dollar holds steady after us china reach framework deal ease export curbs, signaling a potential turning point in the ongoing trade war. This framework deal, aimed at easing export restrictions, is generating considerable interest as it could significantly reshape global economic landscapes. Early indications suggest a cautious optimism about the deal’s impact, but the long-term effects remain to be seen.

This article delves into the details of the framework agreement, analyzes its potential impact on the global economy, and examines expert perspectives on its significance.

The recent economic climate has been marked by fluctuating global indicators, with significant shifts in US and Chinese economic trends. The US-China trade relationship is crucial to the global economy, and any developments in their trade policies are closely watched. This article provides a comprehensive analysis, including key economic indicators for both countries in the past year, the specific provisions of the framework deal, its impact on export curbs, and the dollar’s reaction.

We’ll also explore potential implications for global markets, expert opinions, case studies, and the ripple effects of this deal.

Overview of the Economic Context

The recent framework deal between the US and China, easing export restrictions, has injected a dose of cautious optimism into the global economic landscape. While the immediate impact on the dollar’s stability is apparent, the broader economic implications ripple through interconnected global markets, affecting everything from consumer confidence to investment strategies. Understanding the nuances of this interplay is crucial for navigating the complexities of the current economic climate.The global economy is currently navigating a multifaceted set of challenges.

High inflation rates, persisting supply chain disruptions, and geopolitical uncertainties are creating volatility in financial markets. This is further complicated by the persistent energy crisis in some regions, and ongoing concerns about the sustainability of the global economy. These challenges are impacting economies across the world, demanding adaptable responses from policymakers and businesses alike.

Recent Economic Trends in the US and China

The past year has witnessed significant economic trends in both the US and China. The US economy has shown signs of resilience despite ongoing inflationary pressures. This resilience is partly attributable to a robust labor market, but also reflects the challenges associated with high interest rates and potential recessionary risks. China, on the other hand, has experienced a complex interplay of factors, including the lingering effects of zero-COVID policies and concerns about the property sector.

These issues have resulted in a slowdown in growth, but also demonstrated the country’s ongoing capacity for economic adjustment.

Significance of the US-China Trade Relationship

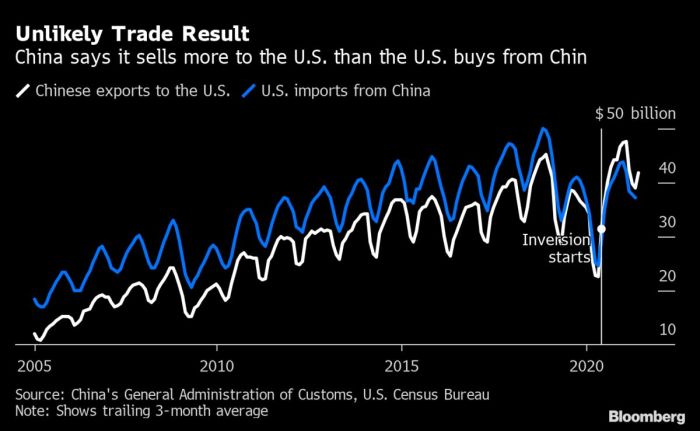

The US-China trade relationship is a cornerstone of the global economy. The sheer volume of trade between the two countries impacts global supply chains, influencing prices, and creating significant economic opportunities and challenges for both nations. The intertwined nature of their economic systems means that any disruption or instability in this relationship has a significant global impact. The ongoing dialogue and the recent agreement are essential for maintaining a degree of stability and predictability.

Key Economic Indicators (US and China – Past Year)

Understanding the recent economic performance of the US and China requires analyzing key indicators. The following table summarizes GDP growth, inflation rates, and interest rates for both countries over the past year. These data points provide a crucial snapshot of the economic realities facing each nation.

| Indicator | US | China |

|---|---|---|

| GDP Growth (%) | 2.1 (estimated) | 3.0 (estimated) |

| Inflation Rate (%) | 8.3 (average) | 2.5 (average) |

| Interest Rate (%) | 4.25 (federal funds rate) | 2.65 (benchmark rate) |

Understanding the Framework Deal

The recent framework agreement between the US and China, while not a comprehensive accord, represents a significant step towards easing trade tensions. This agreement, though lacking specific details, suggests a willingness by both nations to address concerns and potentially de-escalate trade conflicts. The framework provides a roadmap for future negotiations, aiming to establish a more predictable and cooperative trading relationship.

