With Norway lawmakers oppose blocking wealth fund investment firms israeli occupied, a complex debate unfolds over ethical investment practices and geopolitical realities. Norway’s sovereign wealth fund, renowned for its ethical considerations, finds itself at the center of a controversy surrounding investments in the Israeli-occupied territories. Lawmakers are pushing back against calls to halt these investments, raising questions about the fund’s future strategy and the potential ramifications for both Norway and Israel.

This article delves into the background of Norway’s wealth fund, exploring its investment mandate and historical approach to ethical considerations. It examines the complexities of the Israeli-Palestinian conflict and the diverse viewpoints surrounding investments in the region. We’ll analyze the arguments presented by Norwegian lawmakers against a block on investments, considering potential economic, political, and diplomatic consequences. Furthermore, alternative investment strategies and ethical considerations will be evaluated, offering a comprehensive overview of the multifaceted debate.

Background of Norway’s Wealth Fund

Norway’s sovereign wealth fund, formally known as the Government Pension Fund Global, is a unique financial instrument, reflecting the nation’s prudent fiscal management and commitment to long-term economic stability. It’s a cornerstone of Norway’s economic strategy, designed to secure future generations’ well-being. The fund’s operations are carefully orchestrated to balance investment returns with ethical considerations, creating a model for responsible wealth management.The fund’s investment mandate is clearly defined, focusing on global equities, bonds, and real estate.

Its governance structure ensures transparency and accountability. A dedicated board of directors oversees the fund’s operations, employing a multi-layered approach to investment decision-making. This approach seeks to maximize returns while adhering to ethical standards and social responsibility principles.

Investment Mandate and Governance

The fund’s primary investment mandate is to maximize returns while upholding its core principles. This includes careful diversification across various asset classes to mitigate risk. The fund employs a globally diversified portfolio strategy, seeking optimal returns while minimizing risks associated with geographic or economic uncertainties. The fund’s governance structure is designed for transparency and accountability, involving various committees and bodies to review investment strategies and ensure compliance.

Historical Investment Practices

The fund has a history of investing in diverse sectors and geographies. Early investments were primarily in established markets, gradually expanding into emerging economies and sectors with high growth potential. The fund’s investment decisions are continuously reviewed and adjusted based on market conditions and emerging global trends.

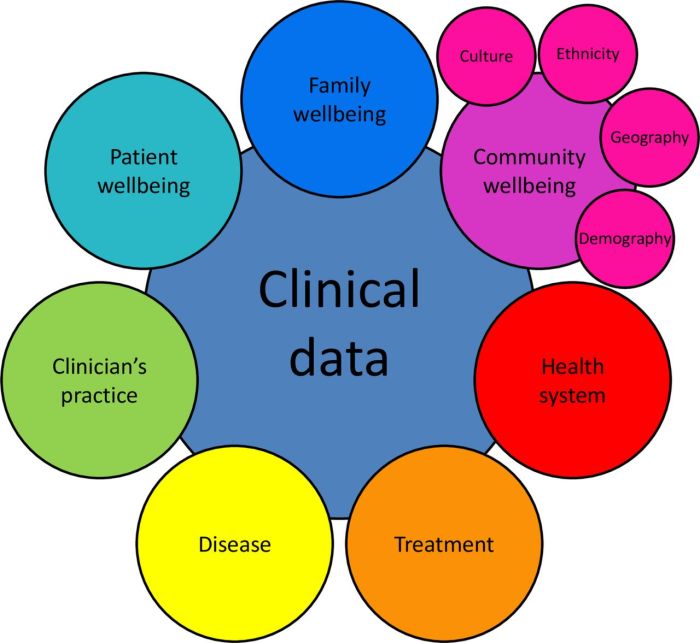

Ethical Considerations

The fund’s investment policies incorporate ethical considerations, including a commitment to sustainability and human rights. The fund screens investments to avoid involvement in sectors or companies with practices deemed detrimental to environmental protection, social welfare, or human rights. This approach aims to align investment decisions with Norway’s social values and long-term interests.

Examples of Investments in Sensitive Regions

The fund’s investments in sensitive regions have often been scrutinized. While the fund has invested in some sectors and countries facing geopolitical or social challenges, its investment criteria have been adjusted to minimize negative impacts. The fund has demonstrated a commitment to engage with companies and countries to encourage positive social and environmental outcomes.

