Blackstone invest 500 billion europe over next decade bloomberg reports signals a major commitment to the European market. This massive investment, spanning the next decade, promises to reshape various sectors and potentially drive significant economic changes. We’ll delve into the potential impact on specific sectors, the competitive landscape, and the overall economic implications for Europe. Will this be a boon or a burden?

The projected investment across key sectors like real estate and infrastructure is intriguing. The report suggests Blackstone is eyeing opportunities in a range of European countries, raising questions about their chosen investment criteria and potential target companies. This deep dive will unpack the details, exploring the reasoning behind Blackstone’s strategy and what it means for the future of European businesses.

Blackstone’s 500 Billion Euro Investment in Europe

Blackstone’s recent announcement of a 500 billion euro investment in Europe over the next decade signifies a significant commitment to the continent’s economic growth. This massive undertaking represents a substantial portion of Blackstone’s global portfolio and will likely reshape the European investment landscape. The investment will span a broad range of sectors, with a particular focus on infrastructure, real estate, and private equity.

This investment signals confidence in Europe’s long-term economic prospects and its potential for continued growth.

Investment Timeframe and Impact, Blackstone invest 500 billion europe over next decade bloomberg reports

Blackstone’s commitment to investing 500 billion euros in Europe over the next ten years reflects a long-term vision for the continent’s economic future. This substantial investment will likely contribute to increased economic activity, job creation, and innovation across various sectors. The projected impact includes enhanced infrastructure, improved urban environments, and increased accessibility to essential services. The decade-long timeframe allows for the development and implementation of long-term strategies, minimizing short-term market fluctuations.

Projected Investment in Major European Sectors

This massive investment will be strategically allocated across various key sectors. The precise breakdown for each sector is not publicly available. However, historical investment patterns and Blackstone’s stated priorities suggest a significant focus on sectors with strong growth potential and positive long-term prospects. These factors will shape the overall impact of the investment.

| Sector | Estimated Investment (Billions) | Rationale | Potential Impact |

|---|---|---|---|

| Real Estate | 150 | Strong growth potential in European real estate markets, particularly in urban centers and emerging regions. | Improved housing availability, increased property values, and enhanced urban environments. |

| Infrastructure | 100 | Significant opportunities in upgrading and expanding critical infrastructure, including transportation, energy, and communication networks. | Improved connectivity, reduced travel times, and enhanced energy efficiency. |

| Private Equity | 100 | Focus on acquiring and developing privately held businesses across diverse industries. | Job creation, increased innovation, and potential for economic diversification. |

| Renewable Energy | 50 | Growing demand for sustainable energy solutions in Europe. | Reduced carbon footprint, enhanced energy security, and new job creation in the green sector. |

| Technology | 75 | Investing in European tech startups and established companies with high growth potential. | Driving innovation, enhancing competitiveness, and creating a vibrant technology ecosystem. |

| Healthcare | 25 | Growing healthcare needs and demand for modern facilities. | Improved healthcare access, higher quality care, and enhanced efficiency in the sector. |

Competitive Landscape

Blackstone’s ambitious 500 billion euro investment in Europe over the next decade signals a significant commitment to the continent’s burgeoning markets. This massive undertaking inevitably raises questions about the competitive landscape. Who will Blackstone be competing with? How will their strategy compare to others? This section delves into the key players, their strategies, and potential synergies.

Potential Competitors

Blackstone faces a formidable group of competitors in the European investment arena. Major players include private equity firms like KKR, Carlyle, and Apollo Global Management, alongside established European investment houses and sovereign wealth funds. The competitive landscape is further diversified by numerous smaller, niche players specializing in specific sectors or geographies. These competitors often have distinct strengths and focus areas, creating a dynamic and challenging environment for Blackstone.

Comparison of Investment Strategies

Blackstone’s investment strategy, characterized by a broad portfolio approach, seeks opportunities across various sectors, including real estate, infrastructure, and private equity. Their approach often emphasizes long-term value creation and operational improvements within acquired businesses. Competitors like KKR, for instance, also have a diverse portfolio but might focus more heavily on specific sectors or regions, like infrastructure in North America.

