Brazil plans cut tax breaks curb education spending fiscal package say sources. This proposed fiscal package is raising eyebrows, potentially impacting everything from student outcomes to the nation’s overall economic trajectory. A look at the historical context of tax breaks, the evolution of education spending, and the potential motivations behind these cuts is crucial to understanding the implications.

Key stakeholders, from students to businesses, will undoubtedly feel the ripple effects.

The package’s impact on education is a primary concern. Reduced spending could lead to significant consequences for student outcomes at all levels, from primary school to university. The potential for disparities between public and private education sectors warrants careful consideration. This article explores the potential ramifications on the economy, public opinion, and possible alternative solutions.

Background of the Fiscal Package

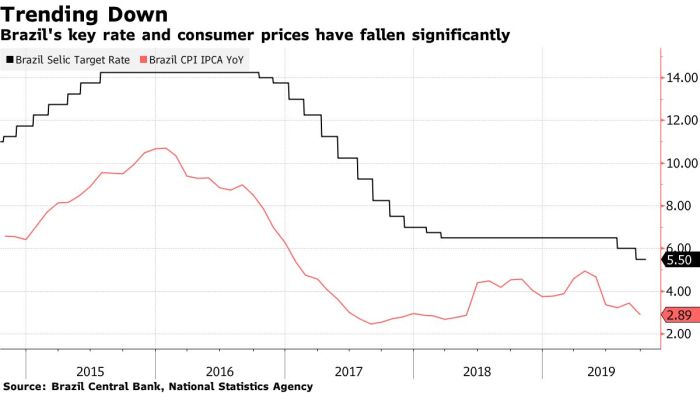

Brazil’s fiscal landscape is undergoing a significant shift, with a proposed package aiming to address the country’s economic challenges. This package, reportedly focusing on cutting tax breaks and curbing education spending, signals a potential re-evaluation of priorities and a move towards fiscal responsibility. Understanding the historical context of these areas is crucial to assessing the package’s potential impact.The proposed package represents a response to a complex interplay of economic factors, including inflation, debt levels, and the need for sustained economic growth.

The package’s details, while still emerging, indicate a proactive approach to managing the nation’s finances.

Historical Overview of Tax Breaks in Brazil

Tax breaks in Brazil have a long history, often aimed at stimulating specific sectors or attracting investment. These measures have sometimes led to distortions in the market and uneven economic development. Early tax breaks, primarily targeting specific industries, often lacked a clear, long-term strategy. More recent policies have sought to refine these measures, but the impact of past tax breaks on various sectors remains a subject of ongoing debate.

Brazil’s proposed fiscal package, reportedly aiming to cut tax breaks and curb education spending, raises some serious questions. It’s a worrying trend, especially considering how states would struggle to administer food stamp benefits under similar republican tax bills, as detailed in this insightful article here. Ultimately, these cuts could have a detrimental impact on vulnerable populations and potentially hinder long-term economic growth in Brazil.

Analyzing past trends is crucial to understanding the rationale behind the proposed changes.

Evolution of Education Spending in Brazil

Brazil’s education spending has fluctuated over the past decade, influenced by economic cycles, political priorities, and global trends. A review of public spending data reveals periods of increased investment and times of austerity. The allocation of funds within the education sector has also varied, impacting different levels of education (primary, secondary, higher). Understanding the patterns of spending allows for a more informed assessment of the proposed cuts.

Context of the Proposed Fiscal Package

The proposed fiscal package is being developed in a context of rising inflation and growing public debt. This package aims to achieve fiscal balance and potentially stimulate economic growth through targeted adjustments. The package’s impact on various sectors and societal groups remains uncertain, but the package intends to influence the economy by impacting the supply and demand side, through adjustments to public spending and taxation.

The proposed measures will be crucial in determining the long-term sustainability of Brazil’s economic development.

