Ireland modifies rent controls it seeks revive homebuilding, a move that promises significant changes in the Irish housing market. This complex policy adjustment aims to spur development and create more affordable housing options, but it also raises crucial questions about the balance between tenant protections and the need for increased housing supply. The potential impact on landlords, developers, and tenants is considerable, and the proposed modifications are already generating significant debate.

Let’s delve into the details of this complex situation and analyze the possible outcomes.

This analysis explores the background of rent controls in Ireland, examining their historical evolution and impact. We’ll assess the potential consequences of the proposed modifications on tenants’ rights, landlords, and the broader housing market. A key focus will be on the potential link between these modifications and a revitalization of the homebuilding sector, including the economic implications and potential challenges.

International comparisons will provide context, and a discussion of stakeholder perspectives and public opinion will round out the analysis.

Background of Rent Controls in Ireland

Rent control policies in Ireland have a complex history, shaped by economic fluctuations and societal pressures. Initially implemented to address housing shortages and affordability concerns, these policies have evolved significantly over time, with varying degrees of success and impact on the Irish housing market. Understanding this historical context is crucial to evaluating the current modifications to rent controls and their potential consequences.Rent control measures in Ireland, like those globally, often emerge in response to periods of rapid population growth, economic boom-bust cycles, or significant societal shifts.

Historically, the goal has been to stabilize rents and make housing more accessible, particularly for lower-income households. However, the long-term effects of these policies have been debated, with arguments for and against their effectiveness persisting.

Historical Overview of Rent Control Policies

Rent control in Ireland, while not a continuous practice, has manifested in various forms throughout the 20th and 21st centuries. The policies have been implemented sporadically, reflecting the changing economic and social landscape. These periods of implementation were often linked to specific social and economic challenges, with each period’s rent control legislation reflecting the unique context.

Evolution of Rent Control Policies Over Time

The evolution of rent control policies mirrors the broader economic and social transformations in Ireland. Early measures aimed at regulating rents in specific sectors or areas. Later iterations of rent control broadened their scope, addressing issues of housing affordability more comprehensively. The policies have been adjusted to accommodate changes in market conditions, although the impact on rental market dynamics has often been debated.

Rationale Behind the Implementation of Rent Controls

Rent control policies in Ireland have historically been implemented to address acute housing shortages and affordability concerns. The rationale often stemmed from a desire to protect vulnerable tenants from excessive rent increases. These policies were often seen as necessary to maintain a semblance of social equity, particularly during times of economic hardship or rapid urbanization.

Specific Rent Control Laws and Their Impact on the Housing Market

Unfortunately, without specific examples of rent control laws, detailed impacts on the Irish housing market cannot be precisely described. The lack of specific laws mentioned in the prompt prevents a focused discussion on their influence.

Perceived Successes and Failures of Past Rent Control Policies

The perceived successes and failures of past rent control policies in Ireland are complex and multifaceted. While rent controls may have provided short-term relief for tenants facing exorbitant rent increases, they have also often been criticized for creating distortions in the housing market. Potential consequences included a decline in new housing construction, reduced availability of rental units, and the potential for housing stock deterioration due to a lack of investment.

Impact of Current Rent Control Modifications

Ireland’s recent modifications to its rent control laws aim to stimulate homebuilding while addressing concerns about tenant rights and affordability. These changes represent a significant shift in the country’s approach to rental housing, with potential ramifications for both tenants and landlords. Understanding the nuances of these modifications is crucial for comprehending the anticipated effects on the rental market.The proposed modifications to Ireland’s rent control framework are complex, and their impact on the rental market is likely to be multifaceted.

Ireland’s tweaking of rent controls, aiming to spark homebuilding, is certainly interesting. It’s a complex issue, though, and considering the recent news about the Fantastic Four, particularly Franklin Richards suing Storm Reed Richards for baby custody, this fascinating legal battle might offer some unique perspectives on family matters, though not directly related. Ultimately, Ireland’s efforts to revitalize their housing market are likely more impactful than the comic book drama.

Some measures may encourage investment in new housing, while others could potentially limit the rights of tenants or lead to increased housing costs. A thorough analysis of these proposed changes is necessary to assess their overall consequences.

Proposed Modifications to Rent Control Laws

The proposed modifications to Ireland’s rent control laws encompass several key areas. These alterations aim to create a more balanced and sustainable rental market. The specifics of these modifications are yet to be finalized, and the final legislation will undoubtedly have a profound impact on the Irish rental sector.

