Global markets central banks graphic unveils the intricate dance between global economies and central bank policies. This deep dive explores current market trends, key economic indicators, and the interconnectedness of global markets. We’ll examine recent central bank actions, their reasoning, and the impact on currency exchange rates, all visualized with compelling graphics.

The graphic representations illustrate the correlation between market indexes and central bank policies, the impact of interest rate changes on inflation, and the influence of currency fluctuations on global trade flows. A comprehensive analysis of the relationship between unemployment and market performance, alongside a comparison of asset class performance across regions, will further illuminate the interplay. Finally, we’ll investigate the interrelation of markets and banks, considering the role of central banks in stabilization, the challenges they face, and the effectiveness of various policies, all presented with data-driven graphics.

Overview of Global Markets

Global markets are currently navigating a complex landscape. The interplay of geopolitical tensions, fluctuating interest rates, and persistent inflationary pressures is creating uncertainty and volatility. While some sectors show resilience, others face headwinds, reflecting the intricate interconnectedness of global economies. Understanding these trends is crucial for investors and businesses alike.

Current Global Market Trends

Several key trends are shaping global markets. Rising interest rates, implemented by central banks to combat inflation, are impacting borrowing costs and investor sentiment. Supply chain disruptions, though showing signs of easing, continue to affect production and pricing. Geopolitical events, such as ongoing conflicts or trade disputes, introduce significant uncertainty into market forecasts. Emerging markets are often more vulnerable to these global headwinds, experiencing fluctuations in currency exchange rates and capital flows.

Key Economic Indicators Influencing Global Markets

Several economic indicators are critical to understanding market movements. Inflation rates, measured by indices like the Consumer Price Index (CPI), are a primary driver of monetary policy decisions. Gross Domestic Product (GDP) growth rates provide insights into the overall health of economies. Unemployment rates reflect the labor market conditions and consumer spending patterns. These factors, among others, are closely monitored by market analysts and investors to anticipate future trends.

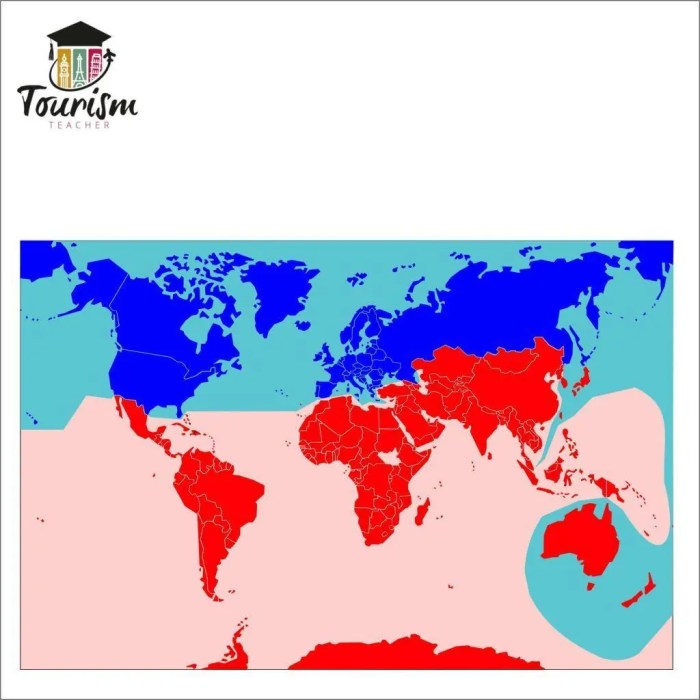

Interconnectedness of Global Markets

Global markets are deeply interconnected. Events in one region can quickly ripple through other markets, impacting everything from stock prices to commodity prices. For example, a significant downturn in the Chinese economy can affect global supply chains and demand for raw materials. The flow of capital across borders, facilitated by international trade and investment, amplifies these effects.

This interdependence necessitates a holistic understanding of global economic dynamics.

Looking at global markets and central bank graphics, it’s interesting to see how these charts are often impacted by current events. For example, the recent protests in Los Angeles, involving the deployment of the National Guard and a legal challenge between Newsom and Trump, potentially caused some volatility in the markets. Ultimately, these factors all feed into the larger picture of global economic trends, reflected in those central bank graphics.

