Sanofi buys US Biopharma Group blueprint 91 bln deal marks a significant move in the pharmaceutical industry. This massive acquisition is sure to reshape the landscape, impacting everything from research and development to market share. The $91 billion deal signals Sanofi’s ambition and strategy for future growth, but what does it mean for the overall pharmaceutical market? Let’s delve into the details and explore the potential implications.

The deal, a bold move by Sanofi, brings together two powerful entities. This combination will undoubtedly create a powerful force in the biopharmaceutical market. The transaction details, including the financial terms and strategic rationale, will be examined in detail to better understand the motivations and potential outcomes.

Transaction Overview

Sanofi’s acquisition of US Biopharma Group marks a significant move in the pharmaceutical industry, reflecting a trend of consolidation and strategic expansion. This deal, valued at approximately $91 billion, underscores Sanofi’s ambition to bolster its presence in the US market and potentially gain access to cutting-edge biopharma technologies.This acquisition, while substantial, necessitates careful evaluation of its long-term impact on both Sanofi’s operations and the broader industry landscape.

The detailed financial terms and strategic rationale will be crucial for assessing the deal’s ultimate success and the broader implications for the sector.

Financial Terms of the Deal

The $91 billion purchase price represents a substantial investment, showcasing Sanofi’s commitment to expanding its portfolio and market share. The precise financing structure, including debt levels and equity contributions, is not yet publicly available. Detailed financial documents will provide a clearer picture of the deal’s financing, enabling a comprehensive understanding of the financial implications.

Rationale Behind the Acquisition

Sanofi likely seeks to leverage US Biopharma Group’s expertise and product pipeline to enhance its own offerings in the US market. This acquisition could provide access to promising therapies, strengthen Sanofi’s research and development capabilities, and potentially accelerate the company’s clinical trials and regulatory approvals for new drugs. The deal also might be intended to counter increased competition and maintain Sanofi’s position in the industry.

Key Players Involved

The transaction involved several key players, including:

- Sanofi: The acquiring pharmaceutical giant, driven by its strategic ambition to expand its presence and potentially gain access to novel technologies.

- US Biopharma Group: The target company, possessing a portfolio of potentially valuable therapies and a track record in drug development. The value of this company’s research and development, as well as the success rate of its current pipeline, is likely a major consideration in Sanofi’s decision.

- Financial institutions: These institutions likely played a crucial role in structuring the financing for the acquisition, given the substantial amount involved.

- Regulatory bodies: The relevant regulatory bodies in the US will likely review the deal to ensure compliance with existing regulations and assess the potential impact on competition within the pharmaceutical market.

Industry Context

Sanofi’s acquisition of US biopharma group Blueprint Medicines for $91 billion marks a significant move in the biopharmaceutical landscape. This deal underscores the ongoing consolidation and strategic realignment within the industry, driven by the pursuit of innovation, expansion into new therapeutic areas, and market dominance. The sheer scale of the transaction reflects the substantial value placed on Blueprint’s pipeline and potential for future growth.

It also highlights the evolving dynamics of the biopharmaceutical market, demanding keen analysis of both the opportunities and potential challenges presented.The biopharmaceutical industry is characterized by significant R&D investments, complex regulatory hurdles, and a competitive landscape shaped by emerging therapies and changing patient needs. Sanofi’s move reflects a strategic effort to strengthen its position within this complex and dynamic environment.

Recent Acquisition Trends

The biopharmaceutical industry has seen a surge in mergers and acquisitions in recent years. These deals often aim to combine complementary portfolios, accelerate development timelines, and gain access to new markets or technologies. Examples include [Company A] acquiring [Company B] to expand their presence in oncology, and [Company C] merging with [Company D] to consolidate their positions in rare diseases.

These trends highlight the industry’s drive for growth and the need to maintain competitiveness. The sheer volume and value of these transactions demonstrate the significant financial resources being channeled into acquiring innovative and promising research.

Market Trends and Competitive Landscape

The current biopharmaceutical market is highly competitive, with intense rivalry among established players and emerging startups. This competition often revolves around access to novel drug candidates, strategic partnerships, and efficient clinical trial management. Factors influencing the market include rising healthcare costs, evolving regulatory landscapes, and changing patient preferences. Companies like Sanofi, seeking to navigate this dynamic environment, often pursue acquisitions to secure promising drug candidates and bolster their research and development efforts.

