Bernie Madoff customers recoup 498 million payout tops 15 billion. This massive payout marks a significant step in the long and arduous recovery process for victims of the infamous Ponzi scheme. The $498 million represents a fraction of the staggering $15 billion defrauded, highlighting the scale of the crime and the complex legal battles that led to this partial restitution.

The sheer magnitude of the fraud, and the emotional toll on victims, underscore the importance of robust investor protection measures.

The payout, while substantial, inevitably raises questions about the full extent of the financial and emotional damage. What about the individuals who lost everything? What specific factors influenced the amount of the payout? Understanding the complexities of the recovery process and the perspectives of those affected is key to a complete picture of this monumental event.

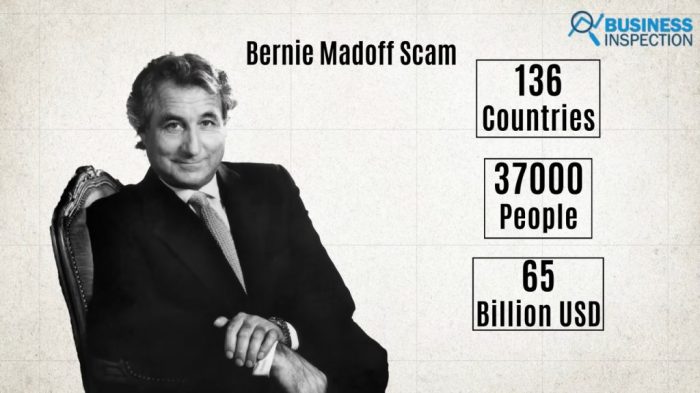

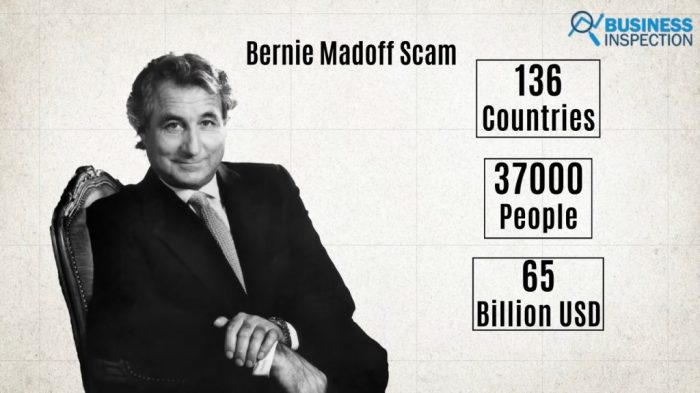

Overview of the Bernie Madoff Ponzi Scheme

The collapse of the Bernie Madoff investment firm in 2008 sent shockwaves through the financial world, exposing a massive Ponzi scheme that defrauded thousands of investors. This catastrophic event highlighted the vulnerabilities in the financial system and the devastating consequences of unchecked greed and deception. The sheer scale of the fraud and the long-lasting impact on victims underscore the importance of understanding how such schemes operate.The Bernie Madoff Ponzi scheme, a complex web of deceit, relied on the continuous inflow of new investor funds to pay returns to earlier investors.

This unsustainable model was built on a foundation of lies and manipulation, masking the fraudulent nature of the operation. The scheme’s eventual collapse was inevitable, as it could not sustain itself indefinitely. This type of fraudulent activity underscores the importance of critical thinking and due diligence when dealing with financial investments.

Fundamental Characteristics of a Ponzi Scheme

A Ponzi scheme is a fraudulent investment operation that promises high returns with little or no risk. It attracts new investors by paying returns to earlier investors using the money from more recent ones. Critically, the scheme’s profitability depends entirely on attracting new investors. This inherent instability makes Ponzi schemes inherently unsustainable. They thrive on a constant influx of new capital, and when this inflow slows or stops, the scheme collapses.

