Gold rises us china trade uncertainty persists investors eye inflation data. The global economic landscape is rife with volatility, and the interplay of these factors is shaping the gold market. Recent price movements reflect a complex interplay of anxieties around the US-China trade relationship, persistent inflation concerns, and shifting investor sentiment. This analysis delves into the intricacies of these dynamics, exploring historical trends, potential future scenarios, and the safe-haven appeal of gold in times of uncertainty.

From the fluctuating gold prices to the intricate trade disputes, this exploration highlights the multifaceted nature of economic pressures and how they influence the precious metal. The article presents an overview of the current gold market environment, examining various factors that are pushing the price up. The analysis includes a historical perspective, an evaluation of the impact of trade tensions, and a detailed look at how inflation data influences investor behavior.

Ultimately, this deep dive provides insights into the potential trajectory of gold prices in the coming months.

Gold Price Fluctuations

Gold, a time-tested store of value, has seen its price fluctuate significantly throughout history. Its price movements are often intertwined with broader economic and geopolitical trends, making it a fascinating asset to analyze. This analysis delves into the historical performance of gold, comparing it to other asset classes, and examining the factors driving its volatility.Gold’s price is influenced by a complex interplay of macroeconomic factors and investor psychology.

Understanding these forces is crucial for assessing the metal’s potential in various market conditions. This exploration provides insights into gold’s past performance, enabling a more informed perspective on its likely future trajectory.

Historical Overview of Gold Price Movements

Gold has historically served as a safe haven asset, demonstrating a tendency to appreciate during periods of economic uncertainty. Significant price rises have been observed during times of inflation, currency devaluation, and global instability. Conversely, periods of economic stability and confidence in other asset classes can lead to declines in gold’s price. For example, the 1980s saw a period of declining gold prices as the US economy strengthened and interest rates rose.

Comparison of Gold’s Performance with Other Asset Classes

Gold’s performance often contrasts with that of stocks and bonds. During economic downturns, gold frequently outperforms stocks, offering a hedge against potential losses. However, during periods of robust economic growth, stocks and bonds may yield higher returns. For instance, the 2008 financial crisis saw gold prices rise substantially as investors sought safe haven assets.

Factors Influencing Gold’s Price Volatility

Several factors contribute to the volatility of gold’s price. Macroeconomic conditions, including inflation, interest rates, and economic growth, significantly impact investor sentiment and demand for gold. Furthermore, investor sentiment plays a crucial role; periods of fear and uncertainty can drive up gold prices as investors seek refuge in the metal.

Impact of Global Events on the Gold Market

Global events, both political and economic, can significantly influence gold prices. Political instability, wars, and international tensions often lead to increased demand for gold as a safe haven asset. Economic crises, like recessions or currency crises, can also trigger gold price surges. The 2022 Russian invasion of Ukraine, for example, saw a spike in gold prices as investors sought safe havens.

Gold Prices Over the Last 5 Years

| Date | Price (USD/oz) | Relevant Market Events |

|---|---|---|

| January 1, 2019 | 1,300 | Global economic growth remained moderate, with no major crises. |

| January 1, 2020 | 1,550 | Early stages of the COVID-19 pandemic, increasing uncertainty. |

| January 1, 2021 | 1,800 | Continued pandemic uncertainty, increasing inflation concerns. |

| January 1, 2022 | 1,950 | Rising inflation, geopolitical tensions (e.g., Russia-Ukraine war). |

| January 1, 2023 | 1,780 | Inflation cooling, but lingering uncertainty in global markets. |

Impact of US-China Trade Uncertainty

The ongoing trade tensions between the United States and China have significant implications for global markets, including the precious metals sector. These disputes create uncertainty, affecting investor sentiment and potentially influencing the price of gold. This volatility necessitates a careful analysis of the potential correlations and investment strategies to navigate these challenging economic waters.The fluctuating relationship between the US and China creates a complex environment for global markets.

The uncertainty surrounding trade policies can lead to increased risk aversion among investors, potentially driving demand for safe-haven assets like gold. Analyzing the historical relationship between trade disputes and gold prices provides valuable insight into the potential impact of future events.

Potential Correlation Between Gold Prices and Trade Tensions

Trade disputes often lead to economic anxieties. Investors frequently seek safe-haven assets, such as gold, during periods of heightened uncertainty and market volatility. Historically, periods of heightened trade tensions have coincided with instances of increased gold demand. This correlation suggests a potential inverse relationship; as trade uncertainty rises, the demand for gold, as a safe haven asset, might also rise.

