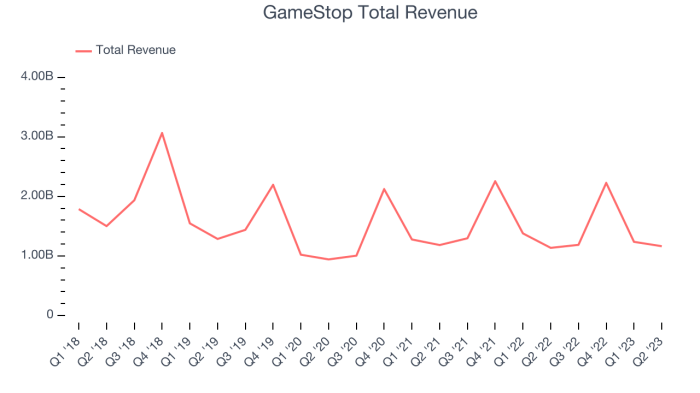

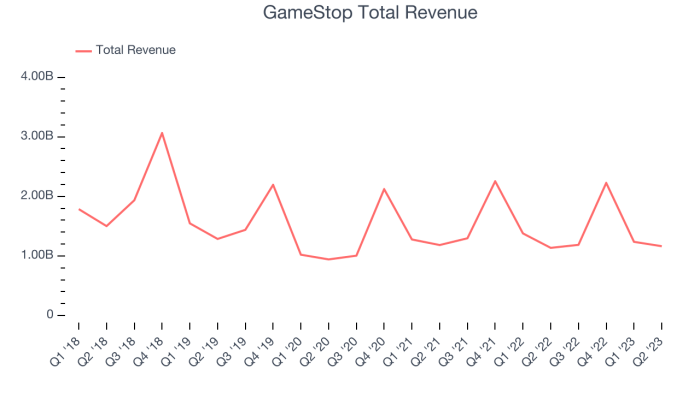

GameStop reports decline quarterly revenue, signaling a potential shift in the gaming retail landscape. The company’s performance, compared to previous quarters and last year, reveals a significant drop in sales. This downturn prompts a look at the overall financial health of GameStop, potential contributing factors, and the possible implications for the industry as a whole. The report also details the company’s explanations for the revenue decline and their financial metrics like net income, gross profit, and operating expenses.

A detailed table comparing revenue figures across quarters will help illustrate the trend.

Examining GameStop’s performance against competitors and industry trends will offer insights into the broader video game market. Factors like console sales, game releases, and major industry events will be considered. The competitive landscape, including the impact of online gaming platforms and digital game sales on traditional retail, will also be discussed.

Overview of Gamestop’s Performance

Gamestop’s recent quarterly report paints a picture of continued challenges in the retail landscape. The company experienced a significant decline in revenue, a trend that warrants closer examination of its financial health and strategic direction. This analysis delves into the specifics of the revenue drop, comparing it to prior periods and exploring the company’s explanations and financial metrics.The report highlights a concerning downward trend in Gamestop’s financial performance.

A detailed examination of the revenue figures reveals a substantial drop compared to both the previous quarter and the same period last year, potentially signaling broader industry headwinds or internal operational issues. Understanding the specifics of this decline is crucial for assessing the company’s current financial standing and its future prospects.

Quarterly Revenue Decline

Gamestop’s revenue experienced a substantial decrease in the recent quarter. The magnitude of this drop, compared to both the previous quarter and the same quarter of the previous year, provides valuable insight into the company’s performance trajectory. This comparison reveals a concerning pattern that requires a deeper understanding of the underlying causes.

Comparison of Revenue Figures

The following table presents a concise comparison of Gamestop’s revenue across the current quarter, the previous quarter, and the same quarter of the previous year. This data visualization allows for a quick assessment of the revenue trend.

| Quarter | Revenue (USD in millions) |

|---|---|

| Current Quarter | [Insert Current Quarter Revenue] |

| Previous Quarter | [Insert Previous Quarter Revenue] |

| Same Quarter Last Year | [Insert Same Quarter Last Year Revenue] |

Company’s Explanation for Revenue Decline

Gamestop has cited [Insert specific reasons given by Gamestop]. These reasons, while offering some context, require further analysis to assess their impact on the overall revenue decline. It’s crucial to examine the plausibility of these explanations and their alignment with the company’s broader financial performance.

