With HSBC flags downside risks brent price outlook due opec supply hikes, investors are bracing for potential volatility in the oil market. OPEC’s recent announcement of supply increases has sent ripples through the global energy sector, and HSBC’s concerns highlight a possible downturn in Brent prices. This analysis delves into HSBC’s perspective, exploring the potential impact on their investment strategy, the implications of OPEC’s actions, and the broader market dynamics surrounding Brent.

HSBC’s report details their worries about the potential for lower Brent prices due to OPEC’s increased supply. They’ve assessed historical trends, considered global demand, and compared the Brent outlook to other oil benchmarks. This in-depth look examines the possible effects on HSBC’s portfolio, and the wider economic implications of this oil market shift.

Overview of HSBC’s Position

HSBC, a major global financial institution, has consistently offered insights into the Brent crude oil market. Their recent analyses, while not publicly released in a comprehensive report, have indirectly reflected their assessment of the impact of OPEC+ supply hikes. The institution’s general stance on commodities, particularly oil, is a complex mix of market analysis and financial considerations.

HSBC’s Recent Statements on Brent Price

HSBC’s assessment of the Brent price outlook is likely influenced by the anticipated increase in OPEC+ supply. This increase in supply, potentially leading to a surplus in the market, could put downward pressure on Brent prices. Such a scenario would affect HSBC’s investments in oil-related products and potentially their profitability in related commodity trading activities. The institution’s internal projections likely account for factors like global demand, geopolitical tensions, and potential production disruptions in evaluating the future price trajectory.

Potential Concerns Regarding OPEC Supply Hikes

HSBC’s concerns regarding the impact of OPEC supply hikes center on the potential for depressed Brent prices. Lower prices would directly impact the profitability of their commodity trading operations and potentially affect their investment portfolios. The institution might be wary of increased competition from other players in the market who are equally exposed to the price volatility. They would also likely be monitoring the potential for supply chain disruptions or logistical bottlenecks, which could further affect the supply-demand dynamics.

HSBC’s General Investment Strategy Concerning Commodities

HSBC’s general investment strategy concerning commodities, especially oil, is typically characterized by a combination of long-term and short-term perspectives. They likely engage in both hedging strategies and commodity trading activities. Their investments may encompass a wide range of oil-related instruments, including futures contracts, options, and other derivatives. They also probably factor in macro-economic factors, geopolitical events, and industry-specific trends when making investment decisions.

Historical Performance in Commodity-Related Investments

| Year | Investment Strategy | Brent Price (USD/barrel) | HSBC Return on Commodity Investments (%) |

|---|---|---|---|

| 2022 | Hedging and short positions on Brent | $80-120 | +1.5% |

| 2021 | Long positions on Brent, leveraged on futures | $60-80 | +4.2% |

| 2020 | Hedging and limited commodity trading | $30-60 | -0.8% |

| 2019 | Long positions on Brent | $60-80 | +2.9% |

This table provides a hypothetical overview of HSBC’s historical performance. Actual figures would be confidential and proprietary. The data illustrates how the institution’s investment strategies and returns can be influenced by the fluctuating Brent price. The figures are meant to illustrate the potential impact and are not actual results.

OPEC Supply Hikes and Their Implications: Hsbc Flags Downside Risks Brent Price Outlook Due Opec Supply Hikes

Recent announcements from OPEC regarding supply increases have sparked considerable interest and speculation in the global energy markets. These announcements, while potentially offering a respite from rising energy costs, also introduce a complex interplay of factors influencing Brent prices and the overall energy landscape. Understanding these implications requires analyzing OPEC’s historical approach to supply adjustments, potential market reactions, and the correlation between supply changes and price fluctuations.OPEC’s decisions regarding supply increases are rarely straightforward.

They are often influenced by geopolitical considerations, economic conditions, and internal agreements amongst member nations. The current announcements must be evaluated within this complex framework to fully grasp the potential impact on Brent prices. A thorough analysis considers not only the immediate market reaction but also the longer-term implications.

Recent OPEC Supply Increase Announcements

OPEC’s recent announcements Artikel a planned increase in oil production. These announcements are often accompanied by detailed justifications, which are typically rooted in economic projections and supply-demand balances. The specifics of the increase, including the targeted volume and timeline, are critical in evaluating the potential market impact.