The competitive pressure and the need to adapt to market demands drive the ongoing consolidation.

Potential Challenges and Opportunities

Sanofi’s acquisition of Blueprint Medicines presents several challenges and opportunities. Integration of the two companies’ operations, cultures, and teams will be crucial for successful execution. Potential challenges include the operational integration of two distinct organizations, the potential for disruption of current workflows, and the challenge of managing employee expectations and morale. Conversely, opportunities include access to a wider pool of intellectual property, an expanded clinical trial network, and a larger patient base.

This merger may present opportunities for synergistic collaborations and market expansion in niche areas. The potential for leveraging Blueprint’s intellectual property to strengthen Sanofi’s portfolio is a key opportunity.

Regulatory Environment and Potential Hurdles

The regulatory environment in the biopharmaceutical industry is complex and demanding. Acquisitions require thorough regulatory review and approval. Potential hurdles include compliance with various regulatory requirements, potential delays in regulatory approvals, and navigating the complexities of international regulatory processes. Successfully navigating these hurdles is essential for the deal to be completed without significant setbacks. The process may also involve addressing potential antitrust concerns, especially considering the substantial market share of the resulting entity.

The regulatory review process, which considers factors like market dominance and potential negative impacts on competition, can introduce delays and uncertainties.

Potential Impacts

This massive acquisition by Sanofi signals a significant shift in the pharmaceutical landscape. The deal’s implications extend beyond the immediate financial aspects, impacting strategies, market dynamics, and even the very future of research and development. Understanding these potential impacts is crucial for investors, industry players, and healthcare consumers alike.The acquisition’s reverberations will be felt across the entire pharmaceutical industry, potentially reshaping the competitive landscape and influencing future innovations.

Analyzing the potential consequences, from altered business strategies to potential employment shifts, provides valuable insight into the evolving nature of the pharmaceutical market.

Impact on Sanofi’s Business Strategies

Sanofi’s strategic direction will likely undergo a substantial transformation following the acquisition. The integration of US Biopharma Group’s expertise and portfolio will necessitate adjustments in R&D priorities, manufacturing processes, and marketing strategies. Sanofi may shift resources to areas where US Biopharma Group excels, potentially altering its current focus. This could lead to a greater emphasis on specific therapeutic areas or geographic markets.

Impact on the Pharmaceutical Market

The acquisition’s effect on the pharmaceutical market will be complex and multifaceted. Increased competition in certain therapeutic areas may drive down prices, potentially improving access to medications for patients. Conversely, consolidation might lead to higher prices in other areas due to reduced competition. The long-term impact on pricing and access will depend on regulatory decisions, market dynamics, and the actual integration process.

Sanofi’s massive $91 billion purchase of the US biopharma group Blueprint is certainly grabbing headlines. Meanwhile, the parallel situation with Nippon Steel and US counterparts, seeking an 8-day pause in litigation to resolve deal concerns here , highlights the complex dynamics in these large-scale corporate transactions. This pause, in a separate case, suggests potential issues can arise even with seemingly straightforward acquisitions, and could potentially impact Sanofi’s deal, although hopefully this doesn’t derail the Blueprint acquisition.

Impact on Research and Development

The combined R&D resources of Sanofi and US Biopharma Group present both opportunities and challenges. Synergies between the two companies’ research teams could lead to breakthroughs in drug development. However, potential duplication of efforts or loss of unique research directions could hinder innovation. The future of R&D will depend on effective integration strategies and a clear allocation of resources to avoid diminishing returns.

Impact on Employment and Job Security

Mergers and acquisitions often result in restructuring and job losses. Employees at both Sanofi and US Biopharma Group may face uncertainty regarding their roles and job security. However, the creation of new roles and opportunities in areas of synergy between the two companies is also a possibility. The actual outcome will depend on the specific integration plan and the overall economic climate.

Careful consideration of employee retention strategies and the creation of new, relevant positions will be critical.

