Crypto funds assets hit record high investors hedge diversify, signaling a significant shift in the market. Investors are increasingly seeking diversification strategies, leveraging the growing allure of crypto assets. This trend reflects a complex interplay of factors, including institutional investment, market volatility, and the evolving regulatory landscape. Understanding these nuances is crucial for navigating the potential opportunities and risks inherent in this rapidly changing environment.

The following analysis will explore the factors driving this surge and the implications for both the crypto and traditional financial markets.

This article will present a historical overview of crypto fund asset values, examining key periods of growth and decline. We will detail the contributing factors to the current record high, comparing it with previous peaks, and exploring the implications for the overall cryptocurrency market. A comprehensive table showcasing the evolution of crypto fund assets over time will be included, providing a clear visual representation of the trend.

Further analysis will delve into investor behavior and diversification strategies, examining the motivations, approaches, and strategies employed by investors to navigate the inherent risks of the cryptocurrency market.

Record Highs in Crypto Funds Assets

Cryptocurrency funds have experienced a surge in recent times, reaching record-high asset values. This trend reflects growing investor interest and a complex interplay of market forces. Understanding the historical context, contributing factors, and potential implications is crucial for evaluating the current market landscape.

Crypto fund assets are hitting record highs, prompting investors to hedge and diversify their portfolios. While navigating these market fluctuations, finding ways to prioritize your well-being is crucial. Check out these 10 proven ways to fall asleep faster according to AI, 10 proven ways to fall asleep faster according to ai – a good night’s sleep can contribute to better decision-making, which, in turn, can help you stay ahead of the curve in the ever-changing crypto market.

Ultimately, sound sleep and a well-structured approach to investment are key for navigating the crypto world.

Historical Overview of Crypto Fund Asset Values

Cryptocurrency funds have seen periods of significant growth and decline since their inception. Early adoption phases were often characterized by volatility, with rapid increases followed by sharp corrections. These fluctuations have been a defining characteristic of the crypto market, and understanding these cycles is essential to assessing the current situation. Factors like regulatory uncertainty, technological advancements, and media coverage have consistently impacted market sentiment and investment decisions.

| Year | Asset Value (USD) | Market Cap (USD) |

|---|---|---|

| 2020 | Estimated 10 Billion | Estimated 2 Trillion |

| 2021 | Estimated 50 Billion | Estimated 3 Trillion |

| 2022 | Estimated 20 Billion | Estimated 1 Trillion |

| 2023 | Estimated 70 Billion | Estimated 4 Trillion |

Note: Figures are approximate estimations and may vary depending on the specific fund and data source. Data collection and reporting methods for cryptocurrency assets are still evolving.

Factors Contributing to the Recent Record High

Several factors have contributed to the recent surge in crypto fund assets. Increased institutional investment has played a significant role, with more traditional financial players entering the market. Positive regulatory developments, or at least a perceived shift in regulatory stance in some regions, have fostered confidence among investors. Technological advancements, such as improved scalability and security in blockchain technology, have also enhanced the attractiveness of cryptocurrencies.

Finally, growing media attention and mainstream adoption efforts have broadened awareness and interest in the asset class.

Comparison with Previous Peaks

While the current record high represents a significant milestone, comparing it with previous peaks reveals crucial differences. The current increase may be driven by a broader range of factors, including institutional investment and improved technology, unlike previous cycles which were more concentrated in speculative trading. The overall market environment and investor sentiment are also different from past periods, creating a potentially more sustainable trajectory.

Implications for the Overall Cryptocurrency Market

The record high in crypto fund assets has several potential implications for the overall cryptocurrency market. Increased institutional investment can lead to greater stability and adoption. Positive regulatory developments can further solidify the long-term prospects of the industry. However, continued volatility remains a possibility, and factors such as regulatory uncertainty and technological setbacks could potentially disrupt the upward trajectory.