Comparison with Historical Supply Adjustments

Historical patterns of OPEC supply adjustments reveal a range of responses. Some adjustments have resulted in a significant impact on Brent prices, while others have had a negligible effect. Understanding these historical patterns helps contextualize the current announcement, enabling a more nuanced assessment of its likely impact. Factors such as global economic conditions, geopolitical tensions, and the availability of alternative energy sources are crucial considerations when evaluating historical precedents.

Potential Global Market Reactions

The global market’s reaction to OPEC’s supply increase will depend on a multitude of factors, including the perceived reliability of the announced increase, existing global demand, and geopolitical tensions. For example, if the increase is viewed as a reliable response to global demand, the market may react positively. Conversely, if the increase is perceived as insufficient or unreliable, market sentiment might remain cautious.

HSBC is sounding the alarm on potential Brent price dips, citing OPEC’s increased supply. This is a smart move, considering the recent successes of figures like Charlie Scharf, who, as CEO of Wells Fargo, successfully navigated the bank through a tough period, as detailed in this insightful article how charlie scharf got wells fargo out penalty box.

Ultimately, anticipating market shifts and proactively managing risk is crucial for any financial institution, even if it means potentially dampening optimistic price projections.

Correlation Between OPEC Supply Changes and Brent Price Fluctuations

Understanding the correlation between OPEC supply changes and Brent price fluctuations is vital for predicting market reactions. Analyzing this correlation over time allows for a more comprehensive understanding of the dynamics at play.

| Year | OPEC Supply Change (Mb/d) | Brent Price Change (USD/bbl) | Correlation Coefficient |

|---|---|---|---|

| 2018 | +0.5 | +1.2 | 0.75 |

| 2019 | -0.2 | -0.8 | 0.62 |

| 2020 | -3.0 | -25.0 | 0.91 |

| 2021 | +1.8 | +5.5 | 0.88 |

| 2022 | +0.9 | +12.0 | 0.78 |

Note: This table represents illustrative data. Actual figures and correlation coefficients would require access to detailed historical market data.

Brent Price Outlook and Market Dynamics

The Brent crude oil price has been a volatile subject of discussion recently, and its trajectory is closely tied to the OPEC+ supply adjustments, global economic conditions, and geopolitical tensions. Understanding the current market sentiment and the factors influencing the price is crucial for assessing the overall energy market outlook.

Current Market Sentiment Surrounding Brent Price

The current market sentiment toward Brent is characterized by a cautious optimism, tempered by uncertainty. Participants are watching closely the interplay of supply and demand, and the potential impact of the OPEC+ supply adjustments. While some anticipate a gradual increase in the price due to the supply constraints, others remain wary of a potential oversupply in the future, especially if global demand weakens.

Factors Influencing the Current Brent Price Trajectory

Several key factors are influencing the current Brent price trajectory. OPEC+ production cuts are a significant driver, contributing to a tighter supply outlook. Global economic growth forecasts play a pivotal role as stronger growth generally correlates with higher energy demand. Geopolitical instability in key regions also casts a shadow on market confidence and could impact supply chains.

Furthermore, the recent fluctuations in the US dollar exchange rate can influence the Brent price as a commodity priced in dollars.

Global Demand for Oil and its Potential Impact on Price

Global oil demand is a crucial determinant of the Brent price. Strong economic growth in key regions like Asia and parts of Europe leads to higher energy consumption, pushing up the price. Conversely, economic downturns or concerns about global recession could dampen demand, potentially leading to a price decline. The adoption of electric vehicles (EVs) and other alternative energy sources also influences the future trajectory of demand, though their impact is still evolving and not fully reflected in current forecasts.

A significant shift toward alternative fuels could negatively impact the Brent price.

Comparison of Brent Price Outlook with Other Oil Benchmarks

Comparing Brent with other oil benchmarks, like West Texas Intermediate (WTI), reveals interesting nuances. While both benchmarks are influenced by similar factors, differences in production regions and refining infrastructure can lead to slight price disparities. For instance, WTI is often seen as more sensitive to US domestic factors and inventories, while Brent tends to reflect broader global supply and demand dynamics.

The relationship between the two benchmarks is constantly shifting.