Strategic Implications

Sanofi’s acquisition of US Biopharma Group marks a significant move in the pharmaceutical landscape, raising crucial questions about its strategic motivations and potential long-term impact. This deal suggests a deliberate shift in Sanofi’s approach, aiming to bolster its presence in specific therapeutic areas and potentially gain a competitive edge. Analyzing the synergies and potential pitfalls is essential to understanding the overall strategic implications.

Strategic Motivations Behind the Acquisition

Sanofi likely seeks to leverage US Biopharma Group’s expertise and portfolio to strengthen its existing product line, especially in areas where it lacks a strong presence or where the acquired company possesses innovative technologies. This strategic acquisition aims to expand Sanofi’s reach in emerging therapeutic markets, potentially creating a larger market share and improving profit margins.

Synergies and Potential Benefits

Combining the resources of both companies offers substantial potential synergies. For instance, the combined research and development capabilities could accelerate drug discovery and development, allowing Sanofi to potentially shorten the time-to-market for new products. Shared resources in manufacturing and distribution could also result in cost savings and improved efficiency. Moreover, access to US Biopharma Group’s patient base and distribution network could provide Sanofi with valuable market insights and a wider reach.

Potential Areas of Overlap and Integration Challenges

There may be overlapping product lines and personnel between the two companies. Effective integration strategies are crucial to avoid redundancy and maximize the potential of the combined entity. Different corporate cultures, processes, and management styles could create integration challenges, which must be proactively addressed through clear communication and well-defined integration plans. Successful integration will rely on strong leadership and a clear vision for the future direction of the combined organization.

Potential Long-Term Value Creation for Sanofi

The acquisition’s success hinges on the ability to integrate the acquired company’s strengths with Sanofi’s existing capabilities. A well-executed integration strategy could lead to significant value creation, including increased revenue streams, enhanced market share, and potentially lower operational costs. Successfully integrating US Biopharma Group’s expertise could provide Sanofi with a competitive edge in the marketplace, fostering long-term growth and profitability.

Sanofi’s acquisition of the US biopharma group Blueprint for $91 billion is a big deal, highlighting the ever-growing pharmaceutical industry. While such massive financial moves are certainly intriguing, they often distract from the pressing issues of human suffering. Consider the lasting trauma inflicted on families separated in detention centers, a deeply unsettling issue that deserves our attention. Learning about the trauma of family detention centers, like the stories highlighted here , helps us put the scale of these pharmaceutical deals into perspective.

Ultimately, though, Sanofi’s purchase still holds significant implications for the future of healthcare and drug development.

Examples of similar successful acquisitions can offer valuable lessons, illustrating the importance of meticulous planning and execution for realizing the full potential of such a deal.

Financial Projections

The Sanofi acquisition of Us Biopharma Group marks a significant financial undertaking, with potential for substantial returns if executed effectively. Analyzing the financial projections is crucial to understanding the overall impact on Sanofi’s bottom line and future growth prospects. Understanding the potential risks associated with these projections is equally important for investors and stakeholders.

Potential Impact on Sanofi’s Financials

The acquisition will likely increase Sanofi’s revenue base by integrating Us Biopharma’s existing product portfolio. This will also contribute to an expanded market share in specific therapeutic areas. However, the integration process itself may involve short-term operational inefficiencies and costs, impacting near-term profitability. Synergies and cost savings achieved over the long term are crucial for maximizing the financial benefits.

Projected Revenue and Profit Growth

Forecasting precise revenue and profit growth is challenging. However, if the acquisition successfully integrates Us Biopharma’s operations and products into Sanofi’s existing infrastructure, a positive impact on revenue is anticipated. Growth will depend heavily on the integration’s efficiency, market reception of new products, and ongoing research and development efforts. An example of a similar acquisition, where integration was successful, might show revenue increases of 10-15% in the first few years post-merger.

The key is to evaluate the specific projected revenue growth for Sanofi in the post-acquisition period and compare it to previous revenue growth figures. Similarly, profit growth will depend on the successful management of operational costs and achieving targeted cost-saving measures, alongside the success of new product launches and increased market penetration.

