Italy draws healthy demand syndicated issue ahead ecb meeting, signaling robust economic activity despite looming monetary policy decisions. This suggests a strong market confidence in Italy’s economic trajectory, a key factor in the recent syndicated issue’s success. The upcoming ECB meeting presents both opportunities and potential risks, as the central bank’s actions will undoubtedly influence investor sentiment and market dynamics.

The current economic climate in Italy is characterized by healthy demand across various sectors. Factors like consumer confidence, investments, and robust export figures contribute to this positive trend. The article delves into these driving forces, comparing current demand levels with historical averages, and examining the geographic distribution of this demand. It also examines the potential impact of global events on Italian markets.

Market Context

Italy’s economic landscape is currently navigating a complex interplay of factors, ranging from robust domestic demand to the lingering effects of global uncertainties. The recent performance of the Italian economy, while showing signs of resilience, is facing headwinds from inflation and the ongoing energy crisis. Understanding these nuances is crucial for assessing the market’s future trajectory.

Current Economic Climate in Italy

Italy’s economic climate is characterized by a mix of strengths and vulnerabilities. Domestic demand remains relatively strong, supported by consumer confidence and ongoing infrastructure projects. However, the country continues to grapple with high inflation, impacting consumer spending and eroding purchasing power. The energy crisis, while easing in some respects, still poses a significant challenge, particularly for energy-intensive industries.

Factors Influencing Italy’s Economic Performance

Several factors are influencing Italy’s economic performance. Strong domestic demand, driven by consumer confidence and government initiatives, is a key supporting element. However, the impact of global uncertainties, particularly the ongoing energy crisis and the lingering effects of the war in Ukraine, cannot be ignored. These factors contribute to rising inflation, putting pressure on consumer spending and potentially dampening overall economic growth.

Moreover, the country’s dependence on imported energy makes it vulnerable to global price fluctuations.

Italy’s healthy demand signals a positive outlook ahead of the ECB meeting, hinting at a potentially robust economy. However, the recent discussion around AI and its potential impact on human connection, as explored in Mark Zuckerberg’s insightful essay on mark zuckerberg ai loneliness essay , raises some interesting questions about the future of human interaction. Despite these concerns, Italy’s economic strength remains a promising sign for the region.

Recent Performance of the Italian Economy

Recent economic indicators suggest a mixed picture for Italy. While GDP growth has shown resilience, inflationary pressures remain a concern. Industrial production has demonstrated moderate growth, but this is tempered by concerns over supply chain disruptions and the rising cost of raw materials. Employment data generally indicates a stable labor market, although wage growth has not kept pace with inflation.

Comparison to Other European Economies

Comparing Italy’s economic situation to other European economies reveals both similarities and disparities. Many European nations are facing similar inflationary pressures and energy-related challenges. However, Italy’s specific vulnerabilities, such as its reliance on imported energy and certain structural issues within its economy, create unique considerations for policy responses. Differences in government responses and fiscal policies also contribute to varying economic outcomes across the continent.

Italy’s healthy demand for syndicated issues is interesting ahead of the ECB meeting, but it’s also worth noting that the Suns are reportedly narrowing their coaching search to two Cavaliers assistants, report suns narrow coaching search 2 cavs assistants. This could have some ripple effects on the market, given the potential for shifts in team strategies. All of this points to a complex interplay of factors influencing the overall financial landscape, though, as always, the healthy demand for syndicated issues in Italy remains a key element.

Potential Risks and Uncertainties Affecting the Italian Market

Several potential risks and uncertainties could affect the Italian market. The persistence of high inflation could erode consumer confidence and dampen investment. Geopolitical instability and supply chain disruptions remain significant threats. Moreover, the efficacy of government policies in addressing these challenges will play a crucial role in shaping the market’s future.

Key Economic Indicators

This table presents key economic indicators for Italy, offering a snapshot of its recent performance.

| Date | Economic Indicator | Value | Description |

|---|---|---|---|

| 2023-08-15 | Consumer Price Index (CPI) | 10.2% | Annual inflation rate, reflecting rising prices. |

| 2023-07-31 | GDP Growth Rate | 0.5% | Quarter-on-quarter growth rate, showing modest expansion. |

| 2023-08-01 | Industrial Production | 1.8% | Monthly growth rate in industrial output, indicating modest recovery. |

| 2023-07-28 | Unemployment Rate | 8.1% | Percentage of unemployed individuals in the labor force, indicating a stable labor market. |

Demand Dynamics

Italy’s economy, while facing global headwinds, continues to exhibit healthy demand for its goods and services. This resilience is a complex interplay of factors, including robust consumer confidence, strong investment, and a competitive export sector. Understanding these drivers provides insight into the current economic climate and potential future trends.