Potential Consequences on Tenants’ Rights

The proposed changes may have a mixed impact on tenants’ rights. While some modifications might enhance protections in specific circumstances, others could potentially reduce the overall strength of existing tenant safeguards. The outcome will depend heavily on the specific wording and implementation of the new regulations. Tenants will need to carefully review the final legislation to assess how their rights are affected.

Comparison with Existing Rent Control Regulations

The proposed changes contrast with existing rent control regulations in several aspects. The current framework may offer more extensive tenant protections in some areas, while the proposed changes might provide different safeguards in other situations. This difference necessitates a comprehensive understanding of the details of the proposed modifications and how they compare to the existing regulations.

Ireland’s tweaking of rent controls, aiming to boost homebuilding, seems like a smart move, but it’s also worth considering the geopolitical backdrop. Recent accusations by Israeli Prime Minister Netanyahu that France, Britain, and Canadian leaders are emboldening Hamas, as reported by DenikeNews , highlight the complex global situation. Ultimately, Ireland’s focus on revitalizing its housing market through these reforms could prove crucial in the long run.

Potential Consequences for Landlords

The proposed changes to rent control may influence landlords’ decision-making concerning rental properties. Landlords may be encouraged to invest in new construction if the modified regulations create more favorable conditions for rental income and property value appreciation. Conversely, some landlords might face challenges if the new rules restrict their ability to increase rents or manage their properties. The financial implications for landlords will vary depending on the specific provisions of the new legislation.

Predicted Effects on Availability and Affordability of Rental Housing

The proposed modifications are expected to affect the availability and affordability of rental housing in Ireland. A rise in homebuilding activity, incentivized by the changes, could potentially increase the supply of rental units, which might drive down rental costs. However, if the modifications discourage investment in rental housing, the availability of rental units could decrease, leading to increased rental costs.

The overall effect on affordability will hinge on the interplay between supply and demand within the Irish rental market.

Connection to Homebuilding Revival: Ireland Modifies Rent Controls It Seeks Revive Homebuilding

Ireland’s recent modifications to rent control policies present a complex interplay with the nation’s homebuilding sector. These changes aim to create a more favorable environment for developers, potentially leading to a surge in construction activity. The anticipated increase in housing supply, however, hinges on a multitude of factors, including developer incentives and the broader economic climate.The core argument is that by easing restrictions on rental income, developers may be more inclined to invest in new housing projects.

This is because the potential for higher returns from rentals can offset the risks associated with construction. A more stable and predictable rental market is a crucial element for attracting investment and driving increased homebuilding.

Potential Incentives for Developers

Developers are typically motivated by the potential for profit. Modifications to rent control regulations can directly impact their financial outlook. Without rent controls, developers can potentially charge higher rents, leading to increased profits. This higher profit margin can justify the investment in land acquisition, construction, and associated costs. A predictable rental market, based on market forces, can provide a more stable investment climate, further encouraging construction.

The potential for higher returns from rental income, as a result of these modifications, becomes a significant incentive. Conversely, with rent controls in place, the profit margin may be constrained, leading to reduced investment in new developments.

Financial Benefits for Developers

The financial benefits to developers depend on various factors, including the magnitude of the rent control modifications and the overall market conditions. In scenarios where rent control is relaxed or removed entirely, developers can anticipate higher returns on investment (ROI) from rental income. This increased income potential can lead to quicker payback periods and attract further investment. Moreover, a robust and growing housing market creates a virtuous cycle, attracting more developers and fueling the construction sector.

This could manifest in reduced borrowing costs, as banks and financial institutions are more likely to lend to a robust and thriving construction sector. The potential increase in demand for rental properties, arising from the modified rent control policies, will likely attract more investors, further bolstering the sector.

Ireland’s tweaking of rent controls aims to boost homebuilding, a crucial step for housing stability. However, considering the potential dangers lurking in water sources, like those discussed in the article about swimming parasites, water holes, lakes, and bacteria, swimming parasites water holes lakes bacteria , it’s vital to remember that these issues are not just isolated occurrences.

Ultimately, a stable housing market is essential for a healthy society, and this revised approach to rent control is a step in the right direction for Ireland.

