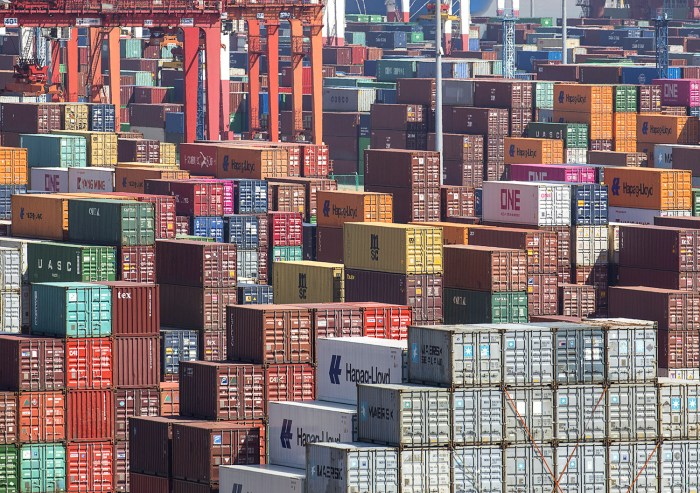

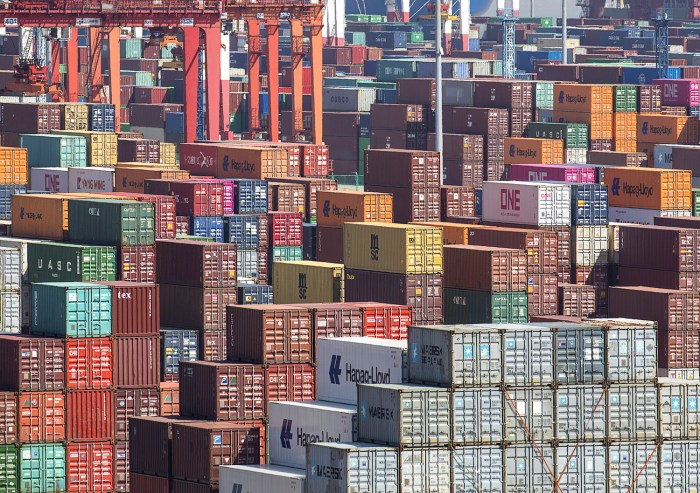

How CEOs beat Trump on tariffs is a fascinating look at how business leaders navigated the complex landscape of trade disputes during the Trump administration. This in-depth analysis delves into the strategies employed by CEOs to mitigate the negative impacts of tariffs, examining diversification, supply chain optimization, and alternative trade routes. We’ll explore the specific industries hit hardest by these policies, the responses from CEOs, and the long-term implications for the global economy.

It’s a story of resilience, innovation, and the evolving relationship between business and government in the face of international trade disputes.

The article examines how CEOs strategized to counteract tariffs imposed by the Trump administration. It explores various approaches including diversification into new markets, optimizing supply chains, and exploring alternative trade agreements. The analysis also highlights the impact of tariffs on specific industries, like automotive and manufacturing, including detailed financial and operational challenges, and the resulting employment and consumer price impacts.

The article further analyzes the actions taken by CEOs, from lobbying efforts to public statements, and the role of international alliances in countering these effects. Ultimately, it examines the long-term trends and implications of these tariffs on global trade and business strategies.

CEO Strategies to Counter Tariffs: How Ceos Beat Trump On Tariffs

Navigating the complexities of international trade, especially when tariffs are introduced, requires CEOs to adopt proactive strategies. This necessitates a deep understanding of the economic impact of tariffs and the ability to adapt business models to minimize negative consequences. Companies must develop flexible and robust strategies to safeguard their bottom lines and maintain competitiveness in a fluctuating global market.The imposition of tariffs often disrupts established supply chains, leading to increased costs and reduced profitability for businesses.

CEOs have responded by implementing various strategies to mitigate these impacts, focusing on diversification, supply chain optimization, and exploring alternative trade routes. By understanding and adapting to these challenges, companies can maintain their market presence and ensure long-term sustainability.

Diversification Strategies to Reduce Reliance on Affected Markets

Diversifying supply chains and market reach is a crucial strategy for mitigating the risks associated with tariffs. This involves sourcing from alternative suppliers in different regions, thereby reducing reliance on a single market or supplier. This approach minimizes vulnerability to tariffs or other trade disruptions. For example, companies in the automotive industry might explore suppliers in countries outside the target market for tariffs, reducing the impact on their production and profitability.

