Ecbs schnabel sees no lasting decoupling fed – ECB Schnabel sees no lasting decoupling fed sets the stage for this insightful analysis. The Federal Reserve’s stance on economic separation from global trends is under scrutiny, particularly in light of recent comments from prominent figures like Peter Schnabel. This piece explores the Fed’s reasoning, Schnabel’s counter-arguments, and the potential global repercussions if the decoupling theory proves inaccurate.

We’ll delve into the historical context, the interconnectedness of global markets, and alternative scenarios.

The Federal Reserve’s current position on decoupling is a crucial topic for economists and investors. Schnabel’s perspective offers a compelling counterpoint, emphasizing the persistent interconnectedness of the global economy. This analysis dissects the arguments on both sides, examining the potential impacts on various sectors and the global financial system as a whole. The analysis will cover potential outcomes of a decoupling scenario, alternative strategies, and the potential responses from different nations.

Fed’s Stance on Decoupling

The Federal Reserve’s (Fed) recent pronouncements on decoupling from global economic headwinds have been a subject of considerable discussion. While the Fed has historically emphasized the interconnectedness of the global economy, recent rhetoric suggests a degree of confidence in the US economy’s resilience. This analysis delves into the Fed’s current position, its supporting arguments, and potential consequences of a miscalculation.The Fed’s current narrative suggests a belief that the US economy can navigate global challenges, such as rising interest rates and inflation in other regions, with minimal impact.

This perspective, however, is not without its critics, who highlight the potential for spillover effects. Understanding the Fed’s reasoning and the historical context surrounding similar economic situations is crucial for assessing the validity of their stance.

Fed’s Current Position on Decoupling

The Fed currently expresses confidence in the US economy’s ability to withstand global economic turbulence, although acknowledging the potential for some impact. This stance is supported by robust domestic labor markets, and relatively low unemployment rates. Furthermore, robust corporate earnings and consumer spending have been cited as indicators of continued economic strength. The Fed’s approach emphasizes the importance of maintaining a stable domestic monetary policy, even in the face of global uncertainties.

Arguments Supporting the Fed’s Stance

The Fed’s belief in decoupling rests on several key arguments. Strong domestic demand, a resilient labor market, and robust corporate earnings are frequently highlighted. The Fed likely also factors in the ongoing fiscal policy measures enacted by the US government. Moreover, the US’s diversified economy, less reliant on specific commodities or industries compared to other regions, is another supportive factor.

Comparison with Previous Pronouncements

The Fed’s current position on decoupling differs somewhat from past pronouncements. Previously, the Fed’s rhetoric often acknowledged the interconnectedness of global markets. However, recent statements have exhibited a greater degree of confidence in the US economy’s insulation from global economic woes. This shift is likely due to the positive economic indicators mentioned above.

Potential Economic Consequences of an Inaccurate Assessment

If the Fed’s assessment of decoupling proves inaccurate, the potential consequences could be significant. A synchronized global recession, or a substantial slowdown in major export markets, could negatively impact US economic growth. This could manifest in decreased consumer spending, reduced corporate profits, and ultimately, a potential economic downturn. The Fed’s response to such a situation would likely be crucial, influencing the severity and duration of any resulting economic hardship.

Historical Context and Fed Responses to Similar Situations

The global economy has experienced periods of interconnected crises. The 2008 financial crisis serves as a prominent example of how interconnectedness can lead to cascading effects across national economies. The Fed’s response during that time involved substantial monetary easing and other policy measures to stabilize the financial system. Understanding the historical context allows for a more nuanced assessment of the current situation and the Fed’s approach.

