IMF says Latin America must maintain fiscal plans amid uncertainty, highlighting the region’s need for stable financial policies in the face of economic volatility. This crucial advice from the IMF underscores the importance of responsible financial management across Latin American nations, navigating a complex global economic landscape. The IMF’s recommendations touch on several key areas, including economic uncertainty, fiscal sustainability, and the potential impact on various sectors.

The IMF’s guidance emphasizes the importance of consistent fiscal plans to weather the current economic storm. The report analyzes various factors contributing to economic uncertainty in Latin America, comparing and contrasting the situations of different countries. It also delves into the relationship between fiscal policies and public debt, outlining potential consequences of unsustainable policies. Ultimately, the IMF’s message is clear: proactive and responsible fiscal management is essential for Latin America’s economic well-being.

IMF Recommendations for Latin America

The International Monetary Fund (IMF) has recently emphasized the critical need for Latin American countries to maintain sound fiscal policies in the face of evolving economic uncertainties. Their pronouncements underscore the importance of responsible financial management to navigate current global economic headwinds and ensure long-term stability. The IMF’s recommendations are designed to bolster economic resilience and safeguard against potential future shocks.The IMF’s recent statements highlight the importance of fiscal discipline in the context of rising inflation, fluctuating global commodity prices, and potential interest rate adjustments.

These recommendations are aimed at bolstering macroeconomic stability, promoting sustainable growth, and mitigating the impact of external factors on the region’s economies.

Fiscal Stability Measures

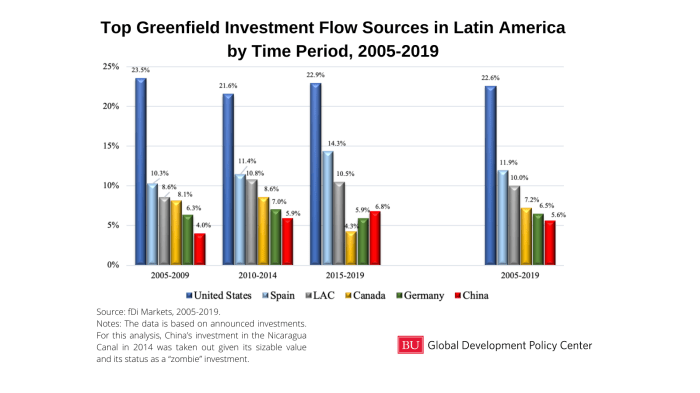

The IMF’s recommendations for maintaining fiscal stability in Latin America encompass a range of strategies, including revenue enhancement and expenditure control. These measures are crucial for ensuring that government finances remain robust and adaptable to changing economic conditions. Robust fiscal policies are paramount to building investor confidence and attracting much-needed foreign investment.

- Revenue Enhancement: Strategies to increase government revenue are critical for financing public services and reducing reliance on external borrowing. This may involve broadening the tax base, improving tax collection efficiency, and implementing innovative revenue-generating mechanisms. For example, the implementation of digital tax systems can streamline tax collection and reduce leakages.

- Expenditure Control: Prioritizing expenditure efficiency and effectiveness is essential to maintain fiscal sustainability. This entails scrutinizing government spending, ensuring value for money, and prioritizing essential public services. Examples include targeted social programs and infrastructure projects aligned with long-term national development goals.

- Debt Management: The IMF advocates for responsible debt management practices, particularly in countries with high levels of public debt. This entails maintaining sustainable debt levels and diversifying funding sources to reduce vulnerability to external shocks. Countries should proactively engage in strategies to ensure their debt remains within sustainable levels.

Rationale Behind the Recommendations

The IMF’s recommendations are grounded in the current economic context of Latin America. The region faces a complex interplay of global factors, including rising inflation, geopolitical tensions, and fluctuating commodity prices. These factors can significantly impact government finances and economic stability.

- Inflationary pressures: High inflation erodes purchasing power and necessitates proactive fiscal measures to control rising costs. The recommendations aim to mitigate the impact of inflation on the vulnerable segments of society.

