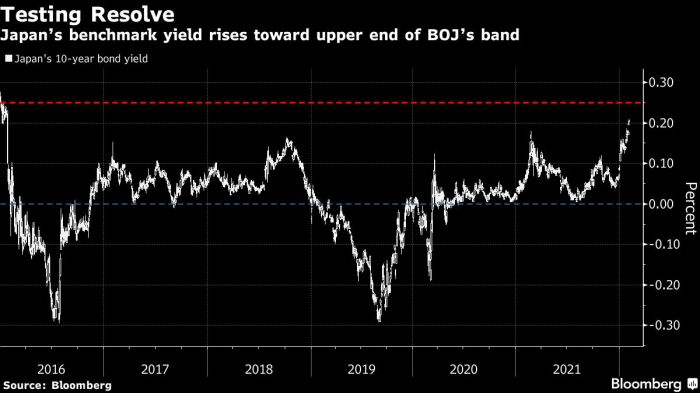

BOJ consider slowing bond taper market jitters persist. Current market conditions are a complex mix of economic indicators like inflation, interest rates, and GDP growth. Recent volatility in the bond market, influenced by global events, reflects broader market sentiment. Investor confidence is also a key factor, along with risk appetite. The table below highlights key economic indicators and their recent performance.

The potential consequences of slowing or halting the bond taper include adjustments to interest rates and borrowing costs, impacting various sectors. Financial institutions and investors are likely to react to any change in the bond tapering strategy. A comparison of different tapering scenarios (slow down, halt, resumption) with their expected impact on interest rates, inflation, and market volatility will be presented in the following sections.

Market Context

The recent market jitters, stemming from concerns about the Federal Reserve’s bond tapering strategy, have largely subsided. While the tapering process continues, investor sentiment appears to be adjusting to the evolving economic landscape. This period of relative calm provides an opportunity to assess the current market context and anticipate potential future trends.

The Bank of Japan (BOJ) considering slowing its bond taper is a response to persistent market jitters. This is a significant move, but it’s worth noting that other global factors are also at play. For instance, Mark Carney’s leadership strategy on climate change in Canada and Mexico, detailed in mark carney canada mexico climate leadership strategy , highlights the importance of international cooperation in tackling these issues.

Ultimately, the BOJ’s decision to potentially slow the taper reflects the complex interplay of economic factors and global challenges.

Current Market Conditions

Current market conditions are characterized by a cautious optimism. Inflation remains a persistent concern, although recent data suggests a potential softening trend. Interest rates, influenced by the Fed’s actions, continue to rise, impacting borrowing costs and potentially slowing economic growth. Preliminary GDP growth figures point to a moderate expansion, but uncertainties persist regarding the overall economic trajectory.

Recent Market Trends and Volatility

Recent market trends indicate a pullback from the extreme volatility witnessed in the prior period. The bond market, in particular, has seen some stabilization, reflecting a reduced level of uncertainty regarding the Fed’s policy path. This stabilization is linked to the broader market sentiment, which is shifting towards a more measured approach. Global events, such as geopolitical tensions or supply chain disruptions, continue to influence market sentiment but have not exerted a significant, immediate impact.

Potential Impact of Global Events

Global events, including geopolitical uncertainties and supply chain disruptions, continue to exert an influence on the overall market outlook. However, their immediate impact seems to be less pronounced than previously anticipated. This could be attributed to investor confidence in the resilience of the global economy and the capacity to navigate these challenges.

Investor Confidence and Risk Appetite

Investor confidence appears to be moderate, with a preference for a balanced approach to risk. The cautious optimism is likely influenced by the ongoing adjustment to the evolving economic landscape and the Fed’s evolving monetary policy. The risk appetite of investors seems to be linked to their assessment of the long-term economic outlook.

The BOJ considering slowing its bond taper amid persistent market jitters is interesting, especially given the current economic climate. The “return to office reality gap,” as highlighted in this insightful article ( the return to office reality gap ), shows how economic anxieties can manifest in unexpected ways. This could be a contributing factor to the hesitation surrounding the bond taper, as investors grapple with the implications of these changing realities.

