India us push finalise interim tariff deal trumps deadline nears – India-US push finalise interim tariff deal trumps deadline nears. Negotiations between the US and India are heating up as they race against the clock to finalize an interim tariff agreement. This crucial deal, potentially impacting a wide range of sectors, is facing a tight deadline, raising concerns about its potential impact on global trade dynamics. The complex interplay of economic interests, political pressures, and historical trade relations will be key in shaping the outcome of these negotiations.

A historical overview of US-India trade relations reveals a complex tapestry of agreements and disputes. From past trade pacts to current tensions, understanding the context is essential. The specific goods and sectors potentially affected by the deal, from technology to agriculture, are crucial factors in the negotiation. Furthermore, the current political climates in both nations play a pivotal role in shaping the trajectory of the talks.

This dynamic backdrop emphasizes the significance of the upcoming deadline in the context of the overall trade relationship, and the potential impact of this deal on global trade dynamics and international relations.

Background and Context: India Us Push Finalise Interim Tariff Deal Trumps Deadline Nears

The US-India trade relationship, while marked by periods of cooperation, has also seen its share of disagreements and negotiations. A complex interplay of economic interests, political considerations, and varying domestic priorities often shapes the trajectory of their trade interactions. This interim tariff deal, emerging as a crucial step toward a broader agreement, highlights the delicate balance between these competing forces.The historical context of trade relations between the US and India is characterized by both cooperation and contention.

Early agreements focused on specific sectors and products, with subsequent negotiations often dealing with issues like intellectual property rights, market access, and agricultural subsidies. Disagreements have centered on tariffs, import restrictions, and concerns over unfair trade practices. These past experiences, both positive and negative, undoubtedly influence the current negotiations and the potential outcomes of this interim agreement.

Key Agreements and Disputes

A historical review of US-India trade relations reveals a series of agreements and disputes, each reflecting the evolving dynamics of their bilateral economic relationship. Early agreements were primarily focused on specific sectors, laying the foundation for future interactions. Subsequent negotiations addressed broader issues, such as intellectual property rights, market access, and agricultural subsidies, often leading to disagreements over tariffs and import restrictions.

These historical experiences have shaped the current negotiation process, impacting the expectations and strategies of both parties.

Specific Goods and Sectors

The interim tariff deal likely encompasses a range of goods and sectors. Potential areas of focus include, but are not limited to, agricultural products, textiles, and technology. Specific details of the deal, including the magnitude of tariffs and the affected goods, are yet to be fully disclosed.

Political Climate in the US and India

The current political climate in both the US and India is crucial to understanding the dynamics of the negotiations. Domestic political priorities and election cycles in both countries often influence trade policy decisions. The interplay of these domestic factors with the international trade landscape is a key element in shaping the current negotiations.

Significance of the Deadline

The approaching deadline for the interim tariff deal underscores the urgency of reaching an agreement. Failure to meet this deadline could lead to disruptions in trade flows, potential retaliatory measures, and uncertainty in the market. The deadline’s significance stems from its role in setting a timeframe for resolving trade issues, ensuring a degree of predictability and encouraging both sides to reach a mutually beneficial outcome.

Potential Impact on Global Trade Dynamics

The US-India interim tariff deal has the potential to significantly impact global trade dynamics. The outcome of these negotiations could influence trade patterns among other countries, potentially leading to adjustments in supply chains and market shares. Any agreements or disputes resulting from the deal could set precedents for future trade negotiations and influence other international trade agreements.

Role of Other Countries or Trade Blocs, India us push finalise interim tariff deal trumps deadline nears

Other countries and trade blocs are not directly party to the US-India interim tariff deal, but their actions and reactions may still be relevant to the negotiations. For instance, the presence of alternative trading partners or trade blocs might affect the bargaining power of either the US or India. The broader global trade environment, including other ongoing trade disputes, also plays a significant role in shaping the context of the current negotiations.

Key Issues and Negotiations

The impending deadline for the India-US interim tariff deal looms large, with both nations facing difficult choices. The negotiations have been fraught with complexities, demanding compromises from both sides to achieve a mutually beneficial agreement. The potential economic and geopolitical ramifications of either a successful or failed resolution are significant.The negotiations center around a range of issues, including specific tariffs, import quotas, and intellectual property rights.

India and the US are racing to finalize an interim tariff deal, with the deadline looming. This complex negotiation highlights the intricate dance of global trade, mirroring the ongoing debates about AI’s future. Elon Musk’s recent letter expressing concerns about OpenAI’s for-profit model, as detailed in this piece , underscores the potential ethical and economic ramifications of technological advancements.

Ultimately, the India-US tariff talks are crucial for global economic stability, and the pressure is on to reach an agreement before the deadline passes.