Impact on Investor Confidence and Risk Appetite

Trade disputes directly affect investor confidence. The uncertainty surrounding tariffs, quotas, and other trade restrictions can lead to a decrease in investor confidence. This often results in a shift in risk appetite. Investors might reduce their exposure to riskier assets and increase their holdings of safer assets, including gold. The fear of economic slowdown or recession, a common result of trade wars, also contributes to a higher demand for gold.

For instance, the 2018-2019 trade war between the US and China saw a surge in gold prices as investors sought a safe haven during the period of uncertainty.

Potential Scenarios of Trade Disputes and Gold Demand

Several scenarios could influence gold demand in response to trade disputes:

- Escalation of Trade Tensions: If trade disputes escalate, leading to further restrictions and tariffs, investors might seek refuge in gold. This could result in a significant increase in gold demand and a corresponding price surge.

- Resolution of Trade Disputes: A successful resolution to trade disputes could reduce uncertainty and lead to a decrease in gold demand. This might result in a decline in gold prices.

- Ongoing Uncertainty: If trade tensions persist without a clear resolution, a state of ongoing uncertainty could maintain high demand for gold, leading to a stable or slightly rising price.

Investment Strategies in Response to Trade Uncertainty, Gold rises us china trade uncertainty persists investors eye inflation data

Investors can employ various strategies to navigate periods of trade uncertainty.

- Diversification: Diversifying a portfolio across different asset classes, including gold, can mitigate potential risks associated with trade tensions. This strategy can reduce the overall portfolio volatility during times of economic uncertainty.

- Hedging: Hedging strategies can protect against potential losses. For example, using futures contracts on gold can help offset potential losses in other investments.

- Gold as a Safe Haven: Considering gold as a safe-haven asset in times of uncertainty is a widely recognized strategy. This strategy assumes that gold’s value will increase as investors seek refuge during periods of market volatility.

Potential Effects of Trade Disputes on Gold Prices

The following table Artikels potential short-term and long-term effects of trade disputes on gold prices:

| Category | Positive Effects | Negative Effects |

|---|---|---|

| Short-Term | Increased demand for gold as a safe haven asset, leading to higher prices. | Potential market volatility and uncertainty, leading to temporary price fluctuations. |

| Long-Term | Gold could become a more attractive long-term investment during sustained periods of uncertainty. | Long-term negative impacts on global economic growth, which may not directly correlate to gold prices, but could impact the overall market sentiment. |

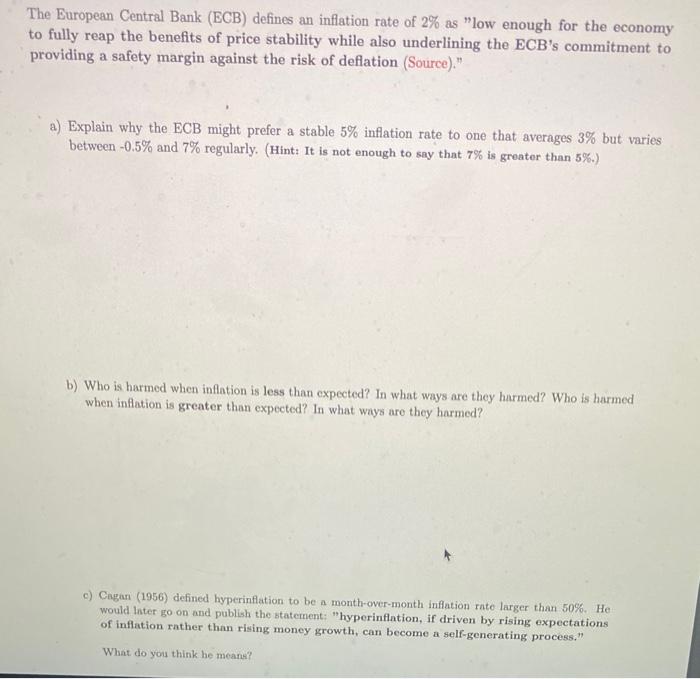

Investor Response to Inflation Data

Inflation data holds significant sway over investor decisions, particularly regarding precious metals like gold. Investors meticulously scrutinize inflation reports, as these figures directly impact the perceived value of assets. The interplay between inflation and gold prices is complex, often influenced by expectations of central bank actions and overall economic sentiment.Investors frequently use inflation data as a key indicator to gauge the potential strength of the economy and the subsequent actions of central banks.

