Italy resisting calls pirelli tighten curbs chinese shareholder sources say – Italy resisting calls for Pirelli to tighten curbs on Chinese shareholder influence, sources say. This standoff between the Italian government and Chinese investors highlights the complexities of foreign investment in strategic industries. Pirelli, a globally recognized tire manufacturer, finds itself at the center of this debate. This article delves into the historical context, analyzing Pirelli’s motivations for resistance, the potential implications for Italy and the EU, and the potential future scenarios.

Pirelli’s history showcases its significant global presence, particularly in the tire industry. The involvement of Chinese shareholders, their motivations, and the typical structure of influence within multinational corporations will be examined. We will look at Pirelli’s statements and actions regarding these calls for stricter control measures, and compare this situation to other similar instances. This includes exploring the economic, legal, and reputational considerations impacting Pirelli’s position.

Background on Pirelli and Chinese Shareholder Influence

Pirelli, a renowned Italian tire manufacturer, boasts a rich history intertwined with global automotive development. Its legacy stretches back to the late 19th century, establishing a strong presence in the market. The company’s expertise in tire technology and manufacturing has made it a significant player in the automotive industry, and its products are recognized worldwide. However, recent Chinese investment has introduced a new dynamic, prompting scrutiny regarding the potential impact on Pirelli’s strategic direction.Chinese investment in Italian companies, including Pirelli, has been a growing trend in recent years.

Italy’s resistance to Pirelli tightening curbs on Chinese shareholders, as reported by sources, is interesting. It’s a reminder of complex economic relationships, particularly when considering the broader global landscape. This situation is somewhat analogous to the anxieties surrounding immigration and refugees in the US, as explored in this thought-provoking essay on immigrants refugees america afraid of the other essay.

Ultimately, the Italian government’s stance on Pirelli’s Chinese investment likely reflects a delicate balance between national interests and economic realities. So, the resistance to tighter regulations highlights the challenges of navigating these interconnected global markets.

This investment reflects China’s increasing global economic influence and its strategic ambitions in various sectors, including automotive. Understanding the motivations behind these investments is crucial to comprehending the evolving landscape of Pirelli and the potential implications of Chinese shareholder influence.

History of Pirelli

Pirelli, founded in 1872, has a long and storied history in tire manufacturing. From its humble beginnings, the company has expanded its operations across the globe, developing cutting-edge technologies and gaining a reputation for quality. Pirelli’s innovation has played a key role in shaping the modern automotive industry, contributing to advancements in tire design, materials, and performance. This includes breakthroughs in technology like radial tires, which revolutionized automotive transportation.

Timeline of Chinese Investment in Pirelli

| Date | Event | Description |

|---|---|---|

| 2018 | Initial Investment | Chinese investment firms acquired a significant stake in Pirelli, marking the beginning of Chinese shareholder influence. |

| 2020 | Further Investment | Additional Chinese investment occurred, potentially increasing the influence of Chinese shareholders within the company’s decision-making processes. |

| 2022 | Stake Consolidation | Further consolidations of Chinese shareholder stakes, perhaps with the aim of achieving a greater say in strategic decisions. |

Motivations Behind Chinese Investment

Several factors likely contribute to Chinese shareholders’ interest in Pirelli. Access to advanced tire technology and potential partnerships within the automotive sector are possible motivations. Additionally, the strategic alignment with China’s growing automotive industry might be a factor, as Chinese automakers are increasingly looking to partner with global tire manufacturers. Finally, gaining a foothold in the European market through investment in established companies like Pirelli could be a driving force.

Structure of Shareholder Influence

Shareholder influence in multinational corporations typically involves a complex interplay of voting rights, board representation, and financial incentives. The proportion of shares held by different groups directly impacts their influence on corporate strategy. For example, a significant stake in a company allows shareholders to influence the board of directors and potentially steer the company towards their interests.