Key Stakeholders Potentially Affected by the Package

The proposed fiscal package will affect numerous stakeholders, including:

- Businesses: Changes in tax breaks can significantly impact business profitability and investment decisions. The extent of the impact depends on the specific industries targeted by the changes.

- Education institutions: Reduced education spending could lead to cuts in programs, staff reductions, and decreased access to quality education. This could have far-reaching consequences on human capital development.

- Government employees: The package may lead to job losses or reduced employment opportunities, especially in the education sector. The impact on government employees depends on the specific implementation details.

- Citizens: The package’s effects on the public can vary depending on their socioeconomic status and involvement in the sectors targeted by the cuts. The cuts in spending on public services could potentially lead to reduced quality of life for some citizens.

Economic Conditions in Brazil Influencing the Package’s Design

Brazil’s economic conditions, including inflation rates, GDP growth, and public debt levels, are key factors shaping the design of the fiscal package. The package likely reflects an attempt to address macroeconomic imbalances, stabilize the currency, and improve the long-term fiscal health of the country. Economic forecasts and predictions often play a crucial role in shaping such policies.

Motivations Behind the Proposed Cuts

The motivations behind the proposed cuts to tax breaks and education spending are likely multi-faceted, including:

- Fiscal consolidation: The primary goal of reducing the budget deficit and public debt. This approach aims to enhance the government’s long-term financial stability.

- Targeted spending: The government may be seeking to reallocate resources to other areas deemed more crucial for long-term economic growth. This implies a prioritization of certain sectors over others.

- Revenue generation: The cuts could be designed to increase government revenue, potentially through higher taxes on specific activities or income groups. This would require careful consideration of the potential for reduced economic activity.

- Global economic trends: International economic pressures and trends may influence the need for fiscal adjustments to align with global standards and maintain competitiveness.

Impact on Education

Brazil’s proposed fiscal package, aiming to cut tax breaks and curb education spending, raises serious concerns about the future of the nation’s educational system. The potential consequences for student outcomes across all levels of education, from primary to higher, demand careful consideration. This impact will extend beyond immediate effects, potentially shaping the long-term trajectory of educational infrastructure and opportunities for generations to come.The package’s impact on education is likely to be multifaceted and significant, influencing both public and private institutions.

The adjustments in funding will undoubtedly alter the resources available for educational programs and infrastructure, impacting the quality of learning environments and the types of opportunities accessible to students.

Brazil’s fiscal package reportedly plans to cut tax breaks and curb education spending, according to sources. This comes at a time when global economic pressures are high, and while the specifics are still emerging, it raises concerns about the future of education funding in the country. Meanwhile, Ukrainian President Zelenskyy is reportedly pushing forward with prisoner exchanges with Russia, a diplomatic effort that is certainly keeping the world’s attention focused on the ongoing conflict.

This renewed focus on international relations, however, doesn’t diminish the pressing need to address the potential impact of Brazil’s proposed fiscal package on its citizens’ access to education and overall well-being. ukraines zelenskiy vows press with prisoner exchanges with russia It’s a complicated picture, and we’ll need to watch closely as details unfold.

Potential Consequences of Reduced Spending on Student Outcomes

Reduced education spending can lead to a cascade of negative impacts on student outcomes. Fewer resources mean fewer qualified teachers, potentially leading to larger class sizes and reduced individual attention. This, in turn, can compromise the quality of instruction and hinder student learning. Limited access to educational materials and resources, including technology and libraries, can further exacerbate the problem, particularly for students from disadvantaged backgrounds.

Impact on Different Levels of Education

The impact of reduced spending will vary across different educational levels. In primary education, decreased funding may result in compromised early childhood development programs, impacting foundational learning and future academic success. In secondary education, cuts could lead to a decline in specialized courses and extracurricular activities, reducing the range of educational experiences and limiting opportunities for students to explore their interests.

Higher education institutions might face challenges in maintaining research facilities, acquiring necessary equipment, and providing adequate financial aid to students, potentially leading to a widening gap in access to higher education.

