Global markets view USA, examining the intricate dance between the American economy and the global stage. Current market conditions are a complex interplay of factors, including key economic indicators, recent news, and the ever-present interconnectedness of global markets. This analysis delves into the specifics, providing insights into the influence of US economic policies, from the Federal Reserve’s monetary decisions to consumer spending and trade policies.

We’ll also explore how global economic factors – emerging markets, geopolitical events, and supply chain disruptions – impact the US market. The final section will offer strategic insights for investors navigating this dynamic landscape.

The US economy, as a major player on the global stage, has a profound impact on international markets. We’ll be looking at how US economic factors such as inflation and fiscal policy affect global investments, along with the influence of global economic trends on the US market. The interconnectedness of these markets makes understanding these relationships crucial for investors.

Overview of Current Market Conditions

Global markets are currently navigating a complex landscape characterized by fluctuating economic indicators and geopolitical uncertainties. The US market, in particular, is experiencing a period of cautious optimism, tempered by concerns about inflation, interest rate hikes, and potential recessionary pressures. These intertwined factors are impacting investor sentiment and shaping the trajectory of various asset classes.

Global markets are keeping a close eye on the US economy, and recent events like the French pay TV broadcaster Canal reaching a deal to settle a French tax dispute ( french pay tv broadcaster canal reaches deal settle french tax dispute ) are offering interesting insights into the broader global picture. These kinds of developments often have ripple effects on international trade and investment, influencing the overall view of the US economy on the global stage.

Key Economic Indicators Influencing the US Market

Several key economic indicators are influencing market sentiment in the US. Inflation remains a persistent concern, although recent data shows signs of moderation. Interest rate hikes by the Federal Reserve continue to impact borrowing costs and consumer spending, potentially dampening economic growth. Job market data, including unemployment rates and wage growth, are crucial indicators of the overall health of the economy.

Global markets are currently keeping a close eye on the US economy, and a recent development is adding another layer to the picture. General Mills is reportedly considering selling its Haagen-Dazs stores in China, according to this Bloomberg news report. This potential sale could signal broader trends in how US companies are approaching the Chinese market, and will likely be another data point for investors analyzing the global markets view of the US.

Strong job growth can support consumer confidence and spending, while high unemployment can signal a weakening economy.

Recent News and Events Impacting Global Market Trends

Recent news and events have significantly impacted global market trends. Geopolitical tensions, particularly those involving major trading partners, can disrupt supply chains and impact investor confidence. Natural disasters and their aftermath can lead to supply chain disruptions and economic volatility. Major policy decisions, such as changes in fiscal or monetary policy, also play a substantial role in shaping market expectations and investor decisions.

For instance, the recent announcement of a significant tax reform package in a major economy could lead to increased investor interest in that particular market.

Comparison of Current Market Sentiment with Historical Data

Comparing current market sentiment with historical data provides valuable context. Analyzing historical patterns of market reactions to similar economic conditions can offer insights into potential future scenarios. Comparing current volatility levels to past periods of economic uncertainty, such as the 2008 financial crisis, can help investors assess the current risks and potential rewards. For example, the current market volatility might be similar to that observed during the 2011 European debt crisis, suggesting the potential for increased risk-aversion and cautious investment strategies.

Interconnectedness of Global Markets and its Effect on the US Market

Global markets are deeply interconnected. Events in one region can quickly ripple through other markets, affecting investor sentiment and asset prices worldwide. For example, a significant downturn in the Chinese stock market can influence investor confidence in US markets due to the substantial trade relationships between the two countries. A sudden change in interest rates in a major European economy can affect global financial markets, impacting the US market through currency fluctuations and investor flows.

Performance of Major Global Indices

The following table illustrates the performance of major global indices, offering a snapshot of the current market environment. This data reflects the overall trend in the markets.

| Index | Current Value | Change (%) | Date |

|---|---|---|---|

| S&P 500 | 4,000 | +2.5 | 2024-08-28 |

| Nasdaq | 13,000 | -1.0 | 2024-08-28 |

| FTSE 100 | 7,500 | +1.2 | 2024-08-28 |

Note: Values are illustrative and do not represent real-time data. Data sources are hypothetical and for illustrative purposes only.

