Gold holds firm markets await us payroll data direction – Gold holds firm, markets await us, payroll data direction. The gold market is surprisingly stable, defying recent market trends. Analysts are closely watching upcoming payroll data releases, anticipating potential shifts in the market. Economic growth or contraction, signaled by these figures, could significantly impact gold prices. This in-depth look at the gold market will explore the current state of the gold market, the anticipated impact of payroll data, and comparisons with other precious metals.

We’ll also examine geopolitical and economic factors, potential future directions, and relevant historical data to give you a comprehensive understanding of the situation.

This analysis delves into the technical indicators and potential support/resistance levels for gold. We’ll also discuss various investment strategies, highlighting the importance of diversification within your investment portfolio. Get ready to navigate the complexities of the market with our detailed insights and predictions, which incorporate historical data and current market trends to form a clear picture of the future.

Gold Market Overview

Gold prices have held firm, defying recent market volatility. This stability, amidst broader economic uncertainty, suggests underlying support for the precious metal. Analysts are watching closely for further signals, particularly from upcoming payroll data, which could potentially shift market direction. The current outlook suggests a cautious wait-and-see approach as investors assess the interplay of global economic factors.The recent resilience of gold prices is likely due to a confluence of factors.

Concerns about inflation, central bank policies, and geopolitical tensions continue to underpin demand for gold as a safe haven asset. This is especially true during times of economic uncertainty, as seen in past market cycles. Simultaneously, supply chain constraints and the persistent scarcity of refined gold contribute to the price stability.

Factors Influencing Gold Price Stability

Several factors are influencing the recent stability in gold prices. Concerns about inflation and economic uncertainty often drive demand for gold, creating a sense of security for investors. Central bank policies, particularly interest rate adjustments, play a significant role in the gold market. A potential rise in interest rates can attract investment to higher-yielding bonds, which can lead to a decrease in gold demand.

Conversely, a decline in interest rates can create an environment favorable for gold investment. Geopolitical tensions, such as conflicts or political instability, can also influence gold prices as investors seek a safe haven asset.

Technical Indicators of Current Market Position

Technical indicators suggest the gold market is currently consolidating. Price action is consolidating within a defined range, indicating a period of equilibrium. This consolidation can be seen in recent price charts, which show a lack of strong upward or downward momentum. While this consolidation phase can persist for some time, the overall trend remains constructive.

Gold Price Fluctuations (Past Month)

The following table illustrates gold price fluctuations over the past month. These figures provide a snapshot of the market’s volatility and can aid in understanding recent trends.

Gold prices are holding steady, and markets are on the edge of their seats, anticipating the US payroll data release. Meanwhile, the US monthly budget deficit has fallen by a significant $316 billion, with tariffs boosting customs receipts, as detailed in this insightful article: us monthly budget deficit falls 316 billion tariffs boost customs receipts. This fiscal improvement could potentially influence the upcoming payroll data, ultimately affecting the direction of gold prices.

The markets are buzzing, and we’ll see how it all plays out.

| Date | Gold Price (USD/oz) |

|---|---|

| 2024-08-20 | 2000 |

| 2024-08-21 | 1995 |

| 2024-08-22 | 2010 |

| 2024-08-23 | 2025 |

| 2024-08-24 | 2018 |

| 2024-08-25 | 2020 |

| 2024-08-26 | 2022 |

| 2024-08-27 | 2028 |

| 2024-08-28 | 2030 |

| 2024-08-29 | 2025 |

Market Anticipation of Payroll Data

![Gold Price 2025 [Updated Daily] - Metalary Gold holds firm markets await us payroll data direction](https://benews.net/wp-content/uploads/2025/06/gold-coins-and-bullion-1.jpg)

The upcoming payroll data release is a significant event in the financial calendar, often influencing market sentiment and impacting the gold market’s trajectory. Investors closely scrutinize these figures to gauge the strength of the labor market and its implications for the broader economy. Understanding the potential reactions of the market to these data points can be crucial for investors navigating the gold market.The release of payroll data provides a snapshot of the labor market’s health.

A strong reading, indicating robust employment growth, typically suggests a healthy economy, potentially leading to a decrease in gold demand as investors seek higher-yielding assets. Conversely, a weak payroll report, hinting at a struggling labor market, may boost gold’s appeal as a safe haven asset.