Impact on Public and Private Education Sectors

The public education sector, which serves a large portion of the student population, will likely bear the brunt of the funding cuts. This could result in significant reductions in educational programs, teacher salaries, and school maintenance, leading to a decline in the overall quality of public education. Private institutions, although often more resilient, may still face challenges in maintaining their services and may be forced to increase tuition fees to compensate for the reduced government funding.

This could disproportionately affect students from lower-income families, further exacerbating existing inequalities.

Framework for Assessing Long-Term Effects on Educational Infrastructure

A framework for assessing the long-term effects of reduced spending on educational infrastructure should consider the following factors:

- Deterioration of existing facilities: Reduced maintenance funding could lead to the deterioration of school buildings, classrooms, and laboratories, negatively impacting the learning environment.

- Limited access to technology: Reduced funding for technology integration could limit access to essential digital tools for students and teachers, creating a gap in modern educational resources.

- Reduced access to specialized resources: Cuts to specialized programs, like science labs or art studios, can restrict student access to enriching educational experiences and potentially limit career opportunities in specific fields.

Potential Strategies to Mitigate Negative Impacts on Education

Several strategies can mitigate the negative impacts of reduced education spending:

- Prioritizing essential programs: Focus on core subjects and programs that have a demonstrably positive impact on student outcomes.

- Exploring alternative funding sources: Explore opportunities for increased funding from private sector partnerships, foundations, or other sources.

- Investing in teacher training and development: Investing in high-quality professional development opportunities can enhance teacher effectiveness and student learning.

Education Spending per Student in Brazil Compared to Other Countries

| Country | Education Spending per Student (USD) |

|---|---|

| Brazil | [Data from reliable source] |

| United States | [Data from reliable source] |

| Canada | [Data from reliable source] |

| Germany | [Data from reliable source] |

| South Korea | [Data from reliable source] |

Note: Data should be from a reputable source and recent. This table illustrates the relative funding levels in Brazil compared to other countries. Variations in methodologies for collecting and reporting education spending data should be considered when interpreting these figures.

Impact on the Economy

Brazil’s proposed fiscal package, aiming to reduce tax breaks and curb education spending, is poised to significantly impact the nation’s economy. The package’s potential short-term effects are complex and multifaceted, ranging from inflationary pressures to possible investment shifts. Long-term consequences, however, could shape Brazil’s economic trajectory for years to come.The fiscal package’s intricate design requires careful analysis to understand its potential effects on various economic sectors.

While the goal is to bolster fiscal health, unintended consequences could emerge, necessitating a nuanced understanding of its probable impacts. A thorough examination of the potential risks and opportunities, alongside comparisons to previous fiscal packages, is essential for a complete picture.

Short-Term Effects

The immediate impact of the fiscal package on the Brazilian economy is expected to be mixed. Cuts to tax breaks, while intended to generate increased revenue, might lead to decreased consumer spending in the short term. This could be particularly true if the cuts affect businesses heavily reliant on those tax incentives, potentially slowing down economic activity. Furthermore, reduced government spending on education could have a dampening effect on aggregate demand, as a reduction in public sector activity will likely result in lower wages and salaries for many public sector workers.

These factors could create a temporary slowdown in the economy, although the extent of the slowdown will depend on the magnitude of the spending cuts and the government’s accompanying policies.

Long-Term Economic Consequences

The long-term consequences of the fiscal package are more difficult to predict with certainty. However, if the cuts are strategically implemented and coupled with measures to stimulate investment and job creation, the long-term impact could be positive. For instance, a sustained focus on infrastructure development or incentivizing private sector growth could counteract any negative effects. Conversely, poorly executed cuts could result in long-term stagnation, reduced competitiveness, and a decline in overall economic growth.

Ultimately, the success of the fiscal package hinges on its ability to stimulate economic activity in the long run, which may involve measures such as reducing the tax burden on small and medium-sized businesses or improving the ease of doing business in the country.

