Cap free wells fargo could be fashion faux pas – Cap-free Wells Fargo could be a fashion faux pas. Imagine a world where your bank account choices aren’t just about functionality, but also about social standing. This article delves into the potential for “cap-free” accounts to be perceived as a style choice, exploring how different demographics might view them and examining the potential for negative perceptions in various social and cultural contexts.

We’ll also explore the factors influencing these perceptions, from cultural norms to media portrayals, and provide illustrative examples of how “cap-free” accounts could be perceived positively or negatively.

This isn’t just about the features of the accounts themselves, but about how they’re presented and perceived. We’ll analyze the nuances of the financial landscape and how personal goals and economic conditions can shift our views. Ultimately, we aim to understand if cap-free accounts might be more than just a financial tool – could they be a statement?

Defining “Cap-Free Wells Fargo”: Cap Free Wells Fargo Could Be Fashion Faux Pas

Wells Fargo, a major financial institution, offers various account types designed to cater to diverse customer needs. One category gaining traction is “cap-free” accounts. These accounts represent a departure from traditional banking models, promising greater flexibility and control over account usage without imposed limitations or restrictions. This article delves into the specifics of cap-free Wells Fargo accounts, their advantages and disadvantages, and how they compare to conventional accounts.

Understanding Cap-Free Accounts

Cap-free Wells Fargo accounts are designed to eliminate certain usage limitations commonly found in traditional accounts. Instead of predefined spending limits or transaction caps, these accounts allow customers greater freedom in their financial activities. This freedom often translates to more flexibility in managing everyday expenses, large purchases, or investments.

Types of Cap-Free Accounts

While Wells Fargo doesn’t explicitly label accounts as “cap-free,” certain account types may functionally offer similar advantages. These could include high-yield savings accounts, checking accounts with flexible features, or premium accounts offering enhanced services.

Comparison with Traditional Accounts

Traditional Wells Fargo accounts, such as basic checking or savings accounts, typically have transaction limits or daily withdrawal restrictions. Cap-free accounts, in contrast, remove these limitations, providing more flexibility for customers to manage their finances without worrying about exceeding predetermined spending limits. The difference often lies in the account’s associated fees and tiered services.

Historical Context of Cap-Free Banking

The concept of cap-free banking is not entirely new. Historically, certain premium banking options and private banking services have allowed for greater flexibility and fewer restrictions. The increasing popularity of online and digital banking has spurred further innovation in account designs that prioritize customer freedom and convenience.

So, a cap-free Wells Fargo account might seem like a savvy financial move, but could it be a fashion faux pas? The seemingly limitless spending power could overshadow the actual value, especially if the alternative is a meticulously managed budget. Plus, consider what a gold card Trump citizenship route, as discussed in what is gold card trump citizenship route how it might work , might mean for your financial future.

Ultimately, a cap-free account’s potential pitfalls outweigh the benefits for some, making it a questionable choice for long-term financial success.

Benefits and Drawbacks

The potential benefits of cap-free accounts are significant. These accounts provide customers with a greater degree of financial autonomy. However, the absence of limitations might also lead to potential overspending or financial mismanagement for customers who lack adequate financial discipline. The lack of imposed spending limits necessitates careful financial planning and awareness.

Key Features of Various Cap-Free Wells Fargo Accounts

| Account Type | Key Feature 1 | Key Feature 2 | Key Feature 3 |

|---|---|---|---|

| High-Yield Savings | Competitive interest rates | Potential for higher returns | Regular interest payouts |

| Premium Checking | Enhanced customer service | Priority account handling | Higher withdrawal limits |

| Business Checking | Dedicated business support | Flexible transaction options | Advanced reporting tools |

Common Misconceptions

Several misconceptions surround cap-free accounts. One common misconception is that these accounts are entirely free of any restrictions. While restrictions are minimized, account terms and conditions still apply, and overdraft protection fees, for example, might still be incurred. Another misconception is that these accounts are only for high-net-worth individuals. While some premium options are targeted at higher-income individuals, basic cap-free accounts may be accessible to a wider customer base.