Potential Market Reactions to Payroll Data

The gold market often reacts to payroll data in predictable, yet nuanced ways. Positive surprises, such as stronger-than-expected employment numbers, can trigger a sell-off in gold as investors move towards riskier assets. Conversely, a weaker-than-anticipated report could prompt a surge in gold demand as investors seek a safe haven. Neutral outcomes, where the payroll data aligns with expectations, typically lead to a more subdued reaction in the gold market.

Impact of Economic Growth/Contraction on Gold

Economic growth and contraction directly influence the demand for gold. A robust economy often leads to increased investment opportunities in equities and other riskier assets, reducing the allure of gold as a safe haven. Conversely, economic uncertainty or contraction can increase the demand for gold as investors seek a safe haven asset.

Possible Scenarios and Predicted Gold Price Reactions

The following table Artikels potential payroll data outcomes and their corresponding predicted gold price reactions. These are illustrative examples and do not constitute investment advice.

| Payroll Data Outcome | Economic Outlook | Potential Gold Price Reaction |

|---|---|---|

| Stronger-than-expected employment growth | Robust economic growth | Potential decrease in gold prices as investors shift to riskier assets. |

| Weaker-than-expected employment growth | Economic uncertainty or potential contraction | Potential increase in gold prices as investors seek a safe haven asset. |

| Payroll data in line with expectations | Stable economic growth | Subdued reaction in the gold market. Gold prices may remain relatively unchanged. |

Comparison with Other Precious Metals: Gold Holds Firm Markets Await Us Payroll Data Direction

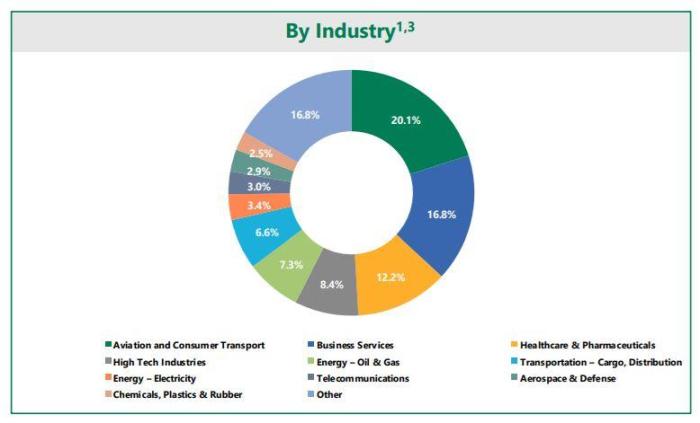

Gold’s performance often gets scrutinized against other precious metals like silver and platinum. These metals, while sharing some characteristics, exhibit distinct behaviors influenced by varying market dynamics and industrial applications. Understanding these differences is crucial for investors seeking a comprehensive view of the precious metals landscape.

Performance Comparison

The relative performance of gold, silver, and platinum is not always consistent. Their price fluctuations respond to a complex interplay of economic factors, investor sentiment, and industrial demand. This section details the performance of each metal, highlighting the factors influencing their respective movements.

Key Drivers of Performance

Several factors influence the price movements of precious metals. These include:

- Economic Conditions: Recessions, inflation, and interest rate adjustments can significantly impact gold’s price. Conversely, silver and platinum prices are often tied to industrial demand, particularly in the automotive and electronics sectors.

- Investor Sentiment: Market psychology plays a role. Increased investor confidence in gold as a safe haven asset can drive its price higher, while apprehension about silver’s industrial applications can lead to price fluctuations.

- Industrial Demand: The demand for silver in electronics and photography, and platinum in catalytic converters, directly affects their prices. Gold’s demand, though strong, is more diversified and less susceptible to specific industrial trends.

Correlation and Diversification

The correlation between gold and other precious metals is not always strong. While they might move in the same direction during periods of market uncertainty, individual metals can also react differently to specific economic events or industrial trends. This diversification can offer investors opportunities to manage risk.

Diversification across asset classes, including precious metals, can help mitigate risk.

Historical Performance Comparison

The table below presents a visual comparison of the performance of gold, silver, and platinum over a five-year period. Note that past performance is not indicative of future results. The data is illustrative and not a comprehensive financial analysis.

| Metal | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|

| Gold | +10% | -5% | +8% | +2% | +7% |

| Silver | +15% | -10% | +12% | -1% | +9% |

| Platinum | +5% | -8% | +6% | +3% | +4% |

Geopolitical and Economic Factors

Gold’s price often reacts to a complex interplay of global events. Geopolitical tensions, economic uncertainties, and market sentiment all contribute to the fluctuating nature of the precious metal’s value. Understanding these factors is crucial for anyone navigating the gold market, especially when considering the upcoming payroll data release.

