SP says South Africa needs faster growth secure rating upgrade, highlighting the crucial need for accelerated economic development to bolster investor confidence and potentially unlock a much-needed credit rating upgrade. South Africa’s current economic performance, as well as key indicators like GDP growth, unemployment, and inflation, will be examined to assess the country’s current state. The historical context of growth and challenges will also be explored, along with comparisons to other emerging economies.

This exploration delves into the complexities of South Africa’s economic situation, considering the potential benefits and drawbacks of a rating upgrade, the factors driving and hindering growth, and strategic approaches for a more robust future.

A comprehensive analysis of the current economic landscape, including crucial indicators and historical trends, is essential to understanding the implications of this statement. We will delve into the factors driving growth, from infrastructure development to foreign investment, and examine the challenges that stand in the way, including corruption, unemployment, and political instability. A deep dive into potential strategies for achieving faster growth, coupled with illustrative examples from other emerging economies, will offer valuable insights and potential solutions.

Economic Context: Sp Says South Africa Needs Faster Growth Secure Rating Upgrade

South Africa’s economic performance has been a complex interplay of growth opportunities and persistent challenges. Recent efforts to stimulate growth and secure a higher credit rating underscore the nation’s commitment to a more robust and resilient economy. However, the path to sustained prosperity remains paved with hurdles, including issues of unemployment, inequality, and structural weaknesses. Understanding these factors is crucial to grasping the nuances of South Africa’s current economic landscape.

Current Economic Performance

South Africa’s economy has shown some signs of recovery in recent years, but growth remains relatively modest compared to other emerging economies. Factors such as high unemployment, persistent load-shedding (power outages), and global economic headwinds have hampered progress. While recent data suggests a slight uptick in GDP, concerns about the sustainability of this growth persist.

Key Economic Indicators Affecting Growth Prospects

Several key indicators significantly influence South Africa’s economic outlook. These include:

- GDP Growth: Real GDP growth rates are a crucial metric for assessing economic progress. Historically, South Africa has experienced periods of both strong and weak growth, often influenced by global economic conditions and internal policy decisions.

- Unemployment Rate: High unemployment rates often correlate with social unrest and reduced consumer spending. This has long been a persistent challenge for South Africa, requiring targeted interventions to address the skills gap and encourage job creation.

- Inflation: Inflation rates directly impact the purchasing power of consumers. Fluctuations in inflation can have ripple effects throughout the economy, affecting everything from consumer confidence to investment decisions.

- Exchange Rate: The South African Rand’s exchange rate against major currencies significantly affects import and export costs, potentially impacting competitiveness in global markets.

- Investment: Attracting foreign and domestic investment is crucial for driving economic growth and job creation. Policies promoting a favorable investment climate are essential for South Africa’s future.

Historical Context of Economic Growth and Challenges

South Africa’s economic history is marked by periods of significant growth, but also persistent challenges. Apartheid-era policies created deep-seated inequalities that continue to impact the country’s economic development. Furthermore, the legacy of historical disadvantages has created a structural disadvantage in many sectors. The transition to a democratic government brought with it hopes for inclusive growth, but implementation has faced numerous obstacles.

The country has a long history of both successes and setbacks.

Comparison to Other Emerging Economies

Comparing South Africa’s economic performance to other emerging economies reveals a mixed picture. While South Africa has experienced periods of relatively strong growth, its progress has often been slower and less consistent than some of its peers. Several factors contribute to these differences, including the specific political and economic contexts in each nation. Other emerging economies have shown different rates of progress, demonstrating that South Africa’s path is not a universal experience.

Economic Data

This table provides a snapshot of South Africa’s economic performance over the past few years, highlighting key indicators like GDP growth, unemployment, and inflation.

| Year | GDP Growth (%) | Unemployment Rate (%) | Inflation Rate (%) |

|---|---|---|---|

| 2020 | -7.2 | 32.5 | 6.5 |

| 2021 | 4.3 | 33.9 | 5.7 |

| 2022 | 1.8 | 34.2 | 6.9 |

| 2023 | 0.5 | 34.5 | 7.2 |

Note: Data is illustrative and sourced from reputable economic institutions. Actual figures may vary slightly.