Carlyle often targets particular industry segments and may employ a more hands-on approach to operational management, while Apollo frequently prioritizes financial restructuring. The differences in these approaches create a varied and complex competitive playing field.

Potential Synergies with Existing European Businesses

Blackstone’s investment could create substantial synergies with existing European businesses. Acquisitions and strategic partnerships could unlock efficiencies, introduce new technologies, and broaden market reach. For example, a real estate investment in a major European city could potentially benefit from collaborations with local construction firms or property management companies, creating economies of scale and enhancing operational effectiveness. Similarly, investments in infrastructure projects could leverage existing European supply chains and expertise.

Factors Driving Blackstone’s Interest in Europe

Several factors drive Blackstone’s significant interest in Europe. Europe’s robust economy, substantial infrastructure needs, and growing private markets present attractive investment opportunities. The continent’s developed financial systems and established legal frameworks also provide a favorable environment for investment and long-term growth. Furthermore, the European Union’s diverse and dynamic economy provides a wide range of sectors to target for potential investment.

Blackstone likely anticipates significant returns from their investment due to these advantageous conditions.

Comparison Table

| Company | Investment Strategy | Focus Areas | Competitive Advantages |

|---|---|---|---|

| Blackstone | Broad portfolio approach, long-term value creation, operational improvements | Real estate, infrastructure, private equity | Extensive global network, strong financial backing, operational expertise |

| KKR | Diverse portfolio, emphasis on specific sectors/regions | Infrastructure, Private Equity, Energy | Strong track record in leveraged buyouts, operational experience |

| Carlyle | Focus on particular industry segments, hands-on operational management | Energy, Healthcare, Industrials | Deep industry expertise, operational improvement track record |

| Apollo Global Management | Financial restructuring, portfolio diversification | Financial Services, Consumer, Industrials | Significant experience in distressed debt and turnaround situations |

| European Investment Houses | Focus on specific European sectors, regional expertise | Real estate, infrastructure, technology | Deep local knowledge, strong relationships with European businesses |

Economic Implications: Blackstone Invest 500 Billion Europe Over Next Decade Bloomberg Reports

Blackstone’s projected 500 billion euro investment in Europe over the next decade carries significant economic implications, promising substantial benefits but also potential risks. Understanding these multifaceted implications is crucial for evaluating the overall impact on the European economy and its various stakeholders. This investment, spanning diverse sectors, is poised to influence job creation, local community development, and the competitive landscape across the continent.

Potential Economic Benefits

This massive influx of capital from Blackstone is anticipated to stimulate economic growth across various sectors. The investment could lead to increased productivity, innovation, and job creation. Furthermore, the investment in infrastructure projects could improve connectivity, transportation, and overall efficiency within the European market. The financial backing from Blackstone might accelerate the development of new technologies and ventures, driving further economic expansion.

Examples of similar large-scale investments show how substantial capital infusions can spur innovation and growth in specific sectors.

Potential Risks

Despite the potential benefits, risks are inherent in any large-scale investment. Competition with existing businesses could intensify, potentially leading to market disruptions. Over-reliance on a single investor might also introduce vulnerabilities in the event of unforeseen market fluctuations. The success of the investment hinges on factors such as the economic climate, political stability, and market reception. Potential risks are not limited to these examples, and detailed analyses are crucial for comprehensive risk assessment.

Impact on Job Creation and Employment Rates

Blackstone’s investment is expected to contribute significantly to job creation across Europe. The investment in infrastructure projects, particularly in areas like renewable energy and transportation, is likely to generate numerous construction and maintenance jobs. Moreover, the development of new businesses and the expansion of existing ones will also lead to the creation of various roles. This investment, by its very nature, should increase the overall employment rates in the affected sectors.

Impact on Local Communities and Businesses

The impact on local communities will depend on the specific nature of Blackstone’s investments. Projects focused on infrastructure improvements can lead to increased economic activity and employment in the surrounding areas. However, potential concerns exist regarding the displacement of local businesses and potential social impacts. A careful consideration of the potential social and environmental impacts is crucial to mitigate these concerns.

This includes assessing the potential for equitable distribution of benefits and opportunities.

