Feds cook sees evidence trade policy weighing economy, highlighting a complex interplay between global trade and domestic economic health. This intricate relationship affects interest rates, inflation, and overall economic performance. Past trade policies have demonstrably impacted the economy, and understanding these historical interactions is crucial for navigating the current landscape and anticipating future scenarios. This discussion delves into the specific ways trade policies influence economic outcomes, contrasting the potential impacts of monetary policy versus trade policy.

It explores the current economic climate, recent trends in global trade, and the possible future implications for both trade and monetary policy.

The analysis considers various methodologies for evaluating the effects of trade policies, offering a nuanced understanding of the complex causal relationships at play. Case studies provide real-world examples to illustrate the practical application of these insights. This overview also examines the potential conflicts and synergies between Federal Reserve actions and trade policies, providing a comprehensive picture of the intricate factors influencing economic performance.

Federal Reserve Policy and Trade Policy Interaction: Feds Cook Sees Evidence Trade Policy Weighing Economy

The Federal Reserve’s monetary policy and trade policies are intertwined, impacting the economy in complex ways. Understanding this interplay is crucial for navigating the challenges of modern economic management. While often treated as distinct areas, these policies frequently influence each other, creating both opportunities and challenges for policymakers.The historical relationship between these policies has been characterized by both cooperation and conflict.

Federal Reserve Chair Cook’s recent comments highlight the impact of trade policies on the US economy. While the current focus is on how these policies are affecting economic growth, it’s interesting to consider how the political climate, like the recent USA-Canada hockey 4-nations face-off final, potentially reflects broader societal anxieties that also intertwine with these economic considerations.

Ultimately, the weight of trade policy on the economy remains a significant concern for the Federal Reserve.

Trade policies, such as tariffs and trade agreements, can affect the overall economic climate, influencing inflation and employment levels, factors directly impacting the Federal Reserve’s interest rate decisions.

Historical Relationship Between Federal Reserve Actions and Trade Policies

Historically, trade policies have often been a significant factor in the decisions of the Federal Reserve. For example, during periods of trade protectionism, increased tariffs or import restrictions could lead to reduced trade volumes, impacting domestic production and potentially causing inflationary pressures. Conversely, periods of open trade could boost economic growth and potentially moderate inflationary pressures. These historical relationships highlight the interconnectedness of these two policy areas.

Impact of Trade Policy Changes on the Economy

Changes in trade policy have had noticeable impacts on the economy, especially in relation to interest rates and inflation. For example, the imposition of tariffs by one country can trigger retaliatory measures from other countries, leading to trade wars. These wars can disrupt supply chains, reducing the availability of goods and potentially leading to higher prices, ultimately impacting the Fed’s interest rate decisions as they respond to inflation pressures.

Potential Conflicts and Synergies Between Policy Areas

Conflicts between these policies can arise when trade policies, like tariffs, increase import costs, potentially fueling inflation. Conversely, synergies are possible when trade policies foster economic growth, potentially reducing the need for aggressive monetary tightening. A balance between the two policies is critical for a healthy economy.

Mechanisms of Trade Policy Influence on Interest Rate Decisions

Trade policy decisions can influence interest rate decisions through their effect on inflation and economic growth. If trade policies lead to higher import costs, this can translate into higher consumer prices, pushing inflation up. The Fed, in response, might raise interest rates to control inflation. Conversely, if trade policies boost economic growth and reduce inflation pressures, the Fed might have less need to raise interest rates.

Effectiveness of Monetary Policy vs. Trade Policy

The effectiveness of monetary policy versus trade policy in addressing economic challenges is debatable. Monetary policy, with its focus on interest rates and the money supply, can be a swift tool for influencing inflation and economic growth. Trade policy, on the other hand, is typically a longer-term strategy with potential benefits and drawbacks that can take years to fully realize.

The optimal approach often involves a combination of both policies.