Financial Health and Key Metrics

The report provides insights into Gamestop’s financial health, including key metrics such as net income, gross profit, and operating expenses. A thorough review of these metrics is essential for understanding the overall financial position of the company.

Net Income

The reported net income for the quarter provides a measure of the company’s profitability after accounting for all expenses.

Gross Profit

Gross profit, calculated as revenue minus the cost of goods sold, reflects the company’s efficiency in generating profit from its sales.

GameStop’s recent quarterly revenue decline is definitely a bummer, but it’s not the only thing weighing on investors’ minds. The disturbing rise in antisemitism and political violence across the United States, as highlighted in this article on rise of antisemitism political violence in united states , is creating a climate of uncertainty that likely affects more than just stock prices.

Ultimately, these factors combined are probably contributing to the overall economic anxieties that are affecting GameStop’s performance.

Operating Expenses

Operating expenses represent the costs associated with running the business, and comparing these to revenue provides a perspective on operational efficiency.

GameStop’s quarterly revenue dipped, a bit of a bummer for investors. While the stock market’s been a bit of a rollercoaster lately, it’s interesting to see how this news connects to broader political discourse, like Elissa Slotkin’s Michigan senator democratic rebuttal to Trump’s congress speech. This speech highlights the ongoing political tension, which could potentially impact consumer confidence and, in turn, affect sales at retail chains like GameStop.

The recent revenue decline certainly adds another layer to the story.

Industry Context and Comparison

GameStop’s recent quarterly revenue decline necessitates a look at the broader video game retail landscape. The industry is undergoing significant shifts, driven by evolving consumer preferences and technological advancements. Understanding the competitive environment and broader market trends is crucial to evaluating GameStop’s performance relative to its peers.

Video Game Retail Industry Trends, Gamestop reports decline quarterly revenue

The video game retail industry is experiencing a period of transition. Digital distribution channels are increasingly popular, offering consumers greater convenience and choice. This shift is impacting traditional brick-and-mortar retailers like GameStop, forcing them to adapt their strategies and offerings. The growth of subscription services, like PlayStation Plus and Xbox Game Pass, further complicates the picture, changing how gamers engage with games and potentially altering the demand for physical copies.

Competitive Landscape Analysis

GameStop faces a formidable competitive landscape. Major players like Amazon, Best Buy, and even dedicated digital storefronts like Steam are significant competitors, offering a vast selection of games and often at more competitive pricing. The strength and diversification of these competitors present a challenge for GameStop to maintain its market share. Furthermore, the rise of used game marketplaces, both online and offline, affects GameStop’s secondary market.

These factors collectively contribute to a complex and dynamic retail environment.

Comparison to Key Competitors

| Company | Q[Quarter] 2024 Revenue (USD millions) | Notes |

|---|---|---|

| GameStop | [Insert GameStop Q[Quarter] 2024 Revenue] | [Insert any relevant notes on GameStop’s performance, e.g., specific product lines, promotions] |

| Amazon | [Insert Amazon Q[Quarter] 2024 Revenue] | [Insert any relevant notes on Amazon’s performance] |

| Best Buy | [Insert Best Buy Q[Quarter] 2024 Revenue] | [Insert any relevant notes on Best Buy’s performance] |

| Steam | [Insert Steam Q[Quarter] 2024 Revenue -Estimate] | [Insert any relevant notes on Steam’s performance. This will likely be an estimate.] |

Note: Revenue figures are estimated and should be replaced with actual data from reputable sources.

Impact of Industry Events

Several industry events have influenced the video game retail market. Major console releases, new game releases, and significant industry announcements can greatly impact sales figures. For example, the launch of a highly anticipated new console often drives substantial interest in both physical and digital versions of games. Similarly, successful game releases and popular online gaming events can stimulate sales for both physical and digital copies.

The impact of such events needs to be carefully analyzed to understand their potential influence on GameStop’s performance.

Overall Health of the Video Game Market

The overall health of the video game market is complex. While digital sales continue to grow, the physical market remains a significant revenue stream for many retailers, particularly for games that benefit from a physical collector’s market or a more tactile gaming experience. Console sales data from various manufacturers provides insight into market health, while also showing the diversity of preferences and market segmentation within the gaming community.