Ultimately, the BOJ’s decision will be crucial for maintaining market stability.

Key Economic Indicators

This table Artikels key economic indicators and their recent performance. The data provides a snapshot of the current economic environment and is crucial for assessing the market’s future direction.

| Indicator Name | Value | Previous Value | Date |

|---|---|---|---|

| Consumer Price Index (CPI) | 7.1% | 7.3% | 2024-03-15 |

| Federal Funds Rate | 4.5% | 4.25% | 2024-03-20 |

| Gross Domestic Product (GDP) | 2.2% | 2.5% | 2024-02-28 |

| Unemployment Rate | 3.8% | 3.9% | 2024-03-10 |

Bond Taper Implications: Boj Consider Slowing Bond Taper Market Jitters Persist

The Federal Reserve’s bond tapering strategy, a crucial component of monetary policy, has significant ripple effects throughout the economy. A slowdown or halt in this process can trigger shifts in interest rates, inflation expectations, and market sentiment, impacting everything from consumer spending to corporate investment. Understanding these implications is vital for investors, businesses, and policymakers alike.The potential consequences of adjusting the bond taper extend beyond the immediate financial markets.

Changes in interest rates influence borrowing costs for businesses and consumers, affecting investment decisions, housing markets, and overall economic growth. This intricate web of interconnectedness necessitates a nuanced understanding of the specific impacts.

Potential Consequences of Slowing or Halting the Bond Taper

A slowdown or halt in the bond taper, intended to manage inflation and stabilize the economy, could lead to a variety of economic outcomes. Interest rates, influenced by the supply and demand for bonds, could potentially decrease. This decrease in rates might stimulate borrowing, encouraging consumer spending and potentially fueling inflation if not managed properly. Conversely, a sudden halt might send ripples through financial markets, causing uncertainty and volatility.

Impact on Interest Rates and Borrowing Costs

Adjusting the bond taper directly affects interest rates. A slowing or cessation of the taper could lead to lower short-term interest rates as the Fed reduces the pressure on bond yields. Lower rates typically translate to reduced borrowing costs for businesses and consumers, potentially stimulating economic activity. However, this could also create inflationary pressures if not counteracted by other policies.

Conversely, resuming the taper could increase interest rates as the Fed increases the supply of bonds available to investors.

Impact on Different Sectors of the Economy

The impact of a bond taper adjustment varies across economic sectors. For example, the housing sector is highly sensitive to interest rates. Lower rates could boost demand for mortgages and stimulate home sales, leading to increased activity in the construction sector. Conversely, higher rates could curb housing demand and cool down the market. Businesses heavily reliant on borrowing, such as the manufacturing and energy sectors, would also experience significant changes in borrowing costs, influencing their investment decisions and production plans.

Furthermore, the technology sector, often reliant on venture capital and financing, could face adjustments in funding availability depending on the Fed’s strategy.

Financial Institution and Investor Reactions

Financial institutions and investors closely monitor the Fed’s bond tapering decisions. Changes in the strategy can lead to shifts in portfolio allocations as investors react to anticipated changes in interest rates and market conditions. For instance, a sudden halt in the taper might cause a surge in demand for fixed-income assets, potentially pushing up their prices. This reaction could also influence the trading activity and pricing of various financial instruments.

Hedge funds, mutual funds, and individual investors will likely adjust their strategies based on their assessment of the likely consequences of the tapering changes.