Factors Influencing Monetary and Trade Policies, Feds cook sees evidence trade policy weighing economy

| Policy Area | Specific Policy | Intended Economic Impact | Potential Unintended Consequences |

|---|---|---|---|

| Monetary | Interest rate hike | Lower inflation | Reduced consumer spending, slower economic growth |

| Monetary | Interest rate cut | Stimulate economic growth | Potential for higher inflation |

| Trade | Tariff imposition | Increase domestic production | Trade wars, retaliation, higher prices |

| Trade | Free trade agreement | Increased trade, lower prices | Job losses in import-competing industries, potential for exploitation of labor |

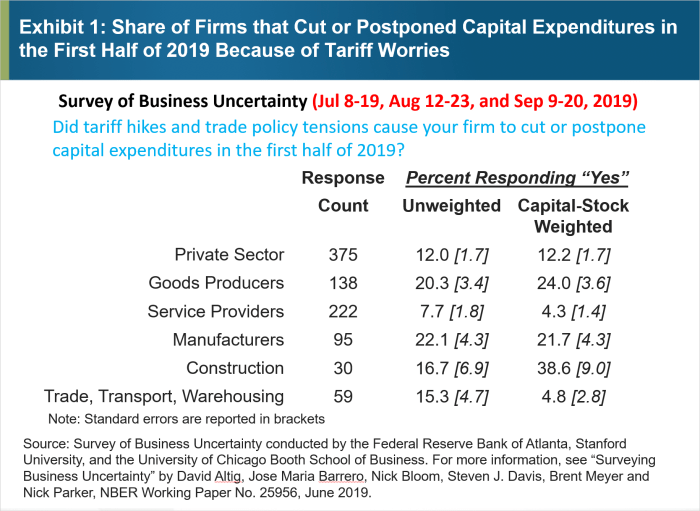

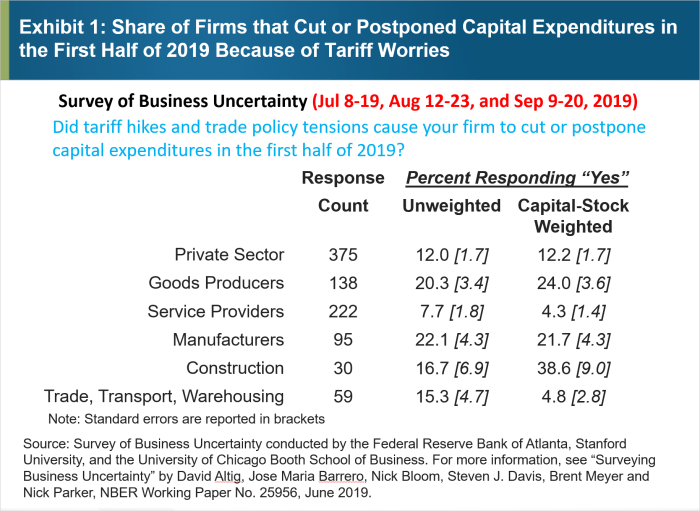

Evidence of Trade Policy Impact on the Economy

Trade policies, encompassing tariffs, quotas, and subsidies, exert a profound influence on the global economy. Understanding how these policies affect various economic indicators is crucial for policymakers and businesses alike. This analysis delves into specific economic indicators reflecting the impact of trade policies, illustrating correlations between trade policies and economic performance, and exploring analytical methodologies for quantifying these relationships.Examining the multifaceted effects of trade policies on economic indicators is essential for comprehending their broader implications.

This involves identifying and interpreting the complex interplay between trade policies and key economic metrics.

Specific Economic Indicators

Several economic indicators can be used to assess the impact of trade policies on the economy. These indicators reflect various aspects of economic performance, such as output, employment, prices, and trade balances. Key indicators include GDP growth rates, employment figures, inflation rates, and trade balances. Changes in these indicators, in relation to trade policy shifts, offer insights into the policy’s effect on the overall economy.

For example, a surge in imports, resulting from reduced tariffs, might initially boost consumer spending but potentially lead to decreased domestic production.

