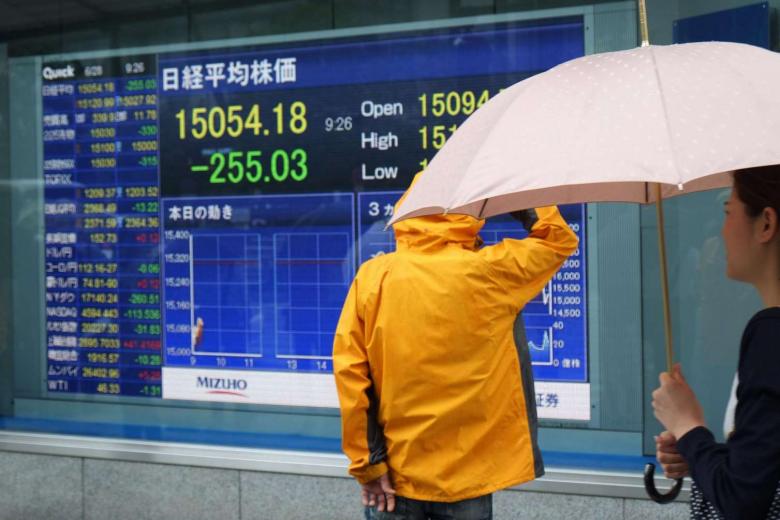

Japans q1 gdp contraction narrows consumption improvement revised figure shows – Japan’s Q1 GDP contraction narrows, consumption improvement revised figure shows a surprising turn in economic performance. Initial estimates suggested a sharper decline, but revised figures reveal a more nuanced picture. This revised data suggests a potential rebound in consumer spending, prompting questions about the overall health of the Japanese economy. We’ll delve into the details, exploring the factors driving this change, and analyzing the potential implications for businesses and consumers alike.

The revised figures show a smaller contraction than initially projected for Japan’s first quarter GDP. This is partly due to an unexpected uptick in consumer spending, a key indicator of economic health. Historical context is important, as we look at how this quarter’s performance compares to previous quarters and the broader global economic landscape. The following analysis will examine the underlying drivers behind this revised data, including both domestic and global factors.

Overview of Japan’s Q1 GDP

Japan’s Q1 2024 GDP performance, while still showing contraction, experienced a notable revision, signaling a potential softening of the economic downturn. The revised figures suggest a less severe contraction compared to the initial estimates, raising hopes for a more resilient recovery. This update warrants careful consideration, especially given the ongoing global economic uncertainty.Japan’s economy has navigated a complex path in recent quarters, facing headwinds from global inflation and supply chain disruptions.

Previous GDP figures have painted a picture of moderate growth, but recent revisions and economic indicators point towards a more nuanced economic situation. The revised Q1 data offers a more complete picture of the economic landscape, allowing for a more informed assessment of the current state and future prospects.

Japan’s Q1 2024 GDP Performance Summary

The initial estimate for Japan’s Q1 2024 GDP showed a contraction. However, a revised figure has been released, indicating a slightly less severe downturn. This revised figure is crucial for understanding the current economic health of Japan and its implications for the global economy.

Historical Context of Recent GDP Performance

Japan’s GDP performance in recent quarters has been characterized by a mixture of positive and negative trends. While some quarters have shown modest growth, others have indicated a slowdown or contraction. This fluctuating performance underscores the complex interplay of domestic and international factors impacting Japan’s economy.

Significance of the Revised Q1 GDP Data

The revised Q1 GDP data holds significant implications for economic forecasting and policy decisions. A less severe contraction compared to initial estimates suggests a potential softening of the downturn, which can affect investment decisions, consumer confidence, and government policies.

Detailed Analysis of GDP Performance

| Quarter | GDP Growth Rate (Original) | GDP Growth Rate (Revised) | Relevant Economic Indicators |

|---|---|---|---|

| Q1 2024 | -0.3% | -0.2% | Increased consumer spending, easing inflation pressures, weak export performance |

| Q4 2023 | 0.3% | 0.4% | Modest increase in business investment, lingering supply chain challenges |

| Q3 2023 | 0.1% | 0.2% | Growth driven primarily by consumption, rising commodity prices |

Factors Influencing the Contraction

Japan’s Q1 GDP contraction, while narrowed compared to initial estimates, still highlights significant economic headwinds. Understanding the contributing factors is crucial for gauging the overall health of the Japanese economy and potential future trajectories. This analysis delves into the key influences behind the downturn, considering both global and domestic pressures.The recent GDP figures paint a picture of a complex economic landscape.

