LyondellBasell talks sell some European assets aequita, raising eyebrows in the chemical industry. This potential divestment of key European holdings signals a strategic shift, likely driven by a complex interplay of economic factors and internal restructuring. Understanding the motivations behind this move and the potential impact on the industry is crucial.

The company’s history in Europe, its current portfolio of assets, and the potential buyers will all play a significant role in the outcome. This blog post will explore the potential motivations, the role of Aequita, and the broader implications for LyondellBasell and the European chemical market.

Background of LyondellBasell and European Assets

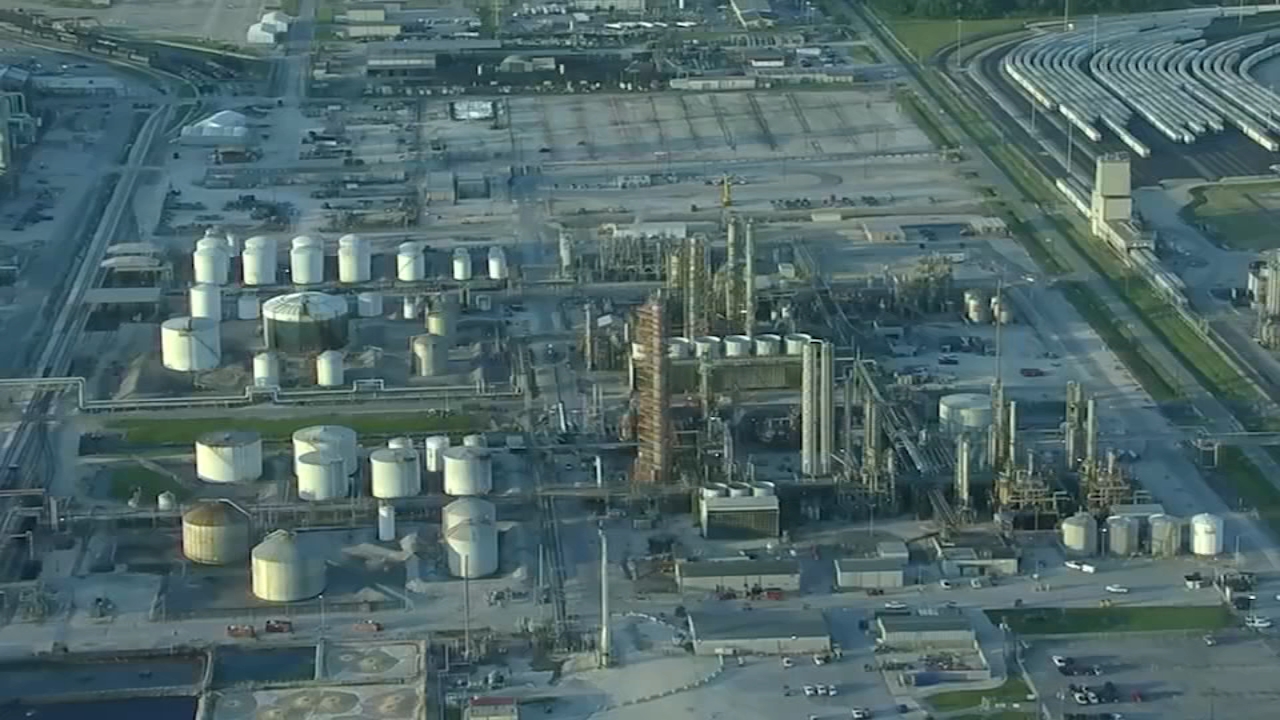

LyondellBasell Industries Holdings N.V. is a global chemical company involved in the production of plastics, chemicals, and polymers. Founded through the merger of Lyondell and Basell in 2016, the company has a rich history in the industry, with roots stretching back decades. This merger significantly expanded the company’s global footprint and capabilities, making it a major player in the global chemical market.LyondellBasell maintains a substantial presence in Europe, with strategically important assets contributing significantly to its global operations.