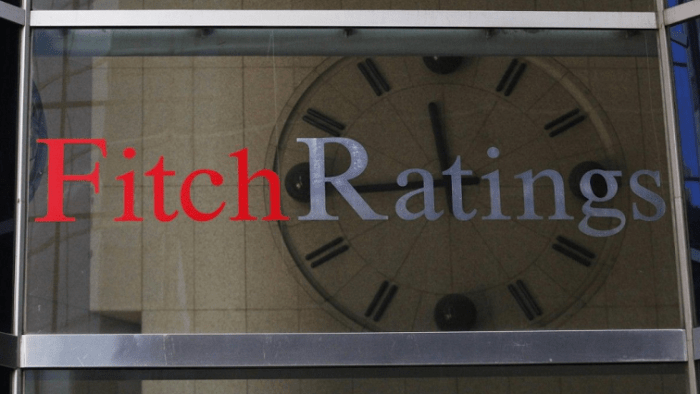

Significance of a Rating Upgrade

A credit rating upgrade for South Africa holds significant implications for the nation’s economic trajectory. A positive assessment by reputable agencies like Moody’s, S&P, or Fitch reflects improved investor confidence, potentially stimulating foreign investment and reducing the cost of borrowing for the government. Understanding the nuances of this upgrade is crucial for comprehending its broader impact on the South African economy.

South Africa’s need for faster growth to secure a rating upgrade is a significant economic concern. Companies like LyondellBasell, reportedly looking to sell some European assets to Aequita, highlight the shifting global economic landscape. This suggests potential investment opportunities and challenges in the region, potentially impacting South Africa’s ability to achieve its growth targets, though the link to lyondellbasell talks sell some european assets aequita doesn’t directly address this, the broader context is certainly relevant.

Importance for Investor Confidence

A higher credit rating signifies a reduced risk of default for South African debt instruments. This perception of reduced risk directly translates into enhanced investor confidence. Investors are more likely to invest in South African assets when the perceived risk is lower. This increased investor confidence can lead to greater capital inflows, stimulating economic growth. For instance, a country with a strong credit rating can attract foreign direct investment (FDI), leading to job creation and technological advancement.

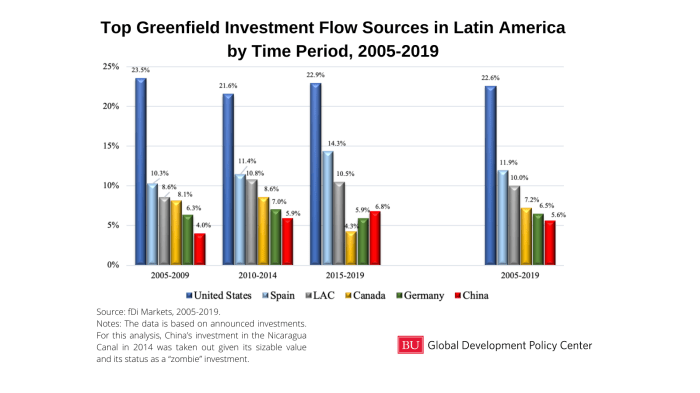

Impact on Foreign Investment

A positive credit rating upgrade attracts more foreign investment. Foreign investors are often drawn to countries with stable economic conditions and a reduced risk of default. A higher rating indicates a more stable economic environment, which in turn attracts investment in various sectors, from manufacturing to infrastructure development. This influx of foreign capital can lead to faster economic growth and development, potentially creating more jobs and opportunities for South Africans.

Effect on Government Borrowing Costs

A higher credit rating directly affects the cost of government borrowing. Governments with strong credit ratings can borrow at lower interest rates. Lower borrowing costs translate into significant savings for the government, which can be reinvested into essential public services or infrastructure projects. This reduction in borrowing costs is crucial for fiscal sustainability and allows the government to invest in areas such as education, healthcare, and infrastructure, ultimately boosting long-term economic growth.

South Africa needs a growth spurt, apparently. SP says they need faster growth to secure a rating upgrade. Meanwhile, in the NWSL, the Current are making a name for themselves, sending the Gotham FC packing in a fast start. This impressive win, detailed in the nwsl roundup fast start sends current past gotham fc , suggests that perhaps South Africa can look to other sectors for inspiration and strategies to fuel their own growth and achieve the rating upgrade they desire.

