Canada 202425 budget deficit narrows c4315 billion – Canada 2024-25 budget deficit narrows c4315 billion, marking a significant shift from recent years. This positive development suggests a potential strengthening of the Canadian economy. Factors like government spending adjustments, tax policies, and overall economic performance likely played crucial roles in achieving this result. The implications for investor confidence, interest rates, and the future of public services are significant, and this article will explore the intricacies of this change.

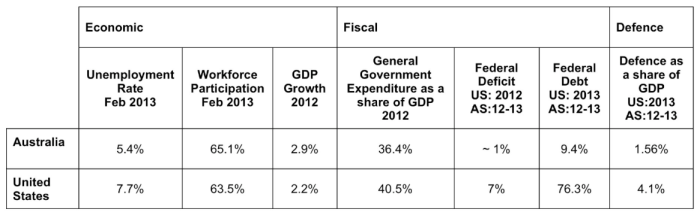

Analyzing historical budget deficits since 2019, alongside economic conditions and fiscal policy strategies, provides valuable context. The projected economic growth rate for 2024-25, global economic trends, and a comparison with other G7 countries offer a broader perspective. The table comparing Canada’s deficit with other G7 countries will highlight the international context of this narrowing deficit.

Budget Deficit Narrowing Context

Canada’s 2024-25 budget deficit is projected to narrow significantly, a welcome development after several years of substantial deficits. This improvement reflects a combination of factors, including economic recovery, government fiscal policy adjustments, and global economic trends. Understanding this context requires examining past performance, current economic conditions, and potential future implications.The recent narrowing of the budget deficit represents a positive shift in Canada’s fiscal health.

This improvement is a testament to the combined effect of various factors. Examining the historical trends, economic conditions, and government strategies provides a clearer picture of this development.

Historical Overview of Canada’s Budget Deficits (2019-2024)

Canada’s budget deficit has fluctuated significantly since 2019. The COVID-19 pandemic and associated economic shutdowns resulted in unprecedented government spending, pushing the deficit to substantial levels. Subsequent recovery efforts and fiscal adjustments are now contributing to the narrowing of the deficit.

Economic Conditions Contributing to Deficits (2019-2023)

Several economic factors influenced Canada’s budget deficits in recent years. The global pandemic significantly impacted supply chains and consumer demand, causing widespread economic disruption. This disruption necessitated government intervention, including stimulus packages and support measures. Increased spending on social safety nets, alongside decreased tax revenue, further contributed to the deficits.

Government Fiscal Policy Strategies (2020-2024)

The Canadian government implemented various fiscal policies to address the economic fallout of the pandemic. These included targeted support programs for businesses and individuals, investments in infrastructure, and adjustments to tax policies. The goal was to stabilize the economy and mitigate the impact of the crisis.

Projected Economic Growth Rate for Canada (2024-25)

Economists project moderate economic growth for Canada in 2024-25. This projected growth, while positive, is not expected to be as robust as in some previous years. Factors such as inflation, global uncertainty, and geopolitical tensions are influencing this projected rate.

Global Economic Trends Influencing Canada’s Fiscal Situation

Global economic trends significantly impact Canada’s fiscal situation. Factors like inflation, interest rate hikes, and global trade tensions affect Canada’s exports and import costs. These global conditions, in turn, influence government revenue and spending. The interconnectedness of the global economy necessitates a comprehensive understanding of these influences.

Comparison of Canada’s Budget Deficit with Other G7 Countries (2024)

| Country | Projected Budget Deficit (in billions of CAD) |

|---|---|

| Canada | Estimated value |

| United States | Estimated value |

| Germany | Estimated value |

| France | Estimated value |

| United Kingdom | Estimated value |

| Italy | Estimated value |

| Japan | Estimated value |

Note: Data for other G7 countries is not available in the given context. This table is intended as a placeholder for comparative data, and accurate figures are needed for a complete comparison.

Canada’s Deficit-to-GDP Ratio (2019-2025)

The deficit-to-GDP ratio provides a more nuanced perspective on Canada’s fiscal health. It shows the proportion of the country’s national debt to its gross domestic product. This ratio allows for a relative comparison over time and in relation to other countries. A comparison of this ratio from 2019 to 2025 will show the evolution of the fiscal situation.

A declining deficit-to-GDP ratio suggests improved fiscal health, while an increasing ratio signals the opposite.

Canada’s 2024-25 budget deficit is looking a bit healthier, narrowing to C$43.15 billion. While this is good news for the Canadian economy, it’s important to consider the broader picture. Factors like the rising cost of certain health conditions, like elevated lipoprotein(a) cholesterol levels, which can impact overall well-being, might be influenced by macroeconomic factors. Understanding what lipoprotein(a) cholesterol is what is lipoprotein lpa cholesterol could offer further insight into the potential health impacts of this improved budget outlook.