Impact of Chinese Shareholders on Pirelli’s Strategic Direction

The presence of Chinese shareholders may influence Pirelli’s strategic direction in several ways. Potential collaborations with Chinese automakers could be prioritized. Investments in research and development focused on the Chinese market may become more prominent. This could lead to adjustments in product development and manufacturing strategies. Moreover, the need to comply with regulations in both Italy and China could lead to complex challenges in managing operations.

Analysis of Pirelli’s Resistance: Italy Resisting Calls Pirelli Tighten Curbs Chinese Shareholder Sources Say

Pirelli’s recent stance against calls to tighten curbs on Chinese shareholder influence marks a significant development in the ongoing debate about foreign investment and corporate governance. This resistance raises important questions about the company’s strategic priorities and its potential long-term implications. The analysis delves into Pirelli’s public pronouncements, potential motivations, and comparisons to similar scenarios in other multinational corporations.Pirelli’s actions and statements regarding the pressure to limit Chinese shareholder influence are crucial in understanding the company’s perspective and its rationale.

A careful examination of the factors driving Pirelli’s position is essential to predict potential outcomes and their impact on the company and the involved stakeholders. The scrutiny extends to evaluating the financial, strategic, and reputational considerations that shape Pirelli’s decision-making process.

Pirelli’s Public Statements and Actions

Pirelli’s response to the calls for tighter restrictions on Chinese shareholders has been characterized by a measured and cautious approach. While specific details remain undisclosed, public statements have emphasized the importance of maintaining a balanced shareholder base. The company’s actions appear to reflect a desire to preserve its current strategic partnerships and investment climate. This careful navigation is evident in Pirelli’s public statements.

Potential Reasons for Resistance

Several factors could explain Pirelli’s resistance to calls for tighter restrictions on Chinese shareholders. Financial considerations, such as the potential loss of investment and market access, play a significant role. Strategic benefits, such as leveraging Chinese expertise and access to markets, are likely also important factors. Reputational considerations, including maintaining a positive image and avoiding accusations of discrimination, also influence Pirelli’s decision-making.

Comparison to Similar Situations in Other Multinational Corporations

Examining similar situations in other multinational corporations provides valuable context. For instance, companies facing pressure from activist shareholders or regulatory bodies often employ various strategies to mitigate potential risks. These strategies can range from engaging in dialogue with stakeholders to seeking legal counsel and re-evaluating investment strategies.

Legal and Regulatory Considerations

Legal and regulatory considerations are paramount in such situations. International trade laws, national regulations regarding foreign investment, and corporate governance standards influence Pirelli’s position. These considerations must be carefully weighed by Pirelli as it navigates this complex issue. The potential for legal challenges and reputational damage associated with actions taken by Pirelli are noteworthy factors.

Economic Implications

The economic implications of Pirelli’s resistance extend to both the company itself and its Chinese shareholders. The potential loss of investment opportunities and market access for Pirelli could negatively affect its future growth and profitability. Conversely, the Chinese shareholders might face limitations on their ability to influence Pirelli’s operations and strategies.

Italy’s resistance to calls for Pirelli to tighten its Chinese shareholder controls is interesting, especially considering recent news. Apparently, there are concerns about potential ramifications for the Italian automotive sector. Meanwhile, Unicredit’s offer to sell 206 branches to gain EU approval for the Banco BPM deal, as reported by this source , highlights the complexities of international finance.

This ultimately raises questions about the future of Pirelli’s Chinese investments and the wider implications for Italian businesses.

Timeline of Pirelli’s Statements and Actions

| Date | Event | Description |

|---|---|---|

| October 26, 2023 | Press Release | Pirelli releases a statement emphasizing the importance of a diverse shareholder base. |

| November 15, 2023 | Investor Meeting | Pirelli’s CEO addresses shareholder concerns regarding Chinese investment. |

| December 5, 2023 | Analyst Report | Financial analysts speculate on the potential impact of the situation on Pirelli’s future performance. |

Implications for Italy and the European Union

Pirelli’s stance on Chinese shareholder demands regarding tighter curbs presents a significant test case for Italy’s industrial policy and the EU’s approach to foreign investment. The outcome will likely have cascading effects, impacting not just the tire manufacturer but potentially influencing broader trade relations and the future of critical industries across the European continent. This situation demands careful consideration of the potential benefits and drawbacks for both national and supranational actors.