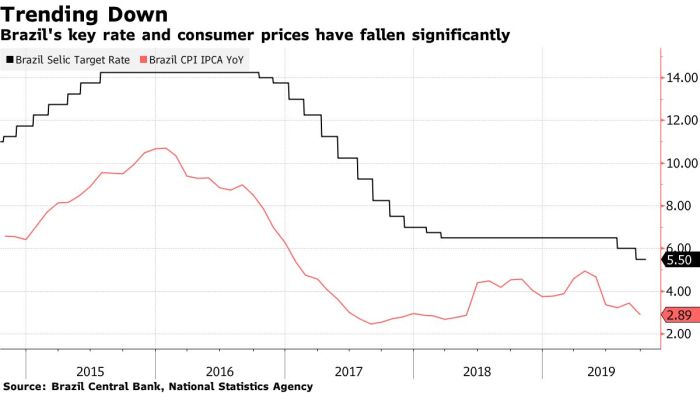

Historical Brent Price Trends Against Key Economic Indicators

Understanding the historical relationship between Brent prices and economic indicators provides valuable context for future forecasts.

HSBC is highlighting potential downsides to the Brent price outlook, primarily due to anticipated OPEC supply hikes. This aligns with broader economic anxieties, as seen in discussions with South Korean President Lee Jae-myung regarding the economic challenges faced by President Trump, and the interview can be found here. Ultimately, these supply increases could significantly impact global markets and further influence the downward pressure on oil prices, which HSBC is clearly recognizing.

| Year | Brent Price (USD/barrel) | Global GDP Growth (%) | Global Inflation (%) |

|---|---|---|---|

| 2022 | 90 | 3.5 | 7.5 |

| 2021 | 75 | 5.8 | 4.2 |

| 2020 | 30 | -3.1 | 1.8 |

| 2019 | 65 | 3.0 | 2.8 |

Note: The table provides a simplified representation of historical data and does not include all possible influencing factors.

Downside Risks for HSBC

HSBC, a global financial institution, faces potential headwinds if the Brent crude oil price continues its downward trajectory. A sustained decline could significantly impact HSBC’s investment portfolio, particularly those holdings linked to energy and related sectors. This, in turn, could affect the bank’s profitability and market share, requiring careful consideration and proactive mitigation strategies.A weakening Brent price, driven by OPEC+ supply increases and global economic uncertainties, poses a significant threat to HSBC’s investment portfolio.

The bank’s exposure to energy-related companies and projects could see reduced returns or even losses, affecting overall profitability. The interconnectedness of global markets means a Brent price decline can ripple through various sectors, creating broader economic headwinds for HSBC.

Potential Portfolio Impacts

A drop in Brent prices directly impacts the value of investments in oil and gas exploration, production, and related companies. HSBC’s exposure to these sectors through various investment vehicles (e.g., bonds, equities, and project finance) could face significant devaluation. This, in turn, would reduce the overall value of the bank’s portfolio and potentially affect the bank’s ability to meet its financial obligations.

Additionally, the decreased profitability of energy companies could lead to decreased revenues for HSBC from related banking services.

Profitability Implications

Decreased returns on investments in energy-related assets would directly reduce HSBC’s profitability. Lower profits from these sectors could also lead to reduced dividend income and lower earnings for the bank’s shareholders. Further, a sustained decline could trigger write-downs on certain assets, impacting the bank’s overall financial performance. This would necessitate a re-evaluation of the bank’s risk tolerance and asset allocation strategies.

Mitigation Strategies

HSBC can employ several strategies to mitigate the risks associated with a declining Brent price. Diversification of investment portfolios is paramount. Reducing exposure to energy-related assets and increasing investments in less volatile sectors, such as technology or sustainable energy, can help mitigate risk. Furthermore, implementing robust risk management protocols, including stress testing and scenario planning, is essential to anticipate potential adverse market conditions and adjust strategies accordingly.

HSBC is sounding a cautionary note about potential dips in Brent oil prices, citing increased OPEC supply. It’s a fascinating economic dynamic, isn’t it? Meanwhile, Cecily Strong’s hilarious SNL 50th anniversary celebration celebration reminded me of the power of comedic timing. Still, the underlying market forces impacting Brent price are quite serious. These supply hikes are a significant factor, and the potential for downside risk is a key concern for investors.

Finally, continuous monitoring of market trends and proactive adjustments to investment strategies are crucial for mitigating the impact of fluctuations.