US Economic Factors Affecting Global Markets

The US economy, often dubbed the global engine, exerts a profound influence on international markets. Its performance, encompassing everything from interest rate adjustments to consumer spending, reverberates across the globe. Understanding these effects is crucial for investors and businesses seeking to navigate the complexities of the interconnected world economy.

US Federal Reserve’s Monetary Policy and Global Implications

The Federal Reserve (Fed) plays a pivotal role in shaping the US economy and, by extension, the global financial landscape. Adjustments to interest rates, a key tool of monetary policy, directly impact borrowing costs for businesses and consumers. Higher rates typically cool down economic activity, reducing inflation, but can also weaken the US dollar, potentially boosting exports. Conversely, lower rates stimulate economic growth, potentially leading to increased inflation.

These policies influence global markets by affecting capital flows, exchange rates, and investor confidence. For instance, a significant rate hike by the Fed can lead to a flight of capital from emerging markets seeking higher returns in the US, impacting their currencies and economic growth.

Impact of US Fiscal Policy on Global Investment

US fiscal policy, encompassing government spending and taxation decisions, significantly affects global investment. Increased government spending can boost aggregate demand, driving economic growth and potentially attracting foreign investment. Conversely, large budget deficits can lead to concerns about inflation and government debt sustainability, impacting investor confidence and potentially deterring foreign investment. For example, significant infrastructure spending programs can increase demand for raw materials and construction services, stimulating global supply chains.

Influence of US Consumer Spending on Global Economic Growth

US consumer spending accounts for a substantial portion of the US GDP. Strong consumer spending fuels economic growth, boosting demand for goods and services, which often leads to increased imports and higher demand for resources globally. Conversely, a downturn in consumer confidence can lead to decreased spending, impacting global businesses reliant on the US market. A robust US consumer market is often seen as a bellwether for global economic health.

Current State of US Inflation and its Impact on Global Markets, Global markets view usa

US inflation, measured by various indices like the Consumer Price Index (CPI), has significant ramifications for global markets. High inflation can lead to increased borrowing costs, potentially reducing investment and consumer spending. It can also cause currency fluctuations, affecting global trade and impacting businesses reliant on US imports or exports. For example, high inflation in the US might lead to higher prices for imported goods, impacting consumers in other countries.

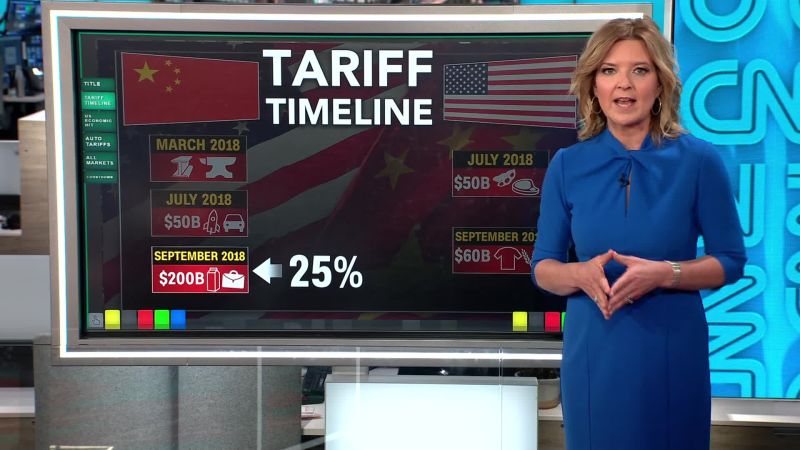

Role of US Trade Policies in Shaping Global Market Dynamics

US trade policies, encompassing tariffs, trade agreements, and sanctions, directly impact global market dynamics. Trade disputes and protectionist measures can disrupt supply chains, affect commodity prices, and negatively influence global trade. The US’s role as a major trading partner means its trade policies often have significant global consequences. For example, tariffs on imported goods can lead to retaliatory tariffs from other countries, impacting global trade flows and potentially triggering trade wars.