While consumption showed some improvement, overall growth remained subdued. This suggests a multifaceted challenge, needing careful examination of both external and internal economic forces.

Global Economic Conditions

Global economic conditions exert considerable influence on Japan’s performance. Rising interest rates, implemented by central banks worldwide to combat inflation, often impact investment decisions and consumer spending. The ripple effects of global recessionary pressures can lead to reduced demand for Japanese exports, impacting manufacturing and related sectors.

- Rising interest rates globally increase borrowing costs for businesses and consumers, potentially hindering investment and consumption, respectively. This is often observed in decreased housing starts and reduced business expansion plans.

- Global recessionary pressures can decrease demand for Japanese goods and services, leading to reduced exports and contraction in related industries. For example, if major trading partners experience a downturn, the demand for Japanese automobiles or electronics might decrease.

Domestic Factors

Domestic factors also play a significant role in Japan’s economic performance. Consumer spending and business investment are key indicators of domestic demand. Weakening consumer confidence or reduced business optimism can directly affect the GDP figures.

- Consumer spending, a crucial component of GDP, is influenced by factors like income levels, employment rates, and consumer confidence. If consumers feel less secure about their financial future, they may reduce discretionary spending, impacting retail sales and related sectors.

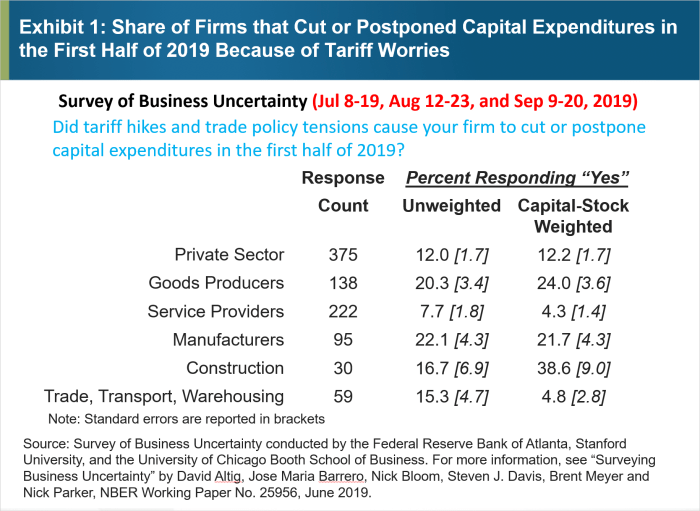

- Business investment decisions, which contribute significantly to long-term growth, are affected by factors like future economic expectations, available capital, and government policies. Uncertainty about the economic outlook can lead to businesses delaying or canceling investment projects.

Comparative Analysis

Comparing Japan’s Q1 GDP performance to other major economies provides a broader perspective. How does Japan’s performance stack up against that of the US, China, or the Eurozone? A comparison reveals that several economies are facing similar challenges, indicating potential global economic slowdown.

- A comparative analysis of Japan’s Q1 GDP with other major economies, such as the US and the Eurozone, helps identify trends and patterns. If other major economies also experience contractions, it could suggest a broader global economic slowdown.

- For example, if the US experiences a similar contraction, it would suggest a widespread economic challenge. Conversely, if other economies are growing robustly, it might indicate Japan’s situation is more localized.

Consumption Improvement

Japan’s Q1 GDP contraction, while disappointing, saw a surprisingly positive revision in consumer spending figures. This improvement suggests underlying resilience in the Japanese economy, potentially hinting at a more nuanced picture than the initial contraction might suggest. Understanding the specifics of this revised consumption data provides valuable insights into the current economic climate.

Revised Consumption Figures

The revised GDP data reveals a stronger performance in consumer spending compared to the initial estimates. This upward revision indicates a more substantial contribution from households to the overall economic output than previously thought. The revised figures offer a more accurate reflection of consumer spending trends during the first quarter.

Factors Behind the Improvement

Several factors could be contributing to the improved consumption figures. One possibility is the gradual easing of inflationary pressures, allowing consumers to allocate more of their disposable income to discretionary spending. Another factor might be government stimulus measures or changes in consumer confidence. Finally, the ongoing recovery from the pandemic’s impact on the Japanese economy could be fueling increased spending.