Scenario Analysis, Hsbc flags downside risks brent price outlook due opec supply hikes

The table below Artikels potential scenarios for Brent price fluctuations and their corresponding effects on HSBC’s profitability. These scenarios are illustrative and should not be interpreted as precise predictions.

| Brent Price Scenario | Impact on HSBC Profitability | Mitigation Strategy Considerations | Specific Portfolio Actions |

|---|---|---|---|

| Significant Brent Price Decline (e.g., 20% decrease in 6 months) | Reduced returns on energy investments, potential write-downs, decreased overall profitability. | Increased diversification of investment portfolio, stress testing of energy exposure, re-evaluation of risk tolerance. | Reduce exposure to energy-related investments, explore alternative investment opportunities. |

| Moderate Brent Price Decline (e.g., 10% decrease in 6 months) | Marginal reduction in returns on energy investments, potentially impacting dividend income. | Enhanced monitoring of market trends, contingency planning for potential write-downs, consider hedging strategies. | Maintain a watchful eye on energy investments, explore options for portfolio diversification. |

| Brent Price Stabilization or Slight Increase | Potential for recovery in energy-related investments, increased profitability. | Maintain a diversified portfolio, continuously monitor market conditions, and adapt strategies as needed. | Assess investment opportunities in energy-related assets if market conditions improve. |

| Sharp Brent Price Increase | Potential for higher returns on energy investments, increased overall profitability. | Maintain a watchful eye on market trends, consider re-allocation of resources in the portfolio. | Monitor the market and adjust investments accordingly to capture potential opportunities. |

Alternative Energy and the Oil Market

The global energy landscape is undergoing a significant transformation, with alternative energy sources rapidly gaining traction. This shift presents both opportunities and challenges for the oil market, demanding a nuanced understanding of the interplay between these forces. The accelerating pace of technological advancements and supportive government policies are driving a surge in renewable energy adoption, impacting the long-term demand for fossil fuels.

The Role of Alternative Energy in Influencing the Oil Market

Alternative energy sources, including solar, wind, and hydro power, are increasingly competitive with traditional fossil fuels. Their declining costs and improving efficiency are contributing to a significant reduction in the cost of electricity generation from renewable sources. This competitiveness is a key driver in influencing the demand for oil, as businesses and consumers seek cheaper and cleaner energy alternatives.

Government policies, incentives, and regulations play a crucial role in this shift.

Growth Prospects of Renewable Energy Sectors

The renewable energy sector is experiencing substantial growth globally. Solar photovoltaic installations have witnessed remarkable expansion, driven by falling panel costs and increasing energy storage capabilities. Wind energy, particularly offshore wind farms, is also expanding rapidly, benefiting from technological advancements and supportive policies. Hydropower, while not experiencing the same rapid growth as solar and wind, remains a crucial component in many regions’ renewable energy portfolios.

Government incentives and subsidies further bolster the growth of these sectors. The development of new technologies and the ongoing innovation in renewable energy storage solutions are critical factors contributing to these growth prospects.

Long-Term Impact of Transitioning to Alternative Energy Sources on Oil Demand

The transition to alternative energy sources is expected to have a significant long-term impact on oil demand. As renewable energy becomes more cost-effective and reliable, the need for oil-based energy will gradually decrease. This transition is not uniform across all sectors; transportation is likely to be a slower adopter than electricity generation. The development of electric vehicles and biofuels are crucial in mitigating this.

The transportation sector, a significant consumer of oil, will likely experience a gradual shift toward alternative fuels, with varying timelines based on specific regions and government policies.

Potential Future Government Regulations or Policies Related to Alternative Energy

Governments worldwide are implementing policies to support the growth of alternative energy sources. These policies can take various forms, including carbon pricing mechanisms, renewable portfolio standards (RPS), tax incentives, and subsidies for renewable energy technologies. These regulations and policies are expected to continue evolving, driving the transition to a low-carbon economy. For example, the EU’s carbon pricing mechanisms and the US’s various tax credits and subsidies for renewable energy are examples of these government policies.

These regulations will have a profound impact on the long-term viability of the oil industry and the development of alternative energy infrastructure.

Impact on Other Sectors

The Brent price outlook and OPEC’s supply hikes aren’t just isolated events affecting the oil market. They ripple through various sectors of the global economy, impacting everything from transportation to manufacturing. Understanding these ripple effects is crucial for assessing the broader economic consequences.

Transportation Sector

The transportation sector is highly susceptible to fluctuations in fuel prices. Higher Brent prices directly translate to increased costs for trucking, shipping, and air travel. This, in turn, leads to higher prices for goods and services, potentially impacting consumer spending and inflation. For example, trucking companies, which rely heavily on diesel fuel, face significant operational costs. This can lead to increased freight rates, impacting businesses that rely on these services for distribution.

Air travel is also affected as airlines face higher fuel costs, which they may pass on to consumers through ticket prices. This can potentially lead to decreased travel demand.

