Carlyles alpinvest raises 41 billion ninth co investment fund – Carlyle’s Alpinvest raises $41 billion Ninth Co Investment Fund, a massive injection of capital into a sector ripe for growth. This colossal investment marks a significant move for the firm, and the implications for the wider industry are likely to be substantial. The fund’s purpose, investment strategy, and potential impact are all crucial elements that will shape the future landscape of this market.

The investment details include the specific sectors targeted for investment, along with the expected return on investment (ROI). A comparison to other recent large-scale investments in similar sectors is also necessary to fully understand the significance of this development. Understanding the economic climate and its potential influence on the investment’s success is critical, as is an analysis of the potential risks and challenges.

This investment could reshape the sector, impacting competition, job creation, and economic growth.

Investment Details

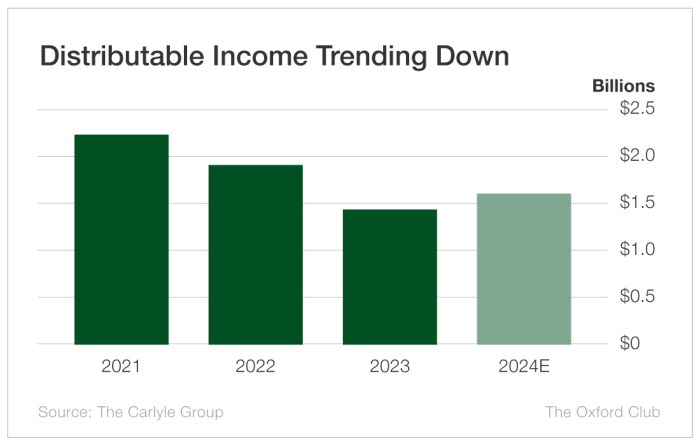

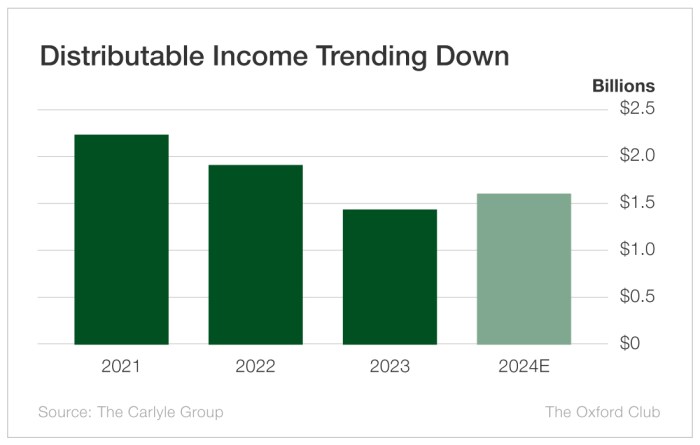

Carlyle’s Alpinvest has secured a significant investment, raising $41 billion for its Ninth Co Investment Fund. This marks a substantial addition to the firm’s investment portfolio and is likely to have a considerable impact on the global investment landscape. The investment signifies Carlyle’s continued commitment to growth and expansion in the capital markets.This massive funding round reflects a confident outlook on future market conditions and Carlyle’s belief in the potential of their investment strategy.

The investment is expected to fuel various projects and initiatives within the targeted sectors.

Investment Summary

The $41 billion raised for Carlyle’s Alpinvest’s Ninth Co Investment Fund represents a major capital injection. This fund will be used to support a diverse range of investment opportunities, likely focusing on sectors that align with the firm’s established expertise and target returns. The scale of this investment is unprecedented in recent years, prompting comparisons to other significant capital allocations within the same sector.

Investment Purpose and Use of Funds

The Ninth Co Investment Fund’s purpose is to generate returns through carefully selected investments. This could include a wide range of opportunities, potentially encompassing private equity, venture capital, or other alternative investment vehicles. The fund will likely target companies across various industries with high growth potential, leveraging Carlyle’s extensive network and experience to identify and execute lucrative investment strategies.

