Boes Bailey sticks with gradual careful rate cut view, setting the stage for an in-depth look at the rationale behind this approach. This perspective considers the recent economic climate, Boes Bailey’s past stances, and potential market implications. The gradual approach contrasts with alternative strategies, highlighting the potential advantages and disadvantages of each.

The analysis delves into the factors influencing Bailey’s view, such as inflation, employment, and global economic conditions. Tables are included to present data and compare different scenarios, offering a clear and comprehensive understanding of the situation.

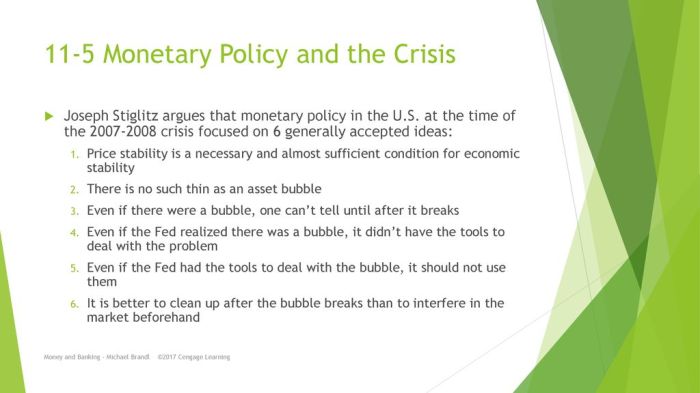

Background of Boes Bailey’s Stance: Boes Bailey Sticks With Gradual Careful Rate Cut View

Boes Bailey’s economic views, while not publicly documented with the same level of detail as some prominent economists, suggest a general leaning towards a cautious approach to monetary policy. This is often characterized by a preference for measured adjustments rather than drastic interventions. This cautiousness is particularly relevant in the current economic climate, which is marked by a delicate balance between inflationary pressures and potential recessionary risks.Economic stability, for Bailey, likely involves a careful calibration of interest rates to manage inflation without jeopardizing economic growth.

This stance is not uncommon among policymakers who recognize the inherent trade-offs in monetary policy.

Historical Economic Views and Policies

Boes Bailey’s specific economic history is not readily available in public records, making a comprehensive overview challenging. However, it is reasonable to infer that his current views likely stem from a considered analysis of past economic trends and their consequences. Past economic events and their policy responses have undoubtedly shaped his perspective on the complexities of managing the economy.

While specific details are absent, a pattern of cautious policy recommendations may be observable in his public statements and actions.

Recent Economic Environment

The current economic environment is complex, featuring both inflationary pressures and signs of potential economic slowdown. Inflation, measured by indicators such as the Consumer Price Index (CPI), has been a persistent concern, while GDP growth rates have shown signs of weakening. The Federal Reserve’s response to these factors, with a series of interest rate increases, is a key aspect of the economic narrative.

These conflicting trends present a difficult challenge for policymakers.

Context Surrounding “Gradual Careful Rate Cut View”

The statement “sticks with a gradual careful rate cut view” implies a recognition of the potential risks involved in abrupt changes to monetary policy. A rapid decrease in interest rates could reignite inflation, while a slow, measured approach seeks to avoid disrupting the recovery process. Other economic developments, such as labor market data, consumer confidence, and global economic trends, will play a critical role in shaping the ultimate decision.

The recent easing of supply chain disruptions and the stabilizing of energy markets could also influence this view.