Companies in the electronics industry, facing tariffs on specific components, might source those components from other countries to avoid disruption to their supply chain. Companies can also explore new markets outside the ones initially targeted by tariffs.

Supply Chain Optimization to Minimize Tariff-Related Costs

Supply chain optimization is another critical strategy to minimize the cost implications of tariffs. This involves re-evaluating existing supply chains, identifying bottlenecks, and streamlining processes to reduce transit times, inventory costs, and other associated expenses. By implementing lean manufacturing principles and technological solutions, companies can enhance their efficiency and reduce their vulnerability to tariff-induced price increases. This might include consolidating transportation routes to reduce freight costs or investing in technology to automate inventory management.

Leveraging Alternative Trade Routes and Agreements to Bypass Tariffs

Companies have also employed alternative trade routes and agreements to bypass tariffs. This includes exploring new trade corridors or using existing agreements with countries not directly affected by the tariffs. For instance, a company facing tariffs on goods shipped from one country might seek to ship those goods through a third country with a preferential trade agreement to reduce or eliminate the tariffs.

Companies can also utilize free trade zones or customs unions to facilitate the movement of goods and bypass tariff barriers.

Examples of Companies Shifting Production or Sourcing to Reduce Tariff Exposure

Several companies have successfully shifted production or sourcing to reduce their tariff exposure. For example, some companies have relocated manufacturing facilities to countries with lower tariffs or no tariffs on specific goods. Others have shifted their sourcing strategies to suppliers located in countries with favorable trade agreements. These strategic decisions allow companies to mitigate the negative impact of tariffs and maintain profitability in a challenging global environment.

CEOs, it seems, have a knack for outsmarting even the most assertive figures. They cleverly navigated Trump’s tariffs by diversifying supply chains and finding new markets. This kind of strategic thinking, often employed in global conflicts like the India-Pakistan Kashmir conflict, Gulf States diplomacy, and peace brokering efforts, is truly fascinating. For instance, exploring the complexities of India-Pakistan Kashmir conflict, Gulf States diplomacy, and peace brokering efforts reveals a similar need for calculated maneuvers to achieve peaceful outcomes.

Ultimately, these business tactics mirror the sophisticated strategies needed to effectively counter protectionist trade policies.

The specific example of companies shifting production or sourcing is dependent on the particular industries and their individual supply chains.

Comparison of Tariff Mitigation Strategies

| Strategy | Description | Industries Affected | Effectiveness |

|---|---|---|---|

| Diversification | Expanding sourcing and market reach to reduce reliance on single markets or suppliers. | Electronics, Automotive, Consumer Goods | Generally effective in reducing vulnerability but requires significant investment and time. |

| Supply Chain Optimization | Streamlining supply chain processes to reduce costs and transit times. | Manufacturing, Retail, Logistics | High potential for cost reduction but requires significant organizational change. |

| Alternative Trade Routes/Agreements | Utilizing alternative trade routes or agreements to bypass tariffs. | Global Trade, Logistics | Effectiveness varies depending on the specific agreements and routes available. |

| Shifting Production/Sourcing | Relocating manufacturing facilities or changing sourcing strategies to countries with lower tariffs. | Manufacturing, Consumer Goods, Apparel | Can be highly effective but has significant relocation costs and potential logistical complexities. |

Impact on Specific Industries

Trump’s tariffs significantly impacted numerous industries, leading to substantial financial and operational challenges for businesses and altering consumer spending habits. The effects varied depending on the sector’s reliance on imported goods and its global supply chain structure. Understanding these impacts is crucial for assessing the long-term effects of protectionist trade policies.

Automotive Industry

The automotive industry faced considerable pressure due to tariffs on imported steel and aluminum, impacting vehicle manufacturing costs. Automakers, heavily reliant on global supply chains, experienced increased input costs, directly affecting their profit margins and potentially their ability to compete in the market. Tariffs forced companies to absorb higher costs or pass them on to consumers through price increases.

- Increased Production Costs: Tariffs on imported steel and aluminum, key components in vehicle manufacturing, drove up the cost of production for automakers. This translated to higher prices for consumers. For example, a 25% tariff on imported steel would directly increase the cost of steel used in car production.

- Reduced Competitiveness: Increased production costs eroded the competitiveness of US-made vehicles in the global market. This was particularly impactful on manufacturers that heavily relied on imported components. Foreign competitors, unburdened by the tariffs, could potentially offer more competitive pricing.