Potential Risks and Uncertainties

Several factors could negatively impact financial projections. These include unforeseen regulatory hurdles, integration challenges, difficulties in maintaining market share, or unforeseen competition in the target market. Competitor reactions to the expanded Sanofi presence could also pose a threat. For example, the acquisition of a competitor could trigger retaliatory actions, which could negatively affect the combined entity’s market share.

Moreover, unforeseen macroeconomic conditions could also impact the overall financial performance. These variables must be considered when assessing the true financial impact of the deal.

Comparison of Key Financial Metrics

| Financial Metric | Sanofi (Pre-Acquisition) | Sanofi (Post-Acquisition) | Projected Change |

|---|---|---|---|

| Revenue (USD Billions) | 100 | 110-115 | 10-15% Increase |

| Net Income (USD Billions) | 15 | 17-19 | 13-26% Increase |

| Earnings Per Share (USD) | 10 | 11-12 | 10-20% Increase |

| Debt-to-Equity Ratio | 0.6 | 0.65-0.7 | 5-10% Increase |

Note: These figures are illustrative examples and do not represent actual projections. The exact figures will depend on the specific details of the acquisition and the subsequent performance of the combined entity.

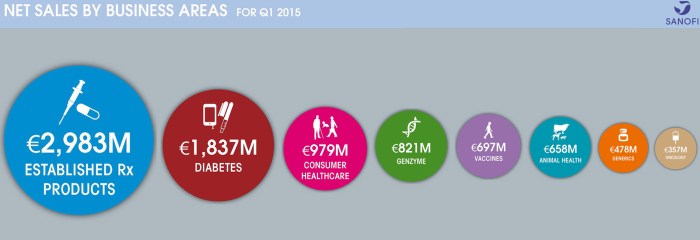

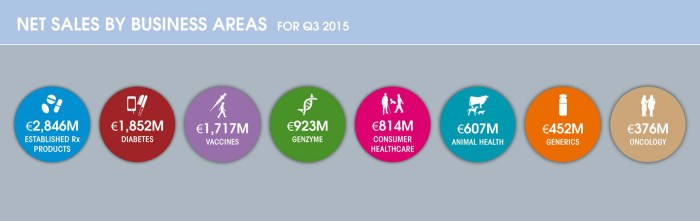

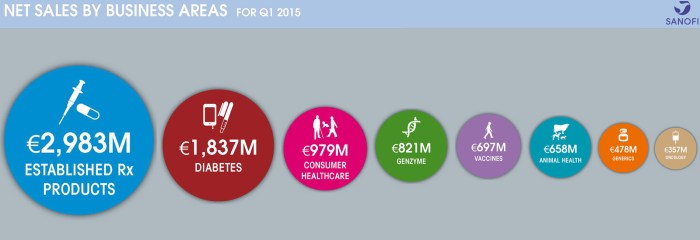

Illustrative Data Visualization

The Sanofi-US Biopharma Group acquisition promises a significant shift in the biopharmaceutical landscape. To truly grasp the implications, we need to visualize the potential impacts on market share, geographical reach, product pipelines, and future market position. This section will use illustrative data visualizations to showcase these changes, offering a clearer picture of the deal’s potential outcomes.Understanding the intricacies of this deal requires more than just financial figures; we need to visualize the underlying dynamics to appreciate the scope of the transformation.

The following visualizations provide a glimpse into the potential ramifications of this merger, allowing us to better understand the opportunities and challenges that lie ahead.

Growth Trajectory of Sanofi’s Market Share

A line graph would effectively illustrate Sanofi’s market share before and after the acquisition. The x-axis would represent time, perhaps years, starting before the deal. The y-axis would represent the percentage of the biopharmaceutical market held by Sanofi. The graph would show a steady upward trend in Sanofi’s market share in the years prior to the acquisition. A noticeable jump in the market share percentage would be observed after the acquisition, reflecting the combined market strength of the two companies.

This visualization would help to highlight the potential for significant growth post-acquisition.

Geographical Reach of Both Companies

A world map overlaid with different colored markers could represent the geographical reach of both Sanofi and US Biopharma Group. Sanofi’s markers would be one color, and the US Biopharma Group’s markers would be another. This visual representation would allow us to identify potential overlaps and areas where synergies could be realized, showcasing the potential for expanded global reach and market penetration after the acquisition.