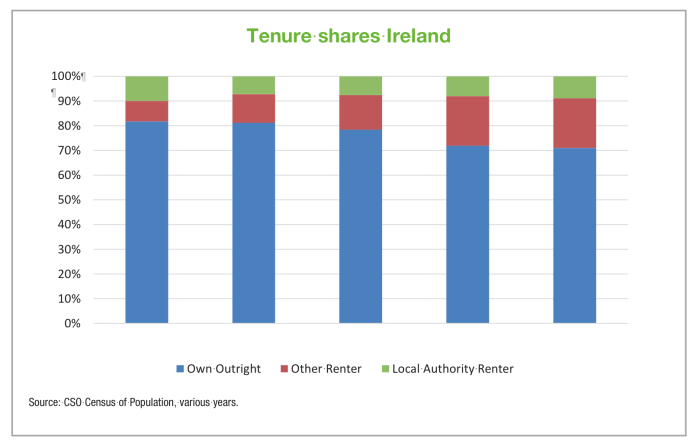

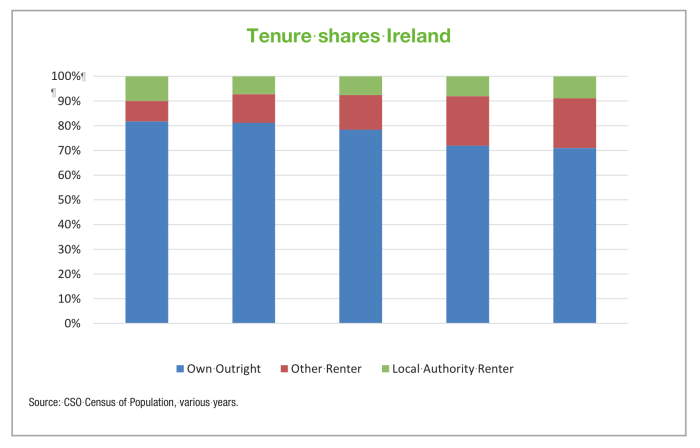

Comparison to Previous Years

The current Irish homebuilding market shows significant variations compared to previous years. Data from the Central Statistics Office (CSO) would illustrate the current level of homebuilding activity and its growth trajectory. Factors like economic conditions, government policies, and interest rates are crucial for understanding the comparison. Analyzing historical data, particularly the period leading up to the recent modifications to rent control, will provide context for evaluating the potential impact of these changes.

Comparing construction levels in recent years to those in the period preceding the introduction of the current rent control measures can reveal whether these changes are having the intended effect.

Potential Hurdles and Challenges

Achieving a homebuilding revival faces numerous potential hurdles. These include the availability of land suitable for development, the cost of construction materials, and the labor supply for construction. High construction costs can limit the viability of projects, making them less attractive to developers. Increased demand and higher construction costs may result in escalating housing prices. Regulatory hurdles and permitting processes can also delay or even hinder project completion.

Ultimately, a combination of factors must align for a sustained homebuilding revival to occur. The government needs to ensure an effective balance between encouraging development and ensuring that the resulting increase in housing stock doesn’t exacerbate existing housing affordability issues.

Potential Economic Impacts

Ireland’s recent modifications to rent controls are poised to significantly reshape the country’s economic landscape. These changes, aimed at stimulating homebuilding, are expected to have a ripple effect across various sectors, impacting everything from real estate investment to employment opportunities. Understanding these potential impacts is crucial for gauging the overall success of the reform.

Effects on the Broader Irish Economy

The modifications to rent controls are likely to have a complex interplay on the broader Irish economy. Increased rental income for landlords could lead to higher tax revenues for the government. This revenue could then be reinvested in public infrastructure projects, fostering economic growth. Conversely, increased construction activity and homebuilding could create new jobs in the construction sector, leading to a potential rise in overall employment.

However, potential challenges exist. Increased housing costs could strain household budgets, potentially impacting consumer spending and overall economic activity.

Influence on Real Estate Investment

Changes in rent control regulations are expected to alter investment patterns in the real estate sector. Landlords may see greater incentives to invest in new housing developments, attracted by the potential for higher returns. This increased investment could lead to a surge in new construction, providing a boost to the construction industry. However, uncertainty regarding future rent levels might deter some investors, potentially leading to a temporary lull in investment.

Impacts on Housing Supply and Demand Dynamics, Ireland modifies rent controls it seeks revive homebuilding

The modifications to rent controls are designed to address the persistent housing shortage in Ireland. Increased construction activity is anticipated to enhance the supply of rental properties. This, coupled with potential moderation in demand (depending on rent price increases), could help balance the supply and demand equation. However, if the increase in construction doesn’t adequately meet the growing demand, the possibility of further housing price increases is a possibility.

