Global markets optimism column pix sets the stage for this enthralling narrative, offering readers a glimpse into the current state of global markets. We’ll explore the factors driving optimism and pessimism across various sectors, from technology to finance, and examine the potential impact of recent economic data releases and central bank policies. A regional comparison of market sentiment will also be presented, highlighting differences in optimism across Asia, Europe, and North America.

The analysis will delve into historical market trends, comparing current conditions to previous periods of significant change. Recurring themes and patterns in market cycles will be identified, along with the influence of geopolitical events. We’ll also analyze sector-specific optimism, exploring the current states of technology, energy, and finance, and compare levels of optimism across different regions and countries.

The discussion will further analyze the impact of external factors like geopolitical tensions, supply chain disruptions, and natural disasters on global markets, and conclude with expert predictions on the future trajectory of markets.

Overview of Global Market Optimism

Global markets are currently exhibiting a mixed bag of optimism and caution. While some sectors are experiencing robust growth, others are grappling with headwinds. This is largely due to the complex interplay of economic data releases, central bank policies, and shifting investor sentiment. The overall tone suggests a cautious optimism, with investors navigating a landscape of potential opportunities and risks.

Current Global Market Sentiment

Current global market sentiment is characterized by a cautious optimism. Investors are cautiously optimistic, driven by a combination of factors, but remain wary of potential economic downturns. This mixed sentiment reflects the complex economic situation, with positive signs alongside lingering concerns. The overall outlook suggests that investors are seeking opportunities but are also aware of the potential for setbacks.

Key Factors Driving Optimism and Pessimism

Several factors are contributing to the current market climate. Strong earnings reports from tech companies are fueling optimism in the technology sector. However, concerns persist about the potential for a global recession, particularly in the energy sector, where high oil prices and geopolitical tensions continue to impact investor confidence. The financial sector is also showing mixed signals, with some institutions demonstrating resilience, but others facing headwinds related to interest rate hikes and inflation.

Impact of Recent Economic Data Releases

Recent economic data releases have played a crucial role in shaping investor confidence. Positive employment data in key economies has generally bolstered optimism, but inflation figures continue to be a source of concern, creating a sense of uncertainty in the market. Data releases on consumer spending and manufacturing output are especially significant, reflecting the health of the economy and impacting market sentiment accordingly.

Role of Central Bank Policies

Central bank policies are undeniably a significant factor in shaping market expectations. The continued tightening of monetary policy by major central banks is impacting interest rates, which is affecting borrowing costs and investment decisions. The balance between controlling inflation and stimulating economic growth is a key consideration, influencing the market’s reaction to central bank announcements. Recent policy decisions, including interest rate adjustments, have a direct impact on investor decisions.

Market Optimism Across Regions

| Region | Key Drivers of Optimism | Key Concerns |

|---|---|---|

| Asia | Strong economic growth in several Asian economies, particularly in emerging markets, coupled with positive investment activity. | Geopolitical tensions and potential supply chain disruptions, impacting manufacturing and trade. |

| Europe | Resilient consumer spending and robust export performance, especially in certain sectors. | High inflation and energy prices, affecting consumer purchasing power and business profitability. |

| North America | Strong labor market and positive consumer sentiment, contributing to optimism in the equity markets. | Persisting inflation concerns and the potential for a recession, which is creating caution in the markets. |

The table above summarizes the market sentiment across different regions, highlighting the key drivers of optimism and concerns that investors face in each area. This comparison demonstrates the nuances of the global market and its multifaceted nature.

Historical Context of Global Market Trends

Global markets are constantly in flux, driven by a complex interplay of economic forces, geopolitical events, and investor sentiment. Understanding the historical patterns of optimism and pessimism is crucial for navigating the present and anticipating future trends. A deeper look into past cycles reveals recurring themes and allows us to contextualize current market conditions within a broader historical framework.Historical market trends often mirror broader societal and economic shifts.

Periods of significant optimism typically coincide with robust economic growth, technological advancements, and a generally positive outlook. Conversely, pessimism often emerges during economic downturns, geopolitical instability, or periods of uncertainty. Examining past market cycles provides valuable insights into the drivers of these fluctuations.