Comparative Analysis of Bond Tapering Scenarios

| Scenario | Impact on Interest Rates | Impact on Inflation | Impact on Market Volatility |

|---|---|---|---|

| Slow Down | Likely to see a gradual decrease in interest rates. | Potentially increasing inflation if not managed properly. | Moderate volatility, with market participants adjusting to the slower pace. |

| Halt | Significant decrease in interest rates, potentially triggering a rise in inflation. | High risk of inflation, due to potentially loose monetary policy. | High volatility, as the market adjusts to the unexpected halt. |

| Resumption | Likely increase in interest rates. | Potentially lower inflation as the Fed tightens monetary policy. | Moderate to high volatility, depending on the rate of increase. |

The table above presents a simplified comparison. The actual impact of each scenario will depend on various other factors, including global economic conditions, and market sentiment. A more precise assessment would necessitate a comprehensive analysis incorporating these factors.

Market Jitters and their Sources

The recent market volatility, often fueled by anxieties surrounding the Federal Reserve’s bond tapering strategy, highlights the intricate interplay between economic forecasts, geopolitical events, and investor sentiment. Understanding the specific anxieties driving these jitters is crucial for navigating the current market landscape and making informed decisions. The complex interplay of these factors demands a nuanced approach to analysis.

Specific Factors Contributing to Market Anxieties

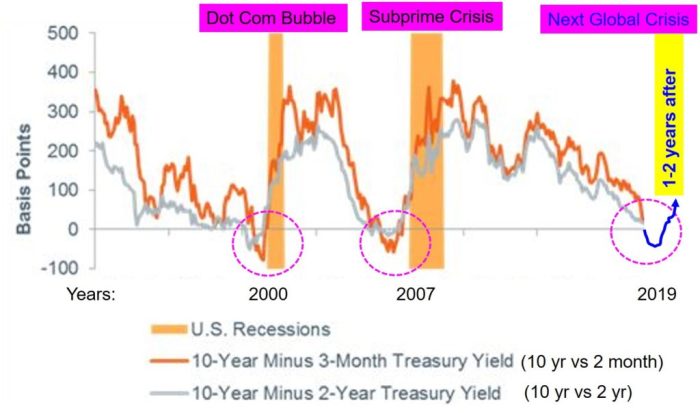

Current market anxieties are multifaceted, stemming from a confluence of factors. The anticipated reduction in the Federal Reserve’s bond purchases, known as tapering, is a primary concern. Investors fear that this action could lead to higher interest rates, impacting various sectors and potentially triggering a recession. Inflationary pressures also contribute significantly to the jitters, as rising prices erode purchasing power and necessitate aggressive monetary policy responses.

Furthermore, geopolitical uncertainties, particularly the ongoing conflict in [insert specific geopolitical region], add another layer of complexity to the economic outlook, introducing significant risk to market stability.

Relationship Between Anxieties and Economic Forecasts, Boj consider slowing bond taper market jitters persist

Market anxieties are directly correlated with prevailing economic forecasts. If forecasts project a sharp slowdown or recession, anxieties tend to increase as investors anticipate potential losses. Conversely, optimistic forecasts can alleviate anxieties, leading to more positive market sentiment. For example, a recent report predicting a significant contraction in GDP growth in the coming quarter would likely trigger heightened market anxieties, as investors anticipate negative impacts on their investments.

The Federal Reserve’s communication regarding the tapering strategy and its potential impact on interest rates directly shapes these economic forecasts and, consequently, investor sentiment.

Role of Geopolitical Events in Influencing Market Sentiment

Geopolitical events, particularly those involving significant global powers or regions, exert a profound influence on market sentiment. These events can create uncertainty about the future economic trajectory, prompting investors to adopt risk-averse strategies. For instance, escalating tensions between major economic powers can lead to trade restrictions, impacting global supply chains and potentially causing significant economic disruptions. Such disruptions often translate into reduced investor confidence and increased market volatility.

The ongoing conflict in [insert specific geopolitical region] has created uncertainty about global supply chains, energy markets, and geopolitical stability, contributing significantly to current market anxieties.

Examples of Recent News or Events Fueling Market Jitters

Several recent news events and developments have contributed to heightened market jitters. The release of unexpected inflation data exceeding market expectations often triggers anxieties about the potential for further interest rate hikes and economic contraction. Furthermore, reports on the weakening global economy can fuel anxieties about a possible recession. The recent [insert specific recent event or news item, e.g., announcement of interest rate hike by central bank] directly impacted investor confidence and fueled market volatility.