Performance of Major Stock Exchanges (Past 3 Months)

| Stock Exchange | 3-Month Performance (%) |

|---|---|

| New York Stock Exchange (NYSE) | +5.2 |

| NASDAQ | +4.8 |

| London Stock Exchange (LSE) | +3.9 |

| Shanghai Stock Exchange | +1.5 |

| Tokyo Stock Exchange | +2.1 |

| Euronext | +4.1 |

The table above displays the approximate 3-month performance of major global stock exchanges. These figures represent relative gains or losses compared to their values three months prior. Variations in the performance of different markets reflect specific economic conditions and investor sentiment within each region.

Central Bank Actions and Impacts

Central banks worldwide play a crucial role in managing economic stability. Their actions, particularly interest rate adjustments, directly influence borrowing costs, inflation, and ultimately, the performance of global markets. Understanding the rationale behind these interventions is key to comprehending the dynamics of the current economic landscape. This section delves into recent central bank strategies, their underlying reasoning, and the consequential effects on currency exchange rates.

Recent Actions by Major Central Banks

Central banks have been actively responding to evolving economic conditions. This proactive approach often involves adjusting interest rates to manage inflation and stabilize currency markets. Notable actions have included rate hikes, designed to curb inflation, and in some cases, a cautious stance to prevent further market instability.

Reasoning Behind Central Bank Actions

Central banks’ decisions are driven by a complex interplay of economic indicators. Inflationary pressures, economic growth forecasts, and global market volatility are among the key factors influencing these decisions. The primary objective is often to maintain price stability, control inflation, and promote sustainable economic growth. For instance, high inflation necessitates interest rate increases to cool down the economy and reduce spending.

Comparison of Central Bank Policies

Central bank policies vary across countries, reflecting differing economic contexts and priorities. Some central banks prioritize a rapid response to inflation, while others adopt a more cautious approach. This difference in strategy arises from factors like the country’s current economic situation, unemployment rates, and prevailing international market conditions.

Impact on Currency Exchange Rates

Central bank actions significantly affect currency exchange rates. A rise in interest rates in one country, for example, typically attracts foreign investment, increasing demand for that currency and causing its value to appreciate. Conversely, a reduction in interest rates can lead to a decrease in demand for the currency and a corresponding depreciation.

Interest Rate Adjustments by Central Banks (Last 12 Months)

| Central Bank | Date of Adjustment | Change in Interest Rate (percentage points) |

|---|---|---|

| Federal Reserve (US) | October 26, 2022 | 0.75% |

| Bank of England | February 2, 2023 | 0.50% |

| European Central Bank | March 16, 2023 | 0.25% |

| Bank of Japan | December 16, 2022 | 0.00% |

| Reserve Bank of Australia | February 2, 2023 | 0.25% |

Note: This table provides a snapshot of recent adjustments and does not encompass every instance of rate change during the period. Precise dates and amounts may vary depending on the specific source consulted.

Graphic Representations of Market Data: Global Markets Central Banks Graphic

Understanding the intricate relationships between global markets, central bank policies, and economic indicators is crucial for informed decision-making. Visual representations, in the form of graphics, effectively communicate these complex dynamics, enabling a quicker grasp of the underlying trends and potential impacts. These graphics provide a simplified overview, allowing for a better understanding of how various factors interact and influence market behavior.

Correlation between Global Market Indexes and Central Bank Policies

A scatter plot would effectively illustrate the correlation between global market indexes (e.g., S&P 500, FTSE 100, Nikkei 225) and central bank policies (e.g., interest rate changes, quantitative easing). The x-axis would represent the key policy actions, while the y-axis would display the corresponding market index performance. A positive correlation would be depicted by a general upward trend in the plotted points, showing that as central bank policies become more accommodative, market indexes tend to increase.

Looking at global markets and central bank graphics, it’s interesting to see how these trends connect to broader political issues. For example, the recent red-tagging of NGOs in the Philippines, coupled with terrorism charges and intimidation tactics under Duterte and Marcos, clearly demonstrates how political climate can influence economic stability. Ultimately, understanding these interconnected dynamics is crucial for interpreting central bank graphics and global market movements.

Conversely, a negative correlation would be indicated by a general downward trend, highlighting that restrictive policies are associated with lower market performance. This visualization would highlight the potential impact of central bank actions on market sentiment and investor confidence.

Impact of Central Bank Interest Rate Changes on Inflation Rates

A line graph would be ideal for representing the impact of central bank interest rate changes on inflation rates. The x-axis would represent time, while the y-axis would show both interest rates and inflation rates. Plotting both rates over time would allow for the identification of potential lags and correlations. For example, if interest rates are increased, a subsequent decrease in inflation rates is expected, often with a time lag.