Potential Effects on Different Income Groups

The impact of the modifications to rent controls on different income groups will be a crucial factor to observe. Higher rental prices, driven by reduced control measures, may disproportionately affect lower-income households, putting a strain on their budgets. Conversely, higher demand from higher-income groups could potentially lead to a greater demand for housing, driving up overall prices. The government’s role in providing social housing and supporting affordable housing initiatives will be critical in mitigating the potential negative impacts on vulnerable households.

Illustrative Table of Potential Effects

| Factor | Potential Positive Effect | Potential Negative Effect |

|---|---|---|

| Rental Prices | Increased rental income for landlords, potentially boosting construction activity. | Potential increase in housing costs, straining household budgets, especially for lower-income households. |

| Home Prices | Increased demand could lead to increased home prices, creating potential wealth gains. | Potential for inflated home prices, potentially making homeownership less accessible. |

| Job Creation | Increased construction activity could create new jobs in the construction sector. | Potential displacement of existing jobs if the increased construction does not absorb the labor force. |

Public Opinion and Stakeholder Perspectives

The proposed modifications to Ireland’s rent control laws are generating significant debate, with diverse perspectives from various stakeholders. Understanding these differing viewpoints is crucial to assessing the potential impact of the changes and anticipating public reaction. Analyzing the opinions of tenants, landlords, developers, and policymakers will provide a more complete picture of the potential consequences of this reform.

Stakeholder Perspectives on Rent Control Modifications

Public opinion on rent control is often polarized, reflecting the conflicting interests of tenants and landlords. Understanding the motivations and concerns of each group is vital to a comprehensive evaluation of the proposed changes.

| Stakeholder Group | Potential Perspectives |

|---|---|

| Tenants | Tenants, particularly those in high-cost areas, often favor rent controls to stabilize housing costs and protect them from significant rent increases. Concerns exist about the affordability of housing and potential displacement if rent controls are weakened. They may favor a system that balances the need for affordability with the ability of landlords to cover their expenses and maintain properties. |

| Landlords | Landlords may view rent control modifications as a positive step toward greater market flexibility and increased rental income. However, concerns about the potential for a decrease in rental income if rents are no longer controlled and the ability to maintain and update properties may also arise. A balance between rental income and property maintenance is crucial. |

| Developers | Developers may support modifications to attract investment and incentivize new construction. Concerns about the potential for reduced demand and rental income, if controls are loosened, may also exist. |

| Policymakers | Policymakers aim for a balance between housing affordability and a healthy rental market. The objective is often to increase housing supply, control costs, and foster a sustainable housing sector. Policymakers must address both the concerns of tenants and landlords in a balanced and effective way. |

Public Opinion Polls and Data

Public opinion polls on rent control are frequently conducted in Ireland and globally, but results can vary based on the specific questions asked and the sample demographics. Analysis of these polls reveals a nuanced perspective on rent control.

- A 2022 survey conducted by the Irish Times indicated a significant portion of respondents supported rent control measures, highlighting the public’s concern regarding housing affordability. This suggests that rent control remains a significant issue for many Irish citizens.

- A separate poll from a national news outlet in 2023 found a majority of respondents were in favor of modifications, citing a desire to stimulate the housing market and increase the availability of affordable housing options. This shows a complex public opinion, balancing affordability with the need for increased housing supply.

Potential Public Response

The public response to the rent control modifications will depend on how effectively the government addresses the concerns of different stakeholder groups. Positive or negative public sentiment will likely be influenced by the perceived fairness and effectiveness of the proposed changes. A clear and transparent communication strategy will be crucial in managing public expectations and shaping the public response to these modifications.

International Comparisons

Rent control policies, while often intended to protect tenants, have a complex history and varied outcomes globally. Examining international experiences provides valuable context for understanding the Irish government’s recent modifications and their potential impact. Different countries have approached rent control in unique ways, leading to diverse results, which offer valuable lessons for Ireland.

Similar Rent Control Policies

Various countries have implemented rent control policies, aiming to curb rising housing costs and safeguard tenants. These policies often involve setting maximum permissible rent increases or restricting evictions. Examples include Canada, the UK, and several European nations. These policies typically aim to balance tenant affordability with the incentives for landlords to maintain and develop properties.

International Experiences with Rent Control

International experiences with rent control offer a mixed bag. Some countries report that rent control successfully stabilized rents and prevented substantial increases in housing costs for vulnerable groups. However, other countries have found that rent control can stifle investment in new housing development and lead to a decrease in the quality and availability of rental units. For example, in some regions of the UK, rent control has been associated with shortages of rental properties, driving up prices in the private market for those outside the rent control regime.