Legal and Regulatory Framework

The fund’s operations are governed by specific legislation and regulations. These regulations Artikel the fund’s investment mandate, ethical guidelines, and reporting requirements. The legal framework provides a solid foundation for the fund’s operations, safeguarding its independence and ensuring its commitment to responsible investment. This framework ensures transparency and accountability in all aspects of the fund’s activities.

Israeli-Palestinian Conflict and Investment Policies

The Israeli-Palestinian conflict is a deeply complex and multifaceted issue, with a history marked by competing narratives and enduring grievances. The conflict’s impact on investment decisions is further complicated by the diverse perspectives on the situation, ranging from staunch support for Israel to strong condemnation of its actions. This inherent complexity necessitates careful consideration of ethical dilemmas and potential consequences when evaluating investment opportunities in the region.The debate surrounding investments in the Israeli-occupied territories is often framed by differing views on the legitimacy of the Israeli presence and the Palestinian struggle for self-determination.

Different stakeholders hold differing interpretations of the conflict’s history and current state, significantly influencing their positions on investment. This creates a situation where seemingly objective economic considerations are intertwined with deeply held political and moral convictions.

Varying Perspectives on the Conflict

The Israeli-Palestinian conflict is viewed differently depending on individual and societal perspectives. These varying viewpoints affect how investors perceive the region and the ethical implications of investment. Understanding these diverse perspectives is essential to navigating the complexities of investment decisions in the region.

- Pro-Israel perspectives often emphasize Israel’s right to self-defense and security concerns, potentially viewing investment as support for economic development and stability. These perspectives frequently highlight Israel’s democratic values and innovative economy, while downplaying the potential human rights implications of certain investments.

- Pro-Palestinian perspectives, conversely, frequently emphasize the Palestinian right to self-determination and the human rights violations experienced by Palestinians under Israeli occupation. These perspectives often criticize investments in the occupied territories as complicit in perpetuating the conflict and the suffering of the Palestinian population.

- Neutral perspectives acknowledge the complexity of the conflict, often highlighting the need for a just and lasting peace resolution. These perspectives emphasize the importance of understanding both sides of the issue before making investment decisions.

Arguments For and Against Investment in the Occupied Territories

The arguments for and against investment in the Israeli-occupied territories often hinge on differing interpretations of the conflict’s legitimacy and ethical implications. The following presents the contrasting viewpoints:

- Arguments for investment frequently center on the potential economic benefits, such as job creation and infrastructure development. Proponents might argue that investment in the region can foster stability and prosperity for all parties, ultimately contributing to a resolution of the conflict.

- Arguments against investment often highlight the potential for investments to perpetuate the occupation, further marginalizing the Palestinian population and hindering the pursuit of a just peace. Opponents may point to the ethical dilemmas posed by the use of resources or materials obtained through occupation.

Ethical Dilemmas of Investment in the Region

Investing in the Israeli-occupied territories presents several ethical dilemmas, necessitating careful consideration of the potential impact on all parties involved. These dilemmas involve the complexities of economic interests and moral obligations.

- Conflict of Interest: Investors face the challenge of balancing economic gains with the potential for complicity in human rights violations and the perpetuation of the conflict.

- Responsibility for Actions: Investors need to consider their role in supporting the status quo in the region and whether their investment contributes to or detracts from a just and lasting peace.

- Potential for Further Marginalization: Investments in the region might disproportionately benefit one party while exacerbating the disadvantages faced by another, thereby hindering the prospects for peace.

Lawmakers’ Opposition to Blocking Investments

Norway’s sovereign wealth fund, a cornerstone of the nation’s financial stability, faces ongoing scrutiny regarding its investments in the Israeli-occupied territories. The debate surrounding potential investment restrictions highlights a complex interplay of economic considerations, ethical concerns, and political sensitivities. This opposition to a block on investments underscores the delicate balance between financial prudence, ethical responsibility, and national interests.The opposition to blocking investments stems from a variety of interconnected arguments, aiming to uphold the fund’s current investment strategy and preserve its long-term profitability.

Norwegian lawmakers are standing firm against proposals to block their wealth fund’s investments in Israeli-occupied territories. While the global focus seems to be shifting towards other pressing issues, like AI regulation, which took a backseat at the recent Paris summit ( ai regulation takes backseat paris summit ), the debate over these investments continues. This highlights a complex interplay of economic interests and political stances.

