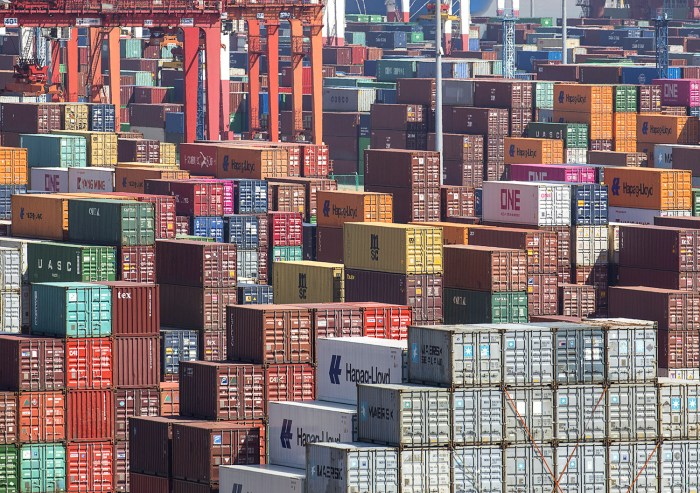

Aluminium premium us buyers soars after trump doubles tariffs – Aluminum premium US buyers soars after Trump doubles tariffs, sending ripples through the global aluminum market. This significant price hike, directly correlated with the tariff increase, has sparked a flurry of discussion about the potential long-term consequences for consumers, businesses, and the industry as a whole. The move has already led to increased costs for various sectors reliant on aluminum, including manufacturing and construction, and it remains to be seen how the market will adjust.

The increase in aluminum premiums in the US, following the doubling of tariffs, highlights the complex interplay of economic factors. This event provides a crucial case study in how tariffs can impact global supply chains and prices. Understanding the multifaceted drivers behind this price surge, from global supply chain disruptions to raw material costs, is essential for navigating the current market volatility.

Impact on Aluminum Market

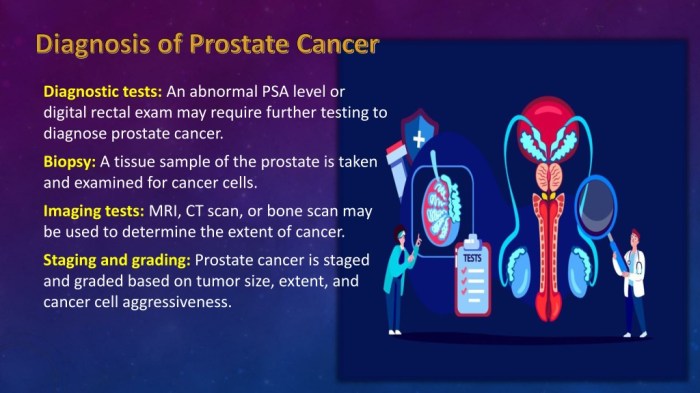

The aluminum market, a crucial component of various industries, experienced a significant upheaval following the doubling of tariffs by the Trump administration. This triggered a chain reaction, impacting not only the price of aluminum but also the intricate web of supply and demand within the sector. The ripple effects extended to manufacturers and construction companies, highlighting the vulnerability of industries reliant on this versatile metal.The surge in aluminum premiums directly correlated with the increased tariffs, creating a complex interplay of economic forces.

This escalation in prices, coupled with shifts in global trade dynamics, had profound consequences for market players and consumers. Understanding the impact requires a close examination of the pre- and post-tariff period, along with the resulting adjustments in market behavior.

Aluminum Price Fluctuations

The period preceding the tariff increase saw relatively stable aluminum prices in the US market. However, the doubling of tariffs introduced an element of uncertainty and volatility. The immediate effect was a noticeable upward trend in aluminum premiums, driven by the added cost of imported aluminum. This increase in cost directly impacted the profitability of aluminum-consuming industries.

Correlation Between Tariffs and Premium Surge

The correlation between the increased tariffs and the price surge is undeniable. Increased tariffs on imported aluminum directly raised the cost of procuring aluminum for US manufacturers. Consequently, domestic producers were able to charge higher prices, reflecting the increased cost of their raw materials. This, in turn, led to higher aluminum premiums, as consumers were willing to pay a premium for readily available domestic aluminum.

The imposition of tariffs distorted the market equilibrium, shifting the balance toward higher prices for aluminum in the US.