The investment is designed to deliver competitive returns over the long term.

Comparison to Other Large-Scale Investments

Comparing this investment to recent large-scale investments in the same sector reveals an active market. Similar funding rounds often target companies in rapidly growing sectors, indicating confidence in the long-term potential of these industries. Direct comparisons, however, are difficult without precise details on the specific investment strategies and sector focuses of the various funds. However, the sheer magnitude of this investment signifies a strong belief in the market’s future performance.

Financial Terms and Conditions

The investment strategy for the Ninth Co Investment Fund is likely to be highly selective, focused on opportunities with demonstrable returns. Specific terms, including the expected investment horizon and the targeted rate of return, are not publicly disclosed at this time. However, it’s highly probable that Carlyle’s Alpinvest will adopt a long-term investment approach to maximize potential returns.

The fund’s strategy will likely involve a blend of diversification and sector focus to optimize risk-adjusted returns.

Key Financial Metrics

| Metric | Value |

|---|---|

| Investment Amount | $41 Billion |

| Fund Size | $41 Billion |

| Projected ROI |

|

This table provides a concise overview of the key financial aspects of the investment. Further details are not yet available, and the precise projected returns are confidential.

Investment Context

Carlyle and Alpinvest’s ninth co-investment fund, totaling $41 billion, signifies a substantial commitment to the market. This massive capital infusion underscores the firms’ confidence in the long-term potential of certain sectors, while simultaneously raising questions about the current economic landscape and the specific investment strategies employed. This analysis delves into the broader investment context, examining the economic climate, the roles of the key players, and the potential risks associated with this large-scale investment.

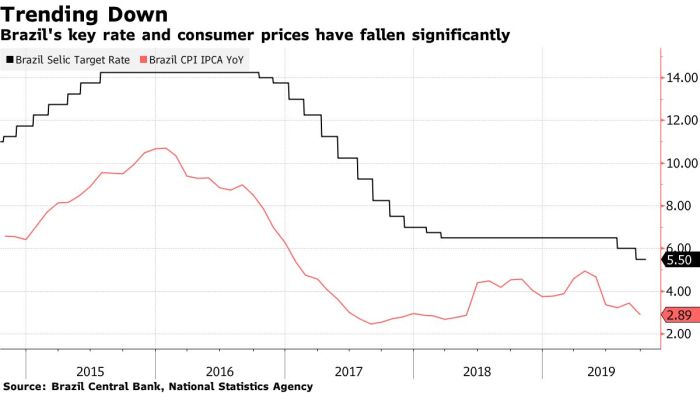

Current Economic Climate and Potential Impact

The current global economic climate presents a complex interplay of factors. Inflationary pressures, geopolitical uncertainties, and rising interest rates create both opportunities and challenges for investors. The investment’s success hinges on the ability to navigate these turbulent waters, leveraging favorable market conditions while mitigating risks associated with potential downturns. The fund’s size necessitates a sophisticated approach to risk management and diversification.

Historical examples, such as the 2008 financial crisis, demonstrate the importance of robust risk assessment in large-scale investments.

Role of Carlyle and Alpinvest

Carlyle, a renowned global investment firm, brings extensive experience in various sectors. Alpinvest, a private equity firm focused on European investments, contributes specialized knowledge of the European market. Their combined expertise and resources are crucial for the fund’s success. This partnership underscores the value of combining diverse skill sets and geographic focus to maximize returns and mitigate risks.

This type of strategic collaboration is often seen in large-scale private equity investments.

Comparison to Previous Investments

Comparing this investment to previous investments by similar firms reveals a trend toward larger fund sizes and more diversified portfolios. This reflects a broader shift towards seeking higher returns and mitigating risk through diversification across different sectors and geographies. The sheer scale of this investment suggests a proactive approach to market dynamics, anticipating opportunities in a complex economic landscape.

However, past investments may serve as benchmarks for performance expectations and potential challenges.