Summary Table: Fed’s Decoupling Perspective

| Date | Statement/Event | Key Economic Indicators |

|---|---|---|

| 2023-Q1 | Fed Chair’s Press Conference | Strong GDP growth, low unemployment, high consumer confidence |

| 2023-Q2 | Beige Book Report | Varied economic conditions across regions, but overall resilience |

| 2023-Q3 | Monetary Policy Meeting Minutes | Concerns about global uncertainties, but emphasis on domestic stability |

Schnabel’s Perspective on Decoupling: Ecbs Schnabel Sees No Lasting Decoupling Fed

Economist Holger Schnabel, a prominent voice in the global economy, offers a unique perspective on the current global economic landscape. His views, often contrasting with the Fed’s stance, highlight the complexities of interconnectedness and the potential for lasting economic repercussions of decoupling. This analysis delves into Schnabel’s interpretation of decoupling, the global factors influencing his assessment, and the implications for market sentiment.

Schnabel’s Interpretation of the Global Economic Landscape

Schnabel’s assessment of the current global economic landscape centers on the ongoing interplay of various factors. He emphasizes the limitations of a simplistic decoupling narrative, suggesting that a complete separation of the US and China economies, or other major economies, is unlikely and potentially harmful. His focus is on the intricate web of supply chains, trade relationships, and financial flows that characterize the modern global economy.

Global Economic Factors Considered by Schnabel

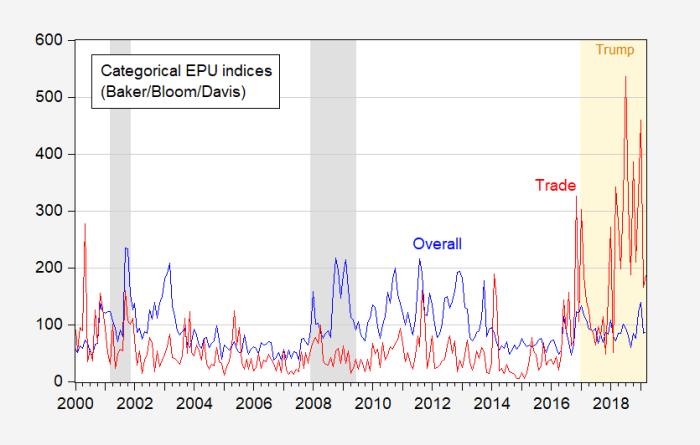

Schnabel’s analysis considers several crucial global economic factors. He acknowledges the persistent trade tensions between major powers, highlighting how these tensions can disrupt supply chains and potentially slow global growth. He also considers the significant role of China’s economic performance and its implications for global trade. Moreover, the ongoing geopolitical instability and its effect on commodity prices are significant factors in his analysis.

ECB’s Schnabel’s recent comments on the Fed’s policies suggest no lasting decoupling is on the horizon. This echoes the ongoing geopolitical tensions, exemplified by discussions surrounding the Trump administration’s proposed “Golden Dome” project in Canada and the potential for Canada becoming the 51st US state, alongside the missile defense costs and the Carney factor. This whole project highlights the interconnectedness of global economies and the difficulty in isolating specific nations from the ripple effects of economic policy.

Ultimately, Schnabel’s stance reinforces the expectation of a continued global economic interplay, rather than a clear separation from the Federal Reserve’s actions.

Potential Risks and Benefits of a Decoupled Economy

Schnabel likely identifies potential risks in a decoupled economy, including the possibility of reduced innovation and slower economic growth due to diminished collaboration. Reduced trade and investment flows could hinder economic progress for many countries. Conversely, he may see benefits in a more regionally focused approach to economic activity. This could lead to greater resilience in individual regions and potentially faster adaptation to new technologies and market conditions.

Comparison with Other Economists’ Views

Comparing Schnabel’s views with other prominent economists, such as those at the Federal Reserve, reveals notable differences. The Fed’s stance tends to emphasize a more optimistic view on the resilience of the US economy and the potential for global growth despite disruptions. Schnabel, however, emphasizes the interconnectedness and potential vulnerability of the global economy. These differing viewpoints are often reflected in their policy recommendations.