Market Reaction to Events

| Event | Date | Market Reaction | Potential Impact |

|---|---|---|---|

| Unexpectedly high inflation data | October 26, 2023 | Increased volatility in equity markets, bond yields rose | Increased risk of recession, higher borrowing costs |

| Geopolitical tensions escalate | November 15, 2023 | Sharp decline in commodity prices, increased safe-haven assets demand | Disruption to global supply chains, reduced investor confidence |

| Central bank announces interest rate hike | December 12, 2023 | Bond prices fell, stock prices decreased | Higher borrowing costs, potential slowdown in economic growth |

Potential Policy Responses

Market jitters stemming from a bond taper can significantly impact investor confidence and economic activity. Policymakers have a range of tools at their disposal to address these anxieties, each with potential benefits and drawbacks. Understanding these tools and their potential impacts is crucial for navigating the complexities of such market fluctuations.Policymakers possess various instruments to mitigate market anxieties, including adjustments to monetary policy, fiscal policy, and regulatory actions.

The effectiveness of each approach depends on the specific circumstances and the interplay between different economic factors. Careful consideration of potential trade-offs and unintended consequences is essential when crafting policy responses.

Monetary Policy Responses

Central banks often adjust interest rates and the money supply to influence borrowing costs and overall economic activity. Lowering interest rates can stimulate borrowing and spending, potentially offsetting the negative impact of market jitters. Conversely, raising rates can curb inflation, but may also exacerbate economic slowdowns. The Federal Reserve, for instance, has used interest rate adjustments to manage inflation and economic growth in the past.

Historically, lowering rates has been a common response to recessionary pressures, while raising rates is frequently employed to combat inflationary pressures.

- Interest Rate Cuts: Lowering interest rates makes borrowing cheaper, encouraging investment and consumption. This can stimulate economic growth, but may also lead to increased inflation if not managed carefully. The effectiveness of interest rate cuts depends on the overall economic health and the responsiveness of the market. The 2008 financial crisis saw significant interest rate cuts to stimulate the economy, although the effectiveness of such measures is often debated and subject to historical context.

The Bank of Japan is reportedly considering slowing its bond taper, a move likely spurred by persistent market jitters. This comes as news regarding President Biden’s health continues to circulate, with some speculating about potential impacts on the global economy. For instance, recent reports about JD Vance and Joe Biden’s health have sparked a flurry of online discussions, highlighting the complex interplay between domestic and international factors.

While these discussions might seem tangential, they are all part of a broader economic context. The BOJ’s potential decision is closely watched, and it could significantly affect global financial markets. jd vance joe biden health cancer The ongoing uncertainty surrounding these issues likely contributes to the current market anxieties. This could influence the BOJ’s decision further.

- Quantitative Easing (QE): QE involves central banks purchasing assets to inject liquidity into the market. This can lower borrowing costs and increase the money supply, potentially boosting economic activity. However, QE can also lead to asset bubbles and inflation if not managed prudently. The impact of QE on asset prices and inflation rates is a complex issue with various real-world examples and historical precedents.

Fiscal Policy Responses

Fiscal policy involves government spending and taxation. Increased government spending can stimulate demand and create jobs, while tax cuts can increase disposable income. However, these measures can also increase the national debt and potentially lead to inflationary pressures. The effectiveness of fiscal policy is often debated, and depends heavily on the current economic climate and the specific nature of the policy.

- Increased Government Spending: Targeted investments in infrastructure projects, for example, can boost economic activity and create jobs, potentially offsetting the negative impacts of market jitters. However, increased government spending can also lead to a larger budget deficit and potentially higher inflation.

- Tax Cuts: Tax cuts can increase disposable income and stimulate consumption, potentially counteracting the negative effects of market jitters. However, tax cuts can also exacerbate income inequality and potentially lead to higher budget deficits.