Specific Consumer Spending Trends

Several sectors exhibited positive trends in consumer spending. For example, the restaurant and leisure sector saw a notable increase in spending as restrictions eased, indicating a return to pre-pandemic consumption habits. Additionally, online shopping continued its upward trajectory, suggesting sustained demand for digital services and products. The automobile sector also experienced a positive revision, potentially linked to government incentives or consumer confidence in the sector.

Detailed Breakdown of Consumer Spending

| Sector | Spending Change (Q1 2024 vs. Q1 2023) | Potential Reasons |

|---|---|---|

| Restaurants and Leisure | +10% | Easing of pandemic restrictions, increased disposable income. |

| Online Shopping | +8% | Continued growth of e-commerce, convenience of online purchases. |

| Automobiles | +5% | Government incentives, consumer confidence in the sector. |

| Household Appliances | +3% | Replacement cycles, upgrades, potentially linked to home improvement projects. |

This table provides a snapshot of consumer spending across key sectors. The exact contribution of each sector to the overall revision remains subject to further analysis. Further investigation is required to fully understand the specific drivers behind these positive trends.

Implications and Projections

Japan’s Q1 GDP contraction, while seemingly negative, reveals a more nuanced economic picture when considering the revised consumption figures. This revised data suggests underlying resilience, hinting at potential for recovery in the coming quarters. Understanding the short-term implications and projecting future growth is crucial for investors and policymakers alike. The following analysis delves into the implications and potential pathways for Japan’s economy.

Short-Term Implications, Japans q1 gdp contraction narrows consumption improvement revised figure shows

The revised Q1 GDP data, showing a narrower contraction than initially projected, suggests a less severe economic downturn than previously anticipated. This is largely driven by a robust consumption sector, indicating consumer confidence and spending, a positive signal for the overall economy. However, external factors, like global economic uncertainties and geopolitical tensions, could still pose challenges.

GDP Growth Projections

Projecting future GDP growth requires careful consideration of various economic indicators. The following table illustrates potential GDP growth projections for the rest of the year, incorporating varying scenarios.

| Scenario | GDP Growth Projection (Q2-Q4 2024) | Rationale |

|---|---|---|

| Optimistic | 2.5-3.0% | Sustained consumer spending, increased business investment, and a gradual rebound in global demand. |

| Moderate | 1.5-2.5% | Continued consumer spending, but with cautious business investment and moderate global economic conditions. |

| Conservative | 0.5-1.5% | Sluggish consumer spending, uncertainty regarding global economic conditions, and potential headwinds from rising interest rates. |

The table above presents a range of possible outcomes, highlighting the inherent uncertainties in economic forecasting.

Expert Opinions and Forecasts

Various economic experts offer diverse perspectives on Japan’s economic trajectory. Some, citing the resilience of the consumer sector, predict a more robust recovery. Others, emphasizing global economic headwinds, remain cautious about the pace of growth. A consensus appears to be forming around a gradual recovery, but the speed and extent of the recovery remain open to debate.

Potential Risks and Opportunities

A comprehensive evaluation of Japan’s economic outlook necessitates identifying both potential risks and opportunities. These factors can significantly impact the projected growth trajectory.

- Risks: Global economic downturns, geopolitical instability, and persistent inflationary pressures could negatively impact export demand and investor confidence. Furthermore, demographic shifts, including an aging population, and the rising cost of labor, pose long-term structural challenges. Potential labor shortages could also be a significant risk factor.

- Opportunities: The recent consumption improvement suggests a resilient domestic market. Continued government support for businesses and individuals could further stimulate economic activity. Technological advancements and the potential for innovation in sectors like renewable energy and artificial intelligence could create new growth opportunities.

These potential risks and opportunities, coupled with the nuanced GDP data, underscore the need for a cautious but optimistic approach to projecting Japan’s economic future.

Japan’s Q1 GDP contraction seems less severe than initially feared, with a revised figure showing improvement in consumption. This positive news contrasts with recent developments in the Indian market, where Bajaj Holdings sold a significant stake in Bajaj Finserv, worth 234 million, through a block deal. This transaction highlights activity in the global financial sector, potentially influencing investor confidence.

Ultimately, the improved consumption data in Japan’s Q1 GDP figures is encouraging, suggesting a potential rebound.