The company’s European operations are not merely geographically dispersed; they represent a crucial component of its overall production and distribution network, enabling it to serve key European markets and support its global customers.

LyondellBasell’s History and European Operations

LyondellBasell’s history encompasses significant milestones in the chemical industry. The integration of Lyondell and Basell in 2016 created a powerhouse in the global petrochemical industry, with a vast array of production facilities and distribution networks. The company’s focus on innovation and sustainability has shaped its operations and positioned it as a leader in the sector. This global reach extends into Europe, where the company has a longstanding history of operations.

Portfolio of European Assets

LyondellBasell’s European assets span a range of industries, from petrochemical production to polymer processing. The company’s presence in Europe is multifaceted, with operations spread across several countries, providing access to key markets and raw materials.

| Asset Type | Location | Brief Description |

|---|---|---|

| Petrochemical Plants | Various locations across Western Europe (e.g., Germany, Italy, Netherlands) | These facilities produce ethylene, propylene, and other essential petrochemical feedstocks, vital for downstream polymer production. |

| Polymer Processing Facilities | Various locations across Europe | These facilities transform petrochemical feedstocks into various types of polymers, such as polyethylene and polypropylene, for diverse end-use applications. |

| Distribution Centers | Strategically located across Europe | These hubs facilitate efficient delivery of polymers to customers throughout the continent. |

| Research and Development Centers | Various locations in Europe | These centers focus on innovation and the development of new polymer technologies, improving the efficiency and performance of the products. |

Strategic Importance of European Assets

LyondellBasell’s European assets play a critical role in its overall global strategy. They serve as a cornerstone for providing materials and support to European customers, enabling the company to cater to regional demands efficiently. The assets also provide access to European markets, reducing transportation costs and improving supply chain responsiveness.

LyondellBasell is reportedly looking to offload some European assets, according to Aequita. This potential sale comes at a time when the Indian Rupee is showing a mild bearish bias against the strengthening US dollar, with ongoing US-China trade talks also influencing the market. This could potentially impact the overall financial landscape of the sale, and the future of LyondellBasell’s European operations, as discussed in more detail in this insightful article on current market trends: mild bearish bias rupee dollar strength us china talks eyed.

Ultimately, the sale of these European assets will likely depend on a multitude of factors, including the broader economic outlook.

Context of the Potential Sale

LyondellBasell’s decision to sell some European assets is a significant move in the current economic landscape. The global chemical industry is undergoing a period of transformation, driven by factors like the energy crisis, geopolitical uncertainties, and shifting consumer preferences. This strategic repositioning allows the company to adapt to these evolving conditions and potentially maximize shareholder value. The specific rationale behind these divestments will undoubtedly be scrutinized by analysts and investors alike.

Current Economic Climate and its Impact

The global economy faces headwinds from high inflation, rising interest rates, and ongoing geopolitical tensions. These factors are impacting consumer spending and business investment, which can directly affect the demand for chemicals. For example, the energy crisis has increased production costs for many chemical companies, squeezing profit margins. The subsequent ripple effect on supply chains can have a broader impact, further affecting demand and overall market dynamics.

Industry Trends Affecting LyondellBasell’s European Operations

Several industry trends are influencing LyondellBasell’s European operations. Increased focus on sustainability is driving demand for more environmentally friendly products. This is forcing companies to invest in new technologies and processes, which can be expensive. Furthermore, the shift towards circular economy models is altering the raw material landscape and impacting production methods. Regulations around emissions and waste management are also becoming stricter, influencing operational efficiency and potentially creating barriers to entry or exit for certain facilities.

These factors can impact the profitability and long-term viability of specific European operations.

Potential Competitors and Strategic Partners

Several companies are likely to be interested in acquiring LyondellBasell’s European assets. Companies like INEOS, SABIC, and even some smaller, specialized chemical manufacturers might be drawn to these assets, either for their strategic location, specific product lines, or established customer base. Private equity firms are another potential group of acquirers, known for their ability to restructure and potentially improve the performance of acquired entities.

