Goldman sachs says deal outlook is good timing is uncertain – Goldman Sachs says deal outlook is good, but timing is uncertain. This suggests a promising landscape for financial transactions, but significant factors are clouding the ideal moment for execution. The current market climate, recent global economic trends, and potential geopolitical events are all playing a crucial role in shaping this complex picture.

The report delves into Goldman Sachs’s reasoning for their optimistic outlook, examining the specific factors driving their assessment. It also explores the multitude of factors contributing to the uncertainty surrounding deal timing, including macroeconomic hurdles, regulatory changes, and market volatility. The analysis further examines various deal types, from mergers and acquisitions to partnerships, highlighting the unique timing considerations for each.

Market Context

Goldman Sachs’ recent report highlights a nuanced market outlook, emphasizing the availability of deals but uncertainty regarding the optimal timing. This reflects the current complexities within the global financial landscape, characterized by intertwined economic and geopolitical forces. The report’s careful consideration of the timing aspect underscores the need for meticulous evaluation of market conditions before committing to large-scale financial transactions.The current market environment presents a mix of opportunities and challenges.

High inflation, interest rate hikes, and fluctuating global economic growth are key factors impacting dealmaking. Understanding these forces is crucial for navigating the present market dynamics and identifying potential risks and rewards. This analysis delves into the critical aspects shaping the financial market outlook.

Current Market Conditions Affecting the Financial Sector

The global financial sector faces a multifaceted set of challenges. Interest rate increases, aimed at curbing inflation, are impacting borrowing costs and potentially dampening investment activity. The ripple effect of these changes is felt across various financial instruments, including bonds, stocks, and derivatives. Inflationary pressures are also influencing consumer spending and business investment decisions, creating an environment of both uncertainty and opportunity.

Recent Trends in the Global Economy Relevant to Financial Markets

Recent trends in the global economy demonstrate a mixed picture. While some economies are experiencing robust growth, others are facing headwinds, particularly those heavily reliant on commodity prices. Supply chain disruptions, exacerbated by geopolitical events, continue to influence commodity markets and input costs. The evolving energy landscape is also a key consideration, with fluctuating energy prices directly impacting production costs and consumer spending patterns.

Key Economic Indicators Influencing the Outlook for Financial Deals, Goldman sachs says deal outlook is good timing is uncertain

Several key economic indicators are critical for assessing the outlook for financial deals. Inflation rates, unemployment figures, and GDP growth projections are all crucial indicators. A strong correlation exists between these indicators and the willingness of investors to engage in financial transactions. For example, periods of high inflation typically lead to higher borrowing costs and reduced investment opportunities.

A detailed analysis of these indicators provides a crucial foundation for assessing the potential risks and rewards of future financial transactions.

Comparison of Current Market Climate with Historical Periods of Similar Conditions

Historical precedent offers valuable insights into the current market climate. Comparing current conditions with past periods of high inflation and interest rate increases reveals a range of outcomes, from periods of significant market corrections to sustained periods of moderate growth. For instance, the late 1970s and early 1980s experienced high inflation and rising interest rates, leading to significant volatility in financial markets.

Careful study of these past periods helps inform current strategies.

Potential Impact of Geopolitical Events on the Market

Geopolitical events can significantly impact financial markets. These events, including trade disputes, political instability, and conflicts, often create uncertainty and volatility. For example, the war in Ukraine has disrupted supply chains, driven up energy prices, and added to inflationary pressures. The unpredictable nature of geopolitical events necessitates careful risk assessment and contingency planning.

Goldman Sachs’s Perspective

Goldman Sachs’s recent assessment of the deal outlook highlights a positive potential, but emphasizes the uncertainty surrounding the optimal timing. Their analysis acknowledges the favorable market conditions, but cautions against rushing into deals without careful consideration of the current environment. This nuanced perspective reflects a deep understanding of the complexities inherent in the modern financial landscape.Goldman Sachs’s evaluation of deal timing hinges on a meticulous analysis of various economic and market factors.