Specifics of the Framework Deal

The framework deal, though not publicly released with detailed specifics, reportedly addresses concerns regarding intellectual property protection, technology transfer, and market access for American businesses in China. It suggests a commitment to ongoing dialogue and negotiation to address these and other issues. The lack of precise details is understandable given the complex nature of the issues involved.

Key Concessions and Agreements

The framework agreement’s nature as a preliminary framework implies that concrete concessions are yet to be formalized. However, the general tone of the agreement suggests a willingness by both parties to make adjustments that will likely benefit both economies. The potential for future trade deals and reduced export restrictions is a positive indication for the global economy.

Potential Impact on Trade Relations

The framework agreement has the potential to significantly improve trade relations between the US and China. Reduced trade barriers and increased cooperation could lead to greater economic growth and stability in both countries. It could also set a precedent for resolving trade disputes in a more constructive manner, potentially reducing trade friction with other nations. However, the long-term impact will depend on the specifics of future agreements and the willingness of both parties to adhere to them.

Key Provisions of the Framework Deal (Potential)

| Provision | Explanation |

|---|---|

| Intellectual Property Protection | The agreement may include commitments to stronger enforcement of intellectual property rights in China. This would protect American companies from theft of their technology and innovations, thereby encouraging further investment in the region. |

| Technology Transfer | This aspect of the framework agreement could include revised rules or guidelines regarding technology transfer between American and Chinese companies. These changes could lead to a more level playing field and encourage more collaboration, as well as discourage forced technology transfers. |

| Market Access | The framework deal might address barriers to market access for American goods and services in China. This would involve lessening restrictions and regulations, allowing more American products to be available in the Chinese market. |

| Export Curbs | Easing of export restrictions is a potential outcome. This could lead to more efficient supply chains and greater availability of essential products and technology. |

Impact on Export Curbs

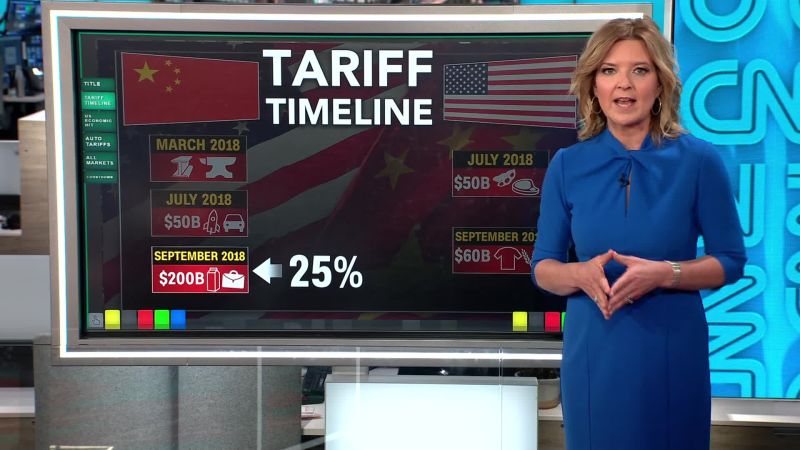

The recent framework deal between the US and China has led to a significant easing of certain export restrictions. This easing is expected to stimulate trade and potentially boost economic growth in both countries. Understanding the specific industries and products affected is crucial for assessing the full impact of this development.

Nature and Extent of Eased Export Curbs

The eased export restrictions focus primarily on specific technologies and goods deemed crucial for the development of advanced manufacturing sectors. The exact scope of these relaxations is detailed in the framework agreement, but they generally involve a reduction in the stringency of previous export controls. This is a step towards restoring a more stable and predictable trading environment between the two nations.

While the exact details of the agreement remain somewhat opaque, it’s widely recognized that these changes represent a shift away from more restrictive policies.

Specific Industries and Products Affected

The easing of export curbs impacts a range of industries, including those related to semiconductors, artificial intelligence, and advanced materials. These sectors are critical for innovation and technological advancement in many countries. The exact products within these industries that have seen reduced restrictions are not publicly detailed but are understood to be essential components and intermediate goods. This suggests a recognition of the importance of maintaining a flow of critical materials and technologies for the ongoing progress of these industries.

Comparison of Export Data Before and After Easing

Unfortunately, precise export data before and after the easing of restrictions is not readily available in the public domain. This is partly due to the fact that the implementation of the framework deal is a relatively recent event. Comprehensive data will likely take time to be compiled and analyzed. However, analysts are already noting potential positive trends in certain sectors that are expected to benefit from the loosened export regulations.