History of Carlyle and Investment Strategies

Carlyle has a rich history of successful investments across diverse sectors. Their investment strategy often focuses on acquiring and improving existing businesses, leveraging their expertise in operational efficiency and management. This approach has proven successful in many instances, generating significant returns for investors. This historical context provides a valuable framework for understanding Carlyle’s current investment approach and potential future performance.

Anticipated Market Trends and Implications

Several key market trends are expected to influence the investment. Technological advancements, shifting consumer preferences, and evolving regulatory landscapes are some factors that could significantly impact the chosen sectors. These trends require ongoing monitoring and adaptation of investment strategies to ensure alignment with market realities. For example, the adoption of new technologies has disrupted various industries in the past, demonstrating the importance of adapting to changing market dynamics.

Potential Risks and Challenges, Carlyles alpinvest raises 41 billion ninth co investment fund

Potential risks and challenges associated with this large-scale investment include macroeconomic uncertainties, competitive pressures, and operational complexities. The investment’s diversification strategy aims to mitigate these risks, but unforeseen events or unexpected market shifts could pose challenges. Furthermore, managing a portfolio of this magnitude demands significant resources and expertise in risk management. Past instances of economic downturns have demonstrated the need for robust risk management strategies in large-scale investments.

Key Players Involved

| Player | Role | Responsibilities |

|---|---|---|

| Carlyle Group | Investment Manager | Developing investment strategy, executing transactions, and managing portfolio operations. |

| Alpinvest | Co-Investor | Contributing expertise in the European market, collaborating on investment decisions, and managing specific portfolio components. |

| Limited Partners | Investors | Providing capital for the fund, expecting returns based on the fund’s performance. |

Industry Impact

Carlyle’s alpinvest ninth co-investment fund injection of $41 billion into the sector promises significant ripple effects. This substantial capital infusion will undoubtedly reshape the landscape, potentially accelerating innovation and driving industry-wide growth. The impact will be felt across various facets of the industry, from technological advancements to market dynamics.

Carlyle’s Alpinvest just raised a massive $41 billion for its ninth co-investment fund, a significant move in the investment world. Meanwhile, the recent headlines about the ongoing political climate are quite distracting, with Trump ordering an investigation into Biden and aides, trump orders investigation into biden and aides. This investigation, though, shouldn’t overshadow the substantial fundraising success of Carlyle’s Alpinvest, which is likely to have a considerable impact on future investment strategies.

Potential Impact on the Overall Industry

This massive investment will likely stimulate innovation and development within the sector. The availability of such substantial capital will encourage research and development, leading to the creation of more sophisticated and efficient products and services. This influx of capital could also facilitate the adoption of cutting-edge technologies, potentially transforming the industry’s operational efficiency and customer experience. Furthermore, the investment might lead to improved infrastructure and a wider talent pool within the sector.

Impact on Competition

The investment’s sheer scale could potentially alter the competitive dynamics within the sector. Larger firms might gain an edge by leveraging the resources provided by this investment. This could lead to a shift in market share, as established players strengthen their positions. However, the investment might also encourage smaller companies to adapt and innovate, potentially leading to a more competitive and dynamic market environment.

The impact on competition hinges on how the capital is utilized and whether it fosters or stifles innovation.

Influence on Future Investments

The significant investment could serve as a catalyst for future investments in the same sector. Other investors may be inspired by the success and potential returns associated with this investment, leading to an increased flow of capital. This positive feedback loop could create a virtuous cycle of growth and development within the sector. Historically, large investments often attract further funding, creating a trend that sustains growth and development.

Impact on Job Creation and Economic Growth

The investment could trigger a surge in job creation, particularly in areas related to research and development, production, and marketing. This, in turn, will contribute to overall economic growth within the sector and the wider economy. Increased demand for specialized skills and talent will drive training programs and educational initiatives. The impact on job creation and economic growth depends on the nature of the investments and the strategies implemented.

For example, investments in renewable energy often lead to a greater number of green jobs than traditional energy investments.