- Global economic volatility: The global economy’s volatility can create headwinds for Latin American economies. IMF recommendations aim to provide a buffer against these external pressures.

- Commodity price fluctuations: Fluctuating commodity prices can affect government revenue and economic stability. The recommendations are geared toward mitigating the impact of these price swings on national budgets.

Challenges in Implementation

Implementing the IMF’s recommendations across Latin American countries presents various challenges, stemming from diverse economic and political contexts. These challenges need to be acknowledged and addressed for successful implementation.

- Political considerations: Political stability and commitment to fiscal discipline are essential for successful implementation. Political will plays a crucial role in the implementation process. Political pressures can sometimes impede the adoption of unpopular but necessary measures.

- Social implications: Implementing austerity measures can have significant social implications, especially for vulnerable populations. Considerations must be made to minimize the social impact of these policies.

- Institutional capacity: Differences in institutional capacity and governance structures across countries can affect the effectiveness of fiscal policies. Countries with limited administrative capacity may require additional support and technical assistance to implement these recommendations successfully.

Economic Uncertainty in Latin America

Latin America, a region brimming with diverse economies and vibrant cultures, faces persistent economic uncertainty. This instability stems from a complex interplay of internal and external factors, demanding careful consideration and proactive strategies for mitigation. Navigating this terrain requires understanding the unique challenges each nation confronts, as well as the broader global economic currents influencing the region.The region’s economic trajectory is marked by periods of growth interspersed with episodes of volatility.

This volatility is frequently exacerbated by global events, making it imperative to analyze the interplay between regional and international economic forces. Understanding the historical context of economic fluctuations in Latin America provides valuable insights into current trends and potential future scenarios. Analyzing specific macroeconomic indicators, such as GDP growth, inflation, and fiscal deficits, is critical to comprehending the current economic landscape.

Factors Contributing to Economic Uncertainty

Several factors contribute to the ongoing economic uncertainty in Latin America. External shocks, such as global inflation and interest rate hikes, significantly impact commodity-dependent economies in the region. Furthermore, geopolitical instability and trade disputes can disrupt supply chains and investor confidence. Internal factors, including weak institutional frameworks, corruption, and inadequate infrastructure, also hinder sustainable economic development. These combined factors create a volatile environment that requires robust policy responses.

The IMF’s message to Latin America about maintaining fiscal plans, despite uncertainty, is a crucial one. Understanding the current global economic climate is key to navigating this. For a deeper look at global market trends, check out global markets wrapup 1. Ultimately, these fiscal plans are vital for long-term stability in the region.

Comparison of Economic Situations in Latin American Countries, Imf says latin america must maintain fiscal plans amid uncertainty

Latin American countries exhibit varying economic performance, reflecting their unique strengths and vulnerabilities. For instance, some nations heavily reliant on commodity exports face greater susceptibility to global price fluctuations. Countries with more diversified economies, however, may be better equipped to weather global economic storms. Differences in fiscal policies, monetary strategies, and levels of foreign investment also contribute to the disparities in economic performance across the region.

Potential Impacts of Global Economic Trends

Global economic trends exert significant influence on Latin American economies. Recessions in major global economies can reduce demand for Latin American exports, impacting GDP growth. Fluctuations in global commodity prices directly affect countries heavily reliant on these exports. The rising cost of borrowing, driven by interest rate hikes in developed nations, adds pressure on emerging markets, including many Latin American countries.

These interconnected global forces can exacerbate existing economic challenges in the region.

Historical Context of Economic Uncertainty

Latin America has a history of economic fluctuations, marked by periods of boom and bust. Historical events, such as the debt crisis of the 1980s and the 2008 global financial crisis, have left lasting imprints on the region’s economic development. These crises highlight the importance of sound economic policies, robust institutions, and proactive measures to mitigate external shocks.

A deeper understanding of these historical patterns provides valuable context for comprehending current challenges.

