Disinflation is greater force right now than inflation mcgeever – Disinflation is greater force right now than inflation, according to McGeever. This analysis delves into McGeever’s perspective, exploring the factors driving disinflation, its potential impact on the economy, and how economists are forecasting its trajectory. We’ll examine the definitions of inflation and disinflation, key indicators, and the arguments for and against the current trend.

McGeever’s perspective on disinflation’s dominance over inflation hinges on a combination of factors, including monetary policy adjustments, supply chain recovery, and consumer spending patterns. He predicts that this disinflationary trend will continue, shaping the future economic landscape. Let’s explore the supporting evidence and potential counterarguments.

Defining Disinflation and Inflation: Disinflation Is Greater Force Right Now Than Inflation Mcgeever

Welcome to a deep dive into the often-confusing worlds of disinflation and inflation. Understanding these economic concepts is crucial for navigating the complexities of financial markets and making informed decisions. These economic forces shape everything from personal finances to national policies.Disinflation and inflation are closely related but represent opposite trends in price levels. Disinflation, a slowing rate of price increases, is not the same as deflation, which is a general decline in prices.

Inflation, conversely, signifies a sustained increase in the general price level of goods and services in an economy over a period of time. This article will explore the nuances of both, their interrelationship, and how they’re measured.

Defining Disinflation

Disinflation is a decrease in the rate of inflation. It signifies a slowing down of price increases, not necessarily a decline in prices. Essentially, the pace at which prices are rising is decelerating. This often occurs as a result of various economic factors, including decreased demand, reduced input costs, or increased productivity.

Defining Inflation

Inflation is a sustained increase in the general price level of goods and services in an economy over a period of time. This results in a decrease in the purchasing power of money—a dollar buys less than it did before. Several factors can contribute to inflation, such as increased demand, rising production costs, or government policies.

Relationship Between Disinflation and Inflation

Disinflation is aphase* within the broader concept of inflation. It’s a period where the rate of inflation is decreasing, but prices are still generally rising, albeit at a slower rate. Think of it as a car slowing down, still moving forward but at a reduced speed. Disinflation can be a temporary or prolonged trend.

Key Economic Indicators

Several key economic indicators are used to measure disinflation and inflation. These indicators reflect changes in prices across various sectors of the economy. The most common indicators include:

- Consumer Price Index (CPI): Measures the average change over time in the prices paid by urban consumers for a basket of consumer goods and services.

- Producer Price Index (PPI): Tracks the average changes in selling prices received by domestic producers for their output.

- GDP Deflator: Measures the change in prices of all goods and services included in a country’s gross domestic product (GDP).

- Core Inflation: Measures inflation excluding volatile components like food and energy, providing a more stable measure of underlying inflation trends.

Types of Inflation and Disinflation

Different types of inflation and disinflation exist, each with its own causes and characteristics.

- Demand-pull inflation: Occurs when aggregate demand in an economy outpaces aggregate supply. This often results in higher prices across the board.

- Cost-push inflation: Arise when the cost of production increases, potentially due to rising wages, raw material prices, or supply chain disruptions. This can lead to higher prices for consumers.

- Hyperinflation: An extremely rapid and out-of-control increase in the general price level, often resulting in a significant loss of purchasing power. This is a dangerous economic phenomenon.

- Creeping inflation: A moderate, gradual increase in the general price level. This is generally considered acceptable by economists.

Comparison of Disinflation and Inflation, Disinflation is greater force right now than inflation mcgeever

The following table provides a comparative analysis of disinflation and inflation across various economic indicators.