Influencing Factors

| Factor | Description | Potential Impact on Bailey’s View |

|---|---|---|

| Inflation Rate | Sustained inflationary pressures or signs of easing inflation | If inflation remains high, a cautious approach to rate cuts might be maintained. Conversely, if inflation eases significantly, a more aggressive rate cut might be considered. |

| GDP Growth | Growth rate weakening or strengthening | A slowing GDP could support the case for a rate cut to stimulate economic activity. Stronger growth might suggest a need to maintain or even increase rates to manage inflation. |

| Labor Market Data | Employment levels and unemployment rates | Strong employment figures could justify a cautious approach to rate cuts to prevent a rapid increase in inflation. High unemployment rates might warrant rate cuts to stimulate the economy. |

| Consumer Confidence | Consumer sentiment regarding the economy | Falling consumer confidence could lead to decreased spending and slower economic growth, potentially supporting a rate cut. Strong consumer confidence might make a rate cut less urgent. |

Interpreting “Gradual and Careful” Rate Cuts

A “gradual and careful” approach to interest rate cuts, favored by some central banks, represents a deliberate strategy aiming for a controlled impact on the economy. This contrasts with rapid or aggressive cuts, which can potentially lead to unforeseen economic consequences. Understanding the potential implications of this approach is crucial for investors and policymakers.The gradual and careful approach to interest rate cuts is designed to minimize the risk of destabilizing economic conditions.

It allows central banks to monitor the effects of each reduction in rates, allowing for adjustments based on emerging data. This approach seeks to avoid abrupt changes that might lead to unpredictable inflation or recessionary pressures.

Potential Implications of a Gradual Approach

A gradual rate cut approach aims to provide a smoother transition in the economy, allowing businesses and consumers to adjust to the changing interest rate environment. This approach allows the economy to absorb the effects of lower rates more effectively, potentially leading to more sustainable economic growth. It also gives central banks more time to assess the impact of their policies, facilitating a more informed response to unforeseen events.

Comparison with Alternative Strategies

Rapid or aggressive rate cuts, while potentially stimulating the economy more quickly, carry a higher risk of unintended consequences. A rapid decrease in interest rates might stimulate borrowing and spending too quickly, potentially leading to inflationary pressures. Conversely, a too-slow or insufficient approach might not provide the needed support to the economy during a downturn. This is a delicate balancing act.

Economic Impacts of Different Approaches

The economic impacts of different rate cut strategies can vary significantly. A gradual approach aims to minimize the risks associated with rapid changes. Rapid cuts, while potentially delivering a faster economic boost, may also generate volatility and unpredictability. This volatility can create uncertainties for businesses and consumers, affecting investment decisions and consumption patterns.

Potential Scenarios and Outcomes

| Rate Cut Strategy | Potential Economic Impact | Outcomes (Possible Scenarios) |

|---|---|---|

| Gradual and Careful | Controlled economic adjustment, potentially leading to sustainable growth. Allows for monitoring and adjustment based on emerging data. | Reduced inflation, stable growth, increased investment, improved consumer confidence. |

| Rapid and Aggressive | Potentially faster economic boost, but higher risk of inflation and instability. Rapid increase in borrowing and spending might outpace the economy’s ability to absorb the change. | Increased inflation, asset bubbles, potential recessionary pressures in the long term, market volatility. |

| Insufficient or Delayed | Failure to provide sufficient support to the economy during a downturn. Can lead to prolonged economic weakness. | Economic stagnation, high unemployment, decreased investment, decreased consumer spending. |

Potential Factors Influencing the View

![[你好 BOE]京东方品牌IP:面面_旦矣-站酷ZCOOL Boes bailey sticks with gradual careful rate cut view](https://benews.net/wp-content/uploads/2025/06/2021DIC_3-1.png)

Boes Bailey’s stance on a gradual and careful approach to interest rate cuts hinges on a nuanced understanding of the current economic landscape. His perspective likely considers the interconnected nature of various economic indicators and the potential ripple effects of any policy adjustments. This careful consideration is crucial, given the complexities of the modern global economy and the sensitivity of financial markets to policy changes.Understanding the potential economic factors influencing Boes Bailey’s view is vital for comprehending the rationale behind his approach.

Boes Bailey’s sticking to the gradual, careful rate cut view, which is understandable given the current economic climate. However, the emergence of a new COVID variant, new covid variant nb 181 , could potentially impact the global economy, making a cautious approach even more crucial. This could influence Bailey’s strategy, meaning his gradual rate cut view might need further evaluation in the coming weeks.