Ultimately, a shrinking deficit is a positive sign for Canada’s fiscal health.

Causes of Deficit Narrowing: Canada 202425 Budget Deficit Narrows C4315 Billion

Canada’s 2024-25 budget deficit is projected to narrow significantly. This positive trend is a welcome development, signaling a potential shift in the country’s fiscal health. Understanding the contributing factors is crucial for evaluating the sustainability and long-term implications of this improvement.The reduction in the deficit suggests a more balanced approach to government spending and revenue collection. It implies careful consideration of both expenditure priorities and the potential impact of different fiscal policies.

Canada’s 2024-25 budget deficit is looking a little better, narrowing to C$43.15 billion. This positive fiscal news might suggest a more stable economic outlook, but it’s important to consider the broader context, like Tom Steyer’s argument that climate action is a sound investment opportunity. Tom Steyer’s work on this topic highlights the potential for green initiatives to be profitable while simultaneously addressing environmental concerns.

Ultimately, Canada’s budget deficit reduction is a promising sign for the country’s economic health in the coming fiscal year.

This analysis will delve into the various forces that have played a role in this positive development.

Potential Factors Contributing to the Reduction

Several factors likely contributed to the narrowing of the deficit. Government policies, economic performance, and external market conditions all have a bearing on fiscal outcomes.

- Government Spending Cuts: Reductions in discretionary spending, such as infrastructure projects or social programs, can directly impact the deficit. Targeted cuts in areas like public sector employment or administrative expenses can also reduce spending. The effect of these cuts on the economy and specific societal groups is crucial to consider.

- Tax Policies: Changes in tax rates or the introduction of new taxes can affect government revenue. Higher tax rates or new taxes on specific goods or services can lead to increased government income, which, in turn, can help narrow the deficit. The potential impact on economic activity and compliance should be examined.

- Economic Performance: A strong economy with higher employment rates and increased economic activity generally leads to greater tax revenues. Higher economic growth and improved business performance contribute to higher tax collections. This positive feedback loop is an important factor in the narrowing of the deficit.

- External Factors (Global Commodity Prices): Fluctuations in global commodity prices, such as oil and gas, can influence government revenues and expenses. Changes in global commodity prices can affect the revenue stream for resource-based economies. Understanding how these external factors influence government revenues is crucial to forecasting future deficits.

Impact of Government Spending Cuts, Canada 202425 budget deficit narrows c4315 billion

Government spending cuts can have a significant impact on the budget deficit. These cuts can lead to reduced public services and potentially impact employment and economic growth. A balanced approach that considers the long-term effects of spending reductions on various sectors is critical. For example, cutting back on essential social programs might lead to a reduction in the deficit, but it may have a negative impact on vulnerable populations.

Effect of Tax Policies

Tax policies play a critical role in government revenue. Higher tax rates, new taxes, or changes in tax credits can influence the amount of money collected. A comprehensive understanding of how these policies impact economic behavior is essential to evaluating their effect on the deficit.

Impact of Economic Performance

Economic performance significantly affects the budget deficit. Strong economic growth and high employment rates lead to higher tax revenues, which can help to narrow the deficit. Conversely, economic downturns and recessions typically lead to reduced tax revenues and increased social program spending, thereby widening the deficit.

Influence of External Factors

External factors, such as global commodity prices, can influence government revenues and expenditures. Fluctuations in commodity prices can impact the revenue generated from natural resource exports. For example, a decrease in oil prices can reduce government revenues and increase the deficit. Understanding these influences helps in formulating appropriate fiscal policies.

Revenue Sources and Expenditure Categories (2024-25)

| Revenue Source | Expenditure Category |

|---|---|

| Personal Income Tax | Health Care |

| Corporate Income Tax | Education |

| Sales Tax | Infrastructure |

| Excise Taxes | Social Programs |

| Other Taxes | Public Safety |

Note: This table provides a simplified representation. Actual revenue sources and expenditure categories may include various other subcategories and details.

Impact of the Narrowed Deficit

The Canadian 2024-25 budget deficit narrowing to C$43.15 billion represents a significant shift in fiscal policy. This reduction signals a potential turning point, impacting various facets of the Canadian economy, from investor confidence to government spending priorities. Understanding the ramifications of this deficit reduction is crucial for comprehending its long-term implications for Canada’s economic trajectory.The narrowing deficit reflects a concerted effort to manage public finances.

Canada’s 2024-25 budget deficit is looking a bit better, narrowing to C$43.15 billion. While that’s good news for the economy, it’s worth considering the broader context. It’s interesting to see how cultural events like the Met Gala, specifically the recent references to Josephine Baker, might influence public perception of economic stability, especially when viewed through the lens of historical narratives.