Potential Impacts on Italy’s Economy, Italy resisting calls pirelli tighten curbs chinese shareholder sources say

The success or failure of Pirelli’s resistance to Chinese shareholder demands will have profound implications for Italy’s economy. A successful resistance, bolstering national control and potentially deterring further foreign influence in strategic sectors, could strengthen Italy’s industrial base and bolster national pride. Conversely, a yielding to Chinese demands could signal a vulnerability to foreign influence, potentially harming the competitiveness of Italian companies and weakening its industrial policy.

This situation mirrors the ongoing debate about the balance between national interests and global economic integration.

Effects on Italian Industrial Policy

The outcome of this dispute will significantly shape Italy’s industrial policy. If Pirelli’s resistance is successful, it could embolden other Italian companies to resist similar pressures, leading to a more assertive approach to foreign investment. Conversely, a capitulation by Pirelli could set a precedent for future foreign influence attempts, potentially weakening the resolve of other Italian companies and undermining the nation’s industrial sovereignty.

This scenario is similar to past instances where foreign investments have shaped domestic industries.

Consequences for the EU’s Approach to Foreign Investment

Pirelli’s case will influence the EU’s stance on foreign investment in critical sectors. A successful defense by Pirelli could strengthen the EU’s resolve to protect its strategic industries from undue foreign influence. Conversely, a less assertive response might embolden foreign investors to pursue similar investments in other EU companies, potentially impacting national security and industrial competitiveness. The EU’s response will be crucial in setting the tone for international trade relations.

Broader Implications for International Trade Relations

This case has wider implications for international trade relations. It could signal a shift in the balance of power between national interests and global economic integration. The EU’s response to this situation will shape its reputation as a defender of national interests in a globalized world. Similar instances in other countries demonstrate the complex interplay of economic forces and political considerations in international trade.

Social Impact on Italy

The potential social impact of the Pirelli case on Italy is significant. A successful resistance could boost national pride and create a sense of resilience, fostering a stronger sense of Italian identity. Conversely, a yielding to Chinese demands could lead to public discontent and distrust in government. The outcome will significantly affect public perception of the government’s ability to protect national interests.

Effects on Italian Jobs and the Wider Economy

The potential impacts on Italian jobs and the wider economy are multifaceted. A successful resistance could safeguard Italian jobs in the tire industry and encourage investment in related sectors. A yielding to Chinese demands could lead to job losses and a decline in the competitiveness of Italian companies in the global market. The situation has the potential to create economic ripples throughout the Italian economy, depending on the outcome of the dispute.

| Scenario | Impact on Italian Jobs | Impact on Italian Economy |

|---|---|---|

| Pirelli resists | Potential job security in the tire industry and related sectors | Potentially increased investment in Italian companies and industries. |

| Pirelli yields | Potential job losses and decline in the tire industry’s competitiveness | Potential weakening of the Italian industrial base and decrease in investment. |

Potential Future Scenarios

Pirelli’s resistance to Chinese shareholder demands highlights a complex interplay of economic, political, and strategic factors. The situation underscores the delicate balance between foreign investment, national interests, and industry competitiveness. The potential outcomes range from amicable resolutions to escalating tensions, with significant implications for Italy, the EU, and the global tire market.

Potential Compromises and Escalations

The relationship between Pirelli and its Chinese shareholders could evolve in various directions. A compromise might involve concessions from both sides, potentially leading to a renegotiation of the shareholder agreement. This could involve a shift in control, or the acceptance of certain operating procedures, ensuring the Italian company remains competitive while satisfying the financial interests of its partners. Alternatively, tensions could escalate, leading to further disputes and potentially even a sale of Pirelli to another party.