They believe that the “good timing” aspect is contingent on a specific alignment of these factors, rather than a simple assessment of current market sentiment. This intricate approach contrasts with a purely optimistic or pessimistic view.

Goldman Sachs’s Reasoning Behind “Good Timing”

Goldman Sachs identifies several crucial factors influencing the optimal timing for deals. These factors include macroeconomic indicators, interest rate movements, market sentiment, and specific industry dynamics. A comprehensive analysis of these variables is essential for a well-informed judgment on the ideal moment for investment.

Factors Considered in Evaluating Deal Timing

Goldman Sachs meticulously assesses numerous economic and market indicators when evaluating the timing of mergers and acquisitions. These factors include:

- Interest Rate Environment: Interest rates significantly impact the cost of capital for acquiring companies. High rates can increase borrowing costs, making deals less attractive. Goldman Sachs analyzes historical data and current projections to gauge the potential impact of interest rate fluctuations on deal values and profitability.

- Market Sentiment: The prevailing market sentiment plays a crucial role in the valuation of companies and the willingness of sellers to part with their assets. Goldman Sachs’s analysts monitor market sentiment through various channels, including news reports, investor conferences, and social media discussions, to identify trends and potential shifts in investor psychology.

- Economic Growth Projections: Goldman Sachs assesses economic growth projections to determine the long-term viability of target companies and the potential for future profitability. They analyze economic data, including GDP growth rates, consumer spending, and employment figures, to forecast the impact on the overall market.

- Industry-Specific Trends: Goldman Sachs also considers industry-specific trends and technological advancements. They evaluate how these factors might affect the value of target companies and the attractiveness of deals.

Methodology for Forecasting Market Outlook

Goldman Sachs employs a sophisticated methodology to forecast the market outlook, incorporating both quantitative and qualitative data. This approach combines statistical modeling, economic analysis, and expert opinions to provide a comprehensive assessment.

- Quantitative Models: Goldman Sachs utilizes quantitative models that incorporate historical market data and economic indicators to project future trends. These models help identify potential risks and opportunities in the market.

“We utilize a proprietary econometric model that integrates various macroeconomic factors to project market volatility and interest rate movements.”

- Qualitative Analysis: Goldman Sachs complements quantitative analysis with qualitative insights from their extensive network of industry experts. These experts provide valuable insights into the specific dynamics of different industries, helping to refine the overall market outlook.

- Scenario Planning: Goldman Sachs engages in scenario planning to anticipate various potential market outcomes. This approach helps them to prepare for diverse possibilities and evaluate the resilience of their investment strategies under different market conditions.

Examples of Previous Investment Banking Advice Regarding Deal Timing

Goldman Sachs’s historical advice regarding deal timing often reflects a cautious approach to market volatility. They emphasize the importance of thorough due diligence and a comprehensive evaluation of market conditions before pursuing a deal.

Historical Accuracy in Predicting Deal Timing

Assessing the historical accuracy of Goldman Sachs’s deal timing predictions is complex. While Goldman Sachs has a strong track record in investment banking, predicting the precise timing of deals with absolute certainty is challenging. Factors such as unforeseen market events, regulatory changes, and unexpected industry developments can affect the accuracy of predictions.

Uncertain Timing

Deal timing, while potentially promising, is shrouded in uncertainty. Market forces, regulatory landscapes, and macroeconomic trends all intertwine to create a complex picture, making precise predictions challenging. Navigating this uncertainty requires careful consideration of potential hurdles and a flexible approach to deal execution.

Factors Contributing to Timing Uncertainty

The multitude of factors influencing deal timing creates a dynamic and unpredictable environment. Geopolitical events, shifting interest rates, and unexpected economic downturns can all disrupt previously established timelines. Market sentiment plays a crucial role, as investor confidence and appetite for risk can change rapidly, affecting the attractiveness of deals. Finally, the often-lengthy and complex due diligence processes inherent in many transactions can lead to unforeseen delays.

