Fed hawks doves us central bankers see no urgency cut – Fed hawks, doves, US central bankers see no urgency for cuts, setting the stage for an in-depth look at the current Federal Reserve policy stance. This analysis delves into the arguments of hawks and doves, examining their differing views on inflation and economic growth. We’ll explore the rationale behind the Fed’s current approach, and the potential market implications of their decisions.

Recent economic data and public statements from key Fed officials will be scrutinized to understand the factors influencing the current policy. A table summarizing key interest rate decisions over the past year and another contrasting hawk and dove arguments will be included, along with a list of economic indicators that could prompt a change in the Fed’s perspective. The potential risks and rewards associated with a rate cut at this time, and the potential consequences of delaying a cut, will be considered.

Fed Policy Stance

The Federal Reserve’s current policy stance reflects a cautious approach to managing inflation while supporting economic growth. Recent pronouncements from Fed officials suggest a willingness to maintain the current interest rate trajectory, but with an emphasis on monitoring economic data closely. This nuanced approach signals a desire to avoid both overheating the economy and succumbing to deflationary pressures.The Federal Reserve’s recent actions and communications indicate a preference for a measured response to economic developments.

This strategy prioritizes data-driven decision-making and careful consideration of the potential ripple effects of any policy adjustments. Fed officials have consistently emphasized the importance of maintaining price stability and sustainable economic growth.

Recent Fed Actions and Communications on Interest Rates

Fed officials have consistently stressed that the current interest rate environment is appropriate given the current economic conditions. Their recent communications have highlighted the need for careful monitoring of inflation and economic growth indicators. The central bank is actively evaluating how various economic factors, including labor market conditions, consumer spending, and global economic trends, might influence their future policy decisions.

Reasoning Behind the Fed’s Current Policy Approach

The Federal Reserve’s current policy approach is rooted in a desire to achieve a delicate balance between controlling inflation and supporting economic activity. A key factor in their decision-making is the ongoing monitoring of inflation data, as well as the labor market situation. The central bank is keenly aware of the potential for adverse consequences if inflation spirals out of control or if the economy falls into a recession.

They are aiming to maintain price stability and avoid both inflationary pressures and recessionary risks.

Comparison of Fed’s Current Stance with Previous Ones

Compared to previous periods of economic uncertainty, the Fed’s current stance demonstrates a greater emphasis on data-driven decision-making. While past policy adjustments have sometimes been more reactive, the current approach emphasizes proactive monitoring and adaptation. This shift reflects a recognition of the complexities of the modern economy and the need for a more nuanced approach to monetary policy.

Key Interest Rate Decisions Over the Past Year

| Date | Federal Funds Rate Target Range | Description of Decision |

|---|---|---|

| October 2022 | 3.75% – 4.00% | Interest rate increase |

| December 2022 | 4.25% – 4.50% | Interest rate increase |

| March 2023 | 4.75% – 5.00% | Interest rate increase |

| May 2023 | 5.00% – 5.25% | Interest rate increase |

| June 2023 | 5.25% – 5.50% | Interest rate increase |

This table Artikels the key interest rate decisions made by the Federal Open Market Committee (FOMC) over the past year. Each decision reflects the FOMC’s assessment of the current economic conditions and their projections for future economic growth and inflation.

Influence of Current Economic Conditions on Fed Decisions

Current economic conditions, including inflation rates, labor market trends, and consumer spending patterns, directly influence the Fed’s decisions. For instance, persistent inflation would likely lead to further interest rate hikes, while a significant slowdown in economic activity might prompt the Fed to consider rate cuts. The interplay of these factors determines the Fed’s current policy approach.