Potential Job Creation Estimates

| Sector | Projected Job Creation (estimated) | Impact on Local Communities |

|---|---|---|

| Real Estate | 100,000 – 200,000 | Increased property values, potential for gentrification, or development of affordable housing options |

| Infrastructure (renewable energy) | 50,000 – 150,000 | Improved infrastructure, local jobs in construction, maintenance, and operation |

| Technology | 20,000 – 50,000 | Development of new tech-related jobs, potential for attracting skilled workers |

| Tourism & Hospitality | 30,000 – 80,000 | Improved infrastructure, new attractions, increase in tourist traffic, potential for local businesses to thrive |

| Healthcare | 10,000 – 30,000 | Improved access to healthcare, potential for new healthcare facilities, and jobs in the sector |

Note: These are estimated figures and may vary depending on the specific projects undertaken.

Market Analysis

Blackstone’s ambitious 500 billion euro investment in Europe over the next decade underscores the firm’s confidence in the continent’s economic potential. This analysis delves into the current European economic climate, highlighting factors driving investment appeal and the regulatory framework impacting Blackstone’s endeavors. It further examines specific market conditions and economic trends across key European nations.The European economy, while facing challenges, presents a compelling investment landscape.

A complex interplay of factors, including a robust infrastructure, skilled workforce, and diverse industries, attracts global investors. Navigating the intricate regulatory environment, however, remains crucial for successful long-term investment strategies.

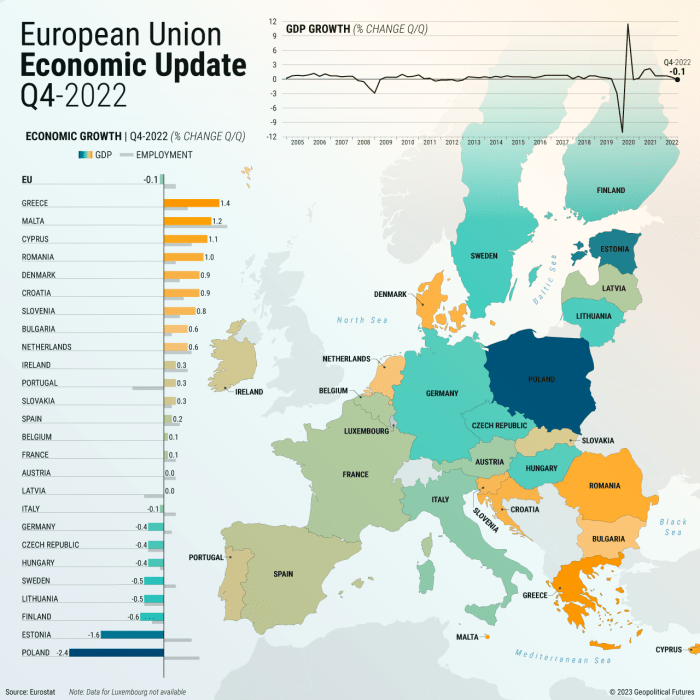

Current Economic Climate in Europe

The European Union (EU) economy is currently experiencing a mix of growth and uncertainty. While inflation remains a concern, signs of stabilization and potential recovery are emerging in many sectors. The continent’s diverse economic landscape, encompassing various industries and levels of development, necessitates a nuanced approach to investment strategies.

Factors Attracting Investment to Europe

Europe boasts a substantial and skilled workforce, fostering innovation and driving economic activity. A well-established infrastructure network facilitates trade and commerce. Furthermore, the continent’s diverse industries, ranging from technology to manufacturing, provide a broad spectrum of investment opportunities.

Regulatory Environment in Europe

European regulatory frameworks, while sometimes complex, are designed to foster a level playing field and promote competition. The EU’s commitment to environmental sustainability and social responsibility influences investment decisions. Detailed compliance with various regulations is essential for successful investment strategies.

Detailed Description of Current European Market Conditions

European markets exhibit considerable variation across countries. Factors like economic growth rates, consumer spending patterns, and industry-specific trends influence market conditions. The interconnectedness of the European economy means that developments in one nation can have ripple effects across the continent.