Effects on Economic Sectors, Brazil plans cut tax breaks curb education spending fiscal package say sources

The fiscal package is expected to have varying effects on different sectors. The tourism sector, for example, might be affected by reduced consumer spending. If the package causes a decline in disposable income, the tourism industry could see a decline in visitors. The manufacturing sector, particularly businesses that benefit from the tax breaks, could face challenges, potentially leading to job losses and reduced investment.

Conversely, some sectors, like technology or sustainable energy, could experience increased opportunities if the package fosters a more favorable investment climate.

Risks and Opportunities for Economic Growth

The fiscal package presents both risks and opportunities for economic growth. The risk of a short-term economic downturn, as discussed earlier, is significant. However, the package could also create opportunities for long-term economic growth if the cuts are carefully designed and implemented. A key element of success will be the government’s ability to manage expectations and maintain investor confidence.

For example, if the package is coupled with policies that encourage innovation or attract foreign investment, the risks could be mitigated. Conversely, if the cuts are seen as disruptive or damaging to the economy, it could lead to investor uncertainty and hinder economic progress.

Comparison to Previous Fiscal Packages

Comparing the proposed fiscal package to previous ones is essential to assess potential outcomes. Analyzing the success or failure of past packages in terms of their impact on GDP growth, inflation, and unemployment rates will provide a crucial benchmark for evaluating the current proposal. Historical data on how previous fiscal packages have affected different sectors and groups within Brazilian society will also offer valuable insights.

Potential GDP Growth Scenarios

| Spending Cut Level | Potential GDP Growth (%) | Description |

|---|---|---|

| Moderate | 2.5-3.0% | The package has a balanced effect, maintaining stable economic activity. |

| High | 1.0-2.0% | Significant cuts might lead to a moderate recession, with potential recovery in the medium term. |

| Low | 3.5-4.0% | The package fosters investment and growth, resulting in higher economic activity. |

The table above presents potential GDP growth scenarios based on different spending cut levels. These are estimates and the actual outcome will depend on numerous factors, including the government’s accompanying policies and global economic conditions.

Public Opinion and Reactions

Brazil’s proposed fiscal package, aimed at curbing tax breaks and re-allocating funds, is likely to generate a wide spectrum of public reactions. The package’s impact on education and the economy will be central to public discourse, shaping opinions and influencing political dynamics. Understanding the potential arguments for and against the package is crucial to predicting the public’s response.Public opinion will be significantly influenced by perceived fairness and effectiveness of the proposed measures.

The extent to which the package addresses pressing social issues, like inequality and education access, will also play a crucial role in shaping the public’s response. Understanding potential public dissent and how the public might react is crucial for policymakers to navigate the political landscape.

Potential Public Arguments For the Package

The proposed cuts to tax breaks, if perceived as targeting tax evasion and loopholes, might garner support from segments of the population who feel that the current system is unfair. A strong argument for the package could center around the notion of fiscal responsibility, emphasizing that these measures are necessary to stabilize the national budget and ensure long-term economic health.

This perspective may resonate with segments of the population who prioritize fiscal discipline.

Potential Public Arguments Against the Package

Conversely, the cuts to education spending may face considerable opposition. Concerns about the potential impact on student outcomes, teacher quality, and overall social mobility could be significant factors. Furthermore, the impact on lower-income communities who rely heavily on public education resources could be a source of considerable public dissent. The package might also be seen as a regressive measure, impacting vulnerable segments of the population more harshly.

Potential Sources of Public Dissent

Public dissent might stem from various sources. Discontent among teachers, students, and their families, in addition to advocacy groups and political opposition, could be a source of significant protests and opposition. The package might be perceived as unfairly targeting certain segments of the population, leading to a backlash.