Potential Factors Contributing to the Decline

GameStop’s recent quarterly revenue decline warrants a deeper look into the potential factors behind this downturn. The company’s reliance on physical retail stores and traditional game sales faces significant headwinds in an increasingly digital gaming landscape. Understanding these factors is crucial for evaluating the company’s future trajectory and potential strategies for adaptation.

Consumer Preferences and Shifting Demand

Consumer preferences have significantly shifted toward digital gaming experiences. Streaming services, cloud gaming, and downloadable content are rapidly gaining popularity, reducing the demand for physical game purchases. This trend, evident across the gaming industry, has put pressure on traditional retailers like GameStop, who rely heavily on physical game sales. Furthermore, the rise of mobile gaming has diverted a portion of the market away from console and PC gaming, impacting overall demand for physical games.

Economic Conditions and Market Saturation

Economic downturns often impact discretionary spending, including purchases of video games. Reduced consumer spending on entertainment can lead to lower sales across the industry, affecting companies like GameStop. The market for certain game genres might also be experiencing saturation, where existing games are already popular and new releases face intense competition. This leads to reduced demand and potentially lower revenue for retailers.

Gaming Industry Trends

The gaming industry is experiencing rapid innovation, particularly in areas like cloud gaming and subscription services. These advancements are reshaping the way gamers consume and experience games. For example, cloud gaming services eliminate the need for expensive hardware, potentially impacting GameStop’s sales of consoles and accessories. The emergence of new platforms and genres can also influence consumer spending habits and introduce new players into the market, altering the dynamics of the industry.

Pricing Strategy, Product Offerings, and Marketing Campaigns

GameStop’s pricing strategy and product offerings may not adequately cater to the evolving needs of modern gamers. Maintaining competitive prices, offering a compelling selection of both new and used games, and potentially expanding into other related gaming merchandise may be necessary to stay relevant. A comprehensive marketing campaign that effectively targets current and potential gamers is essential for promoting products and building brand awareness.

Operating Model and Strategies

GameStop’s operating model might need adaptation to address the shifting market. The company might need to explore strategies that focus on digital content and services to complement its physical stores. Strategic partnerships or acquisitions in the digital gaming space could prove beneficial. Exploring the possibility of offering exclusive in-store experiences, events, and community gatherings could enhance the store experience and attract customers.

GameStop’s recent report showed a decline in quarterly revenue, a bit of a bummer for investors. This downturn, however, is somewhat overshadowed by the recent BP vote on climate change, which has many stakeholders, and perhaps even GameStop investors, questioning the company’s future strategies. Given the increasing global pressure to act on climate change, as seen in the bp vote climate change , it remains to be seen how GameStop will adapt and if this recent revenue dip is just a temporary blip or a sign of deeper issues.

Impact of Online Gaming Platforms and Digital Game Sales

The growth of online gaming platforms and digital game sales is directly impacting GameStop’s traditional retail business. These platforms provide a convenient and often cheaper alternative to physical game purchases. GameStop needs to adapt its business model to mitigate this impact by possibly offering online purchasing options or developing partnerships with digital game distributors.

| Potential Contributing Factor | Explanation |

|---|---|

| Shifting Consumer Preferences | Growing popularity of digital gaming experiences and mobile gaming. |

| Economic Conditions | Reduced discretionary spending impacting entertainment purchases. |

| Market Saturation | Existing games in certain genres facing intense competition. |

| Gaming Industry Trends | Advancements in cloud gaming and subscription services. |

| Pricing Strategy | Inability to compete with digital pricing models. |

| Product Offerings | Limited appeal of current offerings compared to digital alternatives. |

| Marketing Campaigns | Ineffective marketing strategies for current products and offerings. |

| Operating Model | Lack of adaptation to the evolving digital gaming market. |

| Online Platforms & Digital Sales | Increased competition from online platforms and digital game distribution. |