Thinking about those cap-free Wells Fargo outfits? They might be a fashion faux pas, especially considering the larger issues at play. A recent example is the veteran’s outrage over the Trump administration’s trans military ban, a move that deeply betrayed troops, as detailed in this article: veteran trumps trans military ban betrays troops. Ultimately, while the ban is a separate issue, perhaps a more considered approach to fashion choices might be a more thoughtful consideration.

So, maybe those cap-free Wells Fargo outfits are a bit too much.

Fashion Faux Pas Potential

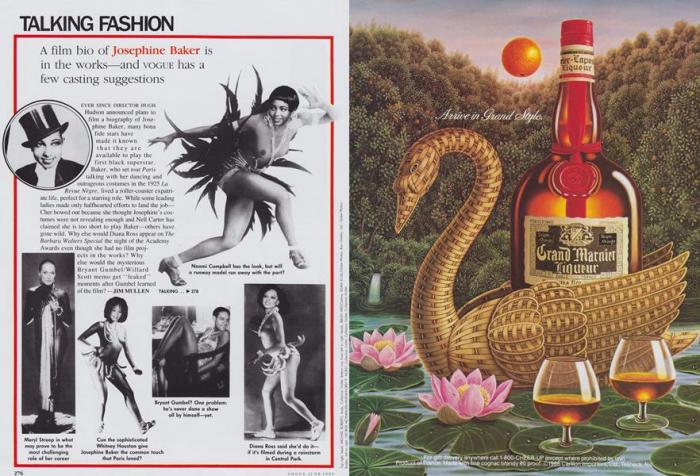

The concept of a “cap-free” Wells Fargo account, while seemingly straightforward, opens a fascinating window into how financial choices can be perceived as style statements. This analysis explores the potential for such an account to be viewed as a fashion faux pas, considering various demographics and social contexts. It’s not just about the account itself; it’s about the implied message it sends about the account holder.This perception is not inherent to the account but rather a social construct.

Similar to choosing a particular brand of clothing or car, a financial choice can signal a certain image or status. The perception of “cap-free” will vary based on the individual’s understanding of financial prudence and social cues. It’s important to consider how this choice might resonate with different groups and the potential pitfalls of a negative perception.

Potential for “Cap-Free” as a Fashion Faux Pas

A “cap-free” account, in the context of personal finance, might be perceived as a risky or irresponsible choice, particularly if not managed strategically. It could be seen as a lack of financial discipline, a willingness to overspend, or a sign of poor financial planning. This perception is not universal and can vary greatly based on cultural and social norms.

Why Someone Might Consider a Cap-Free Account a Style Choice

Some individuals might view a “cap-free” account as a symbol of freedom, control, or a preference for a more active approach to managing their funds. They may see it as a way to avoid the restrictions and perceived limitations of traditional banking methods. The perceived “style” of the account hinges on the individual’s lifestyle and values. For example, someone with a strong entrepreneurial spirit or a desire for greater financial flexibility might embrace a “cap-free” account as a deliberate choice.

Demographic Perceptions of “Cap-Free”

Different demographics will likely have different interpretations of a “cap-free” account. Millennials, for instance, might view it as a modern, progressive approach to finance, potentially associating it with greater control and autonomy. Conversely, older generations may view it with more caution, potentially associating it with a lack of financial responsibility or risk tolerance. The perceived “style” of a cap-free account will likely be viewed differently across generations.

Comparison to Other Financial Choices

The perception of “cap-free” accounts can be compared to other financial choices, like investing or saving. Investing, for example, is often seen as a responsible and forward-thinking choice, while saving might be associated with security and prudence. A “cap-free” account, depending on the individual’s approach, might be perceived as falling somewhere between these two extremes. The perceived “style” of a financial choice is directly correlated with the individual’s perceived lifestyle and goals.

Negative Perceptions in Different Social or Cultural Contexts

In some cultures, a “cap-free” account might be viewed negatively, especially if it’s associated with extravagant spending or a disregard for long-term financial planning. The perceived “style” of a financial choice can be heavily influenced by cultural values. For instance, a culture that prioritizes frugality and saving might view a “cap-free” account as a potentially reckless choice.