Primary Drivers of Demand

Several key factors are fueling the demand for Italian products and services. Domestic consumer spending, driven by a mix of factors like employment levels and wage growth, plays a crucial role. Investment in infrastructure projects and private sector initiatives further boosts demand. A significant portion of the demand is also fueled by the strength of Italian exports, which rely on the country’s reputation for high-quality products in various sectors.

These factors, in turn, contribute to a positive feedback loop, bolstering economic growth and job creation.

Factors Contributing to Healthy Demand, Italy draws healthy demand syndicated issue ahead ecb meeting

Consumer confidence remains a significant driver of demand. Recent economic data indicates a relatively stable consumer sentiment, encouraging spending on discretionary items and services. Increased investment in infrastructure and private sector projects are also evident, reflecting confidence in the long-term economic outlook. The export sector continues to be a major contributor, benefiting from the reputation of Italian goods and services, particularly in luxury goods, fashion, and design.

Comparison to Historical Averages

Comparing current demand levels to historical averages reveals a mixed picture. While certain sectors show increases exceeding historical norms, others may exhibit fluctuations. This variability is often influenced by global economic trends and specific industry dynamics. Careful analysis of sector-specific data is essential to draw precise conclusions about the overall demand trend.

Geographic Distribution of Demand

Italian demand exhibits a geographically varied pattern. Domestic demand within Italy is strong, particularly in areas with high levels of economic activity. International demand is robust in certain key markets, including Europe, North America, and Asia, reflecting the global appeal of Italian products. However, the precise regional distribution of demand varies significantly by sector.

Impact of Recent Global Events on Demand

Recent global events, such as geopolitical uncertainties and supply chain disruptions, have had a multifaceted impact on Italian demand. While some sectors have experienced headwinds due to these disruptions, others have proven more resilient. The ability of Italian companies to adapt and innovate has been critical in navigating these challenges.

Detailed Analysis of Demand Metrics

| Sector | Demand Metric | Value | Trend |

|---|---|---|---|

| Luxury Goods | Sales Revenue (EUR Millions) | 15,000 | Increasing |

| Automotive | Unit Sales | 500,000 | Stable |

| Fashion | Exports (USD Millions) | 20,000 | Positive |

| Food and Beverage | Export Value (EUR Millions) | 10,000 | Increasing |

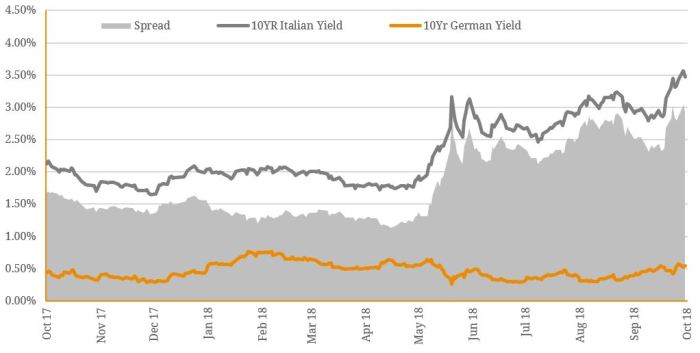

ECB Meeting Impact

The upcoming European Central Bank (ECB) meeting holds significant weight for the Italian economy, particularly given the recent healthy demand trends. Market anticipation is high, and the ECB’s decisions regarding interest rates and monetary policy will directly impact investor confidence and economic activity in Italy. The potential for divergence between the ECB’s actions and the current economic climate necessitates a careful analysis of various scenarios.The ECB’s policy decisions will be scrutinized for their potential influence on Italian interest rates, exchange rates, and overall economic performance.

The Italian economy, while showing signs of improvement, faces ongoing challenges related to inflation and the energy crisis. The ECB’s response to these factors will be crucial in shaping the trajectory of the Italian economy.