- Employment Impacts: While the exact employment figures are complex and debated, some studies suggested a correlation between tariffs and job losses in the automotive sector. Reduced production and competitiveness could have led to layoffs and reduced hiring in the sector.

Consumer Electronics

The consumer electronics industry was another sector significantly affected by tariffs. Many consumer electronics products rely on components imported from countries like China. Tariffs on these components directly increased manufacturing costs, making finished goods more expensive for consumers.

- Increased Costs for Components: Tariffs on imported components, like semiconductors, drastically increased the cost of producing consumer electronics. This led to a decrease in profitability for manufacturers.

- Price Increases for Consumers: Increased manufacturing costs were often passed on to consumers in the form of higher prices for TVs, smartphones, and other electronic devices. For example, a 10% tariff on imported semiconductors would directly increase the cost of manufacturing smartphones.

- Shift in Sourcing: Some companies adjusted their sourcing strategies to find alternative suppliers, potentially from countries with lower tariffs. This shift could lead to longer supply chains and increased logistical complexities.

Agricultural Products

Agricultural products were also targeted by tariffs, impacting farmers and consumers alike. Tariffs on agricultural imports led to price increases for consumers, potentially reducing demand.

- Price Increases for Consumers: Tariffs on imported agricultural products, like certain fruits and vegetables, increased the cost for consumers. This is a direct result of the tariffs.

- Reduced Export Revenue for Farmers: Tariffs imposed by other countries on US agricultural products also reduced the export revenue of US farmers. This was particularly significant for specific agricultural products like soybeans and pork.

- Operational Challenges: Farmers faced challenges in adjusting to new trade policies and potentially had to find new markets or alter their farming practices.

Impact on Selected Companies (Illustrative Table)

| Industry | Impact | Examples | Data Points |

|---|---|---|---|

| Automotive | Increased production costs, reduced competitiveness, potential employment losses | Ford, General Motors, Toyota | Data on specific revenue changes for these companies would require detailed financial reports. General trends show reduced profitability in some cases. |

| Consumer Electronics | Increased component costs, price increases for consumers | Apple, Samsung, Sony | Company financial reports would reveal specific revenue impacts. Industry-wide data showed decreased profitability for some firms. |

| Agricultural Products | Price increases for consumers, reduced export revenue | Large agricultural companies and individual farms | Government data on agricultural exports and consumer prices would provide details. |

CEO Responses and Actions

Navigating the complexities of tariffs required CEOs to adopt multifaceted strategies. Beyond simply reacting to imposed duties, many executives proactively sought to mitigate the negative impact on their businesses and even leverage the situation to their advantage. This involved a combination of operational adjustments, lobbying efforts, and strategic partnerships. The diverse responses across industries highlighted the unique challenges and opportunities presented by the tariff landscape.The effectiveness of CEO responses varied depending on factors like industry-specific vulnerabilities, the scale of the tariffs, and the overall economic climate.

Some CEOs successfully navigated the challenges, while others faced significant obstacles. Understanding the diverse strategies employed by CEOs provides valuable insights into how businesses can respond to future trade policy changes.

Different Approaches to Address Tariff Issues

CEOs employed a range of strategies to confront tariff challenges. Some focused on shifting production to countries outside the targeted regions to minimize the cost impact. Others explored alternative sourcing for raw materials, aiming to reduce reliance on countries subject to tariffs. Furthermore, some corporations explored the use of advanced technologies to optimize their supply chains and reduce costs.

Responses of CEOs in Various Sectors, How ceos beat trump on tariffs

The responses of CEOs varied significantly across different sectors. In the automotive industry, for example, CEOs often focused on relocating manufacturing to regions with lower tariffs or renegotiating supply agreements with suppliers in unaffected regions. In the technology sector, CEOs often emphasized diversification of supply chains and exploring alternative manufacturing partnerships. These responses reflected the sector-specific vulnerabilities to tariffs and the unique approaches needed to mitigate those vulnerabilities.

Lobbying Government Officials

CEOs engaged in robust lobbying efforts to influence tariff policies. This involved direct communication with government officials, participation in industry-specific meetings, and collaboration with trade associations. Lobbying efforts aimed to advocate for alternative trade policies that minimized negative impacts on businesses.

“Effective lobbying relies on a deep understanding of the political landscape, industry specifics, and the potential impact of various policy options.”