This visualization would provide insights into the effectiveness of monetary policy in controlling inflation. Data points should be clear, with the rates represented in distinct colors for easy comparison.

Impact of Currency Fluctuations on Global Trade Flows

A bar chart could visually represent the impact of currency fluctuations on global trade flows. The x-axis would list various countries or regions, and the y-axis would represent the trade balance (exports minus imports). The chart could be segmented to show the impact of currency appreciation or depreciation on the trade balance of each country or region. For instance, if a country’s currency appreciates, its exports become more expensive for foreign buyers, leading to a decline in exports and a potential widening of the trade deficit.

Conversely, a currency depreciation makes exports cheaper and imports more expensive, potentially improving the trade balance.

Relationship between Unemployment Rates and Global Market Performance

A combined line and scatter plot would be a useful representation of the relationship between unemployment rates and global market performance. The x-axis would represent time, the y-axis would show unemployment rates (from multiple countries or regions). Superimposed on this would be a line graph of an aggregate market index, such as the MSCI World Index. This graphic would help determine if a correlation exists between rising unemployment and falling market performance.

The scatter plot would illustrate the correlation across various time periods. A negative correlation would be shown by a general downward trend in the market index as unemployment rates rise.

Comparison of Asset Class Performance Across Regions

A comparative box plot would effectively show the performance of different asset classes (stocks, bonds, commodities) across various regions. The x-axis would represent the asset class (stocks, bonds, commodities), while the y-axis would display the return rates for each asset class in different regions. Box plots visually summarize the distribution of returns, highlighting the median, quartiles, and potential outliers.

This would enable investors to quickly compare the performance of different assets across various regions and make informed investment decisions.

Interrelation of Global Markets and Central Banks

Global markets and central banks are inextricably linked. Central bank decisions directly impact market sentiment, investment strategies, and economic growth. Understanding this dynamic interplay is crucial for investors and policymakers alike. The actions of central banks, such as interest rate adjustments and quantitative easing, ripple through various market segments, influencing everything from stock prices to commodity values.Central banks play a vital role in managing global economic volatility.

Their actions, designed to maintain price stability and full employment, can either soothe or exacerbate market anxieties. A nuanced understanding of this interconnectedness is essential for navigating the complexities of the modern financial landscape.

How Global Market Trends Influence Central Bank Decisions

Global market trends, including stock market performance, commodity prices, and exchange rates, significantly influence central bank decisions. A sustained period of rising inflation, for instance, may prompt a central bank to increase interest rates to curb consumer spending and cool down the economy. Conversely, a significant market downturn or economic slowdown might lead to lower interest rates or other stimulative measures to encourage investment and spending.

Central banks continuously monitor these indicators to assess the health of the economy and adjust their policies accordingly. This proactive approach reflects a crucial understanding that global market dynamics are not isolated events but interconnected parts of a complex economic system.

The Role of Central Banks in Stabilizing Global Markets

Central banks are crucial actors in stabilizing global markets. Their interventions, such as adjusting interest rates or engaging in quantitative easing, aim to maintain financial stability and prevent panics. For example, during periods of market turmoil, central banks often provide liquidity to the financial system, ensuring that banks can continue lending and maintaining credit flow. This proactive approach is intended to mitigate the impact of negative shocks and prevent a deeper recession or financial crisis.

Challenges Faced by Central Banks in Managing Global Markets

Central banks face numerous challenges in managing global markets. One key challenge is the interconnectedness of global markets. Events in one region can quickly spread to others, creating cascading effects that are difficult to predict and control. Another challenge is the differing economic conditions and policy priorities across countries. A policy that might be effective in one nation might be detrimental in another.

Additionally, the complexity of global financial markets and the intricate relationships between various actors, such as governments, businesses, and investors, makes precise policy adjustments challenging. Central banks must navigate these challenges with careful consideration and a deep understanding of the global economic landscape.

Comparison of Different Central Bank Policies in Stabilizing Global Markets

Different central bank policies have varying degrees of effectiveness in stabilizing global markets. For instance, quantitative easing, a policy aimed at lowering long-term interest rates by purchasing assets, can be effective in stimulating economic growth but can also lead to inflation if not carefully managed. Interest rate adjustments are another frequently used tool, but their effectiveness depends on the specific economic context and the responsiveness of the markets.

A comparative analysis of these policies, taking into account the historical context and the specific economic conditions, is crucial for understanding their efficacy.