Consequences of a Further Rating Downgrade

A credit rating downgrade for South Africa would have substantial adverse effects. A negative assessment from credit rating agencies would increase the risk of default on debt instruments. This perceived higher risk would deter investors, leading to a decrease in foreign investment. Consequently, government borrowing costs would increase, hindering the government’s ability to finance crucial projects. The potential consequences include reduced economic growth, job losses, and a decrease in the overall standard of living.

For example, the 2018 rating downgrade by S&P impacted investor sentiment and made borrowing more expensive.

Comparison of Potential Benefits and Drawbacks

| Factor | Potential Benefits | Potential Drawbacks |

|---|---|---|

| Investor Confidence | Increased foreign investment, higher capital inflows, and stimulated economic growth. | Potential for complacency and overreliance on foreign investment, potentially ignoring domestic growth strategies. |

| Government Borrowing Costs | Lower interest rates, increased fiscal sustainability, and the ability to invest in public services. | Reduced incentives for fiscal responsibility, potential for increased spending without adequate measures for long-term sustainability. |

| Economic Growth | Attraction of foreign investment and increased capital inflows can lead to faster economic growth and development. | Over-reliance on foreign investment could create vulnerability to external economic shocks and potentially neglect domestic investment opportunities. |

| Social Impact | Increased investment can lead to job creation and improved living standards. | Increased dependence on foreign investment could potentially shift power dynamics and create vulnerabilities to external influences. |

Factors Driving Growth

South Africa’s economic trajectory hinges on a multitude of interconnected factors. A robust growth outlook requires a concerted effort across various sectors, from infrastructure development to attracting foreign investment and fostering a supportive business environment. A positive rating upgrade signals the potential for improved access to capital and investment, but realizing this potential necessitates proactive strategies.A crucial element in achieving sustainable growth is understanding and leveraging the key drivers of economic activity.

This involves recognizing the intricate relationship between infrastructure, foreign investment, policy reforms, and the overall business environment. A comprehensive approach is essential to unlock South Africa’s economic potential and solidify its position on the global stage.

Infrastructure Development

South Africa faces significant infrastructure challenges, hindering economic productivity and competitiveness. These bottlenecks impact various sectors, from transportation and energy to communication and water supply. Improving infrastructure is a cornerstone of long-term economic growth. Efficient transportation networks, reliable energy supply, and robust communication systems are essential for attracting businesses, facilitating trade, and supporting the development of various industries.Investing in infrastructure projects, such as upgrading ports, expanding rail networks, and improving energy grids, can significantly boost economic activity.

These investments create jobs, stimulate demand, and improve the overall quality of life for South Africans. For example, the expansion of a major port facility could lead to increased trade volume, creating opportunities for businesses in logistics, shipping, and related services.

Attracting Foreign Direct Investment (FDI)

Foreign direct investment (FDI) plays a vital role in fostering economic growth and technological advancement. FDI inflows bring capital, expertise, and innovative technologies that can boost productivity and create jobs. A favorable investment climate is essential to attract FDI. This includes a stable political environment, transparent regulations, and a supportive legal framework. Countries that attract FDI often experience faster economic growth and improved living standards.

Reforms to Improve the Business Environment

Significant reforms are needed to improve the business environment in South Africa. This includes streamlining regulations, reducing bureaucratic hurdles, and ensuring the rule of law. A streamlined regulatory process can reduce compliance costs for businesses, allowing them to invest more in production and expansion. Enhancing transparency and accountability in government processes is critical to fostering investor confidence and promoting economic activity.

Government Policies Promoting Growth

Government policies are crucial for creating a conducive environment for economic growth. These policies must address issues like skills development, education, and employment creation. Strategic investments in human capital are critical for a productive workforce. A well-educated and skilled workforce can increase productivity and innovation, contributing significantly to economic growth. Furthermore, targeted policies to encourage entrepreneurship and small business development are vital for job creation and economic diversification.

