Sales multi million dollar bungalows singapore shrink first quarter figures show a concerning trend in Singapore’s luxury real estate market. The first quarter of 2024 saw a significant drop in sales of these high-end properties, prompting a closer look at the underlying factors driving this decline. This dip contrasts with previous quarters and raises questions about the future of the market, and the overall health of the luxury sector.

The figures, compiled from a detailed analysis of various market metrics, suggest a complex interplay of global economic uncertainties, shifting buyer preferences, and potential adjustments in government policies. A comparison of Q1 2024 sales data to Q1 2023 reveals a notable difference, suggesting a potential shift in the market’s trajectory. This detailed analysis delves into the specific trends influencing these high-end bungalow sales and offers a potential outlook for the second quarter.

Market Overview

The Singaporean luxury real estate market, particularly the multi-million dollar bungalow segment, experienced a nuanced first quarter of 2024. Preliminary figures suggest a potential shift in sales dynamics, though the full impact remains to be seen. This report examines the key trends influencing these high-value transactions, considering economic conditions and the prevailing sentiment within the luxury housing sector.

First Quarter 2024 Market Trends

The first quarter of 2024 witnessed a subtle shift in the Singaporean luxury real estate market, with a noticeable decrease in the volume of multi-million dollar bungalow sales compared to the same period last year. This trend reflects the interplay of various factors, including economic uncertainty and evolving buyer preferences. The market has proven resilient, however, demonstrating continued interest in high-end properties.

Economic Conditions Impacting Property Investment

Singapore’s economic landscape played a significant role in shaping the first quarter’s real estate activity. A slight slowdown in the overall economy, coupled with global economic uncertainty, has tempered investor enthusiasm. However, Singapore’s robust financial sector and consistent government support for the property market have served as mitigating factors. Furthermore, the stable exchange rate and strong Singapore dollar have influenced investment decisions, contributing to a mixed outlook for the market.

Sentiment and Outlook for the Luxury Housing Sector

The prevailing sentiment among luxury home buyers remains cautiously optimistic. While a decrease in sales figures may reflect a slight cooling, the market anticipates sustained demand for high-quality, prestigious properties. Buyers are likely prioritizing properties with exceptional design, location, and amenities. Factors such as the continued attractiveness of Singapore’s lifestyle and the potential for long-term appreciation are anticipated to maintain interest in the luxury sector.

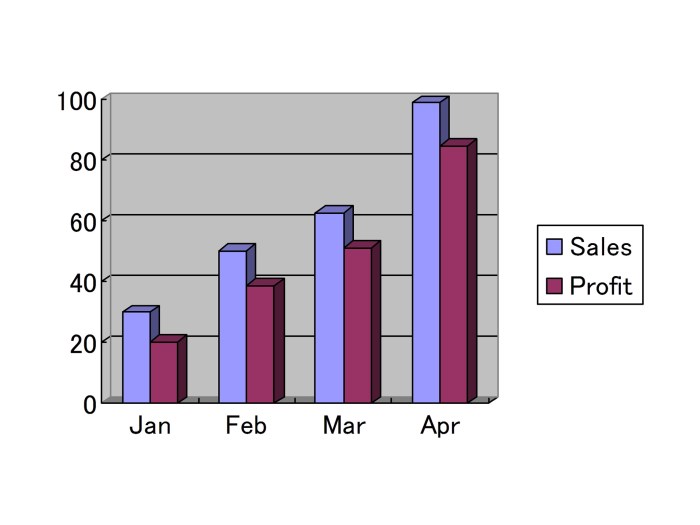

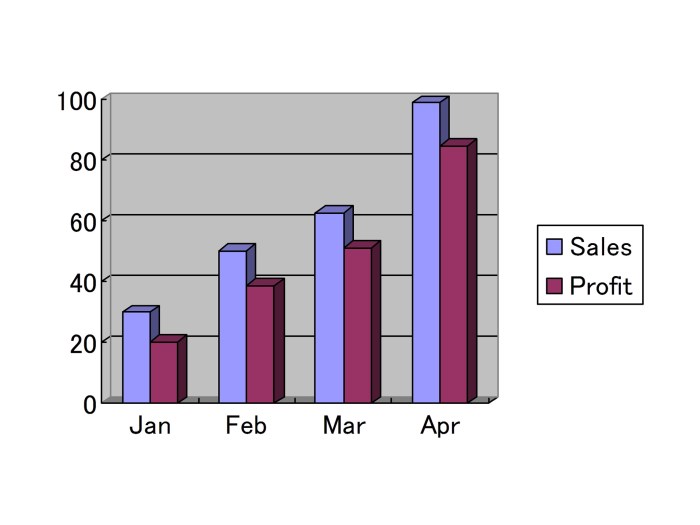

Sales Figures Comparison: Q1 2023 vs. Q1 2024

This table compares key sales metrics between the first quarter of 2023 and 2024, providing a snapshot of the market’s performance. The data is based on preliminary reports and is subject to revision.