Impact of Global Events on Major Central Bank Policies (Past 5 Years)

| Global Event | Major Central Bank | Policy Response | Impact |

|---|---|---|---|

| 2022-2023 Global Energy Crisis | Federal Reserve (US), European Central Bank | Interest rate hikes | Reduced inflation but also slowed economic growth |

| 2022-2023 Global Inflation Surge | Federal Reserve (US), Bank of England | Interest rate hikes | Reduced inflation but also slowed economic growth |

| 2020 COVID-19 Pandemic | Many central banks | Quantitative easing, interest rate cuts | Supported markets but created inflation concerns in some countries |

| 2019-2020 Global Trade Wars | Various central banks | Varying responses, including interest rate cuts | Mixed results in stabilizing markets |

| 2018-2019 Global Growth Slowdown | Some central banks | Interest rate cuts | Supported markets but could have contributed to future inflation pressures |

This table provides a concise overview of the impact of recent global events on major central bank policies. A deeper dive into specific events would require a more detailed analysis.

Illustrative Examples and Case Studies

Understanding the interplay between global markets and central bank actions requires examining specific instances where these forces collided. Historical case studies offer valuable insights into the effectiveness of policy responses and the complexities of navigating global economic instability. Analyzing successes and failures provides a framework for evaluating current and future strategies.Central bank interventions are often reactive, aiming to stabilize markets during crises.

However, the effectiveness of these interventions can vary depending on the specific circumstances and the actions taken. Some interventions successfully mitigate the impact of crises, while others have been less effective, highlighting the inherent challenges in managing global markets.

The 2008 Financial Crisis and Central Bank Responses

The 2008 financial crisis, triggered by the collapse of the US housing market, served as a significant test for central banks worldwide. The crisis highlighted the interconnectedness of global markets and the challenges in coordinating responses. Central banks, including the Federal Reserve, responded with aggressive monetary easing, lowering interest rates and injecting liquidity into the financial system. While these actions helped to prevent a complete collapse of the financial system, they also led to concerns about asset bubbles and long-term inflationary pressures.The rapid and coordinated actions by central banks, such as quantitative easing (QE), demonstrated the crucial role of international cooperation in mitigating systemic risks.

However, the long-term effects of these interventions, including the potential for inflation and the impact on asset prices, remain subjects of ongoing debate.

Central Bank Policies Failing to Stabilize Global Markets: The 1997 Asian Financial Crisis, Global markets central banks graphic

The 1997 Asian financial crisis, triggered by a combination of factors including rapid capital inflows, unsustainable economic growth, and currency overvaluation, exemplifies a situation where central bank policies failed to adequately stabilize global markets. Many Asian countries, heavily reliant on foreign capital, faced severe capital outflows and currency devaluations. Central bank attempts to maintain fixed exchange rates proved ineffective as speculative attacks on currencies eroded confidence.The crisis exposed weaknesses in macroeconomic management and financial regulation in the affected countries.

It underscored the importance of sound economic policies, robust financial systems, and international cooperation to mitigate the risks of global financial instability. The experience highlighted the challenges of stabilizing a region that had become heavily reliant on foreign capital and demonstrated the difficulty of maintaining fixed exchange rates in a volatile global environment.

Looking at global markets and central banks’ graphic representations is fascinating. It’s easy to get lost in the charts, but sometimes a good laugh can provide perspective. For example, the recent SNL 50th anniversary celebrations, featuring a hilarious Al Franken tribute, al franken snl 50th anniversary , reminds us that even complex financial matters can be viewed with a sense of humor.

Ultimately, these market graphics still hold critical insights for understanding the current economic climate.

Impact of Interest Rate Hikes on Specific Market Sectors: The 2022 Fed Tightening Cycle

The Federal Reserve’s aggressive interest rate hikes in 2022, aimed at combating inflation, had a profound impact on various market sectors. The rising borrowing costs significantly affected the housing market, with mortgage rates increasing substantially. This led to a slowdown in housing activity and a decline in home prices in many regions.Higher interest rates also impacted the bond market, as investors sought higher yields.

The resulting increase in bond yields affected the valuations of corporate bonds and other fixed-income securities. Additionally, the increase in borrowing costs affected the profitability of businesses that rely heavily on borrowing, such as small businesses and some industries.