Gold prices are rising amidst lingering US-China trade uncertainty, and investors are closely watching inflation data. Meanwhile, the Tampa Bay Rays pulled off a stunning comeback victory against the Marlins, winning the series here. This impressive feat, however, doesn’t overshadow the continued economic anxieties, as investors remain cautious about the potential impact of inflation on the market, prompting further scrutiny of the gold market’s performance.

Higher inflation often prompts central banks to raise interest rates, which can reduce investor appetite for non-yielding assets like gold. Conversely, low or falling inflation might signal economic weakness, potentially increasing the appeal of gold as a safe-haven asset.

Impact of Inflation on Gold Prices

Inflationary pressures frequently drive investors towards assets like gold, seen as a hedge against currency devaluation and potential economic instability. Historically, periods of rising inflation have often coincided with increased gold demand and subsequent price increases. Conversely, periods of low or stable inflation can lead to a decrease in gold’s appeal and subsequent price drops.

Historical Examples of Inflation and Gold Price Correlation

The 1970s, a period of high inflation, witnessed a notable surge in gold prices as investors sought a safe haven. Similarly, periods of stagflation (simultaneous high inflation and low economic growth) have historically been associated with significant gold price increases. Conversely, the periods of low inflation in the 1990s and 2000s, often saw a decrease in gold prices. The interplay between inflation and gold prices is dynamic, influenced by a multitude of factors.

Investor Interpretations of Inflation Data

Investors interpret inflation data through a variety of lenses. Some investors may focus on the headline inflation rate, while others might analyze core inflation, which excludes volatile food and energy prices. Central banks, in contrast, often consider a wider range of economic indicators, including employment data and GDP growth, when formulating their monetary policy responses. Furthermore, market sentiment, often driven by news events and expert opinions, can heavily influence investor perceptions.

Comparing Interpretations of Inflation Data by Market Participants

Central banks typically prioritize maintaining price stability and achieving their inflation targets. Investors, however, might focus on the potential implications for asset values, including gold. Different participants might prioritize different aspects of inflation data. For example, an investor might focus on the rate of inflation, while a central bank might be more concerned with the underlying causes and long-term trends.

Inflation Scenarios and Potential Gold Price Impacts

| Inflation Scenario | Likely Impact on Gold Prices | Potential Price Movement Range (USD/oz) |

|---|---|---|

| Sustained High Inflation (above 5%) | Increased demand for gold as a hedge; potential price appreciation | +50 to +150 |

| Moderate Inflation (2-4%) | Limited impact on gold; price may fluctuate based on other market factors | -20 to +20 |

| Low Inflation (below 2%) | Decreased demand for gold as a hedge; potential price depreciation | -50 to -100 |

| Deflation (negative inflation) | Potential increased demand for gold as a hedge; price appreciation | +20 to +100 |

Note: These are estimations and not guarantees. Market conditions can vary significantly. This table serves as a general guideline and should not be interpreted as financial advice.

Gold prices are rising as US-China trade uncertainty lingers, and investors are closely watching inflation data. Meanwhile, Spain is gradually restoring power after the outage on the Canary Islands in La Palma, highlighting the vulnerability of energy grids. This, coupled with the ongoing global economic anxieties, likely means investors will continue to be cautious, keeping a close eye on the inflation numbers and the implications for gold.

This recent event further adds to the complexity of the current economic landscape and may even influence gold’s price trajectory in the coming weeks. The fluctuating energy markets add another layer to the factors driving gold’s price and the persistent uncertainty in US-China trade.

Market Analysis and Prediction

Navigating the intricate landscape of the gold market requires a multifaceted approach. Analyzing various factors influencing price fluctuations is crucial for informed predictions. Understanding economic models, central bank policies, and contrasting market opinions can help investors develop a comprehensive strategy. This section delves into the key elements for predicting gold’s future trajectory.Market analysis often relies on a combination of fundamental and technical indicators.

Fundamental analysis considers underlying economic factors such as inflation, interest rates, and geopolitical events. Technical analysis focuses on historical price patterns and trading volume to identify potential trends. The integration of both approaches provides a more robust framework for evaluating gold’s future price.