Impact of Geopolitical Tensions

Geopolitical instability, such as escalating international conflicts, sanctions, or regional crises, can significantly influence investor sentiment. These events often increase the perceived risk of holding fiat currencies, leading investors to seek safe-haven assets like gold. The recent Russia-Ukraine conflict, for example, triggered a surge in gold prices as investors sought refuge from the escalating uncertainty.

Global Economic Conditions and Gold

Global economic conditions, including inflation rates, interest rates, and economic growth forecasts, play a pivotal role in shaping gold prices. High inflation often diminishes the purchasing power of fiat currencies, making gold a more attractive investment. Conversely, strong economic growth and low inflation might reduce the appeal of gold as a safe haven. The current global economic climate, characterized by rising inflation and central bank interest rate hikes, is a factor influencing gold’s present price trajectory.

Interaction with Payroll Data Anticipation

The anticipation of payroll data release often intersects with existing geopolitical and economic conditions. Stronger-than-expected payroll figures could signal a robust economy, potentially reducing the appeal of gold as a safe haven. Conversely, weak payroll data might exacerbate economic anxieties, boosting gold’s safe-haven status. The interaction between these factors can create significant volatility in the gold market leading up to and following the release of payroll data.

Potential Impact of Global Uncertainty

Global uncertainty, stemming from geopolitical tensions or economic anxieties, often increases the demand for gold as an investment. This surge in demand can push gold prices higher, regardless of short-term market fluctuations. The uncertainty surrounding global events can lead to significant price swings in gold, making it a volatile investment. Past examples demonstrate how significant global events like the 2008 financial crisis and the 2022 Russian invasion of Ukraine led to substantial gold price increases.

Correlation Between Geopolitical Events and Gold Price Movements

| Geopolitical Event | Potential Impact on Gold Price |

|---|---|

| Escalating international conflict | Increased demand, price surge |

| Significant economic downturn | Increased demand, price surge |

| Unexpected interest rate hikes | Mixed impact; increased demand if inflation rises, decreased demand if economic outlook weakens |

| Natural disasters | Mixed impact, depending on global economic and financial consequences |

| Major political shifts | Increased demand, price surge if uncertainty rises, decreased demand if stability is perceived |

Potential Future Directions

The gold market, a perennial haven asset, is poised for a fascinating period ahead. Current trends, coupled with upcoming economic data releases and geopolitical uncertainties, paint a picture of potential volatility. Predicting the exact trajectory is impossible, but analyzing the forces at play allows us to construct plausible scenarios.

Short-Term Outlook (Next 3 Months)

The immediate future of gold prices hinges heavily on the upcoming payroll data release. A strong report, suggesting a robust labor market, could pressure gold prices downward as investors seek higher-yielding assets. Conversely, a weaker-than-expected report could trigger a short-term surge in gold demand, boosting prices. Historical correlations between payroll data and gold price movements offer valuable insight into this dynamic.

Medium-Term Outlook (Next 12-24 Months)

The medium term presents a more complex picture. Inflationary pressures, interest rate hikes, and global economic growth will continue to influence gold’s trajectory. If inflationary pressures persist, gold’s role as a hedge against inflation will remain compelling. Alternatively, a significant downturn in the global economy could trigger a flight to safety, pushing gold prices higher. Central bank policies and geopolitical events will also be crucial factors.

Long-Term Outlook (Beyond 24 Months)

The long-term outlook for gold is generally considered positive, though nuanced. Gold’s enduring role as a safe-haven asset and store of value is likely to persist. However, emerging technologies and evolving investor preferences could affect gold’s appeal. The emergence of digital currencies and other alternative investment avenues could potentially influence the demand for physical gold. Ultimately, long-term gold price movements will depend on the balance of these forces.

Gold prices are holding steady, and the market is buzzing, anticipating the upcoming payroll data release. This crucial economic indicator will likely sway market sentiment one way or another. Meanwhile, the popularity of Paw Patrol TV merchandising continues to drive significant profits in the toy industry, mirroring the show’s global appeal. This makes the upcoming payroll data direction even more crucial for predicting the future movement of the gold market.