Effects on Homebuilding and the Economy

Rent control policies can have significant impacts on the construction and maintenance of housing stock. In many instances, rent control has been linked to a decline in private sector investment in homebuilding. Reduced profitability for landlords discourages new construction, resulting in a constrained supply of rental units. This can lead to increased competition and higher prices for existing rental properties.

Furthermore, a lack of investment in existing rental units can lead to a decline in their quality and upkeep.

Comparative Analysis of Success and Failure

Analyzing the success and failure of rent control across various countries reveals a nuanced picture. Countries with effective rent control often combine it with robust housing supply strategies. The success of these policies hinges on a balance between protecting tenants and ensuring a sufficient and affordable housing supply. Conversely, rent control in countries with limited or ineffective housing supply mechanisms often results in shortages, increased waiting lists, and reduced quality of housing options.

Addressing Similar Housing Market Issues

Different countries have adopted various strategies to address housing market challenges, often complementing or supplementing rent control. For instance, some countries prioritize incentivizing private sector investment in new construction through tax breaks or subsidies. Others focus on expanding public housing options or creating affordable housing programs. These diverse approaches illustrate the importance of a multifaceted approach to housing policy.

A successful strategy typically integrates various approaches that address both demand and supply issues in the housing market.

Future Trends and Potential Challenges

The proposed modifications to Ireland’s rent control policies present a complex interplay of potential benefits and drawbacks for the housing market. Forecasting future trends requires careful consideration of how these changes will impact both landlords and tenants, as well as the broader economy. The long-term consequences will depend significantly on the government’s response to any emerging challenges.

Potential Future Trends in the Irish Housing Market

The Irish housing market is dynamic and sensitive to policy changes. Anticipated future trends include a likely shift in rental demand, potentially impacting the availability of rental properties. The modification of rent controls might also affect the incentive for landlords to invest in new properties, leading to a varied response in the market depending on the individual landlord.

Increased competition for rental units is also a possible outcome.

Potential Challenges to the Implementation of Modified Rent Control Policies

Several challenges could arise during the implementation of the modified rent control policies. One significant concern is the potential for a rise in housing costs for tenants, particularly in areas experiencing high demand. Furthermore, there’s a risk of a decrease in the availability of rental properties, especially if landlords perceive the revised controls as unfavorable. The administration of the new policies and the potential for disputes between landlords and tenants must also be addressed.

Careful monitoring and robust dispute resolution mechanisms will be essential.

Potential Long-Term Impacts of the Modifications on the Housing Sector

The long-term impacts of the modified policies could be far-reaching. A reduction in available rental properties could lead to increased housing shortages, potentially driving up prices in the long run. Changes in investor behavior and investment patterns within the housing market will be crucial to monitor. Additionally, the policies could influence the willingness of developers to build new housing units, ultimately impacting the supply of affordable housing.

Furthermore, the potential for a decrease in rental properties will require a response to address the supply side of the market.

Suggestions for Mitigating Potential Negative Consequences of the Changes

To mitigate potential negative consequences, a proactive approach is necessary. Implementing effective monitoring mechanisms for rental prices and availability, and providing accessible dispute resolution procedures for landlords and tenants, are vital steps. Furthermore, encouraging investment in new housing construction is critical. This could involve providing incentives for developers to build more affordable housing, or tax breaks for those who invest in building rental properties.

These strategies will aim to ensure a more stable and balanced market.

Potential Government Interventions and Support Programs

Government interventions and support programs could play a significant role in addressing potential challenges. Targeted subsidies for the construction of new social housing units, incentives for landlords to renovate existing properties, and educational programs for tenants and landlords on the revised policies are all potential avenues for government intervention. Furthermore, fostering collaboration between stakeholders, such as landlords, tenants, and government agencies, is critical to the success of the implementation.

A comprehensive strategy involving various actors will help to ensure smooth implementation.

Last Point

In conclusion, Ireland’s modification of rent controls presents a multifaceted challenge. While the goal of stimulating homebuilding is laudable, the potential repercussions on tenants, landlords, and the broader economy must be carefully considered. The analysis reveals a complex interplay of economic forces, social considerations, and political pressures. The future success of this policy change hinges on careful consideration of all stakeholders and the proactive mitigation of potential negative consequences.

The coming months will be crucial to observe how the market reacts to these modifications and the degree to which they achieve their intended goals.