McGeever’s point about disinflation being a stronger force than inflation right now is interesting, especially considering recent news. Pegatron, a major Taiwanese electronics manufacturer, is reportedly in the final stages of evaluating a US factory plan, as reported by their CEO. This move, potentially spurred by a desire to reduce reliance on Asia, might reflect the broader economic shift and the disinflationary trend McGeever highlights.

| Indicator | Definition | Disinflation Example | Inflation Example |

|---|---|---|---|

| Consumer Price Index (CPI) | Measures the average change in prices of consumer goods and services. | A decrease in the rate of CPI increase from 5% to 2% over a period. | A consistent increase in the rate of CPI, such as from 2% to 5% over a period. |

| Producer Price Index (PPI) | Tracks average selling prices received by domestic producers. | A decline in the rate of PPI increase from 4% to 2% over a period. | A sustained increase in the rate of PPI, such as from 2% to 4% over a period. |

| GDP Deflator | Measures the change in prices of all goods and services in GDP. | A reduction in the rate of GDP deflation from -2% to -1% over a period. | A sustained increase in the rate of GDP deflation, such as from -1% to -2% over a period. |

| Core Inflation | Inflation excluding volatile components (food & energy). | A slowdown in the rate of core inflation from 3% to 2% over a period. | A consistent increase in the rate of core inflation from 2% to 3% over a period. |

The McGeever Perspective

McGeever’s perspective on the current economic landscape centers around the idea that disinflation is a more potent force than inflation. This perspective suggests a shift in the expected trajectory of the economy, one that demands a nuanced understanding of the underlying drivers. His analysis delves into the intricate factors contributing to this dynamic, offering insights into the future path of economic adjustment.McGeever’s argument hinges on the belief that disinflationary pressures are currently overriding inflationary ones.

This assertion rests on a complex interplay of factors, including evolving supply chains, changing consumer behavior, and shifts in global monetary policy. He posits that these forces are leading to a period of economic moderation rather than sustained inflation.

While disinflation is definitely a bigger player right now than inflation, as McGeever points out, it’s still fascinating to see how sports can grab our attention. Just yesterday, Coco Gauff won the French Open, a major accomplishment! coco gauff wins french open It’s a reminder that even amidst economic shifts, human achievement continues. All that said, disinflation’s impact on the broader economy is still a compelling narrative.

McGeever’s Arguments Regarding Disinflation

McGeever’s analysis of disinflation highlights several key factors influencing his perspective. He emphasizes the impact of global supply chain disruptions easing, leading to a decrease in input costs for businesses. Furthermore, he points to shifts in consumer spending habits, with a reduced appetite for certain goods and services, contributing to a cooling effect on demand. Finally, McGeever acknowledges the impact of central banks’ proactive measures to combat inflation, which he argues is now effectively managing price increases.

Key Factors Influencing McGeever’s Perspective

Several factors contribute to McGeever’s viewpoint on disinflation. Reduced supply chain disruptions are a significant contributor. As global supply chains recover, the pressure on input costs diminishes, which directly impacts the cost of goods and services. The subsequent decline in prices is a core element of disinflation. Furthermore, evolving consumer preferences are another factor.

Consumers are shifting towards different products and services, often opting for more affordable alternatives, which further cools demand. This adjustment in consumer behavior directly translates into reduced inflationary pressure. Lastly, the proactive stance of central banks in managing inflation, through interest rate hikes, plays a crucial role. By tightening monetary policy, central banks aim to curb demand-pull inflation, ultimately slowing down price increases.

McGeever’s Predictions on the Future Trajectory of Disinflation

McGeever projects a continued trajectory of disinflation, with prices gradually moderating. He anticipates a period of stable economic growth, supported by the disinflationary trend. This outlook is influenced by his assessment of the easing supply chain issues, persistent shifts in consumer demand, and the sustained impact of central bank policies. This prediction, however, is not without potential caveats.

External factors, like geopolitical instability or unexpected shocks, could disrupt the current trend.

Evidence and Reasoning Behind McGeever’s Viewpoints

McGeever’s reasoning is supported by various indicators. The easing of supply chain bottlenecks, evidenced by falling shipping costs and reduced raw material prices, provides a solid foundation for his disinflationary outlook. Furthermore, recent consumer spending data suggests a shift in preferences, with a decrease in demand for certain goods. These data points provide a quantitative basis for his perspective.