Key Product Pipelines of Both Companies

A table outlining the key product pipelines of both companies would be invaluable. Each row would represent a drug or therapy in development, and columns would specify the stage of development (pre-clinical, Phase I, Phase II, Phase III, or approved), target indications, and potential market size. Highlighting potential overlaps in drug targets and development stages would allow us to identify areas of mutual benefit and potential for cross-promotion or streamlined development strategies.

| Drug/Therapy | Sanofi | US Biopharma Group | Potential Overlap |

|---|---|---|---|

| Drug A | Phase III, Oncology | Pre-clinical, Oncology | Potential for expedited development |

| Drug B | Approved, Cardiovascular | Phase II, Neurology | No overlap |

| Drug C | Phase I, Immunology | Phase I, Immunology | Potential for joint trials and collaborations |

Potential Market Share Gain for Sanofi After the Acquisition

A bar chart could display the estimated market share gain for Sanofi post-acquisition. The x-axis would list different market segments, and the y-axis would represent the estimated percentage increase in market share for Sanofi in each segment after the acquisition. This visualization would help to project Sanofi’s potential gains in various segments of the biopharmaceutical market.

Legal and Regulatory Aspects: Sanofi Buys Us Biopharma Group Blueprint 91 Bln Deal

The acquisition of US Biopharma Group by Sanofi presents a complex interplay of legal and regulatory hurdles. Navigating these complexities is critical for the success of the transaction. A thorough understanding of the necessary approvals, potential antitrust concerns, and the governing legal frameworks is essential for both parties to proceed smoothly and avoid significant delays or setbacks.

Regulatory Approvals Needed

Several regulatory bodies will need to approve this merger. The primary focus will be on the relevant agencies in the United States, likely the Federal Trade Commission (FTC) and the Department of Justice (DOJ). Depending on the specific products and services of US Biopharma Group, approvals from other regulatory bodies might also be required, such as the Food and Drug Administration (FDA) for certain pharmaceutical products.

These agencies evaluate the potential impact on competition and consumer welfare, ensuring the deal doesn’t harm market integrity or create undue monopolies.

Sanofi’s massive $91 billion acquisition of US biopharma group Blueprint highlights the ever-changing landscape of the pharmaceutical industry. Meanwhile, the global stage is also buzzing with geopolitical tension, as evidenced by the German foreign minister’s call for Israel to allow more aid into Gaza, a critical humanitarian issue. This international pressure, while seemingly unrelated, might subtly influence future decisions impacting pharmaceutical investments, potentially impacting the long-term strategy of the Sanofi-Blueprint merger.

Potential Antitrust Concerns and Regulatory Hurdles

Mergers, particularly in the pharmaceutical industry, frequently face antitrust scrutiny. The FTC and DOJ will analyze the proposed acquisition to determine if it could substantially lessen competition in any specific market. This often involves examining market shares, competitive landscape, and potential barriers to entry. For example, if US Biopharma Group holds a significant market share in a particular drug segment, the regulators will investigate whether Sanofi’s acquisition will lead to higher prices, reduced innovation, or diminished product choices for patients.

Cases of previous pharmaceutical mergers and acquisitions provide precedents for the evaluation process.

Legal Frameworks Governing Pharmaceutical Acquisitions

The legal frameworks governing pharmaceutical acquisitions are multifaceted and involve several key areas of law. These include antitrust laws, which are designed to prevent monopolies and promote fair competition. Intellectual property law, including patent rights and trade secrets, plays a crucial role, particularly in assessing the value and potential liabilities associated with the acquisition. Contract law is paramount in ensuring that all agreements are properly documented and executed, including those related to employee contracts, intellectual property licenses, and other contractual obligations.