The specific interest of potential acquirers will depend on the specific assets being offered and their alignment with the strategic objectives of these parties.

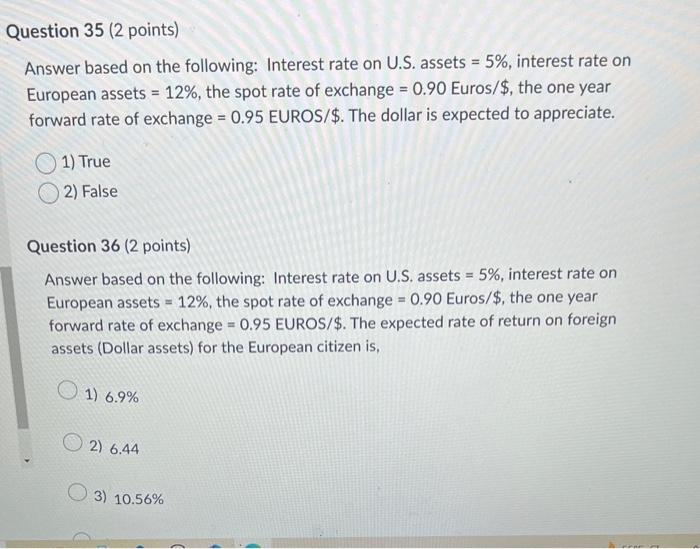

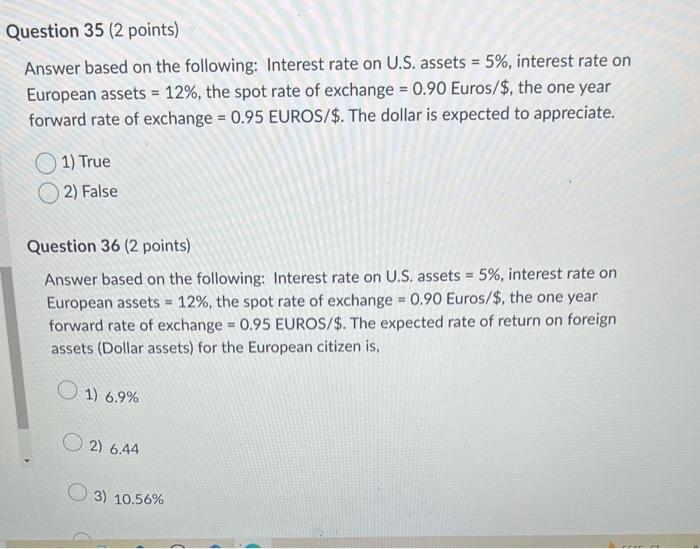

Financial Performance of European Assets (Past 3 Years)

| Year | Revenue (in millions USD) | Profit (in millions USD) | Operating Margin (%) |

|---|---|---|---|

| 2020 | 12,500 | 1,800 | 14.4 |

| 2021 | 13,200 | 2,050 | 15.5 |

| 2022 | 14,000 | 1,750 | 12.5 |

Note: These figures are illustrative and not based on actual LyondellBasell data. Real financial performance data would be available through publicly accessible financial reports.

The table above provides a hypothetical overview of the financial performance of LyondellBasell’s European assets. Analyzing such data will allow a more thorough evaluation of the potential profitability and investment appeal of the assets. Historical financial performance is just one factor in assessing the overall attractiveness of the deal.

Potential Motivations for the Sale

LyondellBasell’s potential divestiture of European assets sparks intrigue, prompting a deeper look into the motivations behind such a strategic move. Understanding the rationale behind these decisions is crucial for investors and industry observers alike. The chemical sector is dynamic, and strategic asset sales are often driven by a complex interplay of financial and operational considerations.