Data Sets Demonstrating Correlations

Numerous data sets demonstrate correlations between trade policies and economic performance. Government agencies, international organizations, and academic research institutions publish comprehensive datasets on trade flows, tariffs, GDP, and employment. The World Bank, the International Monetary Fund (IMF), and the Organization for Economic Co-operation and Development (OECD) are primary sources for such data. Analyzing these datasets over time can reveal patterns and correlations.

Federal Reserve Cook’s comments about trade policy impacting the economy are timely, given the ongoing US-China trade talks. The discussions, now in their second day, us china trade talks resume second day , could significantly influence market sentiment and potentially ease some of the pressure Cook alluded to. The Fed’s careful monitoring of these developments is crucial as they weigh the overall economic picture.

For instance, analyzing import/export data from different countries along with tariff rates can highlight the impact of trade agreements on specific sectors.

Methods for Analyzing Causal Relationships

Determining the causal relationship between trade policies and economic outcomes is complex. Various methods are employed to analyze these relationships. Regression analysis, time series analysis, and event studies are commonly used approaches. These methods aim to isolate the impact of trade policies from other factors that may influence economic performance.

Econometric Models for Quantifying Impact

Econometric models provide a powerful tool for quantifying the impact of trade policies. These models use statistical methods to estimate the effects of specific trade policies on different economic variables. For instance, a gravity model can estimate the impact of distance between countries on trade volumes, while controlling for factors like GDP and trade agreements. Structural models, like computable general equilibrium (CGE) models, simulate the effects of trade policies on a wide range of economic variables.

Example: A CGE model could simulate the impact of a tariff increase on the prices of imported goods, consumer welfare, and domestic production.

Comparison of Methodologies

| Methodology | Strengths | Limitations | Examples of Application |

|---|---|---|---|

| Regression Analysis | Relatively straightforward to implement, can control for other factors | Can struggle with omitted variable bias, may not capture non-linear effects | Estimating the impact of tariffs on import volumes, considering factors like GDP and exchange rates |

| Time Series Analysis | Can capture long-run trends and cyclical patterns | Difficult to isolate specific policy effects from other economic shocks | Analyzing the correlation between trade liberalization and GDP growth over time |

| Event Studies | Useful for analyzing the impact of specific policy events | May not account for pre-existing trends or external factors | Assessing the impact of a trade agreement on bilateral trade volumes |

| CGE Models | Can simulate the impact of trade policies on a wide range of economic variables | Computationally intensive, requires detailed data and assumptions | Simulating the impact of a trade agreement on the welfare of different groups in the economy |

Current Economic Landscape and Policy Considerations

The US economy is navigating a complex interplay of factors, including inflation pressures, labor market dynamics, and evolving trade policies. Understanding the current state of these elements is crucial for assessing the Federal Reserve’s role in managing the economy and for anticipating potential impacts of global trade trends. This analysis delves into the specifics of these factors and their implications.

The Fed’s Cook sees signs that trade policy is impacting the economy, which is definitely a concern. Meanwhile, Hunter Greene’s impressive performance, where he shut down rival brewers hunter greene reds out cool off rival brewers , offers a glimpse of the potential for strong pitching to influence outcomes. This all points back to the broader economic picture and how various factors intertwine.

Current State of the US Economy

The US economy is currently experiencing a period of mixed signals. Inflation remains a significant concern, impacting consumer spending and potentially hindering economic growth. The unemployment rate, while relatively low, presents a nuanced picture, with labor shortages in certain sectors alongside pockets of higher unemployment in others. Gross Domestic Product (GDP) growth has exhibited variations, influenced by factors such as supply chain disruptions and consumer confidence.

Current Trade Policies and Their Effects

Current US trade policies are characterized by a mix of protectionist and free-trade measures. Tariffs on certain imported goods and initiatives aimed at reshoring some manufacturing operations have been implemented. These policies aim to address concerns about trade imbalances and national security, but their long-term effects on overall economic growth and consumer prices are subject to ongoing debate.

The potential for retaliatory measures from trading partners also introduces uncertainty.