Specific Policy Measures

- Streamlining Regulations: Simplifying business licensing procedures and reducing bureaucratic hurdles can significantly reduce compliance costs for businesses, encouraging investment and expansion.

- Investing in Infrastructure: Upgrading transportation networks, energy grids, and communication systems can improve productivity and facilitate trade, leading to increased economic activity.

- Promoting Skills Development: Investing in education and training programs can equip the workforce with the skills needed to meet the demands of a modern economy.

- Attracting Foreign Direct Investment: Implementing policies that attract foreign investment and ensure a stable business environment is crucial for capital inflows, technological advancement, and job creation.

- Supporting Entrepreneurship: Providing access to capital, mentoring, and business development services for startups and small businesses can foster job creation and economic diversification.

Challenges to Faster Growth

South Africa’s journey towards achieving faster economic growth faces numerous obstacles. These challenges, ranging from entrenched corruption to global economic headwinds, impede the nation’s progress and require comprehensive strategies for overcoming them. Addressing these hurdles is crucial for unlocking the country’s significant economic potential and improving the lives of its citizens.

Corruption and Bureaucratic Hurdles, Sp says south africa needs faster growth secure rating upgrade

Corruption and cumbersome bureaucratic processes significantly hinder investment and economic growth. These obstacles create an environment of uncertainty and discourage both domestic and foreign investors. Bribery, embezzlement, and opaque regulations deter entrepreneurs from venturing into new projects, stifle innovation, and divert resources from productive uses. For example, lengthy and complex licensing procedures can delay or even prevent businesses from operating, ultimately impacting overall economic output.

Unemployment and Inequality

High levels of unemployment and inequality contribute to a stagnant economy. A significant portion of the population lacks access to decent employment, limiting consumer spending and reducing overall economic activity. This disparity also fuels social unrest, potentially disrupting business operations and deterring investment. The impact is profound; lower purchasing power due to unemployment and inequality directly translates to reduced demand for goods and services, which in turn slows down economic growth.

Energy Security

Energy security plays a pivotal role in driving economic activity. Power outages, or load shedding, disrupt businesses, reduce productivity, and discourage investment. The lack of reliable and affordable energy negatively impacts manufacturing, industry, and even basic household operations. This reliance on a fragile and unpredictable energy supply creates an environment of uncertainty and impedes economic development.

Skills Shortages

Skills shortages in critical sectors pose a significant impediment to growth. The gap between the skills required by industries and the skills possessed by the workforce hinders productivity and innovation. The lack of qualified personnel in areas like technology, engineering, and healthcare prevents businesses from reaching their full potential. This shortage of skilled workers can result in reduced output and efficiency, limiting the capacity of South Africa’s economy to compete globally.

SP says South Africa needs faster growth to secure a rating upgrade, highlighting the need for economic momentum. Meanwhile, a recent administrative blunder allowed the Danish club Odense to compete in the Champions League, according to officials, a similar kind of oversight could hinder South Africa’s growth trajectory. Ultimately, South Africa needs to address these systemic issues to truly achieve the faster growth rate that SP is calling for.

Political Instability

Political instability and policy uncertainty can significantly undermine investor confidence. Changes in government policies, political turmoil, and lack of consistent governance create a volatile environment, deterring investment and hindering economic growth. Political uncertainty often leads to reduced foreign direct investment, which is a critical component of economic expansion.

High Levels of Crime

High levels of crime, particularly violent crime, have a detrimental impact on economic growth. The fear of crime discourages investment, both domestic and foreign. Businesses may relocate to safer locations, and consumers may reduce spending due to safety concerns. The cost of crime, including the direct costs of security measures and the indirect costs of lost productivity, severely hampers economic development.

Global Economic Climate

The global economic climate significantly affects South Africa’s growth trajectory. Recessions, global crises, and fluctuating commodity prices impact export revenues and investment inflows. For example, a global downturn can reduce demand for South African exports, leading to a decline in economic output. The country’s reliance on commodity exports makes it vulnerable to global economic fluctuations.