Understanding the key sticking points, the negotiating positions, and the potential trade-offs is crucial to assessing the prospects for a successful outcome.

Key Sticking Points

The US and India differ significantly on the extent and scope of concessions needed to finalize the interim deal. Specific tariffs on certain goods and the implementation of import quotas are major areas of contention. India’s concerns about potential market access limitations and the need to safeguard domestic industries are particularly prominent. The US, in turn, emphasizes the need to ensure fair trade practices and protect its own industries.

US and India Negotiating Positions

The US prioritizes opening up Indian markets for American goods and services. This includes reducing tariffs and quotas that disadvantage American exporters. They also seek assurances on intellectual property rights and the enforcement of trade agreements. India, on the other hand, prioritizes protecting its domestic industries, particularly in sectors like agriculture and pharmaceuticals. They are concerned about the potential for increased imports of subsidized goods from the US and are keen to secure favorable access to the US market for Indian exports.

Potential Trade-offs

The interim deal likely involves trade-offs between the US and India’s competing interests. The US may be willing to reduce tariffs on specific Indian goods in exchange for India reducing tariffs on US goods. Conversely, India might concede on some market access issues if the US makes concessions on trade imbalances or provides guarantees against unfair competition.

Compromises Made

While details of the compromises remain confidential, there are likely to be concessions on both sides. Specific sectors like agriculture and pharmaceuticals are expected to be areas where compromises have been reached. These might involve specific tariffs, import quotas, or commitments on intellectual property enforcement. These agreements are likely to be temporary and require further negotiation to achieve long-term agreements.

Consequences of No Agreement

A failure to reach an agreement by the deadline could have significant repercussions for both economies. Disruptions in supply chains, increased trade tensions, and potential damage to investor confidence are all possible outcomes.

Potential Consequences Table

| Event | Sector Impact | Economic Impact | Geopolitical Impact |

|---|---|---|---|

| Deal Reached | Reduced trade barriers, increased trade volumes in certain sectors, potential job creation. | Increased GDP growth, decreased trade friction, boosted investor confidence. | Strengthened bilateral relations, reduced risk of trade wars, positive impact on global trade environment. |

| No Deal | Increased tariffs, disrupted supply chains, potential market access limitations for certain sectors. | Economic slowdown, decreased trade volumes, decreased investor confidence, possible ripple effects on global markets. | Escalated trade tensions, potential for trade wars, negative impact on global trade environment, damage to bilateral relations. |

Potential Impacts and Implications

The interim tariff deal between India and the US, as the Trump administration’s deadline approaches, holds significant implications for both economies and the global landscape. This agreement, while a step forward in resolving trade disputes, presents a complex interplay of potential benefits and drawbacks, affecting various sectors and stakeholders. Navigating these intricacies is crucial for understanding the long-term consequences of this negotiated compromise.

Economic Effects on the US and India

The deal’s economic impact on both nations hinges on the specifics of the agreed-upon tariffs and trade concessions. A reduction in tariffs could stimulate exports from both countries, boosting economic growth. Conversely, if the deal fails to address underlying trade imbalances, it could lead to a shift in production patterns, potentially impacting employment in specific sectors. For instance, if US tariffs on Indian steel are reduced, Indian steel producers might gain a competitive edge in the US market, while US steel producers could face challenges.

Similarly, reduced tariffs on Indian agricultural products could affect US farmers. Overall, the economic effects will depend on the detailed terms of the agreement and how the participating industries adapt to the new conditions.

Social Implications: Job Losses and Gains

The deal’s social implications are inextricably linked to its economic effects. If the deal leads to increased exports for either nation, it could create new jobs in export-oriented industries. However, industries facing increased competition from imported goods might experience job losses. For example, US manufacturing jobs in sectors like steel could be affected by increased imports from India.

Likewise, Indian industries competing with US products may face similar challenges. The potential for job displacement necessitates proactive government policies and workforce retraining programs to mitigate negative impacts.

Impact on the Global Supply Chain

The deal could potentially reshape the global supply chain by influencing the flow of goods between the US and India. If the deal fosters greater trade, it could streamline supply chains, potentially reducing costs and delivery times. Conversely, if the deal fails to address existing trade barriers, it could lead to further fragmentation of global supply chains, increasing logistical complexity and costs.

The long-term impact will depend on the specific provisions of the deal and the reaction of other countries to the agreement.

Influence on International Relations

The deal’s success or failure could significantly influence the broader landscape of international relations. A successful resolution of trade disputes between the US and India could set a precedent for other trade negotiations. Conversely, if the deal falls apart or fails to address fundamental issues, it could lead to increased trade tensions and a more complex global trading environment.

Past instances of trade disputes between nations highlight the significance of effective negotiations and the importance of maintaining amicable international relations.