Fundamental Analysis in Gold Price Prediction

Fundamental analysis considers macroeconomic factors to assess their impact on gold’s price. Inflation plays a significant role, as gold is often seen as a hedge against rising prices. Higher inflation expectations can lead to increased demand for gold, driving up its price. Interest rates also affect gold prices. Higher interest rates can make other investments more attractive, potentially reducing demand for gold.

Geopolitical uncertainties, such as international conflicts or trade disputes, can also influence investor sentiment and lead to increased demand for gold as a safe haven asset.

Economic Models for Gold Market Prediction

Several economic models can be applied to the gold market. The Fisher effect, which relates inflation and interest rates, can be used to assess how these factors influence gold’s attractiveness as an investment. The portfolio balance model considers investor preferences and risk aversion, which can affect the demand for gold as a diversifying asset. Furthermore, supply and demand dynamics, influenced by factors such as production costs and investor sentiment, are also crucial for predicting gold prices.

Central Bank Policies and Gold Prices

Central bank policies significantly impact gold prices. Monetary policy decisions, such as interest rate adjustments and quantitative easing, can influence investor sentiment and the demand for gold. For instance, a central bank easing monetary policy, potentially by lowering interest rates, may lead to increased demand for non-yielding assets like gold. Conversely, tighter monetary policy can reduce the appeal of gold.

The Federal Reserve’s (FED) policies, for example, have a notable impact on the global gold market.

Comparison of Gold Price Predictions

Predictions about gold’s future price trajectory vary significantly. Some analysts predict sustained growth driven by inflation concerns and geopolitical uncertainties, while others forecast a decline, potentially influenced by rising interest rates. A nuanced approach to evaluating various forecasts is essential. Different analysts utilize varying models and methodologies, resulting in different predictions.

Gold prices are rising as US-China trade uncertainty lingers, and investors are closely watching inflation data. Meanwhile, the ongoing conflict in Ukraine, where ukraine needs a ceasefire , continues to add to the global economic anxieties. This geopolitical instability, coupled with the economic concerns, makes it a challenging time for the market. So, the pressure on investors to make the right decisions regarding the gold market is amplified.

Potential Gold Price Scenarios (Next 12 Months)

| Scenario | Probability | Associated Factors | Estimated Gold Price (USD/oz) |

|---|---|---|---|

| Gold price increases | 60% | Rising inflation, geopolitical tensions, and continued low interest rates | 2000-2200 |

| Gold price remains stable | 30% | Stable inflation, moderate interest rate increases, and decreased geopolitical risk | 1800-2000 |

| Gold price declines | 10% | Significant interest rate hikes, decreasing inflation expectations, and resolution of geopolitical uncertainties | 1600-1800 |

These scenarios are estimations and do not constitute financial advice. Numerous variables can affect the gold market, making precise predictions challenging.

Safe Haven Status of Gold

Gold has historically served as a safe haven asset during times of economic uncertainty and crisis. Its perceived stability and scarcity have made it an attractive investment for those seeking protection against inflation, currency devaluation, and geopolitical instability. This allure has led to increased demand for gold, driving its price fluctuations in response to global events.The allure of gold as a safe haven stems from its intrinsic value and historical track record.

In periods of economic turmoil, investors often flock to gold as a tangible asset, a store of value that is less susceptible to the vagaries of the market. This phenomenon is particularly prevalent during periods of high inflation, currency volatility, and political instability, as investors seek a reliable and stable asset.

Historical Role as a Safe Haven

Gold has a long and storied history as a safe haven asset. Throughout history, it has served as a store of value during periods of economic hardship and political unrest. This enduring role is due to its inherent properties, including scarcity, durability, and portability. Gold’s intrinsic value, independent of any fiat currency system, adds to its appeal as a safe haven.

Investor Considerations in Uncertain Times

Investors often consider gold a safe haven during times of uncertainty because of its perceived stability. Its value is less dependent on the performance of financial markets or the economic health of a particular nation. This independence makes it an attractive alternative to more volatile assets like stocks or bonds. However, gold’s performance isn’t always consistent, and it can be influenced by market sentiment and global events.

Alternative Safe Haven Assets and Comparison

Besides gold, several other assets are considered safe havens. These include government bonds, particularly those from financially stable countries, and precious metals like silver. However, the performance of these assets can vary significantly depending on the specific economic climate and market conditions. For instance, while government bonds are often viewed as secure, their yields can be influenced by interest rate changes.