The actions of central banks in raising interest rates to curb inflation are further corroborated by official statements and policy announcements, which confirm McGeever’s reasoning. While acknowledging the potential for external shocks, McGeever’s prediction is anchored in observable economic trends.

McGeever’s Arguments for and Against Inflation (Table)

| Argument | Evidence | Reasoning | Counterargument |

|---|---|---|---|

| Disinflation is a greater force than inflation. | Easing supply chain bottlenecks, shifts in consumer preferences, and central bank actions. | These factors are reducing input costs, curbing demand, and managing price increases. | Potential external shocks or unforeseen events could disrupt the trend. |

| Supply chain disruptions are easing. | Falling shipping costs, reduced raw material prices. | Reduced input costs lead to lower production costs and, consequently, lower prices for consumers. | Geopolitical instability or unforeseen events could disrupt the supply chain. |

| Consumer preferences are shifting towards affordability. | Decreased demand for certain goods and services. | Consumers are opting for more affordable alternatives, which dampens demand-pull inflation. | Unforeseen shifts in consumer behavior could impact this trend. |

| Central banks are effectively managing inflation. | Interest rate hikes and policy announcements. | Tightening monetary policy reduces demand and thus curbs price increases. | Unexpected economic shocks could render central bank actions ineffective. |

Economic Factors Affecting Disinflation

The current economic landscape is marked by a significant shift from inflationary pressures to disinflationary trends. Understanding the interplay of various economic factors is crucial for interpreting this transition and forecasting future economic performance. Several forces are driving this change, including monetary policy adjustments, evolving supply chains, consumer spending patterns, and global economic conditions. These factors are interconnected and influence each other in complex ways.Central banks around the world have been actively adjusting monetary policies to combat inflation.

While disinflation is definitely a stronger force than inflation right now, as McGeever points out, it’s interesting to see how the Yankees are dominating the Red Sox, tallying five runs in the first inning to outlast their rivals. This Yankee victory highlights a different kind of power dynamic, perhaps a sign of the times, which brings me back to the idea that disinflation is truly the bigger story in the current economic landscape.

This involves increasing interest rates, which, in turn, impacts borrowing costs and consumer spending. The impact of these policies ripples through various economic sectors, affecting everything from housing markets to corporate investments. These actions, while aimed at curbing inflation, can also contribute to a slowdown in economic activity, potentially leading to disinflation.

Monetary Policy’s Role in Disinflation

Central banks play a crucial role in managing inflation through monetary policy. They utilize various tools, such as adjusting interest rates and influencing money supply, to achieve their inflation targets. Increasing interest rates makes borrowing more expensive, reducing consumer and business spending. This, in turn, cools down the economy and reduces demand-pull inflation. A prime example is the Federal Reserve’s recent interest rate hikes in the United States.

These actions, while intended to combat inflation, can lead to slower economic growth and potentially trigger disinflationary pressures.

Impact of Supply Chain Disruptions on Disinflation

Global supply chain disruptions, which emerged during the pandemic, significantly impacted inflation. The shortages of raw materials and labor, coupled with increased transportation costs, drove up prices across various sectors. However, as supply chains have gradually normalized, prices for goods and services have started to stabilize or decline. This normalization is a key contributor to the current disinflationary trend.

The easing of supply chain bottlenecks has led to a reduction in input costs, thus impacting the overall price level.

Consumer Spending’s Influence on Disinflation

Consumer spending is a vital component of economic activity. Changes in consumer confidence and spending habits directly influence demand and, consequently, inflation. Factors like rising interest rates, economic uncertainty, and the ongoing cost-of-living crisis can all dampen consumer spending. When consumer spending slows down, the demand for goods and services reduces, putting downward pressure on prices, thereby contributing to disinflation.

The reduced demand due to these factors results in a decrease in the price of goods and services, and in turn, a decline in inflation.