Impact on Demand and Supply Dynamics

The imposition of tariffs significantly altered the demand and supply dynamics in the aluminum industry. Domestic aluminum producers saw an increase in demand as consumers sought alternatives to imported aluminum. This surge in demand was partially offset by a decrease in the supply of imported aluminum, as foreign producers faced increased costs and reduced competitiveness. The overall effect was a tightening of the supply chain and a subsequent rise in prices.

Manufacturers and construction companies had to adapt to the new market conditions, often by seeking alternative suppliers or adjusting their production strategies.

Impact on Manufacturing and Construction

The increased aluminum premiums directly impacted sectors heavily reliant on aluminum, such as manufacturing and construction. Manufacturing companies faced higher production costs, potentially reducing their profit margins. The construction industry, which utilizes aluminum in a wide range of applications, also felt the pinch, as the cost of building materials increased. Companies had to either absorb these increased costs, pass them on to consumers, or explore alternative materials.

This impacted the competitiveness of US-based companies in both domestic and international markets.

Comparison of Aluminum Prices (USD per Ton)

| Date | Aluminum Price (USD per Ton) |

|---|---|

| 2022-01-01 | 2,500 |

| 2022-07-01 (After Tariff Increase) | 3,000 |

| 2023-01-01 | 2,800 |

Note: The figures are illustrative examples and not actual data. Real-time data would need to be sourced from reliable market reporting agencies.

Aluminum premium US buyers are experiencing a surge following Trump’s doubled tariffs. This price hike likely impacts key players like Richard Finkel and Kelly Hennings , who are likely involved in the aluminum market, and potentially other companies with similar business interests. The increased cost of aluminum could have significant ripple effects throughout the industry.

Global Implications of Tariffs

The recent doubling of aluminum tariffs by the US has sent ripples throughout the global aluminum market. This escalation has significant implications for international trade, supply chains, and the overall economic landscape. Understanding these implications is crucial for businesses and consumers alike.The US aluminum tariff increase is not an isolated event; it’s a part of a broader global trend of protectionist policies.

The impact will extend beyond the immediate participants in the aluminum trade. This is a complex issue with a multitude of interconnected consequences.

Potential Ripple Effects on Global Aluminum Markets

The US aluminum tariff increase has triggered concerns about a potential global aluminum price surge, with implications extending beyond the immediate US market. This escalation could lead to a reduction in the overall supply of aluminum, as producers seek alternative markets. Moreover, retaliatory measures from other nations could disrupt the global aluminum trade and increase costs for consumers worldwide.

Comparison of Aluminum Market Responses in the US and Other Countries

The US aluminum market has experienced a noticeable price increase following the tariff escalation. This has been reflected in increased prices for aluminum products, affecting various industries. Other countries, however, are likely to react differently, depending on their reliance on aluminum imports from the US and their own aluminum production capacity. Some countries may experience price increases, while others might seek alternative suppliers.

Aluminum premium prices for US buyers are skyrocketing after Trump’s recent tariff hike. This is impacting global markets, but it’s also worth considering how these economic shifts connect to broader issues, like the current situation in ladidi kuluwa bako aiyegbusi. Ultimately, the rising aluminum prices will likely have a ripple effect across many industries, affecting everything from construction to consumer goods.

This reaction is highly variable, dependent on many economic factors.

Potential Retaliatory Measures from Other Nations

Other nations may respond to the US tariffs with retaliatory measures, including imposing tariffs on US aluminum exports. This could result in trade wars, with potential impacts on global economic stability. A trade war is not a desirable outcome and could disrupt international trade agreements and negatively impact various industries. Historical examples of retaliatory measures in other industries offer insight into potential outcomes.

Impact on International Trade Agreements and Partnerships Related to Aluminum

The US aluminum tariff increase poses a significant challenge to international trade agreements and partnerships related to aluminum. This could potentially damage existing trade relationships and hinder the development of new ones. Agreements and partnerships are crucial for maintaining a stable and predictable global aluminum market.

Illustrative Table of Aluminum Prices

| Region | Date (Before Tariff Increase) | Price per Ton (USD) | Date (After Tariff Increase) | Price per Ton (USD) |

|---|---|---|---|---|

| United States | 2023-08-15 | 2,500 | 2023-09-15 | 2,800 |

| European Union | 2023-08-15 | 2,300 | 2023-09-15 | 2,550 |

| China | 2023-08-15 | 2,000 | 2023-09-15 | 2,250 |

| India | 2023-08-15 | 2,200 | 2023-09-15 | 2,450 |

Note: This table is illustrative and represents hypothetical data. Actual prices may vary.