India and the US are racing to finalize an interim tariff deal, with the deadline looming large. This trade negotiation is crucial for both economies, but while these talks are underway, it’s important to consider the impact of recent developments on public health. For example, understanding how effective treatments like Paxlovid are for COVID-19-vaccinated individuals can influence decisions about pandemic preparedness.

Does Paxlovid work for COVID-19 vaccinated individuals? This knowledge is relevant to ongoing negotiations, as a healthy population is essential for economic stability. Ultimately, the success of the India-US tariff deal hinges on several factors, including these important health considerations.

Impact on Consumer Prices

The deal’s impact on consumer prices is multifaceted and contingent on the specifics of the tariff reductions. Reduced tariffs on imported goods from India could lead to lower prices for certain consumer products in the US. Conversely, reduced tariffs on US goods exported to India could have a similar impact on consumer prices in India. The overall effect on consumer prices will depend on the extent of tariff reductions and the elasticity of demand for the affected goods.

Potential Impacts on Industries

| Industry | Potential Impact (Positive/Negative) | Explanation |

|---|---|---|

| Technology | Positive | Reduced tariffs on technology exports from either country could lead to increased sales and market share, benefiting companies in both markets. This could also lead to more competition and innovation in the technology sector. |

| Agriculture | Negative | Reduced tariffs on agricultural products from India could negatively impact US farmers who compete in the same market. Increased imports could lead to price pressure and potentially force some farmers to leave the market. |

| Manufacturing (Steel) | Negative (US) / Positive (India) | Reduced tariffs on steel from India could negatively impact US steel manufacturers, as they face increased competition. Indian steel producers could gain a significant market share in the US. |

| Pharmaceuticals | Positive | Reduced tariffs could lead to lower prices for pharmaceuticals in both countries, benefiting consumers. Greater access to medicines from the other country could be a positive impact for the health sector. |

Alternatives and Future Outlook

The looming deadline for the US-India interim tariff deal presents a crucial juncture. Failure to finalize an agreement could have significant repercussions, impacting not only bilateral trade but also global economic stability. Understanding potential alternatives is essential for anticipating the future trajectory of these critical relations.

Potential Scenarios if the Deal Fails

If the interim tariff deal falters, several alternative scenarios could unfold. A return to previous tariffs, or even the imposition of new ones, would likely disrupt the established trade flow between the two nations. This disruption could lead to increased costs for consumers, reduced supply chains, and potential job losses in both countries. The current global economic climate, already facing uncertainty, would be further strained by such a development.

India and the US are racing to finalize an interim tariff deal, with the deadline looming. Meanwhile, a separate but equally important event is unfolding: the NTSB is holding a hearing regarding a fatal collision between an American Airlines flight and an Army helicopter. This incident, covered in more detail here: ntsb hold hearing into fatal american airlines collision with army helicopter , highlights the complexities of aviation safety, and serves as a stark reminder of the importance of these crucial negotiations between India and the US, with the tariff deal likely to be impacted by the broader global economic climate.

Implications for Future US-India Trade Relations

The failure to finalize the deal could significantly damage the trust and cooperation built between the US and India in recent years. This could lead to a more adversarial trade relationship, characterized by protectionist measures and a reluctance to engage in future negotiations. The potential for future trade conflicts would increase, potentially impacting the global trading system as a whole.

The current global economic environment, marked by supply chain disruptions and inflation, would suffer further under such circumstances.

Long-Term Impact on the Global Economy

A breakdown in the US-India trade negotiations could trigger a ripple effect throughout the global economy. The two nations are significant players in international trade, and a trade war between them would impact global supply chains, potentially leading to higher prices and reduced economic growth. Examples of past trade disputes, such as the US-China trade war, have demonstrated the devastating consequences of such conflicts on global markets.

Potential Areas for Future Cooperation

Despite the challenges, potential areas for future cooperation remain. These include joint efforts on addressing climate change, technological innovation, and security concerns. Both countries share common interests in fostering a stable and prosperous global economy, and such cooperation could help mitigate the negative consequences of a failed trade deal. Examples of successful international collaborations demonstrate that even amidst tensions, shared goals can lead to mutually beneficial partnerships.