While the global markets optimism column pix are painting a rosy picture, I’ve been focusing on a different kind of positivity lately. Switching to non-toxic cleaning products for housework has really improved my home environment and overall well-being. Non toxic cleaning products housework are surprisingly effective and significantly reduce potential health risks. I’m finding this shift in focus is inspiring a renewed sense of calm and optimism, which I believe will eventually reflect positively on the global markets optimism column pix too.

Recurring Themes in Market Cycles

Historical data reveals several recurring themes in market cycles. These include the influence of interest rate changes, technological advancements, and geopolitical events. A crucial observation is that market cycles, while not perfectly predictable, tend to exhibit certain patterns.

- Interest Rate Fluctuations: Changes in interest rates significantly impact borrowing costs and investment decisions. Periods of low interest rates often stimulate borrowing and investment, fueling market optimism. Conversely, rising interest rates can curb economic activity and dampen market enthusiasm.

- Technological Advancements: Technological breakthroughs often usher in periods of rapid innovation and market expansion. These advancements can drive investor confidence and create new investment opportunities, leading to optimism in sectors like technology, renewable energy, and artificial intelligence.

- Geopolitical Events: Global events, including wars, trade disputes, and political instability, often introduce uncertainty and volatility into the market. These events can lead to pessimism as investors react to the perceived risks.

Comparison with Previous Periods of Significant Change

Comparing current market conditions with past periods of significant change offers valuable insights. For instance, the dot-com bubble of the late 1990s saw a surge in optimism driven by rapid technological advancements. However, this optimism was eventually tempered by a market correction as unsustainable valuations became apparent. Similarly, the 2008 financial crisis was preceded by a period of exuberant optimism in the housing market.

Influence of Geopolitical Events on Global Market Trends

Geopolitical events have a profound impact on global market trends. Wars, trade disputes, and political instability create uncertainty and risk, often leading to market pessimism. For example, the Russian invasion of Ukraine in 2022 triggered a wave of market volatility as investors reacted to the escalating conflict and its potential economic repercussions.

Correlation Between Events and Market Reactions

The table below illustrates the correlation between specific events and market reactions, highlighting the impact of geopolitical events on market trends.

| Event | Market Reaction | Explanation |

|---|---|---|

| 2008 Financial Crisis | Sharp Decline | Subprime mortgage crisis triggered a global financial meltdown, leading to widespread pessimism and market volatility. |

| 2022 Russian Invasion of Ukraine | Market Volatility | Uncertainty regarding the conflict’s economic impact resulted in significant market fluctuations. |

| 2020 COVID-19 Pandemic | Initial Shock, Recovery | The pandemic initially caused a sharp downturn, followed by a period of recovery as economic stimulus measures were implemented. |

| Technological Advancements (e.g., Internet Boom) | Optimism and Growth | Technological advancements create new opportunities and fuel investor optimism. |

Sector-Specific Optimism and Concerns

Global market optimism isn’t uniform across all sectors. While a general sense of positivity exists, underlying concerns and differing levels of enthusiasm exist for specific industries. The tech sector’s rapid pace of innovation and energy sector’s transition to renewables are areas of particular interest, alongside the financial sector’s role in navigating these transformations. Regional variations in sector-specific optimism also play a significant role in the overall global market picture.

Technology Sector Optimism

The technology sector remains a powerhouse of innovation and investment. Optimism stems from continued advancements in artificial intelligence, cloud computing, and the Internet of Things (IoT). Startups are flourishing, attracting substantial venture capital funding, fueled by the potential for disruptive technologies to transform various industries. Large tech companies are investing heavily in research and development, driving further innovation and growth.

However, concerns exist regarding potential regulatory hurdles, ethical considerations surrounding AI, and the ongoing competition between major players.

Energy Sector Outlook, Global markets optimism column pix

The energy sector is experiencing a complex and multifaceted transition. Optimism surrounds the burgeoning renewable energy sector, including solar and wind power. Governments worldwide are implementing policies to support this transition, driven by environmental concerns and the potential for energy independence. Significant investment is flowing into renewable energy projects, and technological advancements are lowering costs. Conversely, concerns exist about the reliability of renewable energy sources, the challenges of grid integration, and the potential for supply chain disruptions.