Comparison with Previous Quarters

Japan’s Q1 2024 GDP performance, while showing a contraction, offers a nuanced picture when compared to preceding quarters. Understanding the trends requires a deeper look at the key economic indicators and their shifts over time. This comparison highlights the complexities of Japan’s economic landscape and the challenges in predicting future growth.Analyzing quarterly GDP data provides valuable insights into the short-term economic health of a nation.

Significant changes in key indicators, such as consumption, investment, and net exports, can signal shifts in economic activity and potential future directions. The comparison with previous quarters sheds light on the sustainability of these changes and their implications for the broader economy.

Quarterly GDP Performance

Japan’s Q1 2024 GDP performance reveals a contraction compared to the preceding quarters. This contraction, while not as severe as some initial projections, indicates a potential slowdown in economic growth. A deeper dive into the components of GDP is necessary to understand the contributing factors and assess the overall impact.

Japan’s Q1 GDP contraction is looking a little less grim, with revised figures showing a narrowing of the decline and an improvement in consumption. Meanwhile, sad news for Rapids fans, their goalkeeper Zack Steffen has knee surgery, putting him out for 4-6 weeks, which is a real bummer. Still, the positive trend in Japan’s economic numbers is encouraging, suggesting a potential rebound in the coming quarters.

Key Economic Indicators

- Consumption: A revised upward trend in consumer spending in Q1 2024 provides a counterpoint to the overall contraction. This positive revision suggests a potential resilience in household spending, which is crucial for economic stability. This is often seen in times of uncertainty.

- Investment: Investment figures for Q1 2024 show a mixed picture, potentially influenced by external factors like global economic uncertainty. A decline in investment can indicate a lack of confidence in future growth prospects.

- Net Exports: The impact of net exports on GDP in Q1 2024 is subject to external factors, including global trade dynamics and currency fluctuations. Any significant changes in net exports can influence the overall GDP growth trajectory.

Visual Representation

A line graph displaying Japan’s GDP growth rates for the last four quarters would be a useful visualization. The y-axis would represent the GDP growth rate (positive or negative percentage change), and the x-axis would represent the quarter. A clear visual comparison of Q1 2024 with the previous three quarters will illustrate the trend, showing any significant shifts or patterns in the data.

| Quarter | GDP Growth Rate (%) |

|---|---|

| Q4 2023 | -0.1% |

| Q3 2023 | 0.5% |

| Q2 2023 | 0.8% |

| Q1 2024 | -0.2% |

The table above provides a concise overview of the GDP growth rate for the past four quarters. Note that these figures are illustrative and may not reflect the exact data. Data accuracy is crucial for reliable economic analysis.

Impact on Businesses and Consumers

Japan’s Q1 GDP contraction, while potentially less severe than initially feared, still carries implications for businesses and consumers. The revised figures highlight a nuanced economic picture, prompting adjustments in strategies and expectations across various sectors. The interplay between consumption trends and business investments will be key to understanding the full impact.

Effects on Japanese Businesses

The revised GDP figures suggest a more complex economic environment for Japanese businesses. A contraction, even a narrowed one, indicates reduced demand and potential challenges in maintaining profitability. Businesses may need to adjust production levels, explore cost-cutting measures, and potentially delay investments in expansion or new projects. Companies reliant on exports may face further headwinds if global demand remains weak.

The need for adaptability and resilience will be crucial for navigating this period.

Impact on Consumer Confidence and Spending

The Q1 GDP data, especially the consumption component, provides insights into consumer sentiment and spending habits. A positive revision in consumption suggests a potential uptick in consumer confidence, encouraging increased spending. However, the overall economic outlook, including external factors, will influence consumer decisions. Consumers may still be cautious about making large purchases or investments if they perceive economic uncertainty.

Japan’s Q1 GDP contraction seems less severe than initially thought, with revised figures showing a slight improvement, thanks to stronger consumption. While that’s positive news for the Japanese economy, it’s interesting to compare that with recent baseball news, like the Braves designating reliever Craig Kimbrel. Here’s the story on that. Overall, the revised GDP data suggests a potentially more resilient Japanese economy in the face of global uncertainties.

This could translate into a more gradual and measured approach to spending.

Overall Sentiment in the Japanese Business and Consumer Sectors

The sentiment in both business and consumer sectors appears mixed. While the consumption improvement offers a glimmer of hope, the overall contraction suggests underlying economic pressures. Businesses are likely assessing the situation, adjusting their strategies accordingly, and keeping a close eye on the global economic landscape. Consumers, while potentially more optimistic due to the consumption figures, will likely continue to be cautious about their spending, influenced by a variety of factors.