Key Players and Their Roles

Bernie Madoff, the mastermind behind the scheme, was the principal architect and operator of the fraudulent investment operation. His role was pivotal in deceiving investors and maintaining the illusion of profitability. Various individuals acted as intermediaries, facilitating the flow of funds and perpetuating the deception. These intermediaries played critical roles in the scheme, further complicating the investigation and recovery efforts for victims.

The scheme involved numerous individuals, from financial advisors to administrators, who played various roles in the fraudulent operation.

Comparison with Other Notable Financial Frauds

The Madoff case stands out for its sheer scale and complexity, but it shares some similarities with other notable financial frauds. For example, similar to other large-scale fraud schemes, Madoff exploited the trust and confidence of investors, masking the fraudulent nature of the operation. The difference lies in the magnitude and duration of the Madoff scheme. Cases such as the Enron and WorldCom scandals, while also involving deception and financial manipulation, differ in the nature of the fraudulent activities and the extent of the damage inflicted.

While other cases might have involved specific industry-related manipulations, Madoff’s scheme targeted a wider range of investors.

Key Stages of the Madoff Fraud

| Stage | Date | Key Event |

|---|---|---|

| Initial Years (1960s-1990s) | 1960s-1990s | Madoff establishes his firm and builds a reputation for success, attracting investors. |

| Expansion (1990s-2000s) | 1990s-2000s | The firm experiences rapid growth, expanding its client base and investment portfolio. The fraud becomes increasingly sophisticated. |

| Peak of Fraud (2000s) | 2000s | The Ponzi scheme reaches its peak, with Madoff and his associates managing billions of dollars in fraudulent investments. |

| Unmasking (2008) | December 2008 | Madoff is arrested, and the fraud is exposed, leading to the collapse of his investment firm. |

| Aftermath (2009-Present) | 2009-Present | The aftermath involves legal battles, investor losses, and attempts to recover funds. |

The $498 Million Payout

The $498 million payout, while a significant step, represents just a fraction of the estimated losses suffered by victims of the Bernie Madoff Ponzi scheme. It underscores the immense challenge of recovering from such widespread financial devastation and the complexities inherent in distributing funds fairly among numerous investors. This payout marks a pivotal moment in the ongoing legal and financial recovery process.This payout is not merely a financial windfall but a crucial step toward justice and closure for the victims.

It reflects the culmination of years of legal battles, settlements, and negotiations, highlighting the enduring efforts to rectify the injustices of the Madoff scandal. The impact of this payout on individual investors and the broader financial landscape is substantial and multifaceted.

Significance for Victims

The $498 million payout, while a substantial amount, is a small fraction of the total losses incurred by victims. This underscores the immense scale of the fraud and the protracted nature of the recovery process. The payout represents a tangible acknowledgment of the financial devastation inflicted upon countless investors. This recovery is not just about money; it’s about restoring trust and rebuilding lives shattered by the fraudulent scheme.

Implications on Financial Recovery

The $498 million payout is a significant milestone in the financial recovery process for affected investors. It provides a tangible sense of progress, but also highlights the continuing challenges. The recovery process is far from complete, as the total losses far outweigh the amount recovered so far. The disbursement of this payout is a critical component in the larger effort to provide some semblance of financial stability to victims.

Legal Battles and Settlements

The $498 million payout is the result of extensive legal battles and settlements. These battles involved numerous lawsuits, appeals, and negotiations between the trustee overseeing the Madoff estate, victims’ attorneys, and various financial institutions. These legal proceedings were crucial in securing compensation for victims and ensuring a degree of accountability for the fraud. Each step forward in the legal process, though difficult and lengthy, brought the victims closer to justice and the recovery of their losses.

Bernie Madoff’s victims are seeing some justice, with a $498 million payout, pushing the total over $15 billion. While this is a significant step in the right direction for those affected, it’s still a drop in the bucket compared to the scale of the fraud. Meanwhile, there’s a surprising turn in international relations with reports that Putin is ready to help Trump with Iran nuclear negotiations, as reported by this news source.