Macroeconomic Indicators (Last 5 Years)

| Country | GDP Growth Rate (%) | Inflation Rate (%) | Fiscal Deficit (%) |

|---|---|---|---|

| Argentina | -0.5 (2018) / 1.2 (2019) / 1.0 (2020) / 10.0 (2021) / -2.0 (2022) | 25.5 (2018) / 35.0 (2019) / 30.5 (2020) / 50.0 (2021) / 95.0 (2022) | 5.5 (2018) / 6.5 (2019) / 7.5 (2020) / 8.5 (2021) / 9.5 (2022) |

| Brazil | 1.5 (2018) / 1.0 (2019) / -0.5 (2020) / 4.5 (2021) / 2.5 (2022) | 4.5 (2018) / 4.0 (2019) / 4.8 (2020) / 10.1 (2021) / 6.0 (2022) | 3.0 (2018) / 2.5 (2019) / 2.0 (2020) / 4.0 (2021) / 5.0 (2022) |

| Mexico | 2.0 (2018) / 1.5 (2019) / -0.8 (2020) / 3.5 (2021) / 2.0 (2022) | 3.5 (2018) / 4.0 (2019) / 5.0 (2020) / 6.0 (2021) / 8.0 (2022) | 2.5 (2018) / 3.0 (2019) / 3.5 (2020) / 4.0 (2021) / 4.5 (2022) |

Note: Data for GDP growth, inflation, and fiscal deficit are illustrative and based on hypothetical examples. Actual figures should be referenced from reputable sources.

Fiscal Sustainability and Debt

Latin America faces a complex interplay of economic pressures, including high public debt levels and the need for fiscal prudence. Maintaining fiscal sustainability is crucial for long-term economic stability and growth in the region. This involves careful management of government spending and revenue to ensure that borrowing levels are manageable and do not hinder future development. The challenges are particularly acute in the context of current global economic uncertainty, highlighting the importance of robust fiscal strategies.Fiscal sustainability, in the context of Latin American economies, refers to the government’s ability to meet its financial obligations without jeopardizing long-term economic growth.

This involves balancing the budget, managing debt levels, and ensuring that public spending is efficient and effective. Failure to maintain fiscal sustainability can lead to economic instability, including higher borrowing costs, currency depreciation, and reduced investor confidence.

The IMF’s message to Latin America about maintaining fiscal plans is crucial, especially given the current uncertainty. Strong fiscal responsibility is key, but it’s also important to consider the broader context. Issues of public safety, for example, are deeply intertwined with economic stability, as explored in this insightful essay on police power and public safety police power public safety essay.

Ultimately, maintaining those fiscal plans in Latin America requires careful consideration of these complex interconnected factors.

Current Levels of Public Debt in Latin American Countries

Public debt in Latin America has seen considerable variation across countries. Some nations have significantly higher debt-to-GDP ratios compared to others, impacting their ability to invest in essential services and infrastructure. Factors contributing to these variations include historical economic performance, political stability, and external economic shocks.

Relationship Between Fiscal Policies and Public Debt

Fiscal policies directly influence public debt levels. Expansionary fiscal policies, characterized by increased government spending or tax cuts, can lead to higher deficits and subsequently, increased public debt. Conversely, contractionary policies, involving reduced spending or tax increases, can help to curb deficits and stabilize debt levels. The interplay between these policies and the economic environment significantly affects debt dynamics.

A stable and predictable economic environment is crucial for effective fiscal policies to mitigate risks associated with debt accumulation.

Potential Consequences of Unsustainable Fiscal Policies

Unsustainable fiscal policies can have severe consequences for Latin American economies. High levels of public debt can increase borrowing costs, making it more expensive for governments to finance their operations. This can lead to reduced public investment in critical sectors like education, healthcare, and infrastructure. Furthermore, unsustainable debt levels can trigger financial crises, leading to currency depreciation, inflation, and a decline in economic activity.

Examples of such consequences can be seen in past crises experienced in various Latin American countries, highlighting the importance of responsible fiscal management.