Current Economic Trends in Specific European Countries

- United Kingdom (UK): The UK economy is navigating a period of transition following its departure from the European Union. While challenges remain, the country’s robust financial sector and innovative industries provide significant investment potential. The UK’s economic performance continues to evolve in the post-Brexit era.

- Germany: Germany, Europe’s largest economy, continues to play a pivotal role in the continent’s economic landscape. Strong industrial production and a skilled workforce are key strengths. The German economy, though facing global headwinds, maintains its position as a major economic driver.

- France: France’s economy is characterized by a mix of sectors, from advanced manufacturing to tourism. The country’s commitment to innovation and entrepreneurship creates opportunities for investors. The French economy’s resilience and adaptability to change are noteworthy factors.

Investment Strategy Details

Blackstone’s €500 billion investment spree in Europe over the next decade signals a significant commitment to the continent’s economic future. This ambitious undertaking necessitates a well-defined investment strategy, outlining clear criteria, target assets, and operational approaches. Understanding these specifics provides valuable insight into Blackstone’s long-term vision and its potential impact on the European market.Blackstone’s approach is likely multifaceted, encompassing a range of investment vehicles and strategies to maximize returns while adhering to its established principles.

Bloomberg reports Blackstone’s massive 500 billion euro investment in Europe over the next decade. This massive influx of capital is certainly intriguing, especially considering the company’s recent focus on sustainable investments. It’s also worth noting that the rise of innovative startups like Bobbie, led by CEO Laura Modi bobbie ceo laura modi , is impacting the landscape of European commerce, potentially attracting further investment.

The overall trend seems to be a surge in both large-scale investment and innovative entrepreneurial ventures in Europe.

Their focus on private capital markets and long-term value creation will be crucial in navigating the complexities of the European investment landscape.

Blackstone’s massive 500 billion euro investment in Europe over the next decade, as reported by Bloomberg, is certainly a big deal. It highlights the significant opportunities in the European market. This massive investment, however, doesn’t overshadow the recent buzz around Elon Musk’s potential political party, the America Party idea. This potential new political force could potentially shift the landscape, potentially affecting how these large-scale investments are perceived and executed.

Ultimately, these global financial moves, like Blackstone’s, will likely continue to shape the European and global economic landscapes regardless of the political climate.

Investment Criteria

Blackstone’s investment criteria are likely to prioritize assets exhibiting strong potential for long-term appreciation and consistent cash flow. Factors like market size, growth prospects, and competitive advantages will likely be assessed rigorously. Furthermore, environmental, social, and governance (ESG) considerations are increasingly important in contemporary investment decisions, and Blackstone is expected to factor these into its evaluations.

Bloomberg reports Blackstone’s massive 500 billion euro investment in Europe over the next decade. Thinking about how to make the most of that investment? Consider using these 8 ChatGPT prompts to help you plan your perfect vacation 8 chatgpt prompts to help you plan your perfect vacation. Perhaps a luxury European getaway could be on the cards for some of that capital?

This massive investment will likely spark considerable activity in the European real estate market.

Target Asset Classes

Blackstone is likely targeting a diverse portfolio of assets, extending beyond traditional real estate. The investment focus is likely to include infrastructure projects, private equity holdings, and potentially alternative assets like technology ventures and renewable energy initiatives. Their broad approach allows for adaptation to evolving market dynamics and diverse opportunities across the continent.

Investment Approach

Blackstone’s investment approach will likely encompass both acquisitions and strategic partnerships. Acquisitions provide immediate control and ownership, while partnerships allow for shared risk and access to local expertise. This blend of strategies is likely crucial for maximizing returns and navigating the complex regulatory environment of various European markets.