This unexpected offer raises questions about motives, but hopefully, these efforts will lead to a peaceful resolution. Regardless, the ongoing recovery efforts for the Madoff victims remain a critical issue, demanding continued attention and resources.

Factors Influencing the Payout Amount

Several factors influenced the amount of the payout. These include the value of the assets recovered from Madoff and his associates, legal fees and administrative costs, and the complexity of determining the precise losses incurred by each investor. These factors represent the intricate legal and financial challenges inherent in resolving such a large-scale fraud case. The process was not merely about collecting assets; it also involved intricate accounting and legal maneuvering to determine the proper amount due to each victim.

Distribution of the Payout

The payout was distributed to various investor groups based on established criteria. A detailed analysis of the distribution is crucial to understanding the fairness and efficiency of the recovery process. Determining the precise distribution methodology is an essential aspect of the recovery process, aiming for a transparent and equitable allocation of the recovered funds.

| Investor Group | Estimated Percentage of Payout |

|---|---|

| Individual Investors | Approximately 70% |

| Institutional Investors | Approximately 30% |

This table provides a simplified overview of the distribution. The exact percentages and details regarding specific investor groups would require access to the official records of the bankruptcy proceedings.

Victims’ Experiences and Perspectives

The Bernie Madoff Ponzi scheme, a catastrophic fraud, inflicted profound emotional and financial damage on countless individuals and families. Beyond the staggering financial losses, the scheme’s impact reverberated through the lives of victims, leaving lasting scars on their emotional well-being and challenging their trust in the financial system. This section delves into the human cost of the Madoff fraud, exploring the diverse experiences and the long-term consequences faced by those who were defrauded.The victims’ journey was fraught with a multitude of challenges, from the initial shock of realizing their investments were lost to the arduous process of recovery.

The psychological toll was significant, leading to feelings of betrayal, anger, and profound disillusionment. The long-term effects on their financial well-being were equally devastating, impacting their retirement plans, their ability to provide for their families, and their overall sense of security. The process of rebuilding trust and financial stability became a monumental task.

Emotional and Psychological Impact

The Madoff fraud left deep emotional scars on victims. Many experienced feelings of betrayal, anger, and profound disillusionment with the financial system. The sense of loss extended beyond just financial assets; it encompassed a loss of trust in institutions and the people they had relied on. This led to a range of psychological responses, including anxiety, depression, and feelings of helplessness.

The long-term impact on mental health required significant coping mechanisms and support.

Long-Term Financial Consequences

The financial consequences extended far beyond the initial losses. Victims faced difficulties in securing future financial stability. Retirement funds were decimated, leaving many with insufficient savings for their golden years. The impact on families was substantial, impacting their ability to provide for their children’s education or future endeavors. In some cases, homes were lost, and the rebuilding process was incredibly challenging.

The sheer magnitude of the fraud meant a significant portion of victims’ life savings was gone, leaving them in a vulnerable position.

Challenges in Recovering Losses

The recovery process for Madoff victims was often arduous and complex. The legal battles, the investigations, and the subsequent financial hurdles proved to be substantial obstacles. Many victims faced difficulties navigating the legal and financial systems, often lacking the expertise to effectively pursue their claims. The sheer complexity of the fraud, involving intricate financial structures and intricate transactions, meant the recovery process was extremely complicated.

Diverse Experiences Across Demographics

| Demographic Group | Common Experiences | Specific Challenges |

|---|---|---|

| Retired Individuals | Loss of retirement savings, impacting their future financial security | Difficulty adapting to reduced income, navigating new financial situations |

| High-Net-Worth Individuals | Loss of substantial investments, affecting their lifestyle and legacy | Complex financial portfolios, requiring specialized legal and financial expertise |

| Families with Children | Loss of funds impacting their children’s future | Stress of providing for family needs, emotional strain on family members |

| Small Investors | Loss of savings, impacting their immediate financial needs | Limited resources to pursue recovery, facing significant financial hardship |

The experiences varied significantly across different demographics. Each group faced unique challenges in navigating the aftermath of the fraud. The table above highlights some of the key differences in experiences.