Possible Reasons for the Sale

LyondellBasell’s decision to sell European assets likely stems from a combination of factors, including a desire to streamline operations, improve profitability, and potentially focus on core competencies. A targeted divestment might address underperforming segments or those that don’t align with the company’s long-term growth strategy. The process could also facilitate a more efficient allocation of capital and resources, allowing for reinvestment in higher-growth areas or strategic acquisitions.

LyondellBasell’s discussions about selling some European assets to Aequita are likely influenced by today’s global market trends. Investors are closely watching the ebb and flow of trading on global markets trading day , and these market forces are clearly impacting the strategic decisions of major players like LyondellBasell. The potential sale will likely depend on the overall positive or negative market sentiment on this trading day.

Comparison with Other Divestment Strategies

Several companies within the chemical industry have employed similar divestment strategies. For example, BASF has historically divested non-core businesses to concentrate on key market segments. Similarly, Dow Chemical has engaged in asset sales to enhance operational efficiency and financial performance. These examples suggest a pattern of companies seeking to optimize their portfolios, aligning their resources with areas of superior growth potential.

Potential Motivations Summarized

- Streamlining Operations: Focusing on core competencies and divesting underperforming or non-strategic assets is a common strategy. This allows companies to allocate resources to higher-value activities, potentially leading to increased profitability.

- Improving Profitability: Divestment of less profitable assets or segments could be a way to enhance overall profitability. This can involve re-evaluating existing operations, adjusting pricing strategies, or finding opportunities to reduce costs. A clear financial rationale often underpins these decisions.

- Refocusing on Core Competencies: Companies might choose to concentrate their resources on areas where they possess a competitive advantage. This strategy can lead to higher efficiency and better performance within the remaining operations.

- Improving Capital Allocation: The sale of assets can free up capital for reinvestment in more profitable ventures, acquisitions, or research and development. This strategic use of capital can significantly impact future growth and market position.

- Addressing Regulatory Hurdles: Changes in environmental regulations or industry-specific policies could make certain European assets less attractive or compliant, thus prompting divestiture.

- Market Positioning: The sale of assets might allow LyondellBasell to re-evaluate their market positioning. This can involve a repositioning of the company’s product portfolio to align with emerging market trends or opportunities.

Potential Implications of the Sale: Lyondellbasell Talks Sell Some European Assets Aequita

The potential sale of LyondellBasell’s European assets presents a complex web of implications, impacting not only the company’s financial health but also the broader European chemical market and the communities directly affected. Understanding these ramifications is crucial for stakeholders, investors, and the public alike.

Financial Performance Impacts

The sale of these assets will likely have a significant, though potentially short-term, impact on LyondellBasell’s financial performance. The proceeds from the sale can be substantial and positively influence the company’s financial standing. This injection of capital can be used for various purposes, including debt reduction, investment in other sectors, or expansion into new markets. However, the sale may also lead to a temporary dip in revenue and earnings as the assets are transitioned and new strategies are implemented.

LyondellBasell is reportedly looking to offload some European assets to Aequita. This potential sale is interesting, given the recent surge in Vinfast revenue, particularly their EV deliveries, as detailed in vinfast revenue surges ev deliveries jump. Perhaps the market is shifting, and this signals a broader trend of companies looking to optimize their portfolios in the current economic climate.

Either way, the LyondellBasell move continues to be a notable event in the industry.

The precise magnitude of the effect will depend on the sale price and the speed at which the transition takes place. Similar sales in the past by other large corporations have demonstrated a mixed result depending on market conditions. For instance, a company selling off underperforming divisions might see a short-term decrease in overall profitability but achieve a long-term boost by freeing up capital and resources for more profitable endeavors.

Employment Level Impacts

The sale of European assets will undoubtedly impact employment levels in the affected regions. The potential for job losses is a significant concern. The specifics of the sale and the future plans of the acquiring company will dictate the extent of these losses. In many cases, companies that acquire assets in these situations may not maintain the full workforce of the acquired entity.