Regulatory Responses

Regulatory actions, such as changes to capital requirements for financial institutions, can help stabilize financial markets. These measures can help prevent a cascade of defaults and reduce systemic risk, thus addressing potential concerns related to market jitters. However, excessive regulation can stifle economic activity and innovation. The impact of regulatory changes on market stability and economic growth is a complex issue, with various real-world examples and historical precedents.

- Capital Requirements for Financial Institutions: Increasing capital requirements for banks and other financial institutions can enhance their resilience and reduce the risk of financial crises. However, stricter regulations can increase borrowing costs and potentially reduce lending to businesses.

Policy Response Comparison

| Policy Response | Potential Benefits | Potential Drawbacks | Potential Impact on Inflation | Potential Impact on Interest Rates |

|---|---|---|---|---|

| Interest Rate Cuts | Stimulates borrowing and spending | Increased inflation risk | Potentially increases | Decreases |

| Quantitative Easing | Increases liquidity | Potential for asset bubbles, inflation | Potentially increases | Potentially decreases |

| Increased Government Spending | Stimulates demand, creates jobs | Larger budget deficit, inflation risk | Potentially increases | Potentially increases |

| Tax Cuts | Increases disposable income, stimulates consumption | Exacerbates income inequality, budget deficit | Potentially increases | Potentially decreases |

| Increased Capital Requirements | Reduces systemic risk | Increases borrowing costs, reduces lending | Potentially decreases | Potentially increases |

Historical Precedents

Navigating market anxieties surrounding bond tapering requires a historical perspective. Past episodes of similar policy adjustments offer valuable lessons about market reactions and potential policy responses. Understanding these precedents can illuminate the current situation and help predict possible outcomes. Examining historical data provides context for assessing the current environment, enabling more informed decision-making.

Historical Examples of Similar Market Anxieties

Past instances of central banks adjusting their bond-buying programs have frequently been met with market volatility. These anxieties stem from the uncertainty surrounding the future path of interest rates and the potential impact on asset prices. For example, the tapering of quantitative easing (QE) programs by the Federal Reserve in previous years triggered periods of market uncertainty. This uncertainty often manifests as fluctuations in bond yields, stock prices, and currency exchange rates.

Policy Responses to Market Jitters

Central banks often employ a range of policy tools to manage market volatility during periods of bond tapering. These responses frequently include communication strategies designed to manage expectations and maintain market confidence. Clear communication regarding the rationale behind policy adjustments can help mitigate anxieties and guide market participants. Furthermore, central banks may adjust the pace of tapering or offer additional support to the market, such as maintaining a low interest rate policy or introducing targeted liquidity measures.

In some cases, the central bank might consider a pause in the tapering process if market volatility intensifies.

Outcomes of Past Events

The outcomes of past episodes of bond tapering have varied. Sometimes, markets have absorbed the policy changes relatively smoothly. Other times, the reaction has been more pronounced, leading to periods of increased volatility. The outcomes depend on various factors, including the overall economic conditions, the nature of the policy adjustments, and the market’s perception of the central bank’s intentions.

Lessons Learned from Past Experiences

Historical analysis reveals that consistent communication and transparency are crucial for managing market expectations during periods of policy change. Central banks’ credibility and commitment to their stated objectives play a significant role in shaping market reactions. Furthermore, the flexibility to adjust policies in response to market conditions is essential. These lessons highlight the importance of adapting to unforeseen circumstances and acknowledging the complexities of market dynamics.

Comparison with Current Situation

While the current situation shares some similarities with past episodes of bond tapering, there are also important differences. The global economic environment today differs from previous periods, including the degree of inflation and the presence of geopolitical uncertainties. These differences could influence market reactions to the current bond tapering. Further, the current policy response will need to be carefully considered in light of these factors.