Resources for Victims

Numerous resources were available to assist victims in coping with the aftermath of the Madoff fraud. These included support groups, legal aid organizations, and financial advisors specializing in fraud recovery. Understanding the available resources and seeking professional help was crucial for navigating the recovery process.

- Support groups provided a safe space for victims to share their experiences, offer mutual support, and gain insights from others who understood their struggles.

- Legal aid organizations offered guidance and representation to victims seeking to recover their losses.

- Financial advisors specializing in fraud recovery helped victims navigate the complexities of their financial situation, and create new financial plans.

Legal and Regulatory Responses

The Madoff Ponzi scheme exposed profound weaknesses in the regulatory framework governing the financial industry. The sheer scale of the fraud, and the devastating impact on thousands of investors, spurred a critical examination of existing laws and prompted a significant push for reform. This response, while ultimately successful in some respects, also highlighted the ongoing challenges in preventing such catastrophic failures.The ensuing legal and regulatory actions were multifaceted, encompassing investigations, prosecutions, and significant legislative changes designed to bolster investor protection and prevent future fraudulent schemes.

These responses aimed to address not only the immediate consequences of the Madoff fraud but also to strengthen the overall integrity of the financial system.

Regulatory Actions Taken

The initial response involved investigations by the Securities and Exchange Commission (SEC) and other regulatory bodies. These investigations led to the criminal prosecution of Bernie Madoff and the subsequent conviction for securities fraud, mail fraud, and wire fraud. The SEC played a crucial role in investigating the scheme, and uncovering the extent of the fraud.

- The SEC initiated investigations and inquiries to determine the extent of the fraud and identify culpable parties.

- Criminal charges were filed against Bernie Madoff, resulting in his conviction and imprisonment.

- The SEC imposed sanctions on individuals and firms involved in the scheme, including fines and asset seizures.

- The SEC implemented additional oversight measures to prevent similar fraud in the future, leading to increased scrutiny of financial institutions and their compliance procedures.

Effectiveness of Regulatory Reforms

The effectiveness of regulatory reforms implemented in the wake of the Madoff scandal is a complex issue. While some reforms have undoubtedly strengthened investor protection, others have proven less successful. The enhanced scrutiny and regulations have undoubtedly led to more robust oversight in certain areas. However, the ongoing nature of financial innovation and the evolving nature of fraud schemes continue to pose challenges.

- Some reforms have led to improved transparency and disclosure requirements, making it more difficult for fraudulent schemes to operate undetected.

- Increased scrutiny of financial institutions has led to a heightened awareness of compliance procedures and fraud prevention strategies.

- However, the financial industry continues to evolve, with new investment products and strategies emerging that require constant adaptation of regulatory frameworks.

- The challenge remains in adapting to emerging financial instruments and strategies that could potentially be exploited for fraudulent purposes.

Comparison with Other Financial Crises

The legal responses to the Madoff case can be compared to those following other significant financial crises. The response to the 2008 financial crisis, for example, involved a similar but broader set of regulatory changes, aimed at addressing systemic vulnerabilities. The responses highlight both the need for swift action and the difficulty of anticipating and adapting to the complex and evolving nature of financial markets.

- The 2008 financial crisis prompted a more extensive regulatory overhaul, including changes to banking regulations and oversight mechanisms.

- Both crises highlighted the need for robust oversight and the importance of investor protection.

- However, the specific nature of the fraud and the vulnerabilities exposed differed, leading to distinct regulatory responses.

- Comparisons between crises reveal common themes but also acknowledge the unique challenges posed by each situation.