Public Statements by CEOs Regarding Tariffs

CEOs frequently issued public statements addressing the impact of tariffs on their businesses and the broader economy. These statements often highlighted the negative consequences of tariffs on consumer prices, job creation, and overall economic growth. Public pronouncements served to raise awareness of the issues and exert pressure on policymakers. For example, statements emphasizing the need for fair and balanced trade policies were common.

Role of International Alliances

International alliances played a crucial role in countering the effects of tariffs. CEOs leveraged partnerships with international counterparts to collectively advocate for alternative trade policies. This involved coordinated lobbying efforts and the exchange of information regarding tariff impacts. These alliances allowed for a unified front in addressing global trade issues.

Advocating for Alternative Trade Policies

CEOs actively advocated for alternative trade policies that were more favorable to businesses. This included promoting free trade agreements, reducing trade barriers, and advocating for a more predictable and transparent international trade system. These actions sought to create a stable and supportive global trade environment.

Process of Lobbying and Advocating for Alternative Trade Policies

| Step | Description |

|---|---|

| 1. Identify Issues | Assess the impact of tariffs on the company and industry. |

| 2. Gather Data | Compile relevant economic data, market research, and industry analysis. |

| 3. Develop Strategy | Artikel specific policy recommendations and lobbying tactics. |

| 4. Contact Officials | Engage with government officials and policymakers. |

| 5. Build Alliances | Collaborate with other businesses and trade associations. |

| 6. Public Advocacy | Communicate the impact of tariffs through public statements and media outreach. |

| 7. Monitor Progress | Track the effectiveness of lobbying efforts and policy changes. |

Long-Term Implications and Trends

Trump’s tariffs, while initially aimed at protecting American industries, have had far-reaching and multifaceted impacts on the global economy. The long-term consequences extend beyond immediate trade imbalances, affecting supply chains, investment decisions, and even geopolitical relations. Understanding these implications is crucial for CEOs navigating the evolving international trade landscape.The prolonged uncertainty created by trade disputes, including tariffs, has led to significant volatility in global markets.

Companies have had to recalibrate their strategies, adjusting production locations, sourcing materials, and anticipating potential disruptions. This dynamic environment necessitates a more proactive and adaptable approach to international trade for businesses.

Long-Term Effects on the Global Economy

The prolonged trade tensions sparked by Trump’s tariffs have profoundly impacted the global economy. Increased costs for businesses, reduced consumer purchasing power in some regions, and shifts in supply chains are just a few of the observable consequences. These ripples extend to the financial sector, affecting investment portfolios and creating volatility.

CEOs cleverly navigated around Trump’s tariffs, often by shifting production to avoid the extra costs. This strategy, coupled with global supply chain adjustments, ultimately undermined the effectiveness of the tariffs. Interestingly, the Trump administration’s controversial military transgender ban, which reached the Supreme Court ( trump military transgender ban supreme court ), highlights a different facet of Trump’s approach, showcasing a contrasting style of policy implementation.

Regardless, CEOs’ ability to adapt to the changing trade landscape ultimately proved more resilient than the tariff policies themselves.

Potential Future Strategies for CEOs

CEOs must anticipate and adapt to potential future trade disputes. Diversifying supply chains, building resilience into operations, and fostering relationships with governments to advocate for fair trade practices are crucial strategies. Companies should also invest in understanding and complying with evolving international trade regulations. Furthermore, the development of robust risk management frameworks is vital.

Evolving Relationship Between Governments and Businesses

The relationship between governments and businesses is undergoing a transformation. Governments are increasingly intervening in international trade, and companies need to adapt to this new reality. Businesses need to engage with governments constructively, advocating for policies that support fair trade and promote economic growth. The need for effective lobbying and engagement in international trade forums is growing.

CEOs, surprisingly, found ways to circumvent Trump’s tariffs. They likely navigated complex supply chains and shifted production to avoid the extra costs. This clever maneuvering highlights the intricate dance of business strategy, particularly when dealing with trade policies. Meanwhile, the ongoing debate about music copyright, like Taylor Swift’s re-recordings, is a fascinating parallel, as artists seek control over their creative work.

music copyright taylors version provides further insight. Ultimately, CEOs’ tariff-dodging strategies show their adaptability in a challenging economic environment.

Changing Dynamics of International Trade

International trade is becoming increasingly complex. Trade agreements are renegotiated, and new rules and regulations emerge frequently. This necessitates a thorough understanding of the nuances of international trade law and a willingness to adapt to changing dynamics. Businesses must stay informed about the evolving landscape and engage with trade organizations to maintain a comprehensive understanding of these developments.