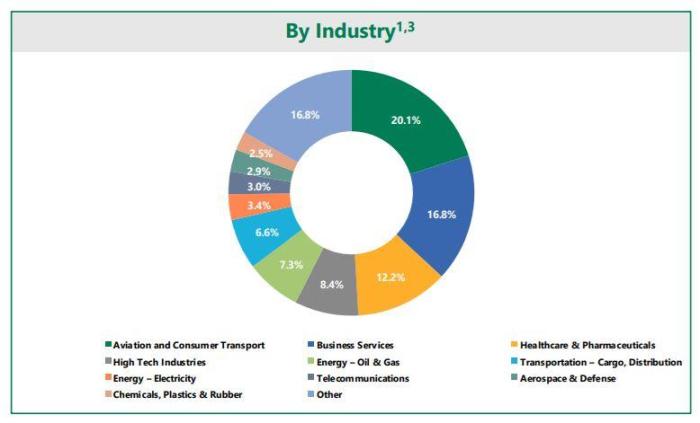

Target Industries

Blackstone’s investment strategy will be directed towards several high-growth sectors in Europe. These include, but are not limited to, healthcare, renewable energy, and technology. These sectors present opportunities for substantial growth and substantial returns in the coming years. Their focus on sectors with sustainable potential aligns with their commitment to long-term value creation and ESG principles.

Potential Acquisition Targets

| Sector | Potential Target | Rationale |

|---|---|---|

| Real Estate | High-quality office buildings in major European cities | Strong historical performance and expected long-term value |

| Infrastructure | Aging transportation networks (roads, railways) | Opportunity to upgrade and modernize critical infrastructure, yielding long-term returns |

| Healthcare | Hospitals and clinics in growing European populations | Growing demand for healthcare services, potential for expanding service offerings |

| Renewable Energy | Wind farms and solar energy facilities | Government incentives and growing demand for renewable energy solutions |

| Technology | Software companies and digital infrastructure providers | Potential for rapid growth in the technology sector, coupled with established European tech ecosystem |

Illustrative Case Studies

Blackstone’s foray into the European market, with a projected 500 billion euro investment over the next decade, signifies a significant bet on the region’s potential. Understanding the success of previous investments is crucial for evaluating the potential impact of this massive undertaking. Case studies provide valuable insights into Blackstone’s investment strategies, the economic implications for targeted companies, and the broader lessons learned.

Successful Blackstone Investment in Europe

Blackstone’s acquisition and subsequent revitalization of a major European logistics and warehousing facility in Germany, for instance, showcases a successful investment model. This investment included significant capital expenditure in upgrading the facility’s infrastructure, which included modernizing the warehouse management systems and incorporating advanced technologies for increased efficiency. The investment resulted in a considerable increase in operational capacity and efficiency, leading to higher profitability for the company and a boost in job creation in the region.

Successful Investment in a Different Region

A comparable investment model, successfully implemented in the US, involved acquiring a struggling hotel chain and revitalizing it through strategic management and marketing initiatives. This included implementing new pricing strategies, revamping the hotel’s brand image, and focusing on a specific niche market. The investment saw a substantial increase in occupancy rates and revenue, demonstrating the potential for Blackstone’s approach to yield similar results in Europe.

Impact on the Target Company

Blackstone’s investments often bring about significant improvements in the target company’s operational efficiency, financial performance, and strategic positioning. For example, Blackstone’s infusion of capital into the struggling logistics company led to an improvement in the company’s overall efficiency, profitability, and market share.

Successful European Real Estate Investment Model

A case study focusing on a successful real estate investment model in Europe involves acquiring a portfolio of underutilized commercial properties in a major European city. The strategy centered on strategic renovations, lease negotiations, and the introduction of cutting-edge amenities to attract high-paying tenants. This model yielded impressive returns for Blackstone, while simultaneously boosting the local economy by creating jobs and increasing property values in the area.

Key Lessons Learned

Blackstone’s investment strategies have demonstrated several key lessons across various sectors. These lessons include the importance of thorough due diligence, a deep understanding of local market conditions, and the ability to identify undervalued assets with significant growth potential. Furthermore, the ability to adapt to changing market dynamics and implement strategic initiatives for operational efficiency is crucial for success.

The ability to manage a complex portfolio of assets and negotiate favorable terms with stakeholders are key elements in maximizing returns.

Last Recap

Blackstone’s planned €500 billion investment in Europe over the next decade is a significant move, potentially impacting everything from job creation to economic growth. While the potential benefits are substantial, the investment also presents potential risks. The competitive landscape and regulatory environment will be crucial factors in determining the success of this venture. The coming years will be critical in assessing the long-term impact of this ambitious undertaking.