The continued reliance on fossil fuels in certain regions also represents a significant challenge to the sector’s transformation.

The global markets optimism column pix are looking pretty positive these days, with a general sense of cautious optimism. However, recent news like the BLET union members voting to ratify a five-year deal with CSX ( blet union members vote ratify 5 year deal with csx ) suggests underlying factors that could potentially impact the market. Overall, while the column pix paint a rosy picture, the complexities of labor relations and other similar developments warrant further observation.

This all adds another layer to the ongoing narrative of global market trends.

Financial Sector Optimism and Concerns

The financial sector displays mixed signals. Optimism stems from a robust global economy and ongoing growth in financial markets. Improved investor confidence and increased capital flows contribute to this positive sentiment. However, concerns about inflation, rising interest rates, and potential economic downturns are present. The global geopolitical landscape and the impact of ongoing crises can also affect the sector’s outlook.

Financial institutions are carefully navigating these uncertainties, adapting their strategies to mitigate potential risks.

Regional Variations in Sector Optimism

Optimism levels differ significantly across regions. For example, the technology sector in Asia-Pacific often displays higher levels of optimism due to strong growth in emerging markets and a focus on innovation. In contrast, the energy sector in Europe may be more focused on transitioning to renewables due to environmental regulations and a strong emphasis on sustainability. These regional variations reflect different economic priorities and political landscapes.

Summary Table of Sector-Specific Optimism/Pessimism Indicators

| Sector | Optimism Indicators | Pessimism Indicators |

|---|---|---|

| Technology | Rapid innovation, VC funding, disruptive tech | Regulatory hurdles, ethical concerns, competition |

| Energy | Renewable energy growth, policy support, cost reductions | Reliability concerns, grid integration challenges, fossil fuel reliance |

| Financial | Robust economy, market growth, investor confidence | Inflation, rising rates, economic downturns, geopolitical risks |

Impact of External Factors on Global Markets

Global markets are a complex tapestry woven from numerous threads, with external factors playing a significant role in shaping their trajectory. Geopolitical instability, supply chain disruptions, natural disasters, and policy shifts all exert influence on investor sentiment and market performance. Understanding these impacts is crucial for navigating the complexities of the global economy and making informed investment decisions.External factors often act as catalysts for significant market movements, sometimes triggering rapid and unpredictable shifts in asset prices.

These factors can either bolster or undermine market confidence, influencing investor decisions and ultimately impacting overall economic activity. A nuanced understanding of these influences is essential for discerning the true picture behind market fluctuations.

Geopolitical Tensions and Market Volatility

Geopolitical tensions, such as international conflicts, trade disputes, and political instability, are significant drivers of market volatility. These events often create uncertainty and fear, leading investors to seek safer investment options. The impact can be seen in a variety of asset classes, from stocks and bonds to commodities and currencies. For example, the ongoing war in Ukraine has disrupted global supply chains, impacting energy markets and commodity prices, and leading to heightened uncertainty in financial markets.

This highlights the profound influence geopolitical events can have on global market dynamics.

Supply Chain Disruptions and Market Sentiment

Supply chain disruptions, often stemming from geopolitical events or natural disasters, can significantly impact market sentiment. Disruptions to the flow of goods and services can lead to shortages, price increases, and reduced production, all of which can negatively affect businesses and investor confidence. For instance, the COVID-19 pandemic exposed vulnerabilities in global supply chains, causing significant disruptions and impacting various industries.

Those global markets optimism column pix are looking pretty good right now, aren’t they? However, with the UK taking a firm stance against rogue financial influencers, like in the recent joint action with foreign regulators here , it’s clear that maintaining a healthy financial environment is a global priority. This ultimately helps bolster the overall confidence in the market, which is fantastic for the optimism column pix.

This emphasized the interconnectedness of global markets and the potential for cascading effects from supply chain problems.

Natural Disasters and Investor Confidence

Natural disasters, including earthquakes, floods, hurricanes, and wildfires, can have a profound impact on investor confidence. These events often lead to significant economic losses and disruptions, impacting businesses and markets. The reconstruction efforts and recovery periods can also affect investor sentiment. For example, the 2011 Tohoku earthquake and tsunami in Japan caused significant damage to infrastructure and supply chains, leading to a temporary downturn in the Japanese economy.