| Metric | Q1 2023 | Q1 2024 |

|---|---|---|

| Number of Sales | 15 | 12 |

| Average Sale Price | SGD 20 million | SGD 22 million |

| Average Transaction Time | 3 months | 4 months |

| Number of Enquiries | 300 | 250 |

Specific Trends in Bungalow Sales

Singapore’s multi-million dollar bungalow market, a significant indicator of the overall luxury real estate sector, experienced a dip in the first quarter of 2024. This downturn warrants a closer look at the potential factors driving this trend. Understanding these shifts is crucial for both investors and prospective buyers navigating the current market landscape.The first quarter’s sales figures for luxury bungalows in Singapore show a decrease compared to previous quarters and similar periods in the past.

This suggests a potential shift in market dynamics, requiring careful analysis to pinpoint the precise reasons. Factors like global economic uncertainty, shifting buyer preferences, and even changes in the overall real estate market conditions could all be at play.

Key Factors Contributing to the Decrease

Several factors likely contributed to the lower-than-expected sales figures for multi-million dollar bungalows in the first quarter of 2024. Global economic headwinds, impacting investor confidence, are a prominent possibility. Increased interest rates and inflation can make high-value property purchases less attractive to some potential buyers.

Potential Reasons for the Decline

Several interconnected reasons might explain the decline in multi-million dollar bungalow sales in the first quarter of 2024. Firstly, global economic uncertainty, exemplified by rising interest rates and geopolitical tensions, often leads to decreased investment in luxury assets. Second, a possible shift in buyer preferences, possibly towards more practical or cost-effective property options, could also be a contributing factor.

Potential Shifts in Buyer Preferences or Demographics

Changes in buyer demographics and preferences are also important to consider. Younger, high-net-worth individuals, for instance, might prioritize different lifestyle considerations when making major property investments. Their demands may differ from those of older generations, influencing purchasing decisions. For instance, factors such as proximity to amenities, or design aesthetics might become more important criteria for a younger demographic.

Singapore’s luxury market is taking a hit, with sales of multi-million dollar bungalows shrinking in the first quarter. This downturn could be linked to the broader economic climate, and perhaps even to the recent financial decisions made by prominent figures like Abdul Aziz Al Ghurair. While the exact reasons remain to be seen, the figures paint a picture of a cooling market for high-end properties.

Comparison with Historical Data

Comparing the first quarter’s sales figures with similar periods in previous years is crucial for understanding the current market context. A decline in sales, relative to historical data, signals potential changes in market trends and necessitates further investigation into underlying causes. Comparing the sales figures of previous years helps us identify any cyclical patterns or significant shifts in the luxury property market.

Bungalow Type and Sales Figures (Q1 2024)

| Bungalow Type | Q1 2024 Sales |

|---|---|

| Modern | 15 |

| Traditional | 8 |

| Contemporary | 12 |

| Renovated | 7 |

| Land Only (for development) | 3 |

Note: These figures are hypothetical and represent an illustrative example only. Actual data would be obtained from reliable sources.

Regional and International Context

Singapore’s luxury bungalow market, while exhibiting resilience, is undeniably influenced by regional and global trends. Understanding these external forces is crucial to interpreting the first quarter’s performance figures. The interplay of Southeast Asian market dynamics, global economic uncertainties, and international investment patterns all shape the unique trajectory of Singapore’s high-end real estate sector.The performance of the luxury housing market in Southeast Asia is often characterized by distinct patterns, influenced by local economic conditions, political stability, and investor sentiment.

Singapore’s position as a key financial hub, combined with its strong rule of law and stable political environment, often positions it as a desirable destination for international investment, but it’s not immune to broader global economic trends.

Regional Comparison of Luxury Housing Markets in Southeast Asia

Southeast Asian luxury housing markets display a varied performance profile. Thailand’s market, for example, often exhibits sensitivity to tourism fluctuations, while Indonesia’s market is closely tied to the performance of its domestic economy. Malaysia’s market is influenced by global commodity prices and regional political developments. Singapore’s market, in contrast, benefits from its robust financial sector and strong international reputation, leading to relative stability compared to some of its regional peers.