Goldman Sachs says the deal outlook is promising, but the timing feels uncertain. It’s a bit like needing laser-focus for a big win, like in the Champions League final – concentration, not obsession, is key, as Inter’s coach wisely pointed out. This echoes the current market sentiment , where the right moment for a deal is less clear than the potential benefits.

Ultimately, the goldman sachs assessment highlights a need for strategic patience.

Macroeconomic and Regulatory Hurdles

Economic downturns, rising inflation, and fluctuating interest rates pose significant macroeconomic challenges. A downturn can drastically alter the value of assets and negatively impact deal valuations, making previously attractive deals less appealing. Similarly, regulatory changes, such as stricter antitrust enforcement or evolving environmental regulations, can create obstacles to deal completion. For example, a recent surge in interest rates has made financing deals more expensive and less accessible, delaying or potentially preventing their completion.

Market Volatility and its Impact

Market volatility is a critical factor influencing deal timing. Sudden shifts in investor sentiment or unexpected events can dramatically alter the market’s appetite for risk, potentially jeopardizing deal valuations and making execution challenging. For instance, the 2020 COVID-19 pandemic caused significant market volatility, impacting many deal timelines. Deals that were initially considered viable became difficult to complete due to the uncertainty surrounding the global economy.

Examples of Unexpected Events Impacting Deal Timing

Several instances demonstrate the impact of unexpected events on deal timing. The 2008 financial crisis saw numerous deals either abandoned or delayed as market conditions deteriorated rapidly. Similarly, the emergence of unexpected geopolitical tensions can significantly disrupt markets and delay deal closings. The unforeseen impacts of a sudden change in political leadership in a target country can also halt or drastically alter deal timelines.

Risks and Rewards of Uncertain Timing

Uncertain deal timing presents a unique set of risks and rewards. A delayed deal might lead to a loss of value, decreased market share, or the emergence of more attractive alternative opportunities. However, waiting for more favorable conditions might enable a deal to close at a more advantageous price or under more favorable circumstances. An astute negotiator must consider both the potential pitfalls and the potential gains when managing uncertain timing.

Potential Deal Types: Goldman Sachs Says Deal Outlook Is Good Timing Is Uncertain

Goldman Sachs’s assessment of a positive deal outlook, though uncertain in timing, highlights the dynamic nature of financial markets. Understanding the different types of deals and the factors influencing their timelines is crucial for navigating this landscape. This analysis delves into various financial transactions, their characteristics, and the current market context’s impact on their execution.

Goldman Sachs says the deal outlook is positive, but the timing is still uncertain. This uncertainty, however, might be offset by the recent surge in inquiries for rare earths, as Australia’s ASM sees a jump in demand amid supply shortages. This suggests that despite the timing concerns, the market is still looking for opportunities, and a strong deal might be just around the corner.

Australia’s ASM sees a jump in rare earths inquiries amid supply shortage could be a key factor in influencing the overall deal landscape.

Financial Deal Types

Different financial deals serve diverse strategic objectives. The choice of deal type hinges on the specific goals of the involved parties.

| Deal Type | Description | Factors Influencing Timing |

|---|---|---|

| Mergers and Acquisitions (M&A) | Combining two or more companies into a single entity. This can be through acquisition (one company buying another) or merger (two companies creating a new entity). | Market valuations, regulatory approvals, antitrust concerns, financial health of target companies, and strategic alignment. |

| Partnerships | Formal agreements between two or more companies to collaborate on specific projects or initiatives. | Complementary skills and resources, market entry strategies, potential risks and benefits, and shared goals. |

| Joint Ventures | Formation of a new entity by two or more companies to pursue a specific business opportunity. This new entity operates independently. | Market opportunities, risk mitigation, and shared capital investments. Clear agreements on decision-making and profit-sharing are crucial. |

| Strategic Alliances | Collaborative arrangements where two or more companies cooperate to achieve mutual goals without creating a new entity. | Market expansion, technology sharing, access to new markets, and complementary product offerings. This involves less integration than a joint venture. |

| Debt Financing | Securing funds through loans or bonds. | Interest rates, creditworthiness of the borrower, and overall market conditions. |

| Equity Financing | Raising capital through the issuance of shares. | Market sentiment, investor confidence, valuation of the company, and overall market conditions. |