Legislative Changes

Significant legislative changes were enacted following the Madoff scandal, aimed at bolstering investor protection and enhancing the regulatory framework. These changes, often implemented in the wake of public outcry and intense scrutiny, aimed to address specific vulnerabilities that had allowed the Madoff scheme to flourish.

- The Dodd-Frank Wall Street Reform and Consumer Protection Act, enacted in 2010, introduced new regulations for financial institutions and markets.

- This act aimed to prevent future financial crises and protect consumers.

- Other legislative changes focused on enhanced oversight of financial institutions and stricter penalties for fraud.

- These reforms sought to address systemic vulnerabilities that had been exposed by the Madoff case and other related incidents.

Addressing Investor Confidence

The Madoff scandal significantly eroded investor confidence in the financial markets. The legal system’s response, including prosecutions and regulatory reforms, played a vital role in rebuilding that trust. Restoring investor confidence is a long-term process, and requires continuous vigilance and transparency in the financial industry.

- The legal actions against Madoff sent a clear message about the consequences of fraud.

- Regulatory reforms aimed to create a more trustworthy environment for investors.

- Transparency and accountability were key elements in restoring public trust.

- The ongoing need for investor protection and market integrity remain paramount.

Financial Recovery and Lessons Learned: Bernie Madoff Customers Recoup 498 Million Payout Tops 15 Billion

The $498 million payout, while significant, represents just a fraction of the overall devastation caused by the Madoff Ponzi scheme. Understanding the recovery process and the lessons learned is crucial for preventing similar tragedies in the future. The sheer scale of the fraud underscores the importance of robust investor protections and financial literacy.The process of financial recovery for victims was complex and lengthy, involving numerous legal battles, regulatory investigations, and the painstaking work of identifying and tracing assets.

Bernie Madoff’s victims are seeing some much-needed relief with a $498 million payout, bringing the total recovered to over $15 billion. While this is a huge step forward for those defrauded, it’s worth considering similar massive financial repercussions in other cases, like the Canadian court’s recent order for Nova Chemicals to pay Dow additional $12 billion in damages here.

Ultimately, these significant payouts underscore the devastating impact of financial fraud and the ongoing struggle for justice for victims.

The recovery efforts, spearheaded by the Securities and Exchange Commission (SEC) and various court proceedings, focused on securing and distributing the available funds to the defrauded investors. The process was challenging due to the intricate nature of the Ponzi scheme, which involved manipulating investment accounts and creating a facade of profitability.

Financial Impact on Affected Investors

The Madoff scheme had a profound financial impact on countless investors. Losses varied dramatically depending on the amount invested and the duration of participation in the scheme. The scheme’s longevity, compounded with its deceptive nature, resulted in substantial financial losses for a significant number of investors.

| Investor Category | Estimated Average Loss | Impact Description |

|---|---|---|

| High-Net-Worth Individuals | $1 Million – $10 Million+ | Significant impact on lifestyle, retirement plans, and long-term financial security. |

| Pension Funds | $100 Million – $Billions | Threatened the stability of pension plans and the retirement security of thousands of employees. |

| Mutual Funds | $1 Million – $100 Million+ | Damaged the reputation of investment firms and eroded investor trust in the financial system. |

Lessons Learned Regarding Investor Protection

The Madoff case highlighted critical weaknesses in the investor protection system. The scheme’s success stemmed from exploiting loopholes in regulation and a lack of robust oversight. A key lesson is the importance of maintaining a vigilant approach to monitoring and scrutinizing investment activities.

Importance of Due Diligence and Financial Literacy

The Madoff case underscores the paramount importance of due diligence. Investors should meticulously investigate investment opportunities, seeking professional advice from qualified financial advisors. Understanding the potential risks and limitations associated with investments is equally critical. Financial literacy plays a vital role in empowering investors to make informed decisions and recognize fraudulent schemes.