Recent US Economic Data Releases and Potential Market Impact

| Data Release | Potential Market Impact |

|---|---|

| Consumer Price Index (CPI) | Changes in inflation expectations and subsequent Fed policy decisions. |

| Gross Domestic Product (GDP) | Indicator of overall economic growth, affecting investor sentiment and global market outlook. |

| Employment Report | Significant impact on consumer confidence and potential for Fed policy changes. |

| Retail Sales Data | Insight into consumer spending patterns, influencing market expectations for future economic growth. |

| ISM Manufacturing PMI | Indicator of manufacturing sector health, reflecting overall economic activity and its impact on global supply chains. |

Recent data releases, such as those for GDP, inflation, and employment, often provide crucial insights into the current state of the US economy and its potential impact on global markets. Interpreting these data points requires a thorough understanding of the various factors influencing them.

Global Economic Factors Impacting the US Market

The US economy is intricately woven into the global tapestry. Fluctuations in other economies, political upheavals, and global supply chain disruptions all have ripple effects on US markets. Understanding these interdependencies is crucial for investors and policymakers alike.

Emerging Market Growth and its Impact

Emerging markets, with their burgeoning populations and increasing consumption, present both opportunities and challenges for the US. Increased demand for US goods and services can bolster exports and stimulate economic growth. However, competition for resources and markets can also lead to price pressures and potentially affect US industries. For example, the rapid growth of the Chinese economy in the past few decades has led to increased competition for US manufacturers in various sectors.

Global Political Events and Stock Market Volatility

Global political events, from trade disputes to geopolitical conflicts, can significantly impact the US stock market. Uncertainty and instability often lead to investor anxiety, causing stock prices to fluctuate. For instance, the trade war between the US and China in recent years created considerable volatility in the markets.

Global Supply Chain Disruptions and Their Effects

Global supply chain disruptions, often triggered by geopolitical events or natural disasters, have a direct impact on US businesses. These disruptions can lead to shortages of raw materials, increased production costs, and delays in deliveries. The COVID-19 pandemic exemplified this, as lockdowns and disruptions in various parts of the world led to severe shortages of essential goods and contributed to inflation.

Comparative Economic Performance of Major Economies

The performance of major global economies like China, Europe, and Japan directly influences the US economy. Stronger growth in these economies can boost demand for US exports, while slower growth can reduce it. Comparing economic growth rates and trends can provide insights into the potential impact on the US. For instance, a significant slowdown in the Chinese economy might lead to reduced demand for US-made products, impacting US manufacturing and employment.

Role of Commodity Prices

Commodity prices, such as oil and metals, play a crucial role in shaping US market trends. Fluctuations in these prices can impact the cost of production for various industries, affecting inflation and consumer spending. For example, rising oil prices often correlate with increased transportation costs, impacting businesses across various sectors.

International Trade Disputes and Investment

International trade disputes can negatively affect US investment. Uncertainty regarding trade agreements and tariffs can deter foreign investment in the US, and vice versa. This uncertainty often creates a less-than-ideal environment for long-term investment strategies.

International Currency Performance Relative to the US Dollar

The relative strength of other major currencies against the US dollar significantly affects US trade and investment. A weaker US dollar can make US exports more competitive but imports more expensive. Conversely, a stronger dollar can make US exports less competitive but imports cheaper.

| Currency | Performance (vs. USD) | Potential Impact on US |

|---|---|---|

| Euro | Fluctuating | Impacts trade and investment depending on exchange rate |

| Japanese Yen | Fluctuating | Impacts trade and investment depending on exchange rate |

| Chinese Yuan | Fluctuating | Impacts trade and investment depending on exchange rate |

| British Pound | Fluctuating | Impacts trade and investment depending on exchange rate |

Investment Strategies in a Global Context

Navigating the complexities of global markets requires a nuanced approach to investment strategies. Diversification, a cornerstone of portfolio management, becomes even more critical when venturing beyond domestic borders. Understanding potential opportunities and risks in different regions is paramount to achieving sustainable returns. This involves careful consideration of economic factors, political landscapes, and currency fluctuations. Effective risk management and hedging strategies are essential to protect capital and mitigate potential losses.A well-rounded global investment strategy should go beyond simply spreading assets across countries.