Influence of Global Economic Conditions on Disinflation

Global economic conditions, including growth rates and inflation in other countries, significantly impact domestic economies. For instance, a global recession could lead to reduced demand for exports and potentially contribute to disinflation in countries with significant international trade. The interconnectedness of global economies ensures that economic events in one country can ripple through the global system, affecting inflation and disinflation trends in other nations.

A downturn in the global economy can decrease demand for goods, leading to lower prices and contributing to disinflation.

Correlation Between Economic Factors and Disinflationary Trends

| Factor | Description | Impact on Disinflation | Example |

|---|---|---|---|

| Monetary Policy | Central bank actions to manage interest rates and money supply. | Higher interest rates can cool down the economy, reducing demand and potentially leading to disinflation. | The Federal Reserve raising interest rates in 2022. |

| Supply Chain Disruptions | Disruptions in the movement of goods and services. | As supply chains normalize, input costs decrease, potentially leading to disinflation. | Easing of semiconductor chip shortages in 2023. |

| Consumer Spending | Expenditure by households. | Decreased consumer spending can reduce demand, putting downward pressure on prices. | Consumers cutting back on discretionary spending due to rising interest rates. |

| Global Economic Conditions | Economic conditions in other countries. | A global recession can reduce demand for exports, leading to disinflation. | A slowdown in China’s economy impacting global demand. |

Impact on the Economy

Disinflation, the slowing of price increases, presents a complex interplay of potential benefits and drawbacks for the economy. While it can ease inflationary pressures, it also carries the risk of economic stagnation and decreased consumer spending. Understanding the nuanced impact across various sectors is crucial for navigating this economic shift. This analysis will delve into the potential advantages and disadvantages of disinflation, examining its effects on different economic segments and income groups.The shifting economic landscape demands a careful assessment of disinflation’s influence on various sectors.

The potential for positive outcomes, like reduced borrowing costs and increased purchasing power, must be weighed against the possibility of slower growth and decreased investment. This detailed examination aims to clarify the multifaceted impact of disinflation on the overall economic health.

Potential Benefits of Disinflation

Disinflation, when managed effectively, can lead to several positive outcomes. Lower inflation rates often translate to reduced borrowing costs for businesses and consumers. This can stimulate investment and spending, potentially fostering economic growth. Reduced inflationary pressures also lead to greater price stability, allowing individuals and businesses to better plan for the future. This predictability can positively influence long-term investments and spending decisions.

Potential Drawbacks of Disinflation

Disinflation, while potentially beneficial in some respects, can also pose challenges. A significant slowdown in price increases can lead to a decrease in consumer spending. Businesses may experience lower revenues and reduced profitability, potentially impacting employment. In extreme cases, disinflation can descend into deflation, a situation where prices consistently fall, which can be devastating for businesses and consumers alike.

Deflationary spirals can be difficult to reverse.

Impact on Specific Sectors

The effects of disinflation vary significantly across economic sectors. Its impact on housing, energy, and technology, for instance, will differ considerably. Analyzing these impacts is crucial for understanding the broader economic consequences of disinflation.

Industries Vulnerable to Disinflation

Certain industries are inherently more susceptible to disinflationary pressures than others. Industries reliant on rapid price increases or those heavily invested in commodity markets often struggle in periods of reduced inflation. Companies operating in industries with high debt levels or those dependent on borrowed funds are especially vulnerable. Understanding these vulnerabilities is vital for strategic planning and mitigation.

Impact on Different Income Groups

Disinflation’s effects on different income groups are not uniform. While lower inflation generally benefits higher-income earners due to increased purchasing power, lower-income households might experience decreased real wages. Disinflation can also affect specific sectors that serve the lower-income segment, such as certain food retailers. The impact on different income groups should be carefully monitored to mitigate any potential social or economic disparities.