Typical Timeframes and Current Market Impact

The duration of financial deals varies significantly depending on the type and complexity.

| Deal Type | Typical Timeframe (in months) | Current Market Conditions Impact |

|---|---|---|

| Mergers & Acquisitions | 6-24+ | Higher interest rates and inflation can slow deal activity due to increased financing costs and lower valuations. Uncertainty about the future can also prolong the process. |

| Partnerships | 1-6 | Faster due diligence and agreement negotiation, though market volatility can still influence decisions regarding deal execution timelines. |

| Joint Ventures | 6-12+ | Complex legal and regulatory processes can be affected by market conditions, particularly if they involve significant regulatory approvals. |

| Strategic Alliances | 2-6 | Negotiation and agreement timelines can be compressed, although market volatility may still influence the finalization of terms. |

| Debt Financing | 1-3 | Interest rate fluctuations impact the cost of borrowing and the overall process. |

| Equity Financing | 2-6 | Investor confidence and market sentiment can impact fundraising timelines. |

Investment Strategies

Navigating a market characterized by a promising deal outlook but uncertain timing requires a nuanced investment strategy. Investors need to be adaptable and prepared to adjust their portfolios based on evolving market signals. The potential for significant returns is present, but so are potential risks, making careful consideration of various investment approaches crucial.Investment strategies should prioritize adaptability and resilience in the face of uncertainty.

The key is to identify potential opportunities while mitigating potential downside risks. A diversified portfolio approach, along with hedging strategies, can help investors navigate the complexities of the current market environment.

Potential Investment Strategies

Investment strategies should be tailored to individual risk tolerances and financial goals. Strategies need to balance the potential for high returns with the need to protect capital during periods of uncertainty. Active portfolio management, incorporating thorough due diligence, will be essential.

- Long-Term Value Investing: Focus on companies with strong fundamentals and a long-term growth outlook. This approach often requires patience and a willingness to hold investments for extended periods, even through temporary market fluctuations. Examples include investing in established companies with a proven track record and a consistent dividend history. These strategies aim to benefit from the long-term growth potential of these businesses.

- Growth Stock Investing: Concentrate on companies with high growth potential. This approach can offer significant returns but carries higher risk due to the volatility of growth stocks. Due diligence is critical to assess the quality of growth drivers. Examples include investing in technology companies with innovative products or disruptive business models. However, a cautious approach is necessary, as the rapid changes in the sector can lead to significant stock fluctuations.

- Defensive Investing: Prioritize stability and capital preservation. This approach involves investing in low-risk assets like bonds or blue-chip stocks. This strategy is best suited for investors who prioritize safety over high returns. Examples include investing in government bonds, or established dividend-paying companies with a stable history.

Hedging Strategies

Hedging strategies are vital in uncertain market environments. These strategies help to mitigate potential losses while preserving capital. Different hedging strategies, including options and futures contracts, can be employed.

Goldman Sachs’s optimistic outlook on deal-making is interesting, but the timing feels uncertain. Meanwhile, Senator Rubio’s stance on the Russia-Ukraine conflict, as seen in his recent Russia Day remarks, which reaffirm his call for peace with Ukraine here , raises some questions about the global environment. This geopolitical backdrop undoubtedly impacts the potential for successful negotiations, potentially affecting the timing of those deals Goldman Sachs is referencing.

- Options Trading: Investors can use options contracts to hedge against potential price movements in specific assets. Options allow for limited risk exposure, while still participating in potential upside. It’s crucial to understand the intricacies of options trading before implementing this strategy. Consider using covered calls to generate income while limiting downside risk on a stock position.