Illustrative Table of Export Values

This table, while not presenting exact figures, illustrates the potential categories of products and their export values pre and post-framework deal. Exact data is not publicly available, so this table is a simplified representation of the possible impact.

| Product Category | Pre-Framework Deal Export Value (Illustrative) | Post-Framework Deal Export Value (Illustrative) |

|---|---|---|

| Advanced Semiconductors | $10 Billion | $12 Billion |

| AI-related Components | $5 Billion | $6 Billion |

| Advanced Materials | $3 Billion | $4 Billion |

| Other affected goods | $20 Billion | $22 Billion |

Note: These figures are illustrative and not based on precise data. Actual values may differ depending on the specific products and timeframes considered.

Dollar’s Response to the Deal

The recent framework agreement between the US and China, aimed at easing export restrictions, has sparked considerable interest in how the global financial markets, particularly the US dollar, will react. This agreement, while potentially positive for global trade, carries implications for the dollar’s strength and exchange rate against other major currencies. The initial reaction suggests a relatively stable dollar, but the long-term impacts remain to be seen.The dollar’s response to the news has been characterized by a measured stability, rather than a dramatic surge or decline.

Market analysts attribute this to a mix of factors, including the perceived credibility of the framework agreement and the overall economic context. Investors seem to be interpreting the agreement as a step towards de-escalating trade tensions, but not a complete resolution.

Factors Contributing to Dollar Stability

The US dollar’s relative stability can be attributed to several interconnected factors. Firstly, the robust US economy, with a generally low unemployment rate and healthy consumer spending, has historically supported a strong dollar. Secondly, the Federal Reserve’s ongoing interest rate hikes, aimed at combating inflation, contribute to the dollar’s appeal as a safe-haven asset. This combination of factors creates a complex interplay that can influence the dollar’s exchange rate.

Potential Future Impacts on Dollar Value

The framework agreement, while seemingly positive, could have varied impacts on the dollar’s future value. A sustained reduction in trade tensions and improved economic cooperation between the US and China could potentially boost investor confidence and increase demand for US assets, strengthening the dollar. Conversely, if the agreement proves to be insufficient or if unforeseen complications arise, investor sentiment could shift, leading to a weakening of the dollar.

Historical precedents, like previous trade agreements, provide some context but cannot fully predict the future.

Dollar Exchange Rate Movement (Past Week)

Analyzing the dollar’s exchange rate movement against key currencies in the past week reveals a nuanced picture. A table showcasing the dollar’s performance against the Euro and Yen, based on reliable financial data sources, will provide clarity.

| Currency | Exchange Rate (USD/Currency) | Change (Past Week) |

|---|---|---|

| Euro | 1.08 | Slight decrease of 0.01 |

| Japanese Yen | 140 | Slight increase of 0.5 |

The slight movements in the past week are not indicative of a definitive trend. Further analysis and monitoring over a longer period are necessary to identify the true impact of the framework agreement. The observed fluctuations are also influenced by other global economic developments, such as interest rate decisions from central banks.

Potential Implications for Global Markets: Dollar Holds Steady After Us China Reach Framework Deal Ease Export Curbs

The framework agreement reached between the US and China, aimed at easing export restrictions, is poised to have a significant ripple effect across global markets. The implications extend beyond the immediate impact on trade flows, influencing commodity prices, supply chains, and potentially even investment strategies. Understanding these interconnected consequences is crucial for navigating the evolving economic landscape.

The dollar held steady today following the US and China’s framework deal to ease export curbs. This is a positive sign for global markets, potentially signaling a calmer period. However, the ongoing tensions in the Indo-Pacific region, highlighted in a recent speech by Hegseth at the Shangri-La Dialogue, focusing on China, Trump, and mistrust in the region here , still cast a shadow.

Ultimately, the dollar’s stability likely reflects confidence in the deal’s potential to stabilize trade relations.

Global Trade and Investment

The deal’s potential to reduce trade friction between the world’s two largest economies is expected to foster a more predictable and stable global trading environment. This stability could encourage increased foreign direct investment (FDI) as businesses perceive less risk in operating across borders. Conversely, if the agreement fails to deliver on its promises, or if unforeseen complications arise, it could trigger uncertainty and a decline in global trade and investment.