Comparison of Growth-Hindering Factors

| Factor | Description | Impact on Growth | Mitigation Strategies |

|---|---|---|---|

| Corruption & Bureaucracy | Obstacles to investment due to bribery, embezzlement, and complex regulations. | Reduces investment, discourages innovation, and diverts resources. | Strengthen anti-corruption measures, streamline bureaucratic processes, and improve transparency. |

| Unemployment & Inequality | High unemployment and income disparity reduces consumer spending and fuels social unrest. | Stagnant economy, reduced demand, and potential social disruption. | Implement job creation programs, promote skills development, and address income inequality. |

| Energy Security | Power outages disrupt businesses, reduce productivity, and deter investment. | Reduced productivity, lower output, and economic uncertainty. | Invest in renewable energy, improve energy infrastructure, and enhance energy efficiency. |

| Skills Shortages | Gap between required skills and workforce skills hinders productivity and innovation. | Lower productivity, reduced competitiveness, and limited growth potential. | Improve vocational training, invest in education, and foster partnerships between industry and education. |

| Political Instability | Policy uncertainty and political turmoil deter investment and hinder growth. | Reduced investor confidence, decreased foreign direct investment, and economic volatility. | Promote political stability, ensure policy consistency, and foster good governance. |

| High Crime | Fear of crime discourages investment and reduces consumer spending. | Reduced investment, lower consumer spending, and increased security costs. | Strengthen law enforcement, improve community safety, and promote crime prevention programs. |

| Global Economic Climate | Global recessions and fluctuating commodity prices impact export revenues and investment. | Reduced export revenues, decreased investment inflows, and economic vulnerability. | Diversify the economy, develop export markets, and enhance resilience to global shocks. |

Potential Strategies for Growth

South Africa’s economic trajectory hinges on a multifaceted approach that fosters sustainable growth and strengthens investor confidence. A combination of targeted strategies, structural reforms, and a proactive investment environment are crucial to unlocking the nation’s full economic potential. This requires a holistic strategy encompassing not only the private sector but also the public sector, addressing social inequalities, and promoting good governance.

Strategies to Accelerate Economic Growth

South Africa’s economic growth requires a comprehensive set of strategies to address various challenges. These strategies need to be implemented in a coordinated manner to achieve meaningful and sustainable progress.

| Strategy | Description | Expected Impact |

|---|---|---|

| Improved Infrastructure | Significant investment in upgrading transport networks (roads, railways, ports), energy infrastructure (power generation, transmission), and digital connectivity is vital. This includes modernizing existing infrastructure and expanding access to reliable services across the country. Developing reliable and efficient public transport systems can also reduce congestion and improve productivity. | Improved logistics, reduced transportation costs, enhanced productivity, increased foreign investment, and improved quality of life for citizens. Examples include reduced delivery times for businesses and improved access to essential services. |

| Attracting Foreign Direct Investment (FDI) | Creating a stable and predictable regulatory environment, streamlining investment processes, and highlighting South Africa’s strengths as an investment destination can significantly attract FDI. This includes ensuring transparency and accountability in government processes. Active promotion of South Africa as a desirable investment hub in international forums and through targeted marketing campaigns are also crucial. | Increased capital inflows, job creation, technology transfer, and improved access to global markets. Examples include the establishment of new industries and expansion of existing ones, creating more employment opportunities. |

| Promoting Technological Advancement | Investing in research and development (R&D) in key sectors, fostering innovation, and promoting the adoption of new technologies can significantly improve productivity and competitiveness. This involves establishing strong partnerships between academia, industry, and government. Providing incentives for businesses to adopt new technologies is also a crucial component. | Enhanced productivity, improved competitiveness, creation of new industries, and development of a skilled workforce. Examples include the development of new technologies for agriculture, mining, or manufacturing, resulting in increased output and efficiency. |

| Addressing Social Inequalities | Tackling poverty, unemployment, and inequality is essential for fostering social cohesion and economic growth. This includes improving access to quality education and healthcare, providing skills development programs, and supporting entrepreneurship among disadvantaged groups. It requires a multi-pronged approach involving government, NGOs, and the private sector. | Increased human capital, improved social mobility, reduced crime rates, and greater social stability. Examples include improved access to education for children in marginalized communities, leading to greater opportunities and productivity in the future. |

| Improving Governance and Accountability | Strengthening institutions, promoting transparency, and reducing corruption are crucial for creating a conducive environment for businesses and investors. This includes implementing anti-corruption measures, improving the efficiency of public service delivery, and empowering citizens to hold their leaders accountable. Combating corruption at all levels of government is vital. | Increased investor confidence, improved public trust, reduced economic risks, and greater efficiency in resource allocation. Examples include reducing the time taken for business registration or licenses, enabling businesses to start and operate more efficiently. |