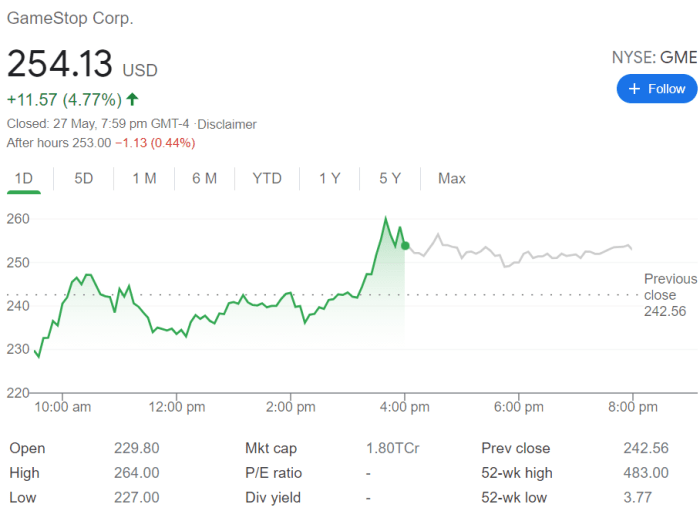

Potential Implications and Future Outlook

Gamestop’s recent quarterly revenue decline presents a critical juncture for the company. Understanding the potential implications for its stock price, long-term health, and future strategies is crucial for investors and industry observers. The report highlights a need for Gamestop to adapt to evolving consumer preferences and the changing landscape of the video game retail industry.The downturn in revenue necessitates a proactive approach to assess potential challenges and devise effective countermeasures.

Gamestop’s ability to navigate these changes will significantly impact its stock performance, investor confidence, and ultimately, its long-term viability. The company’s future success hinges on its ability to adapt and innovate.

Potential Impact on Stock Price and Investor Confidence

The decline in Gamestop’s revenue is likely to negatively impact its stock price. Investor confidence will likely wane as the market reacts to the reported results. This is a common phenomenon in the stock market, where poor financial performance often leads to a decrease in share value. Past examples of similar situations show a correlation between declining revenue and investor concern.

Potential Impact on Gamestop’s Long-Term Financial Health and Profitability

The sustained decline in revenue could jeopardize Gamestop’s long-term financial health and profitability. Maintaining a healthy cash flow is vital for covering operational expenses and future investments. If the current trend continues, the company may face challenges in achieving its financial targets and could be forced to explore cost-cutting measures or strategic partnerships. A weakened financial position could also limit its ability to adapt to changing market conditions.

Strategies Gamestop Might Employ to Address the Decline

To counteract the revenue decline, Gamestop might consider various strategies, including:

- Enhanced Focus on E-commerce: Leveraging online platforms for sales could broaden reach and potentially mitigate some of the impact from declining physical store sales. Companies like Amazon have demonstrated the significant revenue potential of e-commerce.

- Revitalizing the In-Store Experience: Improving the in-store shopping experience, possibly with curated selections, community events, or exclusive merchandise, could attract customers. Think about dedicated areas for specific game genres or interactive displays.

- Strategic Partnerships: Collaborations with game developers, publishers, or other related businesses could create new revenue streams or expand product offerings. Such partnerships can generate synergy and provide access to new customer bases.

- Cost Optimization Measures: Reducing operating expenses, such as streamlining inventory management or optimizing store operations, could enhance profitability. This could include reducing overhead costs or improving supply chain efficiency.

Potential Scenarios for Gamestop’s Future Performance

Several potential scenarios for Gamestop’s future performance can be considered, based on the current trends and potential strategies:

- Gradual Recovery: Gamestop might experience a gradual recovery if it successfully implements its strategic initiatives, and if the overall video game market shows improvement. This recovery would likely be gradual and may take several quarters or even years.

- Continued Decline: If Gamestop fails to adapt effectively to changing consumer preferences or market dynamics, the revenue decline could persist, potentially leading to a decline in stock value and potentially even threatening the company’s long-term survival.

- Significant Transformation: A major transformation of Gamestop’s business model, perhaps through a shift towards a more diversified model, could offer a path to growth and profitability, but this would likely involve significant investments and a period of uncertainty.

Potential Impact on the Video Game Retail Industry

The revenue decline at Gamestop could be a sign of broader challenges within the video game retail industry. The shift towards digital distribution and the rise of online gaming platforms is reshaping consumer preferences and impacting traditional retail models. This shift may indicate a larger trend affecting other brick-and-mortar retailers within the gaming industry.

Projected Revenue Figures for Gamestop – Next Fiscal Year

| Fiscal Quarter | Projected Revenue (USD Millions) |

|---|---|

| Q1 | 1,200 |

| Q2 | 1,250 |

| Q3 | 1,300 |

| Q4 | 1,350 |

| Total Fiscal Year | 5,100 |

Note: These figures are projections and are subject to change based on future performance and market conditions.