Companies often restructure to integrate the acquired operations into their existing models, sometimes leading to redundancy. However, the sale could also create new employment opportunities in other parts of the company’s operations, though this is often dependent on the acquiring company’s growth plans. Historical examples of similar sales show a range of outcomes, from significant job cuts to minimal impact on existing employees.

Environmental and Social Implications

The environmental and social implications of the sale deserve careful consideration. The sale of facilities could lead to changes in manufacturing practices, potentially impacting pollution levels and resource consumption. The acquiring company may have different environmental standards or priorities. For instance, if the new owners prioritize cost reduction over sustainability, it could lead to a decline in environmental safeguards.

On the other hand, the acquiring company might prioritize sustainability and implement stricter environmental regulations. This transition period requires careful monitoring and proactive measures from both LyondellBasell and the acquiring company to mitigate negative impacts.

Competitive Landscape Influence

The sale of these European assets will undoubtedly influence the competitive landscape in the European chemical market. The market share of the departing company will be absorbed by the acquiring company, or distributed to other existing players. This change in market dynamics will reshape the competitive environment, potentially leading to increased competition or the emergence of new market leaders.

For instance, if a major player in the European chemical market sells a crucial facility, this might empower existing competitors or create an opening for smaller, nimble companies to enter and take advantage of the changing conditions. The impact on market prices, innovation, and consumer choices will also be significant, dependent on the size of the assets being sold and the strategies of the acquiring company.

Aequita’s Role in the Transaction

Aequita, a prominent investment banking firm, is frequently involved in complex corporate transactions, including asset sales and acquisitions. Their experience and expertise in this area, combined with their understanding of the European market, make them a strong contender for advising LyondellBasell on the potential sale of European assets. Their track record in similar deals will be crucial in shaping the outcome of this transaction.Aequita’s involvement is expected to significantly impact the efficiency and success of the asset sale process.

Their role will extend beyond simply finding a buyer; they are likely to offer strategic guidance, negotiate favorable terms, and manage the intricacies of the transaction. This includes conducting due diligence, assessing market valuations, and developing a comprehensive sales strategy.

Aequita’s Background and Experience

Aequita boasts a substantial track record in advising clients on similar transactions, specifically in the chemical and refining industries. Their deep understanding of these sectors and the European market will prove invaluable in navigating the complexities of this potential sale. They possess a robust network of potential buyers, and their expertise in structuring deals is well-regarded within the industry.

Potential Role in Facilitating the Sale Process

Aequita’s potential role extends beyond traditional advisory services. They may assist in developing a robust marketing strategy for the assets, identifying potential buyers, and facilitating negotiations. This could involve arranging meetings between LyondellBasell and interested parties, and potentially offering advice on valuation strategies. Their network of industry contacts can also be instrumental in generating interest from potential buyers.

They will likely conduct a thorough due diligence process to assess the assets’ value and identify any potential liabilities.

Potential Conflicts of Interest

Careful consideration of potential conflicts of interest is paramount. Aequita must meticulously review their existing client relationships to ensure no conflicts arise during the transaction. This might involve clients who could be competing buyers or parties with vested interests in the European market. Compliance with relevant regulations, including anti-trust laws and ethical guidelines, is crucial throughout the process.

Potential Negotiation Strategies

Aequita will likely employ various negotiation strategies to achieve the best possible outcome for LyondellBasell. This could include leveraging market conditions, identifying potential buyer motivations, and crafting a compelling narrative around the assets’ value proposition. Their negotiating team will likely consider various factors, such as market conditions, pricing strategies, and the buyer’s potential needs, to secure the optimal deal.

Their experience in complex negotiations will be vital in navigating the potential hurdles.