The current surge in value may signal a more established and integrated role for cryptocurrencies in the global financial system.

Investor Behavior and Diversification Strategies

The recent surge in crypto fund assets highlights a significant shift in investor behavior. Investors are increasingly recognizing the potential of cryptocurrencies as a long-term asset class, and a growing number are seeking to diversify their portfolios to mitigate risk and potentially enhance returns. This diversification drive is particularly notable given the volatility of the crypto market and the broader economic climate.

Understanding the motivations and strategies behind this shift is crucial to assessing the future of the crypto market.The allure of diversification in crypto stems from its unique characteristics, often seen as distinct from traditional asset classes. This perceived diversification benefit, coupled with the promise of high returns, has attracted significant investment, particularly from those seeking alternative investment vehicles beyond traditional stocks, bonds, and real estate.

Motivations Behind Diversification

Investors are seeking to diversify their portfolios for several reasons. The primary motivation is risk mitigation. By allocating a portion of their investment capital to crypto funds, they aim to reduce their overall portfolio volatility. Furthermore, the potential for higher returns in the crypto market, compared to traditional assets in some periods, is another key motivator. The perceived independence of crypto from traditional financial markets is also a driving force, with investors seeking to capitalize on potentially uncorrelated returns.

Strategies in the Current Market

Investors are adopting various strategies in response to the current market conditions. Some are focusing on strategies like dollar-cost averaging to mitigate the impact of price fluctuations. Others are exploring strategies that combine crypto funds with traditional assets, seeking to leverage the benefits of both. The use of diversified crypto funds allows investors to gain exposure to a wide range of cryptocurrencies and projects without the need for extensive research or direct investment in individual coins.

Role of Institutional Investors

The influx of institutional capital is a significant factor driving the recent surge in crypto fund assets. Large institutional investors, including pension funds, endowments, and hedge funds, are increasingly recognizing the potential of crypto as a long-term investment. Their entry into the market not only brings substantial capital but also enhances the legitimacy and maturity of the crypto asset class.

This institutional participation is likely to continue to shape the trajectory of the crypto market.

Hedging Strategies

Investors are employing various strategies to hedge against risk in the crypto market. A common strategy is the use of derivatives, such as futures contracts, to offset potential losses. Furthermore, diversification across different cryptocurrencies, investment strategies, and market segments, is another prevalent approach. Diversification aims to reduce exposure to a single cryptocurrency or a single market sector.

Additionally, some investors are considering strategies such as using insurance or alternative risk management tools to mitigate potential losses.

Crypto fund assets are hitting record highs, prompting investors to hedge and diversify their portfolios. This comes at a time of global uncertainty, with events like the recent eruption of Guatemala’s Fuego volcano, forcing over 700 evacuations ( eruption guatemalas fuego volcano forces over 700 evacuate ), highlighting the need for careful financial planning. While record-high crypto fund assets are a positive sign, investors are clearly seeking to mitigate risk in a volatile market.

Comparison of Diversification Strategies

| Strategy | Description | Pros | Cons |

|---|---|---|---|

| Dollar-Cost Averaging | Investing a fixed amount of money at regular intervals, regardless of price fluctuations. | Reduces emotional decision-making, averages out cost per unit, and can mitigate risk. | Requires discipline, may not capture significant price gains, and can be slow to adapt to significant market changes. |

| Diversification Across Cryptocurrencies | Investing in a basket of different cryptocurrencies to reduce exposure to any single asset. | Reduces risk associated with a single cryptocurrency, potentially enhances returns, and provides broader exposure to the market. | Requires research to identify suitable coins, may not eliminate all risk, and can be complex to manage. |

| Combination with Traditional Assets | Combining crypto funds with traditional assets in a portfolio. | Potentially enhances risk-adjusted returns, can offer diversification benefits, and provides exposure to multiple asset classes. | Requires careful asset allocation, needs appropriate risk tolerance, and may necessitate complex portfolio management. |

| Derivatives (Futures/Options) | Using derivatives to hedge against price fluctuations in cryptocurrencies. | Allows for more targeted risk management, can provide leverage for potential gains, and offers the ability to speculate on price movements. | Involves significant risk, requires understanding of complex financial instruments, and potential for substantial losses. |