Key Differences Between Schnabel’s and the Fed’s Assessment

| Factor | Schnabel’s Assessment | Fed’s Assessment |

|---|---|---|

| Global Interdependence | Significant and potentially limiting | Manageable with adaptation and policy adjustments |

| Geopolitical Risks | A major factor affecting global growth and trade | Potentially manageable with international cooperation |

| Resilience of US Economy | Dependent on global factors and not entirely self-sufficient | Strong and capable of weathering global disruptions |

Influence on Market Sentiment

Schnabel’s views, due to his prominent position and established credibility, could influence market sentiment. His cautious outlook on decoupling could potentially lead to a more risk-averse approach by investors. Conversely, a more optimistic view from other economists could create a more buoyant market environment. The differing perspectives create a dynamic environment where market sentiment is often influenced by the interplay of diverse viewpoints.

ECB’s Schnabel’s recent comments on no lasting decoupling from the Fed’s policies are interesting, but what truly captures my imagination is the fascinating world of dwarf planets like Pluto. Exploring the icy plains and potential subsurface oceans of Pluto, as detailed in what makes Pluto intriguing , provides a unique perspective on the vastness of the universe. Ultimately, the complexities of global economics, like the Fed’s influence on the ECB, still need careful consideration, as Schnabel’s statement highlights.

Potential Impacts of Decoupling

The prospect of a decoupling of the US and China economies, while perhaps seeming abstract, carries profound implications for global stability and economic performance. This potential shift away from interconnectedness could reshape trade patterns, financial flows, and the very fabric of international relations. Understanding these potential impacts is crucial for anticipating and mitigating the potential consequences.The potential for decoupling is not merely a theoretical exercise.

The rise of protectionist policies, geopolitical tensions, and shifts in economic priorities are all factors that can contribute to a more fragmented global landscape. The effects will be multifaceted and far-reaching, impacting economies across the globe.

Consequences for Various Sectors

The consequences of decoupling would extend far beyond trade figures. Different sectors will experience varying degrees of disruption. Industries heavily reliant on global supply chains, like manufacturing and technology, will face significant challenges. Disruptions to the flow of raw materials and components could lead to shortages, price hikes, and production bottlenecks. Sectors that rely heavily on foreign investment, like certain emerging markets, may see a decline in capital inflows, impacting their growth trajectories.

Impact on International Trade and Investment

Decoupling would likely lead to a significant restructuring of international trade. Tariffs, quotas, and other trade barriers could increase, potentially leading to a reduction in global trade volume. Investment flows would also be affected, with capital potentially shifting away from regions perceived as less reliable or politically unstable. The rise of regional trade blocs and the resurgence of protectionist policies would further exacerbate this trend.

A prime example is the ongoing trade disputes and the imposition of tariffs by several countries in recent years.

Impact on the US Economy, Ecbs schnabel sees no lasting decoupling fed

A decoupling scenario could impact the US economy in several ways. Reduced access to Chinese markets for American companies could lead to lower export revenues and potentially higher prices for consumers. The loss of economies of scale associated with global supply chains could also increase production costs. However, the US could potentially benefit from a shift in production toward domestic suppliers and the development of new domestic supply chains, potentially boosting domestic manufacturing jobs and technological innovation.

Impact on Emerging Market Economies

Emerging market economies would likely be among the most vulnerable to a decoupling. These economies often rely heavily on exports to developed countries and foreign investment for growth. A reduction in global trade and investment could lead to slower economic growth, job losses, and increased poverty in these countries. The reliance on a specific partner country, like China, for economic growth and the risk of reduced foreign direct investment could be particularly damaging.

Impact on Global Financial Stability

A significant decoupling could destabilize the global financial system. The interconnectedness of global financial markets means that a disruption in one region can quickly ripple through the entire system. Reduced trade and investment could lead to lower global economic growth, impacting the ability of governments to manage their debts and potentially leading to financial crises. The experience of the 2008 financial crisis, which originated in the US, highlighted the vulnerability of global financial markets to shocks originating in specific economies.