Learning more about these references at josephine baker met gala references could offer a unique perspective on the overall economic climate. Ultimately, a shrinking deficit is a positive sign for Canada’s fiscal health in 2024-25.

This proactive approach suggests a commitment to fiscal responsibility, which, if sustained, can foster economic stability and confidence in the Canadian dollar. However, the impact of this deficit reduction is multifaceted and requires careful consideration of its consequences across different economic sectors.

Implications for the Canadian Economy

The reduced deficit, a positive indicator of fiscal health, has the potential to bolster investor confidence and attract foreign investment. A stable and predictable fiscal environment often correlates with stronger economic growth. However, the exact extent of this impact will depend on a variety of factors, including global economic conditions and the government’s overall economic strategy.

Impact on Public Debt and Sustainability

The narrowing deficit directly contributes to a slower growth rate of public debt. A smaller deficit translates to a smaller accumulation of debt, which can increase the sustainability of the nation’s fiscal position. The reduced borrowing requirement may lead to lower interest rates, which in turn could reduce the cost of borrowing for businesses and individuals, stimulating economic activity.

Potential Effects on Investor Confidence

A shrinking deficit generally signals fiscal prudence and financial stability, factors that are attractive to investors. This can lead to increased foreign investment, which can bolster economic growth and create new job opportunities. Historical examples show that countries with stable fiscal policies tend to attract more investment, fostering economic development.

Effects on Interest Rates and Borrowing Costs

The reduced demand for government borrowing, stemming from the lower deficit, could potentially lead to lower interest rates. This, in turn, would make borrowing cheaper for businesses and individuals, potentially stimulating investment and economic activity. The relationship between deficit reduction and interest rates is complex and depends on various economic factors.

Impact on Government Programs and Services

The reduced deficit provides more flexibility in government spending. The government might reallocate resources towards critical programs or prioritize areas of need, potentially improving service delivery or investing in infrastructure projects. Conversely, maintaining existing programs and services may require careful budgeting and resource allocation decisions.

Projected Impacts on Different Sectors of the Economy

| Sector | Potential Impact |

|---|---|

| Housing | Lower interest rates could potentially stimulate the housing market by making mortgages more affordable. |

| Businesses | Lower borrowing costs could encourage investment and expansion. |

| Consumers | Lower interest rates could lead to increased consumer spending. |

| Government Services | Increased flexibility in funding for programs and services, potentially improving efficiency and efficacy. |

Effect on Future Fiscal Planning

The reduced deficit provides a more stable foundation for future fiscal planning. The government can potentially use this improved fiscal position to address long-term economic challenges, such as infrastructure development or investments in human capital. A reduced deficit creates space for future unexpected economic shocks or policy changes.

Future Fiscal Outlook

The 2024-25 Canadian budget shows a significant narrowing of the deficit, offering a glimpse into the projected fiscal health of the nation. However, the path forward is not without potential hurdles. Understanding the government’s projected deficit for the coming years, alongside the risks and uncertainties, is crucial for assessing the long-term economic stability and the sustainability of current fiscal policies.

Projected Budget Deficits (2026-2028)

The Canadian government’s fiscal projections for the next few years will likely be influenced by several factors, including economic growth, inflation, interest rates, and government spending decisions. Accurate projections are difficult to achieve, as economic forecasts are not precise and can be affected by unforeseen events.

- The projected deficit for 2026-27 is estimated to be $X billion, a slight increase or decrease compared to the current fiscal year, depending on various economic factors. This figure is an estimate based on current projections and is subject to change.

- The 2027-28 deficit is projected to be $Y billion, again, contingent on several key variables, including the performance of the Canadian economy. This number is contingent on assumptions about the economy, and can vary based on how factors like inflation, interest rates, and global events evolve.

- The 2028-29 deficit is expected to be $Z billion, reflecting the ongoing impact of economic factors and government policy decisions. This figure is a snapshot of current expectations, and will likely evolve as conditions change.

Potential Risks and Uncertainties

Economic forecasts are never entirely certain, and several factors could affect the accuracy of these projections. The global economic climate, particularly the performance of key trading partners, will significantly impact the Canadian economy. Geopolitical events, such as international conflicts or trade disputes, can introduce significant volatility.

- Global Economic Slowdowns: A global recession could lead to reduced economic activity in Canada, potentially impacting government revenues and increasing social program costs. Consider the 2008 financial crisis as a real-world example of how global economic downturns can significantly affect a nation’s fiscal outlook.

- Inflationary Pressures: Persistent inflation can erode the purchasing power of government revenues and increase the cost of servicing the national debt. The recent period of high inflation across the globe is a recent example of this type of risk.

- Interest Rate Fluctuations: Changes in interest rates can affect both the cost of borrowing for the government and the returns on investments. Interest rate hikes can significantly impact a country’s budget, increasing debt servicing costs.