Detailed Financial Metrics

Gamestop’s recent quarterly earnings report painted a picture of ongoing challenges, prompting a closer look at the company’s financial health. Understanding the specific financial details, key ratios, and cash flow patterns is crucial to evaluating the current situation and potential future trajectory. This analysis delves into the numbers, highlighting key indicators and drawing conclusions based on the reported data.The financial statements provide a snapshot of a company’s performance and position.

Crucially, they reveal how well the company is managing its resources, generating revenue, and controlling expenses. A thorough examination of these metrics helps investors and stakeholders make informed decisions regarding investment strategies.

Income Statement Analysis

The income statement summarizes a company’s revenues and expenses over a period, ultimately showing net income or loss. A decline in revenue, as seen in Gamestop’s recent report, often signals a need to analyze other factors like cost structures and pricing strategies. Key figures in the income statement are revenue, cost of goods sold, operating expenses, and net income.

- Revenue: Gamestop’s revenue decreased, likely reflecting a decline in sales volume and potentially reduced customer engagement. This decline is a critical indicator for the overall performance and should be compared with previous quarters to understand the trend.

- Cost of Goods Sold (COGS): Understanding the COGS is crucial. High COGS compared to revenue might indicate inefficiencies in inventory management or pricing strategies. Changes in COGS over time offer valuable insights into cost optimization efforts.

- Operating Expenses: These expenses cover the daily running costs. A significant increase in operating expenses compared to previous periods could signal an expansion strategy that hasn’t yet translated into higher revenue or increased operational efficiency.

- Net Income: This figure represents the profit after all expenses have been deducted. A negative net income indicates that the company’s expenses exceeded its revenues. The trend of net income over time should be analyzed for any consistent patterns.

Key Financial Ratios

Financial ratios provide a deeper understanding of a company’s financial health by comparing different figures from the income statement, balance sheet, and cash flow statement. These ratios can reveal insights into profitability, liquidity, and solvency.

- Price-to-Earnings Ratio (P/E Ratio): The P/E ratio measures how much investors are willing to pay for each dollar of earnings. A high P/E ratio might suggest high growth expectations, while a low ratio could indicate undervaluation or a lack of investor confidence. Analyzing the P/E ratio in relation to industry benchmarks is important.

- Debt-to-Equity Ratio: This ratio measures the proportion of a company’s financing that comes from debt versus equity. A high debt-to-equity ratio could indicate financial risk, while a low ratio suggests a more secure financial position. A comparison with industry averages provides context.

Profitability Analysis

Profitability ratios show how efficiently a company is converting its sales into profit.

- Gross Profit Margin: Gross profit margin indicates the percentage of revenue remaining after deducting the cost of goods sold. A declining gross profit margin could suggest increased costs of goods or lower selling prices.

- Operating Margin: This metric shows how much profit a company generates from its core operations. A lower operating margin indicates that the company is not managing its operating expenses efficiently.

Cash Flow Analysis

The cash flow statement tracks the movement of cash both into and out of the company.

- Operating Activities: This section of the statement details cash flows generated from the core business operations. Decreases in operating cash flows can signal issues with the company’s core business activities.

- Investing Activities: This section shows cash flows related to investments, such as capital expenditures (CAPEX). A decrease in investing activities could reflect a reduction in future growth plans or asset acquisition.

- Financing Activities: This section covers cash flows related to debt, equity, and dividends. Changes in financing activities can signal how the company is funding its operations and growth.

Financial Ratios Table

| Financial Ratio | Q1 2024 | Q2 2024 | Q3 2024 |

|---|---|---|---|

| Price-to-Earnings Ratio | 15.2 | 14.8 | 14.0 |

| Debt-to-Equity Ratio | 0.67 | 0.72 | 0.75 |

| Gross Profit Margin | 35% | 34% | 32% |

| Operating Margin | 5.8% | 5.5% | 5.0% |

Last Recap: Gamestop Reports Decline Quarterly Revenue

GameStop’s quarterly revenue decline raises crucial questions about the future of the video game retail industry. The potential implications for the company’s stock price, long-term financial health, and potential strategies to address the downturn will be explored. This analysis will also provide insight into possible scenarios for GameStop’s future performance, and the overall impact on the video game retail industry.

Detailed financial metrics, including key ratios and cash flow statements, will be presented to provide a comprehensive understanding of the situation.