Impact of Significant Policy Changes

Significant policy changes, particularly interest rate adjustments by central banks, can significantly influence market performance. Interest rate changes affect borrowing costs for businesses and consumers, impacting investment decisions and consumption patterns. For instance, central banks raising interest rates to combat inflation can curb economic growth but help stabilize prices.

Correlation Between External Factors and Market Performance

| External Factor | Potential Market Impact | Example |

|---|---|---|

| Geopolitical Tensions | Increased volatility, decreased investor confidence, capital flight | Russia-Ukraine War, trade disputes |

| Supply Chain Disruptions | Reduced production, higher prices, decreased investor confidence | COVID-19 pandemic, port congestion |

| Natural Disasters | Significant economic losses, disruptions to supply chains, decreased investor confidence | Hurricanes, earthquakes, floods |

| Significant Policy Changes (e.g., interest rate adjustments) | Impact on borrowing costs, investment decisions, consumption patterns | Federal Reserve interest rate hikes, fiscal stimulus packages |

Future Outlook and Predictions

The global market landscape is dynamic and complex, influenced by a multitude of interconnected factors. Forecasting the precise trajectory is impossible, but expert analysis offers insights into potential future scenarios. We’ll examine expert predictions, potential catalysts, and the expected impact of upcoming economic reports to paint a clearer picture of the road ahead.

Expert Predictions on Future Market Trajectory

Experts across various sectors are cautiously optimistic about the near-term future. While acknowledging potential headwinds, many foresee a period of steady growth, driven by underlying technological advancements and evolving consumer preferences. For instance, the burgeoning renewable energy sector is anticipated to continue its upward trend, fueled by government incentives and increasing environmental awareness. Similarly, the digital transformation across industries is expected to persist, with companies investing heavily in automation and data-driven strategies.

Potential Catalysts for Market Optimism or Pessimism

Several factors could significantly impact market sentiment in the coming months. Positive catalysts include successful negotiations on international trade agreements, robust consumer spending, and favorable interest rate adjustments. Conversely, rising inflation, geopolitical tensions, and supply chain disruptions could trigger market pessimism. The upcoming release of key economic indicators will be crucial in determining the prevailing sentiment. Examples of significant upcoming reports include GDP figures, inflation rates, and employment data.

Impact of Upcoming Economic Reports

The release of economic reports, such as GDP figures, inflation rates, and employment data, will be pivotal in shaping market sentiment. Positive readings generally boost investor confidence, potentially leading to increased investments and asset price appreciation. Conversely, negative data can trigger market volatility and investor apprehension. A key example is the impact of the recent inflation reports on the stock market, which experienced significant fluctuations following the release of data.

Potential Challenges and Opportunities in Different Market Segments

Specific market segments face varying challenges and opportunities. The technology sector, for example, faces potential competition from emerging markets and the need to adapt to rapidly evolving consumer demands. Conversely, the healthcare sector presents a consistent opportunity due to its inherent necessity and the ongoing need for innovative solutions. The energy sector, while facing environmental pressures, presents opportunities in renewable energy solutions and efficient energy storage.

Anticipated Market Performance Across Various Sectors in the Next Quarter

| Sector | Anticipated Performance | Rationale |

|---|---|---|

| Technology | Moderate Growth | Sustained innovation and investment, but also potential regulatory pressures and competition. |

| Healthcare | Steady Growth | Consistent demand for healthcare services and investment in medical technology. |

| Energy | Mixed | Pressure to transition to renewables, but also potential for continued fossil fuel demand. |

| Consumer Discretionary | Moderate Growth | Consumer spending likely to remain robust, but inflationary pressures could affect purchasing power. |

| Financials | Steady Growth | Interest rate adjustments and potential for increased lending activity. |

Visual Representation of Data: Global Markets Optimism Column Pix

Unveiling the intricate tapestry of global market optimism requires more than just words; it demands compelling visuals to truly grasp the nuances and interconnectedness of the factors at play. Visual representations allow us to quickly identify trends, spot potential risks, and gain a deeper understanding of the driving forces behind market sentiment. The following sections delve into various graphical tools, providing a holistic view of market dynamics.