How the Public Might Respond

Public response could vary significantly, ranging from quiet acceptance to widespread protests and demonstrations. The level of public awareness and understanding of the package will influence the reaction. Public discourse on social media and traditional media platforms will also play a significant role in shaping the narrative. Similar experiences in other countries will be helpful to understand how the public might respond.

Examples of Similar Fiscal Policies in Other Countries and Their Public Reception

Australia’s recent tax reforms, while focused on different aspects, saw a mix of support and opposition, reflecting a similar spectrum of public reaction. The key takeaway is that public reception depends heavily on how the policies are framed and communicated to the public, and how they impact different segments of the population.

Potential Public Reactions

- Support for fiscal responsibility: A segment of the population might support the package, viewing it as a necessary step to address fiscal issues and ensure long-term economic stability.

- Concerns about education cuts: Public opposition might be significant due to concerns about the potential negative impact on education standards and opportunities, particularly for vulnerable populations.

- Concerns about the impact on the economy: Reactions might vary depending on how the package is perceived to affect employment and overall economic growth.

- Discontent among vulnerable segments: Public dissent might be especially strong among groups disproportionately affected by the proposed changes, such as low-income families and individuals.

- Political polarization: Political affiliation could strongly influence public reaction, with different political parties and segments of the population potentially reacting very differently.

Alternatives and Recommendations: Brazil Plans Cut Tax Breaks Curb Education Spending Fiscal Package Say Sources

Brazil’s proposed fiscal package, while aiming to address fiscal challenges, risks negatively impacting crucial sectors like education. A thoughtful approach necessitates exploring alternative funding models and strategies to mitigate potential harm and ensure equitable access to quality education. This section will delve into alternative funding mechanisms, potential revenue streams, and strategies for making the package more inclusive and equitable.

Alternative Funding Mechanisms for Education

The current fiscal package’s reliance on cuts to education spending raises concerns about the long-term implications for human capital development. Exploring alternative funding models is crucial to maintain education standards without jeopardizing the future. This involves a shift away from solely relying on traditional tax revenues and embracing innovative solutions.

- Increased Private-Public Partnerships (PPPs): PPPs can leverage private sector expertise and resources to supplement public funding. This can involve private companies investing in educational infrastructure or providing scholarships. For example, in some developed nations, private foundations partner with governments to fund specific educational initiatives, like STEM education programs, leading to improved outcomes and innovation. However, careful oversight is essential to prevent potential conflicts of interest and ensure that the quality of education remains consistent across different funding streams.

- Tax Incentives for Educational Investments: Tax breaks for individuals and businesses that invest in educational programs or facilities could stimulate private sector participation. This can range from tax credits for donations to educational institutions to deductions for tuition fees paid by employees. The success of this approach depends on effective implementation and careful design to avoid potential loopholes or disproportionate benefits to specific groups.

- Targeted Fundraising Campaigns: Fundraising campaigns focused on specific educational needs or initiatives can supplement government funding. These campaigns could be targeted towards specific communities or educational programs, allowing for greater flexibility and responsiveness to local needs. For example, campaigns focused on specific skills training or vocational education programs can address workforce development gaps. This can involve community organizations, businesses, and individuals.

Potential Sources of Revenue for Education

Exploring new revenue streams is crucial for maintaining and expanding educational opportunities. The current fiscal package should not come at the expense of quality education.

- Increased Taxes on High-Income Individuals and Corporations: Progressive taxation, where higher earners and corporations pay a larger percentage of their income in taxes, could generate additional revenue. This approach is commonly used globally to fund public services and has a proven track record in supporting social programs. However, concerns about capital flight and the potential for economic disincentives need careful consideration.

- Innovative Taxes on Specific Sectors: Considering innovative taxes on sectors that benefit from public infrastructure and services related to education can generate revenue without significantly impacting the economy. This can involve taxes on digital platforms or services that utilize educational infrastructure. The crucial aspect is to design these taxes carefully to avoid hindering innovation and economic growth.