Role of the Federal Reserve in Managing the Economy

The Federal Reserve plays a critical role in managing inflation and maintaining stable economic growth. Given the current economic landscape, the Fed’s actions, including interest rate adjustments and quantitative easing/tightening, are influenced by the evolving trade policies and their impact on inflation and employment. The Fed must carefully balance these considerations to maintain price stability and foster sustainable economic growth.

Recent Trends in Global Trade and Their Impact

Recent trends in global trade reflect shifts in geopolitical landscapes and supply chain realignments. The rise of protectionist sentiments in some countries has led to increased trade tensions and disruptions. The COVID-19 pandemic further complicated global supply chains, highlighting the interconnectedness of economies and the need for resilient trade networks. These disruptions and tensions have significant implications for the US economy, influencing input costs, consumer prices, and overall economic output.

Key Economic Indicators and Recent Trends

Understanding the recent trends of key economic indicators is crucial for assessing the current economic climate and its potential impact on Federal Reserve policy.

| Indicator | Recent Value | Trend | Potential Impact on Fed policy |

|---|---|---|---|

| Inflation Rate (CPI) | 7.1% (October 2023) | Decreasing | May lead to a cautious approach by the Fed, potentially delaying further rate hikes. |

| Unemployment Rate | 3.7% (October 2023) | Stable | Suggests a strong labor market, but could also contribute to inflation pressures if wage growth accelerates. |

| GDP Growth Rate | 2.1% (Q3 2023) | Slowing | Could influence the Fed’s decisions on the pace of interest rate adjustments, potentially signaling a need for more gradual changes. |

| Trade Deficit | 870 Billion (2023) | Increasing | May influence the Fed’s assessment of the economic outlook and the need for continued support or adjustments in monetary policy. |

Potential Future Scenarios and Policy Implications

Navigating the complex interplay between trade policy and the US economy requires careful consideration of potential future scenarios. The Federal Reserve’s response to these scenarios will be crucial in maintaining economic stability. Unforeseen developments in global trade, including potential escalation of trade conflicts or the implementation of new trade agreements, can significantly impact domestic economic conditions.

Potential Future Scenarios for the US Economy

Understanding potential future scenarios for the US economy is vital for policymakers. These scenarios, influenced by various trade policy outcomes, will shape the economic landscape and necessitate appropriate responses from the Federal Reserve. Anticipating these outcomes allows for proactive policy adjustments to mitigate potential negative impacts.

| Scenario | Potential Economic Impact | Implications for Fed Policy | Policy Recommendations |

|---|---|---|---|

| Trade War Escalation | Reduced exports, increased import costs, potential contraction in GDP, job losses in export-oriented sectors, heightened uncertainty in the market, and potential for a global recession. | Increased risk of recessionary pressures, requiring the Fed to lower interest rates to stimulate economic activity. The Fed might also need to communicate clearly to maintain market confidence. | Early intervention to mitigate the escalation of trade tensions, potentially through diplomatic efforts and negotiations. Consider providing targeted support to affected industries. |

| Trade Agreement Implementation | Increased exports, reduced import costs, potentially stimulating economic growth, and enhanced market access. | Reduced risk of recessionary pressures, potentially allowing the Fed to maintain or even raise interest rates to manage inflation, if economic growth becomes robust. | Continued monitoring of economic indicators to assess the impact of the agreement and adjust policies accordingly. |

| Shift in Global Supply Chains | Potential disruptions to supply chains, increased uncertainty, and potential inflation or deflation depending on the nature of the shift. | Increased scrutiny of inflation and employment data, potentially requiring the Fed to adjust interest rates based on emerging trends. Maintaining communication to address market uncertainty is key. | Investing in domestic production capacity and infrastructure to enhance resilience to supply chain disruptions. |

| Technological Advancements in Trade | Increased efficiency in trade, potentially lowering prices and increasing output, and potential for job displacement in certain sectors. | The Fed needs to be vigilant to inflationary or deflationary pressures arising from trade-related technological advances. | Policies to support workers displaced by technological advancements, perhaps through retraining programs. |

Implications for Federal Reserve Policy

The Federal Reserve’s policy response to trade-related developments is crucial. The Fed needs to be vigilant in monitoring the effects of trade policies on inflation and employment. This necessitates adapting interest rates and other monetary tools to maintain price stability and full employment. For example, if trade tensions lead to a decline in economic activity, the Fed might lower interest rates to stimulate investment and consumption.