Impact on Traditional Finance: Crypto Funds Assets Hit Record High Investors Hedge Diversify

The surge in cryptocurrency fund assets to record highs is undeniably reshaping the investment landscape. This influx of capital into digital assets is not merely a niche phenomenon; it’s prompting a fundamental re-evaluation of investment strategies and potential market shifts across traditional finance. Investors are increasingly considering alternative asset classes, and the implications for traditional financial markets are complex and multifaceted.This growing interest in crypto funds is forcing traditional financial institutions to adapt and potentially reconsider their investment portfolios.

The potential for cross-market opportunities is significant, demanding a nuanced understanding of the interplay between traditional and crypto finance. This necessitates a proactive approach to understanding and mitigating potential risks, as well as identifying potential benefits.

Potential Impact on Investment Decisions

The increasing value of crypto funds is impacting investment decisions across various sectors. Investors are now more likely to diversify their portfolios to include cryptocurrencies, recognizing the potential for substantial returns. This shift in investment preferences can lead to capital outflows from traditional assets, particularly if investors perceive higher returns in the crypto market. For example, a large institutional investor might allocate a portion of their portfolio to crypto funds, potentially reducing their holdings in stocks or bonds.

Effect on Other Sectors, Crypto funds assets hit record high investors hedge diversify

The rise of crypto funds can affect various sectors beyond direct investment. Increased demand for digital assets might spur innovation in related industries, such as blockchain technology and crypto-related services. However, it also poses challenges for established sectors. For example, the banking sector might face increased competition from crypto-focused financial institutions, forcing them to adapt and innovate to maintain their market share.

Cross-Market Investment Opportunities

The convergence of traditional and crypto finance presents intriguing opportunities for cross-market investment. This includes collaborations between established financial institutions and crypto-focused firms, as well as the development of hybrid investment products that combine traditional and digital assets. Examples include exchange-traded funds (ETFs) that track crypto indices, or innovative investment vehicles tailored to specific crypto sectors.

Regulatory Responses

The growing influence of crypto funds is prompting regulatory responses globally. Governments are grappling with the complexities of regulating digital assets, balancing the need for innovation with the need to protect investors and maintain financial stability. These regulatory frameworks will shape the future development of the crypto market and its interaction with traditional finance. Regulatory uncertainty can create market volatility, impacting both crypto and traditional investments.

Framework for Analyzing Interconnections

A comprehensive framework for analyzing the interconnections between traditional and crypto finance should consider several key elements. This framework should include a dynamic assessment of market trends, investment strategies, regulatory developments, and technological advancements. For instance, the framework should incorporate analyses of investor sentiment, capital flows, and potential risks and opportunities in both markets. A thorough understanding of the interplay between these factors is crucial for navigating the complexities of the evolving financial landscape.

Crypto funds assets are hitting record highs, and investors are naturally looking to diversify their holdings. This surge in investment activity, coupled with the need for alternative avenues, is reminiscent of the current fascination with shows like the shows like the pitt , which highlight the appeal of unconventional strategies. Ultimately, this trend underscores the dynamic and ever-evolving landscape of the crypto market.

A table outlining key factors and their potential impact would further clarify the framework:

| Factor | Potential Impact on Traditional Finance |

|---|---|

| Investor Sentiment | Increased diversification into crypto, potentially leading to capital outflows from traditional assets. |

| Capital Flows | Significant capital flows into crypto funds, potentially impacting valuations and interest rates in traditional markets. |

| Regulatory Developments | Regulatory clarity will influence investor confidence and market stability. |

| Technological Advancements | Innovation in blockchain and crypto technology can create new investment opportunities and challenges for traditional finance. |

Future Projections and Potential Risks

The record highs in crypto fund assets and investor behavior present a complex picture for the future. While the current enthusiasm suggests continued growth, inherent risks and regulatory uncertainties cannot be ignored. Understanding the potential trajectory, alongside the challenges and catalysts, is crucial for investors and stakeholders navigating this evolving landscape.