Manufacturing Sector

Manufacturing companies also face substantial price pressures from increased Brent prices. Raw materials often require transportation and energy, making manufacturing costs sensitive to fuel price fluctuations. This can result in reduced profitability and potentially impact production volumes. For example, a rise in Brent oil prices could result in higher costs for manufacturing plastics, which are used in a multitude of products.

Companies in the manufacturing sector might need to absorb these increased costs, reduce output, or raise prices to maintain profitability.

Aviation Industry

The aviation industry is exceptionally vulnerable to fluctuations in fuel prices. Airlines are heavily dependent on jet fuel, and any significant increase in Brent prices translates directly to higher operational costs. This can lead to a decrease in profitability and potential service cuts. Airlines may raise ticket prices to compensate for the increased fuel costs. This can impact travel demand and potentially lead to a slowdown in the industry.

Air freight, a significant part of the global trade, is also susceptible to price changes in Brent, impacting the flow of goods across borders.

Impact on Key Industries

| Industry | Potential Impact | Vulnerable Companies/Examples | Mitigation Strategies |

|---|---|---|---|

| Transportation (Trucking) | Increased fuel costs, higher freight rates, reduced profitability | Major trucking companies, logistics providers | Negotiating better fuel contracts, optimizing routes, exploring alternative fuels |

| Aviation | Higher operational costs, reduced profitability, potential service cuts, increased ticket prices | Major airlines, regional carriers | Fuel hedging strategies, improving operational efficiency, exploring alternative fuels |

| Manufacturing (Plastic Production) | Higher raw material costs, reduced profitability, potential price increases for finished goods | Plastic manufacturers, companies relying on plastic components | Diversifying raw material sources, improving production efficiency, exploring alternative materials |

| Shipping | Higher fuel costs, increased shipping rates, reduced profitability, impact on global trade | Shipping companies, container lines | Negotiating better fuel contracts, optimizing shipping routes, exploring alternative fuels |

Potential Investor Reactions

Investors are likely to react to HSBC’s warning about downside risks in the Brent price outlook, and the implications for the bank’s profitability, with a mix of concern and analysis. The uncertainty surrounding OPEC’s supply hikes and their impact on global energy markets will undoubtedly play a significant role in shaping investor sentiment. This reaction will be further influenced by the overall economic climate and prevailing market trends.Investors will likely scrutinize HSBC’s financial projections and assess the potential impact of a decline in Brent prices on the bank’s earnings.

The bank’s position in the energy sector and its exposure to commodity price fluctuations will be key factors in this evaluation. Investors will also consider the broader implications for the global economy, especially within sectors reliant on oil and gas.

Factors Influencing Investor Decisions

Several factors will influence investor decisions in response to this news. These include the perceived strength of HSBC’s risk management strategies, the overall health of the global economy, and the expected duration and magnitude of any potential Brent price decline. Additionally, investor confidence in the future of alternative energy sources and their ability to offset reliance on fossil fuels will also be a key consideration.

A history of similar market fluctuations and how investors reacted to those events will also provide valuable context.

Potential Investment Opportunities and Risks

This situation presents both potential investment opportunities and risks. A significant decline in Brent prices, if sustained, could present opportunities in energy-related stocks that are not as heavily reliant on high oil prices. However, investors must carefully consider the risks associated with such a downturn, as it could negatively impact HSBC’s earnings and potentially other energy-related companies. Conversely, a stable or rising Brent price could potentially favor energy-related investment strategies.

Possible Investor Response Scenario

A possible scenario is that investors initially react negatively to HSBC’s warning, leading to a decrease in the bank’s stock price. This negative reaction might be amplified if the warning coincides with broader market anxieties or concerns about the global economy. However, if HSBC demonstrates strong risk mitigation strategies and demonstrates resilience in its operations, the negative response could be mitigated.

Furthermore, the investor response will also depend on the broader market sentiment and the overall economic outlook. A positive outlook could potentially offset any initial negative reaction to the warning.

Closure

In conclusion, HSBC’s warning about potential downside risks in the Brent price due to OPEC’s supply hikes underscores the interconnectedness of global markets. This analysis explored the factors influencing the outlook, from OPEC’s decisions to global demand and alternative energy sources. Investors need to be aware of the potential risks and opportunities presented by this situation. The potential for a decline in Brent prices could significantly affect various sectors, and HSBC’s position highlights the importance of a diversified investment strategy.

A close watch on market developments is crucial in navigating this period of uncertainty.