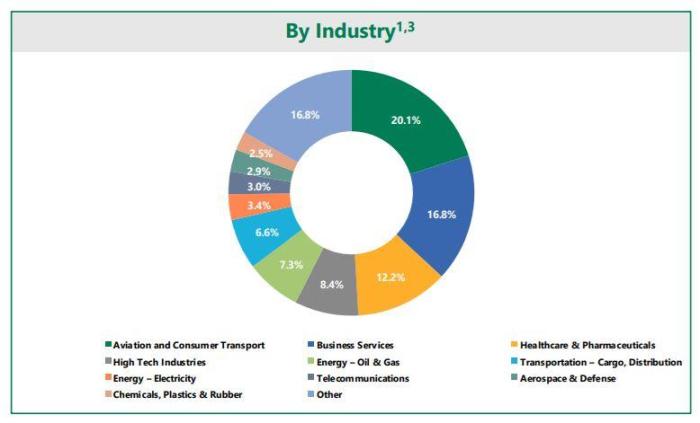

Key Drivers of Global Market Optimism

Understanding the primary drivers of global market optimism is crucial for anticipating future trends. This infographic will employ a circular visualization, with each sector represented as a slice of the circle, sized proportionally to its contribution to the overall optimism. For example, a large slice representing technological innovation would signify a strong positive impact on the market, while a smaller slice representing geopolitical instability would reflect a more muted influence.

Color-coding can further differentiate optimism levels within sectors, creating a dynamic and easily digestible representation.

Historical Relationship Between Market Optimism and Economic Indicators

Visualizing the historical relationship between market optimism and economic indicators is essential for forecasting future movements. A line graph, plotting market optimism (represented by an index or sentiment score) against key indicators like GDP growth, unemployment rates, and inflation, can reveal correlations and patterns. The graph will clearly display the historical data points and trends, allowing for an intuitive understanding of how changes in economic indicators have historically influenced market sentiment.

For instance, periods of robust GDP growth could coincide with high market optimism, whereas economic downturns may correspond with declining optimism.

Sector-Specific Optimism/Pessimism

A bar chart can effectively represent sector-specific optimism and pessimism. The x-axis would list different sectors (e.g., technology, energy, healthcare), and the y-axis would represent the level of optimism or pessimism on a scale. Each bar will correspond to a sector’s sentiment, with colors distinguishing positive from negative sentiments. For example, a tall blue bar for the technology sector would indicate strong optimism, while a short red bar for the energy sector would represent pessimism.

This visual representation will quickly highlight sectors experiencing the most pronounced sentiment shifts.

Timeline of Events Influencing Global Market Sentiment

A timeline, featuring key events and their corresponding impact on global market sentiment, provides a historical context. Events such as major policy decisions, technological breakthroughs, or geopolitical shifts are marked on a horizontal timeline, along with a color-coded indicator (e.g., green for positive impact, red for negative). This visualization offers a clear chronological overview of the sequence of events and their effect on the market’s perception.

For example, the introduction of a new technology might be highlighted on the timeline with a green marker signifying its positive influence on market sentiment.

Data Points for Infographic

| Sector | Optimism Level (Index Score) | Contribution to Overall Optimism (%) |

|---|---|---|

| Technology | 85 | 35 |

| Healthcare | 78 | 28 |

| Energy | 62 | 15 |

| Finance | 70 | 22 |

This table provides sample data for the infographic, illustrating the level of optimism and the proportional contribution of different sectors. The index score is a hypothetical measure, and the percentages represent a calculated proportion of the overall optimism. These figures can be updated with real-world data to provide a more accurate reflection of the current market climate.

Closure

In conclusion, global markets optimism column pix reveals a complex interplay of internal and external factors shaping market sentiment. While optimism persists in some sectors, concerns remain in others, especially considering the impact of external factors. The future outlook presents both challenges and opportunities, with the trajectory depending heavily on economic reports, policy changes, and geopolitical developments. The infographic and charts will help to visualize the key drivers and relationships within the complex global market picture.