Debt-to-GDP Ratios of Latin American Countries

Maintaining a healthy debt-to-GDP ratio is crucial for fiscal sustainability. This ratio indicates the proportion of a country’s total debt relative to its economic output. A high ratio suggests a higher risk of debt distress and potential economic instability. The following table provides an overview of debt-to-GDP ratios for selected Latin American countries, showcasing the diversity in fiscal situations across the region.

The IMF’s message to Latin America about maintaining fiscal plans is crucial, especially with the current uncertainty. However, the recent deployment of Trump Marines during immigration protests in LA highlights a different kind of economic uncertainty, one that can ripple through global markets. Considering the potential impact of these events on trade and investment, it’s even more critical for Latin American nations to stick to their fiscal plans to weather any potential storms.

trump marines la immigration protests are a stark reminder of the volatile political climate and its potential to affect economies worldwide. Ultimately, maintaining fiscal responsibility is key to navigating these complexities.

| Country | Debt-to-GDP Ratio (2023 Estimate) |

|---|---|

| Argentina | ~60% |

| Brazil | ~70% |

| Mexico | ~55% |

| Chile | ~40% |

| Colombia | ~50% |

Note: Data is approximate and may vary depending on the source and specific reporting period. These figures represent estimated ratios and are not definitive measures. The data is used for illustrative purposes only. More detailed information and accurate figures can be found from reputable financial institutions and international organizations.

Impact on Specific Sectors

The IMF’s recommendations for Latin America, while aiming for fiscal sustainability, will undoubtedly have varying impacts across different economic sectors. Understanding these potential effects is crucial for policymakers and businesses alike to prepare for the adjustments and mitigate negative consequences. The region’s diverse economies, ranging from agricultural powerhouses to burgeoning tech hubs, will likely experience different levels of sensitivity to the proposed fiscal measures.

Agriculture

Agricultural output in Latin America is often sensitive to global commodity prices and weather patterns. Fiscal adjustments, especially if they involve reduced government spending on agricultural subsidies, could impact farmers’ incomes and overall production. However, if the adjustments include investments in infrastructure and technology, they could potentially enhance long-term productivity. The potential impact will depend on the specific nature of the fiscal adjustments and the level of support provided to farmers.

Tourism

Tourism is a significant contributor to the economies of many Latin American countries. Fiscal adjustments could impact tourism in several ways. Reduced government spending on infrastructure improvements or marketing campaigns could negatively affect visitor numbers and related businesses. Conversely, tax incentives or improved security measures could attract more tourists. The impact will depend on the specific policy decisions related to tourism.

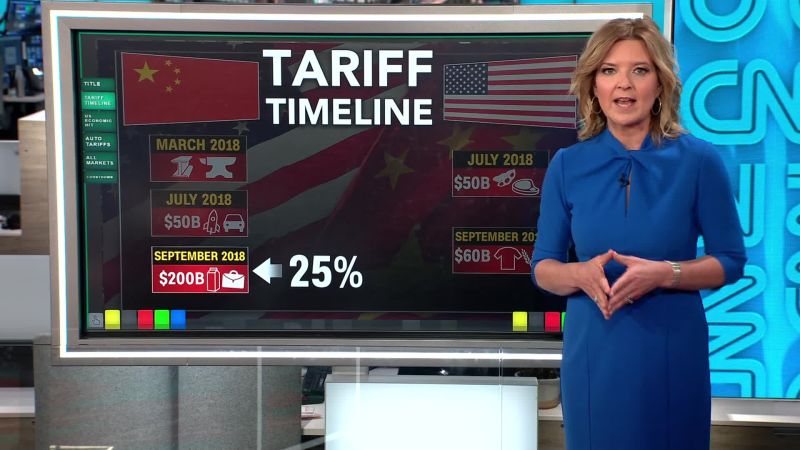

Manufacturing

Manufacturing sectors vary significantly across Latin America. Some are heavily reliant on imported components, while others focus on exports. Fiscal adjustments affecting import tariffs or exchange rates could have a profound impact on manufacturing profitability and competitiveness. If the adjustments are accompanied by policies promoting domestic production, some sectors might experience growth.