Hawks vs. Doves

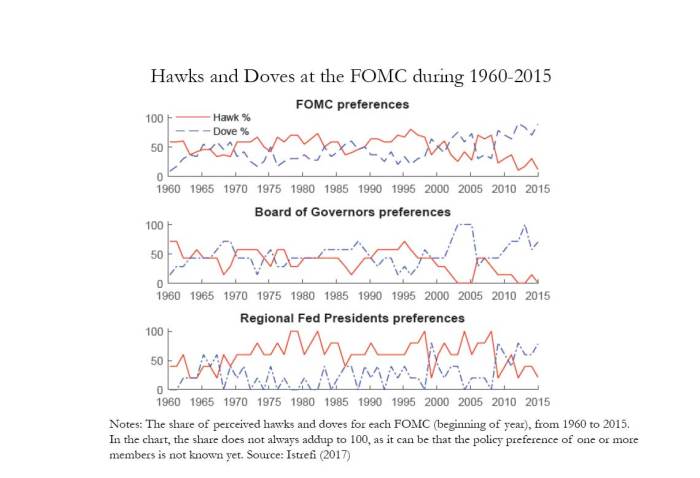

The Federal Reserve, tasked with managing the US economy, is often divided between “hawks” and “doves.” These differing viewpoints significantly impact monetary policy decisions, shaping the nation’s economic trajectory. Hawks prioritize controlling inflation, even if it means potentially slowing economic growth, while doves prioritize maintaining economic growth, even if it means tolerating higher inflation for a time. Understanding these contrasting perspectives is crucial for comprehending the Fed’s actions and their potential effects.The differing views on inflation and economic growth are central to the debate between Fed hawks and doves.

Hawks generally believe that high inflation erodes purchasing power and is detrimental to long-term economic stability. Doves, on the other hand, often argue that some level of inflation is necessary for economic growth, and that the costs of aggressive measures to combat inflation may outweigh the benefits. The potential impact of these differing perspectives on policy decisions is profound, potentially leading to contrasting interest rate adjustments and economic outcomes.

Key Arguments of Fed Hawks

Hawks generally advocate for a more aggressive approach to controlling inflation. Their core argument centers on the belief that persistent high inflation erodes the value of savings and fixed incomes, ultimately hindering long-term economic prosperity. They emphasize the importance of maintaining price stability as a foundation for sustainable economic growth. Hawks often point to historical examples where high inflation has led to economic instability and recession.

A key concern for hawks is the potential for inflation expectations to become entrenched, leading to a self-fulfilling prophecy of rising prices.

US central bankers, the “hawks and doves,” seem unhurried about cutting interest rates. This stance contrasts with the potential need for global stability, as Prime Minister Albanese of Australia highlighted Australia’s role in fostering harmony amidst rising global division, as reported in this article australia has stabilising role amid rising global division says pm albanese. Perhaps a more measured approach from the Fed, considering the broader geopolitical context, is warranted, even if it means no immediate rate cuts.

Key Arguments of Fed Doves

Doves, conversely, emphasize the importance of maintaining economic growth and avoiding unnecessarily harsh measures that could stifle job creation and economic expansion. They often believe that a moderate level of inflation can stimulate spending and investment, leading to increased economic activity. Doves acknowledge the risks of inflation but often argue that the potential costs of aggressive anti-inflationary policies could outweigh the benefits.

They frequently point to the potential for recessions that could result from overly restrictive monetary policy.

Differing Views on Inflation and Economic Growth

Hawks and doves hold fundamentally different views on the relationship between inflation and economic growth. Hawks generally believe that high inflation is incompatible with long-term economic prosperity and that the costs of allowing inflation to persist far outweigh the benefits. Doves, however, tend to believe that a moderate level of inflation can stimulate economic activity and job creation.

The debate often revolves around the appropriate balance between these two competing objectives.

Factors Contributing to Contrasting Viewpoints

The contrasting viewpoints of hawks and doves are shaped by various factors, including differing economic philosophies, varying assessments of current economic conditions, and differing interpretations of historical data. These differences highlight the inherent complexities of macroeconomic policymaking and the challenges in achieving a consensus among policymakers. Economists with different backgrounds and career paths might approach the same data with varying conclusions.

Comparison of Fed Hawks and Doves

| Characteristic | Hawks | Doves |

|---|---|---|

| Primary Goal | Controlling inflation | Maintaining economic growth |

| View on Inflation | High inflation is detrimental to long-term prosperity. | Moderate inflation can stimulate economic activity. |

| Preferred Policy Response | Aggressive interest rate hikes, even if it risks recession. | More cautious approach, avoiding excessively restrictive policies. |

| Emphasis | Price stability | Employment and output |

Historical Success Rates of Hawkish vs. Dovish Policies

Assessing the historical success rates of hawkish and dovish policies is complex. No simple metric exists to quantify success, as outcomes depend on numerous intertwined factors and economic conditions. A rigorous examination of historical data, considering a range of economic variables, would be required to evaluate these policies’ success. While historical data can provide insights, it is crucial to recognize the dynamic and multifaceted nature of economic phenomena.

Simple comparisons can be misleading, requiring a more nuanced approach.

Urgency of Rate Cuts

The Federal Reserve’s recent stance on interest rates has sparked considerable debate, with some economists calling for immediate cuts and others arguing against them. Understanding the factors driving this divergence is crucial for interpreting the Fed’s actions and anticipating their potential impact on the economy. The urgency surrounding rate cuts hinges on a careful assessment of current economic indicators and their potential future trajectory.The Fed’s decision-making process is complex, balancing short-term economic pressures with long-term inflation targets.