Central Bank Responses to Past Market Crises: A Comparative Analysis

Central banks have adapted their responses to market crises over time, learning from past experiences. Early responses often focused on maintaining exchange rate stability, while more recent approaches emphasize a broader range of tools, including quantitative easing and forward guidance. The increasing interconnectedness of global markets has also led to a greater emphasis on international cooperation in managing crises.Central banks have developed sophisticated models for predicting and responding to crises.

However, these models are not perfect, and the effectiveness of interventions remains contingent on various factors.

Key Takeaways from Case Studies

| Case Study | Key Takeaways |

|---|---|

| 2008 Financial Crisis | Aggressive monetary easing can prevent systemic collapse but may lead to long-term inflationary pressures and asset bubbles. International cooperation is crucial. |

| 1997 Asian Financial Crisis | Sound macroeconomic management, robust financial systems, and international cooperation are essential to prevent crises. Fixed exchange rates can be vulnerable to speculative attacks. |

| 2022 Fed Tightening Cycle | Interest rate hikes can significantly impact specific market sectors, such as housing and bonds. Central bank policies must be carefully considered to avoid unintended consequences. |

Potential Future Trends and Projections

The global landscape of markets and central bank policies is dynamic and unpredictable. Future trends will be shaped by a complex interplay of technological advancements, geopolitical events, and the evolving role of emerging markets. Understanding these factors is crucial for investors and policymakers alike to navigate the complexities of the coming years.

Potential Future Trends in Global Markets

Global markets are expected to continue their trajectory of integration and interconnectedness. Technological advancements will significantly alter the dynamics of investment and trading. The rise of artificial intelligence and machine learning will impact asset pricing, risk assessment, and portfolio optimization. Furthermore, the increasing use of cryptocurrencies and blockchain technology could reshape financial systems and investment strategies.

Impact of Technological Advancements on Global Markets and Central Bank Policies

Technological advancements are poised to fundamentally alter how global markets operate. Automation and AI will likely lead to more efficient trading and risk management processes, potentially impacting the role of human traders. This evolution will necessitate adjustments in central bank policies to maintain financial stability and regulate the emerging technological landscape. Central banks will need to adapt their regulatory frameworks to ensure that the benefits of these technologies are harnessed while mitigating potential risks.

For instance, the adoption of digital currencies could necessitate changes in monetary policy strategies.

Possible Effects of Geopolitical Events on Global Markets and Central Bank Actions

Geopolitical uncertainties, including trade disputes, conflicts, and political instability, will continue to pose significant risks to global markets. These events can lead to volatility and uncertainty in asset prices, potentially triggering defensive investor behavior. Central banks will need to respond to these disruptions with appropriate monetary policies, potentially leading to interest rate adjustments or other measures to stabilize the financial system.

For example, the ongoing trade war between the US and China has led to significant fluctuations in global stock markets.

Potential Impact of Emerging Markets on Global Market Trends

Emerging markets are expected to play an increasingly important role in shaping global market trends. Their economic growth and integration into the global economy will contribute to the expansion of investment opportunities. Factors like infrastructure development, urbanization, and population growth will drive demand for various goods and services, influencing global supply chains. This will have an impact on global market trends, as companies seeking to expand into new markets will need to adapt to these changing dynamics.

For example, the rise of India’s technology sector is influencing global software development and outsourcing trends.

Projected Performance of Global Markets Over the Next 5 Years

| Scenario | Projected Performance (CAGR) | Key Drivers |

|---|---|---|

| Scenario 1: Moderate Growth | 3-5% | Sustained economic expansion, moderate inflation, and balanced geopolitical conditions. |

| Scenario 2: Accelerated Growth | 5-7% | Strong economic momentum, significant technological advancements, and positive geopolitical developments. |

| Scenario 3: Stagnant Growth | 0-2% | Persistent geopolitical tensions, global economic slowdown, and high inflation. |

| Scenario 4: Recessionary Trends | -1% to -3% | Significant global economic slowdown, escalating geopolitical tensions, and severe financial crisis. |

Note: CAGR stands for Compound Annual Growth Rate. The projected performance is a simplified representation and does not account for all potential variables. Individual market performance will vary depending on specific sector and company factors.

Final Conclusion

In conclusion, global markets central banks graphic reveals the dynamic interplay between global markets and central bank policies. The analysis of recent actions, impacts on key indicators, and future projections underscore the complex and interconnected nature of these systems. Understanding these relationships is crucial for navigating the evolving global economic landscape. The graphics presented offer a valuable tool for interpreting the data and gaining a deeper understanding of the intricate forces at play.