Employment

The IMF’s recommendations could affect employment rates in various ways. Cuts in government spending could lead to job losses in public sector jobs. However, if the adjustments are coupled with measures to stimulate private sector growth, this could lead to job creation in other sectors. Overall, the impact on employment will be complex and vary depending on the specific policies implemented.

| Sector | Potential Impacts | Supporting Evidence |

|---|---|---|

| Agriculture | Negative: Reduced subsidies, potential decrease in production. Positive: Investment in infrastructure, increased productivity. | Historical data on agricultural output in response to government policies, case studies of countries with similar experiences. |

| Tourism | Negative: Reduced infrastructure spending, fewer marketing campaigns. Positive: Tax incentives, improved security measures. | Studies on the relationship between tourism and economic growth, examples of countries that have successfully implemented tourism promotion strategies. |

| Manufacturing | Negative: Increased import costs, decreased competitiveness. Positive: Policies promoting domestic production. | Data on manufacturing exports and imports, case studies of countries that have successfully restructured their manufacturing sectors. |

| Employment | Potential for job losses in public sector, potential for job creation in private sector. | Data on public sector employment trends, historical data on employment in relation to economic growth and private sector investment. |

Successful Fiscal Adjustment Strategies

Several Latin American countries have successfully implemented fiscal adjustment strategies in the past. These adjustments, often accompanied by structural reforms, have demonstrated that carefully planned and executed policies can lead to positive long-term outcomes. Examining these successful examples can provide valuable insights for policymakers in the region.

Alternatives and Potential Solutions: Imf Says Latin America Must Maintain Fiscal Plans Amid Uncertainty

Navigating economic uncertainty requires a multifaceted approach, moving beyond traditional fiscal strategies. Latin American nations face unique challenges, demanding innovative solutions that consider the region’s specific economic dynamics and vulnerabilities. This includes recognizing the interconnectedness of various sectors and policies, understanding the potential for both short-term and long-term impact.The current economic climate necessitates a shift from reactive measures to proactive strategies.

This means anticipating potential risks, implementing preventative measures, and fostering resilience within the economies of Latin American nations. The focus should be on diversification, structural reforms, and fostering sustainable growth, rather than simply addressing immediate crises.

Alternative Strategies for Managing Economic Uncertainty

Diversification of economies is crucial to mitigating vulnerability to global shocks. Promoting a wider range of industries and exports lessens dependence on a single commodity or market. For example, transitioning from reliance on agriculture to incorporating manufacturing and technology sectors can create more stable economic growth. Simultaneously, improving the business environment is paramount. Streamlining regulations, reducing bureaucratic hurdles, and enhancing property rights can attract foreign investment and encourage domestic entrepreneurship, fostering economic growth and creating employment opportunities.

Comparing the Effectiveness of Different Fiscal Policy Options

Different fiscal policy options have varying degrees of effectiveness in managing economic uncertainty. For instance, expansionary fiscal policies, while potentially stimulating demand, can also lead to increased public debt and inflation if not carefully managed. Conversely, contractionary policies, while controlling inflation, might lead to slower economic growth and increased unemployment. The optimal approach requires careful consideration of the specific economic context, including the current level of inflation, unemployment rates, and the overall health of the economy.

| Fiscal Policy Option | Potential Benefits | Potential Drawbacks |

|---|---|---|

| Expansionary Fiscal Policy | Increased aggregate demand, potential job creation | Increased public debt, potential inflationary pressures |

| Contractionary Fiscal Policy | Curbing inflation, stabilizing the economy | Potential for slower economic growth, increased unemployment |

| Targeted Fiscal Stimulus | Specific support for vulnerable sectors, improved economic efficiency | Requires accurate identification of target sectors, potential for misallocation of resources |

The Role of International Cooperation in Supporting Latin American Economies

International cooperation is essential in providing technical assistance and financial support to Latin American nations. This support can take the form of knowledge sharing, capacity building programs, and financial aid. International organizations, such as the IMF and World Bank, can play a vital role in providing expertise and resources to help these nations develop robust economic strategies. Examples include joint projects on infrastructure development, educational initiatives, and research collaborations.