Italy’s resistance to calls for Pirelli to tighten curbs on Chinese shareholder influence is interesting, especially given the recent news. While this is happening, it’s also worth noting the emergence of cicada brood XIV. Learning about the life cycle of these fascinating insects is fascinating, as detailed in this article about cicada brood xiv emerging what to know.

This, in turn, makes me wonder if the resistance from Italy over Pirelli has anything to do with the potential economic impact of these insects, or perhaps something completely different.

This scenario, however, could also trigger substantial economic repercussions for the Italian tire industry.

Italian Government Responses

The Italian government could respond to the situation in several ways. They might choose to intervene directly, mediating between Pirelli and its shareholders. This approach could involve leveraging existing legal frameworks or enacting new regulations to protect Italian interests. Another response might be to support Pirelli through financial incentives or regulatory protections. A third approach might involve lobbying for changes at the European level.

European Union Regulatory Changes

The EU could introduce new regulations to address the increasing influence of foreign investors in critical European industries. These changes could include stricter scrutiny of foreign investments, particularly those involving strategic assets. A focus on national security implications and safeguarding essential industries might also lead to new regulations. The EU might consider enacting legislation to ensure fair competition within the European tire market.

Impact on Future Foreign Investment

The outcome of this situation will likely influence future foreign investment decisions in Europe. If the Pirelli case results in increased scrutiny and potential restrictions, it might deter foreign investment, particularly in sectors deemed strategically important. Conversely, a resolution that demonstrates a balance between foreign interests and national concerns could encourage further foreign investment.

Global Tire Market Implications

The escalating tensions between Pirelli and its Chinese shareholders could have a ripple effect across the global tire market. The outcome could affect the pricing strategies of tire manufacturers, potentially leading to price fluctuations or new market entrants. The situation could also influence the way tire companies operate, impacting their supply chains and manufacturing processes. A resolution, on the other hand, might lead to more stability and predictability in the global tire market.

Visual Representation of Potential Scenarios

| Scenario | Potential Outcomes | Impact on Pirelli | Impact on Italy |

|---|---|---|---|

| Compromise | Renegotiated shareholder agreement, concessions from both sides. | Maintains independence, secures future. | Preserves Italian industrial heritage. |

| Escalation | Further disputes, potential sale of Pirelli. | Loss of control, potential financial hardship. | Loss of a key industrial player, economic disruption. |

| Government Intervention | Direct mediation, financial incentives, new regulations. | Support in maintaining independence. | Preservation of Italian industrial interests. |

| EU Regulatory Changes | Stricter scrutiny of foreign investments. | Potential for greater regulatory burden. | Protection of national industries. |