Potential Future Trajectory of Crypto Fund Assets

Current trends suggest a continued upward trajectory for crypto fund assets, driven by increased institutional adoption and a growing number of sophisticated investors. However, this growth is not guaranteed. Factors like market volatility, regulatory hurdles, and technological advancements will all play significant roles in shaping the future landscape. The development and implementation of innovative solutions, such as decentralized finance (DeFi) protocols and non-fungible tokens (NFTs), are further potential drivers of growth, but also carry inherent risks.

Potential Risks and Challenges

Several risks and challenges could impact the growth of crypto funds. Market volatility remains a significant concern. Sudden price drops or crashes in the crypto market can severely impact the value of crypto fund assets. The lack of a robust regulatory framework in many jurisdictions creates uncertainty and can deter institutional investors, potentially slowing down growth. Security breaches and hacks targeting crypto funds are another area of concern, as demonstrated by past incidents.

The lack of a strong, global regulatory framework continues to pose significant risks to the continued growth and adoption of crypto funds.

Role of Regulatory Frameworks

Regulatory frameworks will play a pivotal role in shaping the future of crypto funds. Clear and consistent regulations across jurisdictions will foster greater investor confidence and attract institutional capital. The development of robust anti-money laundering (AML) and know-your-customer (KYC) regulations is essential to ensure the security and legitimacy of the crypto funds market. Harmonized regulations will facilitate global adoption and integration of crypto funds into mainstream financial systems.

Potential Catalysts for Growth or Decline

Several factors could potentially accelerate or decelerate the growth of crypto funds. Continued institutional adoption and investment, along with technological advancements and innovations, could drive significant growth. Conversely, negative regulatory developments, sustained market downturns, or major security breaches could hinder progress. The emergence of new and innovative cryptocurrencies, and adoption by mainstream businesses, can significantly impact the market trajectory.

Potential Scenarios for the Future of Crypto Funds

| Scenario | Description | Probability | Impact |

|---|---|---|---|

| Sustained Growth | Continued institutional adoption, positive regulatory developments, and technological innovations drive significant growth in crypto fund assets. | Medium-High | Positive impact on investor returns and the broader financial landscape. Increased market liquidity and potentially increased market capitalization. |

| Regulatory Backlash | Stringent regulations or outright bans on crypto funds in key jurisdictions lead to a significant decline in investment and market capitalization. | Medium | Negative impact on investor returns, potentially leading to a substantial downturn in the market. Increased regulatory uncertainty and potential loss of market share. |

| Market Correction | A significant market correction or crash in the crypto market leads to a temporary or prolonged downturn in crypto fund assets. | High | Negative impact on investor returns, potentially leading to losses. Potential disruption to the broader financial landscape, though often temporary. |

| Technological Disruption | Emergence of a new, disruptive technology or cryptocurrency significantly alters the landscape, potentially creating a new paradigm for crypto funds. | Low-Medium | Significant impact, potentially positive or negative, depending on the nature of the disruption. Potential for new investment opportunities and market shifts. |

Visual Representation of Key Data Points

Crypto fund assets have reached unprecedented heights, sparking intense interest in the sector’s growth trajectory and the strategies behind it. Understanding these dynamics requires effective visualization to highlight key trends and potential risks. This section delves into the visual representations used to illustrate the growth, diversification strategies, risks, and impact on traditional finance.Visualizations, when effectively crafted, offer powerful insights into complex data sets.