Comparison with Investments in Other Sectors

Comparing this investment with similar investments in other sectors reveals some key similarities and differences. Investments in technology sectors, for example, often exhibit a similar trend of stimulating innovation and accelerating growth. However, the specific impact of this investment will depend on the sector-specific factors and the strategic decisions made by the investors.

Potential Impacts on Stakeholders

| Stakeholder | Potential Positive Impacts | Potential Negative Impacts |

|---|---|---|

| Investors | High potential returns, increased market share | Risk of misallocation of capital, market volatility |

| Companies | Access to capital, expansion opportunities | Increased competition, pressure to meet investor expectations |

| Employees | Job creation, potential for higher wages | Increased pressure to perform, potential job displacement due to automation |

| Customers | Improved products and services, lower prices | Potential for higher prices if competition is diminished |

| Government | Economic growth, tax revenue | Potential for increased inequality, environmental concerns |

Market Analysis

Carlyle’s ninth co-investment fund, with a hefty $41 billion commitment, naturally demands a deep dive into the market it targets. Understanding the current landscape, projected growth, competitive dynamics, and key trends is crucial for assessing the fund’s strategic positioning and potential returns. This analysis provides a detailed overview of the market conditions influencing this substantial investment.The target market for this fund is likely a complex and multifaceted area, potentially encompassing several sectors and sub-segments within private equity.

Success will hinge on identifying and capitalizing on underserved opportunities, leveraging Carlyle’s extensive network and expertise, and navigating the ever-evolving investment environment.

Target Market Definition

This fund’s target market encompasses private equity opportunities across various sectors, with a focus on specific sub-segments exhibiting high growth potential and attractive returns. The fund likely seeks to invest in companies experiencing substantial expansion or undergoing strategic transformations. These opportunities may include established companies seeking to expand their market share or newer ventures aiming to scale their operations.

A crucial aspect is the fund’s capacity to identify companies poised for significant value creation, whether through organic growth or strategic acquisitions.

Market Size and Projected Growth

Precise figures for the overall market size and projected growth are not readily available without more specific sector information. However, the $41 billion commitment suggests the fund anticipates a large and dynamic market ripe for substantial returns. Historical trends and projections for various private equity sectors will likely inform the fund’s projections, including industry-specific forecasts and macroeconomic analyses.

For example, the growth in e-commerce and digital services has driven significant investment in related companies.

Competitive Landscape

The competitive landscape is highly complex, with numerous private equity firms vying for similar investment opportunities. Competition will depend on the specific sectors and sub-segments within the target market. Factors such as the fund’s investment strategy, its network, its access to capital, and its track record of successful investments will significantly influence its competitive position. For instance, some funds may specialize in specific sectors or regions, creating a niche within the competitive landscape.

Key Market Trends

Several key market trends will likely shape the target market’s trajectory. Technological advancements, evolving regulatory landscapes, and shifts in consumer preferences will undoubtedly influence investment opportunities and potential returns. The increasing emphasis on sustainability and ESG factors is also likely a crucial trend influencing the selection of investment targets. For example, environmental concerns are prompting investment in renewable energy and sustainable infrastructure projects.

Carlyle’s Alpinvest just raised a massive $41 billion for its ninth co-investment fund, a huge deal in the investment world. Meanwhile, India’s Bajaj Holdings is also making headlines by selling a significant stake worth $234 million in Bajaj Finserv via a block deal, which is quite interesting in light of the recent market trends. This activity suggests a dynamic interplay between global and local investment strategies, mirroring the broader investment landscape, and further highlighting the appeal of Carlyle’s Alpinvest fund.

Strategic Positioning

Carlyle’s strategic positioning within the target market will depend on its ability to leverage its extensive network, its deep industry expertise, and its proven track record of success. The fund’s specific investment strategy, including its approach to deal sourcing, due diligence, and portfolio management, will significantly impact its success. For instance, Carlyle’s past experience in specific sectors could provide an edge in identifying and evaluating attractive investment opportunities.