A rate cut, while potentially stimulating economic growth, could also lead to inflation if not carefully considered. The current economic climate, including inflation, unemployment, and consumer spending, will influence the Fed’s assessment of the need for a rate cut.

Economic Indicators Signaling a Need for Rate Cuts

Several economic indicators can signal the need for a rate cut. Declining consumer confidence, falling business investment, and a slowdown in GDP growth are often seen as factors that could warrant a reduction in interest rates. These indicators suggest a weakening economy that might benefit from the stimulation of lower rates.

Examples of Recent Economic Data and Potential Impact on Rate Decisions

Recent economic data, such as retail sales figures, industrial production data, and unemployment rate reports, can provide insights into the current economic state and its potential future trajectory. For example, a significant drop in retail sales could indicate a weakening consumer market, potentially prompting the Fed to consider a rate cut to stimulate spending. Similarly, if unemployment rises unexpectedly, the Fed might assess a rate cut as a way to boost job creation.

US central bankers, the fed hawks and doves, seem unconcerned about an immediate interest rate cut. It’s a bit like Colorado coach Deion Sanders saying “everything is ok” colorado coach deion sanders everything is ok – maybe a bit too relaxed, but hey, the current economic climate seems stable enough to them. So, for now, the fed hawks and doves are holding firm on their stance, seeing no pressing need to adjust.

These data points are used in conjunction with other indicators to form a comprehensive picture of the economy’s health and to predict its future trajectory.

Reasons Why the Fed Sees No Immediate Urgency for a Rate Cut

The Fed’s decision-making process considers numerous factors, including inflation levels and the overall health of the financial system. If inflation remains stubbornly high, a rate cut might be perceived as counterproductive, potentially fueling inflationary pressures and eroding the Fed’s credibility. Additionally, a strong labor market, even with some softening, may indicate that the economy is still resilient and doesn’t require immediate rate reductions.

Potential Risks and Rewards Associated with a Rate Cut

A rate cut, while potentially stimulating economic growth, carries certain risks. A significant risk is the potential for increased inflation, especially if the rate cut isn’t accompanied by appropriate measures to address underlying inflationary pressures. The reward of a rate cut is potentially increased economic activity, job creation, and higher consumer spending. However, the potential risks associated with a rate cut need careful consideration.

US central bankers, seemingly unfazed by the recent “fed hawks doves” debate, appear to see no immediate urgency in interest rate cuts. Meanwhile, Malaysia is experiencing a surge in investment, with a record RM21 billion in approved investments during Q1 2024. This strong showing might indicate underlying economic strength, potentially influencing future policy decisions, although the US central bank’s current stance on interest rates remains firm.

Potential Economic Indicators That Could Change the Fed’s View on Rate Cuts

A shift in the Fed’s view on rate cuts could occur based on significant changes in key economic indicators.

- A substantial decline in consumer confidence, as measured by relevant surveys.

- A significant drop in business investment, as indicated by capital expenditure data.

- A sustained period of slower GDP growth, as shown by quarterly GDP reports.

- A sharp increase in the unemployment rate.

- A significant decline in inflation expectations, as measured by various market indicators.

- A noticeable deterioration in financial market conditions.

- A substantial rise in the yield curve inversion.

Potential Consequences of Delaying Rate Cuts

Delaying rate cuts could lead to further economic stagnation or contraction, potentially impacting employment and consumer confidence. A prolonged period of high interest rates might also make borrowing more expensive for businesses and consumers, potentially dampening economic growth. The cumulative effect of these delayed actions can significantly impact the overall economic health and recovery time.

Central Banker Perspectives

The Federal Reserve’s communication strategy plays a pivotal role in shaping market expectations and influencing economic outcomes. Central bankers’ public pronouncements, statements, and interviews offer valuable insights into their assessment of the current economic landscape and their policy intentions. Understanding these perspectives is crucial for investors, businesses, and policymakers alike. Their views often reveal nuances and potential shifts in the Fed’s stance, which can be subtle but significant in their overall impact.

Summary of Public Statements by Key Fed Officials

Fed officials frequently communicate their views through speeches, press conferences, and testimony before Congress. These statements provide a comprehensive picture of the prevailing sentiment within the Federal Reserve. Examining these communications reveals consistent themes and varying perspectives among policymakers, offering a multifaceted understanding of the Fed’s approach to monetary policy.