Performance During Past Crises

Gold has consistently demonstrated its ability to serve as a reliable store of value during significant economic crises. Examples include the 2008 financial crisis, the 2010 European debt crisis, and various historical events where gold’s price surged during times of uncertainty. This historical resilience adds to its appeal as a safe haven investment.

Comparison Table of Safe Haven Asset Performance

| Crisis | Gold | US Treasury Bonds | Silver |

|---|---|---|---|

| 2008 Financial Crisis | Increased significantly | Maintained relatively stable value | Increased, but less than gold |

| 2010 European Debt Crisis | Increased | Maintained stability | Increased, but less than gold |

| 1997 Asian Financial Crisis | Increased | Maintained relatively stable value | Increased, but less than gold |

Note: This table provides a simplified comparison. Actual performance may vary depending on specific investment strategies and market conditions.

Illustrative Scenarios: Gold Rises Us China Trade Uncertainty Persists Investors Eye Inflation Data

Gold’s price often reacts to global events, particularly those involving trade relations and economic indicators. Understanding potential scenarios helps investors anticipate possible price movements. These scenarios are illustrative and do not represent guaranteed outcomes.

Rising US-China Trade Tensions Impacting Gold Prices

Escalating trade disputes between the US and China can significantly impact gold prices. Increased uncertainty and potential economic slowdown can prompt investors to seek safe haven assets like gold. A significant escalation, perhaps involving tariffs or sanctions, could trigger a substantial price surge as investors flock to gold to protect their portfolios.

- Scenario: A major trade war erupts, involving significant tariffs on essential goods. Investors perceive a high risk of global economic recession, driving demand for gold.

- Impact: Gold prices experience a sharp increase, potentially exceeding previous highs.

- Example: The 2018-2019 trade war between the US and China saw a notable rise in gold prices as investors sought safe havens amid economic uncertainty.

Unexpectedly Accelerating Inflation Affecting Investor Confidence and Gold Prices

Inflation data plays a critical role in shaping investor sentiment and gold prices. Unexpectedly high inflation can erode investor confidence in fiat currencies, leading to increased demand for gold. A significant divergence between expected and actual inflation data can create volatility in the market.

- Scenario: Unexpectedly high inflation figures are reported, exceeding market expectations. The Federal Reserve reacts slowly, further exacerbating concerns.

- Impact: Investors seek the perceived stability of gold, pushing prices upwards.

- Example: The period of stagflation in the 1970s saw both high inflation and slow economic growth, leading to significant price increases in gold.

Dramatic Central Bank Policy Shifts Potentially Influencing Gold Demand

Central bank policies, including interest rate adjustments and quantitative easing, can significantly affect the appeal of gold. A sudden shift in policy, perhaps a surprise interest rate hike or a shift in monetary policy, can cause uncertainty and influence investor decisions about gold.

- Scenario: A central bank unexpectedly raises interest rates significantly to combat inflation. This shift attracts investors towards interest-bearing assets, potentially decreasing gold demand.

- Impact: Gold prices might experience a temporary dip as investors re-evaluate their portfolios.

- Example: The 2022 Federal Reserve interest rate hikes significantly impacted gold prices as investors sought higher returns in interest-bearing instruments.

Gold Prices Remaining Relatively Stable Despite Persistent Trade Uncertainty

Persistent trade uncertainty doesn’t always translate to a significant gold price surge. Factors like a strong global economy, robust investor confidence, and alternative investment opportunities can mitigate the impact of uncertainty.

- Scenario: US-China trade tensions remain high, yet the global economy experiences robust growth. Investors remain confident in the broader market.

- Impact: Gold prices may experience only moderate fluctuations, or even remain relatively stable.

- Example: Periods of trade tensions in the past have not always resulted in dramatic gold price increases. The market often finds alternative investment opportunities, which can dampen the gold price surge.

Ending Remarks

In conclusion, the gold market is currently responding to a confluence of global uncertainties. The rising gold price reflects investors’ anxieties surrounding the US-China trade war, persistent inflation, and the overall economic climate. This analysis has explored the various influences at play, from historical price movements to the impact of investor sentiment. Ultimately, the future direction of gold prices remains uncertain, but the factors discussed offer valuable insights into the current market dynamics.

Stay tuned for further updates as the situation unfolds.