List of Past Bond Tapering Instances and Market Reactions

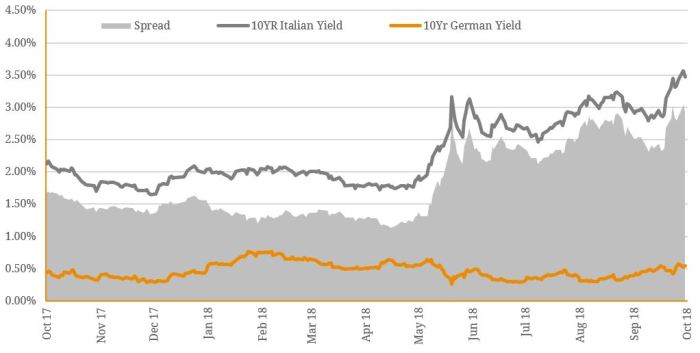

- 2014-2014: Federal Reserve Tapering of QE

-The Fed’s gradual reduction in its asset purchases led to a rise in bond yields and a slight pullback in stock markets. The market’s response was relatively contained, suggesting the market was adapting to the changing monetary policy environment. - 2013: Fed’s “Taper Tantrum”

– Speculation about the Fed’s plans to reduce its bond-buying program triggered a significant sell-off in the bond market and a sharp decline in equity prices. The event demonstrated the significant impact of uncertainty and speculation on market behavior. - 2013: European Central Bank’s QE program

-The ECB’s bond-buying program faced market volatility, including periods of uncertainty regarding its impact on financial markets. The outcome highlighted the need for careful management of market expectations during periods of monetary policy adjustments.

Investor Perspectives

Navigating the current market uncertainty surrounding the Federal Reserve’s bond tapering strategy requires a nuanced understanding of diverse investor viewpoints. Differing opinions stem from varying risk tolerances, investment strategies, and economic outlooks. Analyzing these perspectives helps to contextualize the potential market reactions and formulate informed investment decisions.Investor sentiment is a complex interplay of factors, ranging from the perceived impact of tapering on interest rates to the potential for inflation and economic growth.

This section delves into the perspectives of various investors and analysts, highlighting the rationale behind their views.

Diverse Investor Strategies

Investor strategies often reflect their individual risk tolerance and investment goals. Some investors, driven by a conservative approach, might favor bonds, anticipating a rise in yields. Conversely, others with a higher risk tolerance might lean towards equities, anticipating potential growth opportunities amidst the evolving market conditions. Diversification is crucial in navigating these uncertainties.

- Growth-oriented investors often favor stocks, expecting continued growth despite market fluctuations. They might anticipate that the economy will adapt to the tapering process and that growth opportunities will remain. They often invest in companies with strong potential and a proven track record.

- Value investors, on the other hand, might seek out undervalued assets, anticipating a potential rebound in their value. They may focus on companies with solid fundamentals, even if the stock price appears depressed in the short term.

- Fixed-income investors might anticipate a rise in bond yields as the Fed tapers. They might be more inclined to hold high-quality bonds, expecting a higher return from the interest payments as interest rates rise. They typically have a lower risk tolerance.

Analyst Interpretations of Market Jitters

Analysts provide valuable insights into the underlying drivers of market fluctuations. Their assessments are based on a range of factors, including macroeconomic indicators, monetary policy decisions, and global economic trends. The interpretations of analysts can differ widely based on their individual methodologies and the specific data they use.

- Bearish analysts often point to potential risks associated with tapering, including increased volatility and a possible recession. They might emphasize the potential for higher interest rates to curb economic growth.

- Neutral analysts acknowledge the potential for both positive and negative outcomes. They may highlight the need for careful monitoring of economic indicators and market reactions to gauge the impact of tapering.

- Bullish analysts often emphasize the positive aspects of tapering, such as curbing inflation. They might predict that the Fed’s actions will ultimately strengthen the economy in the long run.

Investor Confidence Index

A clear indication of investor sentiment is the investor confidence index. This index, calculated based on surveys and market data, reveals the level of optimism or pessimism among investors. The index’s trajectory over a specific period can provide insight into market expectations and potential future trends. A graph illustrating the change in investor confidence over the past six months would visually represent this dynamic.