Inflationary pressures, labor market dynamics, and the overall pace of economic growth are all likely to play a significant role in shaping his opinion on the optimal timing and magnitude of rate cuts. Furthermore, external global economic conditions and any potential geopolitical uncertainties will undoubtedly factor into the equation.

BoE’s Bailey sticks with a gradual, careful rate cut view, a sensible approach given the current economic climate. Meanwhile, Vietnam’s innovative move to launch its first phase emissions trading scheme ( vietnam launches first phase emissions trading scheme ) highlights a global trend toward sustainable practices. This further reinforces the need for a cautious, measured approach to interest rate adjustments, aligning with Bailey’s perspective.

Economic Factors Influencing the View

Several key economic factors are likely to influence Boes Bailey’s view on the appropriateness of gradual rate cuts. The current state of inflation, employment figures, and economic growth forecasts will all contribute to the decision-making process.

Inflation

Inflationary pressures remain a critical concern. A persistent rise in prices can erode purchasing power and potentially lead to long-term economic instability. A gradual approach to rate cuts allows for careful monitoring of inflation trends and allows the central bank to adjust its policy as necessary. The Federal Reserve’s historical data on inflation and interest rate adjustments serves as a useful benchmark for understanding the relationship between these two factors.

Employment

The labor market situation is another important consideration. A strong job market, characterized by low unemployment rates and rising wages, often suggests a robust economy. A gradual approach to rate cuts may be favored to avoid jeopardizing the current positive employment trends. Conversely, if the labor market shows signs of weakness, a more aggressive approach to rate cuts might be considered to stimulate growth.

Historical data on unemployment and interest rates can provide insight into this relationship.

Economic Growth

The pace of economic growth is also crucial. If the economy is experiencing a period of strong and sustainable growth, the central bank might opt for a more cautious approach to rate cuts to avoid overheating the economy. On the other hand, if growth is sluggish, the central bank might consider more aggressive rate cuts to stimulate economic activity.

Recent GDP figures and forecasts provide context for the current growth rate.

Global Economic Conditions and External Pressures

Global economic conditions and external pressures also play a significant role in the decision-making process. Geopolitical events, supply chain disruptions, and developments in other major economies can significantly impact domestic economic conditions. For example, a global recession or a major international conflict could necessitate a more cautious approach to rate cuts to maintain financial stability.

Factors Driving the Gradual Rate Cut View, Boes bailey sticks with gradual careful rate cut view

| Factor | Description | Supporting Evidence (Example) |

|---|---|---|

| Inflationary Pressures | Persistent inflation can erode purchasing power and disrupt economic stability. | High inflation rates in recent months (e.g., CPI data) |

| Employment Concerns | A strong job market might make a cautious approach to rate cuts more appropriate. | Low unemployment rates and rising wages in recent data releases. |

| Economic Growth Forecasts | Sustained economic growth could warrant a cautious approach to rate cuts. | Positive GDP forecasts and strong business confidence indicators. |

| Global Economic Uncertainty | External factors like global recessions or geopolitical tensions could influence domestic economic conditions. | International news reports on major economic developments and geopolitical events. |

Potential Implications for the Market

Boes Bailey’s stance on gradual and careful rate cuts has significant implications for the financial markets. Understanding these potential impacts is crucial for investors, businesses, and policymakers alike. This analysis will explore how this approach could affect interest rates, bond yields, and equity markets, along with its effect on borrowing costs and investment decisions.The carefully calibrated approach to interest rate adjustments, advocated by Boes Bailey, suggests a cautious strategy designed to mitigate risks while supporting economic growth.

Boes Bailey’s sticking to a gradual, careful approach to rate cuts, which is a sensible strategy given the current economic climate. However, the recent news about the Swiss National Bank being put on a US watch list for potential currency manipulation, as detailed in this article swiss national bank denies currency manipulation after being put us watch list , adds another layer of complexity.