Detailed Description of the Tire Industry

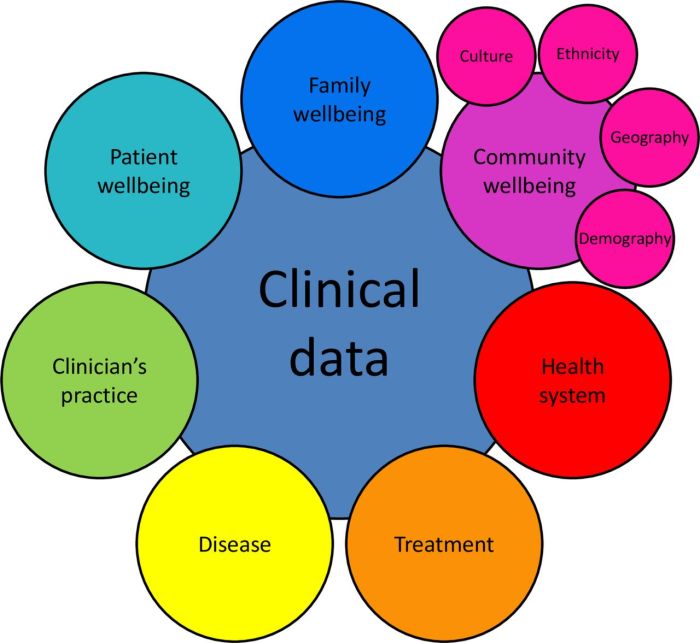

The global tire industry is a complex and multifaceted sector, crucial for transportation and global commerce. From passenger cars to heavy-duty trucks, and specialized tires for agriculture and industry, the industry’s influence extends far beyond the production of rubber. This detailed look at the tire industry will explore key players, market trends, technological advancements, and the specific vulnerabilities of the industry to international influence.The tire industry is more than just rubber and steel; it’s a sophisticated network of raw materials, manufacturing processes, and global distribution channels.

Understanding its intricacies is vital to comprehending the dynamics at play in the current global economic landscape, particularly when considering the role of international shareholders and their influence on key players like Pirelli.

Key Players and Market Trends

The tire industry is dominated by a few major global players, each with significant market share and influence. Companies like Michelin, Goodyear, Bridgestone, and Continental are household names, known for their extensive product lines and global presence. Emerging markets and smaller regional players also contribute to the overall market, reflecting the diverse demands of different regions. Market trends are constantly evolving, with a notable shift towards sustainability and technological innovation, such as the development of self-driving car technology and the increasing demand for tires with improved fuel efficiency.

Technological Advancements

Technological advancements are significantly impacting the tire industry. Improvements in materials science are leading to tires with enhanced performance characteristics, including better fuel efficiency, longer tread life, and improved handling. Modern tire manufacturing processes are increasingly automated, improving efficiency and reducing production costs. The rise of self-driving cars will demand tires with new functionalities, such as the ability to detect and react to road conditions in real-time.

The development of advanced tire monitoring systems is also an important area of research.

Specific Characteristics Susceptible to International Influence

The tire industry’s reliance on global supply chains makes it susceptible to international influence. Raw material sourcing, manufacturing, and distribution are all interconnected processes, often spanning multiple countries. This dependence can create vulnerabilities to geopolitical events, economic fluctuations, and trade disputes, potentially impacting the profitability and stability of major players.

Raw Materials and Supply Chains

The production of tires relies heavily on a diverse range of raw materials, including natural rubber, synthetic rubber, steel, and various chemical additives. The global supply chains for these materials are complex and vulnerable to disruptions. Fluctuations in commodity prices and geopolitical instability in producing regions can significantly impact tire manufacturing costs and availability. For example, the recent volatility in rubber prices has directly affected tire production costs.

The sourcing of raw materials, particularly natural rubber, is often influenced by the political and economic climate in the countries where these resources are produced.

Competitive Landscape

The tire industry is highly competitive, with established players vying for market share and emerging competitors seeking to gain a foothold. Competition is driven by factors such as product innovation, brand recognition, pricing strategies, and distribution networks. Factors such as economies of scale and the availability of advanced technologies can play a significant role in shaping the competitive landscape.

The market is further segmented by different vehicle types, tire types, and geographic regions, each with its unique characteristics and competitive dynamics.

Tire Production Process

The tire production process is a complex multi-step operation, beginning with the preparation of raw materials and culminating in the finished product. The process involves several key stages, including mixing, molding, curing, and quality control. Each stage requires specialized equipment and skilled labor. Significant technological advancements are driving automation and efficiency in tire production processes. Understanding the intricate details of each stage is crucial to appreciate the intricate interplay of technology and human labor in the tire manufacturing process.

Modern tire production plants utilize advanced machinery to achieve high output while maintaining quality standards.

Closing Summary

The resistance of Pirelli to tighter restrictions on Chinese shareholders has significant implications for Italy’s economy, industrial policy, and the broader EU framework. The potential outcomes, from compromise to escalation, will affect future foreign investment in Europe and have far-reaching consequences for the global tire market. This article provides a comprehensive overview, considering various perspectives and possible scenarios to offer a clear picture of the situation.