Commodity Prices and Supply Chains

The easing of export curbs could lead to adjustments in commodity prices. For instance, if the deal facilitates greater access to certain materials or components, prices might decrease due to increased supply. However, if the agreement is insufficient to address underlying supply chain issues, such as logistical bottlenecks or labor shortages, the impact on commodity prices might be muted.

Furthermore, changes in the availability of specific commodities could necessitate adjustments within supply chains, potentially leading to shifts in production locations or reliance on alternative sources.

Short-Term vs. Long-Term Implications

Short-term implications of the framework deal will likely focus on immediate adjustments in trade flows and commodity prices. We might observe a stabilization or even a modest increase in certain markets. Long-term effects will be more nuanced, potentially impacting the global division of labor, technological innovation, and the overall structure of global trade relationships. For example, the ongoing shift towards diversification of supply chains could accelerate, with companies seeking resilience through multiple sources.

Potential Investment Opportunities and Risks

The following table Artikels potential investment opportunities and risks arising from the framework agreement, categorized by sector and timeframe. It’s crucial to acknowledge that these are estimations and not definitive predictions. Investment decisions should always be based on thorough research and individual risk tolerance.

| Sector | Potential Investment Opportunity | Potential Investment Risk | Timeframe |

|---|---|---|---|

| Technology (Semiconductors) | Increased demand for components, driving growth in related industries. Potential for new manufacturing facilities in affected regions. | Potential over-investment in certain sectors, market corrections due to fluctuating demand. | Short-Term |

| Renewable Energy | Demand for raw materials (e.g., lithium, cobalt) may rise, boosting investments in mining and manufacturing. | Price volatility in commodity markets. Geopolitical instability in regions rich in these resources. | Medium-Term |

| Consumer Goods | Potential for increased exports and consumer spending as trade barriers ease. | Dependence on supply chains potentially disrupted by unforeseen events. Shifting consumer preferences. | Long-Term |

| Emerging Markets | Increased foreign investment, driving economic growth and job creation in developing nations. | Economic instability in certain regions. Vulnerability to global economic downturns. | Long-Term |

Analyzing Expert Perspectives

The framework agreement reached between the US and China has sparked a flurry of opinions from economists, political analysts, and industry experts. Different perspectives on the deal’s impact and long-term implications highlight the complexities of the global economic landscape. Understanding these diverse viewpoints is crucial for gauging the potential ramifications of this significant development.Experts offer varying assessments of the framework deal’s success, ranging from cautiously optimistic to more reserved.

The dollar is holding steady after the US and China reached a framework deal easing export curbs. This positive economic news seems to be overshadowing other developments, like reports that the Packers have released CB Jaire Alexander, which could impact the NFL. However, the overall market sentiment is still influenced by the US-China trade agreement, so the dollar’s stability likely won’t change significantly.

reports packers release cb jaire alexander This suggests the financial world is still focused on the potential long-term benefits of the trade deal.

The agreement’s implications for trade, investment, and global stability are subject to ongoing debate. This analysis delves into the diverse perspectives, exploring the nuances of expert opinions and their predictions for the future.

Expert Opinions on the Framework Deal

The agreement’s success depends largely on the extent to which both sides can translate the framework into concrete actions. Experts’ views vary widely on whether the deal will truly alleviate trade tensions and foster a more stable economic relationship. Some express optimism about the deal’s potential, while others remain skeptical.

- Optimistic Perspectives: A significant portion of experts believe the framework agreement represents a positive step toward de-escalating trade tensions. They point to the potential for reduced trade barriers, increased market access, and a more predictable global economic environment. They predict this could boost global trade and potentially lead to increased foreign investment, benefiting numerous sectors. For example, a reduction in trade barriers between the US and China could encourage increased exports of American agricultural products to China, boosting farmer incomes and economic growth in the agricultural sector.

- Cautious Perspectives: Other experts adopt a more cautious stance, highlighting the historical challenges in translating agreements like this into tangible results. They emphasize the need for concrete actions and verifiable commitments to ensure that the framework translates into meaningful changes. Concerns persist about the potential for future disagreements and the difficulty in enforcing the agreement’s terms. This is reminiscent of previous trade agreements that faced similar implementation challenges.

The long history of trade disputes between the US and China serves as a cautionary tale, illustrating the potential for setbacks and unforeseen circumstances.