- Futures Contracts: These contracts allow investors to speculate on future price movements of commodities or other assets. However, futures trading carries substantial risk and requires careful consideration of market conditions. It’s important to have a solid understanding of market trends before entering into futures contracts.

Investment Portfolio Examples

A diversified approach is key to mitigating risk. The optimal portfolio depends on individual risk tolerance and financial goals.

| Portfolio Type | Potential Return (Annualized) | Risk Level | Description |

|---|---|---|---|

| Balanced Portfolio | 6-8% | Moderate | Combines stocks and bonds to balance risk and return. |

| Growth Portfolio | 8-12% | High | Heavily weighted towards stocks with high growth potential. |

| Conservative Portfolio | 3-5% | Low | Focuses on low-risk investments like bonds and dividend stocks. |

Successful Strategies in Similar Market Conditions

Historically, successful investment strategies during periods of market uncertainty have focused on:

- Diversification: Spreading investments across various asset classes reduces the impact of adverse market conditions on overall portfolio performance.

- Thorough Research: Understanding market trends and company fundamentals is essential for informed investment decisions.

- Disciplined Approach: Sticking to a pre-determined investment plan, even during market volatility, is critical for long-term success.

Industry Impact

The Goldman Sachs outlook on dealmaking, while positive in terms of potential opportunities, introduces significant uncertainty regarding the timing of these transactions. This uncertainty ripples through various industries, impacting their strategic planning and potential performance. Understanding the nuances of this impact is crucial for investors and businesses alike.

Potential Impact on Specific Industries

The projected impact of the uncertain deal timing varies across industries. Some sectors, particularly those reliant on capital investment or rapid expansion, will be more susceptible to delays. Technology companies, for instance, heavily involved in mergers and acquisitions, may face difficulties in securing funding or implementing their strategic plans if the timeline extends beyond projections.

Industries Vulnerable to Timing Uncertainty

Certain industries are demonstrably more vulnerable to the uncertainty in deal timing. These include technology firms, particularly those in rapidly evolving segments like AI or cloud computing, where timing can be critical to market positioning. The energy sector, dependent on large-scale projects and capital investment, may also face challenges if deal closures are delayed.

Resilient Industries

Industries with less dependence on rapid expansion or capital investment may be more resilient. Established companies with strong balance sheets and existing infrastructure might face fewer immediate pressures. This resilience, however, does not negate the long-term implications of delayed deals across the entire economy.

Impact on Corporate Strategies

The uncertainty surrounding deal timing necessitates a shift in corporate strategies. Companies must develop contingency plans to address potential delays and recalibrate their timelines for various projects. This may involve prioritizing certain initiatives, exploring alternative financing options, or even adjusting long-term goals. The key is flexibility and adaptation.

Table Demonstrating Projected Sector Impact

| Industry Sector | Potential Impact | Vulnerability Level |

|---|---|---|

| Technology (AI, Cloud) | Delayed funding, altered market positioning | High |

| Energy (Renewable, Oil & Gas) | Project delays, capital expenditure uncertainty | Medium-High |

| Pharmaceuticals | Potential delays in new drug approvals or clinical trials | Low |

| Consumer Goods | Limited impact, unless tied to specific acquisitions | Low |

| Financial Services | Potential shifts in investment strategies, but overall stable | Medium |

Consequences of Delayed Deal Timing on Company Performance

Delays in deal timing can have significant consequences on company performance. Missed market opportunities, disrupted operational timelines, and potentially, diminished investor confidence can all contribute to negative impacts. Consider, for example, a technology company planning a key acquisition to gain market share. A delay in the acquisition could allow competitors to establish a stronger foothold, leading to diminished growth prospects and decreased profitability.

Similarly, in the energy sector, delays in major project funding can result in missed deadlines and substantial cost overruns.