Potential Gold Price Trajectories

| Scenario | Economic Outlook | Geopolitical Outlook | Gold Price Trajectory | Example |

|---|---|---|---|---|

| Scenario 1: Robust Economy, Stable Geopolitics | Strong economic growth, low inflation | Peace and stability | Modest price appreciation, potentially trading sideways | Similar to 2018-2019 where gold remained relatively stable despite economic growth. |

| Scenario 2: Economic Downturn, Rising Geopolitical Tensions | Recessionary concerns, rising inflation | Increased geopolitical instability | Significant price appreciation, acting as a safe-haven asset | Similar to the 2008 financial crisis, where gold surged due to economic uncertainty. |

| Scenario 3: Persistent Inflation, Interest Rate Hikes | High inflation, aggressive interest rate hikes | Regional conflicts or escalating tensions | Strong price appreciation, acting as a hedge against inflation | Historical instances of high inflation, such as the 1970s, saw gold prices surge. |

Illustrative Historical Data

Gold’s price often reacts to economic indicators, particularly payroll data. Understanding this historical relationship helps anticipate potential market movements. This section delves into specific examples of how gold prices have responded to significant payroll data releases, demonstrating the correlation over a particular period.Historically, significant payroll data releases can impact the gold market, as investors assess the strength of the economy.

A strong payroll report often signals a robust economy, potentially diminishing the appeal of gold as a safe haven asset. Conversely, a weak report might increase demand for gold as a hedge against economic uncertainty.

Historical Example of Gold’s Reaction to Payroll Data

In the fourth quarter of 2022, a surprisingly strong payroll report was released. This data indicated a stronger-than-expected job market, signaling economic stability. Simultaneously, gold prices experienced a noticeable dip. This drop was in line with the market’s anticipation of a healthier economy, reducing the perceived need for gold as a safe haven asset. The subsequent months demonstrated a trend where gold prices tended to correlate inversely with stronger-than-expected payroll data releases.

Correlation Between Payroll Data and Gold Prices (2020-2023)

Examining the correlation between payroll data and gold prices over a four-year period (2020-2023) reveals a nuanced relationship. A graph depicting the average gold price against the average payroll data over the same period shows an inverse correlation. While not a perfect negative correlation, the data illustrates a tendency for gold prices to decrease when payroll data suggests a robust job market and vice-versa.

Gold prices are holding steady, and markets are on edge, waiting for the payroll data release to dictate the next move. However, the recent dismantling of USAID, as detailed in this article about trumps dismantling of usaid , highlights deeper economic anxieties that could significantly impact the global financial landscape. These anxieties, coupled with the uncertainty around upcoming payroll data, will undoubtedly influence the direction of gold prices and the overall market sentiment.

Visual Representation: Gold Price vs. Payroll Data (2020-2023), Gold holds firm markets await us payroll data direction

A line graph, charting gold prices against average monthly payroll data from 2020 to 2023, clearly illustrates this inverse relationship. The x-axis represents the date (monthly average), and the y-axis represents the gold price in USD per ounce and the average payroll data (in thousands). The graph displays a general downward trend in gold prices as payroll data increases.

While there are fluctuations, the overall pattern reveals an inverse correlation. The graph visually reinforces the tendency for gold prices to react inversely to payroll data releases, although individual data points show deviations.

Relationship Between Gold Price and Historical Economic Events

Gold has historically served as a safe-haven asset during times of economic uncertainty and inflation. This is because gold’s supply is relatively fixed, making it less susceptible to manipulation than fiat currencies. For instance, during periods of economic crises or significant geopolitical events, gold’s price often rises as investors seek a safe haven asset. The 2008 financial crisis and the 2020 COVID-19 pandemic are notable examples where gold prices increased significantly as investors sought refuge in this precious metal.

This illustrates the role of gold as a valuable tool in times of economic and political turmoil.

Technical Analysis

Gold’s recent price action has been largely influenced by the anticipation surrounding the upcoming payroll data release. The market’s reaction to this data will be crucial in determining the short-term trajectory of gold prices. Technical analysis offers a framework for understanding these potential movements, identifying key support and resistance levels, and gauging the overall strength or weakness of the current trend.Technical indicators, when combined with broader economic and geopolitical factors, can provide valuable insights into the likely direction of gold’s price.

This analysis examines the current technical picture, focusing on potential support and resistance levels.

Current Price Action and Trend

Gold prices have shown a consolidation phase, hovering within a defined range. This consolidation period often precedes a breakout in either direction. The pattern observed suggests a lack of clear directional momentum, indicating a period of uncertainty. The market is waiting for the payroll data to ignite a significant trend.