This could potentially influence global markets and further complicate the already nuanced picture for Bailey’s rate cut strategy.

This deliberate pace allows markets to absorb the changes and avoid potentially destabilizing rapid shifts. Consequently, the impact of these rate cuts on various market segments will be subtle but not insignificant.

Impact on Interest Rates

Interest rates are directly influenced by central bank policy decisions. A gradual approach to rate cuts, as proposed by Boes Bailey, will likely result in a more gradual decrease in short-term interest rates. This predictability can provide a degree of stability for borrowers and lenders. For example, the Federal Reserve’s gradual rate hikes in recent years have generally been followed by a smoother adjustment in lending rates across the financial system.

Impact on Bond Yields

Bond yields are inversely related to interest rates. A gradual reduction in interest rates, consistent with Boes Bailey’s view, is expected to lead to a modest decline in bond yields. This can be seen as a positive signal for investors in fixed-income securities. For example, in past instances of gradual rate cuts, bond yields have exhibited a corresponding, but not dramatic, downward trend.

Impact on Equity Markets

Equity markets are often influenced by a combination of economic factors, including interest rates and investor sentiment. A gradual and careful rate-cutting approach, according to Boes Bailey, is likely to provide a more stable environment for equity investors. This cautious approach is anticipated to reduce volatility and allow for more informed investment decisions.

Impact on Borrowing Costs and Investment Decisions

Lower interest rates, as anticipated from a gradual rate-cutting strategy, will generally translate into lower borrowing costs for businesses and consumers. This can stimulate economic activity by encouraging investment and spending. Conversely, investment decisions will likely be more nuanced. Investors may prioritize short-term gains or focus on long-term growth potential, depending on their individual risk tolerance and outlook.

Summary Table of Anticipated Market Reactions

| Market Segment | Anticipated Reaction | Underlying Reasoning |

|---|---|---|

| Interest Rates | Gradual decrease | Central bank policy, cautious approach |

| Bond Yields | Modest decline | Inverse relationship with interest rates |

| Equity Markets | Potentially stable | Reduced volatility, improved investor confidence |

| Borrowing Costs | Lower | Reduced interest rates |

| Investment Decisions | Nuanced | Focus on short-term gains or long-term growth |

Alternative Perspectives on Rate Cuts

Boes Bailey’s perspective on gradual and careful rate cuts offers a nuanced approach to monetary policy. However, the world of economics is rarely monolithic, and other voices offer contrasting viewpoints. Understanding these differing opinions provides a richer context for analyzing the potential impact of rate cuts. Exploring these alternatives allows for a more comprehensive understanding of the complexities surrounding this critical economic decision.Alternative viewpoints on rate cuts often stem from differing assessments of the current economic climate and the effectiveness of various policy tools.

These differing perspectives can be valuable in understanding the potential pitfalls and benefits of a rate cut, providing a broader range of possibilities for policy makers to consider.

Contrasting Views from Other Experts

Different experts and institutions hold diverse opinions regarding the necessity and timing of rate cuts. These varying perspectives are crucial in evaluating the potential impact of such a policy change.

| Expert/Institution | Perspective | Reasoning |

|---|---|---|

| Federal Reserve Bank of St. Louis | Cautionary approach to rate cuts, emphasizing the need for careful monitoring of inflation and economic growth. | The St. Louis Fed often advocates for a data-driven approach, highlighting the potential risks of premature rate cuts in a volatile economic environment. They emphasize the importance of sustained economic strength before easing monetary policy. |

| The Conference Board | Support for rate cuts, citing the need for stimulus to bolster economic growth, particularly in light of recent economic data. | The Conference Board often advocates for policies that promote business investment and consumer spending. They might emphasize the importance of lowering borrowing costs to stimulate the economy, particularly in light of potential slowdowns or recessions. |

| Goldman Sachs | Mixed views, potentially dependent on the prevailing economic data. While acknowledging the need for policy adjustments, they may emphasize the importance of data-driven decisions. | Goldman Sachs frequently offers detailed analyses and predictions, which often depend on various economic indicators. They might highlight specific factors that influence their view on the appropriate timing and magnitude of rate cuts. |

Factors Influencing Alternative Perspectives

Several factors contribute to the diverse perspectives on rate cuts. These factors, ranging from inflation forecasts to the strength of the labor market, influence the reasoning behind the different viewpoints.