Comparison of Short-Term and Long-Term Effects

| Aspect | Short-Term Effects | Long-Term Effects |

|---|---|---|

| Economic Growth | Potential slowdown in global economic growth, increased uncertainty. | Restructuring of global supply chains, potentially leading to a new global economic order. |

| Trade | Increased trade barriers, reduced volume of international trade. | Rise of regional trade blocs, potential for increased protectionism. |

| Investment | Reduced investment flows to affected regions. | Shifting of investment patterns, new investment opportunities in alternative regions. |

| Financial Stability | Increased volatility in global financial markets. | Potential for long-term changes in the global financial architecture. |

Interconnectedness and Global Economy

The global economy is a complex web of interconnected relationships, where events in one region can quickly ripple through the rest of the world. This interconnectedness, while fostering opportunities for growth and cooperation, also creates vulnerabilities. A decoupling of major economies, while theoretically possible, faces significant challenges due to this intricate web of dependencies. Understanding these complexities is crucial for navigating potential future economic scenarios.The global economy operates on a foundation of interconnectedness.

Trade, finance, supply chains, and even cultural exchange create a network of dependencies. A single nation’s economic downturn can have cascading effects, impacting global markets and potentially triggering a wider recession. This interdependency underscores the importance of managing economic risks and fostering global cooperation.

Factors Hindering Complete Decoupling

Significant barriers exist to a complete decoupling of major economies. The intricate nature of global supply chains makes complete severance impractical. Many industries rely on components and resources sourced from multiple countries. Disruptions to these chains would cause significant economic hardship. Furthermore, financial markets are deeply intertwined, with international investment flows and currency exchange rates impacting economic stability worldwide.

The globalized nature of financial markets means a significant disruption in one region will almost certainly have consequences for others. International institutions play a crucial role in managing these complex interdependencies.

Spillover Effects of Economic Events

Economic events in one region frequently have spillover effects on others. For example, a significant decline in demand in one major economy can lead to reduced exports and investment for other countries. This can trigger a domino effect, leading to contractions in production, job losses, and potentially wider economic downturns in the affected regions. The 2008 global financial crisis serves as a stark reminder of the potential for widespread economic disruption stemming from a single region’s crisis.

Role of International Institutions in Managing Challenges

International organizations, such as the International Monetary Fund (IMF) and the World Trade Organization (WTO), play a crucial role in mitigating global economic risks. These institutions provide a platform for countries to cooperate, share information, and coordinate responses to economic challenges. Their expertise and established frameworks are essential in addressing global economic volatility and ensuring stability. The IMF, for example, offers financial assistance and policy advice to countries facing economic difficulties.

ECB’s Schnabel’s recent comments about no lasting decoupling from the Fed are interesting, especially considering the US’s current efforts to secure a better relationship with China regarding rare earth minerals. A White House aide recently highlighted the US’s desire for a more cooperative approach with China on this front, us seeking handshake rare earths china white house aide says.

Ultimately, Schnabel’s statement suggests a continued interconnectedness between the global economies, even with these potential shifts in geopolitical strategies.

These measures help prevent crises from escalating and spreading globally.

Potential for a Global Recession

A complete decoupling of major economies could potentially trigger a global recession. This is a serious possibility given the interconnected nature of the global economy. Reduced trade, investment, and demand could cause significant economic hardship in many countries. The 2008 financial crisis serves as a cautionary example, illustrating how a crisis in one region can quickly spread to others.

The interconnectedness of the global economy is not just a theoretical concept; it is a practical reality with real-world consequences.