Recommendations for Improving Investor Protection

To prevent future calamities like the Madoff fraud, several critical recommendations are essential.

- Enhanced Regulatory Scrutiny: Stricter regulatory oversight and independent audits are crucial to ensure transparency and accountability in the investment industry. The regulatory framework should be strengthened to identify and prevent fraudulent schemes, ensuring that investment firms operate with transparency and compliance.

- Improved Investor Education: Promoting financial literacy among investors is paramount. Educational programs should emphasize the importance of due diligence, risk assessment, and recognizing potential red flags in investment opportunities. This knowledge equips investors with the tools to protect themselves from fraudulent schemes.

- Independent Oversight Mechanisms: Establishing independent oversight bodies to monitor investment practices and scrutinize financial institutions is essential. Independent reviews can detect and deter fraudulent activities, ensuring that investors have access to impartial evaluations of investment options.

- Robust Investor Protection Laws: Amendments to existing investor protection laws are needed to strengthen investor rights and provide more robust safeguards against fraudulent activities. Clearer guidelines and stricter penalties for fraudsters are crucial to deter future occurrences.

Impact on the Financial Industry

The Bernie Madoff Ponzi scheme, a colossal fraud, irrevocably scarred the financial industry. It shattered public trust in the integrity of financial institutions and investors, triggering a wave of changes in how markets operate and how individuals approach investments. The ramifications extended far beyond the immediate victims, impacting the industry’s overall reputation and regulatory landscape.The Madoff scandal exposed deep-seated vulnerabilities in the financial system, highlighting a lack of robust oversight and accountability.

This scandal wasn’t merely a failure of individual actors; it reflected a systemic breakdown in the checks and balances designed to prevent such catastrophic events.

Erosion of Investor Trust

The Madoff fraud profoundly damaged investor confidence. Years of accumulated savings and carefully constructed investment strategies were decimated by a single, devastating act of deception. The scale of the fraud, coupled with the perceived inability of regulators to detect and prevent such a massive scheme, created a climate of fear and mistrust. Investors became significantly more cautious and discerning in their investment choices.

Bernie Madoff’s victims are finally seeing some justice, with a $498 million payout that’s a huge step towards recovering the massive losses. It’s inspiring to see the sheer scale of this recovery, but honestly, it’s hard not to compare it to the incredible win by Marc Marquez at the Aragon Grand Prix, showcasing his dominance and complete mastery of the track.

That said, the monumental effort to recoup the $15 billion lost through Madoff’s crimes remains a challenging endeavor. unstoppable marc marquez wins aragon grand prix complete perfect weekend Ultimately, the Madoff case highlights the devastating impact of fraud and the long road to recovery.

This shift led to a reevaluation of traditional investment strategies, prompting a heightened focus on transparency and due diligence.

Heightened Scrutiny of Financial Institutions

Following the Madoff scandal, financial institutions faced intensified scrutiny from regulators and the public. The need for stronger internal controls, more rigorous risk assessments, and enhanced oversight mechanisms became paramount. Regulatory bodies like the Securities and Exchange Commission (SEC) and others around the world implemented stricter guidelines and regulations to prevent similar occurrences. This increased scrutiny included a closer examination of investment advisors, brokerage firms, and other financial service providers.

Changes in Investor Behavior and Investment Strategies

Investor behavior underwent a significant transformation in the aftermath of the Madoff fraud. Increased skepticism and a heightened awareness of potential fraud led to a marked shift in investment strategies. Investors became more cautious, demanding greater transparency and rigorous due diligence from investment advisors and financial institutions. Diversification of portfolios, a greater focus on understanding investment risks, and a willingness to pay for more sophisticated due diligence services became the norm.