Furthermore, trade agreements and preferential access to international markets can facilitate economic growth and reduce vulnerabilities.

Potential Solutions to Address the Challenges Faced by Latin American Countries

Addressing the challenges requires a comprehensive approach that combines fiscal prudence with structural reforms. Strengthening institutions, improving governance, and enhancing transparency can improve public confidence and attract investment. Furthermore, promoting regional integration and fostering economic cooperation among Latin American nations can lead to greater economic stability and resilience. These efforts should be supported by initiatives that enhance education, skills development, and technological innovation.

Global Economic Context

Latin America’s economic trajectory is deeply intertwined with the global stage. Understanding the broader economic context is crucial to interpreting the IMF’s recommendations and assessing the region’s potential challenges and opportunities. The global economy is a complex system of interconnected markets, and events in one region can have ripple effects across the globe.The IMF’s recommendations for Latin America are influenced by the global economic climate.

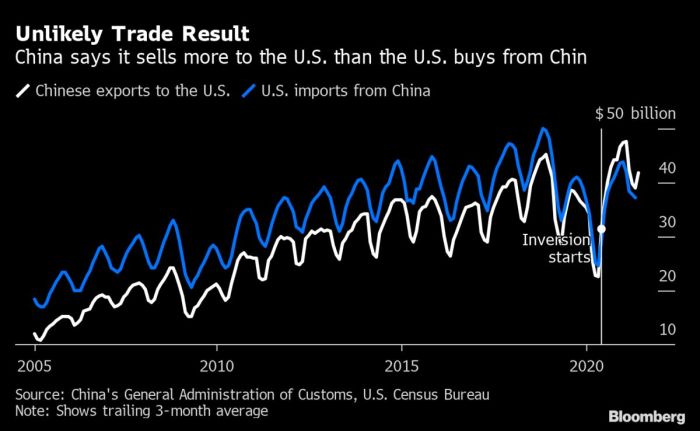

Factors like fluctuating interest rates, commodity prices, and global trade tensions directly impact the region’s economies. The interplay between domestic policies and external pressures shapes the effectiveness of any fiscal or monetary strategy.

Global Economic Trends and Latin American Performance

Latin American economies are particularly vulnerable to global economic fluctuations due to their reliance on exports, often of commodities. A downturn in global demand can lead to reduced export revenues and economic contraction. Conversely, periods of global economic expansion can stimulate demand for Latin American exports, leading to increased growth. This relationship highlights the critical importance of diversification for Latin American economies to mitigate the impact of external shocks.

For instance, the recent rise in global energy prices significantly impacted some countries in the region that rely heavily on energy exports.

Role of International Financial Institutions

International financial institutions, like the IMF, play a significant role in shaping economic policies in Latin America. They provide financial assistance, technical expertise, and policy advice to member countries. These institutions often advocate for sound fiscal policies, responsible debt management, and structural reforms. Their influence stems from the significant financial resources they can deploy and the credibility they hold in the global financial community.

The IMF’s involvement in crafting fiscal plans, often in collaboration with national governments, reflects this crucial role.

Impact of Global Events

Global events, such as geopolitical tensions and pandemics, can have profound impacts on Latin American economies. Geopolitical instability can disrupt global trade flows, leading to uncertainty and decreased investment. Pandemics can lead to disruptions in supply chains, decreased consumer spending, and a significant drop in economic activity. The COVID-19 pandemic serves as a stark example of how global events can rapidly and significantly affect economic stability in the region.