Examples of “Cap-Free” as a Fashion Faux Pas

| Social Context | Negative Perception | Explanation |

|---|---|---|

| Luxury Shopping Culture | Impulsive spending | A cap-free account might be seen as a sign of an inability to manage finances and a preference for immediate gratification over long-term planning. |

| Frugal Communities | Lack of financial discipline | In communities emphasizing saving and careful budgeting, a cap-free account might be perceived as a careless approach to managing funds. |

| High-Net-Worth Individuals | Lack of sophistication | An individual with substantial assets might be perceived as lacking sophistication if their financial management style involves a cap-free account, especially if it’s not used strategically. |

Social Context for “Cap-Free” as a Fashion Faux Pas

The social context where “cap-free” is most likely to be perceived as a fashion faux pas is within groups that value financial prudence, careful budgeting, and long-term planning. The social circle and the norms within that circle will determine the acceptable “style” of financial management. It’s not the account itself, but the implied values and behavior associated with it that are judged.

Factors Influencing Perception

The perception of a “cap-free” Wells Fargo account, or any financial product, isn’t simply based on its features. It’s a complex interplay of cultural influences, media portrayals, personal goals, and economic realities. Understanding these factors is crucial for effective marketing and product design. How consumers perceive this new account type directly affects its success.This exploration delves into the nuanced ways cultural norms, media depictions, economic climates, and individual priorities shape public opinion about “cap-free” financial products.

We’ll examine how these elements combine to create a final consumer perception.

Cultural Norms and Financial Choices

Cultural norms significantly impact financial decision-making. Values surrounding saving, spending, and risk tolerance vary across cultures and social groups. For instance, some cultures emphasize collective saving and investment strategies, while others prioritize immediate gratification and personal consumption. These underlying values directly influence the appeal of “cap-free” accounts.

Thinking about those cap-free Wells Fargo outfits? They might be a fashion faux pas, especially in certain settings. While the German foreign minister’s plea to Israel to allow more aid into Gaza ( german foreign minister tells israel allow more aid into gaza ) is certainly important, it doesn’t exactly make cap-free Wells Fargo outfits look any less like a questionable choice.

Maybe a statement piece, but probably not one that will be embraced universally.

Examples of Cultural Values Influencing Financial Decisions

Numerous examples illustrate the link between cultural values and financial choices. In some cultures, a strong emphasis on family obligations may lead individuals to prioritize savings for future generations, potentially making them more receptive to accounts emphasizing long-term financial security. Conversely, a culture prioritizing immediate gratification might be less inclined to see the value in a long-term “cap-free” account.

Influence of Media Portrayals on Financial Products

Media portrayals significantly influence public perception of financial products. News stories, documentaries, and popular media often highlight successful or unsuccessful financial strategies. This can create biases and preconceived notions about particular products, including “cap-free” accounts. For example, if the media repeatedly connects “cap-free” accounts with negative outcomes (e.g., overspending), this perception will likely carry over into the consumer market.

Impact of Marketing Strategies on Public Perception

Marketing strategies and advertising play a critical role in shaping consumer perception. Effective marketing campaigns can highlight the benefits of “cap-free” accounts, emphasizing features like flexibility and freedom. Conversely, poorly executed campaigns can generate negative associations, damaging the account’s image. The language used, the target audience, and the overall message are crucial.

Generational Differences in Perception

Different generations hold varying perspectives on financial products. Millennials, for instance, may value convenience and digital solutions more than older generations. This difference could translate into varied perceptions of “cap-free” accounts, with some finding their ease of use appealing while others might be concerned about the potential for overspending.

Impact of Economic Conditions

Economic conditions can substantially affect the perception of “cap-free” accounts. During periods of economic uncertainty or recession, consumers may prioritize saving and avoid unnecessary spending, potentially leading to a less favorable view of “cap-free” options. In contrast, during periods of economic growth, the perception of these accounts may be more positive.