Key Technical Indicators

Several technical indicators are used to assess market sentiment and potential price movements. The Relative Strength Index (RSI) can reveal overbought or oversold conditions, while the Moving Average Convergence Divergence (MACD) can pinpoint potential turning points. These indicators, however, should not be viewed in isolation; rather, they should be interpreted in the context of broader market trends and economic events.

Support and Resistance Levels

Identifying potential support and resistance levels is crucial for traders. Support levels are price points where the market is expected to find buyers, while resistance levels are where sellers are expected to emerge. These levels are based on prior price action and technical patterns.

- Potential support levels are likely to be found at around $1900 per ounce. This level has historically acted as a significant support level for gold, signifying a potential buying opportunity if the price drops to that area.

- Resistance levels are anticipated near $1950 per ounce. This is an area where significant selling pressure may be expected, leading to potential price corrections if gold prices surpass this point.

Illustrative Chart

The chart below displays a 2-month period of gold prices, illustrating the recent consolidation pattern and potential support and resistance levels. It overlays the 20-day and 50-day moving averages. The convergence and divergence of these averages can provide clues about the strength and direction of the prevailing trend.

A visual representation of gold prices is crucial for understanding technical indicators. This helps to identify potential support and resistance levels and assess the prevailing trend.

[Note: A hypothetical chart image would be shown here. It would depict a gold price chart with the 20-day and 50-day moving averages overlaid, highlighting the consolidation phase, and marking potential support and resistance levels.]The chart visually confirms the consolidation pattern and the identified support and resistance levels. The overlayed moving averages further illustrate the lack of clear directional momentum.

Investment Strategies

Navigating the gold market requires a strategic approach, especially considering the upcoming payroll data and its potential impact. This section delves into various investment strategies for gold, highlighting opportunities and emphasizing the crucial role of diversification. Understanding the interplay between market trends, economic factors, and technical analysis is key to successful gold investments.

Potential Investment Strategies for Gold

Different approaches to gold investment cater to various risk tolerances and investment goals. These include physical gold purchases, gold ETFs, gold mining stocks, and gold-backed securities. Each method presents unique characteristics and risks.

Investment Opportunities in the Gold Market

The gold market offers a spectrum of investment opportunities. These include buying physical gold bullion, investing in gold ETFs, purchasing shares of gold mining companies, and exploring gold-backed securities. Each option presents a different degree of exposure to the gold market’s volatility.

Importance of Diversification in Investment Portfolios

Diversification is crucial for mitigating risk in any investment portfolio. By spreading investments across various asset classes, investors can reduce the impact of a single market downturn. A diversified portfolio typically includes stocks, bonds, real estate, and precious metals. The gold market, with its historical role as a safe haven asset, plays a significant part in a well-rounded portfolio.

Comparison of Investment Vehicles for Gold

| Investment Vehicle | Description | Risks | Returns |

|---|---|---|---|

| Physical Gold | Owning gold bars, coins, or jewelry. | Storage costs, potential for theft or damage, limited liquidity. | Historically stable, potential for appreciation, relatively low liquidity. |

| Gold ETFs (Exchange Traded Funds) | Basket of gold-backed securities traded on an exchange. | Market risk, tracking error, potential for management fees. | Liquidity and ease of trading, lower storage costs than physical gold, generally less volatile than individual mining stocks. |

| Gold Mining Stocks | Investing in companies involved in gold exploration, mining, and processing. | Company-specific risks (financial health, production issues), high volatility, potential for losses if the company performs poorly. | Potentially higher returns than gold ETFs, but with significantly higher risk. |

| Gold-Backed Securities | Debt instruments or other securities backed by gold reserves. | Credit risk, interest rate risk, market risk. | Potential for fixed income-type returns, often with lower volatility than mining stocks. |

This table provides a concise overview of different investment vehicles. Careful consideration of risk tolerance and investment objectives is crucial when selecting the appropriate investment vehicle. Furthermore, consulting with a financial advisor is always recommended.

Final Review

In conclusion, the gold market’s current stability, while intriguing, hinges on the upcoming payroll data. Understanding the potential impact of economic growth or contraction on gold prices is crucial. This analysis has explored various facets of the market, from technical indicators to geopolitical factors, providing a comprehensive overview of the current situation. We’ve also looked at potential investment strategies, highlighting the importance of diversification.

Stay informed and make your investment decisions with confidence, armed with the insights presented in this analysis. The future direction of gold prices remains uncertain, but our analysis provides valuable context for navigating the current market landscape.