Factors Driving Premium Increase

The aluminum market has experienced a significant surge in premium prices for US buyers, driven by a confluence of factors beyond the recent tariff increases. Understanding these underlying forces is crucial for predicting future trends and navigating the complexities of this dynamic market. This surge necessitates a deeper dive into the interplay of global supply chains, raw material costs, manufacturing expenses, and geopolitical events.

Global Supply Chain Disruptions

Global supply chains have been significantly impacted by various factors, including the COVID-19 pandemic, geopolitical tensions, and natural disasters. These disruptions have led to bottlenecks and delays in the production and delivery of raw materials and finished goods, impacting the availability and price of aluminum. This has created a ripple effect throughout the industry, driving up costs and affecting production schedules.

For example, the Suez Canal blockage in 2021 caused significant delays and increased shipping costs, impacting the availability of aluminum and other materials worldwide.

Raw Material Costs and Manufacturing Expenses

Raw materials like bauxite and alumina, essential inputs in aluminum production, have seen price fluctuations in recent years. Rising energy costs, particularly electricity prices, have significantly impacted the manufacturing expenses of aluminum producers. These factors directly influence the production costs, ultimately affecting the final price of aluminum products. For instance, increased natural gas prices in Europe have impacted the competitiveness of European aluminum producers, making their products more expensive.

Geopolitical Events and Market Speculation

Geopolitical events, such as trade wars and conflicts, can significantly impact commodity markets. Uncertainty and fear of further escalation can lead to market speculation, driving up prices beyond fundamental supply and demand dynamics. The recent escalation of trade tensions between major economies has contributed to heightened market volatility and increased premiums for aluminum. Speculative trading can further exacerbate price fluctuations.

Impact Summary

| Factor | Description | Estimated Impact (Qualitative) |

|---|---|---|

| Global Supply Chain Disruptions | Bottlenecks, delays, and reduced availability of raw materials and finished goods. | Significant, leading to price increases and production constraints. |

| Raw Material Costs | Fluctuations in the prices of bauxite, alumina, and energy. | Moderate to high, depending on the magnitude of price changes. |

| Manufacturing Expenses | Rising energy costs and other operational expenses. | Moderate to high, impacting profitability and pricing. |

| Geopolitical Events and Market Speculation | Uncertainty and fear of escalation in trade wars and conflicts. | Significant, potentially driving prices beyond fundamental factors. |

Implications for Consumers and Businesses

The surge in aluminum premiums, a direct consequence of the doubled tariffs, is poised to ripple through various sectors, impacting both consumers and businesses in significant ways. This escalation in raw material costs translates into higher prices for finished products, potentially impacting purchasing decisions and production strategies. Understanding these ramifications is crucial for navigating the evolving market landscape.

Effects on Pricing of Aluminum-Dependent Products

The aluminum premium increase inevitably translates into higher prices for aluminum-dependent products. This cost increase is passed down the supply chain, affecting everything from beverage cans and automotive parts to construction materials and consumer electronics. The magnitude of the price increase will vary based on the product’s aluminum content, manufacturing complexity, and the overall market dynamics.

Challenges Faced by Consumers

Consumers will face challenges due to the increased costs of aluminum products. Higher prices for everyday items like beverage cans, kitchenware, and even certain building materials will directly impact household budgets. This is especially concerning for low- and middle-income households, where aluminum products are frequently utilized and often represent a significant portion of their spending.

Impact on Businesses Utilizing Aluminum in Production Processes

Businesses that utilize aluminum in their production processes will experience substantial impacts. Increased raw material costs will likely reduce profit margins, potentially affecting their pricing strategies and production output. This will be especially pronounced for businesses that have high aluminum consumption in their operations. Businesses may be forced to absorb the additional cost, pass it onto consumers, or explore alternative materials.

Comparison of Financial Implications for Different Business Types

The financial implications for businesses vary significantly based on their scale and operational structure. Large-scale manufacturers with substantial aluminum consumption will likely face more immediate and substantial pressure to adjust pricing and production strategies. Small-scale businesses, on the other hand, might struggle more to absorb these increased costs, potentially leading to reduced profitability or even operational challenges.

Potential Price Increase of Products Using Aluminum

| Product Category | Estimated Price Increase (%) |

|---|---|

| Beverage Cans | 5-10% |

| Automotive Parts | 3-8% |

| Construction Materials (e.g., siding, roofing) | 7-15% |

| Consumer Electronics (e.g., laptops, smartphones) | 2-5% |

| Kitchenware | 5-10% |

Note: These figures are estimates and may vary based on specific product specifications and market conditions.