A key element in this opposition involves the belief that restricting investments in specific regions could negatively impact the fund’s overall performance.

Arguments Against Blocking Investments

The Norwegian government and lawmakers advocating for maintaining the status quo present several arguments against a complete block on investments in the Israeli-occupied territories. These arguments, stemming from various perspectives, center on economic concerns, international relations, and the principles guiding the fund’s operations.

| Argument | Supporting Evidence | Counterarguments |

|---|---|---|

| Economic Viability | The fund’s diversified portfolio is crucial for long-term returns. Restricting investments in specific sectors or regions could significantly reduce potential gains and negatively affect the fund’s overall performance. Diversification is key to mitigating risk. | Critics argue that this justification overlooks the ethical implications of profiting from investments in territories subject to international disputes. |

| International Relations | Blocking investments could harm Norway’s international standing and relations with key partners. Maintaining a neutral stance and avoiding actions that could be interpreted as taking sides in geopolitical conflicts is paramount. Norway’s international standing and trade relationships could be impacted negatively by such a move. | Supporters of a block on investments argue that maintaining neutrality is not incompatible with supporting human rights and a just resolution to the conflict. |

| Fund’s Mandate | The fund’s mandate is to maximize returns while adhering to ethical principles, not to take political stances. Focusing on profitability and risk management is the primary responsibility of the fund’s management. The fund’s primary goal is financial performance, not political intervention. | Critics argue that the ethical implications of the investment decisions cannot be separated from the fund’s broader mandate. |

Historical Context and Precedents

The debate surrounding Norway’s investment policies in the Israeli-occupied territories mirrors similar discussions in other countries with similar sovereign wealth funds. For example, considerations of ethical investments and their potential impact on international relations have been frequently debated in the context of investments in politically sensitive regions. The debate highlights a broader discussion about the responsibilities of sovereign wealth funds in the global arena.

Norway’s lawmakers are standing firm against proposals to block wealth fund investments in Israeli-occupied territories. This stance highlights a complex geopolitical landscape, especially considering recent news about Rio Tinto revising cost estimates for their Serbian lithium project. The revised figures, as reported in the article rio tinto revising cost serbia lithium project , further emphasizes the global economic implications of these types of political decisions, ultimately impacting the ongoing debate about responsible investment in politically sensitive regions like those occupied by Israel.

Factions and Positions

| Factions | Positions | Motivations |

|---|---|---|

| Pro-Investment | Maintain the current investment policy. | Prioritize financial returns and risk management, while adhering to the fund’s existing ethical guidelines. |

| Anti-Investment | Advocate for restricting or blocking investments. | Focus on the ethical implications of investments in the occupied territories, aligning the fund’s operations with broader human rights concerns. |

Potential Impacts of the Opposition

Norway’s decision to maintain investments in Israeli firms operating in the occupied territories, despite lawmaker opposition, carries significant implications for both the nation and the region. This stance, while potentially bolstering Norway’s economic interests, could strain international relations and challenge its reputation as an ethical investor. The repercussions are multifaceted, extending from economic consequences to diplomatic ramifications and impacts on Norway’s image.

Economic Consequences for Norway and Israel, Norway lawmakers oppose blocking wealth fund investment firms israeli occupied

The Norwegian sovereign wealth fund, a significant financial entity, plays a crucial role in the Norwegian economy. Its investments, particularly in Israeli companies, contribute to both nations’ economic well-being. Maintaining the current investment strategy, despite the opposition, may yield economic benefits for Norway through potential returns and for Israel through foreign investment. Conversely, blocking these investments could lead to financial losses for both countries, potentially impacting their economic stability and growth.

| Impact | Description | Severity |

|---|---|---|

| Reduced Investment Returns for Norway | Decreased profitability from investments in Israeli companies could affect Norway’s financial reserves, potentially impacting social programs and public services. | Moderate to High |

| Diminished Economic Growth for Israel | Reduced foreign investment could hamper Israel’s economic expansion and create job insecurity for Israeli workers. | Moderate to High |

| Diversification of Norwegian Investments | Norway may need to explore alternative investment opportunities, which could take time and resources. | Moderate |

| Potential for Israeli Economic Contraction | Loss of revenue from Norwegian investments could have a significant impact on Israeli companies and the wider economy. | Moderate to High |

Political Implications

The ongoing Israeli-Palestinian conflict remains a highly sensitive issue in the international arena. Norway’s stance on investments in Israeli companies operating in the occupied territories could trigger diplomatic tensions and potentially lead to criticism from various international actors. This could also affect Norway’s relations with countries sympathetic to the Palestinian cause.