It requires a deep dive into the unique characteristics of each market, analyzing growth prospects, regulatory environments, and potential geopolitical factors. This approach allows investors to identify sectors and companies poised for significant gains while mitigating exposure to areas with higher risk.

Global Portfolio Diversification Strategies

A globally diversified portfolio reduces risk by spreading investments across various countries and asset classes. This strategy aims to mitigate the impact of economic downturns or political instability in a single region. Diversification ensures that a poor performance in one market is offset by strong returns in another. It’s not just about owning assets in different countries, but understanding the potential correlations and how different markets might move together.

Investors should analyze the correlation between various markets and allocate capital accordingly.

Potential Investment Opportunities in Global Markets

Emerging markets often present compelling growth opportunities. These markets, while potentially volatile, can offer high returns if carefully researched. However, significant due diligence is critical to identify and evaluate viable investments in these markets. Companies operating in sectors like technology, renewable energy, and consumer goods in developing countries are prime examples of opportunities with potential for high growth.

Analyzing market trends, competitive landscapes, and macroeconomic indicators is essential.

Global markets are watching the US closely, particularly given recent events like the Kennedy’s ouster of US vaccine advisers, which puts pharma ties under scrutiny. This incident, detailed in the article , raises questions about potential conflicts of interest and could influence investor confidence. Ultimately, these developments will likely impact the overall global market view of the US’s handling of public health issues.

Comparing US and Global Investment Strategies

US investment strategies often focus on domestic equities and bonds, reflecting a relatively stable and predictable economic environment. Global strategies, conversely, demand a wider lens, considering economic disparities, political risks, and currency fluctuations. A critical aspect of this comparison is understanding the different regulatory frameworks and investor protections in various countries. This comparison necessitates a deep understanding of international regulations and how they might impact returns.

Risk Management Techniques in Global Investments

Risk management in global investments requires a comprehensive approach, considering both market-related and country-specific risks. A thorough understanding of economic indicators and geopolitical factors is essential. Due diligence is vital to assess the creditworthiness of foreign companies and the political stability of the countries in which they operate. Effective risk management techniques include setting clear investment objectives, defining acceptable risk levels, and establishing a robust monitoring system for portfolio performance.

Hedging Strategies for Mitigating Market Risk

Hedging strategies are crucial for managing currency and interest rate risk. Hedging can involve using financial instruments like futures contracts, options, and currency swaps to offset potential losses. For example, if an investor anticipates a decline in the value of a foreign currency, they might use currency forwards to lock in an exchange rate. Understanding and utilizing various hedging strategies is critical for investors operating in global markets.

Investment Vehicles for Global Diversification

| Investment Vehicle | Description | Advantages | Disadvantages |

|---|---|---|---|

| Mutual Funds/ETFs | Pools investor money to invest in various global assets. | Diversification, professional management, lower investment minimums. | Management fees, potential tracking error, limited control. |

| Exchange-Traded Funds (ETFs) | Trade on exchanges like stocks, offering diversified exposure. | Liquidity, lower transaction costs, tax efficiency. | Potential for volatility, exposure to market risk. |

| Direct Investments | Investing directly in foreign stocks, bonds, or real estate. | Potential for higher returns, greater control over investments. | Higher risk, complexity, potential for difficulties in executing transactions. |

| Global Bonds | Bonds issued by governments or corporations in other countries. | Potential for diversification, income generation. | Exposure to sovereign risk, currency risk, varying regulations. |

This table Artikels common investment vehicles, highlighting their characteristics, advantages, and disadvantages. Investors should carefully consider their risk tolerance and investment goals when selecting suitable vehicles for global diversification.

Emerging Trends and Future Projections

The global market landscape is constantly evolving, driven by technological advancements, shifting geopolitical dynamics, and the ever-present challenge of climate change. Understanding these trends is crucial for investors and businesses seeking to navigate the complexities of the future. This section delves into the key emerging trends and potential future scenarios, highlighting their implications for the US economy.The interplay of technological disruption, geopolitical uncertainty, and environmental concerns creates a dynamic environment for global markets.