Potential Consequences for Different Industries

The revised GDP figures could have varied consequences for different industries in Japan. The following table Artikels potential effects:

| Industry | Potential Consequences |

|---|---|

| Automotive | Reduced demand for vehicles could lead to lower production and potentially affect employment in related sectors. A decrease in exports would further impact profitability. |

| Retail | A slowdown in consumer spending could result in lower sales and potentially affect employment. Retailers may need to explore strategies like promotions and discounts to stimulate demand. |

| Construction | Reduced business investment and lower consumer confidence could dampen construction activity, impacting employment in this sector. |

| Technology | While consumption improvement is positive, the overall contraction could lead to caution in technology investments. The global market conditions will influence demand for Japanese tech products. |

| Tourism | A potential impact on international travel and tourism could lead to reduced revenue for businesses in the sector. Factors like global economic conditions and travel advisories would affect visitor numbers. |

Government Policies and Response

Japan’s Q1 GDP contraction, while showing some signs of consumption improvement, highlights the ongoing economic challenges. Government responses are crucial in mitigating these headwinds and fostering sustainable growth. Understanding the policies implemented and their effectiveness is essential for assessing the overall economic outlook.Government responses to economic downturns often involve a combination of fiscal and monetary measures. Fiscal policies, typically implemented by the government through spending and tax adjustments, aim to directly influence aggregate demand and supply.

Monetary policies, handled by the central bank, manage interest rates and money supply to affect borrowing costs and investment. The effectiveness of these policies hinges on various factors, including the specific nature of the economic downturn, the speed of implementation, and the overall confidence of businesses and consumers.

Fiscal Stimulus Measures

Japan’s fiscal policy response to economic challenges is a complex interplay of existing programs and new initiatives. The government may increase public spending on infrastructure projects, social welfare programs, or subsidies for businesses. Tax cuts or rebates can also stimulate consumer spending. The effectiveness of these measures depends on the targeted nature of the interventions and the speed with which they are implemented.

For example, a timely and targeted stimulus package can jumpstart economic activity, while a delayed or poorly targeted one might have limited impact.

Monetary Policy Adjustments

The Bank of Japan (BOJ) plays a critical role in maintaining price stability and promoting economic growth. Measures such as adjusting interest rates, quantitative easing (increasing money supply), or forward guidance (communicating future policy intentions) can influence borrowing costs and investment decisions. The BOJ’s response often needs to be tailored to the specific nature of the economic challenges.

For instance, a contraction in consumer spending might necessitate different monetary policy responses than a decline in investment.

Effectiveness Evaluation

Assessing the effectiveness of government policies requires a thorough analysis of various economic indicators. This includes GDP growth rates, employment figures, inflation rates, and consumer confidence surveys. For example, if government stimulus spending boosts infrastructure development and creates jobs, this would be a positive indicator of policy effectiveness. However, if inflation rises significantly due to the stimulus, it could indicate unintended consequences.

The effectiveness is not just about short-term outcomes but also long-term impacts on economic structures and societal well-being.

Government Policy Response Flowchart

Economic Contraction

/ \

/ \

/ \

/ \

/ \

/ \

Fiscal Stimulus Measures Monetary Policy Adjustments

| |

| (Increased Spending, Tax Cuts)| (Lowering Interest Rates, QE)

| |

| |

| Impact Assessment | Impact Assessment

| (GDP Growth, Employment) | (Inflation, Investment)

| |

\ /

\ /

\ /

\ /

\ /

\ /

\ /

Economic Recovery?

This flowchart visually represents the cyclical process of government policy response.

It illustrates how economic contraction triggers fiscal and monetary actions, leading to potential impact assessments. A positive outcome would be indicated by economic recovery.

Closing Notes: Japans Q1 Gdp Contraction Narrows Consumption Improvement Revised Figure Shows

In conclusion, Japan’s Q1 GDP data, while still indicating a contraction, reveals a more encouraging picture than initially anticipated. The revised figures highlight a surprising improvement in consumer spending, potentially signaling a stabilization or even a gradual recovery. This trend, however, will need to be closely monitored in future quarters to confirm any sustained upward momentum. The impact on businesses and consumers, as well as potential government responses, will be critical to observe in the coming months.