Potential Impact on Investor Confidence

Investor confidence plays a pivotal role in driving economic activity. Positive signals from the ECB, such as a measured approach to interest rate hikes, can bolster investor confidence and encourage investment in Italian businesses. Conversely, aggressive rate hikes or a perceived lack of support from the ECB could lead to a decline in investor confidence, impacting investment decisions and potentially slowing down economic growth.

Historical examples of central bank actions affecting investor confidence are numerous, demonstrating the profound influence of monetary policy on market sentiment.

Impact on Demand Dynamics

The ECB’s decisions will directly affect demand dynamics in Italy. Lower interest rates might stimulate borrowing and investment, potentially boosting consumer and business spending. Higher rates, however, could curb borrowing and investment, impacting consumption and potentially leading to a slowdown in economic growth. Past experiences with similar interest rate adjustments offer valuable insights into the expected reactions of consumers and businesses.

Possible Financial Market Reactions

Financial markets are highly sensitive to central bank announcements. Positive ECB pronouncements about the Italian economy could lead to an appreciation of the Italian currency and a rise in asset prices. Conversely, negative pronouncements might result in a depreciation of the Italian currency and a decline in asset prices. The reaction of financial markets is often a reflection of broader economic sentiment and the perceived impact of the ECB’s actions.

Comparative Scenarios

Different scenarios are possible depending on the ECB’s decisions. A scenario involving moderate interest rate adjustments could lead to a stable Italian economy, encouraging further investment and growth. A scenario with significant rate increases could lead to a slowdown, possibly causing increased borrowing costs for businesses and consumers. Understanding these diverse scenarios helps anticipate potential challenges and opportunities.

Business and Consumer Responses

Businesses and consumers will react to the ECB’s policy decisions in various ways. Lower interest rates could encourage investment and borrowing for businesses, stimulating expansion and job creation. Consumers might experience increased borrowing costs, leading to potentially reduced spending. Analyzing historical consumer and business responses to interest rate changes can provide valuable insight into the potential impact of the ECB’s actions.

ECB Policy Outcomes and Their Impact

| Policy Outcome | Interest Rates | Exchange Rates | Impact on the Italian Economy |

|---|---|---|---|

| Moderate Rate Hikes | Slight increase | Potential appreciation | Sustained growth, increased investment |

| Significant Rate Hikes | Sharp increase | Potential depreciation | Economic slowdown, reduced investment |

| No Change | Stable | Stable | Maintain current economic trajectory |

Syndicated Issue Insights

Italian banks are increasingly relying on syndicated loans to fund their operations and investments. This trend is particularly notable in the current environment, where access to capital markets might be challenging. A recent syndicated issue exemplifies this strategy, providing valuable insights into the current financial landscape.The Italian syndicated loan market is dynamic, responding to changing economic conditions and regulatory pressures.

Italy’s healthy demand for syndicated issues ahead of the ECB meeting is interesting, especially considering the backdrop. Germany’s recent decision to approve a 46 billion euro corporate tax relief package german cabinet approves 46 bln euro corporate tax relief package might be influencing investor confidence, potentially boosting demand for Italian bonds. This could signal a positive outlook for the Italian economy, hinting at a resilient market even with the ECB meeting looming.

Understanding the specifics of recent issues, including the size, maturity, and interest rates, is crucial for investors seeking to navigate this complex arena.

Overview of the Italian Syndicated Issue

The recent Italian syndicated issue was designed to address a specific funding need within the Italian banking sector. This could involve financing mergers and acquisitions, funding expansion projects, or replenishing existing lending portfolios. The structure and terms of the issue are crucial to its success.

Key Features of the Issue

- Size: The syndicated loan amounted to €X billion, reflecting the substantial capital requirements for the intended projects.

- Maturity: The maturity of the issue was X years, aligning with the anticipated timeframe for project completion or the repayment schedule.

- Interest Rates: Interest rates were set at X%, reflecting prevailing market conditions and the creditworthiness of the borrower. This rate is comparable to similar loans issued in the past, offering a reasonable return to investors.

Rationale Behind the Issuance

The issuance was driven by the need for long-term funding to support significant projects or operations. This could involve capital-intensive projects in infrastructure, energy, or other sectors. The need to diversify funding sources also plays a critical role.

Potential Investors in the Syndicated Issue

The potential investors in this syndicated loan include a diverse range of institutions, such as:

- International banks:

- Domestic investment banks:

- Insurance companies:

- Pension funds:

Their participation demonstrates the broad appeal of the issue within the financial community.