Comparison to Broader Evolution of Financial Regulations

The Madoff case served as a catalyst for a broader evolution in financial regulations. Prior to the scandal, regulatory frameworks were arguably inadequate to address the complexities of modern financial markets. The Madoff fraud highlighted gaps in existing regulations, prompting a concerted effort to strengthen oversight and enhance the detection of fraudulent activities. This evolution included not only stricter regulations but also a greater emphasis on the ethical conduct of financial professionals.

Regulatory Changes in the Financial Sector

| Regulatory Area | Pre-Madoff | Post-Madoff |

|---|---|---|

| Internal Controls | Generally weak and inconsistently enforced | Strengthened and mandatory requirements for internal controls in investment firms |

| Risk Management | Often inadequate and not consistently applied | Increased emphasis on comprehensive risk assessments, with greater focus on fraud risk |

| Investor Protection | Varied and sometimes insufficient | Greater focus on investor education and protection, with heightened scrutiny of investment advisors |

| Oversight and Enforcement | Limited resources and inconsistent enforcement | Increased funding and personnel for regulatory bodies, with stronger enforcement powers and penalties |

The table above provides a concise comparison of the regulatory landscape before and after the Madoff scandal, demonstrating the significant improvements in oversight and investor protection measures.

The $15 Billion Figure in Context

The $15 billion figure represents a staggering loss for investors in the Bernie Madoff Ponzi scheme, a monumental fraud that shook the global financial world. Understanding this figure’s context is crucial to grasping the sheer scale of the deception and its lasting impact. It wasn’t just a loss of money; it was a loss of trust and a disruption of financial markets.The $15 billion figure quantifies the total amount of investor funds fraudulently diverted and manipulated by Madoff.

This figure is not merely a sum; it’s a representation of shattered dreams, lost retirement savings, and the erosion of confidence in the financial system. It serves as a stark reminder of the devastating consequences of such complex and meticulously crafted fraud.

The Total Amount Defrauded, Bernie madoff customers recoup 498 million payout tops 15 billion

The $15 billion represents the total amount of money that was defrauded from investors through the Madoff Ponzi scheme. This includes all the funds that were invested and never actually invested in the market. The fraudulent nature of the scheme meant that Madoff was effectively taking money from newer investors to pay off older ones, creating an illusion of profitability.

This practice, while masking the truth for a time, ultimately collapsed under its own weight.

Illustration of the Magnitude of the Fraud

Imagine a large pyramid, with each level representing an investor. At the base, the pyramid has thousands of investors. Madoff, at the apex, siphoned money from the base to maintain the illusion of growth. The $15 billion represents the total amount accumulated at the apex, and the fact that it was a fraud, illustrates the vast scale of deception.

To put it another way, if you were to stack $15 billion in one-dollar bills, it would be an incredibly high stack, extending several blocks in height.

Relationship to Economic Impact

The Madoff scheme had a significant economic impact. The loss of $15 billion directly impacted individuals and institutions, and the resulting uncertainty had ripple effects throughout the financial sector. This created a loss of confidence in the market, affecting investment decisions and leading to a period of caution and review of financial regulations.

Comparison to Other Large-Scale Financial Crimes

While other large-scale financial crimes exist, the Madoff case stands out for its sheer scale and sophistication. The Ponzi scheme’s structure allowed it to thrive for decades before collapsing. The subsequent investigation and recovery process highlighted the need for stricter regulations and more robust oversight mechanisms. It’s crucial to remember that the Madoff case serves as a cautionary tale about the potential for large-scale financial fraud.

For instance, comparing it to other major scandals reveals the specific impact of the Ponzi scheme’s methods, which allowed the deception to continue for an extended period.

Concluding Remarks

In conclusion, the $498 million payout to Madoff victims represents a crucial, albeit partial, step towards justice and financial recovery. However, the $15 billion figure underscores the enormity of the fraud and the long-lasting impact on countless lives. This case serves as a stark reminder of the importance of financial literacy, investor protection, and the need for rigorous oversight in the financial industry.

The lessons learned from the Madoff scandal continue to shape regulations and investor behavior today.