Impact of Personal Financial Goals

Personal financial goals directly influence the perception of financial products. Individuals saving for a down payment on a house may see the flexibility of a “cap-free” account as beneficial, while those with short-term savings goals may prefer accounts with more structured spending limits. A strong understanding of individual financial goals can greatly influence their perspective on “cap-free” accounts.

Illustrative Examples

The concept of “cap-free” Wells Fargo accounts, while potentially convenient, can evoke a range of perceptions, from sophisticated to unkempt. Understanding these nuances is crucial for effective marketing and customer engagement. This section explores how different scenarios, customer profiles, and marketing strategies can either enhance or detract from the “cap-free” brand image.

Scenarios Where “Cap-Free” Could Be a Fashion Faux Pas

The perception of “cap-free” can be influenced by context and personal style. Imagine a customer presenting a “cap-free” Wells Fargo debit card at a high-end restaurant. The lack of a physical card might be perceived as a sign of financial irresponsibility or a casual disregard for etiquette. Similarly, a young professional using a “cap-free” account at a formal business event could inadvertently convey an image inconsistent with their professional aspirations.

The setting matters.

Scenarios Where “Cap-Free” is a Positive Choice

Conversely, “cap-free” accounts can be perceived positively in certain settings. A tech-savvy millennial using a “cap-free” mobile banking app during a spontaneous weekend trip might find it highly convenient and practical. The ease of access and the ability to manage finances remotely would be viewed as positive attributes. In essence, the suitability of “cap-free” is directly related to the user’s lifestyle and the situation.

How Marketing Campaigns Can Frame “Cap-Free” Accounts

Marketing campaigns play a pivotal role in shaping public perception. A campaign showcasing “cap-free” accounts as a symbol of modern, digital banking, emphasizing ease of use and security, would likely foster a positive image. Conversely, a campaign that portrays “cap-free” as a feature for the financially irresponsible or tech-challenged could severely damage the brand’s reputation. The messaging and imagery used in the campaign are key.

Demographic Perceptions of “Cap-Free” Options

| Demographic | Positive Perception | Negative Perception |

|---|---|---|

| Millennials | Convenience, modernity, efficiency | Potential for security concerns if not well-managed |

| Gen Z | Trendy, cutting-edge, practicality | Potential for social comparison issues |

| Baby Boomers | Simplicity, ease of use if well-explained | Unfamiliarity, concern about technological dependence |

| High-Income Professionals | Sophistication, efficiency | Potential lack of tangible representation of financial standing |

This table illustrates how perceptions of “cap-free” accounts differ across demographics.

Hypothetical Customer Profile: “Mr. Jones”

Mr. Jones, a successful but traditional entrepreneur in his 50s, values tangible representations of his financial achievements. He prefers physical documents and often relies on the visual cue of a credit card or debit card for transactions. For him, a “cap-free” account, without a physical card, might be perceived as impersonal and lacking a sense of security. He might be less comfortable with the technology associated with such an account.

Impact of a Hypothetical Advertisement

An advertisement showcasing a “cap-free” account featuring a young, confident individual effortlessly managing their finances through a sleek mobile app in a bustling city environment would likely evoke a positive perception. The emphasis on ease of use and convenience, alongside the imagery of a modern lifestyle, would enhance the positive association with “cap-free” accounts. Conversely, an advertisement featuring a “cap-free” account with a visibly stressed individual struggling with a complex mobile banking interface would negatively impact the perception of “cap-free” accounts.

The overall message conveyed is crucial.

Alternative Perspectives

Wells Fargo’s “cap-free” account strategy presents a fascinating case study in marketing perception. While the core idea of simplifying banking might seem appealing, the potential for misinterpretation as a “fashion faux pas” necessitates a nuanced approach to framing and promotion. We need to delve into alternative ways to present this concept to avoid the pitfalls of negative connotations.

This requires a shift in focus from highlighting the absence of a feature (the cap) to emphasizing the benefits it unlocks for customers.The key to success lies in reframing the “cap-free” account as a deliberate choice, not a consequence of lack. This perspective change needs to be reflected in every facet of the marketing campaign, from advertising copy to customer service interactions.