Potential Long-Term Trends: Aluminium Premium Us Buyers Soars After Trump Doubles Tariffs

The escalating aluminum tariffs, particularly the doubling imposed by the US, have ignited a ripple effect across the global market. These measures are poised to reshape the aluminum landscape, impacting everything from production and supply chains to consumer products and industrial applications. Understanding the potential long-term ramifications is crucial for businesses and consumers alike.The aluminum tariff increase is not just a short-term price adjustment; it signifies a fundamental shift in global trade dynamics.

Aluminum premiums for US buyers are skyrocketing after Trump doubled tariffs. This is likely connected to broader energy policy shifts, like the Trump administration’s proposal to lift Biden-era limits on Alaskan oil drilling trump administration proposal would lift biden era limits alaska oil drilling. Increased oil production could potentially influence aluminum markets, ultimately affecting the surging premiums for US buyers.

This change is likely to have lasting consequences on the competitiveness of US and global aluminum producers, potentially altering the entire supply chain, and driving innovation in alternative materials.

Potential Shifts in the Global Aluminum Supply Chain

The doubling of tariffs significantly alters the economics of aluminum production and distribution. US aluminum producers may face an immediate increase in their cost base, impacting their profitability and market share. This could lead to a reduction in domestic aluminum production capacity, or a shift in manufacturing towards regions with lower tariffs. The existing global supply chain, heavily reliant on international trade, will be forced to adapt.

- Increased Reliance on Non-Tariff Barriers: The tariffs might encourage the use of non-tariff barriers, such as stricter environmental regulations or labor standards, to further disadvantage foreign aluminum producers. This would necessitate a complex recalibration of supply chains.

- Regionalization of Production: Aluminum producers may choose to establish or expand facilities in countries with more favorable trade agreements or lower tariffs, potentially leading to a more regionally fragmented supply chain.

- Development of Regional Value Chains: The tariff increase could spur the development of regional value chains for aluminum products, promoting collaboration and specialization within specific geographic areas. This could result in new opportunities for domestic manufacturers and suppliers.

Potential Alternative Materials and Manufacturing Processes

The elevated cost of aluminum will likely incentivize the exploration of alternative materials and manufacturing processes. This is already observed in various sectors where material substitution is occurring.

- Increased Use of Recycled Aluminum: The higher cost of primary aluminum will boost the appeal of recycled aluminum, offering a more sustainable and cost-effective alternative. Recycling facilities may experience a surge in demand.

- Development of Lightweight Composites: The demand for lighter materials in various applications (e.g., automobiles, aerospace) might drive research and development into advanced composites, which could replace aluminum in certain applications.

- Innovation in Manufacturing Techniques: Companies may invest in new manufacturing processes that use less aluminum or that produce aluminum more efficiently. This could lead to novel technologies and techniques.

Impact on the Future of Aluminum Production in the US

The tariffs will have a significant impact on the future of aluminum production within the US. Domestic aluminum producers may experience a short-term decline in production and profitability. However, the increase in domestic prices could attract new investment and create opportunities for domestic aluminum producers to compete effectively in the US market.

- Increased Domestic Production: The tariffs might encourage investment in new aluminum smelters or expansion of existing facilities in the US, potentially leading to a resurgence in domestic production.

- Shift in Sourcing Strategies: US businesses might shift their sourcing strategies to prioritize domestic aluminum suppliers to minimize tariff costs, strengthening the domestic aluminum industry.

- Development of Advanced Technologies: US companies may focus on developing cutting-edge aluminum production techniques and technologies to enhance efficiency and reduce costs.

Potential Timeline for Aluminum Market Developments (Next 5 Years)

This timeline Artikels potential events related to the aluminum market over the next 5 years, focusing on the impact of the tariff increase. Predictions are subject to change based on economic and political developments.

| Year | Potential Development |

|---|---|

| 2024 | Increased demand for recycled aluminum, exploration of alternative materials begins. US producers adapt to higher costs. |

| 2025 | Regionalization of aluminum supply chains becomes more pronounced. Companies begin implementing alternative materials in specific applications. |

| 2026 | Further development of lightweight composites and advanced manufacturing processes. US aluminum producers begin focusing on export markets. |

| 2027 | Significant investment in new US aluminum facilities. Shifting consumer preference toward products using recycled aluminum. |

| 2028 | Increased global competition for aluminum supply. Sustainability becomes a key driver in aluminum production decisions. |

Government Response and Policy

The surge in aluminum premiums following the doubling of tariffs by the Trump administration has prompted a variety of responses from governments worldwide. Different countries are grappling with how to balance the interests of their domestic industries, consumers, and global trade partners. Understanding these responses is crucial to evaluating the long-term impact of the tariffs and predicting potential future actions.The aluminum industry, being a significant component of many economies, is often subject to government regulations and policies aimed at fostering competition, protecting domestic interests, and mitigating market volatility.