Recurring Themes in Communications

Several recurring themes emerge from the public statements of key Fed officials. These themes often center on the current economic conditions, the efficacy of ongoing policies, and the outlook for future monetary policy adjustments. Considerations of inflation, employment, and the overall health of the economy are typically prominent. A crucial aspect of these themes is the balance between the need to combat inflation and the risk of jeopardizing economic growth.

Potential Motivations Behind Statements

Central bankers’ motivations for their public pronouncements are multifaceted. They aim to manage market expectations, influence investor behavior, and communicate the Fed’s commitment to its mandate. Maintaining credibility and transparency is vital for maintaining confidence in the institution. These statements also serve as a tool to inform and educate the public about the rationale behind policy decisions.

Understanding the context surrounding these statements helps in interpreting their underlying motivations.

Potential Impact on Market Sentiment

The Fed’s communications can significantly impact market sentiment. Positive pronouncements often lead to increased investor confidence and potentially drive up asset prices. Conversely, hawkish statements, which often signal a more restrictive monetary policy stance, can trigger uncertainty and lead to downward pressure on asset prices. The interplay between the Fed’s communication and market reactions is complex and dynamic.

Table of Public Statements by Fed Officials (Past Quarter), Fed hawks doves us central bankers see no urgency cut

| Fed Official | Date | Statement | Potential Impact |

|---|---|---|---|

| Jerome Powell | 2024-07-18 | “Inflation remains stubbornly high, but the economy is showing signs of resilience. We remain committed to bringing inflation back to 2%.” | Hawkish, potentially increasing market uncertainty. |

| Lael Brainard | 2024-07-25 | “The labor market is still robust, but wage pressures are moderating. Rate hikes are necessary to tame inflation.” | Balanced view, potentially stabilizing market sentiment. |

| Michael Barr | 2024-08-01 | “The Fed’s commitment to price stability is unwavering. The current path of rate hikes is necessary to achieve the desired outcomes.” | Hawkish, potentially reinforcing market expectations of further rate hikes. |

| Christopher Waller | 2024-08-08 | “Inflation remains a concern, but the economy is showing signs of softening. We will continue to monitor the data carefully.” | Cautious, potentially signaling a less aggressive approach. |

Differing Perspectives of Central Bankers

The table above illustrates how central bankers’ perspectives can differ. While some officials maintain a hawkish stance, emphasizing the need for continued rate hikes to combat inflation, others express a more cautious or balanced viewpoint, recognizing the potential risks of overly restrictive policies. These differing opinions reflect the complexity of economic factors and the challenges faced by policymakers in navigating the current economic environment.

Market Implications

The Federal Reserve’s stance, whether hawkish or dovish, significantly impacts market expectations and investor behavior. The current policy of maintaining the status quo, with no immediate urgency for rate cuts, reflects a cautious approach to managing inflation. This approach is likely to influence market sentiment and potentially affect various sectors differently.

Impact on Market Expectations

The Fed’s policy of maintaining the current interest rate level, in the absence of an urgent need for cuts, influences market expectations by signaling a commitment to controlling inflation. This approach suggests a preference for a steady hand in managing the economy, potentially discouraging aggressive speculation and promoting a more measured approach to investment.

Reactions of Different Market Segments

The Fed’s current stance is expected to have varying impacts on different market segments.

- Stocks: A steady policy might lead to a more stable stock market, reducing volatility. Investors may seek out companies with strong fundamentals and a demonstrated ability to withstand potential economic headwinds. The lack of immediate rate cuts could support the valuations of higher-yielding equities.

- Bonds: With no immediate rate cuts anticipated, bond yields are likely to remain relatively stable or even rise slightly, especially for longer-term bonds. This reflects the Fed’s continued commitment to controlling inflation, which often translates to higher borrowing costs.

- Currency: The Fed’s policy could strengthen the US dollar as investors seek the safety and perceived stability of the American economy. This is a common reaction when central banks maintain a firm grip on inflation.

- Consumer Confidence: The Fed’s current stance, while not immediately impacting consumers, could subtly influence their spending habits. A perception of controlled inflation may foster a sense of stability, leading to more moderate spending decisions. However, sustained high inflation could erode consumer confidence in the long term.

Potential Areas of Concern

While the current policy aims to balance economic growth and inflation control, potential areas of concern include:

- Lagged Effects: Economic conditions can change rapidly, and the full impact of the Fed’s current stance may not be immediately apparent. The current policy may not adequately address any potential future economic downturn.

- Unforeseen Events: Unexpected global events or domestic economic shocks could alter the economic landscape and necessitate adjustments to the Fed’s current policy.