Table of Potential Alternatives

| Alternative | Advantages | Disadvantages |

|---|---|---|

| Continued Negotiations & Extension | Provides time for a comprehensive agreement, potentially minimizing disruption. Maintains diplomatic channels open. | Could lead to further delays and uncertainty, risking the collapse of negotiations entirely. May not resolve fundamental issues. |

| Reimposition of Tariffs | Could be seen as a firm stance on trade practices. | Potentially escalates tensions, disrupts supply chains, increases costs for consumers, and damages the reputation of both countries. May trigger retaliatory measures from other countries. |

| Alternative Trade Agreements with Other Countries | Allows countries to diversify trade partners, building resilience to economic shocks. | Could lead to fragmentation of the global trading system, potentially hindering economic growth. Requires substantial effort to establish new agreements. |

| Focus on Non-Tariff Barriers | Allows for continued trade, focusing on streamlining regulations and reducing administrative hurdles. | Could be less impactful in addressing fundamental trade imbalances. May not be enough to resolve underlying trade tensions. |

Illustrations and Visualizations

The looming US-India tariff deal, as the deadline approaches, necessitates a clear understanding of its potential impacts. Visualizations are crucial to grasping the complexities and nuances of this agreement, translating abstract data into easily digestible insights. These visualizations will help to understand the historical context, potential economic shifts, and geopolitical implications of the deal.Understanding the multifaceted impact of the deal requires a comprehensive approach.

Illustrative representations can highlight the potential gains and losses across various sectors, helping stakeholders and the public assess the agreement’s overall significance.

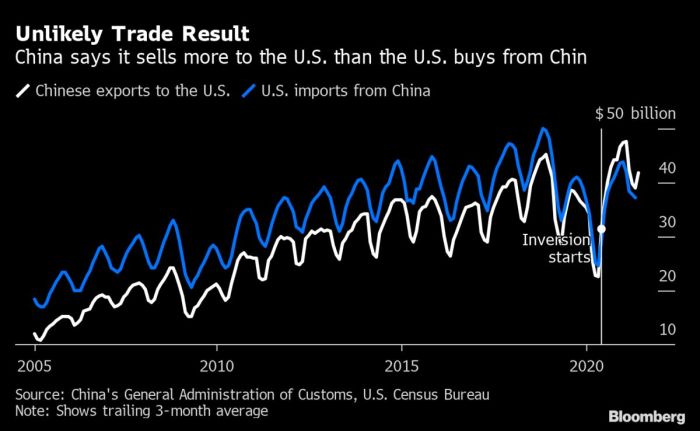

Historical Trade Volume Between US and India

Visualizing the historical trade volume between the US and India provides context for understanding the current negotiations and potential future outcomes. A line graph would be effective. The x-axis would represent years, and the y-axis would represent the total trade value in US dollars. The graph would showcase the upward trend in bilateral trade over the past two decades, highlighting periods of significant growth and any notable fluctuations.

This visualization will visually demonstrate the substantial increase in trade between the two nations, a key factor in the importance of the current negotiations.

Potential Economic Impact on Specific Sectors

The potential economic impact of the deal on specific sectors can be effectively visualized using a stacked bar chart. The x-axis would represent the sectors (e.g., technology, pharmaceuticals, agriculture). The y-axis would represent the projected value of the deal’s impact on each sector, with different colored bars representing positive and negative impacts. For example, a significant portion of the bar for the technology sector might be colored green to indicate positive impact, while a portion of the agriculture sector bar might be red to indicate a potential negative impact.

The visualization would clearly show which sectors are expected to gain or lose from the deal, allowing for targeted analysis and policy adjustments.

Geopolitical Implications of the Deal

A world map infographic would be ideal to represent the geopolitical implications. Different colored regions would be used to illustrate potential benefits or concerns. For example, a region experiencing increased trade with the US might be colored in a shade of blue, while regions with decreased trade could be colored in shades of red or orange. This visual representation will immediately convey the geopolitical impact of the deal, including regional power dynamics and the broader impact on global trade patterns.

Potential Impact on Consumer Prices

A simple pie chart could effectively display the potential impact on consumer prices. The pie slices would represent different sectors (e.g., food, clothing, electronics), and their corresponding percentage contribution to the overall price increase or decrease. This visualization will immediately show how the tariff deal might impact consumers, providing a snapshot of potential price changes across different goods and services.

For instance, a larger slice of the pie representing food could indicate a greater potential impact on food prices.

Hypothetical Global Supply Chain Network

A global supply chain network could be visualized as a complex interconnected network diagram, with nodes representing countries and lines connecting them to show trade flows. If the deal isn’t reached, the lines connecting India and the US would be shown as potentially disrupted or weakened, with potential ramifications on other countries. This hypothetical visualization would clearly illustrate the disruption to the global supply chain if the deal fails, showing how this could impact businesses and consumers globally.

A red dashed line could represent a potential disruption, emphasizing the importance of reaching an agreement.

Wrap-Up

The India-US tariff deal hangs in the balance as the deadline looms. The potential benefits and drawbacks for both nations, and the global economy, are substantial. A successful agreement would have positive consequences for various sectors, potentially boosting trade and economic growth. Conversely, failure to reach an accord could lead to disruptions in the global supply chain, economic instability, and a setback in the US-India relationship.

The outcome of these negotiations will undoubtedly have lasting implications for global trade and international relations.