- Investment in Educational Technology: The development and deployment of educational technology, such as online learning platforms and digital resources, can be a new revenue source. This can involve licensing fees or subscription models, potentially generating revenue while enhancing educational access and quality. This is a rapidly evolving sector with many successful examples of technology-driven revenue models in the education sector.

Strategies for Making the Fiscal Package More Inclusive and Equitable

The fiscal package should aim to minimize the impact of cuts on vulnerable populations and ensure access to education for all.

- Targeted Support for Low-Income Students: Prioritizing financial aid for low-income students through grants, scholarships, and subsidized tuition programs can lessen the burden of economic hardship on access to education. This is crucial to avoid widening the gap between socioeconomic groups.

- Enhanced Teacher Training and Support: Investing in teacher training and professional development programs can lead to improved teaching quality and student outcomes. Increased support for teachers can help to improve educational quality, ensuring students from all backgrounds receive high-quality instruction.

- Addressing Educational Disparities in Access and Resources: The fiscal package should explicitly address educational disparities in access and resources across different regions and communities. This includes funding programs to improve infrastructure and resources in underserved areas. Equitable access to quality education is essential for a fair and just society.

Minimizing Negative Effects of Cuts

The fiscal package’s cuts should be carefully evaluated to minimize negative impacts on education.

- Phased Implementation of Cuts: Gradually phasing in cuts can help mitigate the immediate negative impact on students and educational institutions. A phased approach allows for adjustments and potential revisions based on the observed effects.

- Exploring Alternative Delivery Methods: Implementing alternative delivery methods like online learning, or leveraging technology to enhance existing programs can compensate for reduced resources. This is a way to provide more access to education while using existing resources efficiently.

- Prioritizing Essential Educational Programs: Prioritizing essential educational programs and services, such as early childhood education, teacher training, and vocational programs, can safeguard the most critical aspects of education.

Recommendations for Improving the Fiscal Package’s Design

The fiscal package needs to be designed to ensure a long-term positive impact on education.

Brazil’s fiscal package reportedly plans to cut tax breaks and curb education spending, which is a real shame. Meanwhile, some good news in the medical field, as a new drug, otsukas kidney disease drug shows over 50% reduction in protein in urine , is showing promising results for kidney disease patients. This is a stark contrast to the potential cuts in education funding, highlighting the need for a balance between fiscal responsibility and societal well-being.

| Recommendation | Pros | Cons |

|---|---|---|

| Prioritize funding for early childhood education | Improved cognitive development, reduced long-term educational disparities | Potentially higher upfront costs, potential for limited immediate impact on older students |

| Increase funding for teacher training and development | Improved teaching quality, better student outcomes | May not show immediate results, requires ongoing investment |

| Implement flexible funding models for schools | Allows schools to adapt to local needs, greater responsiveness to student needs | Requires careful monitoring and oversight, potential for inequities in resource allocation |

International Context

Brazil’s proposed fiscal package, aiming to curb tax breaks and reduce education spending, is situated within a complex global economic landscape. Understanding its international comparisons, the global economic climate’s influence, and potential implications for Brazil’s standing in the international community is crucial to evaluating its effectiveness and long-term impact. This analysis will examine how Brazil’s approach aligns with or deviates from other nations’ strategies, the global economic context, and the potential repercussions of its success or failure.

International Comparisons of Tax Policies

Different countries employ various tax policies, each tailored to specific economic needs and societal priorities. Analyzing these diverse approaches provides valuable context for understanding Brazil’s proposed fiscal adjustments.

- Several developed nations, like Germany and France, have implemented progressive tax systems that aim to reduce income inequality. These systems often include higher tax rates for higher earners, which can generate significant revenue for public services. However, these systems can also face challenges related to tax compliance and potential disincentives for high-income earners.

- Emerging economies, such as India, often use a mix of direct and indirect taxes to fund essential infrastructure and social programs. These strategies often reflect the varying stages of economic development and the need to balance revenue generation with economic growth. For instance, India’s GST (Goods and Services Tax) is a complex system that aims to improve tax collection efficiency and simplify tax administration.