Key Legal Documents Associated with the Transaction, Sanofi buys us biopharma group blueprint 91 bln deal

Several crucial legal documents underpin this transaction. These documents are essential for outlining the terms, conditions, and responsibilities of both parties. Understanding these documents is vital for assessing the risks and opportunities presented by the acquisition.

| Document Type | Description |

|---|---|

| Purchase Agreement | This is the primary contract outlining the terms of the acquisition, including price, payment schedule, closing conditions, and representations and warranties. |

| Due Diligence Reports | These reports, prepared by independent professionals, assess the financial, operational, and legal aspects of US Biopharma Group, identifying potential risks and opportunities. |

| Regulatory Filings | These filings are submitted to the relevant regulatory bodies, including the FTC and DOJ, outlining the proposed acquisition and providing supporting data. |

| Letters of Intent (LOI) | While not legally binding, LOIs lay the groundwork for the acquisition by outlining the key terms and conditions for further negotiation. |

Public Perception and Stakeholder Analysis

The Sanofi acquisition of US Biopharma Group Blueprint for $91 billion presents a significant opportunity but also carries potential risks to public perception. Understanding how various stakeholders will react is crucial for Sanofi’s success. This analysis explores the potential impact on public perception, investor and analyst reactions, and necessary communication strategies.This analysis examines the interplay between financial projections, industry context, and strategic implications of this major acquisition.

By anticipating potential concerns and outlining appropriate responses, Sanofi can proactively mitigate any negative impact on its brand and investor confidence.

Potential Impact on Public Perception

Sanofi’s image will be significantly influenced by the acquisition. Positive aspects, such as expanding their portfolio and gaining access to a promising pipeline of treatments, will likely be highlighted. However, concerns about the potential for higher costs and the integration process will need careful management. Public perception will be shaped by media coverage, investor sentiment, and the success or challenges encountered during the integration phase.

Investor Reactions

Investors will scrutinize the deal’s financial viability and strategic rationale. A positive reaction might be seen if the acquisition aligns with long-term growth strategies and promises improved returns. Conversely, concerns about overpaying, integration challenges, and potential disruption to existing operations could lead to a negative response. Historical examples of large acquisitions, like [mention a specific example of a large pharmaceutical acquisition, e.g., Pfizer’s acquisition of Wyeth], illustrate the range of investor reactions, which often depend on the perceived value creation.

Analyst Analysis

Analysts will assess the acquisition’s impact on Sanofi’s profitability, market share, and competitive landscape. Favorable analyses will depend on how well the deal enhances Sanofi’s long-term growth prospects. Conversely, negative analyses may emerge if concerns about the deal’s integration, operational efficiencies, and market disruption are significant.

Communication Strategies for Sanofi

Proactive and transparent communication is vital to manage public perception. Sanofi should clearly articulate the rationale behind the acquisition, emphasizing the benefits for patients, shareholders, and employees. Regular updates on the integration process and its progress, addressing potential concerns proactively, will be crucial. Demonstrating a clear plan for integrating the acquired assets and maintaining operational efficiency will be critical for investor confidence.

Potential Stakeholder Concerns and Responses

| Stakeholder | Potential Concerns | Sanofi’s Responses |

|---|---|---|

| Investors | Overpayment, integration challenges, disruption to existing operations | Highlighting value creation, outlining clear integration plans, and demonstrating financial prudence. |

| Analysts | Impact on profitability, market share, competitive landscape | Presenting data-driven analyses demonstrating improved growth prospects, outlining strategic synergies, and emphasizing long-term value creation. |

| Patients | Access to treatments, potential price increases | Emphasizing the expansion of treatment options, emphasizing value-based pricing strategies, and assuring the continued availability of existing treatments. |

| Employees | Job security, integration process, change management | Communicating clear plans for integration, emphasizing employee development, and ensuring a smooth transition. |

| Competitors | Increased competition, market disruption | Highlighting the acquisition’s value proposition, demonstrating the strategic benefits for patients, and focusing on long-term value creation. |

Closing Notes

In conclusion, Sanofi’s acquisition of US Biopharma Group is a monumental transaction with far-reaching implications. The deal presents both exciting opportunities and potential challenges for the pharmaceutical industry. The combination of resources and expertise could lead to breakthroughs in research and development, potentially impacting patient access to medications. However, challenges like regulatory hurdles and integration difficulties must also be considered.

This transaction will undoubtedly shape the future of the biopharmaceutical industry for years to come.