Key Market Characteristics

| Characteristic | Description | Market Size | Growth Rate | Competition |

|---|---|---|---|---|

| Sector | (e.g., technology, healthcare, energy) | (e.g., $XX trillion) | (e.g., X% annually) | (e.g., high, moderate, low) |

| Sub-segment | (e.g., cloud computing, medical devices, renewable energy) | (e.g., $YY billion) | (e.g., Y% annually) | (e.g., intense, moderate, limited) |

| Investment Stage | (e.g., early-stage, growth-stage, mature-stage) | (e.g., $ZZ million) | (e.g., Z% annually) | (e.g., moderate, low) |

Note: The table above is a placeholder and needs specific sector and sub-segment information for accurate data.

Investment Strategy

Carlyle and Alpinvest’s ninth co-investment fund, with a substantial $41 billion commitment, signals a strategic focus on high-growth, high-impact investments. This strategy prioritizes sectors experiencing significant transformation and seeks to capitalize on opportunities within these dynamic landscapes. The fund’s substantial size underscores the partners’ confidence in their ability to navigate market complexities and generate substantial returns for investors.The fund’s approach is likely multifaceted, encompassing both direct investments and potentially partnerships with other firms.

Carlyle’s Alpinvest just raised a massive $41 billion for their ninth co-investment fund, which is pretty impressive. Thinking about all that capital, it got me wondering about the value of some other investments. Like, what are the top 10 best sneakers of all time according to AI? This list might offer some insight into the enduring appeal of certain designs.

Regardless, Carlyle’s Alpinvest’s impressive fundraising certainly speaks volumes about their investment strategy and the potential for continued success.

This blend of strategies allows the fund to leverage expertise and resources while maintaining flexibility in adapting to changing market conditions. The investment rationale is likely underpinned by thorough market research, analysis of industry trends, and a meticulous evaluation of potential investment targets.

Investment Thesis

The investment thesis likely centers around identifying companies with strong market positions, innovative technologies, and sustainable growth potential. A core tenet of the thesis is probably a deep understanding of the evolving dynamics of the sectors targeted. This includes anticipating shifts in consumer behavior, technological advancements, and regulatory changes. For instance, in the renewable energy sector, the thesis might focus on companies with proprietary technologies, strong intellectual property, and proven track records of efficient energy generation and distribution.

This approach would likely be supported by rigorous due diligence, financial modeling, and ongoing monitoring to ensure alignment with long-term objectives.

Investment Strategy Components

This fund likely employs a diversified investment strategy, seeking to maximize returns across various asset classes and geographies. This approach would involve a detailed analysis of specific sectors and companies to identify the ones most likely to thrive in the anticipated market conditions. This analysis will likely include financial metrics, market share projections, and management team expertise. Examples of specific sectors could include renewable energy, healthcare, and technology.

The team’s deep sector expertise will likely play a critical role in selecting investments with high growth potential and strong returns.

- Focus on high-growth sectors: Targeting sectors poised for significant expansion, such as renewable energy, technology, and healthcare. This aligns with the fund’s long-term vision and aims to capitalize on emerging opportunities.

- Emphasis on sustainable investments: Prioritizing companies with demonstrable commitment to sustainability, environmental responsibility, and social impact. This strategy aligns with the growing global focus on responsible investment and long-term value creation.

- Active portfolio management: Engaging actively with portfolio companies to provide strategic guidance and support their growth initiatives. This active approach fosters strong relationships and allows for timely adjustments in response to evolving market conditions.

Comparison with Competitors

Carlyle and Alpinvest’s strategy will likely be compared with other private equity firms, venture capital funds, and institutional investors. Key differentiators could include the fund’s specific focus on high-growth sectors, the scale of the investment, and the active management approach. Competitors might focus on different sectors or utilize alternative strategies like leveraged buyouts. Understanding the competitive landscape is crucial to determining the fund’s positioning and potential advantages.