Examples of Business Adaptation

Companies are actively adapting to the more complex global trade landscape. Some are diversifying their supply chains, sourcing materials from different regions to mitigate risk. Others are investing in technologies that automate processes or enhance supply chain visibility. Examples include companies shifting production to countries outside of tariff-affected regions or developing strategies to navigate regulatory complexities.

Influence of Tariffs on Corporate Strategies and Investments

Tariffs have directly influenced corporate strategies and investments. Companies are shifting production locations, re-evaluating supply chains, and adjusting investment portfolios. The uncertainty created by tariffs necessitates a more cautious and adaptable approach to global operations. Companies are assessing risk more rigorously and investing in diversification.

Timeline of Key Events and CEO Responses

- 2018: Initiation of steel and aluminum tariffs. Companies responded with discussions with government officials, re-evaluation of supply chains, and lobbying efforts.

- 2019: Escalation of trade disputes with China. CEOs of companies involved in US-China trade sought to mitigate potential impacts through strategic alliances and alternative partnerships.

- 2020-Present: Ongoing trade negotiations and shifting geopolitical landscapes. CEOs continue to monitor global trade developments, adjust strategies, and advocate for favorable trade policies.

Illustrative Case Studies

Navigating the complexities of tariffs requires a nuanced approach. Companies must adapt their strategies to mitigate the impact of these trade policies. Illustrative case studies offer valuable insights into how CEOs have responded to tariff pressures and the effectiveness of their chosen strategies. These examples reveal not only the tactical adjustments made but also the long-term implications for the companies involved and the broader industry landscape.

A Case Study: Ford’s Response to Steel Tariffs

Ford, facing rising steel costs due to tariffs, implemented a multi-pronged strategy. Instead of simply absorbing the increased costs, Ford actively sought alternative suppliers, diversifying its sourcing network. This involved negotiations with steel producers in countries outside the tariff zone, potentially involving long-term contracts and potentially higher initial costs for the sake of greater security. Ford also invested in research and development to explore alternative materials and manufacturing processes, potentially using composites or advanced alloys.

The effectiveness of Ford’s strategy can be evaluated through several key metrics:

- Reduced reliance on steel from tariff-affected regions: Ford reduced its dependence on steel from countries subject to tariffs, lowering the risk associated with fluctuating prices and supply disruptions.

- Diversified supply chain: This diversification provided a buffer against future tariff increases or disruptions. This is crucial in a globalized economy where supply chain security is paramount.

- Potential for future cost savings: Ford’s investment in alternative materials and processes could potentially lead to lower production costs in the long run, if the new materials and processes prove to be more efficient.

- Impact on financial performance: Ford’s financial reports (available via SEC filings or company press releases) should be reviewed to assess the financial impact of the strategy on profit margins and overall profitability.

Comparative Analysis with Other Automakers

Other automakers responded to steel tariffs in various ways. Some focused on negotiating with steel suppliers to secure favorable pricing terms, while others emphasized cost-cutting measures throughout their supply chain, aiming for reduced overhead and improved efficiency. A comparative analysis of Ford’s approach against these strategies provides insights into the range of options available to companies. Such analysis should be based on published financial data, company press releases, and industry reports.

Data on inventory turnover, production costs, and profit margins would be useful in the comparison.

A key difference in Ford’s approach is its proactive investment in R&D. This suggests a longer-term perspective, potentially aimed at reducing dependence on steel and its associated price fluctuations. The effectiveness of this strategy remains to be seen, but it demonstrates a more comprehensive approach compared to simply negotiating price reductions.

Visual Representation of Ford’s Strategy

(Illustrative Infographic – Placeholder)This infographic would depict the timeline of Ford’s response, showing the key stages: identification of the tariff impact, diversification of sourcing, R&D investment, and the projected financial outcomes. It would visually represent the diversification of the supply chain, contrasting it with the concentration on specific regions in the initial phase. It should also display data points highlighting the financial performance metrics.

Final Summary

In conclusion, CEOs effectively navigated the complexities of Trump’s tariffs through a combination of proactive strategies. Diversification, supply chain optimization, and alternative trade routes proved crucial in mitigating the damage. The impact on specific industries varied, but CEOs responded with innovative approaches, including lobbying and advocating for alternative trade policies. This period underscores the evolving relationship between business and government in the face of global trade disputes, and offers valuable insights for future international trade policy challenges.