- Strain on International Relations: Norway’s decision might lead to strained relations with countries that prioritize ethical investment and condemn Israel’s policies. The recent actions of other countries like the Netherlands, who have already imposed stricter regulations on investments in Israeli settlements, provide a precedent.

- Damage to Norway’s Reputation: A lack of transparency or clear ethical guidelines regarding investments could tarnish Norway’s image as a responsible and ethical investor, potentially impacting its global standing. The controversy surrounding the divestment movement highlights this risk.

- International Pressure: Norway may face increased pressure to align its investment policies with international norms and standards, which could lead to complex political maneuvering and negotiations. The ongoing debates and activism around the issue are a clear indication of the potential for this pressure.

Impact on Norway’s Ethical Investment Reputation

Norway’s reputation as a leader in ethical investment practices is crucial to its international standing. The ongoing debate on investments in Israeli firms operating in the occupied territories could significantly impact its reputation. If Norway’s stance is perceived as prioritizing economic gains over ethical concerns, it could lead to a decline in its credibility and influence on global investment standards.

Diplomatic Ramifications

The opposition to blocking wealth fund investments in Israeli occupied territories could have significant diplomatic ramifications. Norway’s position on this issue could impact its relations with both Israel and countries supporting the Palestinian cause. It might also influence Norway’s participation in international forums and its standing on global issues.

Alternative Investment Strategies and Ethical Considerations

Norway’s sovereign wealth fund, a significant global investor, faces complex ethical dilemmas regarding investments in the Israeli-occupied territories. The fund’s mandate, alongside the sensitivities surrounding the Israeli-Palestinian conflict, necessitates careful consideration of alternative investment strategies that align with ethical principles. This necessitates a deeper exploration of various approaches to navigate these challenging circumstances.Navigating the ethical landscape of international investment requires nuanced strategies.

Simply divesting from certain sectors isn’t always the sole solution, and often entails further investigation into alternative investment opportunities that remain ethically sound. Engagement and dialogue with affected parties, combined with meticulous due diligence, can lead to more impactful and sustainable solutions.

Ethical Investment Strategies

Ethical investments in the region require meticulous screening and consideration of potential impacts. Several strategies can be employed to ensure investments align with ethical principles, while still yielding returns. These include prioritizing companies with strong labor practices, environmental records, and commitment to fair trade.

- Impact Investing: This approach focuses on investments that generate positive social or environmental impact alongside financial returns. For example, investing in renewable energy projects in Palestine or supporting businesses promoting sustainable agriculture can contribute to both economic development and positive social change. This strategy requires rigorous due diligence to ensure impact is measurable and authentic.

- Sustainable and Responsible Investing: This strategy emphasizes integrating environmental, social, and governance (ESG) factors into investment decisions. By analyzing companies’ performance on these factors, investors can identify and support companies committed to sustainability and responsible practices. This can involve examining a company’s carbon footprint, labor policies, and corporate governance structures.

- Community Development Financing: This involves directly supporting local businesses and communities in the region. This can take the form of microloans, investments in infrastructure projects, or support for small-scale enterprises. This approach can directly contribute to local economic development and empowerment.

Divestment and its Implications

Divestment, the act of selling or ceasing investment in a particular sector or entity, is a complex strategy with potentially profound consequences. It can be a powerful tool for sending a strong message, but its efficacy and long-term impact need careful consideration.

Norwegian lawmakers are standing firm against proposals to restrict their wealth fund’s investments in Israeli-occupied territories. This stance contrasts with the recent news about impressive economic growth in Europe, as evidenced by the ECB’s wage tracker showing a 31% increase this year. ecbs wage tracker points 31 growth this year. While economic indicators show positive trends elsewhere, Norway remains committed to its investment strategies, highlighting the complex interplay between economic policy and geopolitical considerations.

- Potential for Signaling: Divestment can be a powerful way to express disapproval of a particular policy or action. However, its effectiveness as a catalyst for change is often debated.