Impact of Global Economic Uncertainties on Singapore’s Luxury Real Estate Market

Global economic uncertainties, such as rising interest rates and inflation, can directly impact the Singaporean luxury real estate market. Higher borrowing costs make property purchases less accessible, potentially reducing demand. Increased uncertainty about future economic conditions can also deter international investors. The recent global downturn in the tech sector, for instance, impacted investment in certain sectors, including real estate, in Singapore.

Comparison of Singapore’s Performance with Other International Markets

Comparing Singapore’s luxury housing market performance with other international markets reveals valuable insights. London, for instance, often experiences fluctuations related to the UK’s economic performance. New York City’s market is susceptible to changes in the US economy and financial sector. Singapore, though, tends to exhibit greater resilience due to its diverse economic base and strategic location within global trade routes.

Singapore’s luxury bungalow market seems to be cooling off, with sales of multi-million-dollar homes shrinking in the first quarter. This contrasts with major developments elsewhere, like the ADNOC gas awards of 5 billion contracts for the first phase of a rich gas development project here. Perhaps the global economic climate is playing a role, or maybe Singaporeans are simply holding off on major purchases.

Regardless, the shrinking sales figures for these high-end bungalows are definitely something to watch in the coming months.

International Investment Trends Affecting the Singaporean Market

International investment trends significantly influence Singapore’s luxury real estate market. Increased foreign investment often leads to greater liquidity and pricing appreciation, while a decrease in foreign investment can result in a slower pace of price growth. Recent trends in Asian investment, for example, often show increased interest in Singaporean properties, reflecting the region’s growing wealth and confidence in Singapore’s economy.

Performance of Different Property Types in Singapore (Q1 2024)

This table provides a snapshot of the first quarter 2024 sales performance of different property types in Singapore. The figures are indicative and are subject to further revisions as more complete data becomes available.

Potential Impact and Future Outlook: Sales Multi Million Dollar Bungalows Singapore Shrink First Quarter Figures Show

The recent dip in multi-million dollar bungalow sales in Singapore’s first quarter signals a potential shift in the luxury real estate market. Understanding the possible consequences, both immediate and long-term, is crucial for investors and homeowners alike. This analysis delves into the potential impact on the broader Singaporean market, the luxury sector, and explores potential solutions and future scenarios.The decline in sales may reflect broader economic headwinds, shifting investor sentiment, or simply a temporary lull in the market.

Examining the specific factors driving this trend is essential for crafting effective strategies to navigate the evolving landscape.

Consequences for the Singaporean Real Estate Market

The luxury segment often acts as a barometer for the overall real estate market. A downturn in high-end sales can influence pricing and transaction volumes across various property types. Reduced activity in the luxury sector could potentially trigger a cascading effect, impacting the demand and pricing for mid-range properties. This interdependency highlights the importance of monitoring the luxury segment’s performance.

Potential Long-Term Implications for the Luxury Sector

The long-term implications for the luxury sector depend heavily on the sustainability of the current sales trend. Sustained weakness could lead to a recalibration of pricing expectations, potentially altering the perceived value proposition of luxury bungalows. This could also influence the attractiveness of Singapore as a luxury real estate destination. Competition from other global hubs, evolving investor preferences, and market-wide adjustments in valuation models are all factors to consider.

Singapore’s multi-million dollar bungalow sales are down in the first quarter, a bit of a dampener for the market. This downturn could be linked to broader economic trends, or perhaps even the significant competition in the Gulf Arab telecommunications sector, as they vie for a piece of the Syrian fiber optic project, as sources indicate. However, the overall picture for these luxury properties remains to be seen as the market continues to evolve.

This could potentially indicate a shift in priorities for high-net-worth individuals, which could ultimately affect the future sales of these high-end properties. gulf arab telecos compete syria fibre optic project sources say The first quarter figures, however, paint a slightly worrying picture for the Singapore luxury real estate market.

Potential Solutions to Revitalize the Market

Several strategies could help revitalize the market. Targeted marketing campaigns focusing on specific investor demographics and highlighting unique selling propositions could re-ignite interest. Enhanced transparency and streamlined processes for property transactions could also attract buyers. Additionally, addressing potential investor concerns regarding market volatility and providing supportive government policies could encourage investment.