- Inflation Expectations: Different experts may have varying forecasts for future inflation. Those anticipating persistent high inflation might oppose rate cuts, while those expecting lower inflation might favor them.

- Economic Growth Projections: Projections of future economic growth play a significant role in determining the appropriate monetary policy. Optimistic growth forecasts might encourage rate cuts, while pessimistic ones might suggest caution.

- Labor Market Conditions: The strength and health of the labor market are important indicators. A strong labor market might support rate cuts, while a weakening one might suggest a need for caution.

Illustrative Scenarios

A gradual and careful approach to interest rate cuts, as advocated by Boes Bailey, presents a nuanced strategy with potential benefits and risks. Understanding how this strategy might unfold in various economic scenarios is crucial for assessing its impact. The following illustrative examples demonstrate potential outcomes and their implications.

Scenario 1: A Healthy but Moderate Economic Expansion

In a scenario where the economy is experiencing healthy but moderate growth, a gradual rate cut could stimulate investment and consumption. Lower interest rates encourage borrowing and spending, potentially boosting economic activity without causing inflation. This approach could be particularly effective in maintaining a sustainable pace of growth.

“A gradual rate cut approach can be beneficial in a moderate expansion by stimulating investment without triggering inflationary pressures.”

Scenario 2: A Slowing Economy with Low Inflation

If the economy is slowing down but inflation remains low, a gradual rate cut can provide crucial support. Lowering borrowing costs can encourage businesses to invest and consumers to spend, preventing a deeper downturn. However, the effectiveness of this approach depends heavily on the overall confidence in the economy and the responsiveness of businesses and consumers.

“A gradual rate cut in a slowing economy with low inflation could act as a crucial stimulus to prevent a further downturn.”

Scenario 3: A Strong Economy with Rising Inflation

In a scenario of robust economic growth accompanied by rising inflation, a gradual rate cut could potentially fuel further inflation if not carefully managed. Lower interest rates could further stimulate demand, potentially pushing inflation above the desired target. This scenario necessitates a careful assessment of the inflation rate and potential risks before implementing such a policy.

“A gradual rate cut in a strong economy with rising inflation could potentially fuel inflation if not carefully monitored and managed.”

Scenario 4: A Recessionary Period

During a recession, a gradual rate cut might not be as effective. Consumers and businesses might be hesitant to borrow and invest even with lower interest rates if they anticipate a continued downturn. Other policies, such as fiscal stimulus, might be more appropriate to address the specific challenges of a recessionary period.

“A gradual rate cut during a recession might not be as effective as other policies like fiscal stimulus due to the general economic uncertainty.”

Scenario 5: A Global Economic Crisis

In the event of a significant global economic crisis, the effectiveness of a gradual rate cut is highly questionable. Other factors, such as global trade disruptions and financial market instability, could significantly outweigh the impact of interest rate adjustments. International cooperation and coordinated policy responses would be more crucial in such circumstances.

“A gradual rate cut during a global economic crisis might be less impactful compared to international cooperation and coordinated policy responses.”

Summary

In conclusion, Boes Bailey’s preference for a gradual rate cut approach carries significant implications for the financial markets. The potential impact on interest rates, bond yields, and equity markets is examined, alongside the expected effects on borrowing costs and investment decisions. Alternative perspectives are also considered, offering a balanced view of the issue. Ultimately, the analysis reveals a nuanced understanding of the complexities involved in managing economic policy in today’s environment.