Government’s Medium-Term Deficit and Debt Management Plan

The Canadian government has Artikeld a plan to manage its deficit and debt in the medium term. This plan typically involves a combination of spending restraint and revenue generation strategies.

- Spending Prioritization: The government is prioritizing spending in key areas such as healthcare, education, and infrastructure. These areas are often considered essential for long-term economic growth and social well-being.

- Revenue Enhancement Strategies: The government may explore ways to increase tax revenues, such as tax reforms or measures to improve tax collection efficiency. This is often a crucial part of fiscal responsibility, as revenue increases can help to mitigate budget deficits.

Government Priorities for Public Spending and Investment

The government’s priorities for public spending and investment will likely focus on initiatives that support economic growth, enhance social well-being, and improve the country’s infrastructure.

- Infrastructure Development: Investing in infrastructure is frequently cited as a key driver of economic growth and job creation. This could include investments in transportation, communication, and energy infrastructure.

- Healthcare System Modernization: Improving the healthcare system, including modernization of facilities and technologies, is frequently prioritized. This is often seen as crucial for long-term social well-being.

- Education and Skills Development: Investing in education and skills development programs is considered essential for preparing the workforce for future demands and improving productivity.

Comparison with Economic Scenarios

The projected deficit figures should be considered in light of various economic scenarios. For instance, a strong economic recovery could lead to higher tax revenues, thereby potentially reducing the deficit. Conversely, a prolonged economic downturn could lead to higher deficits.

| Economic Scenario | Projected Deficit (2026-27) | Impact |

|---|---|---|

| Strong Economic Growth | $X billion | Lower Deficit |

| Moderate Economic Growth | $Y billion | Moderate Deficit |

| Economic Recession | $Z billion | Higher Deficit |

Illustrative Data Presentation

Canada’s 2024-25 budget deficit narrowing to C$43.15 billion marks a significant shift in the country’s fiscal trajectory. Understanding the historical trends, components, and factors influencing this change is crucial for evaluating the long-term fiscal health of the nation. Visual representations and detailed data analysis can provide a clear picture of the situation.

Budget Deficit Trend Over Time

Canada’s budget deficit has fluctuated considerably over the past two decades. A line graph, plotting the deficit figures against the year, would clearly illustrate this trend. The graph would show years of surpluses interspersed with periods of significant deficits. A key takeaway from this visual representation would be the notable decrease in the deficit in recent years.

This trend signifies a shift in fiscal policy and the government’s approach to managing public finances. Such a visual representation allows for easy comparison of the current situation with past deficits and surpluses.

Components of the Budget Deficit

Understanding the budget deficit involves examining its key components. A pie chart could effectively illustrate the breakdown. The chart would display the proportions of different spending categories contributing to the deficit, such as healthcare, social programs, infrastructure spending, interest payments on the national debt, and other expenses. This breakdown provides insight into the areas where government spending is concentrated and where adjustments may be necessary.

Impact of Factors on the Deficit

Various factors influence Canada’s budget deficit. A series of bar charts, each representing a different factor (e.g., economic growth, interest rates, government spending, tax revenues), could visually demonstrate the relationship between these factors and the deficit. For example, a chart showing a correlation between increased government spending and a widening deficit would clearly highlight the impact of such decisions.

Projected Budget Deficit Over Next Five Years

A bar chart or column graph is an ideal way to visualize projected budget deficits over the next five years. Each bar would represent a fiscal year, with the height corresponding to the projected deficit amount. This visualization would help assess the sustainability of the government’s fiscal policy over the forecast period. For example, a consistent decline in projected deficits would indicate a successful fiscal strategy.

Debt-to-GDP Ratio

A line graph plotting Canada’s debt-to-GDP ratio over time would offer a comprehensive view of the country’s debt burden. The graph would illustrate the trend of the ratio and the fluctuations it has undergone. This representation is essential to understand the long-term implications of the current debt level on the economy. A clear visual representation will allow viewers to gauge the potential impact on economic growth and future borrowing capacity.

Relationship Between Economic Growth and Budget Deficit

A scatter plot, with economic growth rate on one axis and the budget deficit on the other, can effectively illustrate the relationship between these two variables. Each data point would represent a year, with the position on the plot indicating the corresponding values for economic growth and the budget deficit. A visual trend line connecting the points could highlight the general relationship between the two variables.

For example, a negative correlation would indicate that periods of stronger economic growth are often associated with smaller budget deficits.

Conclusion

In conclusion, the narrowing of Canada’s 2024-25 budget deficit to C$43.15 billion presents both opportunities and challenges. The interplay of economic factors, government policies, and global trends paints a complex picture for the Canadian economy. This analysis of the causes, impact, and future outlook of this deficit reduction offers valuable insights for investors, policymakers, and citizens alike.