A strong and consistent message emphasizing the account’s advantages is crucial to building a positive perception.

Reframing the Message, Cap free wells fargo could be fashion faux pas

Instead of focusing on the absence of a cap, highlight the freedom and flexibility it grants customers. This shift in emphasis can transform the account from a potentially stigmatized product to a desirable choice. The message should resonate with customers who value control and personalized financial management. For example, rather than saying “no cap,” emphasize “complete control over your spending.” This subtle but significant change in wording shifts the narrative.

Alternative Marketing Strategies

A variety of marketing strategies can be employed to promote “cap-free” accounts. These strategies should be tailored to specific customer segments and carefully consider the overall brand image.

- Focus on User Empowerment: Highlight the freedom and flexibility customers gain with the “cap-free” account. Illustrate how they can control their spending without restrictions. Emphasize the personal financial management aspect. This strategy will appeal to customers who prioritize autonomy.

- Highlight Value-Added Services: Instead of solely focusing on the “cap-free” aspect, showcase complementary services, such as robust budgeting tools or rewards programs. This approach broadens the appeal beyond a single feature and positions the account as a comprehensive financial solution.

- Target Specific Demographics: Different demographics may react differently to the concept of “cap-free.” Tailor marketing campaigns to resonate with the specific needs and preferences of these segments. For example, a campaign targeting young adults might focus on the freedom to manage their finances as they see fit, whereas a campaign targeting older adults might emphasize the flexibility and peace of mind in managing expenses.

Educating the Public

Clear and concise explanations of the benefits of “cap-free” accounts are vital. Avoiding jargon and focusing on tangible advantages is key.

- Clear and Concise Language: Use straightforward language to explain the account’s features and advantages. Avoid technical terms and focus on benefits customers can easily understand. Examples include simplified terms and use of relatable scenarios.

- Customer Testimonials: Showcase testimonials from satisfied customers who have benefited from the “cap-free” account. Real-life examples build trust and credibility.

- Educational Materials: Develop informative brochures, online articles, or videos that explain the benefits of the “cap-free” account in a user-friendly format. This will address potential concerns and demonstrate the value proposition.

Successful Marketing Campaigns

Analyzing successful financial product marketing campaigns can provide valuable insights. These campaigns typically feature relatable narratives, clear value propositions, and emotional connections with the target audience.

- Comparison to competitors’ offerings: Highlighting the advantages of the “cap-free” account over similar offerings from competitors can demonstrate its value proposition effectively. A direct comparison can clearly Artikel the strengths and limitations of each account.

- Social Media engagement: Using social media platforms to showcase the account’s benefits through engaging content can reach a broad audience. User-generated content can enhance the campaign’s impact.

- Emphasize ease of use: A key component of a successful marketing campaign for financial products is to highlight the simplicity and ease of use. This will attract customers who value straightforward financial solutions.

Addressing the Potential Fashion Faux Pas

A comprehensive strategy is required to mitigate the risk of the “cap-free” account being perceived as a fashion faux pas.

- Develop a brand personality: Creating a distinct brand identity can help establish a specific image and appeal to a target audience. This brand identity should emphasize the account’s advantages and the target audience’s needs.

- Build a strong brand narrative: Developing a clear brand narrative that resonates with the target audience is essential to create a positive perception. This narrative should highlight the account’s value proposition.

- Consistent messaging across all platforms: A consistent message across all marketing channels is vital to ensure a unified brand image. This will reinforce the account’s value proposition and target audience appeal.

Closing Notes

In conclusion, the perception of cap-free Wells Fargo accounts as a fashion faux pas is complex and multifaceted. It’s not just about the accounts themselves, but about how they’re perceived within various social and cultural contexts. Ultimately, the success of marketing these accounts hinges on understanding these perceptions and crafting strategies that avoid negative associations. We’ve explored the factors driving these perceptions and presented illustrative examples to help paint a clearer picture.

While some may see “cap-free” as a bold financial choice, others might view it as a sign of something else entirely.