- Economic Impacts: Divestment can have significant economic repercussions. It can negatively affect the economic prospects of the targeted entities and potentially deter future investment, thereby potentially hindering economic growth.

- Alternative Funding Sources: Divestment can lead to the need for alternative funding sources. It is crucial to explore whether these alternative sources are ethically sound and will have a similar positive impact.

Engaging with Companies and Governments

Engaging with companies or governments in sensitive areas is a crucial aspect of ethical investment. Different approaches offer varying levels of impact and potential for success.

- Dialogue and Collaboration: Direct dialogue and collaboration with companies or governments in the region can offer opportunities to address concerns, promote transparency, and foster ethical practices. This often requires significant resources and dedication to long-term engagement.

- Advocacy and Policy Influence: Investors can engage in advocacy efforts to influence policies and regulations in the region, thereby promoting more sustainable and ethical practices. This can involve lobbying or working with other stakeholders.

- Due Diligence and Transparency: Implementing robust due diligence procedures and promoting transparency in business operations can help identify and address ethical concerns. Transparency builds trust and accountability within the affected communities and sectors.

Comparative Analysis of Strategies

| Strategy | Pros | Cons |

|---|---|---|

| Impact Investing | Potentially positive social and environmental impact; potential for financial returns | Requires significant due diligence; measurement of impact can be challenging |

| Sustainable and Responsible Investing | Alignment with ESG factors; potential for long-term returns | May not directly address underlying ethical issues; effectiveness in changing practices can be limited |

| Community Development Financing | Direct support for local communities; potential for positive economic development | Limited reach; may face political and bureaucratic hurdles; potential for misappropriation of funds |

| Divestment | Strong symbolic message; potential for shifting public opinion | Potential economic consequences for affected parties; may not lead to desired change |

| Engagement | Opportunity for dialogue and influence; potential for positive change | Requires significant resources; may not always yield desired results; can be perceived as supporting the status quo |

International Relations and Investment Decisions: Norway Lawmakers Oppose Blocking Wealth Fund Investment Firms Israeli Occupied

The Norway sovereign wealth fund’s investment decisions in the Israeli-Palestinian conflict are not isolated incidents. They are deeply embedded within a complex web of international relations, political pressures, and ethical considerations. Understanding this global context is crucial for evaluating the fund’s actions and their potential ramifications.The fund’s actions are not simply about financial gain; they reflect Norway’s position on a global stage, its relationships with other nations, and its commitment to certain principles.

This interplay of factors shapes the fund’s decisions, creating a dynamic that often challenges easy answers.

Global Context of the Conflict

The Israeli-Palestinian conflict is a multifaceted and deeply rooted dispute with global ramifications. It’s a conflict with significant historical and political dimensions that have influenced international relations for decades. The involvement of various nations and organizations complicates the issue further, making investment decisions even more challenging.

Role of International Organizations

Several international organizations, including the United Nations and various human rights bodies, have actively engaged in mediating the conflict. These organizations have issued reports and resolutions that often address human rights violations and the need for a peaceful resolution. Their influence can be significant in shaping global opinions and potentially impacting investment policies.

Norway’s Relationship with Other Countries

Norway’s relationships with other countries, particularly those with strong stances on the conflict, are relevant to its investment decisions. These relationships can influence Norway’s foreign policy and its approach to international economic cooperation. For instance, Norway’s strong commitment to international humanitarian aid and peace efforts often leads to complex trade-offs between financial interests and political considerations.

Impact of Political Pressures and Global Opinions

Political pressures and global opinions play a substantial role in investment decisions. A nation’s image and reputation are often linked to its investment policies, particularly in sensitive conflicts. The fund’s decisions can face criticism or praise depending on the prevailing global sentiment. Examples from other nations demonstrate that a nation’s reputation can be significantly impacted by its foreign policy, including its investment choices.

Wrap-Up

The debate surrounding Norway’s investment policies in the Israeli-occupied territories highlights the delicate balance between financial interests, ethical considerations, and geopolitical realities. Lawmakers’ opposition to blocking investments reflects a nuanced perspective, balancing potential economic repercussions with the desire to maintain Norway’s reputation for ethical investment practices. Ultimately, this case study underscores the challenges of navigating complex ethical dilemmas in international investment, emphasizing the need for a nuanced approach that considers diverse perspectives and potential consequences.