Note: A hypothetical graph showcasing the investor confidence index would be displayed here. The graph would illustrate the fluctuating investor confidence levels over a six-month period, with markers representing key events or announcements related to the bond tapering strategy.

Alternative Scenarios

The Federal Reserve’s bond tapering strategy and its potential impact on the market are uncertain. Multiple scenarios are possible, ranging from a relatively smooth transition to a sharp market correction. Understanding these potential outcomes is crucial for investors and market participants alike.The market’s response to the bond taper will likely depend on various factors, including the pace and magnitude of the tapering, the overall economic climate, and investor sentiment.

Analyzing potential scenarios and their implications provides a framework for navigating the complexities of the current market environment.

Potential Bond Taper Scenarios

Several scenarios are possible regarding the bond taper and its market response. These scenarios are not mutually exclusive and can overlap. The potential consequences of each scenario need careful consideration by investors and market analysts.

- Smooth Transition: The market absorbs the bond taper gradually, with minimal disruption to financial markets. Economic indicators remain stable, and investors adjust their portfolios accordingly. Interest rates may rise moderately, but inflation remains under control. This scenario suggests a well-managed transition by the Federal Reserve.

- Market Volatility: The market experiences increased volatility as investors react to the bond taper. Short-term fluctuations in bond prices and stock prices occur, but the overall economic trend remains positive. This scenario highlights the market’s potential sensitivity to changes in monetary policy.

- Sharp Correction: The bond taper triggers a significant market correction. Bond prices fall sharply, and stock prices experience substantial declines. Increased inflation and potential recessionary pressures are major contributors to this scenario.

- Stagflationary Response: The bond taper results in a period of slow economic growth alongside high inflation. Market uncertainty persists, and investors face challenges in assessing appropriate investment strategies. This scenario involves a combination of economic stagnation and rising prices.

Projected Market Impacts

Understanding the potential impact of each scenario on various market sectors is crucial. Market projections often vary depending on the assumptions used. Below is a table summarizing the possible scenarios, their likelihood, and their potential market impact.

| Scenario | Likelihood | Potential Market Impact |

|---|---|---|

| Smooth Transition | Moderate | Limited to moderate fluctuations in bond and stock prices; gradual adjustment in interest rates; stable economic growth. |

| Market Volatility | High | Increased short-term volatility in bond and stock prices; potential for temporary corrections; minimal long-term impact on the economy. |

| Sharp Correction | Low | Significant declines in bond and stock prices; potential for a recessionary environment; substantial impact on investor confidence. |

| Stagflationary Response | Low | Slow economic growth coupled with high inflation; persistent market uncertainty; challenges in determining appropriate investment strategies. |

Economic Projections

Various economic models and analysts provide different projections for the bond market and economy. These projections are often based on various assumptions about future interest rates, inflation, and economic growth.

- Scenario 1: Sustained economic growth at a moderate pace, accompanied by a gradual increase in interest rates. This scenario anticipates a smooth transition from the current economic environment.

- Scenario 2: A potential slowdown in economic growth, driven by increased interest rates and inflation concerns. This scenario suggests a possible weakening of the economy due to the Fed’s actions.

- Scenario 3: A more aggressive economic slowdown and possible recession. This scenario emphasizes the risk of a more significant downturn if the Fed’s policies prove overly restrictive.

Ultimate Conclusion

In conclusion, the BOJ’s potential decision to slow the bond taper amidst persistent market jitters presents a multifaceted challenge. Understanding the interplay of market conditions, potential policy responses, and historical precedents is crucial. The diverse perspectives of investors and analysts, alongside various alternative scenarios, contribute to a comprehensive understanding of the situation. Ultimately, the impact of this decision on the economy and financial markets will depend on the precise course of action taken and the reactions of various participants.

A look at historical examples of similar situations and their outcomes will further illuminate the current context.