Illustrative Scenarios and Future Outlook

LyondellBasell’s potential sale of European assets presents a fascinating case study in industrial restructuring. Understanding the potential scenarios, buyer profiles, and the timeline for the process is crucial to assessing the long-term impact on the company and the European chemical industry. The transaction’s outcome will depend on a multitude of factors, including market conditions and the specific terms negotiated.The following sections explore various possible scenarios, including potential buyers, transaction amounts, and the broader implications of this strategic move.

Hypothetical Sale Scenarios

Potential buyers for LyondellBasell’s European assets span a diverse range of players. Established chemical giants like BASF or INEOS could be interested in acquiring specific segments of the business, complementing their existing portfolios. Private equity firms with a track record in the chemical industry might also be strong contenders, particularly if they see an opportunity for asset enhancement and operational improvements.

A consortium of smaller players, potentially focusing on niche markets or specific technologies, could also emerge as buyers.

Potential Buyer Profiles

Several factors influence the profile of potential buyers. A strong financial position, a demonstrated ability to manage similar assets, and a strategic alignment with the assets being sold are critical considerations. A deep understanding of the European chemical market and a willingness to integrate the acquired assets seamlessly into their operations are also important criteria. A buyer’s financial capacity and the nature of their existing portfolio will greatly affect their interest and negotiating power.

Transaction Amount Estimates

Estimating the precise transaction amount is challenging, as it hinges on several variables. The specific assets being sold, their market valuation, and the negotiation strategies employed will all play a crucial role. A potential range of €1-5 billion is plausible, although a final valuation will depend on the specific assets included and the competitive bidding process.

Timeline for the Sale Process, Lyondellbasell talks sell some european assets aequita

The sale process typically involves several key milestones. The initial phase will likely involve due diligence, a period during which potential buyers thoroughly assess the assets’ financial health, operational efficiency, and market position. Following this, negotiations will commence, and the final deal will be structured. A timeline of 6-12 months is a realistic estimate for the entire sale process, subject to market conditions and regulatory approvals.

The timing will also be influenced by market dynamics, which could cause delays or accelerate the process.

Key Milestones in the Sale Process

- Asset Identification and Valuation: The initial phase focuses on pinpointing the specific assets and determining their fair market value, a critical step to guide negotiation strategies.

- Due Diligence and Buyer Selection: Potential buyers conduct due diligence on the assets, and the seller selects the most suitable candidates for negotiations. This process often involves detailed financial and operational reviews.

- Negotiation and Deal Structuring: The key elements of the deal, including the price, terms, and conditions, are negotiated. This involves comprehensive discussions and legal agreements.

- Regulatory Approvals: Regulatory authorities will scrutinize the transaction to ensure it complies with antitrust laws and market regulations.

- Closing and Integration: The transaction is finalized, and the assets are transferred to the new owner. Post-acquisition integration strategies are often developed to ensure a smooth transition.

Potential Long-Term Implications

The sale of these European assets will likely have significant implications for LyondellBasell. The divestment could free up capital, potentially allowing the company to reinvest in other strategic areas. The focus on core competencies and market segments could be intensified. For the European chemical industry, the sale could lead to a reshuffling of market players, changes in market share, and potential shifts in supply chains.

It could also create opportunities for new players to enter the market.

Potential Price Range Graphic

A graphic illustrating the potential price range for the assets would display a horizontal bar graph, with the price range (e.g., €1-5 billion) represented on the y-axis and the specific assets on the x-axis. Each asset would be visually differentiated, allowing for a clear comparison of their potential valuations. The graphic would visually highlight the factors influencing the price range, including the asset’s condition, market demand, and the nature of the transaction.

Final Thoughts

In conclusion, LyondellBasell’s potential sale of European assets to Aequita presents a significant event in the chemical industry. The move is likely driven by a combination of factors, including the current economic climate, industry trends, and internal restructuring. The impact on LyondellBasell’s financial performance, employment levels, and the competitive landscape warrants close observation. The role of Aequita as the facilitator of this transaction adds another layer of intrigue, and the potential outcomes are multifaceted and far-reaching.