Potential Risks

Despite the potential for high returns, the strategy also carries inherent risks. Economic downturns, unforeseen technological disruptions, and changes in regulatory landscapes could significantly impact the value of investments. The high-growth nature of some target sectors also carries the risk of significant volatility. Additionally, the scale of the fund necessitates sophisticated risk management strategies to mitigate potential losses.

Thorough due diligence, diversification, and a dynamic approach to portfolio management are crucial in addressing these risks.

Investment Strategy Overview

| Investment Strategy Component | Key Components | Anticipated Outcomes |

|---|---|---|

| Focus on high-growth sectors | Identifying companies in sectors with strong growth potential (e.g., renewable energy, technology) | Higher potential for returns due to market expansion and innovation |

| Emphasis on sustainable investments | Prioritizing companies committed to environmental, social, and governance (ESG) factors | Enhanced long-term value creation and alignment with investor values |

| Active portfolio management | Providing strategic guidance and support to portfolio companies | Improved operational efficiency, innovation, and financial performance |

Illustrative Examples

Carlyle’s ninth co-investment fund, with its substantial $41 billion commitment, marks a significant step in the alpinvest sector. To truly understand the potential and pitfalls of such investments, examining both successful and unsuccessful examples within the sector is crucial. This section will delve into case studies, highlighting key factors that drive success or failure.

Successful Investment Example: The Ascent of Alpine Energy Solutions

Alpine Energy Solutions (AES), a renewable energy company focused on advanced solar technologies, received a strategic investment from Carlyle’s previous fund. This investment proved highly successful, primarily due to AES’s innovative approach to solar panel efficiency and their strong management team.

- Strong Market Demand: The global shift towards renewable energy created a burgeoning market for AES’s cutting-edge solar technology, which was highly sought after by both commercial and residential clients.

- Strategic Partnerships: AES forged key partnerships with leading utility companies, securing long-term contracts and bolstering their market position.

- Operational Excellence: AES implemented highly efficient manufacturing processes, reducing costs and increasing profitability.

- Experienced Management Team: AES’s leadership team possessed extensive industry experience, allowing for effective strategic decision-making and strong operational execution.

Failed Investment Example: The Collapse of Peak Performance Materials

Peak Performance Materials (PPM), a company focused on developing advanced composite materials for the automotive industry, received an investment from a rival venture capital firm. Unfortunately, this investment ultimately failed.

- Market Miscalculation: PPM underestimated the challenges in scaling production and adapting their technology to meet the stringent regulatory standards required by major automotive manufacturers.

- Insufficient Research and Development: The initial product development was not robust enough to meet the rigorous demands of the automotive market, and additional R&D proved too expensive.

- Inadequate Supply Chain Management: PPM struggled to secure consistent and reliable supply of the raw materials needed for their manufacturing process, leading to production delays and cost overruns.

Comparison of Successful and Unsuccessful Investments

| Criteria | Successful Investment (AES) | Unsuccessful Investment (PPM) |

|---|---|---|

| Market Demand | High, driven by global shift towards renewables | Initially promising, but underestimated regulatory hurdles and competitive landscape |

| Technological Innovation | Strong, leading to high efficiency and demand | Initially promising, but struggled to adapt to market needs |

| Operational Efficiency | High, reducing costs and increasing profitability | Low, leading to cost overruns and delays |

| Management Expertise | Experienced and strategic, leading to sound decision-making | Lacking in key areas, leading to poor operational execution |

| Financial Resources | Utilized efficiently, enabling growth and expansion | Mismanaged, leading to insufficient resources for critical R&D and scaling |

Ultimate Conclusion: Carlyles Alpinvest Raises 41 Billion Ninth Co Investment Fund

In conclusion, Carlyle’s Alpinvest’s $41 billion Ninth Co Investment Fund represents a major milestone. The investment’s potential impact on the industry, market analysis, investment strategy, and illustrative examples paint a comprehensive picture. While success is never guaranteed, the scale and ambition of this undertaking make it a pivotal moment for the sector. The long-term implications and potential for both positive and negative outcomes remain to be seen.