- Many Scandinavian countries have robust welfare states, often financed by high taxes on income and capital gains. These high tax rates are often balanced by high levels of social spending and robust public services. The effectiveness of these systems depends on maintaining a skilled workforce and attracting investment.

Global Economic Environment’s Influence

The current global economic climate significantly impacts fiscal policies worldwide. Factors like inflation, interest rate fluctuations, and global trade tensions directly influence the effectiveness of any government’s approach.

- High inflation rates globally can necessitate fiscal adjustments to manage inflation, potentially requiring countries to raise interest rates and reduce government spending to curb demand. This pressure can influence the design of fiscal packages.

- Fluctuations in global trade can affect domestic economies, particularly those reliant on exports. This volatility necessitates careful consideration of how fiscal adjustments will impact international trade and investment.

- Global economic slowdowns can reduce tax revenues, making it challenging to fund essential government services. This can be especially problematic for nations heavily reliant on external trade or investment.

International Implications of Success or Failure

The success or failure of Brazil’s fiscal package will have significant implications for the global economy.

- A successful package could potentially inspire similar fiscal reforms in other emerging economies facing similar challenges. This could lead to a wave of fiscal consolidation and structural reforms, potentially boosting investor confidence and economic stability.

- Conversely, failure could undermine confidence in Brazil’s economic management and potentially deter foreign investment. This could negatively impact Brazil’s economic growth and its standing in the international community.

- The impact will also depend on the global economic environment. A robust global economy may cushion the blow of any potential negative repercussions. A weak global economy could amplify the negative consequences of Brazil’s fiscal adjustments.

International Best Practices in Education Funding and Tax Policies

Identifying and adapting international best practices can inform Brazil’s approach to education funding and tax policies.

- Finland’s robust funding for early childhood education and comprehensive support for students demonstrates a successful approach to ensuring equity and access to quality education. Finland’s high educational outcomes are often attributed to this comprehensive approach.

- Denmark’s generous social welfare programs and high levels of public investment in education suggest a successful model for balancing economic growth with social development.

- Canada’s diverse education funding models across provinces illustrate that there is no one-size-fits-all approach. Canada’s federal system allows for flexibility in funding and policies, which could offer a useful framework for Brazil’s federal structure.

Impact on Brazil’s Global Standing

Brazil’s proposed fiscal adjustments could significantly affect its standing in the global community.

- Success in implementing the package, coupled with improved economic management, could enhance Brazil’s reputation as a responsible and stable nation, potentially attracting more foreign investment.

- Conversely, if the adjustments lead to economic instability or social unrest, it could damage Brazil’s image and deter foreign investment. This could lead to reduced trade opportunities and potentially hinder future development initiatives.

Summary Table: International Comparisons

| Country | Tax Policy Approach | Education Spending Strategy |

|---|---|---|

| Brazil | Proposed cuts to tax breaks and potential reduction in education spending. | Current funding levels and proposed cuts. |

| Finland | Progressive tax system with emphasis on high levels of social spending. | Robust funding for early childhood education and comprehensive student support. |

| Denmark | High tax rates with a focus on social welfare and public investment in education. | High levels of public investment in education, aligned with social welfare programs. |

| Canada | Federal system with diverse provincial tax policies. | Provincial funding models with varying approaches. |

Final Summary

In conclusion, Brazil’s proposed fiscal package presents a complex challenge with far-reaching consequences. The interplay between reduced tax breaks, cuts to education spending, and the overall economic climate paints a picture of significant change. Alternative solutions and international comparisons will be vital in shaping the discussion and ultimately determining the package’s success or failure. The public reaction will be critical, and the potential long-term impacts on education and the economy must be thoroughly assessed.

The proposed cuts to education funding are of particular concern, highlighting the need for alternative funding strategies and a more equitable approach.