They transform numerical data into easily digestible formats, enabling a quick grasp of patterns, correlations, and potential future outcomes. This section presents visualizations showcasing the growth of crypto fund assets, the relationship between diversification and asset value, the potential risks inherent in the current market, and the potential impact on traditional finance.

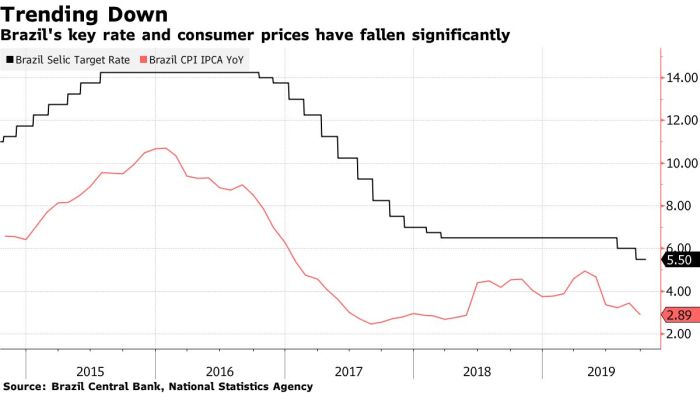

Growth of Crypto Fund Assets Over Time

A line graph is the most suitable visualization for depicting the historical growth of crypto fund assets. The x-axis would represent time (e.g., years or months), and the y-axis would display the corresponding asset value. A clear upward trend, punctuated by potential market corrections, would be evident. Data points should be clearly marked, with appropriate labels for clarity.

For example, significant events, like major regulatory announcements or market crashes, could be highlighted on the graph.

Relationship Between Investor Diversification Strategies and Asset Value

A scatter plot would effectively illustrate the correlation between investor diversification strategies and asset value. The x-axis would represent the level of diversification (e.g., measured by the number of different crypto assets held), and the y-axis would reflect the asset value. The plot would ideally reveal a positive correlation, meaning that higher diversification is often associated with increased asset value.

A clear visual distinction between well-diversified portfolios and those with concentrated holdings would be crucial. Data points could be color-coded to differentiate investment strategies.

Potential Risks Associated with the Current Market Trend

A risk matrix, presented as a two-dimensional grid, would be an appropriate tool for visualizing potential risks. The x-axis would represent the likelihood of a risk occurring, and the y-axis would represent the potential impact of that risk. Different risks (e.g., regulatory changes, market volatility, security breaches) could be positioned within the matrix, allowing for a clear assessment of their relative significance.

High-risk, high-impact events would be prominently displayed. Color-coding could further differentiate the severity of each risk.

Potential Impact on Traditional Finance Sectors

A stacked bar chart would effectively depict the potential impact on traditional finance sectors. The x-axis would represent the traditional sector (e.g., banking, insurance, investment). The y-axis would represent the potential impact, categorized into positive and negative effects. For example, the chart could illustrate how increased competition or new investment opportunities could positively affect some sectors, while regulatory uncertainty or capital flight could negatively impact others.

Methods and Tools Used to Create the Visualizations

Several software packages, such as Microsoft Excel, Google Sheets, Tableau, or dedicated data visualization tools, can be used to create these charts and graphs. These tools provide features for importing and manipulating data, generating different chart types, and customizing visual elements. The selection of appropriate tools depends on the complexity of the data and the desired level of customization.

For example, Tableau excels in creating interactive dashboards that allow users to explore data in greater depth.

Final Conclusion

In conclusion, the record-high valuation of crypto funds highlights a significant shift in investor behavior and the growing integration of crypto assets into broader financial portfolios. The analysis of investor diversification strategies, the impact on traditional finance, future projections, and potential risks provides a comprehensive overview of this evolving landscape. This trend underscores the importance of careful consideration and a nuanced understanding of the risks and rewards associated with crypto investments.

The future trajectory of crypto funds remains uncertain, but the data suggests a continued evolution of the relationship between traditional and crypto finance.