Structural Reforms

Implementing structural reforms is vital for enhancing South Africa’s competitiveness and attracting investment. These reforms must focus on improving the business environment, enhancing infrastructure, and creating a more inclusive society. It requires a long-term commitment from government, businesses, and civil society.

Importance of Attracting Foreign Investment

Foreign direct investment (FDI) plays a crucial role in fostering economic growth, bringing in much-needed capital, technology, and expertise. It is essential to develop policies that attract and retain FDI, while also ensuring that it contributes to the broader development goals of the country. Creating an attractive investment environment can help South Africa achieve faster growth and attract much-needed capital.

Improved Infrastructure and Technology

Modernizing infrastructure and embracing technological advancements are essential for enhancing productivity and competitiveness. Improved infrastructure reduces costs, improves efficiency, and increases connectivity. Investing in digital infrastructure and promoting the use of technology in various sectors can boost economic output and competitiveness.

Addressing Social Inequalities

Tackling social inequalities is vital for fostering social cohesion and economic growth. A more inclusive society benefits everyone, promoting a more equitable distribution of wealth and opportunities. This requires a comprehensive approach to address poverty, unemployment, and inequality, leading to a more stable and productive society.

Improved Governance and Accountability

Good governance and accountability are crucial for building investor confidence and fostering economic growth. A transparent and accountable government enhances the country’s reputation and fosters trust, which is essential for attracting both domestic and foreign investment. Promoting transparency and accountability reduces corruption and fosters a more stable and predictable business environment.

Promoting Transparency and Reducing Corruption

Promoting transparency and reducing corruption are critical for building public trust and creating a more stable and predictable environment for businesses. Implementing measures to combat corruption at all levels of government, while also empowering citizens to hold their leaders accountable, is essential for fostering sustainable economic growth. Transparency and accountability lead to greater trust and stability.

Illustrative Examples

Looking beyond South Africa’s unique circumstances, examining successful growth strategies in other emerging economies offers valuable insights. By studying their journeys, we can identify transferable lessons and potentially adapt them to South Africa’s specific context. Successful economic growth in emerging economies often involves a complex interplay of factors, from macroeconomic stability to effective structural reforms.

Successful Growth Strategies in Emerging Economies

Analyzing the experiences of other emerging economies provides a wealth of knowledge for South Africa’s economic development. Countries like China, India, and Brazil have demonstrated significant growth spurts, offering valuable lessons for South Africa’s trajectory. Each case study highlights specific strategies and their impact.

“Sustainable economic growth requires a multifaceted approach, encompassing fiscal responsibility, strategic investments, and robust private sector development.”

China’s Economic Rise

China’s phenomenal economic growth, from a centrally planned economy to a global powerhouse, exemplifies the importance of targeted investments in infrastructure and human capital. The focus on industrialization, coupled with export-oriented policies, played a crucial role in creating a large manufacturing sector. Significant investments in education and technology transfer further bolstered this growth.

“China’s economic success stemmed from a strong emphasis on infrastructure development, strategic industrial policies, and a significant investment in human capital.”

- Infrastructure Development: Massive investments in transportation, energy, and communication networks facilitated economic activity and reduced transaction costs. This laid the foundation for industrialization and trade.

- Targeted Industrial Policies: Government support for specific industries, like manufacturing and technology, fostered their growth and positioned China as a global manufacturing hub.

- Human Capital Investment: A focus on education and training created a skilled workforce capable of driving innovation and productivity improvements.

India’s Growth through Services

India’s economic growth has been significantly driven by the expansion of its services sector. A strong foundation in education and skilled labor provided a competitive advantage in fields like information technology and business process outsourcing. Further, a supportive regulatory environment facilitated the growth of these industries.

“India’s growth trajectory highlights the importance of leveraging existing strengths in human capital and fostering a favorable regulatory environment.”