Global Economic Indicators Affected by Decoupling

| Indicator | Potential Impact of Decoupling |

|---|---|

| Global Trade Volume | Likely decrease due to reduced demand and disruptions in supply chains. |

| Foreign Direct Investment (FDI) | Likely decrease as businesses reassess investment strategies in a less integrated global market. |

| Global GDP Growth | Potentially slower growth or even contraction in many regions. |

| Commodity Prices | Fluctuations depending on the specific commodity and the nature of the decoupling. |

| Currency Exchange Rates | Significant volatility as investors react to the uncertainty and shifting economic dynamics. |

| Unemployment Rates | Likely increase in several regions as businesses cut back on production and investment. |

Alternative Scenarios and Potential Outcomes

The potential for global economic decoupling, while currently debated, presents a range of possible scenarios, each with varying degrees of severity and implications. Understanding these alternative pathways is crucial for policymakers and investors alike, as the choices made in response will significantly shape the future trajectory of the global economy. The interconnected nature of global markets means that any substantial shift in one region can have ripples across the entire system.

Alternative Scenarios for Global Decoupling

Different degrees of decoupling can lead to distinct outcomes. A complete decoupling, though highly improbable, would involve significant economic isolation between regions. Conversely, a partial decoupling, focusing on specific sectors or areas, could still have substantial impacts on global trade patterns and investment flows. The extent of decoupling will depend on various factors, including political relations, technological advancements, and the resilience of global supply chains.

Likelihood of Each Scenario and Potential Economic Outcomes

Assessing the likelihood of each scenario requires careful consideration of historical precedents and current geopolitical dynamics. A complete decoupling is less likely due to the deep integration of global markets and the significant economic benefits derived from international trade. However, a partial decoupling, focused on specific sectors or regions, could become more prevalent. Potential economic outcomes could range from a slowdown in global growth to more significant economic disruptions, depending on the extent and nature of the decoupling.

The degree of interconnectedness in specific sectors, like technology or finance, would play a crucial role in determining the impact. Historical examples, such as the 1980s trade wars, offer valuable insights into the potential economic consequences of trade tensions.

Potential Policy Responses to Address Decoupling

Different countries will likely adopt various policy responses to address the challenges posed by decoupling. These responses could include diversification of supply chains, regional trade agreements, and investment in domestic industries. For example, a country heavily reliant on a specific foreign market might prioritize diversifying its export destinations. The effectiveness of these policies will depend on the specific circumstances of each nation.

Examples of Past Economic Events with Similar Characteristics and Outcomes

Several past economic events, like the 2008 financial crisis or the trade wars of the early 2010s, offer insights into the potential outcomes of decoupling scenarios. The 2008 crisis highlighted the interconnectedness of global financial markets, illustrating how a crisis in one region can rapidly spread globally. The trade wars of the early 2010s demonstrated the potential for trade disputes to disrupt global supply chains and reduce economic growth.

Table Comparing Potential Outcomes of Different Policy Responses

| Policy Response | Potential Outcome (Economic Growth) | Potential Outcome (Trade) | Potential Outcome (Investment) |

|---|---|---|---|

| Diversification of supply chains | Moderate increase in economic growth | Increased regional trade | Attracting investments in diversified markets |

| Regional trade agreements | Moderate increase in economic growth | Increased trade within the region | Increased investment in the region |

| Investment in domestic industries | Potential for moderate growth, but depends on the sector | Limited direct impact on trade | Increased domestic investment |

Potential Impact on Individual Investors

The potential impact on individual investors depends on the nature of the decoupling and the specific investments held. Investors in global equities or commodities might experience volatility if global trade patterns change. Diversification of investment portfolios across different regions and asset classes can mitigate some of these risks. Holding assets in countries less affected by the decoupling could provide a buffer against potential downturns.

Understanding the dynamics of the global economy and adjusting investment strategies accordingly is crucial to managing potential risks.

Final Thoughts

In conclusion, the debate surrounding decoupling, fueled by the Fed’s perspective and Schnabel’s counterpoint, highlights the complex and interconnected nature of the global economy. The analysis demonstrates that a complete decoupling is unlikely due to the deep interdependence of various economies. The potential consequences of an inaccurate assessment of decoupling are significant, emphasizing the need for a nuanced understanding of global economic dynamics.

Further investigation into alternative scenarios and potential policy responses will provide a clearer picture for investors and policymakers alike.