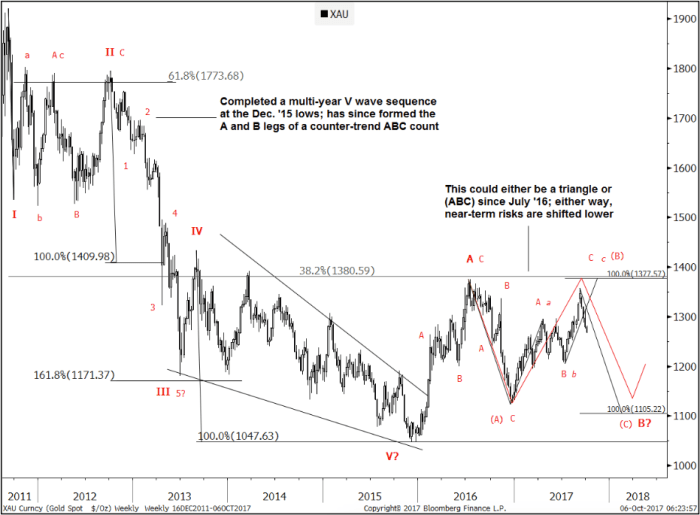

Visual Representation

Goldman Sachs’s outlook suggests a favorable environment for deals, but the timing remains uncertain. Visualizing this dynamic interplay between market conditions and deal timing is crucial for investors to effectively navigate the landscape. Understanding the potential impact on various investment portfolios, along with the inherent risks and rewards, is essential for informed decision-making.Market conditions are a complex interplay of factors, including economic indicators, interest rates, and investor sentiment.

This fluidity necessitates a visual representation that captures the multifaceted nature of the current environment and its potential impact on deal timing.

Market Conditions and Deal Timing

A line graph, with market conditions (e.g., GDP growth, inflation rate, and investor confidence) on the horizontal axis and deal timing (e.g., quarter, year) on the vertical axis, can effectively illustrate the relationship. This graph can show the trend of deal activity over time, with areas of higher activity correlated with positive market conditions. Shaded areas on the graph can highlight periods of heightened uncertainty or volatility, which could affect the timing of deals.

Impact on Investment Portfolios

Visualizing the impact on different investment portfolios requires a combination of charts. A bar chart comparing potential returns across various asset classes (e.g., equities, bonds, real estate) under different deal timing scenarios (e.g., early, late, or delayed) is helpful. For instance, one bar could represent the return of an equity portfolio if deals are completed early, while another bar would reflect the return if deals are delayed.

This visual comparison allows investors to assess the relative risk and reward profiles of different portfolio structures.

Potential Risks and Rewards

A risk-reward matrix is a powerful visual tool to illustrate the potential trade-offs. The horizontal axis represents potential risk levels, ranging from low to high, while the vertical axis represents potential reward levels. Each quadrant would contain potential deal types and associated outcomes (e.g., high risk/high reward for venture capital investments, or low risk/low reward for fixed-income instruments). Color-coding the matrix elements helps to visually differentiate risk levels and potential outcomes.

“Uncertain timing presents both opportunities and challenges. Early-stage deals could be lucrative but require more diligence and patience. Late-stage deals may have less risk but also lower returns.”

Alternative Visualizations

A series of interconnected circles or nodes can represent different investment strategies. Connecting nodes that lead to successful deals and those that result in missed opportunities or losses would provide a clear visual depiction of the strategy’s potential outcomes. This interconnected network, with colors and different sizes representing the degree of success or failure, allows for a comprehensive overview.

Another approach is a SWOT analysis matrix in a visually engaging format, highlighting the strengths, weaknesses, opportunities, and threats associated with the uncertain timing of deals.

Last Word

Goldman Sachs’s assessment paints a nuanced picture of the current financial market. While the outlook for deals appears positive, the timing remains uncertain, influenced by a complex interplay of economic indicators, geopolitical events, and market volatility. Investors need to carefully consider the potential risks and rewards, adapting their strategies to navigate this uncertain landscape. The analysis provides a comprehensive overview, covering potential investment strategies, industry impact, and various deal types, equipping readers with the knowledge to make informed decisions.