Conversely, if trade agreements lead to increased economic growth and inflation, the Fed might raise interest rates to manage inflationary pressures.

Potential Policy Responses from the Federal Reserve

The Fed’s response to trade-related developments can take several forms. These include adjusting interest rates, altering reserve requirements, and implementing quantitative easing or tightening. The specific response will depend on the nature and severity of the trade policy impacts. Historical examples of similar policy responses, such as during the 2008 financial crisis, provide valuable lessons for navigating the current landscape.

Potential for the Fed to Adjust Interest Rates

The Fed’s ability to adjust interest rates based on trade policy developments is substantial. Changes in interest rates can influence investment, consumption, and overall economic activity. For instance, a rise in interest rates could curb inflation stemming from trade-related supply chain issues, while a decrease in rates could support economic growth if trade policy negatively impacts the economy.

Historical examples illustrate the impact of interest rate adjustments on economic outcomes.

Illustrative Case Studies of Trade Policy Effects

Understanding the complex interplay between trade policies and economic outcomes requires examining specific instances. Analyzing historical case studies provides valuable insights into the potential consequences of various trade actions, allowing us to better predict and mitigate future impacts. These studies also highlight the crucial role of the Federal Reserve in navigating economic shifts brought on by trade policy changes.The following case study explores the impact of a specific trade policy and its ripple effects through the economy.

It details the historical context, rationale, and economic consequences, including the Federal Reserve’s response. This example demonstrates how trade policies can influence macroeconomic variables, necessitating a comprehensive understanding of their potential implications.

The North American Free Trade Agreement (NAFTA) and its Impact

NAFTA, a trilateral trade agreement between the United States, Canada, and Mexico, came into effect in 1994. Its primary goal was to reduce trade barriers and promote economic integration among the three nations. The rationale behind NAFTA stemmed from the belief that reduced tariffs and increased trade would boost economic growth for all parties involved.

- NAFTA’s Impact on Trade Flows: NAFTA significantly increased trade among the three countries. For example, U.S. exports to Mexico increased by over 250% from 1993 to 2019. This increase in trade was fueled by the elimination of tariffs and other trade barriers, making it more cost-effective for companies to import and export goods across the borders.

Data from the U.S. Census Bureau provides a detailed record of trade volumes between the three countries before and after the implementation of NAFTA.

- Economic Consequences: The economic consequences of NAFTA were varied and complex. While some industries experienced job losses due to competition from lower-cost producers in Mexico, other industries saw increased export opportunities and job creation. Estimates of job losses and gains varied widely, depending on the methodology and assumptions used in the studies. For example, the Congressional Research Service compiled reports analyzing the effects of NAFTA on employment and wages.

- Federal Reserve Response: The Federal Reserve’s response to NAFTA was multifaceted. The central bank monitored the evolving economic conditions and adjusted monetary policy accordingly. The Fed’s actions were influenced by factors such as changes in inflation rates, employment levels, and overall economic growth. The Federal Reserve Board’s minutes and press releases from the period offer insight into their deliberations and decisions.

“NAFTA’s impact was multifaceted, with both positive and negative consequences for various sectors of the economy. While it fostered increased trade and economic integration, it also led to job displacement in certain industries. The Fed’s response involved monitoring economic trends and adjusting policies to maintain price stability and full employment.”

Closure

In conclusion, the interconnectedness of trade policy and the economy is undeniable. The Federal Reserve’s role in managing the economy becomes significantly more complex when considering trade policy’s impact. The analysis reveals potential future scenarios, offering policymakers a glimpse into the challenges and opportunities ahead. By examining historical precedents, current economic indicators, and potential future scenarios, a more comprehensive understanding of the dynamic relationship between trade policy and the economy emerges, highlighting the need for careful consideration and proactive policy responses.