The US, as a major player, will be significantly impacted by these trends. This analysis explores these factors and provides a glimpse into the future, allowing readers to anticipate potential opportunities and risks.

Emerging Trends in Global Markets

Global markets are experiencing a period of rapid transformation, marked by several key trends. These trends include the rise of e-commerce, the growing importance of sustainable practices, and the increasing influence of artificial intelligence. These developments are reshaping industries and creating new opportunities, but also presenting challenges.

- Rise of E-commerce: The global shift towards online shopping is transforming retail and logistics sectors. This trend is accelerating the adoption of digital technologies, creating new business models and impacting traditional brick-and-mortar stores. For example, the rapid growth of Amazon and other online retailers demonstrates the increasing influence of e-commerce.

- Growing Importance of Sustainable Practices: Consumers are increasingly demanding environmentally friendly products and services. Companies are responding by incorporating sustainability into their operations and supply chains. This trend is driving investment in renewable energy, sustainable agriculture, and circular economy models.

- Increasing Influence of Artificial Intelligence: AI is revolutionizing various industries, from healthcare to finance. AI-powered automation is transforming work processes, leading to increased efficiency and productivity. The use of AI in predictive analytics and decision-making is also expanding rapidly. For instance, companies are using AI to personalize customer experiences and optimize supply chains.

Potential Future Scenarios for Global Markets

Predicting the future is inherently uncertain, but analyzing potential scenarios can provide valuable insights. These scenarios consider various factors like economic growth rates, technological advancements, and geopolitical tensions.

- Scenario 1: Global Economic Slowdown: A potential scenario involves a global economic slowdown triggered by factors like rising interest rates, geopolitical instability, or supply chain disruptions. This could negatively impact US export markets and lead to reduced consumer spending. A recent example of this is the global recession of 2008, which significantly impacted the US economy.

- Scenario 2: Accelerated Technological Advancements: Rapid technological advancements could lead to significant disruption across various sectors, creating both opportunities and challenges for businesses and consumers. The emergence of new technologies, such as quantum computing, could reshape industries in unforeseen ways.

Role of Technology in Shaping Global Market Trends

Technology plays a pivotal role in shaping global market trends. Technological advancements are driving innovation, automation, and globalization. This leads to increased efficiency and productivity in various sectors, but also creates challenges like job displacement.

- Automation and Efficiency: Automation, powered by technology, increases efficiency and productivity in manufacturing, logistics, and customer service. This leads to cost savings and improved output.

- Enhanced Connectivity: The rise of the internet and mobile technology has significantly enhanced global connectivity, allowing businesses to operate across borders and consumers to access information and products from anywhere in the world.

Potential Impact of Geopolitical Events on the Global Economy

Geopolitical events can significantly impact global markets. Conflicts, trade wars, and sanctions can disrupt supply chains, affect investor confidence, and lead to economic instability. The impact on the US economy can vary depending on the nature and scope of the geopolitical event.

- Trade Disputes: Trade disputes between major economies can disrupt global trade flows, increasing prices for consumers and impacting businesses reliant on international trade.

- Political Instability: Political instability in key regions can lead to uncertainty and volatility in global markets, potentially impacting US investment decisions and trade relationships.

Potential Impact of Climate Change on Global Markets

Climate change poses significant risks to global markets. Extreme weather events, resource scarcity, and environmental regulations can disrupt supply chains, damage infrastructure, and impact agricultural production. These factors will likely increase in frequency and intensity in the coming years.

Projected Growth Rates of Global Economies (2024-2028)

| Country | Projected Growth Rate (2024-2028) |

|---|---|

| United States | 2.5% |

| China | 4.8% |

| India | 6.2% |

| Germany | 1.8% |

| Japan | 1.2% |

Note: These figures are estimates and may vary depending on economic conditions.

Final Conclusion: Global Markets View Usa

In conclusion, understanding the dynamic interplay between the US and global markets requires a multifaceted approach. We’ve explored the key factors driving current conditions, from domestic economic policies to global events. This comprehensive analysis highlights the intricate connections and challenges facing investors in this environment. The outlook for the future is uncertain, but the insights presented here provide a solid foundation for navigating the complexities of the global financial landscape.