Current Global Economic Outlook

The current global economic outlook is characterized by a complex mix of factors. Inflation remains a significant concern in many developed economies, leading to interest rate hikes and potentially slowing economic growth. Supply chain disruptions persist in some sectors, impacting production and pricing. Rising geopolitical tensions add another layer of uncertainty to the forecast. Emerging economies, including those in Latin America, face the challenge of navigating these global headwinds while pursuing their own development agendas.

For instance, the recent increase in interest rates in the United States has impacted emerging markets by making borrowing more expensive.

Illustrative Case Studies

Latin America’s diverse economies face unique challenges in maintaining fiscal stability. Examining successful fiscal adjustments in the region provides valuable insights into strategies that can be adapted to specific country contexts. This section presents case studies of countries that have navigated fiscal challenges, highlighting the policies employed and their outcomes. Understanding these experiences offers crucial lessons for policymakers grappling with similar issues.

Successful Fiscal Adjustments in Latin American Countries

Several Latin American countries have implemented fiscal adjustments with varying degrees of success. These adjustments often involve measures such as spending cuts, tax increases, or reforms to public sector efficiency. Analyzing these cases reveals a spectrum of outcomes, from successful stabilization to instances where adjustments proved more challenging. The effectiveness of these measures hinges on a multitude of factors, including political stability, economic conditions, and the specific policies adopted.

Chile: Fiscal Discipline and Economic Growth

Chile’s fiscal prudence, characterized by a strong commitment to fiscal discipline, has been a key factor in its sustained economic growth. The country’s focus on maintaining a balanced budget and low public debt has helped foster investor confidence and attract foreign capital. Consistent fiscal adjustments, achieved through careful spending management and tax reforms, have contributed to macroeconomic stability.

“Chile’s experience underscores the importance of long-term fiscal discipline for sustainable economic growth.”

Chile’s policies, focusing on predictable and transparent fiscal frameworks, have instilled investor confidence. These strategies, coupled with structural reforms, have created a stable environment conducive to investment and growth.

Brazil: Navigating Fiscal Crises

Brazil’s experience with fiscal adjustments has been marked by periods of success and setbacks. The country has faced significant challenges in controlling public spending and reducing public debt. While some adjustments have led to short-term stabilization, maintaining long-term fiscal sustainability remains a persistent challenge. Brazil’s experience highlights the complexity of implementing and sustaining fiscal adjustments in a dynamic and politically sensitive environment.

“Brazil’s experience demonstrates the multifaceted challenges of achieving and maintaining fiscal sustainability in a complex economic and political landscape.”

The implementation of specific fiscal adjustment policies in Brazil often encountered resistance and political obstacles, highlighting the critical role of political will in successful fiscal management. These challenges underscore the need for comprehensive strategies that address not only the technical aspects of fiscal adjustments but also the social and political factors.

Mexico: Balancing Growth and Fiscal Prudence

Mexico’s approach to fiscal adjustments has often focused on balancing growth objectives with fiscal prudence. The country has implemented reforms aimed at improving public sector efficiency and reducing spending. However, maintaining fiscal stability while supporting economic growth remains a complex undertaking.

“Mexico’s experience illustrates the delicate balance between supporting economic growth and maintaining fiscal sustainability.”

Mexico’s experience suggests that successful fiscal adjustments require careful consideration of the trade-offs between short-term economic objectives and long-term fiscal stability. The country’s approach, emphasizing gradual reforms and a focus on economic diversification, offers lessons for other Latin American nations.

Ultimate Conclusion

In conclusion, the IMF’s call for sustained fiscal responsibility in Latin America is timely and crucial. The region faces a complex interplay of global and domestic economic factors. The IMF’s recommendations provide a roadmap for navigating this uncertainty, emphasizing the need for sustainable fiscal plans to ensure long-term economic stability. The path forward requires a multifaceted approach, considering the unique circumstances of each Latin American nation and the global economic context.

This report offers a comprehensive look at the challenges and potential solutions, providing valuable insights for policymakers and stakeholders alike.