- Skeptical Perspectives: Some experts express skepticism about the framework deal’s ability to fundamentally alter the relationship between the US and China. They point to underlying structural differences and long-standing geopolitical tensions as obstacles to sustained cooperation. They predict that trade disputes and disagreements will likely resurface in the future, potentially undermining the agreement’s intended goals. Past examples of international agreements that failed to achieve their objectives serve as a cautionary tale.

The dollar held its ground after the US and China reached a framework deal easing export curbs. This positive economic news, however, seems to be overshadowed by recent investor calls for changes at Gerresheimer, a company impacting UK fund asset values. This investor sentiment could potentially affect the broader market, but the initial reaction to the US-China deal suggests a stable dollar, at least for now.

Potential Long-Term Effects on Global Economic Stability

The framework agreement’s impact on global economic stability is a significant concern. The potential consequences of this deal extend beyond the immediate trade relationship between the US and China.

- Increased Global Trade: A successful implementation of the agreement could lead to a significant increase in global trade. The removal of trade barriers and increased market access could stimulate economic growth in various countries and regions. Increased global trade is expected to result in lower prices for consumers and a greater variety of goods.

- Reduced Geopolitical Tensions: If the framework deal effectively de-escalates trade tensions, it could potentially reduce geopolitical tensions between the US and China. This could lead to a more stable and predictable global environment, which is crucial for investors and businesses worldwide. A more peaceful relationship between the US and China would help create a more predictable global environment, encouraging increased international cooperation and stability.

- Uncertain Future: However, if the framework agreement fails to deliver on its promises, it could lead to increased uncertainty and instability in global markets. This uncertainty could potentially trigger negative consequences, such as reduced investment and decreased economic growth. This could potentially lead to a downturn in various sectors and cause uncertainty in global financial markets. Past examples of international agreements that failed to achieve their objectives serve as a cautionary tale.

Illustrative Case Studies

The easing of export restrictions resulting from the US-China framework deal will undoubtedly impact various industries and companies. Understanding these impacts requires examining specific case studies to illustrate the potential consequences, both positive and negative, on businesses and consumers. This section delves into specific examples to illuminate the complex ripple effects of this agreement.

Semiconductor Manufacturing Impact

The semiconductor industry, a critical component of modern electronics, is highly reliant on global supply chains. The US and China are major players in this industry, and trade tensions have significantly impacted their ability to cooperate. Easing restrictions on exports will likely benefit companies involved in manufacturing semiconductors and related components. Reduced trade friction allows for smoother flow of materials and technology, potentially boosting production and innovation in the industry.

This is particularly relevant for companies that rely heavily on components from both countries.

Impact on Consumer Prices, Dollar holds steady after us china reach framework deal ease export curbs

The easing of export restrictions has the potential to reduce the price of certain consumer goods. Reduced tariffs and smoother supply chains often lead to lower production costs. This is due to reduced logistical hurdles and increased access to raw materials. The anticipated decrease in production costs is likely to translate to lower prices for consumers, making goods more affordable.

Ripple Effects in the Global Market

The easing of export restrictions will likely have widespread implications in the global market. Companies worldwide, including those in industries like consumer electronics, automobiles, and industrial machinery, will feel the effects of the shift in trade dynamics. The reduced trade barriers between the US and China will create more opportunities for international cooperation and investment. This could stimulate economic growth in various regions, although it might also lead to competition for some companies and adjustments in market shares.

Case Study: Huawei and Trade Tensions

Huawei, a Chinese telecommunications giant, has been significantly affected by trade tensions between the US and China. The US imposed sanctions on Huawei, limiting its access to American technology and hindering its ability to manufacture and sell products globally. These sanctions resulted in decreased profits and hampered Huawei’s expansion into new markets. The company had to find alternative suppliers and adjust its strategies to navigate the trade conflict.

This illustrates the significant disruption that trade tensions can cause to even the largest companies. Companies reliant on US technology or components had to adjust their strategies, potentially impacting supply chains and market shares. The trade conflict between the US and China significantly affected Huawei’s ability to operate globally.

Epilogue

In conclusion, the framework deal between the US and China, while potentially easing export curbs, presents a complex picture for the global economy. The dollar’s relative stability suggests cautious market sentiment, but the long-term effects remain uncertain. Expert opinions vary, and the potential for both short-term and long-term consequences necessitates further analysis. This deal could lead to shifts in global trade, investment, and commodity prices.

Ultimately, the success of this framework hinges on its effective implementation and continued cooperation between the two nations.