Detailed Analysis of Sectoral Impact

| Sector | Benefit | Drawback | Example |

|---|---|---|---|

| Housing | Lower mortgage rates, potentially increased affordability | Reduced property values, decreased construction activity | Lower interest rates make home purchases more accessible but can also depress property values if sales slow. |

| Energy | Lower energy prices, potentially increased affordability for consumers | Decreased profitability for energy companies, reduced investment in new projects | Lower oil prices benefit consumers but may discourage investment in new oil exploration and production. |

| Technology | Lower input costs, potentially increased profitability | Reduced demand for new technology, lower growth in tech sector | Reduced costs for computer components can benefit manufacturers but may also reduce consumer demand for new products. |

| Retail | Increased purchasing power for consumers, potential for higher sales | Reduced profit margins, pressure on inventory management | Consumers with more disposable income can buy more, but retailers face challenges in maintaining profit margins. |

| Agriculture | Lower input costs, potentially increased profitability for farmers | Reduced demand for agricultural products, lower prices for crops | Lower fertilizer prices can benefit farmers, but falling crop prices can reduce their income. |

Forecasting Disinflation

Predicting the path of disinflation is a complex endeavor, requiring a nuanced understanding of various economic forces and their potential interactions. Forecasting disinflationary trends necessitates careful consideration of the interplay between monetary policy, supply-side factors, and market expectations. Accurate predictions are crucial for businesses, investors, and policymakers alike, enabling them to adapt strategies and prepare for the evolving economic landscape.

Methods for Forecasting Disinflation

A variety of methods are employed to forecast disinflation, each with its own strengths and limitations. These methods draw on historical data, current economic indicators, and expert opinions to create projections about future price trends. Central banks and economic research institutions often use a combination of these techniques to build a comprehensive picture of the disinflationary trajectory.

Examples of Past Disinflationary Periods

Several historical episodes illustrate the complexities of disinflationary periods. The 1980s saw a period of significant disinflation in the United States, driven by the Federal Reserve’s tight monetary policy. The outcome was a reduction in inflation, but also a period of economic recession. Other historical examples demonstrate the nuanced and often unpredictable nature of disinflation, including instances where disinflation was accompanied by economic stagnation or rapid growth.

Understanding the unique characteristics of each historical period is essential for comprehending the possible outcomes of current disinflationary trends.

Economic Models in Disinflationary Forecasting

Sophisticated economic models are frequently used to forecast disinflation. These models attempt to capture the complex relationships between various economic variables, including inflation, interest rates, and output. Models like the Phillips Curve, for example, can help forecast the relationship between unemployment and inflation. These models often incorporate different assumptions and parameters, and their predictive accuracy can vary depending on the specific model and the context of the economic environment.

Role of Market Expectations in Disinflation

Market expectations play a significant role in shaping disinflationary trends. If investors anticipate sustained disinflation, it can influence their investment decisions, leading to changes in asset prices and potentially affecting consumer behavior. Conversely, if market expectations turn pessimistic, it might lead to a self-fulfilling prophecy, hindering the disinflationary process. This illustrates the importance of understanding market sentiment and its potential impact on the economy.

Potential Risks and Uncertainties

Forecasting disinflation involves inherent risks and uncertainties. Unexpected external shocks, such as geopolitical events or supply chain disruptions, can significantly alter the course of disinflation. Furthermore, the interaction of various economic forces is complex and often difficult to model precisely. Unforeseen changes in consumer behavior or business investment decisions can also impact the accuracy of disinflationary forecasts.

Table: Forecasting Methods for Disinflation

| Method | Description | Pros | Cons |

|---|---|---|---|

| Phillips Curve Analysis | Examines the inverse relationship between unemployment and inflation. | Provides a framework for understanding inflation-unemployment tradeoffs. | Simplified representation of complex interactions; may not accurately reflect current economic realities. |

| Econometric Modeling | Uses statistical techniques to build models incorporating various economic variables. | Can incorporate numerous variables; often more sophisticated than simple analysis. | Requires significant data; model accuracy depends on assumptions. |

| Expert Opinion | Insights from economists, analysts, and market experts. | Provides qualitative insights; draws on experience and knowledge. | Subjective; may not reflect the full range of potential outcomes. |

| Market Sentiment Analysis | Assessing market expectations and investor behavior. | Provides a real-time indicator of market confidence. | Difficult to quantify; may be influenced by speculative behavior. |

