes retaliatory measures. The European Parliament also has a significant say in trade policy, approving trade agreements and exercising oversight over the Commission’s actions.

Potential Actions to Mitigate Tariff Impacts

The EU possesses several tools to mitigate the impact of tariffs. These include:

- Negotiation and Diplomacy: The EU can engage in bilateral or multilateral negotiations with the countries imposing tariffs to seek a resolution. Examples include the EU’s ongoing discussions with the US regarding trade disputes.

- Legal Recourse: The EU can utilize the World Trade Organization (WTO) dispute settlement mechanism to challenge tariffs deemed unfair or in violation of international trade rules. This has proven effective in past instances where the EU successfully challenged unfair trade practices.

- Retaliatory Tariffs: As a last resort, the EU can impose retaliatory tariffs on products from the country imposing tariffs. This approach, while potentially escalating tensions, aims to level the playing field and deter future protectionist measures.

- Diversification of Trade Partners: The EU can actively seek to diversify its trade relationships with countries that do not impose tariffs or impose less stringent ones, to lessen its reliance on the affected market.

Likely Strategies and Procedures

The EU’s response to tariffs typically follows a structured process:

- Assessment of the Impact: The European Commission assesses the economic consequences of the tariffs on various sectors and member states.

- Negotiation Efforts: The Commission initiates negotiations with the country imposing tariffs, aiming for a mutually agreeable solution. This involves consultations and attempts to find common ground.

- WTO Dispute Settlement (if applicable): If negotiations fail, the EU may initiate a dispute settlement process at the WTO, presenting evidence and arguments against the tariffs.

- Implementation of Retaliatory Measures (if necessary): In cases where the dispute resolution process or negotiations do not yield desired results, the EU may impose retaliatory tariffs on specific products or sectors.

- Internal Consultation and Coordination: Throughout the process, there’s internal consultation among the EU institutions and member states to ensure a unified response.

EU’s Negotiating Power

The EU’s negotiating power stems from its large and diverse economy, its significant share of global trade, and the collective strength of its member states. The EU’s combined economic weight and political influence provide considerable leverage in international trade negotiations.

“The EU’s negotiating power is not absolute, and success depends on various factors, including the nature of the dispute and the political will of the countries involved.”

End of Discussion

In conclusion, the potential impact of tariffs on Europe’s single market is multifaceted and significant. From the disruption of trade flows to the exacerbation of economic disparities, the consequences are far-reaching. Alternative policy responses and the proactive role of EU institutions will be crucial in mitigating these negative impacts and ensuring the continued success of the single market in the face of global trade challenges.

The discussion highlights the importance of careful consideration and proactive measures to navigate the complexities of international trade and safeguard Europe’s economic future.