- Inflation Persistence: If inflation remains stubbornly high despite the current policy, the Fed may be forced to implement more aggressive measures, potentially leading to market volatility.

Potential Market Reactions

| Market Segment | Potential Reaction |

|---|---|

| Stocks | Stable or slightly positive, but potentially muted gains due to uncertainty. |

| Bonds | Slightly higher yields, especially on longer-term bonds. |

| Currency | Potential strengthening of the US dollar. |

| Consumer Confidence | May remain steady, but could erode with persistent high inflation. |

Comparison with Past Periods

Comparing the current market conditions with past periods of similar Fed policies reveals some interesting parallels and potential differences. For instance, a comparison with the period leading up to the 2008 financial crisis reveals some cautionary similarities, though significant differences also exist in terms of current economic conditions and global circumstances. A deeper analysis of historical data and macroeconomic factors would be necessary to provide a more precise comparison.

Economic Outlook

The Federal Reserve’s assessment of the current economic climate plays a crucial role in shaping its monetary policy decisions. Understanding their projections for economic growth, the influencing factors, and the associated risks is vital for market participants and investors. This section delves into the Fed’s view of the economic outlook, considering various potential scenarios.The Fed’s economic outlook hinges on several key factors, including inflation rates, labor market conditions, and consumer spending patterns.

These factors, along with global economic trends, are meticulously analyzed to project future economic growth. The projections consider a range of possibilities, from optimistic to pessimistic scenarios, highlighting the inherent uncertainties in forecasting.

Fed’s Assessment of the Current Economic Climate

The Fed’s current assessment of the economic climate reveals a complex picture. Inflation remains a significant concern, though recent data shows signs of moderation. The labor market remains robust, with low unemployment rates, but wage growth is also a crucial factor to monitor. Consumer spending continues to be a key driver of economic activity, but its future trajectory is uncertain.

Projected Economic Growth Rates

The Fed’s projections for economic growth vary depending on the assumptions about inflation, interest rates, and global economic conditions. The consensus suggests moderate growth in the coming quarters, with some analysts forecasting a potential slowdown. For example, a recent report by the Congressional Budget Office projected a 1.9% GDP growth rate for 2024, reflecting the anticipated moderation in economic activity.

Factors Influencing the Economic Outlook

Several factors are crucial in shaping the Fed’s economic outlook. These include:

- Inflationary pressures: The persistence of inflation and the efficacy of the Fed’s monetary policy actions are significant factors in determining future economic performance. The Fed’s attempts to tame inflation by raising interest rates have a direct impact on the economy.

- Labor market dynamics: Sustained low unemployment rates and wage growth can stimulate consumer spending but could also fuel inflationary pressures.

- Global economic conditions: Events in other major economies, such as the European energy crisis, affect the overall global economic climate and influence domestic economic growth prospects.

- Geopolitical uncertainties: Uncertainties like war, trade disputes, and political instability contribute to heightened economic risks.

Risks and Uncertainties Associated with Economic Forecasts

Economic forecasts inherently involve risks and uncertainties. Unforeseen events, like unexpected supply chain disruptions or sudden shifts in consumer confidence, can significantly alter the projected trajectory. These uncertainties are reflected in the range of possible outcomes Artikeld in the various scenarios.

Economic Outlook Summary

| Scenario | GDP Growth Rate (2024) | Inflation Rate (2024) | Unemployment Rate (2024) |

|---|---|---|---|

| Base Case | 2.0% | 3.5% | 4.0% |

| Pessimistic | 1.5% | 4.5% | 4.5% |

| Optimistic | 2.5% | 3.0% | 3.5% |

Potential Challenges Impacting the Outlook

Potential challenges that could significantly impact the economic outlook include:

- Recessionary pressures: A prolonged period of high interest rates could lead to a contraction in economic activity, resulting in a recession. The impact of past recessions, such as the 2008 financial crisis, illustrates the potential consequences.

- Supply chain disruptions: Persistent supply chain issues can lead to higher prices and reduced production, affecting overall economic growth.

- Geopolitical instability: International conflicts or crises can destabilize global markets and hinder economic growth in many countries.

Outcome Summary: Fed Hawks Doves Us Central Bankers See No Urgency Cut

In conclusion, the Fed’s current stance, influenced by the interplay of hawks and doves, suggests a cautious approach to rate cuts. Market implications and the economic outlook, as assessed by the Fed, paint a picture of a complex situation. The potential for shifts in market sentiment and consumer confidence, as well as the potential challenges to the economic outlook, are all significant factors to consider.

The discussion highlights the intricate balance central bankers must navigate in managing the economy.