Visualizing Disinflation Trends

Disinflation, the easing of inflation, is a complex economic phenomenon. Visual representations are crucial for understanding its dynamics and potential impacts. These visualizations can highlight historical trends, current conditions, and potential future trajectories, allowing for a more nuanced understanding of this critical economic shift.Understanding disinflation requires a clear picture of its evolution. Visual tools, like graphs and charts, can help us identify patterns and correlations, allowing for a more comprehensive analysis.

This section will present visual representations of disinflationary trends, utilizing various chart types to illustrate key aspects of this economic shift.

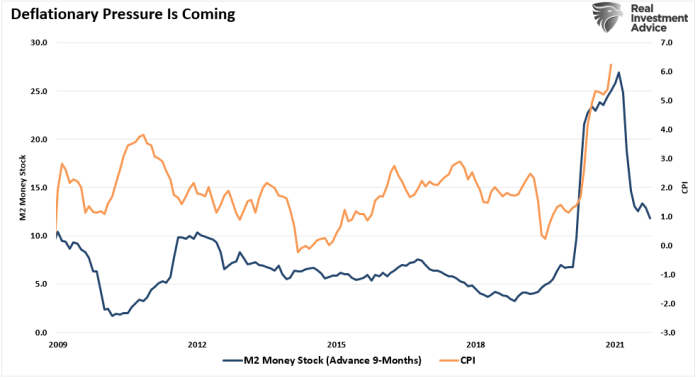

Historical Inflation Rate vs. Current Disinflationary Trend

A bar graph, displaying historical inflation rates alongside the current disinflationary trend, provides a clear comparison. The x-axis would represent different time periods (e.g., yearly), and the y-axis would represent the inflation rate. Separate bars would show the inflation rate for each year, with a highlighted area illustrating the current disinflationary period. This visualization would immediately show the change in the rate of price increases over time.

Data sources would include official government inflation reports, such as the Consumer Price Index (CPI) reports from the Bureau of Labor Statistics (BLS).

Evolution of Key Economic Indicators During Disinflationary Periods

A line graph illustrating the evolution of key economic indicators during disinflationary periods will show the interconnectedness of economic factors. The x-axis would again represent time periods, and the y-axis would display the values of the indicators. The graph would track indicators like GDP growth, unemployment rate, and consumer spending, showing how these indicators react during disinflationary periods.

This visual representation allows for analysis of the overall economic health during periods of decreasing inflation. Data sources would include official government reports on GDP, unemployment, and consumer spending.

Correlation Between Consumer Confidence and Disinflationary Trends

A scatter plot displaying the correlation between consumer confidence and disinflationary trends will show how public perception impacts economic outcomes. The x-axis would represent the consumer confidence index (measured by a reputable organization, such as the Conference Board), and the y-axis would represent the inflation rate. Each data point would represent a specific time period, showing the relationship between consumer sentiment and the disinflationary trend.

This visualization would help determine if consumer confidence plays a significant role in the disinflationary process. Data sources include reports from reputable organizations that track consumer confidence.

Data Sources and Compilation

The data used in these visualizations is primarily drawn from official government sources, including the Bureau of Labor Statistics (BLS) for inflation data, the Bureau of Economic Analysis (BEA) for GDP data, and the Department of Labor for unemployment data. The data compilation involves extracting relevant data points from the original reports, ensuring accuracy and consistency. Data points are meticulously collected, processed, and analyzed to create accurate and reliable visualizations.

Closing Summary

In conclusion, disinflation appears to be the dominant economic force currently, challenging the prevailing inflationary pressures. McGeever’s analysis highlights the complex interplay of economic factors and the importance of understanding the nuances of this shift. While disinflation offers potential benefits, it also presents certain risks and challenges for various sectors. The future trajectory will depend on how these factors continue to evolve.