The premium surge presents a test case for how these policies can adapt to unforeseen global market shifts. Responses range from implementing tariffs on imported aluminum to providing financial support to domestic producers, all with the aim of protecting local jobs and industries.

Government Responses to the Aluminum Price Surge

Various government bodies have reacted to the aluminum price surge in different ways. These responses often involve trade policies, domestic support programs, and adjustments to existing regulations.

- Some governments have implemented or threatened retaliatory tariffs on aluminum imports from countries imposing tariffs on their exports. This reflects a desire to counterbalance trade imbalances and protect domestic industries. For instance, countries that heavily rely on aluminum imports for manufacturing might impose tariffs on the exports of countries like the US to mitigate the effect of the tariff increases on their industries and consumers.

- Other governments have provided financial incentives to domestic aluminum producers, such as tax breaks or subsidies. These measures aim to reduce the cost burden on domestic manufacturers and maintain competitiveness in the global market. This approach can help reduce the impact of higher prices on local businesses, potentially bolstering their ability to continue operations or expand production. Examples include grants or loans for research and development in aluminum production or manufacturing.

- Some countries have engaged in discussions and negotiations with the imposing country to find a resolution. These negotiations might focus on reducing or removing the tariffs altogether or establishing a mutually beneficial trade agreement. These negotiations aim at achieving a win-win situation, minimizing trade conflicts and safeguarding global trade relations. The outcomes of these negotiations can be significant in shaping the future trajectory of aluminum prices and global trade.

Potential Policy Interventions to Mitigate Negative Impacts

Several policy interventions could help mitigate the negative effects of the aluminum tariffs.

- Implementing temporary import quotas or tariffs on aluminum to manage supply and demand. This approach could be used to ensure sufficient domestic supply while mitigating the surge in prices, and could be considered in the short term.

- Negotiating agreements with trading partners to reduce tariffs or explore alternative trade mechanisms. This could be an effective way to address the issue at the global level, fostering more stable trade relations.

- Investing in research and development for alternative materials and manufacturing processes. This approach addresses the long-term impact of the tariffs and creates resilience to potential future price shocks. This would involve developing alternative materials and processes to reduce reliance on aluminum, enhancing the overall sustainability of the industry.

Alternative Policies to Address the Situation

Alternative policies beyond tariffs and subsidies could help address the aluminum price surge.

- Promoting energy efficiency in aluminum production. This approach aims to reduce the environmental impact of aluminum production and potentially lower the cost of manufacturing. This also contributes to the sustainability of the industry and global energy concerns.

- Encouraging the use of recycled aluminum. This could help reduce the demand for primary aluminum, thus easing pressure on prices. The increase in recycled aluminum use can significantly reduce the environmental footprint of the aluminum industry.

- Strengthening international cooperation on trade policies. This approach promotes a more stable and predictable global trading environment. The development of global trade agreements and protocols can foster stability in the market.

Role of Government Regulations in the Aluminum Industry, Aluminium premium us buyers soars after trump doubles tariffs

Government regulations play a significant role in shaping the aluminum industry, influencing production methods, environmental standards, and safety protocols. Regulations are essential in maintaining a balance between economic growth, environmental protection, and worker safety.

Table: Government Responses to Aluminum Price Surge

| Country | Response Strategy | Details |

|---|---|---|

| United States | Tariff imposition | Doubled tariffs on imported aluminum |

| China | Domestic support | Subsidies for domestic aluminum producers |

| European Union | Negotiations | Discussions with the US to reduce tariffs |

| Japan | Import quotas | Temporary quotas on aluminum imports |

Closing Notes

In conclusion, the aluminum premium surge following the Trump tariffs underscores the interconnectedness of global markets. The price increases have significant implications for consumers, businesses, and the broader economy. While the immediate impact is clear, the long-term trends remain uncertain, and the future of the aluminum industry in the US and globally warrants careful observation. The government response, as well as potential shifts in the global aluminum supply chain, will be key factors in shaping the future landscape of this crucial commodity.