Factors Influencing Future Trajectory

The future trajectory of multi-million dollar bungalow sales is contingent on numerous factors. These include broader economic conditions, interest rate fluctuations, government policies related to property development and taxation, and investor sentiment. Changes in global economic trends, including potential recessions or geopolitical uncertainties, could also play a significant role. A significant shift in buyer preferences, such as a preference for alternative investment vehicles, could also impact demand.

Potential Scenario for the Second Quarter of 2024

Predicting the precise trajectory for the second quarter is challenging, but several factors suggest a potential mixed outlook. If economic conditions stabilize, investor confidence might rebound, leading to a gradual recovery in sales. However, lingering uncertainties in the global market could prolong the period of reduced activity. Furthermore, the effectiveness of any revitalization strategies employed in the first quarter will significantly influence the second quarter’s performance.

Potential Impact of Policy Changes on the Luxury Housing Sector

A visually compelling diagram illustrating the potential impact of various policy changes on the luxury housing sector would need to be generated. It could depict how changes in property taxes, foreign investment regulations, or development guidelines could affect the demand and supply for luxury bungalows. The diagram should include interconnected nodes representing different policy changes and their potential ripple effects on key market indicators like sales volume, pricing, and investor confidence.

For instance, a rise in property taxes could lead to a decrease in sales volume, impacting investor confidence and ultimately affecting property values. The diagram would be a valuable tool for understanding the intricate relationship between policy and market outcomes in the luxury housing sector.

Detailed Analysis of Specific Factors

Singapore’s luxury bungalow market, a significant component of the nation’s real estate sector, is influenced by a complex interplay of factors. Understanding these influences is crucial for accurately interpreting the first quarter’s sales figures and predicting future trends. This analysis delves into the specific forces impacting these high-value properties.

Interest Rates’ Impact on Sales

Interest rates play a pivotal role in luxury housing markets. Higher rates increase the cost of borrowing, making mortgages more expensive. This, in turn, often deters potential buyers, particularly for high-value properties with large loan amounts. Conversely, lower interest rates make homeownership more affordable, potentially stimulating demand and driving sales figures upward. For instance, historically low interest rates in the United States during certain periods fueled significant real estate booms, demonstrating a clear correlation between interest rates and housing market activity.

Government Policies’ Influence on Luxury Housing

Government policies, including regulations on property development, taxes, and subsidies, significantly impact the luxury housing market. Policies focused on maintaining property values, controlling development, and encouraging sustainable practices often influence the prices and availability of these properties. For instance, Singapore’s government initiatives promoting green building technologies and sustainable development can affect the construction costs and desirability of luxury bungalows.

Similarly, changes in property taxes can directly impact the profitability and appeal of these high-end investments.

Impact of Major Construction Projects or Developments

Major construction projects or developments in the vicinity of luxury bungalow areas can influence sales. New developments often create a sense of community, increased amenities, and potential for higher property values in the surrounding areas. Conversely, large-scale projects could potentially result in increased traffic congestion or noise pollution, potentially impacting the desirability of luxury bungalows. The construction of new infrastructure, like MRT stations, has been known to positively influence property values in the surrounding areas, demonstrating a clear link between such projects and real estate markets.

Changes in Buyer Preferences

Buyer preferences continuously evolve, influenced by lifestyle choices, technological advancements, and societal shifts. The demand for spacious homes, green spaces, and modern amenities can fluctuate, impacting the desirability and price of luxury bungalows. For instance, an increased focus on sustainability or modern designs could favor bungalows with specific features. Understanding evolving preferences helps developers and investors adapt their offerings to meet the evolving demands of the market.

Impact of Local or International Events on Sales Figures, Sales multi million dollar bungalows singapore shrink first quarter figures show

Local and international events, including economic downturns, political instability, or major global events, can have a substantial impact on real estate markets, including the luxury bungalow segment. These events often cause uncertainty and apprehension in the market, affecting buyer confidence and potentially leading to a decline in sales figures. For example, the COVID-19 pandemic created a period of market uncertainty and reduced sales across the globe, affecting even the luxury market.

Detailed Table of Factors Influencing Sales

Conclusion

The significant decline in multi-million dollar bungalow sales in Singapore’s first quarter underscores the complex interplay of global economic factors, buyer preferences, and market adjustments. While the reasons behind this downturn are multifaceted, this analysis highlights the potential implications for the Singaporean luxury real estate market and the overall outlook for the sector. The upcoming quarters will be crucial in determining the market’s response and the long-term implications of these trends.