- Leveraging Human Capital: India’s significant pool of educated and skilled labor formed the basis of its growth in services-related sectors.

- Favorable Regulatory Environment: Policies conducive to attracting foreign investment and facilitating business operations further contributed to this growth.

- Strategic Focus on Services: Recognizing and capitalizing on existing strengths in the services sector facilitated rapid expansion.

Brazil’s Growth and Challenges

Brazil’s experience underscores the importance of diversifying the economy beyond commodities. While initial growth was driven by agriculture and mining, sustained growth required a shift towards manufacturing and services. Challenges related to macroeconomic stability and institutional reforms played a critical role in the success and setbacks experienced.

“Brazil’s economic growth journey underscores the necessity of diversification beyond reliance on commodity exports, combined with addressing macroeconomic instability and institutional inefficiencies.”

- Diversification: Shifting from a commodity-dependent economy to a more diversified one, with a focus on manufacturing and services, was crucial for sustainable growth.

- Macroeconomic Stability: Maintaining macroeconomic stability through sound fiscal and monetary policies is essential for attracting investment and fostering growth.

- Institutional Reforms: Addressing corruption and improving the efficiency of government institutions is critical for creating a favorable investment climate.

Visual Representation

South Africa’s economic journey over the past decade is a complex tapestry woven with threads of growth, challenges, and policy shifts. Visualizing this journey allows us to grasp the nuances and identify key turning points, facilitating a deeper understanding of the nation’s economic performance. A well-designed visualization can transform complex economic data into easily digestible insights, making the story of South Africa’s economic progress more accessible and impactful.

Visualizing Economic Performance

A line graph, meticulously crafted, serves as a powerful tool to represent South Africa’s GDP growth over the past ten years. The x-axis displays the years, while the y-axis tracks the GDP growth rate. The graph should include a distinct line representing the GDP growth, allowing viewers to easily discern the trends and fluctuations. Color-coding can be strategically used to highlight periods of rapid growth, stagnation, or decline.

Key economic milestones, such as policy changes, natural disasters, or global economic shocks, can be visually represented by adding vertical markers on the graph. This approach makes the graph dynamic, emphasizing the interplay between internal and external factors.

Data Visualization Techniques

The choice of visualization technique is crucial for effectively conveying complex information. A combination of line graphs and bar charts proves particularly valuable. Line graphs, as mentioned earlier, are ideal for tracking trends over time, while bar charts excel at showcasing comparisons across different years or categories. For example, a bar chart alongside the line graph could compare South Africa’s GDP growth with its regional counterparts.

Interactive elements, such as tooltips, allow users to hover over specific data points to reveal more detailed information, thus enhancing the user experience. This approach empowers viewers to delve deeper into the data.

Key Economic Indicators

Several key economic indicators, including GDP growth, inflation rate, unemployment rate, and foreign investment flows, significantly impact South Africa’s growth. A scatter plot, incorporating the aforementioned indicators, can reveal correlations and relationships between them. For instance, a negative correlation between unemployment and GDP growth could be clearly depicted on the scatter plot. A similar technique can be applied to show the relationship between foreign investment and GDP growth, thereby illustrating the role of external factors in shaping the South African economy.

Data Sources

The data for this visualization originates from reputable sources, such as the World Bank, the International Monetary Fund (IMF), and Statistics South Africa. These sources provide reliable and comprehensive data on various economic indicators, ensuring the accuracy and credibility of the visualization. Using a diverse range of data sources further enhances the objectivity and reliability of the analysis.

The consistency of the data collection methodology across these sources contributes to the reliability of the visualizations. The reliability and comprehensiveness of the data are vital to ensure the integrity of the visualizations.

Conclusive Thoughts

In conclusion, the call for faster growth in South Africa, as articulated by SP, underscores the critical need for a multi-faceted approach. This includes not only addressing the immediate challenges but also fostering long-term sustainable growth. By examining the historical context, current indicators, and potential strategies, a clear path forward for South Africa emerges. The ultimate goal is to not only secure a credit rating upgrade but also to establish a foundation for sustained and inclusive economic development, paving the way for a brighter future for the nation.