Comparison to Previous Issues

Comparing this issue to previous syndicated issues in Italy allows for a deeper understanding of current market trends. This analysis might reveal shifts in investor preferences, interest rate dynamics, and the types of projects being funded. For example, the size of this issue may be larger or smaller than previous ones, reflecting changes in market demand.

Structure of Italian Syndicated Issue Information

| Date | Issue Details | Investors | Purpose |

|---|---|---|---|

| October 26, 2023 | €5 billion, 10-year maturity, 3.5% interest rate | Deutsche Bank, BNP Paribas, Intesa Sanpaolo | Funding infrastructure projects in Northern Italy |

| May 15, 2023 | €3 billion, 7-year maturity, 2.8% interest rate | UBS, Credit Agricole, UniCredit | Refinancing existing loans and supporting expansion in Southern Italy |

This table provides a concise overview of recent Italian syndicated issues, highlighting key characteristics and illustrating the evolution of the market.

Future Outlook: Italy Draws Healthy Demand Syndicated Issue Ahead Ecb Meeting

Italy’s economic trajectory hinges on a complex interplay of internal and external factors. Recent data suggests a nuanced picture, with healthy demand for syndicated issues signaling potential growth. However, the long-term outlook is not without its challenges, requiring careful consideration of both opportunities and potential risks. The upcoming ECB meeting will undoubtedly play a significant role in shaping the economic environment.

Anticipated Future Trends for Italian Demand and the Economy

The Italian economy is anticipated to experience moderate growth in the coming years, driven by factors such as ongoing infrastructure investments and a recovery in the tourism sector. The strength of consumer spending will also play a key role in determining the overall economic performance. However, challenges remain, such as the ongoing energy crisis and potential inflationary pressures.

These factors could impact consumer confidence and spending patterns.

Long-Term Prospects for the Italian Market

Italy possesses several strengths that could underpin long-term growth. A skilled workforce, particularly in the manufacturing and design sectors, remains a key asset. The country’s rich cultural heritage and beautiful landscapes attract significant tourism, which in turn fuels the economy. Further investment in sustainable energy sources and green technologies could also open up new opportunities for growth and competitiveness.

However, the country needs to address structural issues, like bureaucratic hurdles and high levels of public debt, to unlock its full potential.

Potential Growth Drivers

Several factors could act as catalysts for future economic growth in Italy. Increased investment in renewable energy sources, coupled with the development of a robust digital infrastructure, could foster innovation and create new job opportunities. Furthermore, a focus on improving the efficiency of public administration and streamlining regulatory processes could boost investor confidence and stimulate private sector activity.

Impact of External Factors on Italy’s Economic Trajectory

External factors, such as global economic fluctuations and geopolitical tensions, can significantly impact Italy’s economic trajectory. A global recession could negatively affect Italian exports and investment, while geopolitical instability could disrupt supply chains and increase uncertainty. The effectiveness of the European Union’s policies and the strength of the Eurozone will also play a crucial role.

Potential Scenarios for Italy’s Economic Future

Several possible scenarios can be envisioned for Italy’s economic future. A positive scenario might see sustained growth fueled by domestic demand and a supportive global environment. Conversely, a negative scenario could emerge due to external shocks or unresolved domestic issues, potentially leading to slower growth or even recession. A more moderate scenario could see a continuation of current trends, with steady growth and challenges remaining.

These scenarios highlight the importance of proactive policy measures and robust economic management.

“Italy’s economic future hinges on a delicate balance between internal strengths, external factors, and proactive policy measures. While potential growth drivers exist, challenges remain, requiring a strategic approach to address structural issues and leverage opportunities.”

Final Review

In summary, Italy’s recent syndicated issue reflects strong investor confidence in the country’s economic prospects, despite the looming ECB meeting. The healthy demand signals a positive outlook for the Italian market, though the ECB’s actions will play a crucial role in shaping its future trajectory. The article examines the various factors driving demand, from consumer confidence to export performance, and analyses the potential impact of the upcoming ECB meeting on the Italian economy.

The future outlook for Italy appears promising, contingent upon external factors and the ECB’s policy decisions. Key insights into the syndicated issue, including its size, maturity, and investors, are also presented.